Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, RD, Sloan Trends, Inc.07.01.13

Hispanics are about twice as likely as the general population to spend whatever it takes to look younger and are willing to pay just about anything when it concerns their health. They’re most often first to try a new health food, nutritional product or diet, according to Packaged Facts/Experian 2013 Consumer Health Survey.

With a median age of 27.6 compared to 37.3 for the U.S. population overall, Hispanics are, not surprisingly, more likely to focus on lifestyle issues and live in households with small children.

A positive mental state/mood and getting enough sleep are the most important elements of a healthy lifestyle for two-thirds of Hispanics, followed by exercising regularly, managing stress and limiting processed foods, reported Mintel’s Hispanic Diet and Wellness – US, Mar. 2013.

Hispanics are uniquely focused on energy and performance. Half (53%) are making an effort to eat a nutritious diet or take nutritional supplements to improve physical performance/endurance or to get an energy boost/enhancement (50%), per Multi-sponsor Surveys’ 2011 Gallup Study of Hispanic Nutrition & Supplement Use.

Young Hispanic men represent an enormous, untapped sports nutrition opportunity; 18% of men aged 18-24 and 12% aged 25-49 take a sports supplement, according to the Gallup study.

Hispanic households are nearly three times more likely to use baby food, cereal and juice, according to Nielsen’s Hispanic Facts, 2013. Hispanics are the most likely group to buy nutritional products for their children (Mintel’s Nutritional Food & Drink – US, Jan. 2013).

On the other side of the demographic spectrum, the Hispanic population aged 50+ is projected to grow 63% from 2011-2021, creating a new and virtually untapped condition-specific market, per Gallup.

While marketing to a group that comes from a wide range of countries and cultures is difficult, the diversity of health products used by Hispanics makes it well worth the effort. For example, 38% of Hispanics use homeopathic or herbal remedies, per Mintel’s Homeopathic and Herbal Remedies – US, Mar. 2013.

Market Potential

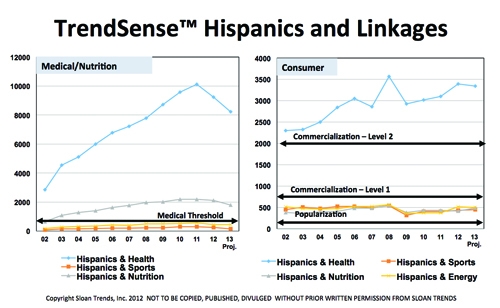

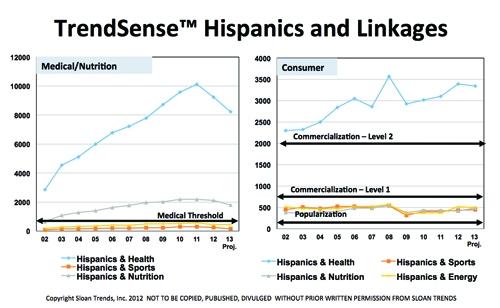

According to Sloan Trends’ TrendSense predictive model, Hispanics and health have represented a large and growing Level 2 mass market—on par with vitamin D or omega 3s—throughout the past decade. There was an artificially inflated jump in marketability of Hispanics and health around 2007-08, likely coinciding with the spotlight on immigration with discussions of Hispanic health issues during the 2008 presidential election.

Interest in Hispanic-specific nutrition is also on the rise. Hispanic nutrition crossed the Medical Threshold in 2002, indicating the beginning of a long-term sustainable trend. The rise of Hispanic health issues in the medical and research communities is likely the result of increasing awareness of the unique predisposition the Hispanic population has for some chronic diseases.

Hispanic sports and energy products have been a stable market in the specialty and health food arenas during the past 10 years. Energy, immunity, weight, satiety and prostate supplements/functional products are more likely to be purchased through traditional Hispanic retail channels (e.g., bodegas, tienda de alimentos naturales, and farmacias) vs. chain drug stores, reported Packaged Fact’s 2012 Targeted Health & Wellness Foods/Beverages.

Growth Opportunities

• Hispanic women over-index for use of menopause, women’s, pre-natal, appearance/beauty, anti-aging supplements and functional foods/drinks (Packaged Facts/Experian).

• Hispanics have high potential in the practitioner channel; they make fewer MD visits but get more MD supplement recommendations than other groups (68% vs. 48% general population, per Gallup).

• Backache, flu, high cholesterol, heartburn, high blood pressure, acid reflux disease, overweight and arthritis are the top diagnosed health conditions among Hispanics (Mintel’s Hispanic Diet & Wellness – US – Mar. 2013).

