By Julian Mellentin, Director, New Nutrition Business11.11.21

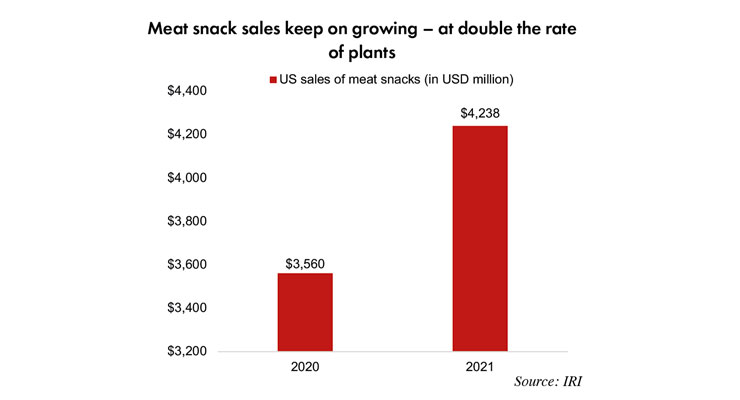

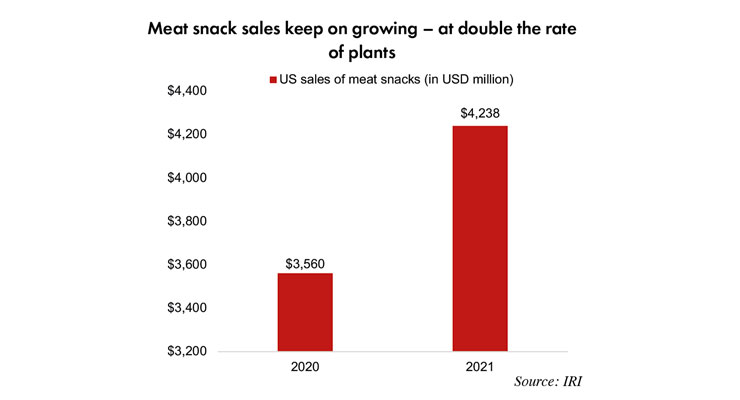

If someone had told you back in 2015 that by 2021 the meat snacking category would be 300% bigger than the entire plant-based meat substitutes category—and growing twice as fast—you likely wouldn’t have believed them.

Nor would you have found it easy to believe that in 2020 one of the 10 most-successful new product launches in America would be an ice cream (Rebel) that is 25% dairy fat, sports the catchphrase “Embrace the Fat,” and is eaten as part of a weight management diet.

You may also have found it unbelievable if someone had told you whole milk would increase its sales by $1 billion between 2016 and 2021—and that would be the exact same dollar sales increase as the plant-milks market.

Equally improbable would have been the idea that General Mills, best known for selling low-fat grain products, would launch a line of snack bars (Ratio) that are 41% fat—and that it would be a success.

All of these possibilities defied what was back then the conventional wisdom of our industry—and all of them have happened. Consumers have been losing their fear of fat as the media has reported evolving science. Low-carbohydrate-high-fat (LCHF) diets have entered the medical mainstream as treatments for diabetes and overweight; in the U.K. for example, thousands of mainstream family physicians are being trained in how to use them. Protein has become “the nutrient that can do no wrong,” and there’s no sign of these trends losing momentum.

Fragmented Consumer Beliefs

Plant-based is, of course, also growing strongly. But it’s just one of a wide variety of choices that consumers make. That’s because consumers’ beliefs about what “healthy” means have fragmented. One of the biggest drivers of this change is technology. A host of websites, apps, and social media platforms have empowered consumers to do their own research; and with this knowledge people feel more confident about creating personalized healthy eating patterns and dietary choices.

For example, according to the mainstream media and to branding consultants the most important trend is meat reducing and flexitarianism. But the fragmentation of consumers’ health beliefs does not allow you to have such one-eyed views of the world.

