By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.07.12.21

Beyond Meat’s Beyond Sausage was the 10th best-selling new U.S. food/beverage in 2020, with $53 million in year-one sales; 36 of the top 100 products had plant-based attributes, 22 were vegan, per IRI’s 2021 New Product Pacesetters.

Plant-based meat alternatives were the fastest growing gourmet/specialty food category last year, followed by dairy/plant creamers, according to the Specialty Foods Association. McDonald’s is testing a plant-based P.L.T. burger.

Sales of foods/drinks touting a botanical or plant-based oil benefit (e.g., lavender or citrus) jumped 12% in 2020 in mass outlets, per IRI. Herb/botanical supplement sales reached $11.4 billion in 2020, up 17% over 2019, according to the Nutrition Business Journal 2021 Supplement Business Report.

One-quarter of global consumers say plant-based fare has become more important to them, led by those in South Asia, East Asia Pacific, and Latin America, per HealthFocus’ 2021 Global Plant Report. Half (53%) of global consumers now look for botanicals to improve their health, per Kerry’s 2021 Botanical State-of-Mind.

Despite impressive gains, there are some trends that may well disrupt the momentum of the plant-based category. Marketing for plant-based products is tracking practices previously seen in “gluten-free” products, with products that never contained gluten marketed as gluten-free. Similarly, naturally plant-based products including wine, coffee, tea, and potato chips are carrying plant-based labels—a practice that can erode the credibility of the category.

Other trends that may hamper the category’s growth include a disproportionate reliance on personal values to sell products, over-processing, lack of nutritional parody, and poor cooking performance.

The development of cell-based biotechnology-driven meat, poultry, seafood, and dairy proteins will likely impact the plant-based category in the coming years.

Plant-Based Consumers

Nearly half (48%) of adults look for products labeled “plant-based,” per the Hartman Group’s 2021 Health & Wellness: Reimagining Well-Being COVID-19 Report. Nearly one in five (17%) consumers say they always/usually choose plant-based foods/drinks, according to HealthFocus’ 2021 USA Trend Study.

Of those buying plant-based products, 49% are female, 56% are Gen Z or Millennial, 37% have kids at home, 53% are college graduates, and 44% are core or mid-level wellness consumers, per Hartman’s 2020 Food & Technology: From Plant-Based to Lab-Grown Report.

Just over one-third of adults (36%) are currently following a flexitarian eating plan, 5% are true vegetarians, and 3% each are either true vegans or pescatarians, per Packaged Facts’ 2020 Vegan, Vegetarian & Flexitarian Consumers.

Vegans, vegetarians, and flexitarians (VVF) tend to be high income ($100k+), urbanites, and live in the West and Northeast, per Packaged Facts. One-third of mainstream plant-based eaters are interested in vegetarian or vegan fare, per Datassential.

In the past year, 18% of adults have tried a plant-based diet; among these, 10% have tried vegetarian, 7% flexitarian, and 6% vegan, according to Hartman.

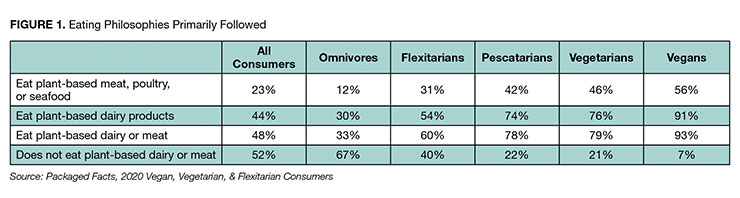

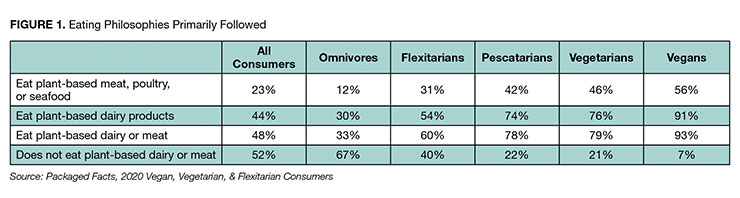

Although vegetarians and vegans are the most likely to consume meat/dairy alternatives and other plant-based foods, their numbers are small. The sweet spot for growing sales will include targeting flexitarian and omnivore consumers who make up a greater percentage of the market. Sixty percent of flexitarians eat both meat and dairy alternatives (Figure 1).