• One-quarter of Hispanics buy over-the-counter products to strengthen hair/nails, cold/flu (e.g., Airborne, Emergen-C and allergy remedies); one in five joint/muscle stimulants or pain medications (Mintel, Diet & Health).

• 42% of Hispanics are watching their diet for health; 53% to lose or maintain weight, 31% for cholesterol, 29% blood sugar levels, 20% high blood pressure and 20% diabetes (Mintel Diet/Wellness).

• Heart disease, cancer, stroke and diabetes are the top causes of death among Hispanics; other significant conditions include asthma and liver disease (CDC, 2013).

• Half (48%) Mexican-American women have high cholesterol, 48% of men; 29% of women have hypertension, 30% of men (American Heart Association, AHA, 2013).

• Mexican-Americans are twice as likely as Whites to be diagnosed with diabetes, 50% more likely to die (American Diabetes Association, 2013).

• 79% of Hispanics are overweight and 39% obese; 32% of Mexican-American boys aged 2-5 are overweight, 47% aged 6-11 and 41% aged 12-19 (AHA, 2013).

• Hispanics are 30% more likely to buy supplements for arthritis/joint pain (Packaged Facts). Hispanics with arthritis have almost twice the prevalence of work limitation and severe pain vs. Whites (National Arthritis Foundation, 2013).

• Mexican women have the highest rate of diabetes in the U.S.; Mexican men are #1 for high cholesterol; Cuban women for high blood pressure and heart disease (AHA, 2013).

Functional Foods

Hispanics are more likely than Whites to be functional food users. Making up for non-healthy eating/supplementing their diet is their #1 reason for use, followed by digestion, weight control and specific conditions (Mintel, Functional Foods - US, Aug. 2009).

Hispanics are also the most frequent users of functional beverages. Calcium, antioxidants, added vitamins, omega 3s, fiber, green tea and ginseng are among their most sought after drink ingredients (Mintel, Functional Beverages – US, May 2010).

Hispanics are second only to seniors for use of meal supplements (e.g., Ensure); protein is their top reason for use. They’re the #1 users of energy drinks/shots, sports beverages and 100% juice/juice drinks (Packaged Facts, Targeted Health & Wellness Foods & Beverages, Feb. 2012).

Dietary Supplements

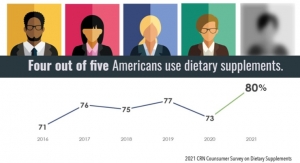

Three-quarters (74%) of adult Hispanics use supplements; 42% make a strong effort to get more nutrients—on par with the general population. They are 6% lower in consumption of vitamins/minerals vs. the general population, but have above average use of herbal supplements (Gallup).

Along with their high use of sports supplements, Hispanics offer other supplement opportunities. They prefer individual supplements to multis. Hispanics over-index for the use of antioxidants, beta-carotene, garlic, flaxseed, gingko biloba and pre-natal vitamins (Gallup).

Lastly, when it comes to conditions, they disproportionately suffer from athlete’s foot, diabetes Type 1 and 2, flu, heartburn and nail fungus (Packaged Facts/Experian, 2013).

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

With a median age of 27.6 compared to 37.3 for the U.S. population overall, Hispanics are, not surprisingly, more likely to focus on lifestyle issues and live in households with small children.

A positive mental state/mood and getting enough sleep are the most important elements of a healthy lifestyle for two-thirds of Hispanics, followed by exercising regularly, managing stress and limiting processed foods, reported Mintel’s Hispanic Diet and Wellness – US, Mar. 2013.

Hispanics are uniquely focused on energy and performance. Half (53%) are making an effort to eat a nutritious diet or take nutritional supplements to improve physical performance/endurance or to get an energy boost/enhancement (50%), per Multi-sponsor Surveys’ 2011 Gallup Study of Hispanic Nutrition & Supplement Use.

Young Hispanic men represent an enormous, untapped sports nutrition opportunity; 18% of men aged 18-24 and 12% aged 25-49 take a sports supplement, according to the Gallup study.

Hispanic households are nearly three times more likely to use baby food, cereal and juice, according to Nielsen’s Hispanic Facts, 2013. Hispanics are the most likely group to buy nutritional products for their children (Mintel’s Nutritional Food & Drink – US, Jan. 2013).

On the other side of the demographic spectrum, the Hispanic population aged 50+ is projected to grow 63% from 2011-2021, creating a new and virtually untapped condition-specific market, per Gallup.

While marketing to a group that comes from a wide range of countries and cultures is difficult, the diversity of health products used by Hispanics makes it well worth the effort. For example, 38% of Hispanics use homeopathic or herbal remedies, per Mintel’s Homeopathic and Herbal Remedies – US, Mar. 2013.

