By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.12.03.21

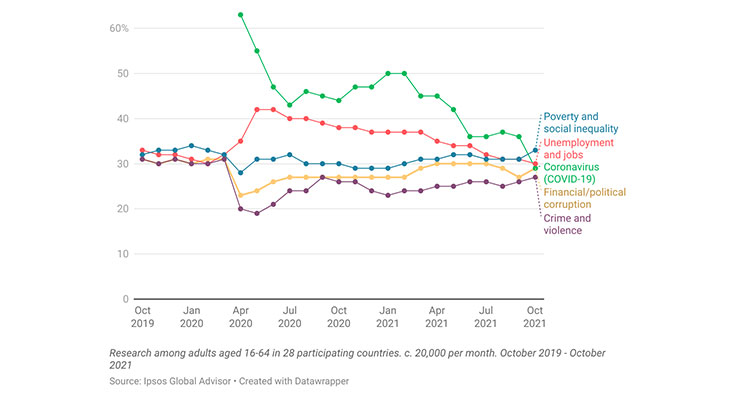

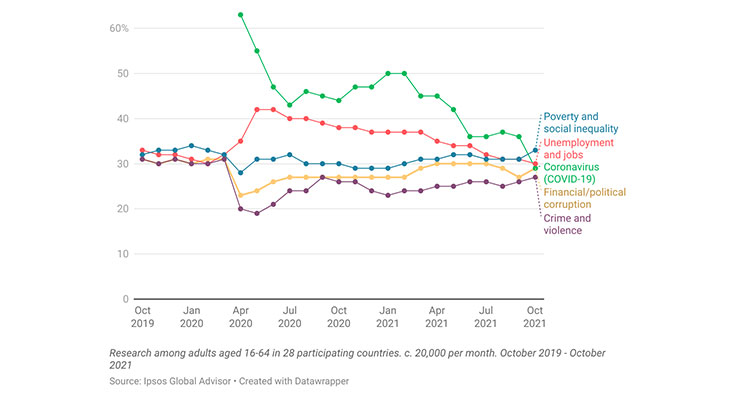

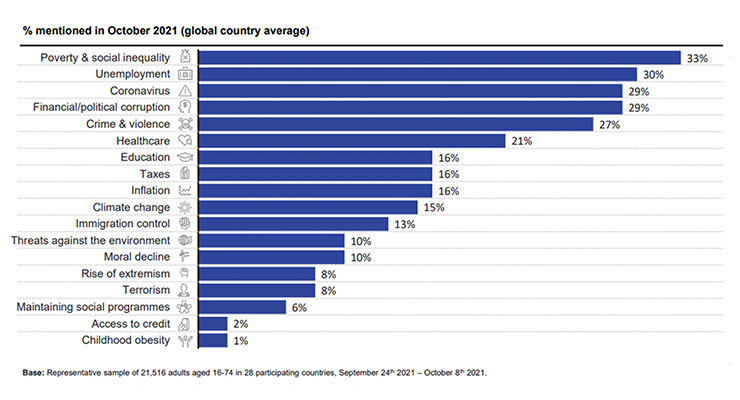

Although coronavirus fell from first to third place among the issues global consumers are most worried about, according to Ipsos’ October 2021 What Worries the World monthly surveys (28 countries, 23,000 adults), pandemic-savvy consumers are continuing to pursue an even more aggressive and diverse approach to health (Figure 1). COVID-19 remains the top concern in Australia, Great Britain, Malaysia, and the U.S.; poverty/social inequity, and unemployment now rank second and third.

Figure 1. What Worries the World?

Global sales of fortified/functional foods reached $172 billion in 2020; functional beverages $102 billion, per Euromonitor (August 2021 Health & Wellness Passport). Four in 10 (42%) global consumers bought more functional foods this year than in 2020, per Kerry’s 2021 global survey (16 countries). Hydration, gut health, immunity, long-lasting energy, and enhanced everyday performance are the new motivators for global functional food/drink purchases, per Innova Market Insights’ 11-country survey (2021).

Weight loss products were the 10th fastest-growing U.S. CPG category overall in mass and convenience channels during the first half of 2021, according to IRI. Sales of foods/beverages carrying an excellent source of potassium claim grew 23%; vitamin E 17%. Those touting higher levels of magnesium jumped 415%, vitamin C 24%, and potassium 23%. Center-store foods/drinks for diabetes support grew 14%; hypertension 9%; low sodium 12%. Year-end 2020 sales of foods/drinks promoting immunity, antioxidants, or botanicals were each up 12%; those carrying an FDA nutrient claim 10%, per IRI.

Four in five (79%) U.S. adults now take dietary supplements, an all-time high, according to the Council for Responsible Nutrition’s 2021 Consumer Survey on Dietary Supplements (November 2021).

While U.S. supplement sales are expected to slow from the spike of 14.5% in 2020 to $55.7 billion, Nutrition Business Journal (NBJ) projects they will deliver an additional $1.8 billion in sales by 2024.

Global supplement sales reached $156 billion, up 9.7% in 2020: $22.9 billion in China, $18.8 billion in Europe, and $17.1 billion in Asia (not including China or India), per NBJ.

Among the 40% of U.S. adults who say their views on health/wellness have changed this year, two-thirds are more concerned about their immediate/long-term health, 60% mental health, 56% being physically active, and 42% about aging, per the Hartman Group’s 2021 Health & Wellness report.

IRI/Kline’s 2021 Consumer Health-Care Explosion report noted that 28% of U.S. adults are avid self-care consumers; an additional 41% now take some daily health-related action; 24% act occasionally.

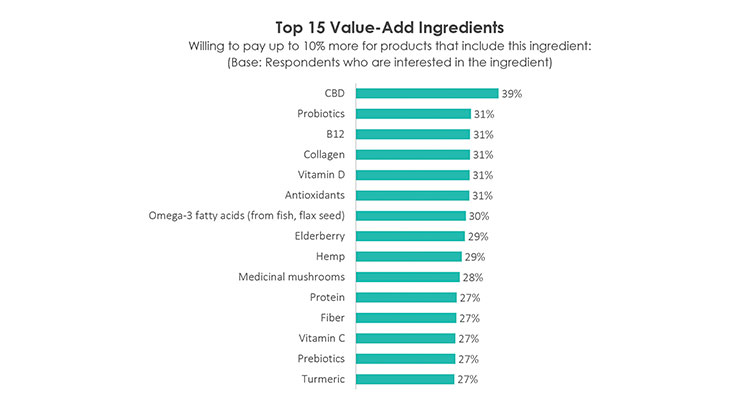

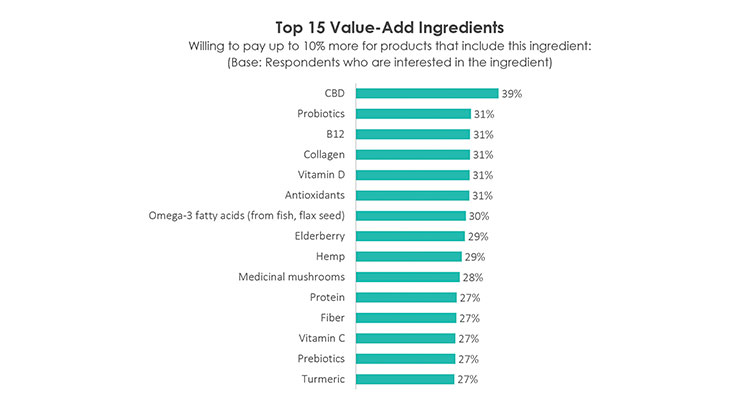

Moreover, post-pandemic consumers have reprioritized the list of nutritional ingredients they’re willing to pay more for, according to HealthFocus’ 2021 USA Survey. CBD, probiotics, vitamin B12, collagen, vitamin D, and antioxidants topped the list.

