By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.07.06.20

The COVID-19 pandemic has accelerated an already aggressive approach to healthy eating. It has focused consumers’ attention on prevention of health conditions, vitamins/minerals, immunity, and consideration for at-risk individuals. Most important, it has skyrocketed the “food as medicine” movement.

According to IRI’s June 16, 2020 “Charting the Course for Center Store Growth,” 35% more consumers are proactively trying to take care of their physical/emotional health now than before the pandemic; 22% have changed their eating habits to be healthier.

In 2019, buying foods for “specific health benefits for my body” surpassed more passive/holistic strategies, e.g., clean, natural, organic, local, and whole foods, for the first time; 61% vs. 48%. By mid-April 2020, 63% were buying for benefits; 53% for holistic reasons, per FMI’s 2019 and 2020 “U.S. Grocery Shopper Trends.”

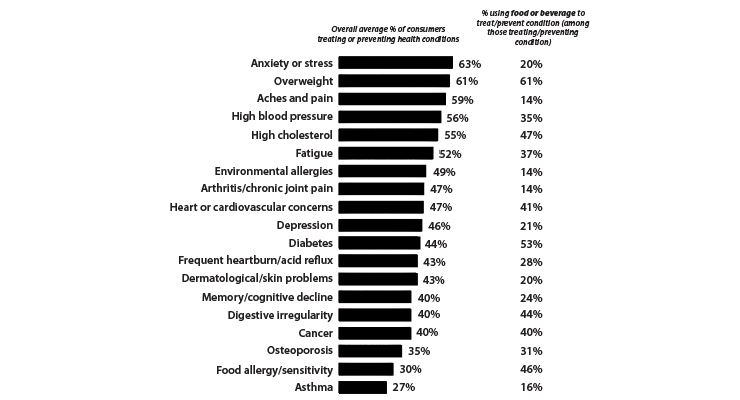

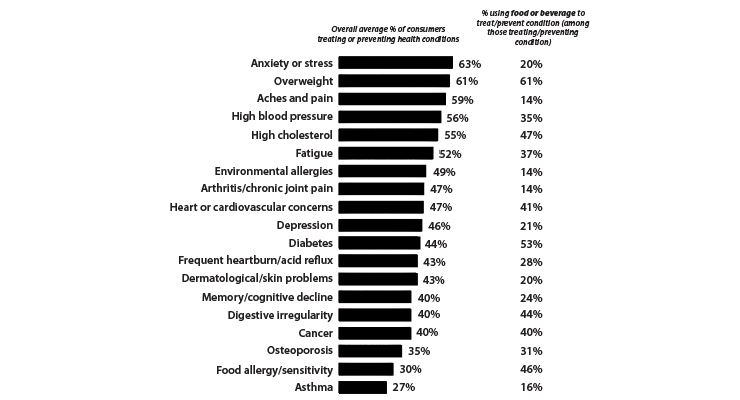

Over half of consumers were already dealing with one or more chronic conditions in their household last year, according to the Hartman Group’s 2019 “Health + Wellness: From Moderation to Mindfulness.” On average, consumers were treating 3.5 conditions and trying to prevent 6.1 (Figure 1).

Figure 1: Food or Beverage as a Remedy for Health Conditions

Source: Hartman Group’s 2019 Health + Wellness: From Moderation to Mindfulness report

Further, consumers use food to treat/prevent an average of 2.7 health conditions and use beverages to treat/prevent an average of 1.4 health conditions.

Overweight tops the list of conditions consumers tried to treat/prevent using food/beverages, followed by diabetes, high cholesterol, food allergies/insensitivities, irregularity, heart concerns, cancer, fatigue, high blood pressure, and osteoporosis, per Hartman.

The pandemic amplified the need to minimize/prevent disease states. During the 8-week COVID period (Mar. 8 to Apr. 26), dollar sales of center store foods/drinks that offered diabetes support increased nine-times 2019 sales, according to IRI. Weight control product sales increased 11-times and moved from negative to positive unit sales. Products aimed at helping control hypertension posted a 22% dollar sales increase vs. 2019.