Market Potential

According to Sloan Trends’ TrendSense predictive model, Hispanics and health have represented a large and growing Level 2 mass market—on par with vitamin D or omega 3s—throughout the past decade. There was an artificially inflated jump in marketability of Hispanics and health around 2007-08, likely coinciding with the spotlight on immigration with discussions of Hispanic health issues during the 2008 presidential election.

Interest in Hispanic-specific nutrition is also on the rise. Hispanic nutrition crossed the Medical Threshold in 2002, indicating the beginning of a long-term sustainable trend. The rise of Hispanic health issues in the medical and research communities is likely the result of increasing awareness of the unique predisposition the Hispanic population has for some chronic diseases.

Hispanic sports and energy products have been a stable market in the specialty and health food arenas during the past 10 years. Energy, immunity, weight, satiety and prostate supplements/functional products are more likely to be purchased through traditional Hispanic retail channels (e.g., bodegas, tienda de alimentos naturales, and farmacias) vs. chain drug stores, reported Packaged Fact’s 2012 Targeted Health & Wellness Foods/Beverages.

Growth Opportunities

• Hispanic women over-index for use of menopause, women’s, pre-natal, appearance/beauty, anti-aging supplements and functional foods/drinks (Packaged Facts/Experian).

• Hispanics have high potential in the practitioner channel; they make fewer MD visits but get more MD supplement recommendations than other groups (68% vs. 48% general population, per Gallup).

• Backache, flu, high cholesterol, heartburn, high blood pressure, acid reflux disease, overweight and arthritis are the top diagnosed health conditions among Hispanics (Mintel’s Hispanic Diet & Wellness – US – Mar. 2013).

• One-quarter of Hispanics buy over-the-counter products to strengthen hair/nails, cold/flu (e.g., Airborne, Emergen-C and allergy remedies); one in five joint/muscle stimulants or pain medications (Mintel, Diet & Health).

• 42% of Hispanics are watching their diet for health; 53% to lose or maintain weight, 31% for cholesterol, 29% blood sugar levels, 20% high blood pressure and 20% diabetes (Mintel Diet/Wellness).

• Heart disease, cancer, stroke and diabetes are the top causes of death among Hispanics; other significant conditions include asthma and liver disease (CDC, 2013).

• Half (48%) Mexican-American women have high cholesterol, 48% of men; 29% of women have hypertension, 30% of men (American Heart Association, AHA, 2013).

• Mexican-Americans are twice as likely as Whites to be diagnosed with diabetes, 50% more likely to die (American Diabetes Association, 2013).

• 79% of Hispanics are overweight and 39% obese; 32% of Mexican-American boys aged 2-5 are overweight, 47% aged 6-11 and 41% aged 12-19 (AHA, 2013).

• Hispanics are 30% more likely to buy supplements for arthritis/joint pain (Packaged Facts). Hispanics with arthritis have almost twice the prevalence of work limitation and severe pain vs. Whites (National Arthritis Foundation, 2013).

• Mexican women have the highest rate of diabetes in the U.S.; Mexican men are #1 for high cholesterol; Cuban women for high blood pressure and heart disease (AHA, 2013).

Functional Foods

Hispanics are more likely than Whites to be functional food users. Making up for non-healthy eating/supplementing their diet is their #1 reason for use, followed by digestion, weight control and specific conditions (Mintel, Functional Foods - US, Aug. 2009).

Hispanics are also the most frequent users of functional beverages. Calcium, antioxidants, added vitamins, omega 3s, fiber, green tea and ginseng are among their most sought after drink ingredients (Mintel, Functional Beverages – US, May 2010).

Hispanics are second only to seniors for use of meal supplements (e.g., Ensure); protein is their top reason for use. They’re the #1 users of energy drinks/shots, sports beverages and 100% juice/juice drinks (Packaged Facts, Targeted Health & Wellness Foods & Beverages, Feb. 2012).

Dietary Supplements

Three-quarters (74%) of adult Hispanics use supplements; 42% make a strong effort to get more nutrients—on par with the general population. They are 6% lower in consumption of vitamins/minerals vs. the general population, but have above average use of herbal supplements (Gallup).

Along with their high use of sports supplements, Hispanics offer other supplement opportunities. They prefer individual supplements to multis. Hispanics over-index for the use of antioxidants, beta-carotene, garlic, flaxseed, gingko biloba and pre-natal vitamins (Gallup).

Lastly, when it comes to conditions, they disproportionately suffer from athlete’s foot, diabetes Type 1 and 2, flu, heartburn and nail fungus (Packaged Facts/Experian, 2013).

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.