By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.03.02.20

The global sleep aid market which includes prescription (Rx), over-the-counter (OTC), natural formulations, personal care products, digital sleep aids, smart beds/pillows, clinics/coaches, and more is projected to reach $101.9 billion by 2023 with a CAGR of 7.4%, according to Prescient & Strategic Intelligence.

Six in 10 global consumers said they sleep somewhat or not at all well, according to Philips’ 2019 Global Sleep Survey; 40% said their sleep issues have gotten worse over the past five years. Those in South Korea, Japan, Peru, and Chile were most likely to say they don’t get enough sleep. Sleep issues are also increasing in developing countries, estimated by WHO in 2019 to affect an additional 150

million adults.

In the U.S., 82% of adults have trouble sleeping at least one night per week; 39% five or more nights, according to Packaged Facts’ 2017 Sleep Management in the U.S.

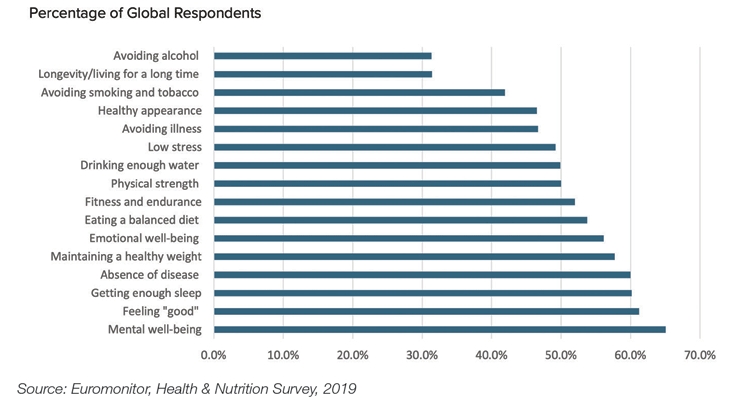

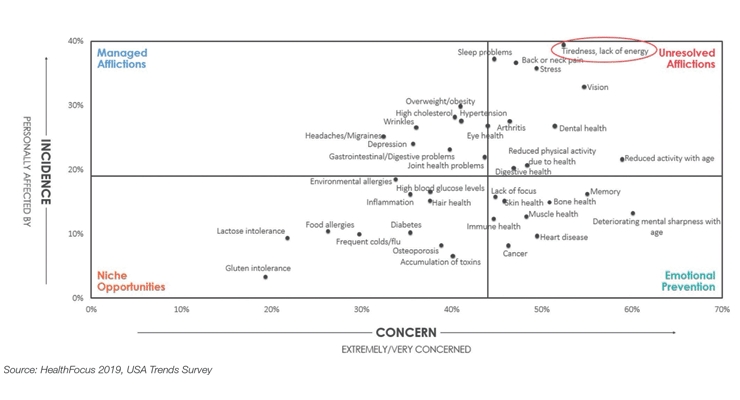

The recent redefinition of “healthy” to include “mental well-being” is among the megatrends that will help drive the sleep market. Two-thirds of global consumers in Euromonitor’s 2019 Health & Nutrition Survey cited “mental well-being” as the number one criterion defining “being healthy,” followed by “feeling good,” “getting enough sleep,” and “being free-from disease” (Figure 1).

FIGURE 1

In the U.S., 82% of consumers now rank “getting enough sleep” as the most important, and 79% the most effective factor for maintaining good health and preventing health issues, per HealthFocus’ 2019 USA Trend Study.

In the last two years, concern over stress, anxiety, and mood have skyrocketed to become major health issues. Just over half of global consumers surveyed by Euromonitor reported that stress and anxiety have a moderate to severe impact on their life. Last year, stress and anxiety became the top health issues that U.S. households were trying to treat or prevent, above weight control, according to the Hartman Group’s Health + Wellness 2019.

Lastly, the everyday reality of our electronically “on call,” wired lifestyle has made it nearly impossible to unplug before bedtime, driving new demands for sleep aids beyond simply falling and staying asleep.