Accelerating health trends of self-reliance, prevention, alternative therapies, digital health support, and an increased comfort with data sharing in exchange for personalized products/services are among the new nutraceutical market drivers. Moreover, the recent economic bifurcation of consumer purchasing behavior will offer further opportunities for premium and value-based multi-functional health solutions.

While we will be identifying new and emerging opportunities and issues in our 2022 Getting Ahead of the Curve series, before going forward, it is important that nutraceutical marketers reevaluate the emerging nuances of some currently trendy industry platforms.

Over-Reliance on Sustainability

While sustainability, planetary health concerns, and social issues continue to elicit a high level of consumer concern—and emotion worldwide—relying too heavily on these causes to help market nutraceutical products often underdelivers on point-of-purchase expectations. One-quarter of U.S. consumers say they always/usually base their purchases on sustainability, up 4 points vs. 2019, per the Hartman Group’s “Sustainability 2021 Environment and Society in Focus.”

Some overzealous market researchers have gone as far as predicting that planetary health will be a greater global purchase motivator/concern in 2022 than consumers’ own or their family’s personal health.

Moreover, although seven in 10 (72%) U.S. consumers say they’d spend more/extra money on a product or company that aligns with their personal sustainability values, only 22% can identify a sustainable product; 17% a sustainable company, according to Hartman. Although nine in 10 adults consider at least one environmental or social well-being issue when choosing foods/drinks, no one issue dominates their thought process.

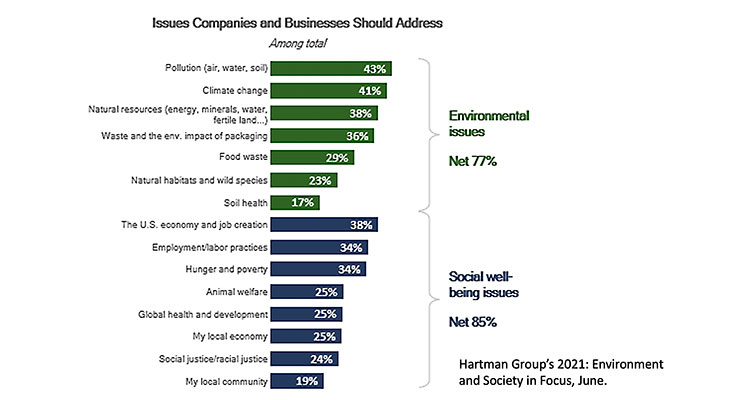

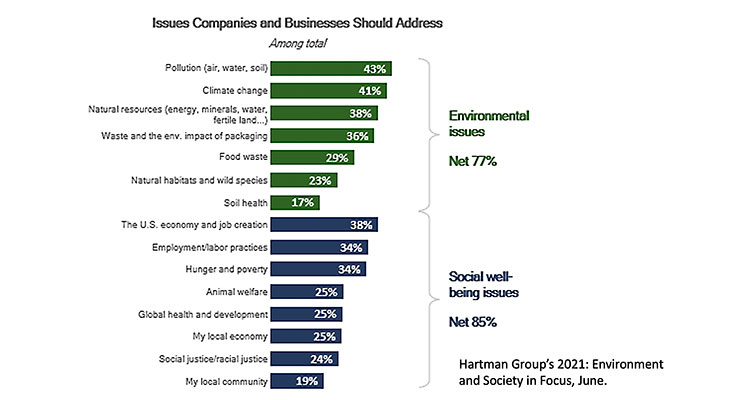

Since 2019, U.S. consumers have redefined their sustainability agenda and now see the environment and social well-being as two separate but equal important areas of need. In the environmental arena, shoppers look to minimizing pollution, impacting climate change, and preserving natural resources (Figure 2). Young consumers are more likely to want marketers to tackle issues further removed from home (e.g., food waste, soil health, and planet health), per Hartman.

Figure 2. Issues Companies and Businesses Should Address

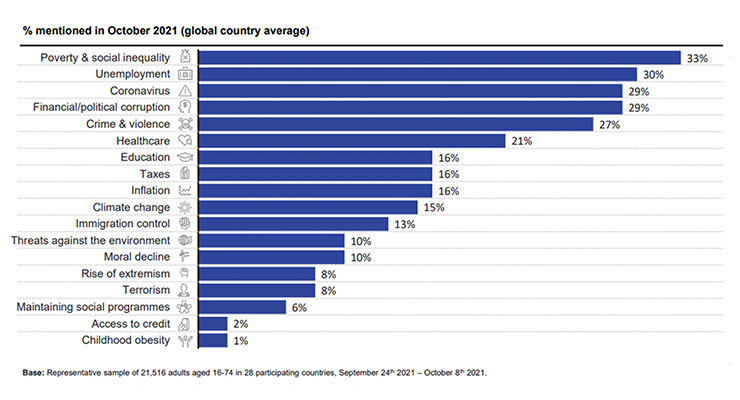

Climate Change. Climate change ranks 10th among the top 18 issues global consumers are most worried about, per Ipsos, cited by 15%—just behind education, taxes, and inflation. Over half (56%) of global consumers say they’ve modified their behavior due to climate change, down from 69% in January 2020, per Ipsos 2021 Global Advisor online platform (23,000, 29 countries) (Figure 3). Canada, Germany, Australia, the Netherlands, and Great Britain are the most concerned about climate change, with just under one-third of residents citing it in their top three concerns; one-quarter in the U.S.

Figure 3. World Worries: The Full List

Globally, the individual actions most often taken to counteract climate change are recycling or composting (each 46%); four in 10 are trying to save water/energy at home and minimize food waste; one-quarter avoid over-packaged products; 27% buy more sustainable food; 22% eat less meat, and 12% less dairy, according to Ipsos.

The countries experiencing the biggest decline since last year in their share of environmentally-conscientious consumers include Malaysia (62%, down 23 points), Spain (53%, down 23 points), Poland (49%, down 23 points), and France (52%, down 21 points).

In the U.S., 8% of adults regularly look for small carbon footprint or carbon neutral on-pack information when shopping for food, 15% when shopping online, per IFIC’s 2021 Food & Health survey. Of the 39% aware of a Certified Carbon Neutral label, when present, 29% would be very likely to buy the product, per Hartman.

Only 1% of U.S. consumers say that “climatarian” best describes the way they eat today, per Datassential.

In November 2021, the U.S. Department of Agriculture announced a new global platform designed to address global sustainability and climate change in collaboration with the European Union. The U.K.’s Net-Zero strategy will force U.K. firms to show how they will adopt a low-carbon future from 2023. Mondelez and Panera Bread are among the diverse companies pledging net zero greenhouse gases by 2050.

Sustainable Sourcing. Of Americans who believe that a product’s environmental sustainability is very/somewhat important to them, recyclable packaging (50%) and being labeled as sustainably-sourced (45%) top the list, according to IFIC. Seven percent of supplement buyers look for packaging made with recyclable content, per CRN.

Although 42% of consumers believe that animal agriculture has the greatest negative impact on the environment, per IFIC, just 10% of meat shoppers “strongly believe” that it has a lot of negative impact. Only 17% consider better-for-the-planet, workers, or animals when shopping in the meat department, per FMI’s 2021 Power of Meat report. One-third (31%) of seafood eaters now opt for sustainably sourced fish/seafood.

Pure & Simple. Traditional claims conveying pure and natural still resonate best with consumers when purchasing supplements and functional foods.

Three-quarters of consumers look for foods/beverages that are locally grown/produced, up 5% vs. 2019; two-thirds look for antibiotic-free, up 6%, and hormone-free, up 3%, per Hartman’s wellness report. Six in 10 look for products that are non-GMO verified, up 6%, or those labeled organic. One-third buy organic to avoid GMOs, per the Organic Trade Association.