Globally, four in 10 (38%) consumers always/usually chose foods/beverages for specific medical purposes, up from 30% in 2016, according to HealthFocus International’s “2020 Global Trend Study on Shoppers’ Journey Towards Living & Eating Healthier.” Seven in 10 strongly believe in the food as medicine concept.

Euromonitor’s “Health & Wellness 2020” reported worldwide sales of fortified/functional foods at $267 billion in February 2020; naturally healthy foods $259 billion. In 2019, 46% of global consumers purchased functional foods, per Kerry’s 2019 Find the Right Format.

U.S. functional foods/drinks were projected by Nutrition Business Journal to grow from $72 billion in 2019 to $88 billion by 2022. As cash strapped consumers turn an eye to value, products with more than one claim will get the nod. According to Mintel’s “Nutrition Drinks – US – Feb. 2020,” adding an immunity claim to a weight management or general wellness claim on nutritional drinks would motivate 67% of consumers to buy the products vs. 44% for weight alone.

Tasty Solutions for Conditions

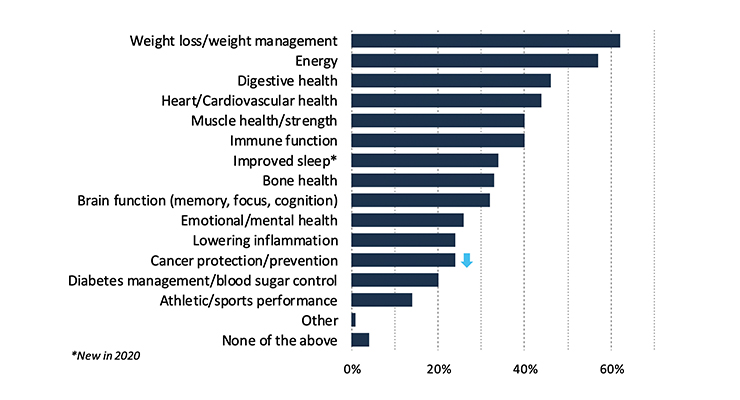

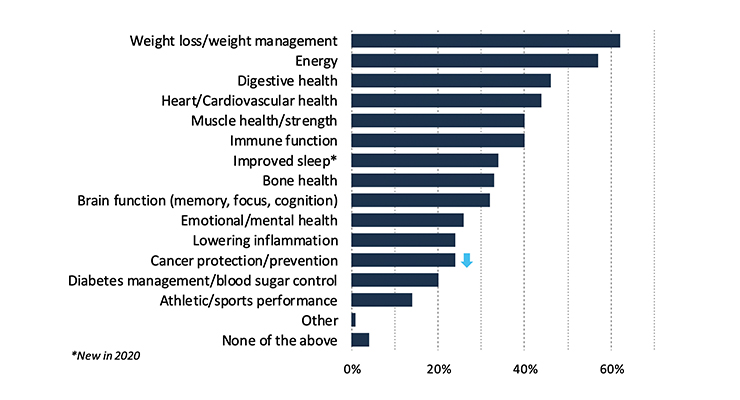

Weight loss/management followed by energy, digestive health, heart health, and muscle health/strength top the 2020 list of health benefits consumers most want to get from foods, per IFIC’s June 2020 “Food & Health Survey”; heart health tops the list for those over 50 years old. Immunity moved ahead of bone health, brain/emotional health, and sleep vs. 2019; cancer prevention declined slightly (Figure 2).

Figure 2: Top Sought After Health Benefits (Of Those Who Seek Health Benefits From Foods)

Managing weight and providing satiety are the top two most desired functional food benefits, per HealthFocus’ 2019 USA study. Mintel’s 2019 “Diet Trends & Fads” reported that 120 million U.S. adults tried to lose weight last year; 168 million were overweight and 74 million obese, according to the American Heart Association’s (AHA) 2020 statistics.

Mintel predicted sales of meal replacement/weight loss beverages will reach $6.5 billion by 2024; 25% of households use meal replacement drinks and 19% weight control beverages. Just over half (53%) of adults associated protein with weight management, 24% satiety, per HealthFocus.

