By Vince Cavallini and Mark Fahlin, Cargill 03.02.22

The protein-fortified beverage space has undergone tremendous shifts in the last decade, as consumer tastes and formulation possibilities have evolved. The big mover in the marketplace has been the rise of plant-based products.

A decade ago, brands were still experimenting with first generation plant-based milk alternatives. Built around soy protein, these category pioneers were plagued with significant flavor challenges. Subsequent product development efforts ushered in a second and third generation of products that delivered much improved taste profiles and an expanding array of botanical sources. Almond milk muscled its way to the top of the heap, usurping soy to attain category dominance.

Fast-forward to today, and we’re in the midst of a fourth wave of product development. This time, protein fortification is the watchword, as brands race to close the protein gap between plant-based options and conventional milks. Many of the current offerings have just 1 gram of protein. That low level was fine for earlier product iterations when the struggle was singularly focused on creating a beverage with a palatable taste profile. Today, however, brands have made huge strides on the flavor front; now the challenge is to maintain those gains, while also boosting protein levels.

The Push for More

Consumers may not know, or care, about the ins and outs of “complete” versus “incomplete” proteins, but they do understand grams of total protein, and this exposes a vulnerability to continued growth. A quick survey of product labels finds most plant-based alternatives fail to measure up. Dairy milks consistently deliver 8 grams of protein, and the new class of ultra-filtered milks deliver even more of the in-demand macronutrient.

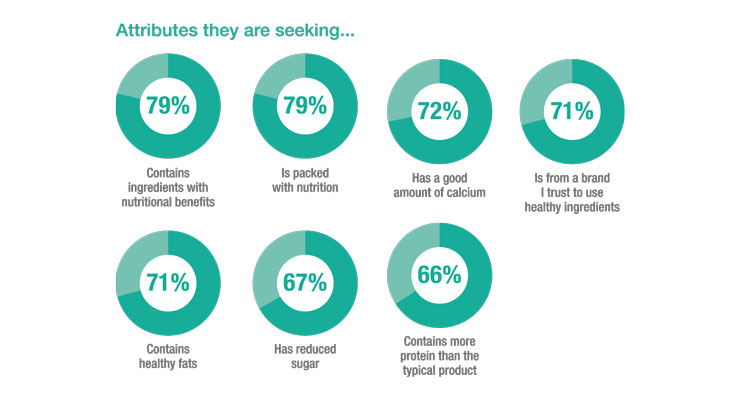

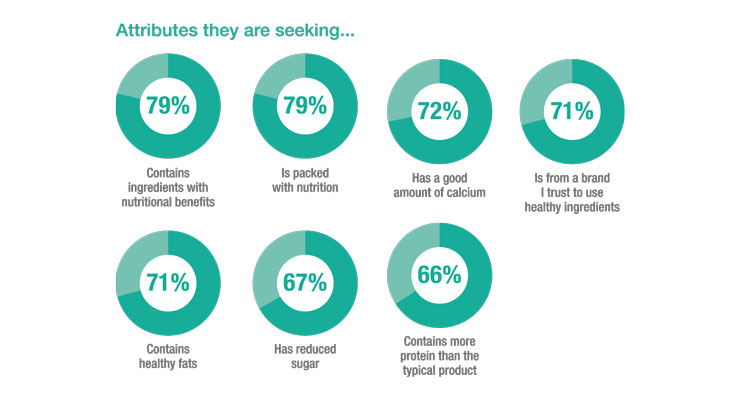

Therein lies the rub. Proprietary research from Cargill finds today’s plant-based consumer is most often motivated by health perceptions (see Figure 1); yet many of these products are dismally short on protein. Little wonder that brands are adopting a new rallying cry: fortify, fortify, fortify.

Figure 1. Consumer Expectations for Plant-Based Dairy Alternatives

Source: Cargill proprietary consumer research, 2021

This leads to another trend shaping the marketplace: category blurring. Historically, the protein-fortified beverage space was divided between two distinct segments: performance nutrition drinks packed with 20 or more grams of protein; and traditional dairy milks and their plant-based alternatives, averaging anywhere from 1-10 grams of protein.

That left a big gap in the middle, which brands are only beginning to fill. First came the ultra-filtered milks, which bumped protein levels from 8 grams to 13 or more. Now, we’re seeing innovation on the plant-based side, as a handful of entrants launch products touting double-digit protein levels paired with viscosities more akin to dairy milk than a performance shake.

Weighing Protein Choices

Brands can only push the boundaries of protein fortification if they also continue to meet consumers’ taste and texture expectations. Newer botanical sources, like up-and-comers oat and coconut, are a help. Oat has familiar cereal-tinged notes, while coconut brings a sweeter, lighter flavor. Those profiles can be easier to work with than many of the botanical options on the market, but nutritionally, they have their limits.

That’s where protein blends come into play. Most often, pea protein is the go-to protein-fortifying ingredient in today’s plant-based beverages. It’s high in protein—Cargill’s option from PURIS is at least 80% protein—and it has a solid PDCAS (protein digestibility corrected amino acid score) of 0.78, well above most plant proteins. Beyond its nutritional benefits, it has a neutral flavor profile and good solubility and emulsion properties. Equally important, pea protein’s more robust supply chain offers greater ingredient availability and a better value proposition as compared to oat, coconut, or even category-leader almond.

