11.30.16

When a giant food company invests $32 million in a startup focusing on personalized nutrition—as Campbell’s recently has—it’s clear that “personalization” has reached its tipping point.

Personalized nutrition is a key growth opportunity for food and beverage companies as consumers increasingly turn to individually-tailored diets.

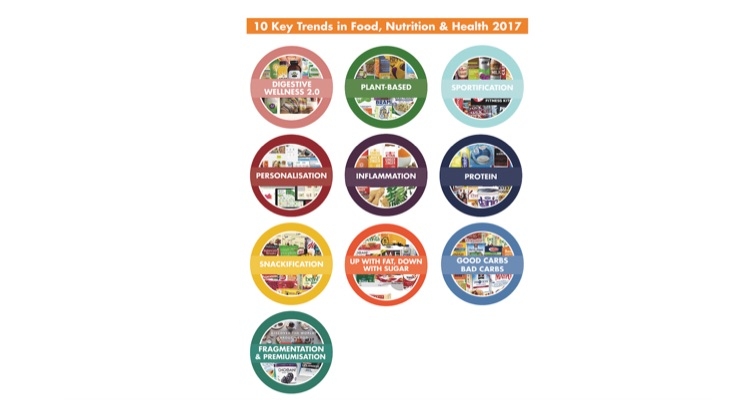

“Personalization is about consumers ‘taking back control’,” said Julian Mellentin, director of New Nutrition Business and author of the newly-published report 10 Key Trends in Food, Nutrition and Health 2017. “They want to feel more empowered and confident to create their own healthy eating patterns. It goes hand-in-hand with growing awareness that diet is a personal matter—and it’s another stage in the long slow death of “one size fits all” dietary recommendations.”

Many consumers are embracing personalized services such as wearable gadgets providing guidelines based on their weight, height, sleep pattern, heart rate and activity. A smaller but growing number of consumers look for more in-depth services, such as a genetic profile, or metabolism and disease risk via DNA tests.

“The industry can tap into the personalization trend in three ways,” said Mr. Mellentin. “First, smart companies will create a portfolio of brands, made to meet the needs of different consumer diets and preferences. Second, they will invest in a multi-platform approach, offering support and tailored dietary advice. This means partnering with entities providing advice on diet planning or with fitness gadgets. Finally, they should invest in e-commerce, as it has proven to be a main route to niche consumers.”

Personalized nutrition services also include tests for biomarkers for chronic inflammation, connecting to another Key Trend for 2017, Inflammation. Mr. Mellentin said this is “the next gluten-free”, or the next high-potential long-term growth opportunity.

“Just like gluten-free back in 2001, many people say inflammation faces several challenges: consumers don’t understand it, it doesn’t have strong scientific support, and you cannot immediately feel the benefit of anti-inflammatory foods. In fact, all of these objections are rapidly being overcome,” said Mr. Mellentin.

And like gluten-free before it, one of the most important drivers of growing interest in inflammation is consumer belief. Like gluten-free, inflammation taps into deeper wells of consumer concern than is immediately apparent. Like gluten-free, it is fuelled by multiple benefit platforms (including the powerful Digestive Wellness trend) and early signs of its potential are connected to the intense growth in consumer interest reflected already in surging sales of supplements of the “flagship” anti-inflammatory spice, turmeric.

Turmeric is a trend in itself—and also a health halo ingredient that acts as a gateway for consumers to the complex idea of inflammation. Turmeric lattes can be found in cutting-edge city-center cafes from Australia to Scotland, and a small but increasing number of adventurous, trend-riding entrepreneurs are starting to use turmeric as a health halo in foods and beverages.

And turmeric’s appeal is not limited to entrepreneurs. Larabar, a former startup nutrition-bar brand now owned by General Mills, recently introduced a line of Organic Superfoods bars in three varieties based on “trend-forward” ingredients, two of which include turmeric.

Growth opportunities can also be found in Key Trend 3: Sportification. Regular foods with a health halo are increasingly popular among people who do sport for health reasons—as opposed to elite athletes—and they want a natural product. “Some people have long argued that sports nutrition would go mainstream, and that foods designed for elite athletes would become regular food for everyone,” said Mr. Mellentin. “While this is happening to some extent, by far the bigger trend is one which has gone the opposite direction. ‘All-natural’ foods are becoming more attractive in sport. Regular food companies, that are not sports-oriented, can drive success if they attach their product to the image of health and sport.”