Globally, nearly half of those who buy high-protein foods (59%) do so for weight loss. During the year ending April 2020, 43% of U.S. adults experimented with a dietary regimen: 10% intermittent fasting; 7% each the Whole30 diet or a juice/detox cleanse; 6% Weight Watchers (WW); and 5% each the elimination, ketogenic, or paleo diet, per IFIC. Most important, Hartman’s 2019 study found that only 3% who try these diet plans stay on one plan exclusively.

Nearly half (47%) of those using food to prevent/manage a condition are aiming at lowering cholesterol, 41% cardiovascular concerns, and 35% high blood pressure, per Hartman. HealthFocus reported 49% are very/extremely concerned about heart disease.

With 1.5 million new cases per year in the U.S., the demand for diabetic-friendly fare continues to grow. Four in 10 use only foods/supplements to manage blood sugar, 38% both Rx medications and food/supplements, per Kerry. Just over one-quarter (28%) of consumers want foods to help manage blood glucose levels, according to HealthFocus.

Immunity ranks seventh globally among health issues cited that are extremely/very important (54%), per HealthFocus 2020 global survey. During the 8-week pandemic period, center store foods/beverages with an immunity claim grew 19% in dollar sales and almost doubled 2019 growth. Those products touting a “good source” of vitamin C sold 20% of 2019 dollar sales, antioxidants 18%, in only 15% of the weeks; both going from negative to positive unit sales. Sales of foods touting vitamin D grew 11 times vs. 2019, per IRI.

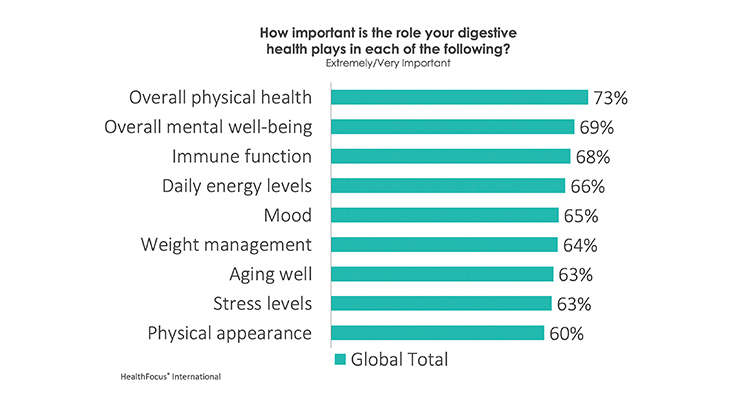

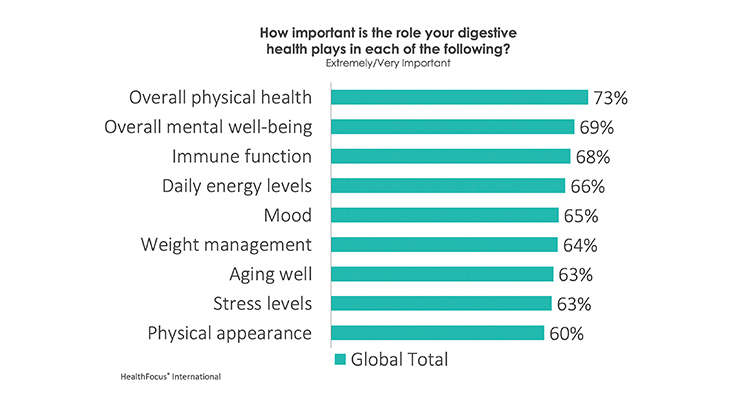

Right after immunity, improved digestion is the second most important health benefit global shoppers are looking for from food, followed by bone health/strength, enhanced everyday performance, and energy, per HealthFocus. Over half (55%) of global shoppers select foods with digestive health benefits in mind.

Figure 3: Gut Health & Overall Health

In the U.S. 44% are trying to prevent/treat digestive irregularity with food; 28% acid reflux/heartburn, per Hartman. In 2019, 43% of consumers tried to consume more probiotic foods; 23% foods with prebiotics.

Everyday Performance

Energy is second only to weight control as the health benefit consumers would most like to get from foods. Over one-third (37%) are trying to treat/prevent fatigue using foods/beverages, per Hartman.

More than half of consumers are extremely/very concerned about tiredness/lack of energy; globally 56% are very/extremely concerned, per HealthFocus.

