By Sean Moloughney, Editor10.07.19

We’ve dedicated what I perceive to be a fair amount of editorial space to the topic of cannabidiol (CBD) in recent months considering the market eruption that followed passage of the Farm Bill in December 2018. In 10+ years in this industry I’ve seen my share of trends shine, flicker, and fade. But this feels different. This has the potential to be seismic so long as industry can get on the same page with federal regulators.

While I’m a strong advocate for reasonable and responsible product development that’s guided by sound quality controls, the nutraceuticals industry can’t afford to get too far off track, losing the forest for the hemp leaves so to speak.

For example, omega-3s remain one of the most studied and recognized nutraceutical ingredients in today’s modern wellness marketplace. Beyond dollars and margins, the health implications of delivering appropriate doses of omega-3 EPA and DHA to specific populations are enormous.

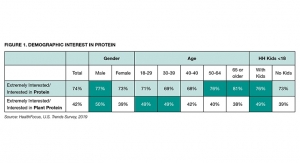

Meanwhile, protein is another macronutrient that can significantly impact health and wellness for consumers across the demographic spectrum. According to analysis from Cargill, “nearly half of respondents indicated they are trying to get more protein in their diets. One in four American shoppers contend more protein is always better, while six in 10 were at least somewhat likely to check the ingredient list for protein.”

Consumers are looking for protein for energy, satiety, muscle maintenance, and overall health benefits. Still, about two in 10 indicated they don’t get as much protein as they should, and few reported following a high-protein diet, leaving plenty of room for improvement.

As a class of ingredients, plant-protein in particular is capturing more market share. According to Mordor Intelligence, the global plant-based protein market reached $6.37 billion in 2018 and could grow to $9.5 billion by 2025 representing a CAGR of 7%. This shift toward plant-based eating is a global phenomenon. Notably, more than 70% of consumers around the world have made this change in the last two years and almost as many (60%) call it a permanent shift in their diets, according to HealthFocus International.

Sure there’s room for CBD among other nutraceuticals of note. But my point is that brands shouldn’t lose focus amid all the hype and bright shiny trends in the spotlight.

While I’m a strong advocate for reasonable and responsible product development that’s guided by sound quality controls, the nutraceuticals industry can’t afford to get too far off track, losing the forest for the hemp leaves so to speak.

For example, omega-3s remain one of the most studied and recognized nutraceutical ingredients in today’s modern wellness marketplace. Beyond dollars and margins, the health implications of delivering appropriate doses of omega-3 EPA and DHA to specific populations are enormous.

Meanwhile, protein is another macronutrient that can significantly impact health and wellness for consumers across the demographic spectrum. According to analysis from Cargill, “nearly half of respondents indicated they are trying to get more protein in their diets. One in four American shoppers contend more protein is always better, while six in 10 were at least somewhat likely to check the ingredient list for protein.”

Consumers are looking for protein for energy, satiety, muscle maintenance, and overall health benefits. Still, about two in 10 indicated they don’t get as much protein as they should, and few reported following a high-protein diet, leaving plenty of room for improvement.

As a class of ingredients, plant-protein in particular is capturing more market share. According to Mordor Intelligence, the global plant-based protein market reached $6.37 billion in 2018 and could grow to $9.5 billion by 2025 representing a CAGR of 7%. This shift toward plant-based eating is a global phenomenon. Notably, more than 70% of consumers around the world have made this change in the last two years and almost as many (60%) call it a permanent shift in their diets, according to HealthFocus International.

Sure there’s room for CBD among other nutraceuticals of note. But my point is that brands shouldn’t lose focus amid all the hype and bright shiny trends in the spotlight.