The Timing is Right

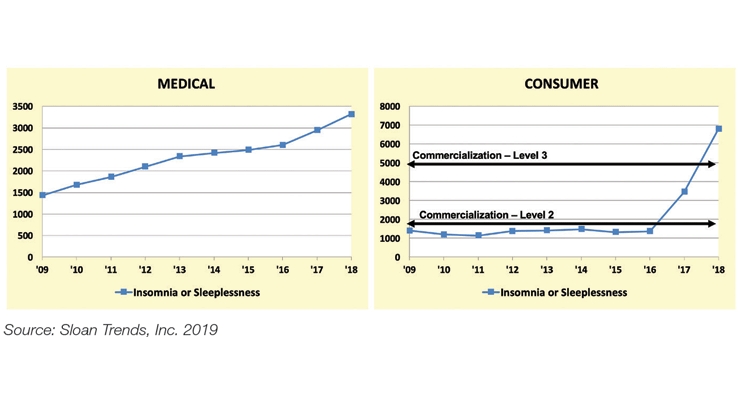

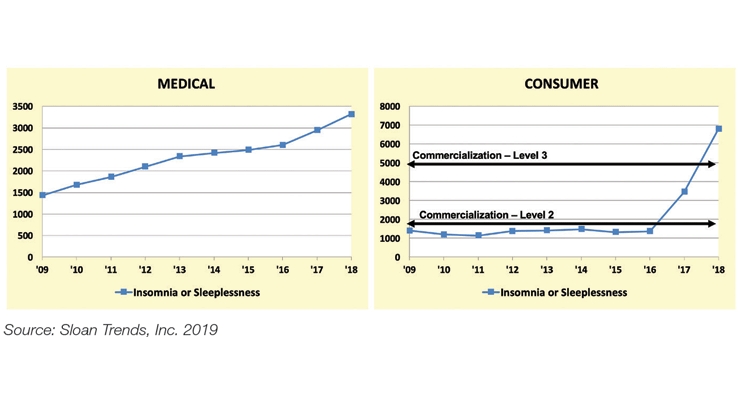

According to Sloan Trends TrendSense predictive model (Figure 2), the marketability of nutraceutical sleeplessness/insomnia products, while already strong and stable, has accelerated fast since 2016; keeping pace with growing concerns about, and the marketability of, stress, anxiety, mood, and other selected cognitive issues (Getting Ahead of the Curve: Mental Health, Nutraceuticals World, December 2019).

FIGURE 2

Over the past decade, research/medcal activity has shown no sign of slowing down and will continue to deliver new scientific platforms and linkages that are supported by scientific evidence for related market opportunities for the foreseeable future.

But despite product proliferations, personally satisfying sleep solutions remain an elusive target. In 2019, 48% of consumers in Euromonitor’s global survey said they’re looking for new solutions to help prevent sleep problems; 50% stress and anxiety issues.