With mental/emotional balance now as important to eight in 10 consumers as physical health; using foods to help cope with anxiety, stress, relaxation, sleeplessness, and to improve cognition remains a virtually untapped opportunity. One in five are treating/preventing anxiety with foods, per Hartman.

Prior to the pandemic, retail sales of cannabis edibles were projected to grow from nearly $1.2 billion in 2019 to $4.9 billion in 2024, per Packaged Facts 2019 “Cannabis & CBD.” IRI reported CBD food sales grew eight times more in dollar sales during the eight-week COVID period than in 2019.

Four in 10 of those who used a hemp-based CBD food or supplement did so for anxiety, 36% for pain, 34% for relaxation, 29% for sleeplessness, and 24% for depression, according to NBJ (2019).

Food Active Ingredients

Two-thirds of U.S. consumers are looking for everyday foods with health-promoting attributes beyond their inherent benefits, per Kerry’s Proactive Health.

According to Hartman’s 2020 the “Future of Food Technology,” 64% seek out foods/drinks with added vitamins/minerals. One-quarter are aware of nutrient fortification using nanotechnology; one-third are interested in purchasing these products.

In 2019, 31% of supplement users took vitamin D, 28% vitamin C, 21% protein, 20% calcium, 20% B complex, 16% omega-3s, 15% green tea, 14% magnesium, 13% probiotics, 13% iron, 12% turmeric, and 12% vitamin E, per CRN.

Fiber, protein, vitamin D, calcium, nuts/seeds, whole grains, healthier oils, and antioxidants are the ingredients more than half of consumers are increasingly adding to their diet; over four in 10 omega-3s, green tea, and probiotics, per Hartman’s Health + Wellness report.

According to Sloan Trends’ TrendSense model, potassium is of growing interest in the nutraceuticals category. Potassium was identified as a nutrient of public health concern by the U.S. Dietary Guidelines in 2015 and has been added to mandatory nutrition labeling by the FDA. Potassium plays a key role in muscle function, including heart, and is likely the cause of many muscle cramps. Supplements have been restricted to a maximum of no more than 100 mg/capsule by the FDA since 1975, and getting the recommended 4,700 mg each day is challenging.

When choosing healthy foods, 42% looked for foods that were unique (e.g., superfoods), up 8% from 2019, per FMI. Generation Z and millennials are most likely to do so (54%), vs. boomers/matures (27%).

Fermented foods topped the list of trendy superfoods for 2020 followed by avocado, seeds, exotic fruits, ancient grains, blueberries, nuts, non-dairy milks, beets, and green tea, according to Pollock Communications’ annual survey.

Green tea, honey, coffee beans, probiotics, apple cider vinegar, oats, garlic, grapefruit, and dark chocolate are among the top foods that consumers believe deliver functional benefits, per Kerry.

Herbals are the fastest-growing supplement category with sales reaching $9.6 billion, up 10% in 2019, per NBJ. Half of supplement users took an herbal last year, per CRN. In March, herbal/homeopathic supplement sales jumped 85% in mainstream and 100% in natural product stores, falling off to an impressive 30% and 35%, respectively, for the 8-week period ending May 17, 2020, per IRI’s Jun. 23, 2020 “Supporting the Natural Consumer.”

Forms & Formats

Nutritional beverages, yogurt, and protein powders are the categories that over 50% of consumers consider for added functionality; bars, cereals, smoothies, and juice by more than 40%; and milk, water, sports drinks, oatmeal, energy drinks, and green tea over one-third, per Kerry.

Bottled water sales topped $18.1 billion for the year ended May 17, 2020 in U.S. multioutlet/convenience stores (MULO+C), per IRI. Refrigerated ready-to-drink (RTD) teas topped $1.7 billion for the year ended May 17, 2020, up 6% vs 2019; tea bags and loose-leaf tea $1.3 billion, up over 9%, per IRI. Refrigerated RTD coffee sales reached $487 million, up 20%.

Sales in the energy beverage category topped $12.8 billion, per IRI, up over 9%. Energy mixes grew 13.5% to $124.5 million, while energy shot sales fell 8% to $977 million, per IRI.