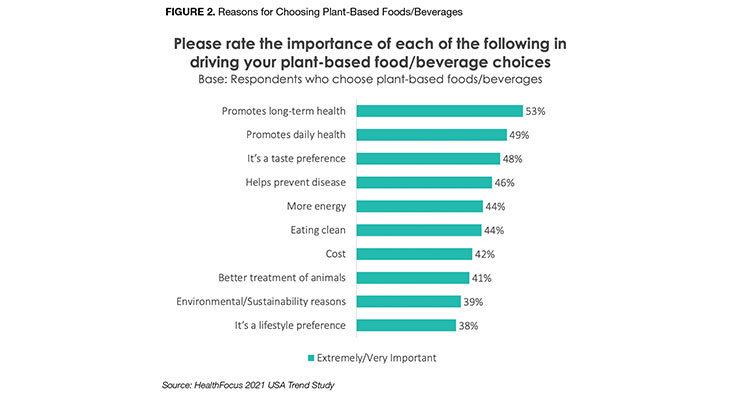

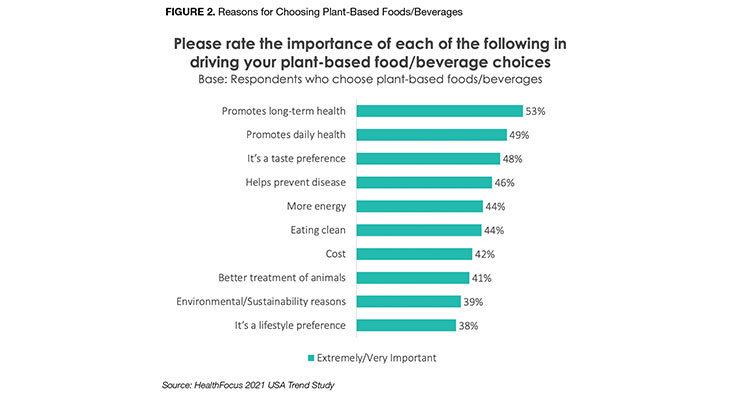

Health drives plant-based product choices for just over half of consumers; energy is a relatively new driver for plant-based eating (Figure 2).

Plant-Based Food Sales Growing

Sales of plant-based foods/beverages reached $7 billion for the year ended (Y/E) 12/27/21, up 27% vs. 2019, per the Plant-Based Foods Association. Alternative eggs, dairy spreads/dips, meat, cheese, and tofu/tempeh were the fastest growing categories. Datassential reports that 71% of Americans have tried at least one type of plant-based alternative.

Sales of alternative meats/poultry are expected to reach $2 billion by 2024 (CAGR 13.6%), according to Packaged Fact’s 2020 Meat, Poultry & Seafood Alternatives. Beef, pork, and chicken will be the largest categories; value-added cuts, e.g., chunks, strips, or nuggets, will be the fastest growing.

Alternative seafood sales are estimated to reach $62 million by 2024. One-quarter of seafood consumers say they are very likely to try it, per FMI’s 2021 Power of Seafood. SPINS reports that fishless tuna was the fastest growing shelf-stable plant-based food item for the Y/E 1/21/21.

Plant-based dairy is projected to grow to $5.2 billion by 2024, per Packaged Facts’ 2020 Dairy & Egg Alternatives. Milk, followed by ice cream, yogurt, creamers, and cheese will be the largest categories. Alternative eggs will top $54 million by 2024. Forty-two percent use plant-based milks, ice cream 9%, creamers 8%, yogurt 8%, butter 7%, and cheese 5%.

One-quarter of adults eat plant-based meat or poultry fairly often, per Packaged Facts; 40% have tried alternative meats in the past year, per Mintel’s Plant-Protein U.S. – May - 2021. Those aged 18-44, those in upper-income households ($100k+), urbanites, and those with kids at home are most likely to do so.

Three-quarters of consumers want more blended meat/vegetable items, 64% more plant-based meat alternatives, per FMI’s 2021 Power of Meat.

A clear hierarchy of consumer interest in plant-based foods has emerged. Among frozen foods, 71% are most interested in meals that have more fruits and/or vegetables; 58% plant-based carb/starch alternatives (e.g., riced cauliflower, zucchini pasta); 52% more blended meat/vegetable items; 51% more plant-based entrées; and 43% more meat alternatives, per AFFI’s 2021 Power of Frozen. Plant-based frozen meals posted sales of $520 million in 2020, up 29%, per PBFA.