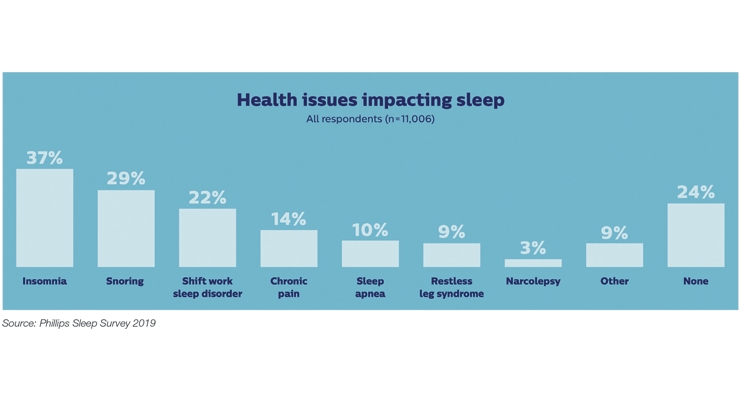

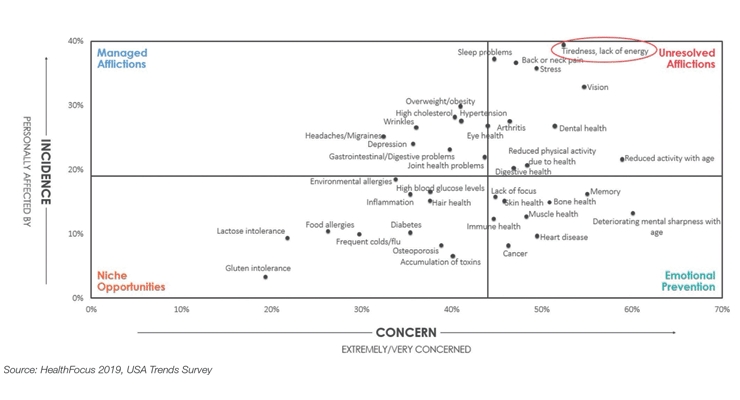

In the U.S., HealthFocus’ 2019 Consumer Trend Survey’s analysis placed both sleeplessness and being tired in the high-potential quadrant of “unsolved afflictions” characterized as “high concern and currently affected.” (Figure 3).

FIGURE 3

Supplemental Income

Although Rx and traditional OTC solutions are clearly among the most effective sleep aids, fear of adverse side effects, chemicals, and medicinal hangovers continue to drive consumers toward more natural sleep solutions. Herbals now comprise 16% of global OTC healthcare sales, according to Euromonitor. Globally, natural sleep supplements are among the top five sleep solutions for millennials and gen Z.

Euromonitor reported global sales of “natural OTCs,” supplement, and traditional ingredient sleep aids* reached $2.97 billion in 2019 (Figure 4). The U.S. and Western Europe remain the largest markets.

FIGURE 4

In a July 2018 Consumer Reports survey, nearly one-third of adults who complained of sleep problems at least once per week self-reported they used an OTC or Rx sleep drug in the past year.

The number of U.S. supplement users who use a sleep supplement jumped from 11% in 2018—the average yearly use since 2015—to 19% in 2019, according to CRN’s Consumer Survey on Dietary Supplements. Among those aged 18-34, usage rose from 12% in 2018 to 19% in 2019; from 12% to 17% for those 35-54; and 12% to 17% for those aged 55 and older.

SPINS reported that cross-channel sales of sleep/mood supplements grew 16% for the year ended Oct. 6, 2019. Sales of the sleep aid tablet category jumped 16.8% to $730 million in mass channels, according to IRI for the year ended Aug. 11, 2019.

Natural sleep supplements now account for six out of the top 10 U.S. best-selling sleep aid brands. Private label led the list (up 14% in dollar sales); followed by Natrol (up 15%), Nature’s Bounty (up 9%), Nature Made (up 26%), ZzzQuil OTC (up 0.2%), Unisom Sleep gels (up 4%), Unisom Sleep tabs (up 6%), Sundown Naturals (up 5%), ZzzQuil Pure supplement was introduced but too early for meaningful sales data, and Olly supplements (up 37%), per IRI.

In 2019, 18% of supplement users took a melatonin supplement: 12% of men and 16% women. Those aged 18-24 are the most likely to use melatonin; 18% vs. 13% of those 35-54 and 12% age 55 and older. SPINS reported that multichannel sales of melatonin grew nearly 29% to $367 million for the year ended Oct. 5, 2019.

Nutrition Business Journal (NBJ) projected that melatonin, combination herbs, valerian, magnesium, 5-HTP, and chamomile will be among the fastest growing sleep supplements. L-Theanine, passionflower, lavender, Kava, ashwagandha, hops, and homeopathic options are also getting attention.