Meat vs. Plant-Based

U.S. sales of meat snacks, for example, grew an impressive 19% in 2021, to $4.6 billion, reflecting how well they align with many consumer needs. They are one of the biggest and least well-known success stories in the supermarket, yet marked out by many successful brands. The Old Wisconsin meat snack brand, for example, achieved retail sales of $165 million in 2021, a 24% increase over 2020. Its focus is provenance, naturalness, and the strong consumer appeal of 9 g of protein and 13 g of fat per 56 g serving. For comparison, it’s worth noting that sales of all plant-based meats (sausages, burgers, etc.) totaled just $1 billion in the same period and had a growth rate of 10%.

Meat snacks are a success with a healthy percentage of consumers looking for a tasty, satiating, low-carb, low/no sugar snack that is naturally high in protein. Many brands already promote the sustainability aspect of their products (e.g., “grass-fed”), which can help win over yet more consumers who are waiting for “permission to indulge” in animal protein.

Consumers’ desire for “what works for me” makes them flexible and open to innovations. Women of all ages—but particularly Gen Z and younger Millennials—have eagerly embraced collagen—that’s bovine collagen, harvested from scraping the hides of cattle. And these buyers include mostly younger women who describe their diets as plant-based.

Collagen has become a must-have in the morning routine of a growing percentage of young women, who often add collagen powder to their morning smoothies to maintain healthy skin, hair, and nails. Nestlé has gotten into the collagen business, acquiring U.S. market leader Vital Proteins and rolling out its products in Europe and in China on TMall, the country’s biggest online retailer.

The success of collagen reminds us that consumers don’t only want plant-based products; they are also very open to innovations of all kinds as long as they deliver benefits. Skin care is, of course, one of the most compelling benefits, alongside weight management, because what humans want most is to look and feel good.

Consumers also want more plants in their diets for their powerful health halo. But they also want them in a convenient form. Over the last decade, creative product developers and ingredient suppliers have devised a host of ways to make it easier to incorporate a percentage of vegetables into packaged foods. Some consumers want a high percentage, but most are happy with 20% or even as low as 5%. And people welcome their inclusion in most categories, from snacks to bakery, side dishes and mini meals, as the examples that follow show.

Vegetables also succeed as a healthy alternative to a starchy carb and are an increasingly common sight in the supermarket, such as Target’s Good & Gather zucchini spirals, Caulipower cauliflower pizza bases, and Birds Eye Veggie Pasta made from zucchini and legumes.

Plants’ appearance on a product label gives people “permission to indulge,” which is one of the most effective selling messages.

The Plant Protein Paradox

Plant-based proteins, on the other hand, are faced with a paradox. Consumer interest is high and demand is growing, particularly for easy-to-understand and less processed products, like almonds and pistachios. Plant proteins are being incorporated into bakery products, such as wraps and tortillas. The BFree brand, from Ireland, delivers 12 g of protein per 42 g wrap.

But for many applications there are technical and taste challenges, and as a result, plant proteins are often delivered as part of a package of specialty ingredients, resulting in long ingredient lists that are the opposite of what health-aware consumers have been telling us they want for almost 20 years.

This challenge can be seen at its most acute in the plant-based meat substitutes segment. It’s a niche, worth only $1 billion according to IRI data, dwarfed even by niches like meat snacks. The growth rate in 2021 was a healthy 10%, but at that rate it will take 10 years before it makes a dent in animal proteins. Products underperform on taste, texture, nutrition, and versatility, not to mention price. And makers of substitutes aren’t all having an easy time. Beyond Meat, with 23% market share as the number two brand, has never made a profit and its losses are steadily worsening. Dropping price to build volume will only make its losses greater.

To really thrive, plant proteins need a new strategy, and this can be seen in some of the steps that Danone has taken recently. It both upped the protein content of its Silk Greek-style plant-based yogurt from 1 g to 10 g and cut the ingredient list. Together with better taste, this is the strategy that dairy substitutes are quietly adopting, and why they will perform better than meat substitutes.

One of the consistent growth opportunities for plants is in powders. They are convenient, quick to prepare, versatile, and portable. For many people, powders are a way to get more plants into their life in a clean, nutrient-dense way.

Millennials have adopted them and for Gen Z they are just a normal part of life. Moreover, what was an American habit is now being adopted by younger consumers in Europe, where more and more stores have sections dedicated to plant-based powders. Unsurprisingly, the plant powders business is growing at a steady 8% a year.