Natural is the label term most important for 20% when buying supplements, per CRN’s 2021 survey; 19% look for supplements labeled non-GMO; 14% organic.

The definition of local has broadened beyond a mile radius or state lines to include the country of source and family farms, per FMI’s 2021 Power of Produce.

Products with origin claims (e.g., “made in the USA,” “artisanal,” “local,” or “craft”) posted the highest dollar sales growth among foods/beverages carrying a benefit descriptor in 2020, up 18%, according to IRI.

Sales of foods positioned as non-GMO grew 12% in 2020, per IRI. Knowing whether a food/ingredient is bioengineered is important to four in 10 consumers, according to IFIC. Half of consumers still rank pesticides/residues among the top three food safety issues.

Ag Production. Agricultural production and sourcing attributes are increasingly shaping consumers’ consideration set when shopping for food/beverages, according to Hartman’s wellness report.

Knowing a food was produced using farming techniques that help reduce the impact on natural resources is very/important to four in 10 consumers, according to IFIC.

Interest in grass-fed animal products has climbed by 8% since 2019. Sales of organic, antibiotic-free/hormone-free, and grass-fed meat account for 11.4% of all meat sales, up 18.1% to $9.3 billion, according to FMI’s meat report.

Hartman reports that over half of U.S. consumers are aware of the term regenerative agriculture, up 10 points from 2019. Among those aware (32%) of the Regenerative Organic Certified label, 68% are more likely to buy the product. One-third say they know a lot/little about the Upcycled Certified label; of those, it makes 70% more willing to buy.

According to Hartman, just over half of consumers look for foods/drinks that are fair trade certified, up 8 points vs. 2019; cooperatively produced, up 7%; and are heritage/heirloom, up 5%.

A Plant-Based Plateau?

There is little doubt that interest in plant-based is strong. Nearly half (48%) of consumers look for foods/drinks labeled “plant-based,” per Hartman’s wellness report. Twenty-nine percent of adults eat meat alternatives at least once a month; 40% of those aged 18-44, per YouGov’s May 2021 Meatless Products survey.

Despite strong growth in the plant-based foods sector, unchecked issues with over-processing; rising demand for natural, whole-food alternatives; interest in the completeness of protein and its amino acid complement; as well as emerging negative perceptions of plant-based protein’s impact on the environment may well re-align the plant-based segment.

Growing concern about ingredients and processing levels of these products—especially plant-based meat alternatives—is sending more discerning consumers, including vegans, in search of simpler, purer replacements, per Hartman’s 2021 Wellness report. Consumer avoidance of plant-based protein has doubled since 2019 to 14%, per Hartman’s Health + Wellness report.

Three-quarters look for foods/drinks that are minimally processed, up 3% since 2019, per Hartman. Plant-based consumers are among the most willing to pay for clean labels. Six in 10 plant-based consumers would eat more meat alternatives if they were less processed, according to Mintel’s 2021 Plant Protein - U.S.

Trial and repeat sales of plant-based meat alternatives are cooling at retail, per IRI/210 Analytics. At mid-year, plant-based meat alternatives had a U.S. household penetration of 8.1%. Although still growing, albeit from a small base, sales of frozen alternatives were up 7% to $730 million; refrigerated up 25% to $480 million. IRI projects that, ultimately, plant-based meat alternatives will continue as a “nice niche” similar to organic and grass-fed.

In restaurants, orders of plant-based burgers/sandwiches were unchanged for the year ended June 2021, while beef burger orders climbed 12%, per NPD/CREST (October 2021). Some fast food restaurant tests for plant-based burgers are stalling in trials; others (e.g., Dunkin’) have pulled their alternate meat offerings.

Plant-based consumers are more likely to reach for whole food protein sources like beans and whole grains, according to Mintel. Nearly two-thirds (63%) would like more meat alternatives made with whole foods (e.g., vegetables).

Half of plant-based consumers are interested in using more nuts/seeds as a protein source; 43% more legumes (e.g., peas, beans, lentils, and chickpeas); 42% grains (e.g., rice, quinoa, and oats); and 16% more tofu/tempeh, according to HealthFocus.

IFIC reports one-quarter of consumers are eating more plant protein than last year. One in five (21%) supplement users took a protein supplement in 2021; 27% aged 18-34; 27% aged 35-54; and 12% aged 55 and older, per CRN’s 2021 survey.

More than half (58%) of protein supplement, bar, or drink users took whey protein; 51% took plant protein; and 29% soy protein. Completeness, digestibility, and amino acid content are among the important up-and-coming issues for plant protein in the U.S.

One-quarter (26%) of global consumers say they are very particular about the sources of protein they consume, and avoid certain ones. The top factors for a “good protein” are a natural source, followed by a complete source, a clean source, and a nutrient-dense source, per HealthFocus’ 2021 Global Protein Report.

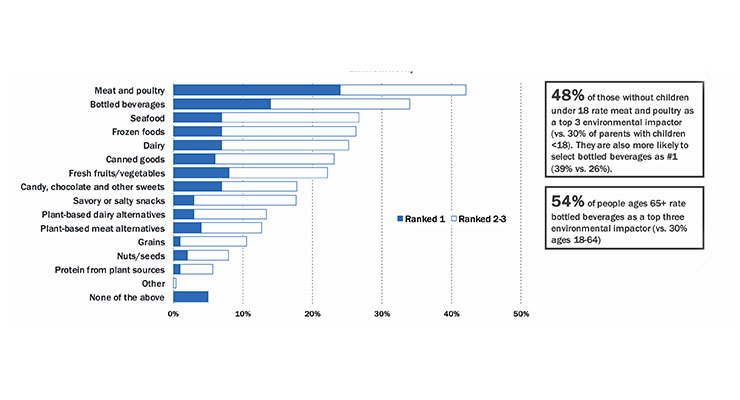

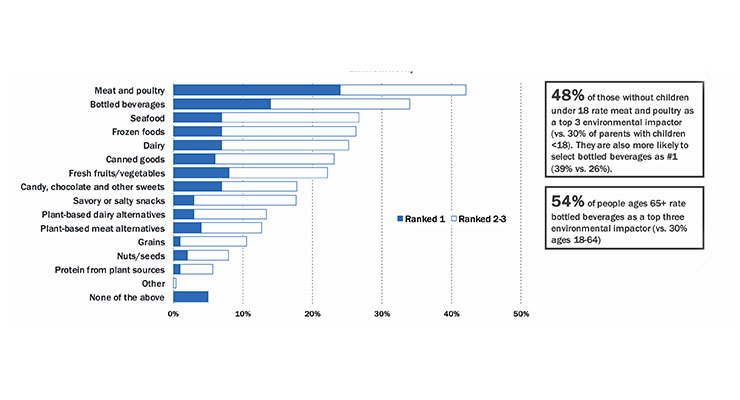

At the same time, plant-based meat/dairy are increasingly being considered as destructive to the environment/planet. IFIC reports that 13% of adults cite plant-based dairy, and 12% mention meat alternatives as being among the top three food practices that have the greatest negative effect on the environment (Figure 4).

Figure 4. Items with the Greatest Negative Impact on the Environment

Only 10% say that environmental concerns “best describe their motivation” for purchasing plant-based foods; 15% of Gen Z and 11% of Millennials, per Datassential.

Labeling products that are naturally plant-based, such as wine, coffee/tea, or potato chips, as “plant-based,” is increasing and may well lead to a loss of credibility, similar to the use of the terms natural and gluten-free.

True nutritional parity for animal alternatives is essential (e.g., dairy vs plant-based milks), especially for companies interested in entering the children’s

food market.