One Size Doesn’t Fit All

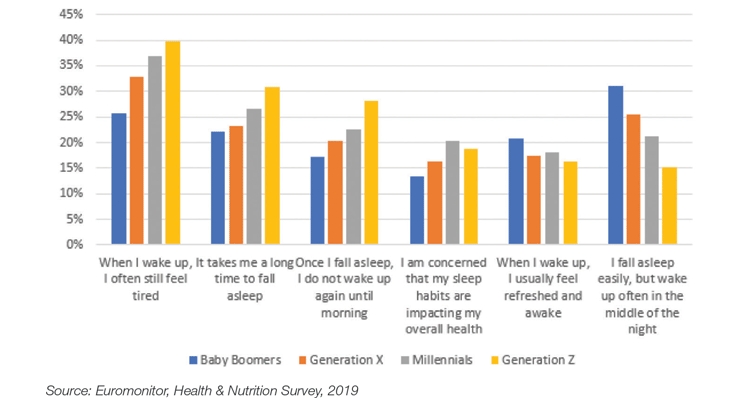

Those aged 18-34 (52%) and those living in households with children (52%) are the most likely to be “extremely/very concerned” about their sleep problems, per HealthFocus (Figure 5).

FIGURE 5

Young adults use sleep aids primarily to fall asleep, older adults to stay asleep, per Euromonitor (Figure 6). Those in the Southeastern U.S. are the most likely to suffer from inadequate sleep, per the CDC. One in three has mild insomnia.

FIGURE 6

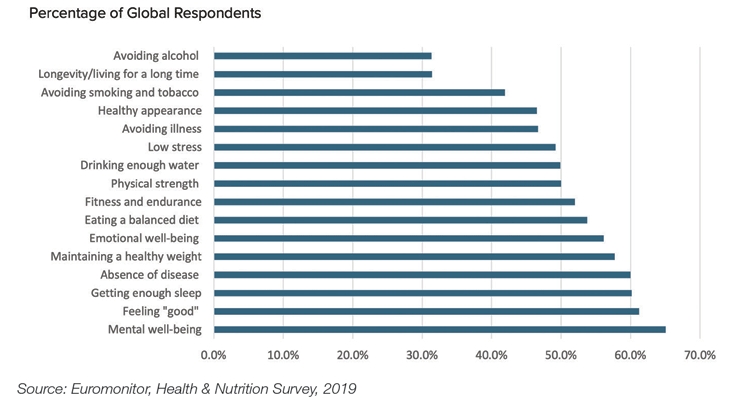

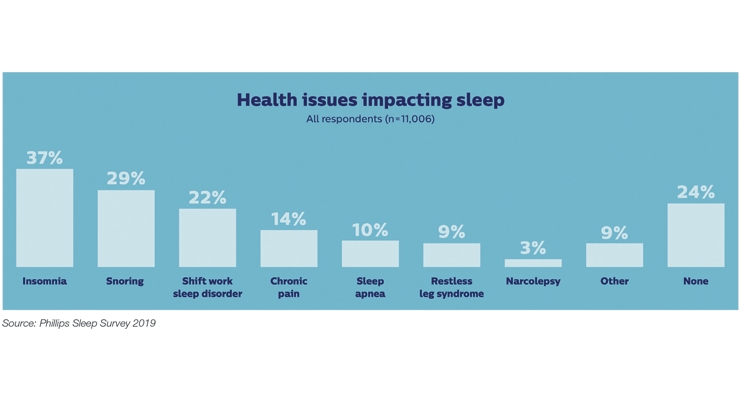

Four in 10 of those who have trouble sleeping in the U.S. have at least one major sleeping disorder, 12% chronic insomnia, 15% sleep apnea, and 10% restless leg syndrome, per Packaged Facts; four in 10 men snore. Globally, insomnia is the most prominent sleep condition, per Phillips (Figure 7).

FIGURE 7

Overweight adults, women (especially post-menopausal and pregnant), diabetics, smokers, and alcoholic beverage consumers are among the most prone to sleep issues.

The National Institute on Aging has recently drawn attention to the rise of periodic limb movement disorder and rapid eye movement sleep disorder in older adults.

Less than half of U.S. children aged 6-12 get the recommended eight hours of sleep, 58% of those aged 15-17, per the National Sleep Foundation. Homeopathic remedies remain most appealing to parents of young children.

Unprecedented Market Diversification

New in-demand sleep product attributes now go beyond the traditional claims of falling asleep fast and staying asleep, to focus on calming and relaxation.

