By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc10.02.18

The $46 billion over-the-counter (OTC) drug category targets many of the ailments for which consumers would rather have natural alternatives. A new marketing category has emerged that has been captured by the coined phrase “natural OTCs.”

With nearly half of consumers worried about the potential effects of long-term use of OTCs, the risk of dependency/immunity, and potential interactions with Rx drugs—per Mintel’s Digestive Health, U.S. 2017—creating natural hybrid OTC-like products that pair medically-active bioactives with specialty nutritionals to help manage occasional minor ailments is a significant idea.

In the past year, 82% of consumers said they have used an OTC drug to treat a new minor ailment; 62% a supplement and/or natural home remedy, per the Consumer Healthcare Products Association. Google reported searches for “self-care” health information jumped 27% in 2017.

While so-called natural OTCs seem to align closely with the condition-specific/specialty supplement category, by definition, they are more focused on managing the symptoms of occasional minor ailments vs. treating disease.

And the future looks good. In 2017, 38% of supplement users took specialty/condition-specific supplements; 29% an herb/botanical, according to CRN’s 2017 Consumer Survey of Dietary Supplements. Herb/botanical supplement sales topped $8.2 billion in 2017; specialty $7.8 billion, per Nutrition Business Journal (NBJ).

Four in 10 consumers were more satisfied with natural OTCs vs. their traditional drug counterparts and 32% equally satisfied, according to Kline & Co. 2016 Natural OTC report. One-third view natural ingredients as more effective; 34% as equally effective. Just about half of adults believe natural OTCs are safer compared to other drugs and 49% would give them to their children.

Sales of homeopathic remedies reached $1.9 billion in 2017, per SPINS. Transparency Market Research’s 2017 Homeopathy Product Market report projected global sales of homeopathic remedies will reach $17.5 billion by 2024.

Categorically Speaking

Cough, cold, and flu remain the largest natural OTC/homeopathic categories. Sales of Hyland’s Oscillococcinum and Hylands’ and Similasan Corp.’s cough/cold homeopathic brands jumped 14% last year. Zicam’s homeopathic Cold Remedy Medicated Fruit Drops claim to help shorten colds. Boiron’s non-drowsy ThroatCalm tablets melt under your tongue. Three of the top 10 best-selling nasal sprays in 2017 were natural remedies, per IRI.

But the opportunity is bigger still. Sales of cough/allergy/sinus tablets posted IRI multi-channel sales of $4.75 billion, up 2.5% for the year ended Mar. 25, 2018, followed by powders, $1.3 billion, up 2.5%; and nasal spray, $1.2 billion, up 3.2%. Sales of cough/sore throat drops topped $175 million, up 5.8% in 2017; cough syrup $146 million, up 10.2%; chest rubs $35 million, up 18.9%; and sore throat remedies for kids of $10 million, up 2.1%.

According to 2018 data from the Centers for Disease Control and Prevention (CDC), 5-20% of U.S. adults catch the flu every year; adults average two to three colds each year—children even more.

Sales of natural remedies for kids continue to soar. Honeyworks’ Kids Soothing Throat Spray Plus Zinc is made with organic honey. Hyland’s Kids and Baby Cold ‘n Mucus products come in day and night formula. Culturelle’s Baby Calm + Comfort drops claim to help reduce crying/fussiness due to upset stomach.

Natural skin care products for babies are used to manage diaper rash; natural fluoride-free, kid-specific training toothpastes and baby electrolytes are other fast-emerging, natural OTC infant opportunities.

Sleep aids are among the fastest growing natural OTC sectors. Category leader Procter & Gamble introduced ZzzQuil Pure Zzzs, which shares the ZzzQuil brand name but contains no drug ingredients and only dietary supplement ingredients (including herbals) to help “fall asleep naturally.” For the year ended Jul. 6, 2017, seven of the top 10 best-selling sleep aid tablets were natural OTCs; eight in 10 of the top liquid sleep aids. Natrol’s Sleep’n Restore Melatonin Gummies contain melatonin instead of drugs as a sleep aid and claim to allow users to “wake up restored with powerful antioxidants.”