Digestive Wellness is a long-established benefit platform now entering a new era thanks to new technologies, new products and new understanding of the broad effects that gut health has on overall health. Key trend 1: Digestive Wellness 2.0 explains that consumers want to “feel the benefit” and they are willing to try a variety of routes to get it. The popularity of products with a free-from benefit, such as gluten-, lactose- and dairy-free, was powered by the perception that avoidance of a specific ingredient would make consumers feel better. Many new types of avoidance are emerging—and new food types, notably fermented foods (like kimchi) and drinks (like kombucha) are taking digestive wellness in exciting new directions.

Personalized nutrition is a key growth opportunity for food and beverage companies as consumers increasingly turn to individually-tailored diets.

“Personalization is about consumers ‘taking back control’,” said Julian Mellentin, director of New Nutrition Business and author of the newly-published report 10 Key Trends in Food, Nutrition and Health 2017. “They want to feel more empowered and confident to create their own healthy eating patterns. It goes hand-in-hand with growing awareness that diet is a personal matter—and it’s another stage in the long slow death of “one size fits all” dietary recommendations.”

Many consumers are embracing personalized services such as wearable gadgets providing guidelines based on their weight, height, sleep pattern, heart rate and activity. A smaller but growing number of consumers look for more in-depth services, such as a genetic profile, or metabolism and disease risk via DNA tests.

“The industry can tap into the personalization trend in three ways,” said Mr. Mellentin. “First, smart companies will create a portfolio of brands, made to meet the needs of different consumer diets and preferences. Second, they will invest in a multi-platform approach, offering support and tailored dietary advice. This means partnering with entities providing advice on diet planning or with fitness gadgets. Finally, they should invest in e-commerce, as it has proven to be a main route to niche consumers.”

Personalized nutrition services also include tests for biomarkers for chronic inflammation, connecting to another Key Trend for 2017, Inflammation. Mr. Mellentin said this is “the next gluten-free”, or the next high-potential long-term growth opportunity.

“Just like gluten-free back in 2001, many people say inflammation faces several challenges: consumers don’t understand it, it doesn’t have strong scientific support, and you cannot immediately feel the benefit of anti-inflammatory foods. In fact, all of these objections are rapidly being overcome,” said Mr. Mellentin.

And like gluten-free before it, one of the most important drivers of growing interest in inflammation is consumer belief. Like gluten-free, inflammation taps into deeper wells of consumer concern than is immediately apparent. Like gluten-free, it is fuelled by multiple benefit platforms (including the powerful Digestive Wellness trend) and early signs of its potential are connected to the intense growth in consumer interest reflected already in surging sales of supplements of the “flagship” anti-inflammatory spice, turmeric.

Turmeric is a trend in itself—and also a health halo ingredient that acts as a gateway for consumers to the complex idea of inflammation. Turmeric lattes can be found in cutting-edge city-center cafes from Australia to Scotland, and a small but increasing number of adventurous, trend-riding entrepreneurs are starting to use turmeric as a health halo in foods and beverages.

And turmeric’s appeal is not limited to entrepreneurs. Larabar, a former startup nutrition-bar brand now owned by General Mills, recently introduced a line of Organic Superfoods bars in three varieties based on “trend-forward” ingredients, two of which include turmeric.

Growth opportunities can also be found in Key Trend 3: Sportification. Regular foods with a health halo are increasingly popular among people who do sport for health reasons—as opposed to elite athletes—and they want a natural product. “Some people have long argued that sports nutrition would go mainstream, and that foods designed for elite athletes would become regular food for everyone,” said Mr. Mellentin. “While this is happening to some extent, by far the bigger trend is one which has gone the opposite direction. ‘All-natural’ foods are becoming more attractive in sport. Regular food companies, that are not sports-oriented, can drive success if they attach their product to the image of health and sport.”

Digestive Wellness is a long-established benefit platform now entering a new era thanks to new technologies, new products and new understanding of the broad effects that gut health has on overall health. Key trend 1: Digestive Wellness 2.0 explains that consumers want to “feel the benefit” and they are willing to try a variety of routes to get it. The popularity of products with a free-from benefit, such as gluten-, lactose- and dairy-free, was powered by the perception that avoidance of a specific ingredient would make consumers feel better. Many new types of avoidance are emerging—and new food types, notably fermented foods (like kimchi) and drinks (like kombucha) are taking digestive wellness in exciting new directions.