Concerns about satiety/feeling hungry and not getting enough protein are among the top issues with plant-forward eating, per Datassential, cited by 35% and 28% of consumers, respectively. Conversely, more energy, weight management, and heart health benefits are among the new untapped motivators, per Mintel.

In the past year, 18% of adults have tried a plant-based diet; among these, 10% have tried vegetarian, 7% flexitarian, and 6% vegan, according to Hartman.

Lastly, the development of cell-based, biotechnology-driven meat, poultry, seafood, and dairy proteins will likely impact the plant-based category in the coming years. One in five (18%) are very/extremely interested in cellular agriculture, per HealthFocus. Conversely, 55% of food shoppers reject the idea of cell-based meat/poultry and say they’d never purchase it, per FMI’s meat report.

Aligning Scientific Support with Market Terminology

With misinformation projected to be the next global health pandemic by Axios, anchoring nutraceutical claims/benefits to a strong, reputable medical body of evidence is more important than ever. Consumers rely on the product label to convey information about the product and are interested in claims.

According to CRN’s 2021 Consumer Survey on Dietary Supplements, 22% of consumers said that “label claims (e.g., heart health, maintain joint health)” are the most important purchase-decision-making factor. Doctor’s recommendations and price are other primary drivers for purchase decisions. Somewhat alarming is that only 9% believe that “marketing claims indicating product ingredient(s) are backed by science.”

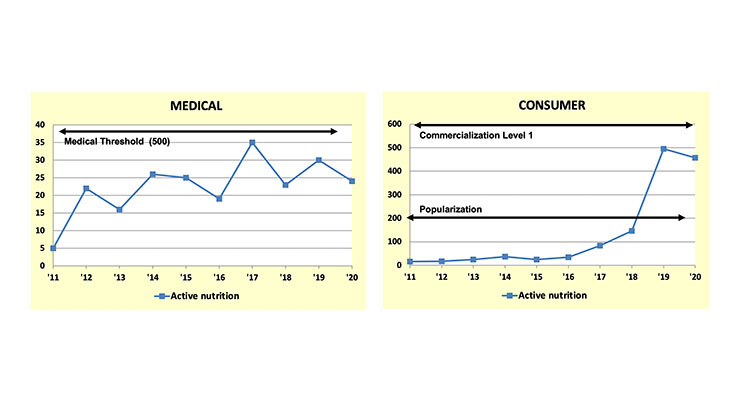

To remain credible with consumers, it is also important that marketers label new market segments, ingredients, or even demographic groups using terminology that is consistent with terminology in the scientific literature. For example, in 2017 Sloan Trends first identified a new “fit consumer” mainstream demographic and nutraceutical opportunity characterized by consumers who exercised three or more days per week and were taking action to improve their everyday mental/physical performance, and presented it at SupplySide West. This “fit” consumer began to dominate the traditional sports nutrition marketplace.

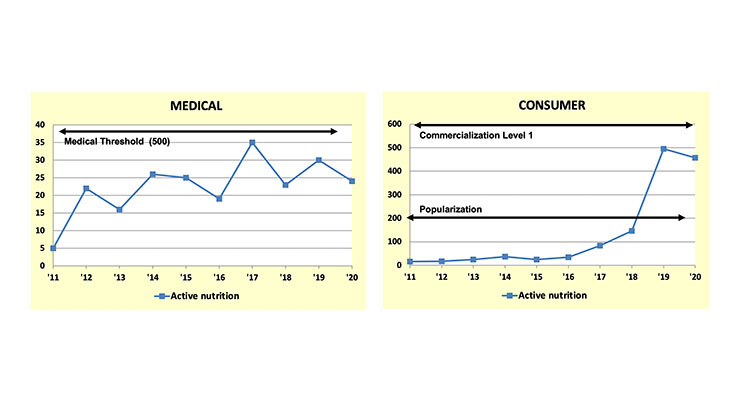

According to Sloan Trend’s TrendSense model, this new demographic quickly became a viable market opportunity in specialty/health food channels and among very health-conscious core consumers. Some marketers have begun to refer to this segment as “active nutrition.” At this time, it appears that “active nutrition” is not an ideal term for this emerging market as it does not link directly to terms or real medical concepts being researched in the medical literature, nor is it a formal nutrition/medical discipline (Figure 5).

Figure 5. TrendSense Predictive Model: Active Nutrition

Active nutrition has not crossed over the Medical Threshold, which signals a long-term sustainable trend and a strong and growing body of scientific research supporting the same terminology. Use of other terms (e.g., relating to everyday performance) is likely highly preferable. Globally, 53% are buying foods/drinks for everyday performance, 40% for athletic support. Conversely, well-described terms (e.g., exercise and heart) have reached mega market status.

At the same time, as markets mature and consumers become more sophisticated about a topic, they tend to circumscribe into more specific terms. Who can forget the term phytochemical, a classic umbrella category which eventually gave way to highly marketable ingredients (e.g., lycopene and lutein). Knowing when a category is about to migrate and refine terminology can provide a significant market edge. Classic category terms (e.g., women’s health), are currently less attractive than marketing their individual categories or components.

The Promised ‘High’ from CBD May Be Wearing Off

The simple way to summarize the cannabidiol (CBD) marketplace today is, well, it’s complicated. Following aggressive sales and projections in the mid 2010s, growth in the sale of CBD products, including supplements, topicals, and food and beverage, has stalled.

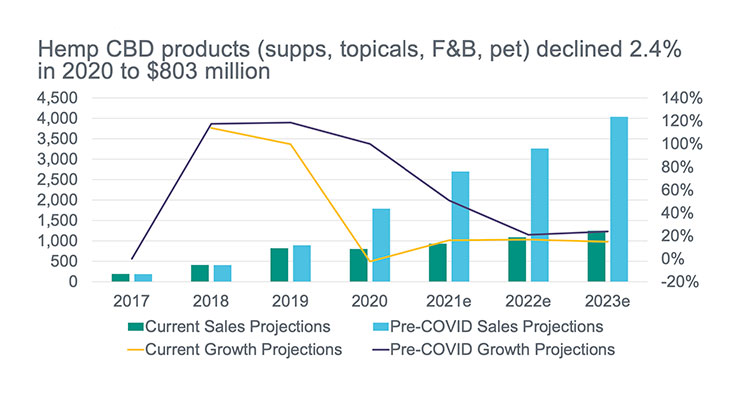

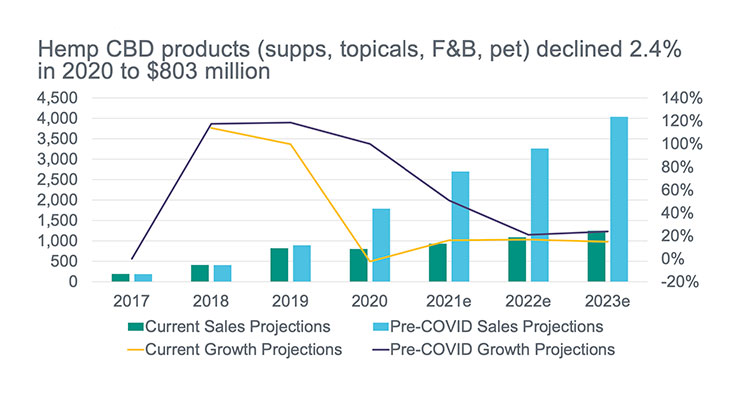

Sales of hemp/CBD natural and organic products including supplements, topicals, food/beverage, and pets posted disappointing sales of $803 million, down 2.3% in 2020, despite urgent demands for relief during the pandemic (Figure 6). This situation can be explained by one or both of two phenomena. First, sale of hemp-derived CBD in foods, beverages, and dietary supplements is illegal in the U.S. today. Second, there is little “high” associated with consumption of hemp-derived CBD containing less than 0.3% THC (delta-9-tetrahydrocannabinol, one of the active components in marijuana).

