By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.10.01.20

Heart disease has long been the leading cause of death in the U.S., claiming more lives each year than all forms of cancer and chronic lower respiratory disease combined. Every 40 seconds an American has a heart attack; every 3 minutes and 35 seconds someone dies from a stroke (AHA, 2020). Ischemic heart disease and stroke are the top two causes of death worldwide, per the World Health Organization (WHO).

As of mid-September 2020, the number of COVID-19 deaths in the U.S. was less than one-quarter of the number of deaths due to cardiovascular disease (CVD) in 2017, the latest year for which statistics are available. According to the American Heart Association (AHA), 121.5 million Americans had some form of CVD between 2013-2016, affecting a far greater number than the 6.6 million cases of COVID-19 in the U.S. (as of September 2020).

But, with the Centers for Disease Control and Prevention (CDC) in August reconfirming that those with pre-existing serious heart conditions—including coronary artery disease and hypertension—are at an increased risk of severe illness from COVID-19, there is an even greater incentive to more aggressively manage, monitor, and treat CVD.

On the same date in August, the AHA issued a press release stating that the risk of death from COVID-19-related heart damage now appears to be as, or more important than, other COVID-related risk factors (e.g., age, diabetes mellitus, chronic pulmonary disease, or a prior history of CVD). While coronavirus was initially thought to be an infection causing disease of the lungs, inflammation of the vascular system and injury to the heart appear to be more common features, occurring in 20-30% of hospitalized patients and contributing to 40% of deaths, according to the AHA.

More people in the U.S. are dying during the COVID-19 pandemic, but not just because of coronavirus, as fearful consumers avoid emergency room visits, delay regular checkups, and postpone non-emergency treatments. Hospital emergency room visits for possible heart attacks fell 23% and 20% for strokes for the 10 pandemic weeks ending late June 2020 (AHA).

Over half (55%) of Hispanics, 45% of Blacks, and 40% of Caucasians said they would be afraid to go to a hospital if they thought they were having a heart attack or stroke due to COVID-19; 41%, 33%, and 24%, respectively, would stay home (AHA). As a result, the AHA has initiated the “Don’t Die of Doubt” campaign to encourage people to seek medical help for heart issues, despite the pandemic.

Time to Rethink Health Priorities!

In early 2020, cardiovascular/heart disease ranked 18th on the list of health concerns that global consumers were very/extremely concerned about (49%), according to HealthFocus.

In the U.S., those very/extremely concerned about heart disease fell from 81% in 2010 to 49% in 2019, ranking seventh in 2019 among consumer health concerns. Those aged 40 and older were the age group most concerned in 2019, per HealthFocus.

Heart fell from number one to the number four position in terms of the health benefits U.S. consumers most wanted from foods last year; heart remained in fourth place behind weight management, energy, and digestive health when surveyed in mid-April 2020. Lowering inflammation ranked 11th, cited by about one-quarter of adults, according to the International Food Information Council (IFIC).

Over half of consumers were already dealing with one or more chronic conditions in their household last year. More than half (56%) were trying to manage high blood pressure, 55% high cholesterol, and 47% other cardio concerns, according to the Hartman Group (2019).

Just over one-third of the U.S. population has some form of CVD, 46% high blood pressure, 38% cholesterol levels over 200 mg/dL (12% > 240 mg/dL), 29% undesirably high LDL, and 19% low HDL levels (AHA).

Ethnic groups remain an overlooked heart health target. Nearly half (47%) of U.S. Hispanic men have high blood pressure, 40% cholesterol levels > 200 mg/dL, 34% high LDL, and 33% low HDL. Over half (56%) of Black women have high blood pressure, one-third cholesterol levels > 200 mg/dL, and one-quarter high LDL (AHA).

Heart health is becoming increasingly important for children. Only half of U.S. kids ages 6-19 are in the ideal range for blood lipids, 25% are clinically high (JAMA, 2019).

Half of global moms are very/extremely concerned about protecting their children from diseases later in life (HealthFocus, 2020). In developing nations, heart healthy ranks third behind all-natural and preservative-free among parents’ top preferences for their children’s food/drinks (Euromonitor, 2019).

Globally, 423 million adults have coronary heart disease; 39% have high cholesterol, and 26% high blood pressure (WHO, 2019).