Non-aseptic sports drinks posted sales of $7 billion for the year ended May 17, up over 7%. The $103 million sports drink mixes sub-segment grew almost 18%.

In 2019, wellness snacks grew 28% in dollar sales, 1.9% in units; permissibly indulgent snacks 25% and 3.1%, respectively, per IRI’s Apr. 14, 2020 “Snacking Lifestyles are Here to Stay.” Just over half (54%) of consumers said they want snacks that contain vitamins/minerals, 48% high fiber, and 38% probiotics.

Sales of nutrition/intrinsic value, energy, diet bars reached $3.6 billion in 2019, up 3.7%. All snack, meal, and nutrition bars collectively are projected to reach $8.4 billion by 2024, up from $7.2 in 2019, per Packaged Facts June 2020 Food Outlook. Retail dollar sales of yogurt are forecast to decline with a CAGR of 0.3% to $8.6 billion in 2020; breakfast cereals from $11.8 billion in 2020 to $10.2 billion by 2024.

For the complete story get a copy of the July/August print issue of Nutraceuticals World.

About the authors: Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

According to IRI’s June 16, 2020 “Charting the Course for Center Store Growth,” 35% more consumers are proactively trying to take care of their physical/emotional health now than before the pandemic; 22% have changed their eating habits to be healthier.

In 2019, buying foods for “specific health benefits for my body” surpassed more passive/holistic strategies, e.g., clean, natural, organic, local, and whole foods, for the first time; 61% vs. 48%. By mid-April 2020, 63% were buying for benefits; 53% for holistic reasons, per FMI’s 2019 and 2020 “U.S. Grocery Shopper Trends.”

Over half of consumers were already dealing with one or more chronic conditions in their household last year, according to the Hartman Group’s 2019 “Health + Wellness: From Moderation to Mindfulness.” On average, consumers were treating 3.5 conditions and trying to prevent 6.1 (Figure 1).

Figure 1: Food or Beverage as a Remedy for Health Conditions

Source: Hartman Group’s 2019 Health + Wellness: From Moderation to Mindfulness report

Further, consumers use food to treat/prevent an average of 2.7 health conditions and use beverages to treat/prevent an average of 1.4 health conditions.

Overweight tops the list of conditions consumers tried to treat/prevent using food/beverages, followed by diabetes, high cholesterol, food allergies/insensitivities, irregularity, heart concerns, cancer, fatigue, high blood pressure, and osteoporosis, per Hartman.

The pandemic amplified the need to minimize/prevent disease states. During the 8-week COVID period (Mar. 8 to Apr. 26), dollar sales of center store foods/drinks that offered diabetes support increased nine-times 2019 sales, according to IRI. Weight control product sales increased 11-times and moved from negative to positive unit sales. Products aimed at helping control hypertension posted a 22% dollar sales increase vs. 2019.

Globally, four in 10 (38%) consumers always/usually chose foods/beverages for specific medical purposes, up from 30% in 2016, according to HealthFocus International’s “2020 Global Trend Study on Shoppers’ Journey Towards Living & Eating Healthier.” Seven in 10 strongly believe in the food as medicine concept.

Euromonitor’s “Health & Wellness 2020” reported worldwide sales of fortified/functional foods at $267 billion in February 2020; naturally healthy foods $259 billion. In 2019, 46% of global consumers purchased functional foods, per Kerry’s 2019 Find the Right Format.

U.S. functional foods/drinks were projected by Nutrition Business Journal to grow from $72 billion in 2019 to $88 billion by 2022. As cash strapped consumers turn an eye to value, products with more than one claim will get the nod. According to Mintel’s “Nutrition Drinks – US – Feb. 2020,” adding an immunity claim to a weight management or general wellness claim on nutritional drinks would motivate 67% of consumers to buy the products vs. 44% for weight alone.

Tasty Solutions for Conditions

Weight loss/management followed by energy, digestive health, heart health, and muscle health/strength top the 2020 list of health benefits consumers most want to get from foods, per IFIC’s June 2020 “Food & Health Survey”; heart health tops the list for those over 50 years old. Immunity moved ahead of bone health, brain/emotional health, and sleep vs. 2019; cancer prevention declined slightly (Figure 2).