One business that provides a good case study of how to succeed in powders is California-based Mud Wtr. It has understood that many people want a tangible effect and so it has positioned itself as a plant-forward alternative to coffee: “Mud gives you natural energy, focus and more without the jitters.” It’s a super-premium product, selling at a price equivalent to $270 a kilo, but it justifies this both with the claimed benefit and an ingredient list that appeals to the strongly-held beliefs of the most health-active people: cordyceps, lion’s mane, reishi, chaga, and turmeric.

Mood & Mind

The market for products that support mood and mind has been on most companies’ opportunity list for over a decade. Consumer interest is high and they are mainstream concerns. The problem is that a wealth of start-ups and challenger brands have tried and failed, or live on as niche businesses.

The cause is simply that many products don’t deliver a benefit the consumer can feel, or at least think they can feel. This is one of those areas of consumer need where “feel the benefit” counts if you’re going to get repeat purchase.

There’s a wealth of mood and mind products that have cool branding, interesting ingredients, and great social media campaigns. But they still mostly fail because they lack an underpinning of science and a feel-the-benefit advantage. For companies based in science, these challenges are opportunities.

Probiotic Opportunities

Probiotics with mood and mind benefits, based in good science, may be one of the ingredients that succeed. That’s partly because the gut-brain connection is discussed on social and mainstream media, so it has some consumer awareness, and people have heard of probiotics, which after 20 years of industry marketing now have a general health halo. It’s an emergent area and you will need a long-term focus to succeed. But taking probiotics beyond digestion and immunity to mood and mind benefits will be credible for consumers. Some mainstream brands are already starting to educate consumers about the connection, such as Lifeway Kefir.

Consumers are already over-supplied with probiotic choices. Whether you are commercializing a probiotic ingredient or a finished consumer product, marketing creativity now matters more than science. Probiotic businesses that succeed will do so by being experts in consumers and markets as well as in science.

U.K. probiotic brand Symprove is a good example of how effective this strategy can be. Symprove developed a liquid food supplement containing four strains of bacteria with a “feel the benefit” digestive wellness message. It has invested in science that shows the efficacy of its product, working with Kings College London and University College London.

But its success (it is both fast-growing and profitable) in a market in which it is not allowed to make any health claim can be attributed squarely to its focus on a direct-to-consumer business model, allowing it to communicate better with consumers, get consumer feedback, and retain margin that would otherwise be shared with retailers—and with none of the stresses that go with trying to keep a niche brand on the shelf in retail.

By contrast with Symprove, Blis Technologies in New Zealand was long a case study of how not to commercialize new probiotic science. Its strains offer an oral health benefit. But it had 15 years of dismal sales, losing money every year, before it turned its fortunes around and began generating profits. It did so by adopting the strategy of becoming as much of an expert in markets and consumers as it is in science and, like Symprove, focusing on developing a strong D2C business.

In probiotic ingredients, the market’s future probably lies in the hands of companies which have scientifically-validated strains and extensive sales and marketing networks. The future is bright for probiotics, but it is intensely competitive. Consumers are over-supplied with choice, and finding success requires more creativity than ever before.

Lastly, let’s talk about the emergent trend of “nutrient density.” The concept of foods being nutrient dense has been floating around for more than 20 years in nutrition circles, but it has moved rapidly in the past two or three years, legitimized by the term “nutrient density” being used in the U.S. Dietary Guidelines.

Nutrient density has come onto companies’ radar screens and is emerging as a marketing term. One of the attractions of this terminology for marketers is that there is no one agreed definition, either in regulatory terms or in the mind of the consumer. In terms of company strategy, it can be linked to important issues including sustainability (soil health and regenerative agriculture, for example), bioavailability, and the growing scientific and consumer concern about “ultra-processed foods” (UPFs).

Nutrient density has some value because it’s still a long way from becoming a meaningless marketing label in the way that “plant-based” is becoming. For now, it’s got the potential to create value among the 25-30% most health-active consumers. And it’s such a simple idea that it’s also easy for mainstream consumers to embrace. We were surprised when in our 2021 five-country consumer survey we asked, for the first time, about nutrient density and 12% of consumers (and 21% of Spanish respondents) claimed to have heard of it.

