By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.05.01.17

Sleep problems rank fifth among the health issues consumers say they are personally affected by, right after tiredness/lack of energy, back/neck pain, stress, and overweight, according to HealthFocus.

In 2016, 206 million adults (82%) had trouble sleeping at least once a week; 97 million (39%) five or more nights per week, according to Packaged Facts’ Sleep Management in the U.S. (Feb. 2017).

Four in 10 of those who have trouble sleeping have at least one major sleeping disorder: 23% insomnia, 16% sleep apnea, 10% restless leg syndrome, and 2% narcolepsy, per Packaged Facts.

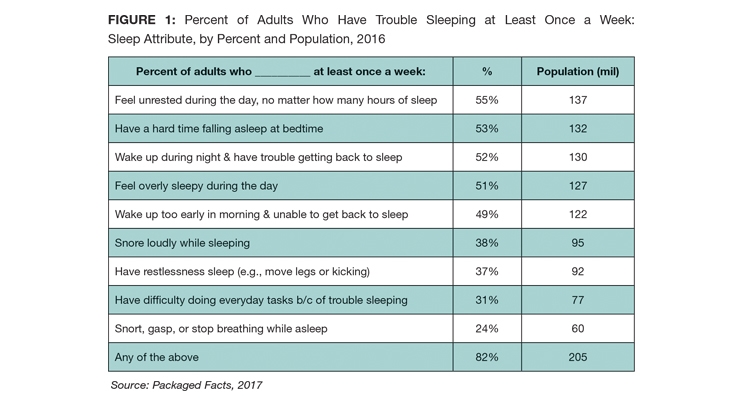

Fifty-five percent of those with sleep issues say they feel unrested no matter how many hours of sleep they have; 53% have trouble falling asleep, 52% wake up at night/can’t fall back asleep, 51% feel sleepy during the day, and 49% wake up early and can’t get back to sleep (see Figure 1).

Four in 10 adults with sleep issues snore. Boomer/senior men are the most likely to do so and to have sleep apnea. Boomer women with household incomes < $50k are the most likely to suffer from insomnia, per Packaged Facts.

The prevalence of more severe forms of insomnia and other sleep disorders has increased 20% from 2007 to 2016; snoring/sleep apnea 18%. Those reporting mild sleep apnea and snoring issues skyrocketed 65%, according to the Centers for Disease Control and Prevention (CDC).

Taking Action

In 2016, 19% of those who had a sleep issue at least once a week took an OTC (e.g., Benadryl, Sominex, or Unisom), 23% an Rx medication. Women aged 45-54 and over 65 were the most likely to take a sleeping pill, according to Packaged Facts.

Those with sleep conditions are more likely to use traditional medications—36% of insomniacs used an OTC and 51% an Rx medication; 31% and 46%, respectively, of those with sleep apnea.

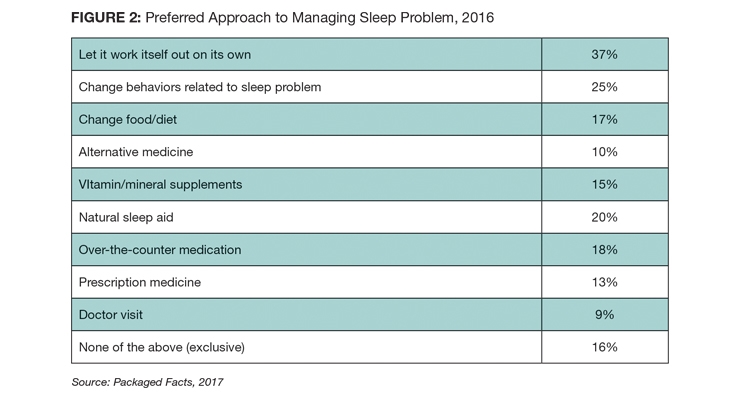

But with worry over the side effects of Rx sleep medications, and one in five of those with sleep issues citing natural sleep aids as their preferred approach to managing sleep problems, it’s not surprising that combination OTC/supplement products are dominating the sleep market (see Figure 2).

For the year ended Nov. 27, 2016, P&G’s ZzzQuil liquids led sales in the mass market sleep remedy category with unit sales up 9.1%, followed by Natrol tablets 5.7%, Nature’s Bounty tablets 5.5%, ZzzQuil tablets 4.5%, Nature Made tablets 4.5%, Unisom Sleepgels 3.0%, Sundown Naturals tablets 3.4%, Unisom Sleeptabs 1.4%, Alteril tablets 0.7%, and Neuro Sleep liquid 5.7%, per IRI.