Déjà vu: Seeking Heart-Healthy Foods

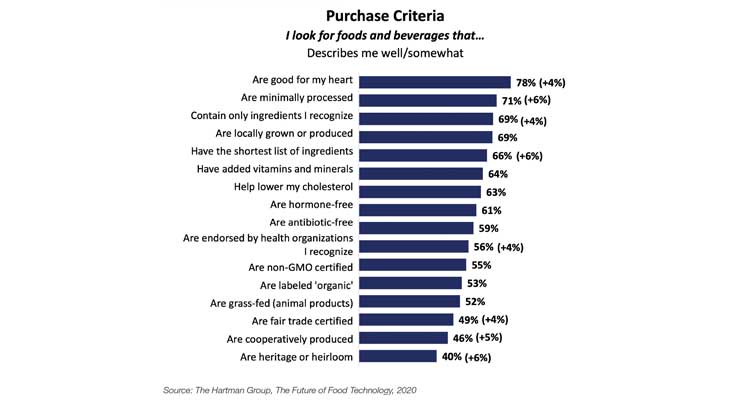

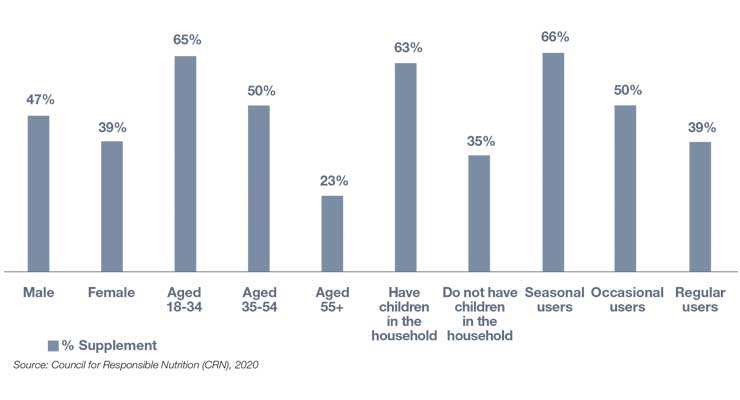

In late April, more than three-quarters of U.S. adults reported they look for foods/beverages that are good for their heart, up 4% vs. before the pandemic; 63% that help lower their cholesterol; and 56% that are endorsed by health organizations, also up 4% (Hartman) (Figure 1).

Figure 1. Purchase Criteria for Food & Beverages

During the eight-week COVID period (Mar. 8 to Apr. 26), center store foods/drinks that offered hypertension support netted one-quarter of their entire 2019-dollar sales in only 15% of this period; those claiming a good source of antioxidants jumped 18% in dollar and unit sales. Foods and drinks touting a good source of magnesium, sold 12 times the dollar and unit sales of 2019 in only 8 weeks (IRI, 2020).

At the end of May, 43% said they were eating healthier since the pandemic began; 53% of U.S. Hispanics (IFIC, 2020). Nearly two-thirds (63%) bought foods for specific benefits for their body for the year ended June vs. 53% for more passive strategies (e.g., organic, clean, and whole food nutrition), in late spring 2020 (FMI, 2020).

Of those trying to prevent/treat a condition with food/beverages last year, 47% tried to manage high cholesterol, 41% other cardio concerns, and 35% high blood pressure (Hartman, 2019).

Three in 10 consumers now consume more functional foods/beverages vs. before the pandemic; one-third are using functional foods daily. Half of functional food users are looking for specific health benefits; more than one-third to prevent possible disease/illness/injury (Hartman, 2020).

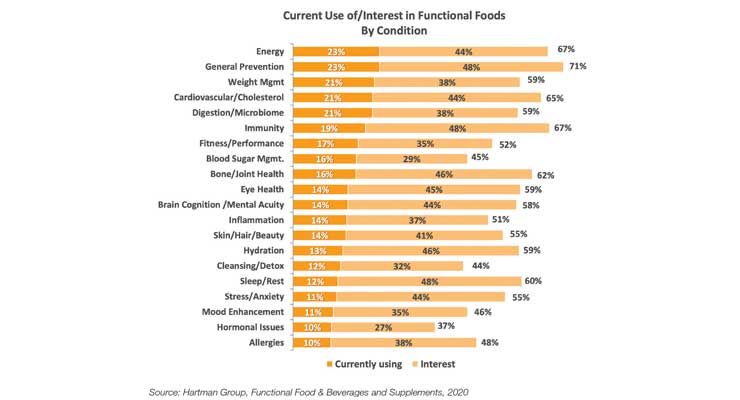

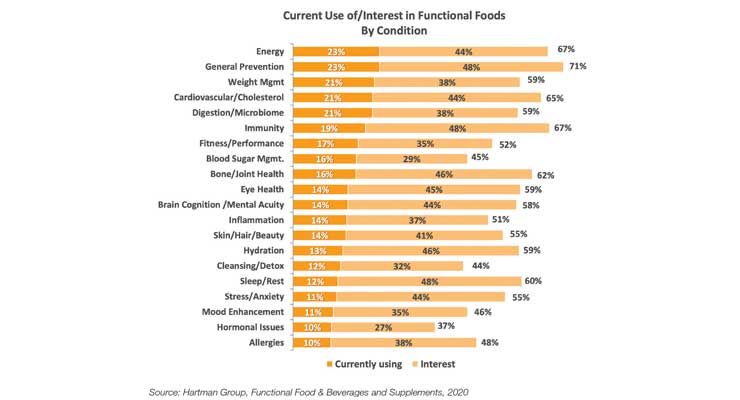

Cardiovascular/cholesterol ranks fourth in terms of use/interest in functional foods, cited by 65%, behind energy, general prevention, and weight management; 54% for use/interest for functional beverages.

Forty-five percent would be interested in more cardio-benefiting functional beverages; 44% cardio positive foods (Hartman, 2020) (Figure 2).