Nature’s Bounty Sleep3 is a time-released, tri-level dietary supplement sleep tablet layered to calm you, help you to fall asleep quickly, and to stay asleep.

Natrol’s Stress & Anxiety co-packaged morning and evening supplements promote calm, relaxation, and limit occasional anxiety during the day; and help you fall asleep faster and stay asleep at night.

Natural “sleep and restore” supplements are promising to improve skin, build bone, and boost immunity overnight.

Olly’s sleep supplements come in vibrant gummy flavors (e.g., blackberry vanilla). Airborne’s Good Rest Gummies with vitamin C and 13 other vitamins, minerals, herbs, and L-theanine are in an effervescent format.

Just over one-quarter “always/usually” choose beverages to promote good sleep, 37% of parents with children, per HealthFocus.

Vick’s PUREZzzs Soothing Aromatherapy Balm with lavender/chamomile and essential oils are moving center stage. La Mend’s hemp/CBD Nite body patch in the U.S. helps assure a sound sleep.

Natural and chemical-free alternatives to leading global OTC sleep brands now also co-exist side by side (e.g., Procter & Gamble’s Vicks’ OTC, ZzzQuil and its natural alternative, ZzzQuil PURE Zzz).

Bayer’s Alka-Seltzer’s Dietary Supplement PM for “heartburn relief and sleep support” gummy breaks new ground in helping to alleviate symptoms that interrupt sleep beyond pain.

In the U.S., those with insomnia sleep disorder index 501 for chronic pain, 427 for depression, 412 for chronic obstructive pulmonary disease, 385 for overactive bladder, 384 for anxiety, 299 for overweight, 290 for heart burn, 278 for arthritis, and 254 for backache, per Packaged Facts.

According to IPSOS, 2019 Family Sleep Survey, having to go the bathroom was the number one reason that 60% of parents woke in the middle of the night, followed by stress and anxiety.

Hemp-based CBD products are found in a growing number of consumer healthcare categories, (e.g., supplements, sleep aids, and topical analgesics), although their regulatory status is complex. According to a 2019 NBJ consumer survey, anxiety is the top reason 44% have used a hemp product, followed by pain 36%, relaxation 34%, and sleeplessness 29%. CBD’s role in the future sleep aid market is almost certain to grow.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com

Six in 10 global consumers said they sleep somewhat or not at all well, according to Philips’ 2019 Global Sleep Survey; 40% said their sleep issues have gotten worse over the past five years. Those in South Korea, Japan, Peru, and Chile were most likely to say they don’t get enough sleep. Sleep issues are also increasing in developing countries, estimated by WHO in 2019 to affect an additional 150

million adults.

In the U.S., 82% of adults have trouble sleeping at least one night per week; 39% five or more nights, according to Packaged Facts’ 2017 Sleep Management in the U.S.

The recent redefinition of “healthy” to include “mental well-being” is among the megatrends that will help drive the sleep market. Two-thirds of global consumers in Euromonitor’s 2019 Health & Nutrition Survey cited “mental well-being” as the number one criterion defining “being healthy,” followed by “feeling good,” “getting enough sleep,” and “being free-from disease” (Figure 1).

FIGURE 1

In the U.S., 82% of consumers now rank “getting enough sleep” as the most important, and 79% the most effective factor for maintaining good health and preventing health issues, per HealthFocus’ 2019 USA Trend Study.

In the last two years, concern over stress, anxiety, and mood have skyrocketed to become major health issues. Just over half of global consumers surveyed by Euromonitor reported that stress and anxiety have a moderate to severe impact on their life. Last year, stress and anxiety became the top health issues that U.S. households were trying to treat or prevent, above weight control, according to the Hartman Group’s Health + Wellness 2019.

Lastly, the everyday reality of our electronically “on call,” wired lifestyle has made it nearly impossible to unplug before bedtime, driving new demands for sleep aids beyond simply falling and staying asleep.