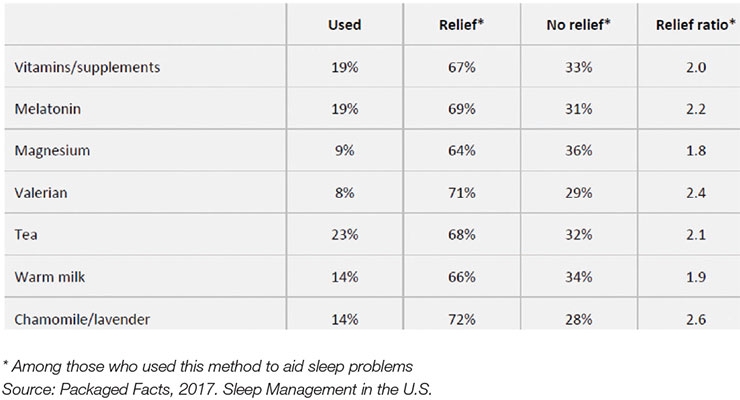

According to Packaged Facts’ 2017 Sleep Management in the U.S., 82% of adults have trouble sleeping at least once a week; 39% five or more nights. Natural sleep aids are the preferred solution for 20% of adults; 18% use OTCs and 15% use supplements. In 2017, 19% took melatonin, 14% chamomile/lavender, 9% magnesium, and 8% valerian for sleep (see Figure 1).

Although sales of probiotic supplements grew 10.2% in 2017 to $1.9 billion and digestive enzymes to $364 million, other untapped opportunities exist in the digestive category for natural OTCs. CRN reported 16% of adults and 13% of millennials took a probiotic supplement last year; 10% of millennials used digestive enzymes.

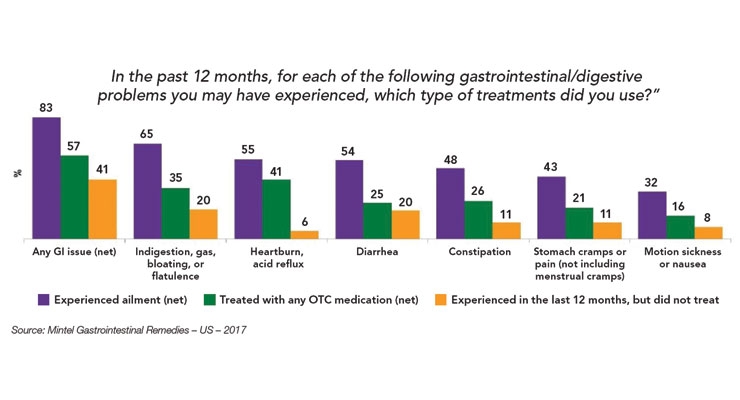

According to Mintel’s Gastrointestinal Remedies – US – 2017, 65% of adults experienced and treated gas, bloating, or flatulence; 55% heartburn/acid reflux; 54% diarrhea; 48% constipation; 43% stomach cramps; and 32% nausea/motion sickness in the past year (see Figure 2). Millennials are the most likely to report GI issues.

With sales of antacid tablets reaching $2.2 billion for the year ended Mar. 25, 2018, per IRI, Nature’s Bounty’s 100% Drug Free Digest HB Gutgard Heartburn Formula will likely find a welcome market.

Laxatives, with sales of $1.8 billion, are another big opportunity for natural OTCs. In 2017, 14% of adults and 23% of millennials took a fiber supplement, per CRN. P&G’s Metamucil fiber supplement claims to not only improve digestive health, but also to lower cholesterol, and helps with appetite and blood sugar control when used as part of a healthy diet.

Millennials are increasingly self-diagnosing themselves with IBS, per Mintel. Schiff’s Digestive Advantage Intensive Bowel Support and Lactose Defense Formula are “symptom-specific probiotic supplements for those who suffer with digestive discomfort.”

Natural pediatric digestive remedies, with U.S. sales of over $200 million last year, are another untapped natural OTC opportunity. One in three children are sent home from school each year with stomach issues, according to the CDC.

Room to Grow

Sales of internal analgesics reached $3.4 billion for the year ended Mar. 25, 2018, per IRI. In 2017, BC’s Aspirin and Acetaminophen pain relieving powders, which contain caffeine, broke into the top 10 U.S. best-selling analgesics list for the year ended Aug. 13, 2017, alongside industry giants including Tylenol, Advil, and Aleve.

With 58% suffering from low back pain, 50% joint pain/soreness, 44% muscle pain, 38% neck pain, 31% foot pain, and 28% headaches (not migraine), according to Packaged Facts’ 2017 Pain Management, more natural pain relievers with fewer side effects are in high demand (see Figure 3).