Figure 2. Percent of Consumers Seeking Health Benefits from Functional Foods

When surveyed in April, dark green vegetables, fiber, antioxidants, probiotics, and omega-3s were the top five benefits/fortifications functional food users sought from their foods (Hartman).

Omega-3/fish oils, dietary fiber, oats, healthy oils, green tea, garlic, and dark chocolate are among the food ingredients consumers perceive to benefit heart health/cholesterol (Kerry, 2019). Four in 10 are aware of soy protein’s FDA qualified health claim for heart disease (United Soybean Board, 2019); canola and olive oil also have qualified health claims.

Nearly six in 10 are trying to limit total fat in their diet at least some of the time, led by those aged 45 years and older and Hispanic Americans. One-third aged 65 and older and one-quarter aged 45-64 look for foods low in saturated fats, per IFIC’s July fats/oils survey.

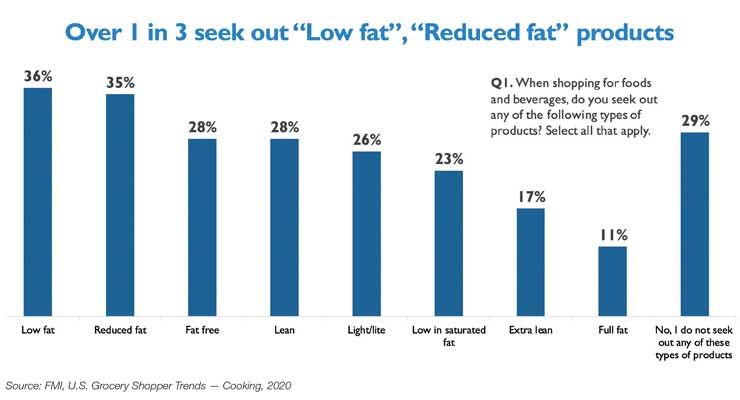

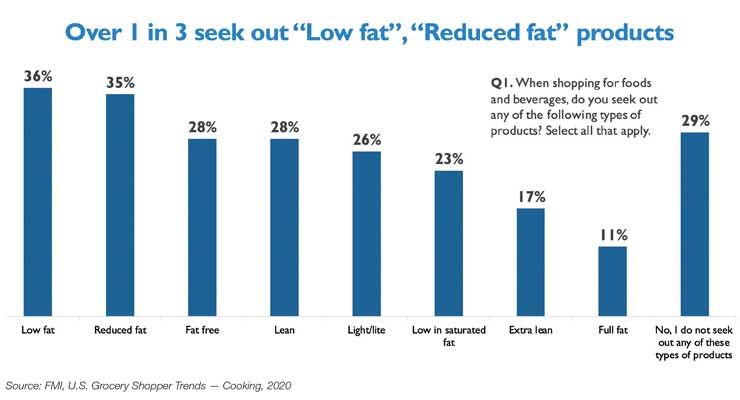

Just over one-third of consumers seek “low-fat” or “reduced fat” claims when food shopping; 28% “fat-free” or “lean”; 26% “light/lite”; and 23% “low in saturated fat.” Consumers are most likely to opt for lower fat dairy products, followed by snack foods, meat/poultry, desserts, and soups (IFIC, 2020). One-third look for low-sodium claims (FMI, 2020) (Figure 3).

Figure 3. Fat-Related Health Claims Sought by Consumers

Globally, just over one-third (35%) of consumers tried to reduce their salt intake last year; about 30% saturated fat (Euromonitor, 2019).

Just under half of those who buy plant-based cheese do so for health reasons; 57% to reduce cholesterol, 37% to lower blood pressure, and 50% for less fat. Lowering cholesterol and fat intake are important purchase motivators for plant-based ice cream, lower fat intake for plant-based yogurt (Kerry, 2020).

One in five look for cholesterol claims on baked goods, 31% fiber, and 24% sodium claims (American Bakers Association, 2019). Four in 10 frozen food buyers pay attention to salt/sodium, 31% fat/saturated fat, 20% cholesterol, and 11% antioxidants (FMI, 2019).

Half (51%) say they buy seafood because it is heart healthy (FMI, 2019). Five in 10 shoppers also associate fresh produce with improved heart health (FMI, 2020).

Supplement Use Increases During Pandemic

Although supplements may not legally claim to treat, cure, or prevent coronavirus or any other disease, 83% of users believe that supplements play an important role in helping to support health/wellness during COVID-19 (Council for Responsible Nutrition, 2020).