The Timing is Right

According to Sloan Trends TrendSense predictive model (Figure 2), the marketability of nutraceutical sleeplessness/insomnia products, while already strong and stable, has accelerated fast since 2016; keeping pace with growing concerns about, and the marketability of, stress, anxiety, mood, and other selected cognitive issues (Getting Ahead of the Curve: Mental Health, Nutraceuticals World, December 2019).

FIGURE 2

Over the past decade, research/medcal activity has shown no sign of slowing down and will continue to deliver new scientific platforms and linkages that are supported by scientific evidence for related market opportunities for the foreseeable future.

But despite product proliferations, personally satisfying sleep solutions remain an elusive target. In 2019, 48% of consumers in Euromonitor’s global survey said they’re looking for new solutions to help prevent sleep problems; 50% stress and anxiety issues.

In the U.S., HealthFocus’ 2019 Consumer Trend Survey’s analysis placed both sleeplessness and being tired in the high-potential quadrant of “unsolved afflictions” characterized as “high concern and currently affected.” (Figure 3).

FIGURE 3

Supplemental Income

Although Rx and traditional OTC solutions are clearly among the most effective sleep aids, fear of adverse side effects, chemicals, and medicinal hangovers continue to drive consumers toward more natural sleep solutions. Herbals now comprise 16% of global OTC healthcare sales, according to Euromonitor. Globally, natural sleep supplements are among the top five sleep solutions for millennials and gen Z.

Euromonitor reported global sales of “natural OTCs,” supplement, and traditional ingredient sleep aids* reached $2.97 billion in 2019 (Figure 4). The U.S. and Western Europe remain the largest markets.

FIGURE 4

In a July 2018 Consumer Reports survey, nearly one-third of adults who complained of sleep problems at least once per week self-reported they used an OTC or Rx sleep drug in the past year.

The number of U.S. supplement users who use a sleep supplement jumped from 11% in 2018—the average yearly use since 2015—to 19% in 2019, according to CRN’s Consumer Survey on Dietary Supplements. Among those aged 18-34, usage rose from 12% in 2018 to 19% in 2019; from 12% to 17% for those 35-54; and 12% to 17% for those aged 55 and older.

SPINS reported that cross-channel sales of sleep/mood supplements grew 16% for the year ended Oct. 6, 2019. Sales of the sleep aid tablet category jumped 16.8% to $730 million in mass channels, according to IRI for the year ended Aug. 11, 2019.

Natural sleep supplements now account for six out of the top 10 U.S. best-selling sleep aid brands. Private label led the list (up 14% in dollar sales); followed by Natrol (up 15%), Nature’s Bounty (up 9%), Nature Made (up 26%), ZzzQuil OTC (up 0.2%), Unisom Sleep gels (up 4%), Unisom Sleep tabs (up 6%), Sundown Naturals (up 5%), ZzzQuil Pure supplement was introduced but too early for meaningful sales data, and Olly supplements (up 37%), per IRI.

In 2019, 18% of supplement users took a melatonin supplement: 12% of men and 16% women. Those aged 18-24 are the most likely to use melatonin; 18% vs. 13% of those 35-54 and 12% age 55 and older. SPINS reported that multichannel sales of melatonin grew nearly 29% to $367 million for the year ended Oct. 5, 2019.

Nutrition Business Journal (NBJ) projected that melatonin, combination herbs, valerian, magnesium, 5-HTP, and chamomile will be among the fastest growing sleep supplements. L-Theanine, passionflower, lavender, Kava, ashwagandha, hops, and homeopathic options are also getting attention.

One Size Doesn’t Fit All

Those aged 18-34 (52%) and those living in households with children (52%) are the most likely to be “extremely/very concerned” about their sleep problems, per HealthFocus (Figure 5).