SPINS reports that frozen breakfast plant-based entrees grew 84%, snacks/appetizers 83%, breakfast patties 59%, and pizza 25% for Y/E 4/18/21, albeit from a small base.

Vegan/vegetarian was the fastest growing dessert claim over the past three years, up 12%, per Mintel’s 2021 Trending on U.S. Menus: Desserts. Lunch, snacks (beyond chips and jerky), and plant-powered/vegan breads/tortillas are other untapped alternative opportunities.

The Plant-Based Food Consumer

Plant-based product consumers are foodies, three-quarters enjoy cooking, 55% bake frequently at home, and 69% regularly seek new products to try, per Packaged Facts.

They are much more willing to pay for clean labels. Sales of plant-based foods/drinks with organic ingredients grew 28% for the Y/E 1/24/21, per SPINS; 27% for non-GMO, 14% Certified B Corporation, and 15% fair trade.

Despite marketers trying to align plant-based eating with popular diets, there is no difference between VVF consumers vs. the general population—with the exception of vegetarians being above average for gluten-free and vegans above average for the keto diet. Low-carb is the most popular diet among VVF and general consumers, per Packaged Facts.

VVF consumers are more than twice as concerned about sensitivities/allergens as the general population. SPINS reports that sales of plant products that were soy-free rose 32% for the Y/E 1/23/21, wheat-free 25%.

Opportunities to grow the plant-based market and drive repeat sales for these informed consumers will include closing the nutrient parity gap, especially critical to entering the children’s market, and providing better instructions for optimal preparation and cooking.

Type of Plant Protein Important for Plant-Based Consumers

One-third of consumers seek out plant-based protein, per Hartman’s 2021 Health + Wellness report. One-quarter say they are eating more plant protein than last year, 22% more meat alternatives, and 18% more dairy alternatives, per IFIC’s June 2021 Health & Nutrition Survey. One-third (31%) are trying to limit their meat intake, per Mintel; 10% all the time, 21% most of the time.

Plant-based consumers are more likely overall to reach for whole food protein sources (e.g., beans/whole grains vs. alternatives, according to Mintel. More than one-quarter of plant-based users mix these products with animal-based foods. Plant-based eaters are equally as likely to select burgers made from whole foods as they are for the trendy meat-like alternatives.

Half of consumers would be extremely/very interested in using more nuts/seeds as a protein source; 43% legumes, including peas, beans, lentils, chickpeas; 43% grains, including wheat, rice, quinoa, oats; tofu/tempeh 16%; and hemp 15%, per HealthFocus USA Study.

There is a very high level of protein experimentation among VVF consumers. Vegetarians are most likely to try new legumes.

Dinner is the most important daypart for considering protein for VVF consumers; vegetarians look for protein nearly equally at breakfast, lunch, and dinner, per Packaged Facts’ Vegetarian report.

Concerns about satiety (being hungry three hours later) and not getting enough protein are among the top concerns with plant-forward eating, per Datassential, cited by 35% and 28% of consumers, respectively. Only 39% of adults feel that vegetarian/vegan meals are as filling as animal/seafood-based options, per Technomic’s 2021 Center of the Plate: Seafood & Vegetarian Trend Report. Helping to satisfy hunger is second only to ensuring a balanced diet as the top motivation for trying to get more protein, per IFIC’s protein report.

One-quarter (26%) of global consumers say they are very particular about the sources of protein they consume and avoid certain ones. The top factors for a “good protein” are a natural source, followed by a complete source, a clean source, and a nutrient-dense source, per HealthFocus’ 2021 Global Protein Report.

Completeness, digestibility, and amino acid content are among the important up-and-coming issues for plant protein in the U.S.

One in five (20%) supplement users took a protein supplement in 2020; 23% of those aged 18-34, 24% 35-54, and 11% aged 55 and older, per CRN’s 2020 Consumer Survey on Dietary Supplements. One in 10 (11%) protein supplement, bar, or drink users took whey protein, 9% plant protein, and 6% soy protein. Sports nutrition protein powders continue to grow as a $6.09 billion business, up 6.5% in 2020 vs 2019, according to Informa Markets.