Figure 6. Hemp CBD Product Sales Decline

The Food and Drug Administration (FDA) has approved only one CBD product, a prescription drug (Epidiolex) used to treat seizures associated with rare pediatric diseases, including Lennox Gastaut syndrome (LGS), Dravet syndrome (DS), or tuberous sclerosis complex (TSC) in people over one year of age.

The Farm Bill of 2018 removed hemp and derivatives of cannabis with less than 0.3% THC from the legal definition of marijuana, thereby removing it from the controlled substance list. Three hemp seed products advanced through the FDA’s GRAS (Generally Recognized As Safe) review in 2018 and may be used in foods, including hulled hemp seed, hemp seed protein powder, and hemp seed oil. But hemp seeds do not contain any THC.

FDA has issued warning letters to marketers of CBD-containing products. The agency recognizes these products and claims associated with them as marketing of unapproved new drugs. FDA has stated that it’s monitoring the marketplace for CBD-containing products and will take action to protect public health.

Meanwhile, the agency is evaluating the safety of CBD and is very likely aware of the sale of CBD-containing food products which are being marketed illegally. Despite states that have legalized the recreational use of marijuana, it remains illegal to put marijuana or cannabis-derived CBD in foods, beverages, and dietary supplements. Some states have legalized the use of cannabis-derived CBD for medical use only. Products available in CBD dispensaries vary by state and include oils, pills, vaporizers, sprays, and foods. But any CBD-containing food product sold in the U.S. is under the authority of the FDA, which says, no, it’s not legal (at least not yet).

Meanwhile, the CBD marketplace churns along, albeit slowly, with fairly robust projections. According to IRI (BDSA Consumer Research, 2021), almost half of Americans favor legal cannabis (48%) and 64% believe it has medical benefits. State-approved dispensaries and medical marijuana continue to gain strength and are posting significant sales, representing a key barometer. According to projections from IRI and its CBD research partner, BDSA, sales of medical marijuana will reach $2.7 billion by 2026, CBD hemp infused product sales at retail will hit $16.9 billion, and “legalized” dispensaries will yield $41.3 billion.

In 2021, 7% of U.S. supplement users took CBD, up from 4% in 2020; 11% of those aged 18-34, 8% aged 35-54, and 4% aged 55 and older, per CRN. CBD now tops the list of value-added health ingredients for which consumers would be willing to pay up to 10% more, according to HealthFocus (Figure 7).

Figure 7. Health Ingredients Consumers Willing to Pay up to 10% More

Adult-use continues to grow in states with relatively long-standing cannabis legalization, up 25% in 2021 vs. 2020 in California; and growth is more rapid in states only recently legalizing the substance, up 101% in Illinois. The projected top markets for CBD products in 2026 are California, Colorado, Florida, New York, and New Jersey.

Dollar sales of edibles are up 39% in 2021 vs. 2020 with candy the number one product (i.e., gummies). Beverages, although much touted in the media, are actually a small percentage of sales, at 5% of the market. Consumers are seeking CBD products to help them relax, get mellow, relieve pain, and sleep better. They are represented equally in gender at 50-50, almost half (41%) have children, most (84%) are city or suburban dwellers, and they tend to be more highly educated than the general population.

The CBD market for pets is strong with product sales fast approaching $100 million, according to Packaged Facts 2021 Pet Supplement Report. One in five (21%) dog owners and 10% of cat owners have purchased a CBD supplement in the past year. Half of dog or cat owners would be interested in purchasing CBD supplements for their pet if they were legal, up from 29% a year ago; 48% if they remain in the gray regulatory area. Stress, anxiety, and calming are the top reasons owners purchased pet CBD supplements; followed by general health, joint/mobility, skin/coat, immunity, and pain management.

Following Fake News — It’s Time to Fix It

Social media is a powerful tool for raising awareness and personally engaging with consumers about nutraceutical products and services. But fast-emerging trust issues, including inappropriate intent to influence internet trends and manipulate search data to guide product development and market products, threaten to dampen the value and credibility of this powerful business tool.

Although three-quarters of CPG brands have planned to increase their advertising budget for social media over the next year, per the 2021 Nielsen Total Audience Report, only 16% of those aged 18-34, 17% aged 35-49, and 20% aged 50 and older say that product claims made in advertisements on social media are very trustworthy: 23%, 26%, and 31% only somewhat trustworthy.

Moreover, of the 53% of U.S. consumers who get news on social media, including health news, only 39% expect it to be accurate, per Pew Research Center’s April 2021 Social Media Use in 2021. Only one-third of companies are confident they can accurately measure return on investment for social media.

Globally in 2021, 4.5 billion people age 13 and older or 63% of the population were social media users, according to Backlinko. The average social media user engages with 6.6 social media platforms. Facebook is the leading social network globally with 2.9 billion monthly active users, followed by YouTube (2.3 billion), WhatsApp (2 billion), FB Messenger (1.3 billion), and WeChat (1.2 billion).

In the U.S. there are 240 million social media users, 72% of all Americans. YouTube and Facebook continue to dominate with 81% and 59%, respectively, using their sites, per Pew. Four in 10 use Instagram; about three in 10 Pinterest or LinkedIn; one-quarter each Snapchat, Twitter, or What’s App; 21% TikTok; and 13% Nextdoor.

Some 84% of those aged 18-39, 81% aged 30-49, 73% aged 50-64, and 45% age 65 and older in the U.S. are social media users, per Pew Research; more women than men. Hispanics and Blacks are more likely to use Instagram and What’s App. Those with higher education are more likely to use LinkedIn, women Pinterest, and urbanites Nextdoor, per Pew.

Internet trends and consumers’ internet search data have long proven to be misleading as a major data source to guide new product development and should only be considered as a peripheral data point. For example, U.S. and worldwide Google consumer search data show searches for information on heart health and magnesium is flat over the past few years, and interest in weight loss information is falling in 2021. But these categories are all enjoying double-digit growth.

What is often missed for trend work is that these social media channels are driven by paid advertising and public relations organizations promoting their products/messages, often front-loading information and creating a swell of clicks to position their messaging as setting a trend. Social media is not a channel where consumers pursue content on their own, but rather respond to what is there.

Lastly, with the percentage of e-commerce-purchased supplements sales projected by NBJ to rise from 10% in 2019 to 24% in 2024, marketers will have an even greater opportunity to promote their products and make health claims on the internet vs. point-of-purchase materials.

As such, it will be critical to provide sound scientific support for product positioning and claims. Currently, the Cleveland Clinic has begun challenging copy and experts at TikTok to help stem the current tide of rising misinformation.

Marketers of nutraceutical products will be well-served to know the proven benefits of their products and to appropriately market them to consumers. FDA has become a savvy purveyor of company websites and e-commerce marketing tools (e.g., Amazon). Health claims are valuable tools to market products, and appropriate structure/function claims about health promotion are permissible; disease prevention claims are not. FDA delivers warning letters to marketers unaware of the nutraceutical labeling rules, or those willing to bend or break them. It is possible to stay within the regulatory lines and use truthful and artful marketing to sell products to consumers, without the threat of product seizure.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Figure 1. What Worries the World?

Global sales of fortified/functional foods reached $172 billion in 2020; functional beverages $102 billion, per Euromonitor (August 2021 Health & Wellness Passport). Four in 10 (42%) global consumers bought more functional foods this year than in 2020, per Kerry’s 2021 global survey (16 countries). Hydration, gut health, immunity, long-lasting energy, and enhanced everyday performance are the new motivators for global functional food/drink purchases, per Innova Market Insights’ 11-country survey (2021).