In 2016, 19% of consumers took supplements to help with sleep issues, according to Packaged. Facts; 19% used melatonin, 14% chamomile/lavender, 9% magnesium, and 8% valerian.

Sleep supplement sales reached $609 million in 2016, up 7.1% vs. 2015, and are projected to top $808 million by 2020, according to Nutrition Business Journal (NBJ).

Melatonin was the leading sleep supplement ingredient in 2015, accounting for 62% of sales, followed by homeopathics 11%, combination herbs 9%, valerian 9%, 5-HTP 3%, and magnesium 3%. Melatonin supplement sales topped $436 million, up 8.1% in 2016, and are projected to reach $601 million in 2020, per NBJ.

Insomnia/sleep disorder sufferers are 30% more likely to trust homeopathic remedies than the general population. Despite recent challenges by FDA, NBJ reported that homeopathic supplement sales topped $1.3 billion in 2016, up 3.4%, and projected sales will reach $1.6 billion by 2020.

Seventeen percent of those with sleep issues used massage therapy last year, 8% aromatherapy/essential oils, 6% acupuncture, 5% physical therapy, 4% electrical simulation, and 4% biofeedback. Nearly one in three have treated their sleep problem with exercise, per Packaged Facts. According to the Hartman Group, 17% are trying to prevent sleep issues; 27% used exercise, 24% OTCs, 22% supplements, 15% food, and 13% Rx medications.

Natural and personal care aromatherapy sales surpassed $800 million in 2016, per NBJ, and are expected to approach $1.3 billion by 2020 with an annual growth rate of at least 20%.

Growth Opportunities

Those with sleep issues are more likely to also suffer from other health conditions, creating a series of opportunities for multi-functional remedies. Insomnia/sleep disorder sufferers index 501 for chronic pain, 427 for depression, 412 for chronic obstructive pulmonary disease, 385 for overactive bladder, 384 for anxiety, 299 for overweight, 290 for heartburn, 278 for any arthritis and 265 for backache. (Note: average among general population = 100; Packaged Facts.)

With troubled sleepers less likely to say they rarely get sick, immunity is another important need state, as is weight loss. Those diagnosed with snoring/sleep apnea are 15 times more likely to be at least 30 pounds overweight. The number of consumers using OTC headache/pain relievers (e.g., Aleve pm sleep aid plus 12 hour pain relief), jumped 8.6% from 2015 to 2016.

Only 37% of consumers feel in control of their stress, according to Mintel (Jan. 2017).

Kids also suffer from sleep issues. According to the National Sleep Foundation, less than half of kids aged 6-12 get the recommended 9 hours of sleep; 58% of 15 to 17 year olds.

One in four individuals say they have driven when they could barely stay awake, one in five do so frequently, especially those with long commutes or who drive for a living (e.g., truckers), according to the National Highway Traffic Safety Administration (2017).

Ingredients Used for Sleep

Ingredients used for sleep include herbs, hormones, and amino acids. Mechanisms of action are varied and include effects on the central nervous system and modulation of neurotransmitters. Herbs including valerian, hops, passion flower, magnolia extract, Apocynum venetum leaf extract (AVLE), and ginseng (Panax ginseng, Panax quinquefolius, Panax vietnamensis) may have sedative and hypnotic effects; ashwanganda acts as an adaptogen. The amino acid tryptophan may induce sleepiness and reduce sleep latency; 5-hydroxytryptophan (5-HTP) is a precursor to the mood modulating neurotransmitter serotonin. According to the 2016 Council for Responsible Nutrition (CRN) Consumer Survey on Dietary Supplements, 11% of supplement users between the ages of 18-34 took an amino acid in 2016. However, the strongest body of scientific support for sleep aid is for the hormone melatonin.

Functional Foods

Nearly half of adults would be interested in foods/beverages that help promote sleep, according to HealthFocus. One in five troubled sleepers looked to dietary changes/food to help with their sleep issues. One quarter used tea (e.g., Celestial Seasonings Sleepytime Herbal Tea) last year—more than supplements—to aid sleep. Warm milk, caffeine-free drinks and chamomile/lavender are other popular home remedies. Adults with sleep disorders are less likely to view their diet as healthy, to count calories or to look for organic/natural foods, per Packaged Facts.