Plant-Powered Ingredients

Dark green vegetables are the most sought-after fortification/benefit ingredients in functional foods, per the Hartman Group’s 2020 Functional Foods & Beverages and Dietary Supplements. One-third look for superfruits/tree nuts; one-quarter beans, legumes, pulses, and seeds; one in in five cinnamon and turmeric and plant-based protein.

Antioxidants, green tea, electrolytes, superfruits, fiber/prebiotics, and greens are the most sought-after fortifications in functional beverages; one in five look for coconut water, apple cider vinegar, ginger, or turmeric, per Hartman.

Fermented foods, followed by blueberries, green tea, exotic fruits, seeds (e.g., chia, hemp), avocados, spinach/leafy greens, kale, nuts, and salmon are the most sought-after superfoods in 2021, per Pollock Communications’ 2021 What’s Trending in Nutrition Survey.

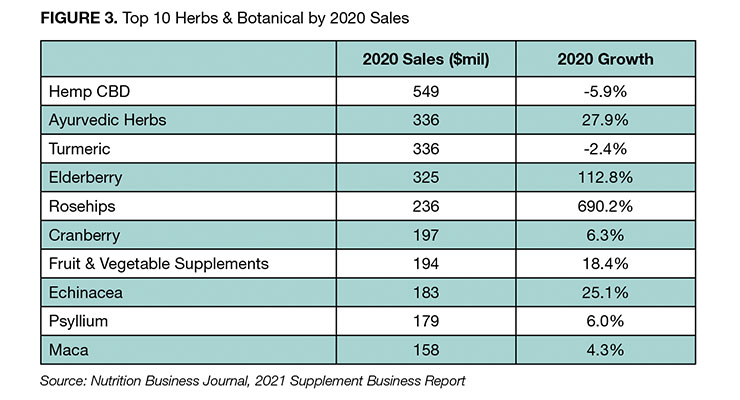

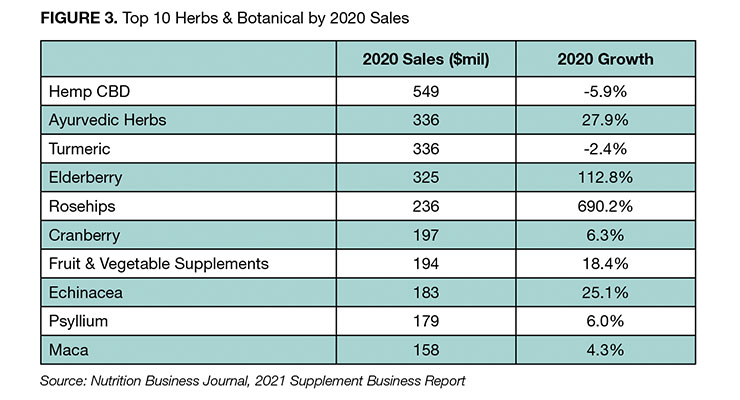

Hemp CBD was the largest herb/botanical supplement category in 2020 with sales of $549 million, per NBJ’s supplement report (Figure 3).

Four in 10 (44%) of supplement users took herbals/botanicals in 2020; 47% aged 18-34, 51% aged 35-55, and 35% aged 55 and older, per CRN’s 2020 Consumer Survey. Green tea, followed by turmeric, garlic, aloe, cranberry, ginseng, and elderberry were the most taken herbals/botanicals.

Digestive health is the benefit most associated with botanicals, 61% of global consumers; followed by immune support 55%, heart health 53%, weight management 45%, and aging 45%, per Kerry’s 2021 survey.

Historically, weight- and heart-concerned adults have been among the most likely to buy plant-based alternatives. One-third of all generations, except Gen Z, are still struggling with COVID weight gains, per Hunter’s Jan. 2021 Food Study: Wave 2.

Over the last three years, beverages containing botanical extracts have increased by 46% globally, per Kerry’s report. Guava grew 38% and passion fruit 58% in alcoholic beverages, acerola up 146%, and ginger 48% in soft drinks. Honey, cinnamon, blueberry, mint, and raspberry are the most appealing botanical flavors in North America.

