Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.10.01.14

Sales of organic foods and beverages skyrocketed by 12% in 2013, reaching an all-time high of $29.5 billion, according to Nutrition Business Journal (NBJ). Most important, sales are projected to grow at about the same rate through 2017.

All organic food/drink categories enjoyed double-digit growth, with the exception of the $4.7 billion organic dairy and $3.3 billion organic beverage categories. However, these markets turned in respectable growth of 8% and 7%, respectively. Fruits/vegetables remained the largest organic sector with sales of $13.4 billion, +15%; organic condiments at $1.1 billion was the fastest growing, +17%.

Three-quarters of consumers use organic foods/beverages; one-third use them once a month or more, according to The Hartman Group’s Organic & Natural 2014 Report; 28% overall and 38% of organic users self-reported buying more organic products in 2014 vs. 2013. Millennials and parents have increased organic purchases most, with 80% saying they are purchasing more organic than before.

The proportion of moms who don’t buy organic foods for their families has fallen over the past five years from 27% in 2009 to 19% in 2014. Parents who are buying less organic now than in previous years dropped from 12% to 4%, according to the Organic Trade Association’s 2014 U.S. Families’ Organic Attitudes & Beliefs Tracking Study. Use of organic foods/drinks for kids is highest among moms with children under the age of 2 (39%). Moms’ use of organic products falls as their children age, with 25% of moms buying organic for their children aged 12-19 years (Packaged Facts, Moms as Food Shoppers, 2012).

Consumer interest in natural still outpaces organic, with 38% of shoppers saying that natural is among their most sought after food/drink claim compared to 25% for organic, according to the Food Marketing Institute’s (FMI) 2014 U.S. Grocery Shopper Trends.

The rise of class-action lawsuits, consumer confusion and regulatory scrutiny has caused many manufacturers to cut back on natural claims. Although up slightly in 2013, natural claims have fallen from a high of 33% of all new better-for-you food/drink claims in 2007 to 22% in 2013; organic claims accounted for 12.3% in 2014, also up slightly last year (Datamonitor, 2014). The term “organic” is better supported than “natural,” with prescriptive criteria and oversight through the USDA’s National Organic Program (NOP).

Notably, one-quarter of consumers reported buying organic in order to avoid GMOs, according to Packaged Facts’ Non-GMO Foods, 2013. About half of consumers (47%) reported being worried about genetically modified foods and 22% are very worried. According to FMI’s U.S. Grocery Shopper Trends, Shopping for Health Report 2014, only about a quarter of those who are aware of genetically modified foods believe that they are safe.

The term organic is more likely to convey to consumers the absence of genetically modified ingredients (54%) vs. 46% for all-natural (Hartman Group, Organic & Natural 2014 Report). Moreover, middle-income moms ($50-99k) aged 25-39 with children under 11 years of age is the demographic most concerned about genetically modified foods and is the category that buys organic food most. Greater awareness of genetically modified ingredients, retailer pressures and potential labeling requirements are likely to further boost organic food and ingredients sales.

One-third of Millennials see their food/beverage purchases as more organic and more natural than their parents’ (Hartman Group, Culture of Millennials, 2012).

Market Potential

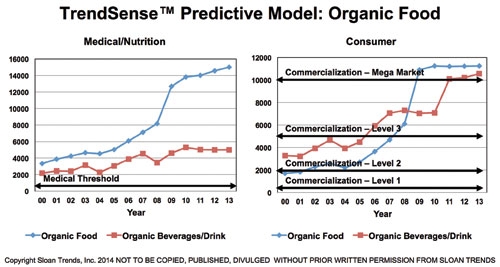

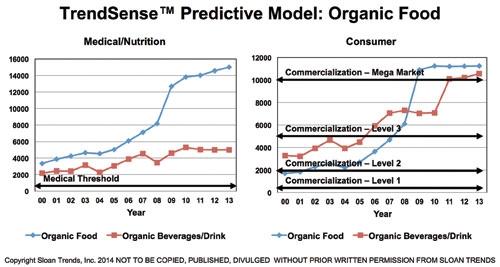

According to Sloan Trends’ TrendSense Predictive Model, organic foods and beverages are strong and stable Mega Mass markets. Most important, research/medical activity is very high for organic foods, nearly quadrupling in volume in the past decade. This foundation of interest within the research and medical communities will likely support strong consumer growth of organic in the future.

Growth Opportunities

Organic foods continue to represent a viable premium option, although the focus on organic foods by Walmart may work to reduce premium product margins. Categories where safety is a high priority—fresh fruits/vegetables, meat/poultry, fish and child/infant food/drinks are high priority organic categories for food manufacturers and retailers.

Moms spend a higher proportion of their budget on organic. Yogurt, meat/poultry, bread, cheese and produce are the top fresh organic food categories bought by moms; frozen food, pasta sauces/marinades, soups, chocolate and cereal are top in the center store (Packaged Facts, 2012).

Sales of organic juice have skyrocketed and are posting exceptionally strong growth, +25% per year for the past two years. Their growth is projected to continue to be strong, at 17% in 2014 (NBJ).

Consumers looking for organic in the supplement category can find them, with USDA’s NOP program formally accepting labeling of appropriate supplements as organic.

Despite food manufacturer and retailer uncertainties surrounding use of the term “natural,” marketers should not abandon pursuit of natural foods—it was a $27.4 billion sector in 2013, up 11% according to NBJ.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

All organic food/drink categories enjoyed double-digit growth, with the exception of the $4.7 billion organic dairy and $3.3 billion organic beverage categories. However, these markets turned in respectable growth of 8% and 7%, respectively. Fruits/vegetables remained the largest organic sector with sales of $13.4 billion, +15%; organic condiments at $1.1 billion was the fastest growing, +17%.