NightFood and Dreamits are among the latest sleep-promoting foods to enter the market. Kiwis and tart cherry juice are among the latest superfoods being linked to sleep promotion.

Dietary Supplements

Products that naturally align with sleep are a big idea (e.g., night-repair inner beauty for skin, hair, and nails). Extension of this concept to building muscle, lowering cholesterol, or improving calcium levels, which are modulated during sleep, may be big opportunities.

Fast-acting and/or time-release pharma technology, such as capsule-within-a-capsule, that would support dual-action products for falling asleep and staying asleep should also have high appeal. Tylenol’s TY 500 rapid release gels for fast pain relief have been a huge success. There is some scientific support for the combination of GABA (to help fall asleep) and AVLE (to induce deep sleep), which might be an opportunity for a dual-action type product.

In 2016, sales of mood supplements reached $594 million, up 3.2% vs. 2015 and are projected to reach $691 million by 2020, per NBJ.

Doctor-recommended is a highly influential purchase motivator for sleep remedies, per Packaged Facts.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

In 2016, 206 million adults (82%) had trouble sleeping at least once a week; 97 million (39%) five or more nights per week, according to Packaged Facts’ Sleep Management in the U.S. (Feb. 2017).

Four in 10 of those who have trouble sleeping have at least one major sleeping disorder: 23% insomnia, 16% sleep apnea, 10% restless leg syndrome, and 2% narcolepsy, per Packaged Facts.

Fifty-five percent of those with sleep issues say they feel unrested no matter how many hours of sleep they have; 53% have trouble falling asleep, 52% wake up at night/can’t fall back asleep, 51% feel sleepy during the day, and 49% wake up early and can’t get back to sleep (see Figure 1).

Four in 10 adults with sleep issues snore. Boomer/senior men are the most likely to do so and to have sleep apnea. Boomer women with household incomes < $50k are the most likely to suffer from insomnia, per Packaged Facts.

The prevalence of more severe forms of insomnia and other sleep disorders has increased 20% from 2007 to 2016; snoring/sleep apnea 18%. Those reporting mild sleep apnea and snoring issues skyrocketed 65%, according to the Centers for Disease Control and Prevention (CDC).

Taking Action

In 2016, 19% of those who had a sleep issue at least once a week took an OTC (e.g., Benadryl, Sominex, or Unisom), 23% an Rx medication. Women aged 45-54 and over 65 were the most likely to take a sleeping pill, according to Packaged Facts.

Those with sleep conditions are more likely to use traditional medications—36% of insomniacs used an OTC and 51% an Rx medication; 31% and 46%, respectively, of those with sleep apnea.

But with worry over the side effects of Rx sleep medications, and one in five of those with sleep issues citing natural sleep aids as their preferred approach to managing sleep problems, it’s not surprising that combination OTC/supplement products are dominating the sleep market (see Figure 2).

For the year ended Nov. 27, 2016, P&G’s ZzzQuil liquids led sales in the mass market sleep remedy category with unit sales up 9.1%, followed by Natrol tablets 5.7%, Nature’s Bounty tablets 5.5%, ZzzQuil tablets 4.5%, Nature Made tablets 4.5%, Unisom Sleepgels 3.0%, Sundown Naturals tablets 3.4%, Unisom Sleeptabs 1.4%, Alteril tablets 0.7%, and Neuro Sleep liquid 5.7%, per IRI.

In 2016, 19% of consumers took supplements to help with sleep issues, according to Packaged. Facts; 19% used melatonin, 14% chamomile/lavender, 9% magnesium, and 8% valerian.

Sleep supplement sales reached $609 million in 2016, up 7.1% vs. 2015, and are projected to top $808 million by 2020, according to Nutrition Business Journal (NBJ).

Melatonin was the leading sleep supplement ingredient in 2015, accounting for 62% of sales, followed by homeopathics 11%, combination herbs 9%, valerian 9%, 5-HTP 3%, and magnesium 3%. Melatonin supplement sales topped $436 million, up 8.1% in 2016, and are projected to reach $601 million in 2020, per NBJ.

Insomnia/sleep disorder sufferers are 30% more likely to trust homeopathic remedies than the general population. Despite recent challenges by FDA, NBJ reported that homeopathic supplement sales topped $1.3 billion in 2016, up 3.4%, and projected sales will reach $1.6 billion by 2020.