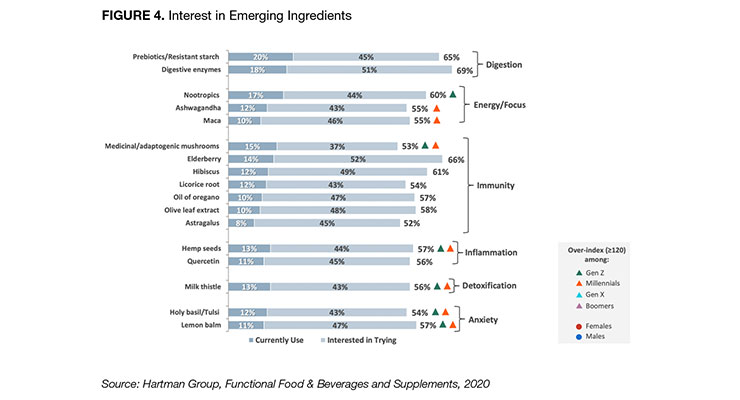

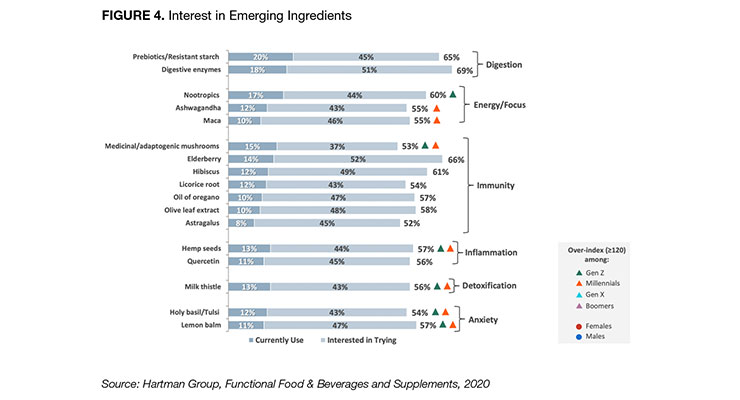

Most important going forward is the degree to which younger consumers are looking to emerging plant-based/botanical ingredients for health solutions (Figure 4). Millennials and Gen Zers over index (>120) for use of holy basil/lemon balm for anxiety, milk thistle for detoxification, medicinal mushrooms for immunity, and hemp for inflammation, per Hartman’s supplement study.

Barriers to Business: The Cautionary Tale

As meat/dairy alternative businesses continue to mature, it is becoming more important to rely on balanced and credible product promotions that focus first on taste and health. While IFIC reports that the environment/sustainability has a great impact on food purchase decisions (ranked 4 or 5 out of 5) for 31% of consumers, over-relying on sustainable issues to help sell plant-based foods does not always deliver on expectations.

Only 10% of consumers say that environmental impact best describes their motivation for purchasing plant-based foods, 15% of Gen Z, and 11% of Millennials. Likewise, only 1% of all consumers say climatarian best describes how they eat today, 3% for Gen Z, and 1% for Millennials, per Datassential.

Likewise, while 42% of consumers cite animal agriculture as having the greatest negative impact on the environment in 2021, per IFIC, only 10% of meat shoppers strongly believe that animal agriculture has a lot of negative impact on the environment. Moreover, only 17% of shoppers consider better-for-the-planet, better-for-the-farm worker, and better-for-the-animal when shopping in the meat department, per FMI’s 2021 Power of Meat.

Competition is stiff; organic, no antibiotics ever, and grass-fed now account for 11% of total meat/poultry sales in 2020, or $9.3 billion, per FMI.

Lastly, six in 10 plant-based consumers would eat more meat alternatives if they were less processed; 63% would like to see more meat alternatives made with whole foods (e.g., vegetables), per Mintel. Six in 10 consumers look for minimally processed foods. Only 9% of adults are looking forward to seeing more lab-grown proteins in 2021, according to Datassential.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Plant-based meat alternatives were the fastest growing gourmet/specialty food category last year, followed by dairy/plant creamers, according to the Specialty Foods Association. McDonald’s is testing a plant-based P.L.T. burger.

Sales of foods/drinks touting a botanical or plant-based oil benefit (e.g., lavender or citrus) jumped 12% in 2020 in mass outlets, per IRI. Herb/botanical supplement sales reached $11.4 billion in 2020, up 17% over 2019, according to the Nutrition Business Journal 2021 Supplement Business Report.