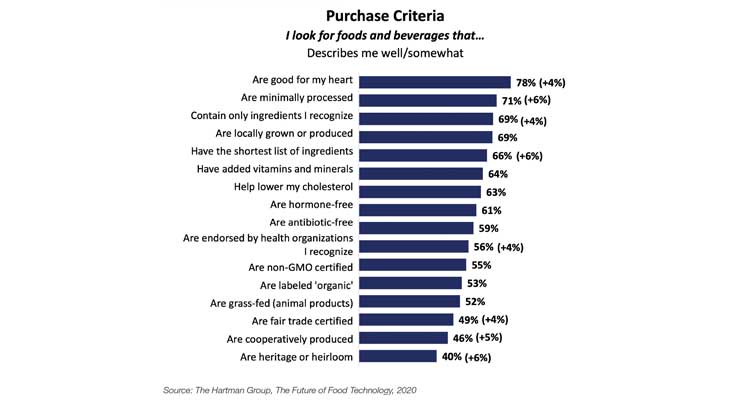

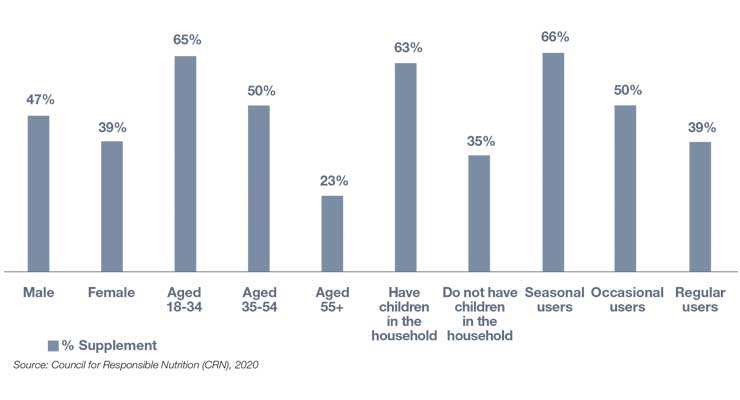

Over four in 10 users have changed their supplement routine since the pandemic began, with 93% increasing the supplements they take; 46% added new supplements, 25% took the same supplements more regularly, and 22% increased their dose. Nearly all users who changed their regimen (98%) said they will continue their new routine going forward (CRN, 2020) (Figure 4).

Figure 4. Supplement Users Who Have Altered Their Routine During COVID-19

Although overall immunity and general health/wellness benefits were the most common reasons users increased supplement use, 42% did so to help reduce the risk of serious illness (CRN).

In the fall of 2020, 23% of supplement users took a dietary supplement to support heart health, the same as in the fall of 2019. Men were slightly more likely to do so (29% vs. 27% in 2019); women slightly less likely (17% vs. 19% in 2019). CRN reported those aged 55 and older were less likely (25% vs. 30% in 2019) to take a supplement for heart health this fall, those aged 35-44 slightly more likely (22% vs. 20% in 2019), and those 18-34 slightly more likely (19% vs. 16% in 2019).

In April 2020, cardiovascular/cholesterol topped the list of current conditions that supplements users were interested in taking more supplements for, cited by 40%, ranking just slightly ahead of general wellness and energy (Hartman, 2020).

Nutrition Business Journal projected sales of heart supplements will reach $3.334 billion in 2021, $3.334 billion in 2022, and $3.388 billion in 2023—up 3.0% and 1.5%, respectively.

Adequate consumption of a variety of nutrients is essential for heart health. Heart healthy favorites, e.g., vitamin D, B-vitamins, magnesium, vitamin E, and omega-3 fatty acids remained among the top 10 used dietary supplements in the fall of 2020 (fielded Jul. 30 to Aug. 4) (CRN, 2020). (See Table 1.)

Table 1. Increases Among Supplement Users During COVID Period, and Top 10 Supplements Taken by Users in September 2020

Sales of some heart health-related supplements have shown increases in dollar sales in the past four weeks vs last year (ending Aug. 2, 2020), e.g., magnesium, beet root, coenzyme Q10, vitamin B/B complex (IRI, 2020) (Table 2). Consistent with COVID-19 concerns, sales of immune-supportive supplements (e.g., vitamin D, vitamin C, zinc, elderberry, and echinacea) increased to a greater degree than heart-related supplements.

Table 2. Increases in Dollar Sales in the Past Four Weeks vs Year Ago (%) (Ending Aug. 2, 2020)

Other heart-related supplements include pantethine, red yeast rice, and cocoa flavanols. Pantethine is a form of pantothenic acid, or vitamin B5. Several clinical trials have shown that the form of pantothenic acid known as pantethine reduces lipid levels when taken in large amounts (900 mg), but pantothenic acid itself does not appear to have the same effects (NIH).

Red yeast rice is produced by fermenting red rice with strains of yeast. Red yeast rice can contain substantial amounts of monacolin K, a compound chemically identical to the active ingredient in the cholesterol lowering drug lovastatin. However, there is no way of knowing how much monacolin K is in a supplement; and supplements with more than trace amounts of the compound may not be legally sold as dietary supplements. Red yeast rice products containing citrinin may cause kidney failure (NIH).

There is a substantial body of scientific evidence in support of cocoa flavanols for enhancing circulation. The mechanism of action is through increasing the availability of nitric oxide in the blood, which acts as a vasodilator and reduces blood pressure (Nutrients, 2019). Beet root has a similar effect on natural pools of nitric oxide in the body to reduce blood pressure (Nutrients, 2015).