Seventeen percent of those with sleep issues used massage therapy last year, 8% aromatherapy/essential oils, 6% acupuncture, 5% physical therapy, 4% electrical simulation, and 4% biofeedback. Nearly one in three have treated their sleep problem with exercise, per Packaged Facts. According to the Hartman Group, 17% are trying to prevent sleep issues; 27% used exercise, 24% OTCs, 22% supplements, 15% food, and 13% Rx medications.

Natural and personal care aromatherapy sales surpassed $800 million in 2016, per NBJ, and are expected to approach $1.3 billion by 2020 with an annual growth rate of at least 20%.

Growth Opportunities

Those with sleep issues are more likely to also suffer from other health conditions, creating a series of opportunities for multi-functional remedies. Insomnia/sleep disorder sufferers index 501 for chronic pain, 427 for depression, 412 for chronic obstructive pulmonary disease, 385 for overactive bladder, 384 for anxiety, 299 for overweight, 290 for heartburn, 278 for any arthritis and 265 for backache. (Note: average among general population = 100; Packaged Facts.)

With troubled sleepers less likely to say they rarely get sick, immunity is another important need state, as is weight loss. Those diagnosed with snoring/sleep apnea are 15 times more likely to be at least 30 pounds overweight. The number of consumers using OTC headache/pain relievers (e.g., Aleve pm sleep aid plus 12 hour pain relief), jumped 8.6% from 2015 to 2016.

Only 37% of consumers feel in control of their stress, according to Mintel (Jan. 2017).

Kids also suffer from sleep issues. According to the National Sleep Foundation, less than half of kids aged 6-12 get the recommended 9 hours of sleep; 58% of 15 to 17 year olds.

One in four individuals say they have driven when they could barely stay awake, one in five do so frequently, especially those with long commutes or who drive for a living (e.g., truckers), according to the National Highway Traffic Safety Administration (2017).

Ingredients Used for Sleep

Ingredients used for sleep include herbs, hormones, and amino acids. Mechanisms of action are varied and include effects on the central nervous system and modulation of neurotransmitters. Herbs including valerian, hops, passion flower, magnolia extract, Apocynum venetum leaf extract (AVLE), and ginseng (Panax ginseng, Panax quinquefolius, Panax vietnamensis) may have sedative and hypnotic effects; ashwanganda acts as an adaptogen. The amino acid tryptophan may induce sleepiness and reduce sleep latency; 5-hydroxytryptophan (5-HTP) is a precursor to the mood modulating neurotransmitter serotonin. According to the 2016 Council for Responsible Nutrition (CRN) Consumer Survey on Dietary Supplements, 11% of supplement users between the ages of 18-34 took an amino acid in 2016. However, the strongest body of scientific support for sleep aid is for the hormone melatonin.

Functional Foods

Nearly half of adults would be interested in foods/beverages that help promote sleep, according to HealthFocus. One in five troubled sleepers looked to dietary changes/food to help with their sleep issues. One quarter used tea (e.g., Celestial Seasonings Sleepytime Herbal Tea) last year—more than supplements—to aid sleep. Warm milk, caffeine-free drinks and chamomile/lavender are other popular home remedies. Adults with sleep disorders are less likely to view their diet as healthy, to count calories or to look for organic/natural foods, per Packaged Facts.

NightFood and Dreamits are among the latest sleep-promoting foods to enter the market. Kiwis and tart cherry juice are among the latest superfoods being linked to sleep promotion.

Dietary Supplements

Products that naturally align with sleep are a big idea (e.g., night-repair inner beauty for skin, hair, and nails). Extension of this concept to building muscle, lowering cholesterol, or improving calcium levels, which are modulated during sleep, may be big opportunities.

Fast-acting and/or time-release pharma technology, such as capsule-within-a-capsule, that would support dual-action products for falling asleep and staying asleep should also have high appeal. Tylenol’s TY 500 rapid release gels for fast pain relief have been a huge success. There is some scientific support for the combination of GABA (to help fall asleep) and AVLE (to induce deep sleep), which might be an opportunity for a dual-action type product.

In 2016, sales of mood supplements reached $594 million, up 3.2% vs. 2015 and are projected to reach $691 million by 2020, per NBJ.

Doctor-recommended is a highly influential purchase motivator for sleep remedies, per Packaged Facts.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.