Weight loss products were the 10th fastest-growing U.S. CPG category overall in mass and convenience channels during the first half of 2021, according to IRI. Sales of foods/beverages carrying an excellent source of potassium claim grew 23%; vitamin E 17%. Those touting higher levels of magnesium jumped 415%, vitamin C 24%, and potassium 23%. Center-store foods/drinks for diabetes support grew 14%; hypertension 9%; low sodium 12%. Year-end 2020 sales of foods/drinks promoting immunity, antioxidants, or botanicals were each up 12%; those carrying an FDA nutrient claim 10%, per IRI.

Four in five (79%) U.S. adults now take dietary supplements, an all-time high, according to the Council for Responsible Nutrition’s 2021 Consumer Survey on Dietary Supplements (November 2021).

While U.S. supplement sales are expected to slow from the spike of 14.5% in 2020 to $55.7 billion, Nutrition Business Journal (NBJ) projects they will deliver an additional $1.8 billion in sales by 2024.

Global supplement sales reached $156 billion, up 9.7% in 2020: $22.9 billion in China, $18.8 billion in Europe, and $17.1 billion in Asia (not including China or India), per NBJ.

Among the 40% of U.S. adults who say their views on health/wellness have changed this year, two-thirds are more concerned about their immediate/long-term health, 60% mental health, 56% being physically active, and 42% about aging, per the Hartman Group’s 2021 Health & Wellness report.

IRI/Kline’s 2021 Consumer Health-Care Explosion report noted that 28% of U.S. adults are avid self-care consumers; an additional 41% now take some daily health-related action; 24% act occasionally.

Moreover, post-pandemic consumers have reprioritized the list of nutritional ingredients they’re willing to pay more for, according to HealthFocus’ 2021 USA Survey. CBD, probiotics, vitamin B12, collagen, vitamin D, and antioxidants topped the list.

Accelerating health trends of self-reliance, prevention, alternative therapies, digital health support, and an increased comfort with data sharing in exchange for personalized products/services are among the new nutraceutical market drivers. Moreover, the recent economic bifurcation of consumer purchasing behavior will offer further opportunities for premium and value-based multi-functional health solutions.

While we will be identifying new and emerging opportunities and issues in our 2022 Getting Ahead of the Curve series, before going forward, it is important that nutraceutical marketers reevaluate the emerging nuances of some currently trendy industry platforms.

Over-Reliance on Sustainability

While sustainability, planetary health concerns, and social issues continue to elicit a high level of consumer concern—and emotion worldwide—relying too heavily on these causes to help market nutraceutical products often underdelivers on point-of-purchase expectations. One-quarter of U.S. consumers say they always/usually base their purchases on sustainability, up 4 points vs. 2019, per the Hartman Group’s “Sustainability 2021 Environment and Society in Focus.”

Some overzealous market researchers have gone as far as predicting that planetary health will be a greater global purchase motivator/concern in 2022 than consumers’ own or their family’s personal health.

Moreover, although seven in 10 (72%) U.S. consumers say they’d spend more/extra money on a product or company that aligns with their personal sustainability values, only 22% can identify a sustainable product; 17% a sustainable company, according to Hartman. Although nine in 10 adults consider at least one environmental or social well-being issue when choosing foods/drinks, no one issue dominates their thought process.

Since 2019, U.S. consumers have redefined their sustainability agenda and now see the environment and social well-being as two separate but equal important areas of need. In the environmental arena, shoppers look to minimizing pollution, impacting climate change, and preserving natural resources (Figure 2). Young consumers are more likely to want marketers to tackle issues further removed from home (e.g., food waste, soil health, and planet health), per Hartman.

Figure 2. Issues Companies and Businesses Should Address

Source: The Hartman Group’s Sustainability 2021: Environment and Society in Focus

Climate Change. Climate change ranks 10th among the top 18 issues global consumers are most worried about, per Ipsos, cited by 15%—just behind education, taxes, and inflation. Over half (56%) of global consumers say they’ve modified their behavior due to climate change, down from 69% in January 2020, per Ipsos 2021 Global Advisor online platform (23,000, 29 countries) (Figure 3). Canada, Germany, Australia, the Netherlands, and Great Britain are the most concerned about climate change, with just under one-third of residents citing it in their top three concerns; one-quarter in the U.S.

Figure 3. World Worries: The Full List

Source: Ipsos, October 2021

Globally, the individual actions most often taken to counteract climate change are recycling or composting (each 46%); four in 10 are trying to save water/energy at home and minimize food waste; one-quarter avoid over-packaged products; 27% buy more sustainable food; 22% eat less meat, and 12% less dairy, according to Ipsos.

The countries experiencing the biggest decline since last year in their share of environmentally-conscientious consumers include Malaysia (62%, down 23 points), Spain (53%, down 23 points), Poland (49%, down 23 points), and France (52%, down 21 points).

In the U.S., 8% of adults regularly look for small carbon footprint or carbon neutral on-pack information when shopping for food, 15% when shopping online, per IFIC’s 2021 Food & Health survey. Of the 39% aware of a Certified Carbon Neutral label, when present, 29% would be very likely to buy the product, per Hartman.

Only 1% of U.S. consumers say that “climatarian” best describes the way they eat today, per Datassential.

In November 2021, the U.S. Department of Agriculture announced a new global platform designed to address global sustainability and climate change in collaboration with the European Union. The U.K.’s Net-Zero strategy will force U.K. firms to show how they will adopt a low-carbon future from 2023. Mondelez and Panera Bread are among the diverse companies pledging net zero greenhouse gases by 2050.

Sustainable Sourcing. Of Americans who believe that a product’s environmental sustainability is very/somewhat important to them, recyclable packaging (50%) and being labeled as sustainably-sourced (45%) top the list, according to IFIC. Seven percent of supplement buyers look for packaging made with recyclable content, per CRN.

Although 42% of consumers believe that animal agriculture has the greatest negative impact on the environment, per IFIC, just 10% of meat shoppers “strongly believe” that it has a lot of negative impact. Only 17% consider better-for-the-planet, workers, or animals when shopping in the meat department, per FMI’s 2021 Power of Meat report. One-third (31%) of seafood eaters now opt for sustainably sourced fish/seafood.

Pure & Simple. Traditional claims conveying pure and natural still resonate best with consumers when purchasing supplements and functional foods.

Three-quarters of consumers look for foods/beverages that are locally grown/produced, up 5% vs. 2019; two-thirds look for antibiotic-free, up 6%, and hormone-free, up 3%, per Hartman’s wellness report. Six in 10 look for products that are non-GMO verified, up 6%, or those labeled organic. One-third buy organic to avoid GMOs, per the Organic Trade Association.

Natural is the label term most important for 20% when buying supplements, per CRN’s 2021 survey; 19% look for supplements labeled non-GMO; 14% organic.

The definition of local has broadened beyond a mile radius or state lines to include the country of source and family farms, per FMI’s 2021 Power of Produce.

Products with origin claims (e.g., “made in the USA,” “artisanal,” “local,” or “craft”) posted the highest dollar sales growth among foods/beverages carrying a benefit descriptor in 2020, up 18%, according to IRI.

Sales of foods positioned as non-GMO grew 12% in 2020, per IRI. Knowing whether a food/ingredient is bioengineered is important to four in 10 consumers, according to IFIC. Half of consumers still rank pesticides/residues among the top three food safety issues.

Ag Production. Agricultural production and sourcing attributes are increasingly shaping consumers’ consideration set when shopping for food/beverages, according to Hartman’s wellness report.

Knowing a food was produced using farming techniques that help reduce the impact on natural resources is very/important to four in 10 consumers, according to IFIC.

Interest in grass-fed animal products has climbed by 8% since 2019. Sales of organic, antibiotic-free/hormone-free, and grass-fed meat account for 11.4% of all meat sales, up 18.1% to $9.3 billion, according to FMI’s meat report.