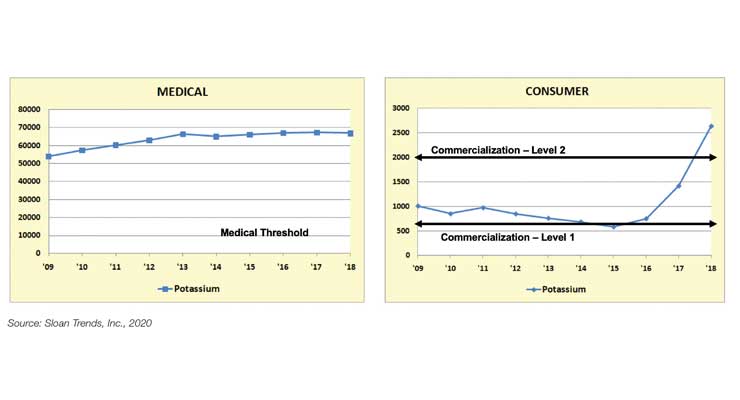

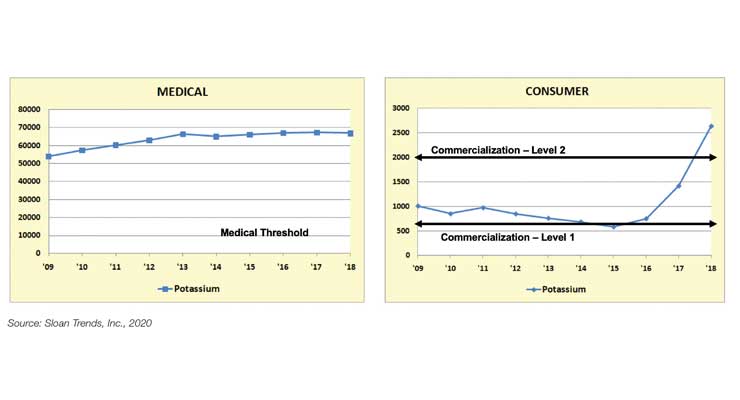

According to Sloan Trends’ TrendSense model, potassium is of growing interest in the nutraceuticals category (Figure 5). Potassium was identified as a nutrient of public health concern by the U.S. Dietary Guidelines in 2015 and has been added to mandatory nutrition labeling by the FDA. Potassium remains an under-consumed nutrient identified in the Scientific Report of the 2020 Dietary Guidelines Advisory Committee (USDA, HHS, 2020). Potassium plays a key role in muscle function, including heart. Supplements have been restricted to a maximum of no more than 100 mg/capsule by the FDA since 1975 and getting the recommended 4,700 mg each day is confounding. It’s time to overturn this ruling.

Figure 5. TrendSense Predictive Model: Potassium

Non-Dietary Solutions

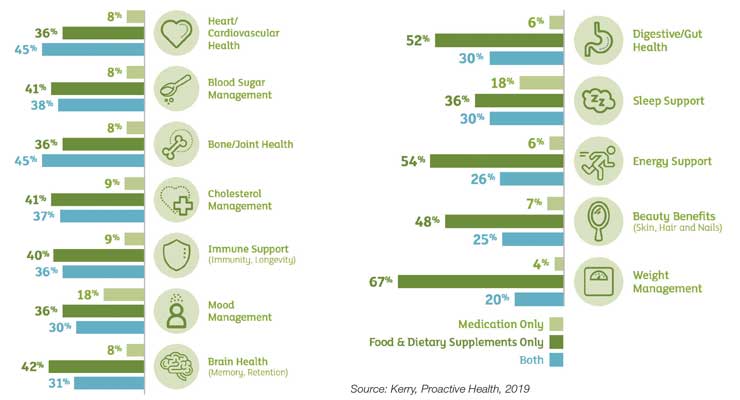

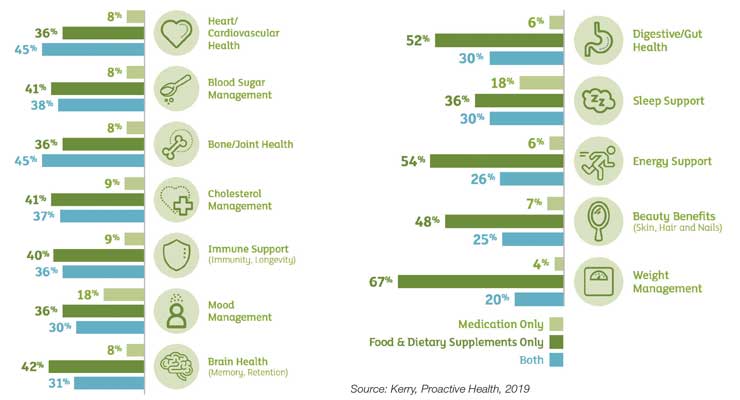

Cardio health and cholesterol are among the concerns consumers are most likely to be managing with a combination of medication, supplements, and diet (Kerry, 2019) (Figure 6). Just over one-third (36%) use only foods/supplements to manage their cardio issues, 41% cholesterol; 8% and 9%, respectively, use only Rx medication; and 45% and 37%, respectively, use both (Kerry 2019). In 2018, more than 35 million U.S. adults were taking prescription statins (e.g., Lipitor, Crestor, and Zocor) (IQVIA 2019).