One-quarter of global consumers say plant-based fare has become more important to them, led by those in South Asia, East Asia Pacific, and Latin America, per HealthFocus’ 2021 Global Plant Report. Half (53%) of global consumers now look for botanicals to improve their health, per Kerry’s 2021 Botanical State-of-Mind.

Despite impressive gains, there are some trends that may well disrupt the momentum of the plant-based category. Marketing for plant-based products is tracking practices previously seen in “gluten-free” products, with products that never contained gluten marketed as gluten-free. Similarly, naturally plant-based products including wine, coffee, tea, and potato chips are carrying plant-based labels—a practice that can erode the credibility of the category.

Other trends that may hamper the category’s growth include a disproportionate reliance on personal values to sell products, over-processing, lack of nutritional parody, and poor cooking performance.

The development of cell-based biotechnology-driven meat, poultry, seafood, and dairy proteins will likely impact the plant-based category in the coming years.

Plant-Based Consumers

Nearly half (48%) of adults look for products labeled “plant-based,” per the Hartman Group’s 2021 Health & Wellness: Reimagining Well-Being COVID-19 Report. Nearly one in five (17%) consumers say they always/usually choose plant-based foods/drinks, according to HealthFocus’ 2021 USA Trend Study.

Of those buying plant-based products, 49% are female, 56% are Gen Z or Millennial, 37% have kids at home, 53% are college graduates, and 44% are core or mid-level wellness consumers, per Hartman’s 2020 Food & Technology: From Plant-Based to Lab-Grown Report.

Just over one-third of adults (36%) are currently following a flexitarian eating plan, 5% are true vegetarians, and 3% each are either true vegans or pescatarians, per Packaged Facts’ 2020 Vegan, Vegetarian & Flexitarian Consumers.

Vegans, vegetarians, and flexitarians (VVF) tend to be high income ($100k+), urbanites, and live in the West and Northeast, per Packaged Facts. One-third of mainstream plant-based eaters are interested in vegetarian or vegan fare, per Datassential.

In the past year, 18% of adults have tried a plant-based diet; among these, 10% have tried vegetarian, 7% flexitarian, and 6% vegan, according to Hartman.

Although vegetarians and vegans are the most likely to consume meat/dairy alternatives and other plant-based foods, their numbers are small. The sweet spot for growing sales will include targeting flexitarian and omnivore consumers who make up a greater percentage of the market. Sixty percent of flexitarians eat both meat and dairy alternatives (Figure 1).

Health drives plant-based product choices for just over half of consumers; energy is a relatively new driver for plant-based eating (Figure 2).

Plant-Based Food Sales Growing

Sales of plant-based foods/beverages reached $7 billion for the year ended (Y/E) 12/27/21, up 27% vs. 2019, per the Plant-Based Foods Association. Alternative eggs, dairy spreads/dips, meat, cheese, and tofu/tempeh were the fastest growing categories. Datassential reports that 71% of Americans have tried at least one type of plant-based alternative.

Sales of alternative meats/poultry are expected to reach $2 billion by 2024 (CAGR 13.6%), according to Packaged Fact’s 2020 Meat, Poultry & Seafood Alternatives. Beef, pork, and chicken will be the largest categories; value-added cuts, e.g., chunks, strips, or nuggets, will be the fastest growing.

Alternative seafood sales are estimated to reach $62 million by 2024. One-quarter of seafood consumers say they are very likely to try it, per FMI’s 2021 Power of Seafood. SPINS reports that fishless tuna was the fastest growing shelf-stable plant-based food item for the Y/E 1/21/21.

Plant-based dairy is projected to grow to $5.2 billion by 2024, per Packaged Facts’ 2020 Dairy & Egg Alternatives. Milk, followed by ice cream, yogurt, creamers, and cheese will be the largest categories. Alternative eggs will top $54 million by 2024. Forty-two percent use plant-based milks, ice cream 9%, creamers 8%, yogurt 8%, butter 7%, and cheese 5%.

One-quarter of adults eat plant-based meat or poultry fairly often, per Packaged Facts; 40% have tried alternative meats in the past year, per Mintel’s Plant-Protein U.S. – May - 2021. Those aged 18-44, those in upper-income households ($100k+), urbanites, and those with kids at home are most likely to do so.