Hartman reports that over half of U.S. consumers are aware of the term regenerative agriculture, up 10 points from 2019. Among those aware (32%) of the Regenerative Organic Certified label, 68% are more likely to buy the product. One-third say they know a lot/little about the Upcycled Certified label; of those, it makes 70% more willing to buy.

According to Hartman, just over half of consumers look for foods/drinks that are fair trade certified, up 8 points vs. 2019; cooperatively produced, up 7%; and are heritage/heirloom, up 5%.

A Plant-Based Plateau?

There is little doubt that interest in plant-based is strong. Nearly half (48%) of consumers look for foods/drinks labeled “plant-based,” per Hartman’s wellness report. Twenty-nine percent of adults eat meat alternatives at least once a month; 40% of those aged 18-44, per YouGov’s May 2021 Meatless Products survey.

Despite strong growth in the plant-based foods sector, unchecked issues with over-processing; rising demand for natural, whole-food alternatives; interest in the completeness of protein and its amino acid complement; as well as emerging negative perceptions of plant-based protein’s impact on the environment may well re-align the plant-based segment.

Growing concern about ingredients and processing levels of these products—especially plant-based meat alternatives—is sending more discerning consumers, including vegans, in search of simpler, purer replacements, per Hartman’s 2021 Wellness report. Consumer avoidance of plant-based protein has doubled since 2019 to 14%, per Hartman’s Health + Wellness report.

Three-quarters look for foods/drinks that are minimally processed, up 3% since 2019, per Hartman. Plant-based consumers are among the most willing to pay for clean labels. Six in 10 plant-based consumers would eat more meat alternatives if they were less processed, according to Mintel’s 2021 Plant Protein - U.S.

Trial and repeat sales of plant-based meat alternatives are cooling at retail, per IRI/210 Analytics. At mid-year, plant-based meat alternatives had a U.S. household penetration of 8.1%. Although still growing, albeit from a small base, sales of frozen alternatives were up 7% to $730 million; refrigerated up 25% to $480 million. IRI projects that, ultimately, plant-based meat alternatives will continue as a “nice niche” similar to organic and grass-fed.

In restaurants, orders of plant-based burgers/sandwiches were unchanged for the year ended June 2021, while beef burger orders climbed 12%, per NPD/CREST (October 2021). Some fast food restaurant tests for plant-based burgers are stalling in trials; others (e.g., Dunkin’) have pulled their alternate meat offerings.

Plant-based consumers are more likely to reach for whole food protein sources like beans and whole grains, according to Mintel. Nearly two-thirds (63%) would like more meat alternatives made with whole foods (e.g., vegetables).

Half of plant-based consumers are interested in using more nuts/seeds as a protein source; 43% more legumes (e.g., peas, beans, lentils, and chickpeas); 42% grains (e.g., rice, quinoa, and oats); and 16% more tofu/tempeh, according to HealthFocus.

IFIC reports one-quarter of consumers are eating more plant protein than last year. One in five (21%) supplement users took a protein supplement in 2021; 27% aged 18-34; 27% aged 35-54; and 12% aged 55 and older, per CRN’s 2021 survey.

More than half (58%) of protein supplement, bar, or drink users took whey protein; 51% took plant protein; and 29% soy protein. Completeness, digestibility, and amino acid content are among the important up-and-coming issues for plant protein in the U.S.

One-quarter (26%) of global consumers say they are very particular about the sources of protein they consume, and avoid certain ones. The top factors for a “good protein” are a natural source, followed by a complete source, a clean source, and a nutrient-dense source, per HealthFocus’ 2021 Global Protein Report.

At the same time, plant-based meat/dairy are increasingly being considered as destructive to the environment/planet. IFIC reports that 13% of adults cite plant-based dairy, and 12% mention meat alternatives as being among the top three food practices that have the greatest negative effect on the environment (Figure 4).

Figure 4. Items with the Greatest Negative Impact on the Environment

Source: IFIC 2021 Food & Health Survey

Only 10% say that environmental concerns “best describe their motivation” for purchasing plant-based foods; 15% of Gen Z and 11% of Millennials, per Datassential.

Labeling products that are naturally plant-based, such as wine, coffee/tea, or potato chips, as “plant-based,” is increasing and may well lead to a loss of credibility, similar to the use of the terms natural and gluten-free.

True nutritional parity for animal alternatives is essential (e.g., dairy vs plant-based milks), especially for companies interested in entering the children’s

food market.

Concerns about satiety/feeling hungry and not getting enough protein are among the top issues with plant-forward eating, per Datassential, cited by 35% and 28% of consumers, respectively. Conversely, more energy, weight management, and heart health benefits are among the new untapped motivators, per Mintel.

In the past year, 18% of adults have tried a plant-based diet; among these, 10% have tried vegetarian, 7% flexitarian, and 6% vegan, according to Hartman.

Lastly, the development of cell-based, biotechnology-driven meat, poultry, seafood, and dairy proteins will likely impact the plant-based category in the coming years. One in five (18%) are very/extremely interested in cellular agriculture, per HealthFocus. Conversely, 55% of food shoppers reject the idea of cell-based meat/poultry and say they’d never purchase it, per FMI’s meat report.

Aligning Scientific Support with Market Terminology

With misinformation projected to be the next global health pandemic by Axios, anchoring nutraceutical claims/benefits to a strong, reputable medical body of evidence is more important than ever. Consumers rely on the product label to convey information about the product and are interested in claims.

According to CRN’s 2021 Consumer Survey on Dietary Supplements, 22% of consumers said that “label claims (e.g., heart health, maintain joint health)” are the most important purchase-decision-making factor. Doctor’s recommendations and price are other primary drivers for purchase decisions. Somewhat alarming is that only 9% believe that “marketing claims indicating product ingredient(s) are backed by science.”

To remain credible with consumers, it is also important that marketers label new market segments, ingredients, or even demographic groups using terminology that is consistent with terminology in the scientific literature. For example, in 2017 Sloan Trends first identified a new “fit consumer” mainstream demographic and nutraceutical opportunity characterized by consumers who exercised three or more days per week and were taking action to improve their everyday mental/physical performance, and presented it at SupplySide West. This “fit” consumer began to dominate the traditional sports nutrition marketplace.

According to Sloan Trend’s TrendSense model, this new demographic quickly became a viable market opportunity in specialty/health food channels and among very health-conscious core consumers. Some marketers have begun to refer to this segment as “active nutrition.” At this time, it appears that “active nutrition” is not an ideal term for this emerging market as it does not link directly to terms or real medical concepts being researched in the medical literature, nor is it a formal nutrition/medical discipline (Figure 5).

Figure 5. TrendSense Predictive Model: Active Nutrition

Source: Sloan Trends, Inc., 2021

Active nutrition has not crossed over the Medical Threshold, which signals a long-term sustainable trend and a strong and growing body of scientific research supporting the same terminology. Use of other terms (e.g., relating to everyday performance) is likely highly preferable. Globally, 53% are buying foods/drinks for everyday performance, 40% for athletic support. Conversely, well-described terms (e.g., exercise and heart) have reached mega market status.

At the same time, as markets mature and consumers become more sophisticated about a topic, they tend to circumscribe into more specific terms. Who can forget the term phytochemical, a classic umbrella category which eventually gave way to highly marketable ingredients (e.g., lycopene and lutein). Knowing when a category is about to migrate and refine terminology can provide a significant market edge. Classic category terms (e.g., women’s health), are currently less attractive than marketing their individual categories or components.

The Promised ‘High’ from CBD May Be Wearing Off

The simple way to summarize the cannabidiol (CBD) marketplace today is, well, it’s complicated. Following aggressive sales and projections in the mid 2010s, growth in the sale of CBD products, including supplements, topicals, and food and beverage, has stalled.