Figure 6. Consumer Health Needs Managed by Medicine, Supplements & Diet

New global exercise trends, including “exercise as medicine” and exercise as “lifestyle medicine,” are virtually untapped opportunities for cardio concerned consumers. More consumers preferentially reach for exercise vs. supplements or functional foods to help manage or treat cardiovascular concerns, including high blood pressure (Hartman, 2019).

Digital apps, smart devices, and home monitoring meters for heart health are other fast-growing sectors. Omron Healthcare has introduced a blood pressure monitoring HeartGuide watch. AliveCor’s KardiaMobile EKG now delivers a report every 90 days by a board-certified cardiologist.

Of the 52% of households with a member following a specific diet plan, 5% are following the Mediterranean Diet, a diet known for its heart healthy results (FMI, 2020). Leading medical authorities have recommended/endorsed the Mediterranean-style of eating, including the AHA, The Mayo Clinic, and the U.S. Dietary Guidelines.

Lastly, functional foods are becoming more influential in foodservice. Heart health, energy, weight management, and gut health are the most influential health conditions (Datassential, 2019).

As of mid-September 2020, the number of COVID-19 deaths in the U.S. was less than one-quarter of the number of deaths due to cardiovascular disease (CVD) in 2017, the latest year for which statistics are available. According to the American Heart Association (AHA), 121.5 million Americans had some form of CVD between 2013-2016, affecting a far greater number than the 6.6 million cases of COVID-19 in the U.S. (as of September 2020).

But, with the Centers for Disease Control and Prevention (CDC) in August reconfirming that those with pre-existing serious heart conditions—including coronary artery disease and hypertension—are at an increased risk of severe illness from COVID-19, there is an even greater incentive to more aggressively manage, monitor, and treat CVD.

On the same date in August, the AHA issued a press release stating that the risk of death from COVID-19-related heart damage now appears to be as, or more important than, other COVID-related risk factors (e.g., age, diabetes mellitus, chronic pulmonary disease, or a prior history of CVD). While coronavirus was initially thought to be an infection causing disease of the lungs, inflammation of the vascular system and injury to the heart appear to be more common features, occurring in 20-30% of hospitalized patients and contributing to 40% of deaths, according to the AHA.

More people in the U.S. are dying during the COVID-19 pandemic, but not just because of coronavirus, as fearful consumers avoid emergency room visits, delay regular checkups, and postpone non-emergency treatments. Hospital emergency room visits for possible heart attacks fell 23% and 20% for strokes for the 10 pandemic weeks ending late June 2020 (AHA).

Over half (55%) of Hispanics, 45% of Blacks, and 40% of Caucasians said they would be afraid to go to a hospital if they thought they were having a heart attack or stroke due to COVID-19; 41%, 33%, and 24%, respectively, would stay home (AHA). As a result, the AHA has initiated the “Don’t Die of Doubt” campaign to encourage people to seek medical help for heart issues, despite the pandemic.

Time to Rethink Health Priorities!

In early 2020, cardiovascular/heart disease ranked 18th on the list of health concerns that global consumers were very/extremely concerned about (49%), according to HealthFocus.

In the U.S., those very/extremely concerned about heart disease fell from 81% in 2010 to 49% in 2019, ranking seventh in 2019 among consumer health concerns. Those aged 40 and older were the age group most concerned in 2019, per HealthFocus.

Heart fell from number one to the number four position in terms of the health benefits U.S. consumers most wanted from foods last year; heart remained in fourth place behind weight management, energy, and digestive health when surveyed in mid-April 2020. Lowering inflammation ranked 11th, cited by about one-quarter of adults, according to the International Food Information Council (IFIC).

Over half of consumers were already dealing with one or more chronic conditions in their household last year. More than half (56%) were trying to manage high blood pressure, 55% high cholesterol, and 47% other cardio concerns, according to the Hartman Group (2019).

Just over one-third of the U.S. population has some form of CVD, 46% high blood pressure, 38% cholesterol levels over 200 mg/dL (12% > 240 mg/dL), 29% undesirably high LDL, and 19% low HDL levels (AHA).

Ethnic groups remain an overlooked heart health target. Nearly half (47%) of U.S. Hispanic men have high blood pressure, 40% cholesterol levels > 200 mg/dL, 34% high LDL, and 33% low HDL. Over half (56%) of Black women have high blood pressure, one-third cholesterol levels > 200 mg/dL, and one-quarter high LDL (AHA).

Heart health is becoming increasingly important for children. Only half of U.S. kids ages 6-19 are in the ideal range for blood lipids, 25% are clinically high (JAMA, 2019).

Half of global moms are very/extremely concerned about protecting their children from diseases later in life (HealthFocus, 2020). In developing nations, heart healthy ranks third behind all-natural and preservative-free among parents’ top preferences for their children’s food/drinks (Euromonitor, 2019).