Three-quarters of consumers want more blended meat/vegetable items, 64% more plant-based meat alternatives, per FMI’s 2021 Power of Meat.

A clear hierarchy of consumer interest in plant-based foods has emerged. Among frozen foods, 71% are most interested in meals that have more fruits and/or vegetables; 58% plant-based carb/starch alternatives (e.g., riced cauliflower, zucchini pasta); 52% more blended meat/vegetable items; 51% more plant-based entrées; and 43% more meat alternatives, per AFFI’s 2021 Power of Frozen. Plant-based frozen meals posted sales of $520 million in 2020, up 29%, per PBFA.

SPINS reports that frozen breakfast plant-based entrees grew 84%, snacks/appetizers 83%, breakfast patties 59%, and pizza 25% for Y/E 4/18/21, albeit from a small base.

Vegan/vegetarian was the fastest growing dessert claim over the past three years, up 12%, per Mintel’s 2021 Trending on U.S. Menus: Desserts. Lunch, snacks (beyond chips and jerky), and plant-powered/vegan breads/tortillas are other untapped alternative opportunities.

The Plant-Based Food Consumer

Plant-based product consumers are foodies, three-quarters enjoy cooking, 55% bake frequently at home, and 69% regularly seek new products to try, per Packaged Facts.

They are much more willing to pay for clean labels. Sales of plant-based foods/drinks with organic ingredients grew 28% for the Y/E 1/24/21, per SPINS; 27% for non-GMO, 14% Certified B Corporation, and 15% fair trade.

Despite marketers trying to align plant-based eating with popular diets, there is no difference between VVF consumers vs. the general population—with the exception of vegetarians being above average for gluten-free and vegans above average for the keto diet. Low-carb is the most popular diet among VVF and general consumers, per Packaged Facts.

VVF consumers are more than twice as concerned about sensitivities/allergens as the general population. SPINS reports that sales of plant products that were soy-free rose 32% for the Y/E 1/23/21, wheat-free 25%.

Opportunities to grow the plant-based market and drive repeat sales for these informed consumers will include closing the nutrient parity gap, especially critical to entering the children’s market, and providing better instructions for optimal preparation and cooking.

Type of Plant Protein Important for Plant-Based Consumers

One-third of consumers seek out plant-based protein, per Hartman’s 2021 Health + Wellness report. One-quarter say they are eating more plant protein than last year, 22% more meat alternatives, and 18% more dairy alternatives, per IFIC’s June 2021 Health & Nutrition Survey. One-third (31%) are trying to limit their meat intake, per Mintel; 10% all the time, 21% most of the time.

Plant-based consumers are more likely overall to reach for whole food protein sources (e.g., beans/whole grains vs. alternatives, according to Mintel. More than one-quarter of plant-based users mix these products with animal-based foods. Plant-based eaters are equally as likely to select burgers made from whole foods as they are for the trendy meat-like alternatives.

Half of consumers would be extremely/very interested in using more nuts/seeds as a protein source; 43% legumes, including peas, beans, lentils, chickpeas; 43% grains, including wheat, rice, quinoa, oats; tofu/tempeh 16%; and hemp 15%, per HealthFocus USA Study.

There is a very high level of protein experimentation among VVF consumers. Vegetarians are most likely to try new legumes.

Dinner is the most important daypart for considering protein for VVF consumers; vegetarians look for protein nearly equally at breakfast, lunch, and dinner, per Packaged Facts’ Vegetarian report.

Concerns about satiety (being hungry three hours later) and not getting enough protein are among the top concerns with plant-forward eating, per Datassential, cited by 35% and 28% of consumers, respectively. Only 39% of adults feel that vegetarian/vegan meals are as filling as animal/seafood-based options, per Technomic’s 2021 Center of the Plate: Seafood & Vegetarian Trend Report. Helping to satisfy hunger is second only to ensuring a balanced diet as the top motivation for trying to get more protein, per IFIC’s protein report.

One-quarter (26%) of global consumers say they are very particular about the sources of protein they consume and avoid certain ones. The top factors for a “good protein” are a natural source, followed by a complete source, a clean source, and a nutrient-dense source, per HealthFocus’ 2021 Global Protein Report.

Completeness, digestibility, and amino acid content are among the important up-and-coming issues for plant protein in the U.S.