U.S. brands such as Elmhurst plant milks are using the terminology, based on a processing method that guarantees the benefit; baby food brands such as Cerebelly are adopting it; so are peanut butter brands such as Blis Out “Nutrient Dense Peanut Butter” in Portugal. Engaging with nutrient density is a long-term strategy, but one that everyone will have to think about 5 years from now.

Everyone loves discussing consumer trends, especially anything emergent. But we need to apply a hard, cold eye to them. That often starts with technology. Is there an ingredient or technology you can use to deliver the benefit (either as an effective dose or as a lighter health halo)? And will the product still have great taste and texture—two elements which are the king and queen of success? Then you need to be sure you can get a price that will get you a decent margin, and have some money to invest for the long term; for in our industry it’s the businesses that patiently work toward long-term success that make a difference. Get these basics right, harness them to the consumer trends, and you are on a good path.

About the Author: Julian Mellentin is the founder of New Nutrition Business, a consulting company specialized in the business of food, nutrition and health since 1995. For more information: www.new-nutrition.com; julian.mellentin@new-nutrition.com.

Nor would you have found it easy to believe that in 2020 one of the 10 most-successful new product launches in America would be an ice cream (Rebel) that is 25% dairy fat, sports the catchphrase “Embrace the Fat,” and is eaten as part of a weight management diet.

You may also have found it unbelievable if someone had told you whole milk would increase its sales by $1 billion between 2016 and 2021—and that would be the exact same dollar sales increase as the plant-milks market.

Equally improbable would have been the idea that General Mills, best known for selling low-fat grain products, would launch a line of snack bars (Ratio) that are 41% fat—and that it would be a success.

All of these possibilities defied what was back then the conventional wisdom of our industry—and all of them have happened. Consumers have been losing their fear of fat as the media has reported evolving science. Low-carbohydrate-high-fat (LCHF) diets have entered the medical mainstream as treatments for diabetes and overweight; in the U.K. for example, thousands of mainstream family physicians are being trained in how to use them. Protein has become “the nutrient that can do no wrong,” and there’s no sign of these trends losing momentum.

Fragmented Consumer Beliefs

Plant-based is, of course, also growing strongly. But it’s just one of a wide variety of choices that consumers make. That’s because consumers’ beliefs about what “healthy” means have fragmented. One of the biggest drivers of this change is technology. A host of websites, apps, and social media platforms have empowered consumers to do their own research; and with this knowledge people feel more confident about creating personalized healthy eating patterns and dietary choices.

For example, according to the mainstream media and to branding consultants the most important trend is meat reducing and flexitarianism. But the fragmentation of consumers’ health beliefs does not allow you to have such one-eyed views of the world.

Nestlé has gotten into the collagen business, acquiring Vital Proteins, and rolling out products in Europe and China.

Meat vs. Plant-Based

U.S. sales of meat snacks, for example, grew an impressive 19% in 2021, to $4.6 billion, reflecting how well they align with many consumer needs. They are one of the biggest and least well-known success stories in the supermarket, yet marked out by many successful brands. The Old Wisconsin meat snack brand, for example, achieved retail sales of $165 million in 2021, a 24% increase over 2020. Its focus is provenance, naturalness, and the strong consumer appeal of 9 g of protein and 13 g of fat per 56 g serving. For comparison, it’s worth noting that sales of all plant-based meats (sausages, burgers, etc.) totaled just $1 billion in the same period and had a growth rate of 10%.

Meat snacks are a success with a healthy percentage of consumers looking for a tasty, satiating, low-carb, low/no sugar snack that is naturally high in protein. Many brands already promote the sustainability aspect of their products (e.g., “grass-fed”), which can help win over yet more consumers who are waiting for “permission to indulge” in animal protein.

Consumers’ desire for “what works for me” makes them flexible and open to innovations. Women of all ages—but particularly Gen Z and younger Millennials—have eagerly embraced collagen—that’s bovine collagen, harvested from scraping the hides of cattle. And these buyers include mostly younger women who describe their diets as plant-based.

Collagen has become a must-have in the morning routine of a growing percentage of young women, who often add collagen powder to their morning smoothies to maintain healthy skin, hair, and nails. Nestlé has gotten into the collagen business, acquiring U.S. market leader Vital Proteins and rolling out its products in Europe and in China on TMall, the country’s biggest online retailer.