Globally, 423 million adults have coronary heart disease; 39% have high cholesterol, and 26% high blood pressure (WHO, 2019).

Déjà vu: Seeking Heart-Healthy Foods

In late April, more than three-quarters of U.S. adults reported they look for foods/beverages that are good for their heart, up 4% vs. before the pandemic; 63% that help lower their cholesterol; and 56% that are endorsed by health organizations, also up 4% (Hartman) (Figure 1).

Figure 1. Purchase Criteria for Food & Beverages

During the eight-week COVID period (Mar. 8 to Apr. 26), center store foods/drinks that offered hypertension support netted one-quarter of their entire 2019-dollar sales in only 15% of this period; those claiming a good source of antioxidants jumped 18% in dollar and unit sales. Foods and drinks touting a good source of magnesium, sold 12 times the dollar and unit sales of 2019 in only 8 weeks (IRI, 2020).

At the end of May, 43% said they were eating healthier since the pandemic began; 53% of U.S. Hispanics (IFIC, 2020). Nearly two-thirds (63%) bought foods for specific benefits for their body for the year ended June vs. 53% for more passive strategies (e.g., organic, clean, and whole food nutrition), in late spring 2020 (FMI, 2020).

Of those trying to prevent/treat a condition with food/beverages last year, 47% tried to manage high cholesterol, 41% other cardio concerns, and 35% high blood pressure (Hartman, 2019).

Three in 10 consumers now consume more functional foods/beverages vs. before the pandemic; one-third are using functional foods daily. Half of functional food users are looking for specific health benefits; more than one-third to prevent possible disease/illness/injury (Hartman, 2020).

Cardiovascular/cholesterol ranks fourth in terms of use/interest in functional foods, cited by 65%, behind energy, general prevention, and weight management; 54% for use/interest for functional beverages.

Forty-five percent would be interested in more cardio-benefiting functional beverages; 44% cardio positive foods (Hartman, 2020) (Figure 2).

Figure 2. Percent of Consumers Seeking Health Benefits from Functional Foods

When surveyed in April, dark green vegetables, fiber, antioxidants, probiotics, and omega-3s were the top five benefits/fortifications functional food users sought from their foods (Hartman).

Omega-3/fish oils, dietary fiber, oats, healthy oils, green tea, garlic, and dark chocolate are among the food ingredients consumers perceive to benefit heart health/cholesterol (Kerry, 2019). Four in 10 are aware of soy protein’s FDA qualified health claim for heart disease (United Soybean Board, 2019); canola and olive oil also have qualified health claims.

Nearly six in 10 are trying to limit total fat in their diet at least some of the time, led by those aged 45 years and older and Hispanic Americans. One-third aged 65 and older and one-quarter aged 45-64 look for foods low in saturated fats, per IFIC’s July fats/oils survey.

Just over one-third of consumers seek “low-fat” or “reduced fat” claims when food shopping; 28% “fat-free” or “lean”; 26% “light/lite”; and 23% “low in saturated fat.” Consumers are most likely to opt for lower fat dairy products, followed by snack foods, meat/poultry, desserts, and soups (IFIC, 2020). One-third look for low-sodium claims (FMI, 2020) (Figure 3).

Figure 3. Fat-Related Health Claims Sought by Consumers

Globally, just over one-third (35%) of consumers tried to reduce their salt intake last year; about 30% saturated fat (Euromonitor, 2019).

Just under half of those who buy plant-based cheese do so for health reasons; 57% to reduce cholesterol, 37% to lower blood pressure, and 50% for less fat. Lowering cholesterol and fat intake are important purchase motivators for plant-based ice cream, lower fat intake for plant-based yogurt (Kerry, 2020).

One in five look for cholesterol claims on baked goods, 31% fiber, and 24% sodium claims (American Bakers Association, 2019). Four in 10 frozen food buyers pay attention to salt/sodium, 31% fat/saturated fat, 20% cholesterol, and 11% antioxidants (FMI, 2019).

Half (51%) say they buy seafood because it is heart healthy (FMI, 2019). Five in 10 shoppers also associate fresh produce with improved heart health (FMI, 2020).

Supplement Use Increases During Pandemic

Although supplements may not legally claim to treat, cure, or prevent coronavirus or any other disease, 83% of users believe that supplements play an important role in helping to support health/wellness during COVID-19 (Council for Responsible Nutrition, 2020).

Over four in 10 users have changed their supplement routine since the pandemic began, with 93% increasing the supplements they take; 46% added new supplements, 25% took the same supplements more regularly, and 22% increased their dose. Nearly all users who changed their regimen (98%) said they will continue their new routine going forward (CRN, 2020) (Figure 4).

Figure 4. Supplement Users Who Have Altered Their Routine During COVID-19

Although overall immunity and general health/wellness benefits were the most common reasons users increased supplement use, 42% did so to help reduce the risk of serious illness (CRN).

