02.05.19

Sustainable Bioproducts, a biotechnology company developing a new way to grow edible protein, has raised $33 million in Series A financing from premier venture capital funds and two of the world’s largest food and agribusiness companies.

1955 Capital, a Silicon Valley-based venture fund founded by Andrew Chung, led the round. Among the participants: Breakthrough Energy Ventures, a $1 billion investor-led fund created to help stop climate change; ADM Ventures, the venture investing arm of global food and feed ingredient provider Archer Daniels Midland Company; Danone Manifesto Ventures, the venture-investing arm of French food and beverage company Danone; Lauder Partners; and the Liebelson family office.

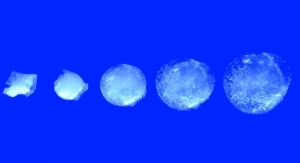

Sustainable Bioproducts’ technology emerged out of fundamental research into extremophile organisms that live in Yellowstone National Park’s volcanic springs. That work led to the development of an innovative fermentation technology, which can grow protein with great nutritional value and minimal impact on the environment.

“Curiosity and a passion for exploration led us to Yellowstone, one of the harshest ecosystems in the world,” said Thomas Jonas, Sustainable Bioproducts’ CEO and co-founder. “By observing how life optimizes the use of resources in this challenging environment, we have invented a way to make protein that is radically more efficient and gentler on our planet.”

NASA, the National Science Foundation, the National Park Service, the U.S. Environmental Protection Agency (EPA), the U.S. Department of Agriculture (USDA), the State of Montana and Montana State University have provided financial and in-kind support to the company. The company currently is based out of the University of Chicago’s Polsky Center for Entrepreneurship and Innovation.

“We have witnessed incredible growth in the demand for new proteins in recent years and believe Sustainable Bioproducts has the most compelling and efficient solution to satisfy this demand,” said Chung, managing partner of 1955 Capital. “This demand will not only come from the west, but from the developing world where the need for protein will become more severe.”

1955 Capital, a Silicon Valley-based venture fund founded by Andrew Chung, led the round. Among the participants: Breakthrough Energy Ventures, a $1 billion investor-led fund created to help stop climate change; ADM Ventures, the venture investing arm of global food and feed ingredient provider Archer Daniels Midland Company; Danone Manifesto Ventures, the venture-investing arm of French food and beverage company Danone; Lauder Partners; and the Liebelson family office.

Sustainable Bioproducts’ technology emerged out of fundamental research into extremophile organisms that live in Yellowstone National Park’s volcanic springs. That work led to the development of an innovative fermentation technology, which can grow protein with great nutritional value and minimal impact on the environment.

“Curiosity and a passion for exploration led us to Yellowstone, one of the harshest ecosystems in the world,” said Thomas Jonas, Sustainable Bioproducts’ CEO and co-founder. “By observing how life optimizes the use of resources in this challenging environment, we have invented a way to make protein that is radically more efficient and gentler on our planet.”

NASA, the National Science Foundation, the National Park Service, the U.S. Environmental Protection Agency (EPA), the U.S. Department of Agriculture (USDA), the State of Montana and Montana State University have provided financial and in-kind support to the company. The company currently is based out of the University of Chicago’s Polsky Center for Entrepreneurship and Innovation.

“We have witnessed incredible growth in the demand for new proteins in recent years and believe Sustainable Bioproducts has the most compelling and efficient solution to satisfy this demand,” said Chung, managing partner of 1955 Capital. “This demand will not only come from the west, but from the developing world where the need for protein will become more severe.”