Figure 2: Top Sought After Health Benefits (Of Those Who Seek Health Benefits From Foods)

Source: IFIC 2020 Food and Health Survey

Managing weight and providing satiety are the top two most desired functional food benefits, per HealthFocus’ 2019 USA study. Mintel’s 2019 “Diet Trends & Fads” reported that 120 million U.S. adults tried to lose weight last year; 168 million were overweight and 74 million obese, according to the American Heart Association’s (AHA) 2020 statistics.

Mintel predicted sales of meal replacement/weight loss beverages will reach $6.5 billion by 2024; 25% of households use meal replacement drinks and 19% weight control beverages. Just over half (53%) of adults associated protein with weight management, 24% satiety, per HealthFocus.

Globally, nearly half of those who buy high-protein foods (59%) do so for weight loss. During the year ending April 2020, 43% of U.S. adults experimented with a dietary regimen: 10% intermittent fasting; 7% each the Whole30 diet or a juice/detox cleanse; 6% Weight Watchers (WW); and 5% each the elimination, ketogenic, or paleo diet, per IFIC. Most important, Hartman’s 2019 study found that only 3% who try these diet plans stay on one plan exclusively.

Nearly half (47%) of those using food to prevent/manage a condition are aiming at lowering cholesterol, 41% cardiovascular concerns, and 35% high blood pressure, per Hartman. HealthFocus reported 49% are very/extremely concerned about heart disease.

With 1.5 million new cases per year in the U.S., the demand for diabetic-friendly fare continues to grow. Four in 10 use only foods/supplements to manage blood sugar, 38% both Rx medications and food/supplements, per Kerry. Just over one-quarter (28%) of consumers want foods to help manage blood glucose levels, according to HealthFocus.

Immunity ranks seventh globally among health issues cited that are extremely/very important (54%), per HealthFocus 2020 global survey. During the 8-week pandemic period, center store foods/beverages with an immunity claim grew 19% in dollar sales and almost doubled 2019 growth. Those products touting a “good source” of vitamin C sold 20% of 2019 dollar sales, antioxidants 18%, in only 15% of the weeks; both going from negative to positive unit sales. Sales of foods touting vitamin D grew 11 times vs. 2019, per IRI.

Right after immunity, improved digestion is the second most important health benefit global shoppers are looking for from food, followed by bone health/strength, enhanced everyday performance, and energy, per HealthFocus. Over half (55%) of global shoppers select foods with digestive health benefits in mind.

Figure 3: Gut Health & Overall Health

Source: HealthFocus International

In the U.S. 44% are trying to prevent/treat digestive irregularity with food; 28% acid reflux/heartburn, per Hartman. In 2019, 43% of consumers tried to consume more probiotic foods; 23% foods with prebiotics.

Everyday Performance

Energy is second only to weight control as the health benefit consumers would most like to get from foods. Over one-third (37%) are trying to treat/prevent fatigue using foods/beverages, per Hartman.

More than half of consumers are extremely/very concerned about tiredness/lack of energy; globally 56% are very/extremely concerned, per HealthFocus.

With mental/emotional balance now as important to eight in 10 consumers as physical health; using foods to help cope with anxiety, stress, relaxation, sleeplessness, and to improve cognition remains a virtually untapped opportunity. One in five are treating/preventing anxiety with foods, per Hartman.

Prior to the pandemic, retail sales of cannabis edibles were projected to grow from nearly $1.2 billion in 2019 to $4.9 billion in 2024, per Packaged Facts 2019 “Cannabis & CBD.” IRI reported CBD food sales grew eight times more in dollar sales during the eight-week COVID period than in 2019.

Four in 10 of those who used a hemp-based CBD food or supplement did so for anxiety, 36% for pain, 34% for relaxation, 29% for sleeplessness, and 24% for depression, according to NBJ (2019).

Food Active Ingredients

Two-thirds of U.S. consumers are looking for everyday foods with health-promoting attributes beyond their inherent benefits, per Kerry’s Proactive Health.

According to Hartman’s 2020 the “Future of Food Technology,” 64% seek out foods/drinks with added vitamins/minerals. One-quarter are aware of nutrient fortification using nanotechnology; one-third are interested in purchasing these products.