In the fall of 2020, 23% of supplement users took a dietary supplement to support heart health, the same as in the fall of 2019. Men were slightly more likely to do so (29% vs. 27% in 2019); women slightly less likely (17% vs. 19% in 2019). CRN reported those aged 55 and older were less likely (25% vs. 30% in 2019) to take a supplement for heart health this fall, those aged 35-44 slightly more likely (22% vs. 20% in 2019), and those 18-34 slightly more likely (19% vs. 16% in 2019).

In April 2020, cardiovascular/cholesterol topped the list of current conditions that supplements users were interested in taking more supplements for, cited by 40%, ranking just slightly ahead of general wellness and energy (Hartman, 2020).

Nutrition Business Journal projected sales of heart supplements will reach $3.334 billion in 2021, $3.334 billion in 2022, and $3.388 billion in 2023—up 3.0% and 1.5%, respectively.

Adequate consumption of a variety of nutrients is essential for heart health. Heart healthy favorites, e.g., vitamin D, B-vitamins, magnesium, vitamin E, and omega-3 fatty acids remained among the top 10 used dietary supplements in the fall of 2020 (fielded Jul. 30 to Aug. 4) (CRN, 2020). (See Table 1.)

Table 1. Increases Among Supplement Users During COVID Period, and Top 10 Supplements Taken by Users in September 2020

Sales of some heart health-related supplements have shown increases in dollar sales in the past four weeks vs last year (ending Aug. 2, 2020), e.g., magnesium, beet root, coenzyme Q10, vitamin B/B complex (IRI, 2020) (Table 2). Consistent with COVID-19 concerns, sales of immune-supportive supplements (e.g., vitamin D, vitamin C, zinc, elderberry, and echinacea) increased to a greater degree than heart-related supplements.

Table 2. Increases in Dollar Sales in the Past Four Weeks vs Year Ago (%) (Ending Aug. 2, 2020)

Other heart-related supplements include pantethine, red yeast rice, and cocoa flavanols. Pantethine is a form of pantothenic acid, or vitamin B5. Several clinical trials have shown that the form of pantothenic acid known as pantethine reduces lipid levels when taken in large amounts (900 mg), but pantothenic acid itself does not appear to have the same effects (NIH).

Red yeast rice is produced by fermenting red rice with strains of yeast. Red yeast rice can contain substantial amounts of monacolin K, a compound chemically identical to the active ingredient in the cholesterol lowering drug lovastatin. However, there is no way of knowing how much monacolin K is in a supplement; and supplements with more than trace amounts of the compound may not be legally sold as dietary supplements. Red yeast rice products containing citrinin may cause kidney failure (NIH).

There is a substantial body of scientific evidence in support of cocoa flavanols for enhancing circulation. The mechanism of action is through increasing the availability of nitric oxide in the blood, which acts as a vasodilator and reduces blood pressure (Nutrients, 2019). Beet root has a similar effect on natural pools of nitric oxide in the body to reduce blood pressure (Nutrients, 2015).

According to Sloan Trends’ TrendSense model, potassium is of growing interest in the nutraceuticals category (Figure 5). Potassium was identified as a nutrient of public health concern by the U.S. Dietary Guidelines in 2015 and has been added to mandatory nutrition labeling by the FDA. Potassium remains an under-consumed nutrient identified in the Scientific Report of the 2020 Dietary Guidelines Advisory Committee (USDA, HHS, 2020). Potassium plays a key role in muscle function, including heart. Supplements have been restricted to a maximum of no more than 100 mg/capsule by the FDA since 1975 and getting the recommended 4,700 mg each day is confounding. It’s time to overturn this ruling.

Figure 5. TrendSense Predictive Model: Potassium

Non-Dietary Solutions

Cardio health and cholesterol are among the concerns consumers are most likely to be managing with a combination of medication, supplements, and diet (Kerry, 2019) (Figure 6). Just over one-third (36%) use only foods/supplements to manage their cardio issues, 41% cholesterol; 8% and 9%, respectively, use only Rx medication; and 45% and 37%, respectively, use both (Kerry 2019). In 2018, more than 35 million U.S. adults were taking prescription statins (e.g., Lipitor, Crestor, and Zocor) (IQVIA 2019).

Figure 6. Consumer Health Needs Managed by Medicine, Supplements & Diet

New global exercise trends, including “exercise as medicine” and exercise as “lifestyle medicine,” are virtually untapped opportunities for cardio concerned consumers. More consumers preferentially reach for exercise vs. supplements or functional foods to help manage or treat cardiovascular concerns, including high blood pressure (Hartman, 2019).

Digital apps, smart devices, and home monitoring meters for heart health are other fast-growing sectors. Omron Healthcare has introduced a blood pressure monitoring HeartGuide watch. AliveCor’s KardiaMobile EKG now delivers a report every 90 days by a board-certified cardiologist.

Of the 52% of households with a member following a specific diet plan, 5% are following the Mediterranean Diet, a diet known for its heart healthy results (FMI, 2020). Leading medical authorities have recommended/endorsed the Mediterranean-style of eating, including the AHA, The Mayo Clinic, and the U.S. Dietary Guidelines.

Lastly, functional foods are becoming more influential in foodservice. Heart health, energy, weight management, and gut health are the most influential health conditions (Datassential, 2019).