Five of the top 10 best-sellers in the external analgesic category are natural OTCs including Australian Dream, Blue Emu, and Boiron’s Arnicare. For the year ended Mar. 25, 2018, external analgesic sales topped $799 million, up a whopping 14%, per IRI. Vizuri Pain Bloc topical helps provide arthritis pain relief for 24 hours in a roll-on package.

Similasan Dry Eye Easy Mist has a unique misting spray system and contains natural extracts, including alpine rose and liposomes. According to an October 2017 report in the J. of Ophthalmology (Farrand et. al.), half of adults experience dry eye frequently/occasionally; 16.4 million have been doctor-diagnosed with chronic dry eye. Sales of eye/lens care products reached $1.8 billion, up 2.8% for the year ended Mar. 25, 2018, per IRI.

Two homeopathic brands are among the top four best-sellers in the ear care category. Ear pain, itch, and wax buildup are the major ear-related issues. Consumers spent $86.8 million on ear wax remedies last year, according to IRI.

Five out of the top 10 first-aid ointments, with category sales of $926 million, were also natural OTCs, per IRI. Olay’s Medicated Natural Lip Balm contains Aloe barbadensis leaf extract and other botanical ingredients. Florajen Acidophilus claims to help boost “immunity, digestive, and vaginal/urinary health in women.”

Acne, bruising, and snoring are other emerging homeopathic/natural OTC categories. Boiron’s Arnicare Bruise homeopathic remedy, with all-natural ingredients, reports to help reduce pain, swelling, and discoloration.

Lastly, aromatherapy sales are on fire, up 57% in 2017, per Nielsen. TABS predicted sales will grow 46% in the drug channel in 2018.

Crossover Claims

Not surprisingly, natural OTCs are borrowing classic pharma claims (e.g., triple strength, fast-acting, and technology) for their new products.

Nature’s Bounty’s Optimal Solutions Probiotic has a “controlled delivery, targeted release” system. EZC Pak with echinacea, zinc, and vitamin C is a five-day tapered, step down immune support pill pack. Osteo Bi-Flex’s Joint Health comes in “triple strength” and “shows improved joint comfort within 7 days.”

Not surprisingly, savvy marketers are also borrowing food cues and forms. Metamucil, which comes in an Orange Smooth flavor is also available as a thin cookie, a drink mix, and in to-go packets. Berry Sleepy Sleep, a drinkable sleep solution includes “super fruits, serotonin, thiamine, and melatonin.”

Perhaps most inventive of all are Theraflu’s PowerPods Night and Day Severe Cold, infused with menthol and green tea flavors that allow fast cold relief to be brewed instantly.

Natural OTCs Are Not OTCs

So-called natural OTCs are not drugs and are regulated by the Food and Drug Administration (FDA) as dietary supplements or homeopathic medicines. The OTC market is regulated strictly through a set of published monographs, which include formulas that must be used in order to make allowable disease prevention or treatment claims. Homeopathic products are permitted to make drug claims; but in recognition of their growing market, FDA stated in December 2017 that it intends to increase enforcement action against unproven products or those that target infants.

The bottom line here is that there’s high demand for natural products that treat condition-specific symptoms and everyday ailments. Careful formulations with appropriate-to-regulatory-category messages and claims are imperative, but the economic benefits seem readily available for taking many traditional OTC targets all-natural.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

With nearly half of consumers worried about the potential effects of long-term use of OTCs, the risk of dependency/immunity, and potential interactions with Rx drugs—per Mintel’s Digestive Health, U.S. 2017—creating natural hybrid OTC-like products that pair medically-active bioactives with specialty nutritionals to help manage occasional minor ailments is a significant idea.

In the past year, 82% of consumers said they have used an OTC drug to treat a new minor ailment; 62% a supplement and/or natural home remedy, per the Consumer Healthcare Products Association. Google reported searches for “self-care” health information jumped 27% in 2017.

While so-called natural OTCs seem to align closely with the condition-specific/specialty supplement category, by definition, they are more focused on managing the symptoms of occasional minor ailments vs. treating disease.

And the future looks good. In 2017, 38% of supplement users took specialty/condition-specific supplements; 29% an herb/botanical, according to CRN’s 2017 Consumer Survey of Dietary Supplements. Herb/botanical supplement sales topped $8.2 billion in 2017; specialty $7.8 billion, per Nutrition Business Journal (NBJ).