Vegetables succeed as healthy alternatives to starchy carbs.

Innovation that Delivers Benefits

The success of collagen reminds us that consumers don’t only want plant-based products; they are also very open to innovations of all kinds as long as they deliver benefits. Skin care is, of course, one of the most compelling benefits, alongside weight management, because what humans want most is to look and feel good.

Consumers also want more plants in their diets for their powerful health halo. But they also want them in a convenient form. Over the last decade, creative product developers and ingredient suppliers have devised a host of ways to make it easier to incorporate a percentage of vegetables into packaged foods. Some consumers want a high percentage, but most are happy with 20% or even as low as 5%. And people welcome their inclusion in most categories, from snacks to bakery, side dishes and mini meals, as the examples that follow show.

Vegetables also succeed as a healthy alternative to a starchy carb and are an increasingly common sight in the supermarket, such as Target’s Good & Gather zucchini spirals, Caulipower cauliflower pizza bases, and Birds Eye Veggie Pasta made from zucchini and legumes.

Plants’ appearance on a product label gives people “permission to indulge,” which is one of the most effective selling messages.

The Plant Protein Paradox

Plant-based proteins, on the other hand, are faced with a paradox. Consumer interest is high and demand is growing, particularly for easy-to-understand and less processed products, like almonds and pistachios. Plant proteins are being incorporated into bakery products, such as wraps and tortillas. The BFree brand, from Ireland, delivers 12 g of protein per 42 g wrap.

But for many applications there are technical and taste challenges, and as a result, plant proteins are often delivered as part of a package of specialty ingredients, resulting in long ingredient lists that are the opposite of what health-aware consumers have been telling us they want for almost 20 years.

This challenge can be seen at its most acute in the plant-based meat substitutes segment. It’s a niche, worth only $1 billion according to IRI data, dwarfed even by niches like meat snacks. The growth rate in 2021 was a healthy 10%, but at that rate it will take 10 years before it makes a dent in animal proteins. Products underperform on taste, texture, nutrition, and versatility, not to mention price. And makers of substitutes aren’t all having an easy time. Beyond Meat, with 23% market share as the number two brand, has never made a profit and its losses are steadily worsening. Dropping price to build volume will only make its losses greater.

To really thrive, plant proteins need a new strategy, and this can be seen in some of the steps that Danone has taken recently. It both upped the protein content of its Silk Greek-style plant-based yogurt from 1 g to 10 g and cut the ingredient list. Together with better taste, this is the strategy that dairy substitutes are quietly adopting, and why they will perform better than meat substitutes.

One of the consistent growth opportunities for plants is in powders. They are convenient, quick to prepare, versatile, and portable. For many people, powders are a way to get more plants into their life in a clean, nutrient-dense way.

Millennials have adopted them and for Gen Z they are just a normal part of life. Moreover, what was an American habit is now being adopted by younger consumers in Europe, where more and more stores have sections dedicated to plant-based powders. Unsurprisingly, the plant powders business is growing at a steady 8% a year.

One business that provides a good case study of how to succeed in powders is California-based Mud Wtr. It has understood that many people want a tangible effect and so it has positioned itself as a plant-forward alternative to coffee: “Mud gives you natural energy, focus and more without the jitters.” It’s a super-premium product, selling at a price equivalent to $270 a kilo, but it justifies this both with the claimed benefit and an ingredient list that appeals to the strongly-held beliefs of the most health-active people: cordyceps, lion’s mane, reishi, chaga, and turmeric.

Mood & Mind

The market for products that support mood and mind has been on most companies’ opportunity list for over a decade. Consumer interest is high and they are mainstream concerns. The problem is that a wealth of start-ups and challenger brands have tried and failed, or live on as niche businesses.

The cause is simply that many products don’t deliver a benefit the consumer can feel, or at least think they can feel. This is one of those areas of consumer need where “feel the benefit” counts if you’re going to get repeat purchase.

There’s a wealth of mood and mind products that have cool branding, interesting ingredients, and great social media campaigns. But they still mostly fail because they lack an underpinning of science and a feel-the-benefit advantage. For companies based in science, these challenges are opportunities.