In 2019, 31% of supplement users took vitamin D, 28% vitamin C, 21% protein, 20% calcium, 20% B complex, 16% omega-3s, 15% green tea, 14% magnesium, 13% probiotics, 13% iron, 12% turmeric, and 12% vitamin E, per CRN.

Fiber, protein, vitamin D, calcium, nuts/seeds, whole grains, healthier oils, and antioxidants are the ingredients more than half of consumers are increasingly adding to their diet; over four in 10 omega-3s, green tea, and probiotics, per Hartman’s Health + Wellness report.

According to Sloan Trends’ TrendSense model, potassium is of growing interest in the nutraceuticals category. Potassium was identified as a nutrient of public health concern by the U.S. Dietary Guidelines in 2015 and has been added to mandatory nutrition labeling by the FDA. Potassium plays a key role in muscle function, including heart, and is likely the cause of many muscle cramps. Supplements have been restricted to a maximum of no more than 100 mg/capsule by the FDA since 1975, and getting the recommended 4,700 mg each day is challenging.

When choosing healthy foods, 42% looked for foods that were unique (e.g., superfoods), up 8% from 2019, per FMI. Generation Z and millennials are most likely to do so (54%), vs. boomers/matures (27%).

Fermented foods topped the list of trendy superfoods for 2020 followed by avocado, seeds, exotic fruits, ancient grains, blueberries, nuts, non-dairy milks, beets, and green tea, according to Pollock Communications’ annual survey.

Green tea, honey, coffee beans, probiotics, apple cider vinegar, oats, garlic, grapefruit, and dark chocolate are among the top foods that consumers believe deliver functional benefits, per Kerry.

Herbals are the fastest-growing supplement category with sales reaching $9.6 billion, up 10% in 2019, per NBJ. Half of supplement users took an herbal last year, per CRN. In March, herbal/homeopathic supplement sales jumped 85% in mainstream and 100% in natural product stores, falling off to an impressive 30% and 35%, respectively, for the 8-week period ending May 17, 2020, per IRI’s Jun. 23, 2020 “Supporting the Natural Consumer.”

Forms & Formats

Nutritional beverages, yogurt, and protein powders are the categories that over 50% of consumers consider for added functionality; bars, cereals, smoothies, and juice by more than 40%; and milk, water, sports drinks, oatmeal, energy drinks, and green tea over one-third, per Kerry.

Bottled water sales topped $18.1 billion for the year ended May 17, 2020 in U.S. multioutlet/convenience stores (MULO+C), per IRI. Refrigerated ready-to-drink (RTD) teas topped $1.7 billion for the year ended May 17, 2020, up 6% vs 2019; tea bags and loose-leaf tea $1.3 billion, up over 9%, per IRI. Refrigerated RTD coffee sales reached $487 million, up 20%.

Sales in the energy beverage category topped $12.8 billion, per IRI, up over 9%. Energy mixes grew 13.5% to $124.5 million, while energy shot sales fell 8% to $977 million, per IRI.

Non-aseptic sports drinks posted sales of $7 billion for the year ended May 17, up over 7%. The $103 million sports drink mixes sub-segment grew almost 18%.

In 2019, wellness snacks grew 28% in dollar sales, 1.9% in units; permissibly indulgent snacks 25% and 3.1%, respectively, per IRI’s Apr. 14, 2020 “Snacking Lifestyles are Here to Stay.” Just over half (54%) of consumers said they want snacks that contain vitamins/minerals, 48% high fiber, and 38% probiotics.

Sales of nutrition/intrinsic value, energy, diet bars reached $3.6 billion in 2019, up 3.7%. All snack, meal, and nutrition bars collectively are projected to reach $8.4 billion by 2024, up from $7.2 in 2019, per Packaged Facts June 2020 Food Outlook. Retail dollar sales of yogurt are forecast to decline with a CAGR of 0.3% to $8.6 billion in 2020; breakfast cereals from $11.8 billion in 2020 to $10.2 billion by 2024.

For the complete story get a copy of the July/August print issue of Nutraceuticals World.

About the authors: Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.