Four in 10 consumers were more satisfied with natural OTCs vs. their traditional drug counterparts and 32% equally satisfied, according to Kline & Co. 2016 Natural OTC report. One-third view natural ingredients as more effective; 34% as equally effective. Just about half of adults believe natural OTCs are safer compared to other drugs and 49% would give them to their children.

Sales of homeopathic remedies reached $1.9 billion in 2017, per SPINS. Transparency Market Research’s 2017 Homeopathy Product Market report projected global sales of homeopathic remedies will reach $17.5 billion by 2024.

Categorically Speaking

Cough, cold, and flu remain the largest natural OTC/homeopathic categories. Sales of Hyland’s Oscillococcinum and Hylands’ and Similasan Corp.’s cough/cold homeopathic brands jumped 14% last year. Zicam’s homeopathic Cold Remedy Medicated Fruit Drops claim to help shorten colds. Boiron’s non-drowsy ThroatCalm tablets melt under your tongue. Three of the top 10 best-selling nasal sprays in 2017 were natural remedies, per IRI.

But the opportunity is bigger still. Sales of cough/allergy/sinus tablets posted IRI multi-channel sales of $4.75 billion, up 2.5% for the year ended Mar. 25, 2018, followed by powders, $1.3 billion, up 2.5%; and nasal spray, $1.2 billion, up 3.2%. Sales of cough/sore throat drops topped $175 million, up 5.8% in 2017; cough syrup $146 million, up 10.2%; chest rubs $35 million, up 18.9%; and sore throat remedies for kids of $10 million, up 2.1%.

According to 2018 data from the Centers for Disease Control and Prevention (CDC), 5-20% of U.S. adults catch the flu every year; adults average two to three colds each year—children even more.

Sales of natural remedies for kids continue to soar. Honeyworks’ Kids Soothing Throat Spray Plus Zinc is made with organic honey. Hyland’s Kids and Baby Cold ‘n Mucus products come in day and night formula. Culturelle’s Baby Calm + Comfort drops claim to help reduce crying/fussiness due to upset stomach.

Natural skin care products for babies are used to manage diaper rash; natural fluoride-free, kid-specific training toothpastes and baby electrolytes are other fast-emerging, natural OTC infant opportunities.

Sleep aids are among the fastest growing natural OTC sectors. Category leader Procter & Gamble introduced ZzzQuil Pure Zzzs, which shares the ZzzQuil brand name but contains no drug ingredients and only dietary supplement ingredients (including herbals) to help “fall asleep naturally.” For the year ended Jul. 6, 2017, seven of the top 10 best-selling sleep aid tablets were natural OTCs; eight in 10 of the top liquid sleep aids. Natrol’s Sleep’n Restore Melatonin Gummies contain melatonin instead of drugs as a sleep aid and claim to allow users to “wake up restored with powerful antioxidants.”

According to Packaged Facts’ 2017 Sleep Management in the U.S., 82% of adults have trouble sleeping at least once a week; 39% five or more nights. Natural sleep aids are the preferred solution for 20% of adults; 18% use OTCs and 15% use supplements. In 2017, 19% took melatonin, 14% chamomile/lavender, 9% magnesium, and 8% valerian for sleep (see Figure 1).

Although sales of probiotic supplements grew 10.2% in 2017 to $1.9 billion and digestive enzymes to $364 million, other untapped opportunities exist in the digestive category for natural OTCs. CRN reported 16% of adults and 13% of millennials took a probiotic supplement last year; 10% of millennials used digestive enzymes.

According to Mintel’s Gastrointestinal Remedies – US – 2017, 65% of adults experienced and treated gas, bloating, or flatulence; 55% heartburn/acid reflux; 54% diarrhea; 48% constipation; 43% stomach cramps; and 32% nausea/motion sickness in the past year (see Figure 2). Millennials are the most likely to report GI issues.

With sales of antacid tablets reaching $2.2 billion for the year ended Mar. 25, 2018, per IRI, Nature’s Bounty’s 100% Drug Free Digest HB Gutgard Heartburn Formula will likely find a welcome market.

Laxatives, with sales of $1.8 billion, are another big opportunity for natural OTCs. In 2017, 14% of adults and 23% of millennials took a fiber supplement, per CRN. P&G’s Metamucil fiber supplement claims to not only improve digestive health, but also to lower cholesterol, and helps with appetite and blood sugar control when used as part of a healthy diet.