Sales of hemp/CBD natural and organic products including supplements, topicals, food/beverage, and pets posted disappointing sales of $803 million, down 2.3% in 2020, despite urgent demands for relief during the pandemic (Figure 6). This situation can be explained by one or both of two phenomena. First, sale of hemp-derived CBD in foods, beverages, and dietary supplements is illegal in the U.S. today. Second, there is little “high” associated with consumption of hemp-derived CBD containing less than 0.3% THC (delta-9-tetrahydrocannabinol, one of the active components in marijuana).

Figure 6. Hemp CBD Product Sales Decline

Source: Nutrition Business Journal, 2021

The Food and Drug Administration (FDA) has approved only one CBD product, a prescription drug (Epidiolex) used to treat seizures associated with rare pediatric diseases, including Lennox Gastaut syndrome (LGS), Dravet syndrome (DS), or tuberous sclerosis complex (TSC) in people over one year of age.

The Farm Bill of 2018 removed hemp and derivatives of cannabis with less than 0.3% THC from the legal definition of marijuana, thereby removing it from the controlled substance list. Three hemp seed products advanced through the FDA’s GRAS (Generally Recognized As Safe) review in 2018 and may be used in foods, including hulled hemp seed, hemp seed protein powder, and hemp seed oil. But hemp seeds do not contain any THC.

FDA has issued warning letters to marketers of CBD-containing products. The agency recognizes these products and claims associated with them as marketing of unapproved new drugs. FDA has stated that it’s monitoring the marketplace for CBD-containing products and will take action to protect public health.

Meanwhile, the agency is evaluating the safety of CBD and is very likely aware of the sale of CBD-containing food products which are being marketed illegally. Despite states that have legalized the recreational use of marijuana, it remains illegal to put marijuana or cannabis-derived CBD in foods, beverages, and dietary supplements. Some states have legalized the use of cannabis-derived CBD for medical use only. Products available in CBD dispensaries vary by state and include oils, pills, vaporizers, sprays, and foods. But any CBD-containing food product sold in the U.S. is under the authority of the FDA, which says, no, it’s not legal (at least not yet).

Meanwhile, the CBD marketplace churns along, albeit slowly, with fairly robust projections. According to IRI (BDSA Consumer Research, 2021), almost half of Americans favor legal cannabis (48%) and 64% believe it has medical benefits. State-approved dispensaries and medical marijuana continue to gain strength and are posting significant sales, representing a key barometer. According to projections from IRI and its CBD research partner, BDSA, sales of medical marijuana will reach $2.7 billion by 2026, CBD hemp infused product sales at retail will hit $16.9 billion, and “legalized” dispensaries will yield $41.3 billion.

In 2021, 7% of U.S. supplement users took CBD, up from 4% in 2020; 11% of those aged 18-34, 8% aged 35-54, and 4% aged 55 and older, per CRN. CBD now tops the list of value-added health ingredients for which consumers would be willing to pay up to 10% more, according to HealthFocus (Figure 7).

Figure 7. Health Ingredients Consumers Willing to Pay up to 10% More

Source: HealthFocus International, 2021

Adult-use continues to grow in states with relatively long-standing cannabis legalization, up 25% in 2021 vs. 2020 in California; and growth is more rapid in states only recently legalizing the substance, up 101% in Illinois. The projected top markets for CBD products in 2026 are California, Colorado, Florida, New York, and New Jersey.

Dollar sales of edibles are up 39% in 2021 vs. 2020 with candy the number one product (i.e., gummies). Beverages, although much touted in the media, are actually a small percentage of sales, at 5% of the market. Consumers are seeking CBD products to help them relax, get mellow, relieve pain, and sleep better. They are represented equally in gender at 50-50, almost half (41%) have children, most (84%) are city or suburban dwellers, and they tend to be more highly educated than the general population.

The CBD market for pets is strong with product sales fast approaching $100 million, according to Packaged Facts 2021 Pet Supplement Report. One in five (21%) dog owners and 10% of cat owners have purchased a CBD supplement in the past year. Half of dog or cat owners would be interested in purchasing CBD supplements for their pet if they were legal, up from 29% a year ago; 48% if they remain in the gray regulatory area. Stress, anxiety, and calming are the top reasons owners purchased pet CBD supplements; followed by general health, joint/mobility, skin/coat, immunity, and pain management.

Following Fake News — It’s Time to Fix It

Social media is a powerful tool for raising awareness and personally engaging with consumers about nutraceutical products and services. But fast-emerging trust issues, including inappropriate intent to influence internet trends and manipulate search data to guide product development and market products, threaten to dampen the value and credibility of this powerful business tool.

Although three-quarters of CPG brands have planned to increase their advertising budget for social media over the next year, per the 2021 Nielsen Total Audience Report, only 16% of those aged 18-34, 17% aged 35-49, and 20% aged 50 and older say that product claims made in advertisements on social media are very trustworthy: 23%, 26%, and 31% only somewhat trustworthy.

Moreover, of the 53% of U.S. consumers who get news on social media, including health news, only 39% expect it to be accurate, per Pew Research Center’s April 2021 Social Media Use in 2021. Only one-third of companies are confident they can accurately measure return on investment for social media.

Globally in 2021, 4.5 billion people age 13 and older or 63% of the population were social media users, according to Backlinko. The average social media user engages with 6.6 social media platforms. Facebook is the leading social network globally with 2.9 billion monthly active users, followed by YouTube (2.3 billion), WhatsApp (2 billion), FB Messenger (1.3 billion), and WeChat (1.2 billion).

In the U.S. there are 240 million social media users, 72% of all Americans. YouTube and Facebook continue to dominate with 81% and 59%, respectively, using their sites, per Pew. Four in 10 use Instagram; about three in 10 Pinterest or LinkedIn; one-quarter each Snapchat, Twitter, or What’s App; 21% TikTok; and 13% Nextdoor.

Some 84% of those aged 18-39, 81% aged 30-49, 73% aged 50-64, and 45% age 65 and older in the U.S. are social media users, per Pew Research; more women than men. Hispanics and Blacks are more likely to use Instagram and What’s App. Those with higher education are more likely to use LinkedIn, women Pinterest, and urbanites Nextdoor, per Pew.

Internet trends and consumers’ internet search data have long proven to be misleading as a major data source to guide new product development and should only be considered as a peripheral data point. For example, U.S. and worldwide Google consumer search data show searches for information on heart health and magnesium is flat over the past few years, and interest in weight loss information is falling in 2021. But these categories are all enjoying double-digit growth.

What is often missed for trend work is that these social media channels are driven by paid advertising and public relations organizations promoting their products/messages, often front-loading information and creating a swell of clicks to position their messaging as setting a trend. Social media is not a channel where consumers pursue content on their own, but rather respond to what is there.

Lastly, with the percentage of e-commerce-purchased supplements sales projected by NBJ to rise from 10% in 2019 to 24% in 2024, marketers will have an even greater opportunity to promote their products and make health claims on the internet vs. point-of-purchase materials.

As such, it will be critical to provide sound scientific support for product positioning and claims. Currently, the Cleveland Clinic has begun challenging copy and experts at TikTok to help stem the current tide of rising misinformation.

Marketers of nutraceutical products will be well-served to know the proven benefits of their products and to appropriately market them to consumers. FDA has become a savvy purveyor of company websites and e-commerce marketing tools (e.g., Amazon). Health claims are valuable tools to market products, and appropriate structure/function claims about health promotion are permissible; disease prevention claims are not. FDA delivers warning letters to marketers unaware of the nutraceutical labeling rules, or those willing to bend or break them. It is possible to stay within the regulatory lines and use truthful and artful marketing to sell products to consumers, without the threat of product seizure.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.