Three-quarters of consumers use organic foods/beverages; one-third use them once a month or more, according to The Hartman Group’s Organic & Natural 2014 Report; 28% overall and 38% of organic users self-reported buying more organic products in 2014 vs. 2013. Millennials and parents have increased organic purchases most, with 80% saying they are purchasing more organic than before.

The proportion of moms who don’t buy organic foods for their families has fallen over the past five years from 27% in 2009 to 19% in 2014. Parents who are buying less organic now than in previous years dropped from 12% to 4%, according to the Organic Trade Association’s 2014 U.S. Families’ Organic Attitudes & Beliefs Tracking Study. Use of organic foods/drinks for kids is highest among moms with children under the age of 2 (39%). Moms’ use of organic products falls as their children age, with 25% of moms buying organic for their children aged 12-19 years (Packaged Facts, Moms as Food Shoppers, 2012).

Consumer interest in natural still outpaces organic, with 38% of shoppers saying that natural is among their most sought after food/drink claim compared to 25% for organic, according to the Food Marketing Institute’s (FMI) 2014 U.S. Grocery Shopper Trends.

The rise of class-action lawsuits, consumer confusion and regulatory scrutiny has caused many manufacturers to cut back on natural claims. Although up slightly in 2013, natural claims have fallen from a high of 33% of all new better-for-you food/drink claims in 2007 to 22% in 2013; organic claims accounted for 12.3% in 2014, also up slightly last year (Datamonitor, 2014). The term “organic” is better supported than “natural,” with prescriptive criteria and oversight through the USDA’s National Organic Program (NOP).

Notably, one-quarter of consumers reported buying organic in order to avoid GMOs, according to Packaged Facts’ Non-GMO Foods, 2013. About half of consumers (47%) reported being worried about genetically modified foods and 22% are very worried. According to FMI’s U.S. Grocery Shopper Trends, Shopping for Health Report 2014, only about a quarter of those who are aware of genetically modified foods believe that they are safe.

The term organic is more likely to convey to consumers the absence of genetically modified ingredients (54%) vs. 46% for all-natural (Hartman Group, Organic & Natural 2014 Report). Moreover, middle-income moms ($50-99k) aged 25-39 with children under 11 years of age is the demographic most concerned about genetically modified foods and is the category that buys organic food most. Greater awareness of genetically modified ingredients, retailer pressures and potential labeling requirements are likely to further boost organic food and ingredients sales.

One-third of Millennials see their food/beverage purchases as more organic and more natural than their parents’ (Hartman Group, Culture of Millennials, 2012).

Market Potential

According to Sloan Trends’ TrendSense Predictive Model, organic foods and beverages are strong and stable Mega Mass markets. Most important, research/medical activity is very high for organic foods, nearly quadrupling in volume in the past decade. This foundation of interest within the research and medical communities will likely support strong consumer growth of organic in the future.

Growth Opportunities

- 84% of consumers thought about the chemicals in their food/drink in the past year: 75% pesticides and 56% animal antibiotics; more than 55% of consumers associate organic as free from these negatives (International Food Information Council, Food & Health Survey, 2014; Hartman, Reimagining Nutrition, 2013).

- 4 in 10 of the best-selling new better-for-you foods/beverages in 2013 carried a natural or organic claim, up from 31% in 2012 (IRI, New Product Pacesetters Report, 2014).

- 1 in 4 consumers are strong clean label advocates (2013 Gallup Study of Clean Food & Beverage Labels).

- Natural and organic are ranked on par with each other—and second only to healthy—as the most important high need/interest attributes for beverages in 2014 (Beverage Industry’s 2014 Product Development Survey).

- 34% of shoppers purchase organic/natural meats; 38% plan to buy more (FMI, Power of Meat, 2014). Organic meat, fish and poultry sales were $910 million in 2013, +11% (NBJ).

- Hispanics have significantly higher interest in organic compared with other demographics; 36% of Hispanics anticipated increasing the proportion of organic groceries they use (Packaged Facts, Hispanic Food Shoppers in the U.S., 2014).

- 44% of kids under age 12 eat or drink organic foods/beverage at least once per week (2013 Study of Children’s Nutrition and Eating Habits).

- New product introductions continue to climb: 14,986 new organic food/drinks launched in 2013 across the world; 3,515 in North America (Innova Marketing Insights, August 2014).

Organic foods continue to represent a viable premium option, although the focus on organic foods by Walmart may work to reduce premium product margins. Categories where safety is a high priority—fresh fruits/vegetables, meat/poultry, fish and child/infant food/drinks are high priority organic categories for food manufacturers and retailers.

Moms spend a higher proportion of their budget on organic. Yogurt, meat/poultry, bread, cheese and produce are the top fresh organic food categories bought by moms; frozen food, pasta sauces/marinades, soups, chocolate and cereal are top in the center store (Packaged Facts, 2012).

Sales of organic juice have skyrocketed and are posting exceptionally strong growth, +25% per year for the past two years. Their growth is projected to continue to be strong, at 17% in 2014 (NBJ).

Consumers looking for organic in the supplement category can find them, with USDA’s NOP program formally accepting labeling of appropriate supplements as organic.

Despite food manufacturer and retailer uncertainties surrounding use of the term “natural,” marketers should not abandon pursuit of natural foods—it was a $27.4 billion sector in 2013, up 11% according to NBJ.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.