Millennials are increasingly self-diagnosing themselves with IBS, per Mintel. Schiff’s Digestive Advantage Intensive Bowel Support and Lactose Defense Formula are “symptom-specific probiotic supplements for those who suffer with digestive discomfort.”

Natural pediatric digestive remedies, with U.S. sales of over $200 million last year, are another untapped natural OTC opportunity. One in three children are sent home from school each year with stomach issues, according to the CDC.

Room to Grow

Sales of internal analgesics reached $3.4 billion for the year ended Mar. 25, 2018, per IRI. In 2017, BC’s Aspirin and Acetaminophen pain relieving powders, which contain caffeine, broke into the top 10 U.S. best-selling analgesics list for the year ended Aug. 13, 2017, alongside industry giants including Tylenol, Advil, and Aleve.

With 58% suffering from low back pain, 50% joint pain/soreness, 44% muscle pain, 38% neck pain, 31% foot pain, and 28% headaches (not migraine), according to Packaged Facts’ 2017 Pain Management, more natural pain relievers with fewer side effects are in high demand (see Figure 3).

Five of the top 10 best-sellers in the external analgesic category are natural OTCs including Australian Dream, Blue Emu, and Boiron’s Arnicare. For the year ended Mar. 25, 2018, external analgesic sales topped $799 million, up a whopping 14%, per IRI. Vizuri Pain Bloc topical helps provide arthritis pain relief for 24 hours in a roll-on package.

Similasan Dry Eye Easy Mist has a unique misting spray system and contains natural extracts, including alpine rose and liposomes. According to an October 2017 report in the J. of Ophthalmology (Farrand et. al.), half of adults experience dry eye frequently/occasionally; 16.4 million have been doctor-diagnosed with chronic dry eye. Sales of eye/lens care products reached $1.8 billion, up 2.8% for the year ended Mar. 25, 2018, per IRI.

Two homeopathic brands are among the top four best-sellers in the ear care category. Ear pain, itch, and wax buildup are the major ear-related issues. Consumers spent $86.8 million on ear wax remedies last year, according to IRI.

Five out of the top 10 first-aid ointments, with category sales of $926 million, were also natural OTCs, per IRI. Olay’s Medicated Natural Lip Balm contains Aloe barbadensis leaf extract and other botanical ingredients. Florajen Acidophilus claims to help boost “immunity, digestive, and vaginal/urinary health in women.”

Acne, bruising, and snoring are other emerging homeopathic/natural OTC categories. Boiron’s Arnicare Bruise homeopathic remedy, with all-natural ingredients, reports to help reduce pain, swelling, and discoloration.

Lastly, aromatherapy sales are on fire, up 57% in 2017, per Nielsen. TABS predicted sales will grow 46% in the drug channel in 2018.

Crossover Claims

Not surprisingly, natural OTCs are borrowing classic pharma claims (e.g., triple strength, fast-acting, and technology) for their new products.

Nature’s Bounty’s Optimal Solutions Probiotic has a “controlled delivery, targeted release” system. EZC Pak with echinacea, zinc, and vitamin C is a five-day tapered, step down immune support pill pack. Osteo Bi-Flex’s Joint Health comes in “triple strength” and “shows improved joint comfort within 7 days.”

Not surprisingly, savvy marketers are also borrowing food cues and forms. Metamucil, which comes in an Orange Smooth flavor is also available as a thin cookie, a drink mix, and in to-go packets. Berry Sleepy Sleep, a drinkable sleep solution includes “super fruits, serotonin, thiamine, and melatonin.”

Perhaps most inventive of all are Theraflu’s PowerPods Night and Day Severe Cold, infused with menthol and green tea flavors that allow fast cold relief to be brewed instantly.

Natural OTCs Are Not OTCs

So-called natural OTCs are not drugs and are regulated by the Food and Drug Administration (FDA) as dietary supplements or homeopathic medicines. The OTC market is regulated strictly through a set of published monographs, which include formulas that must be used in order to make allowable disease prevention or treatment claims. Homeopathic products are permitted to make drug claims; but in recognition of their growing market, FDA stated in December 2017 that it intends to increase enforcement action against unproven products or those that target infants.

The bottom line here is that there’s high demand for natural products that treat condition-specific symptoms and everyday ailments. Careful formulations with appropriate-to-regulatory-category messages and claims are imperative, but the economic benefits seem readily available for taking many traditional OTC targets all-natural.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.