One in five (20%) supplement users took a protein supplement in 2020; 23% of those aged 18-34, 24% 35-54, and 11% aged 55 and older, per CRN’s 2020 Consumer Survey on Dietary Supplements. One in 10 (11%) protein supplement, bar, or drink users took whey protein, 9% plant protein, and 6% soy protein. Sports nutrition protein powders continue to grow as a $6.09 billion business, up 6.5% in 2020 vs 2019, according to Informa Markets.

Plant-Powered Ingredients

Dark green vegetables are the most sought-after fortification/benefit ingredients in functional foods, per the Hartman Group’s 2020 Functional Foods & Beverages and Dietary Supplements. One-third look for superfruits/tree nuts; one-quarter beans, legumes, pulses, and seeds; one in in five cinnamon and turmeric and plant-based protein.

Antioxidants, green tea, electrolytes, superfruits, fiber/prebiotics, and greens are the most sought-after fortifications in functional beverages; one in five look for coconut water, apple cider vinegar, ginger, or turmeric, per Hartman.

Fermented foods, followed by blueberries, green tea, exotic fruits, seeds (e.g., chia, hemp), avocados, spinach/leafy greens, kale, nuts, and salmon are the most sought-after superfoods in 2021, per Pollock Communications’ 2021 What’s Trending in Nutrition Survey.

Hemp CBD was the largest herb/botanical supplement category in 2020 with sales of $549 million, per NBJ’s supplement report (Figure 3).

Four in 10 (44%) of supplement users took herbals/botanicals in 2020; 47% aged 18-34, 51% aged 35-55, and 35% aged 55 and older, per CRN’s 2020 Consumer Survey. Green tea, followed by turmeric, garlic, aloe, cranberry, ginseng, and elderberry were the most taken herbals/botanicals.

Digestive health is the benefit most associated with botanicals, 61% of global consumers; followed by immune support 55%, heart health 53%, weight management 45%, and aging 45%, per Kerry’s 2021 survey.

Historically, weight- and heart-concerned adults have been among the most likely to buy plant-based alternatives. One-third of all generations, except Gen Z, are still struggling with COVID weight gains, per Hunter’s Jan. 2021 Food Study: Wave 2.

Over the last three years, beverages containing botanical extracts have increased by 46% globally, per Kerry’s report. Guava grew 38% and passion fruit 58% in alcoholic beverages, acerola up 146%, and ginger 48% in soft drinks. Honey, cinnamon, blueberry, mint, and raspberry are the most appealing botanical flavors in North America.

Most important going forward is the degree to which younger consumers are looking to emerging plant-based/botanical ingredients for health solutions (Figure 4). Millennials and Gen Zers over index (>120) for use of holy basil/lemon balm for anxiety, milk thistle for detoxification, medicinal mushrooms for immunity, and hemp for inflammation, per Hartman’s supplement study.

Barriers to Business: The Cautionary Tale

As meat/dairy alternative businesses continue to mature, it is becoming more important to rely on balanced and credible product promotions that focus first on taste and health. While IFIC reports that the environment/sustainability has a great impact on food purchase decisions (ranked 4 or 5 out of 5) for 31% of consumers, over-relying on sustainable issues to help sell plant-based foods does not always deliver on expectations.

Only 10% of consumers say that environmental impact best describes their motivation for purchasing plant-based foods, 15% of Gen Z, and 11% of Millennials. Likewise, only 1% of all consumers say climatarian best describes how they eat today, 3% for Gen Z, and 1% for Millennials, per Datassential.

Likewise, while 42% of consumers cite animal agriculture as having the greatest negative impact on the environment in 2021, per IFIC, only 10% of meat shoppers strongly believe that animal agriculture has a lot of negative impact on the environment. Moreover, only 17% of shoppers consider better-for-the-planet, better-for-the-farm worker, and better-for-the-animal when shopping in the meat department, per FMI’s 2021 Power of Meat.

Competition is stiff; organic, no antibiotics ever, and grass-fed now account for 11% of total meat/poultry sales in 2020, or $9.3 billion, per FMI.

Lastly, six in 10 plant-based consumers would eat more meat alternatives if they were less processed; 63% would like to see more meat alternatives made with whole foods (e.g., vegetables), per Mintel. Six in 10 consumers look for minimally processed foods. Only 9% of adults are looking forward to seeing more lab-grown proteins in 2021, according to Datassential.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.