FIGURE 5

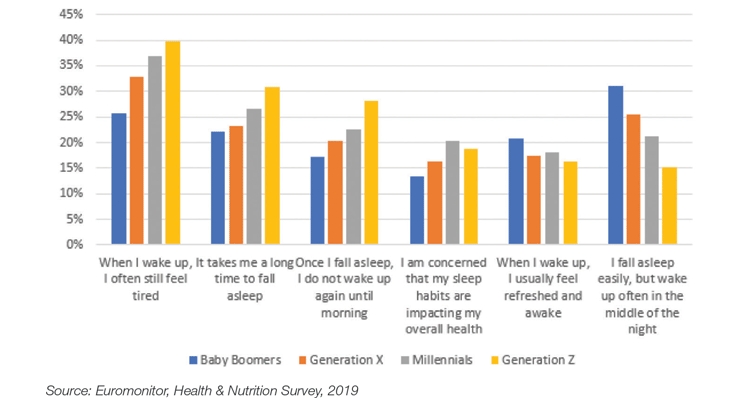

Young adults use sleep aids primarily to fall asleep, older adults to stay asleep, per Euromonitor (Figure 6). Those in the Southeastern U.S. are the most likely to suffer from inadequate sleep, per the CDC. One in three has mild insomnia.

FIGURE 6

Four in 10 of those who have trouble sleeping in the U.S. have at least one major sleeping disorder, 12% chronic insomnia, 15% sleep apnea, and 10% restless leg syndrome, per Packaged Facts; four in 10 men snore. Globally, insomnia is the most prominent sleep condition, per Phillips (Figure 7).

FIGURE 7

Overweight adults, women (especially post-menopausal and pregnant), diabetics, smokers, and alcoholic beverage consumers are among the most prone to sleep issues.

The National Institute on Aging has recently drawn attention to the rise of periodic limb movement disorder and rapid eye movement sleep disorder in older adults.

Less than half of U.S. children aged 6-12 get the recommended eight hours of sleep, 58% of those aged 15-17, per the National Sleep Foundation. Homeopathic remedies remain most appealing to parents of young children.

Unprecedented Market Diversification

New in-demand sleep product attributes now go beyond the traditional claims of falling asleep fast and staying asleep, to focus on calming and relaxation.

Nature’s Bounty Sleep3 is a time-released, tri-level dietary supplement sleep tablet layered to calm you, help you to fall asleep quickly, and to stay asleep.

Natrol’s Stress & Anxiety co-packaged morning and evening supplements promote calm, relaxation, and limit occasional anxiety during the day; and help you fall asleep faster and stay asleep at night.

Natural “sleep and restore” supplements are promising to improve skin, build bone, and boost immunity overnight.

Olly’s sleep supplements come in vibrant gummy flavors (e.g., blackberry vanilla). Airborne’s Good Rest Gummies with vitamin C and 13 other vitamins, minerals, herbs, and L-theanine are in an effervescent format.

Just over one-quarter “always/usually” choose beverages to promote good sleep, 37% of parents with children, per HealthFocus.

Vick’s PUREZzzs Soothing Aromatherapy Balm with lavender/chamomile and essential oils are moving center stage. La Mend’s hemp/CBD Nite body patch in the U.S. helps assure a sound sleep.

Natural and chemical-free alternatives to leading global OTC sleep brands now also co-exist side by side (e.g., Procter & Gamble’s Vicks’ OTC, ZzzQuil and its natural alternative, ZzzQuil PURE Zzz).

Bayer’s Alka-Seltzer’s Dietary Supplement PM for “heartburn relief and sleep support” gummy breaks new ground in helping to alleviate symptoms that interrupt sleep beyond pain.

In the U.S., those with insomnia sleep disorder index 501 for chronic pain, 427 for depression, 412 for chronic obstructive pulmonary disease, 385 for overactive bladder, 384 for anxiety, 299 for overweight, 290 for heart burn, 278 for arthritis, and 254 for backache, per Packaged Facts.

According to IPSOS, 2019 Family Sleep Survey, having to go the bathroom was the number one reason that 60% of parents woke in the middle of the night, followed by stress and anxiety.

Hemp-based CBD products are found in a growing number of consumer healthcare categories, (e.g., supplements, sleep aids, and topical analgesics), although their regulatory status is complex. According to a 2019 NBJ consumer survey, anxiety is the top reason 44% have used a hemp product, followed by pain 36%, relaxation 34%, and sleeplessness 29%. CBD’s role in the future sleep aid market is almost certain to grow.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com