U.K. probiotic brand Symprove has found success with a direct-to-consumer model, allowing for better communication and customer feedback.

Probiotic Opportunities

Probiotics with mood and mind benefits, based in good science, may be one of the ingredients that succeed. That’s partly because the gut-brain connection is discussed on social and mainstream media, so it has some consumer awareness, and people have heard of probiotics, which after 20 years of industry marketing now have a general health halo. It’s an emergent area and you will need a long-term focus to succeed. But taking probiotics beyond digestion and immunity to mood and mind benefits will be credible for consumers. Some mainstream brands are already starting to educate consumers about the connection, such as Lifeway Kefir.

Consumers are already over-supplied with probiotic choices. Whether you are commercializing a probiotic ingredient or a finished consumer product, marketing creativity now matters more than science. Probiotic businesses that succeed will do so by being experts in consumers and markets as well as in science.

U.K. probiotic brand Symprove is a good example of how effective this strategy can be. Symprove developed a liquid food supplement containing four strains of bacteria with a “feel the benefit” digestive wellness message. It has invested in science that shows the efficacy of its product, working with Kings College London and University College London.

But its success (it is both fast-growing and profitable) in a market in which it is not allowed to make any health claim can be attributed squarely to its focus on a direct-to-consumer business model, allowing it to communicate better with consumers, get consumer feedback, and retain margin that would otherwise be shared with retailers—and with none of the stresses that go with trying to keep a niche brand on the shelf in retail.

By contrast with Symprove, Blis Technologies in New Zealand was long a case study of how not to commercialize new probiotic science. Its strains offer an oral health benefit. But it had 15 years of dismal sales, losing money every year, before it turned its fortunes around and began generating profits. It did so by adopting the strategy of becoming as much of an expert in markets and consumers as it is in science and, like Symprove, focusing on developing a strong D2C business.

In probiotic ingredients, the market’s future probably lies in the hands of companies which have scientifically-validated strains and extensive sales and marketing networks. The future is bright for probiotics, but it is intensely competitive. Consumers are over-supplied with choice, and finding success requires more creativity than ever before.

Meat snacks appeal to consumers by offering a satiating, low-carb, low/no sugar snack that is naturally high in protein.

Nutrient Density

Lastly, let’s talk about the emergent trend of “nutrient density.” The concept of foods being nutrient dense has been floating around for more than 20 years in nutrition circles, but it has moved rapidly in the past two or three years, legitimized by the term “nutrient density” being used in the U.S. Dietary Guidelines.

Nutrient density has come onto companies’ radar screens and is emerging as a marketing term. One of the attractions of this terminology for marketers is that there is no one agreed definition, either in regulatory terms or in the mind of the consumer. In terms of company strategy, it can be linked to important issues including sustainability (soil health and regenerative agriculture, for example), bioavailability, and the growing scientific and consumer concern about “ultra-processed foods” (UPFs).

Nutrient density has some value because it’s still a long way from becoming a meaningless marketing label in the way that “plant-based” is becoming. For now, it’s got the potential to create value among the 25-30% most health-active consumers. And it’s such a simple idea that it’s also easy for mainstream consumers to embrace. We were surprised when in our 2021 five-country consumer survey we asked, for the first time, about nutrient density and 12% of consumers (and 21% of Spanish respondents) claimed to have heard of it.

U.S. brands such as Elmhurst plant milks are using the terminology, based on a processing method that guarantees the benefit; baby food brands such as Cerebelly are adopting it; so are peanut butter brands such as Blis Out “Nutrient Dense Peanut Butter” in Portugal. Engaging with nutrient density is a long-term strategy, but one that everyone will have to think about 5 years from now.

Everyone loves discussing consumer trends, especially anything emergent. But we need to apply a hard, cold eye to them. That often starts with technology. Is there an ingredient or technology you can use to deliver the benefit (either as an effective dose or as a lighter health halo)? And will the product still have great taste and texture—two elements which are the king and queen of success? Then you need to be sure you can get a price that will get you a decent margin, and have some money to invest for the long term; for in our industry it’s the businesses that patiently work toward long-term success that make a difference. Get these basics right, harness them to the consumer trends, and you are on a good path.