Soy has many of these same benefits, including a “complete” PDCAS score of 1, but it’s fallen out of favor with some brands. In part, that’s because consumers who trialed early iterations of plant-based beverages still have a bad taste in their mouth from previous encounters with soy milk. Others may aim to avoid major allergens or associate soy with GMOs. Unencumbered by those concerns, relative newcomer pea protein is today’s star of plant-based protein fortification.

Formulating Possibilities

Settling on a workable protein blend is a good start, but from a formulation perspective, the amount of protein is the real decision driver. The higher the protein content, the bigger the formulation headaches. Flavor, forever king in the food and beverage world, is the major consideration.

In the beverage space, flavors can be very exposed. Add protein to a snack bar, and there are a host of other ingredients that help cover off-notes. Push protein levels in an almond milk and there’s not as much room to hide. While flavor profiles of botanical proteins have come a long way in a short time, they remain prone to earthy, beany, and grassy notes—off-tastes that become more apparent as inclusion levels rise. Compensating starts with selecting a characterizing flavor that pairs well with the protein. Chocolate and vanilla are often good choices, especially when aided by flavor or protein maskers, which can dramatically improve the finished product’s sensory profile.

Plant-based beverages also need the right stabilizer. Left to their own devices, high-protein beverages, whether made with animal or plant proteins, tend to thicken and gel over shelf life, creating off-putting textures and mouthfeels. In these situations, adding hydrocolloids like carrageenan or gellan gum help stabilize proteins and maintain viscosity.

Solubility is another concern. For beverages targeting 1-10 grams of protein, options like pea protein typically provide enough solubility. However, push past those inclusion levels and brands historically run into texture and mouthfeel challenges, as grittiness, sandiness, and viscosity become a factor.

Fortunately, advances on the ingredient side are rapidly chipping away at this limitation. Suppliers have made significant improvements in protein solubility over the last decade, and plant proteins with even greater solubility are on the horizon. Today, 10 grams of plant protein is widely viewed as the limit for most botanicals, but the next generation of ingredients with enhanced solubility will give developers more flexibility. These advances could open the door to plant-based beverages with 15 or more grams of protein.

Sugar levels can be another stumbling block. Brands launching plant-based fortified protein beverages often want to double down on their health halo by formulating reduced-sugar products. High-intensity sweeteners like stevia are widely used in this space, and another example of how improvements on the ingredient side are reshaping formulation possibilities.

Cargill’s newest solution, which combines our best-tasting Reb M and Reb D EverSweet stevia sweetener with a natural flavor, is a great example. The combination, sold as EverSweet + ClearFlo, delivers the most sugar-like flavor profile yet, with plenty of sweetness and little linger, while also modifying off-notes associated with plant proteins.

Sustainable Solutions

Factors like health and taste weigh heaviest on purchase decisions, but environmental and ethical sourcing considerations are influential for a segment of plant-based consumers. Plants generally enjoy favorable views on this front, and botanicals like pea have an especially strong story to tell. Part of the legume family, peas convert nitrogen to fertilizer, enriching the soil for themselves and other crops. This reduces the need for commercial fertilizers, which in turn helps protect vulnerable waterways. They also serve as cover crops, helping to hold soil, promote soil health, improve soil water-holding capacity, and increase organic matter. In the years ahead, these earth-friendly credentials may hold even greater sway with consumers.

Plants Poised for Continued Growth

The plant-based, protein-fortified beverage space has been one of the most dynamic categories for the last decade, growing from a small niche into a market segment with true mainstream appeal. Recent developments suggest it’s far from done, as consumer demands for products with great taste, high protein, reduced sugar, and a solid sustainability story align with ongoing ingredient advances on both the sweetener and plant protein side. Together, these forces are kick-starting a fourth wave of innovation, which promises to dramatically boost both protein levels and consumer appeal for plant-based, protein-fortified beverages.

About the Authors: Vince Cavallini is Cargill’s beverage, dairy and convenience foods applications manager. With 21 years of experience in the food and beverage industry, Vince has a deep understanding of beverage processing and has helped bring countless new products to market. Mark Fahlin is responsible for business development at Cargill. For over 20 years, he has supported innovation in the U.S. and abroad. Currently, he leads Cargill’s dairy, plant-based, and meat alternative development efforts.

A decade ago, brands were still experimenting with first generation plant-based milk alternatives. Built around soy protein, these category pioneers were plagued with significant flavor challenges. Subsequent product development efforts ushered in a second and third generation of products that delivered much improved taste profiles and an expanding array of botanical sources. Almond milk muscled its way to the top of the heap, usurping soy to attain category dominance.

Fast-forward to today, and we’re in the midst of a fourth wave of product development. This time, protein fortification is the watchword, as brands race to close the protein gap between plant-based options and conventional milks. Many of the current offerings have just 1 gram of protein. That low level was fine for earlier product iterations when the struggle was singularly focused on creating a beverage with a palatable taste profile. Today, however, brands have made huge strides on the flavor front; now the challenge is to maintain those gains, while also boosting protein levels.

The Push for More

Consumers may not know, or care, about the ins and outs of “complete” versus “incomplete” proteins, but they do understand grams of total protein, and this exposes a vulnerability to continued growth. A quick survey of product labels finds most plant-based alternatives fail to measure up. Dairy milks consistently deliver 8 grams of protein, and the new class of ultra-filtered milks deliver even more of the in-demand macronutrient.

Therein lies the rub. Proprietary research from Cargill finds today’s plant-based consumer is most often motivated by health perceptions (see Figure 1); yet many of these products are dismally short on protein. Little wonder that brands are adopting a new rallying cry: fortify, fortify, fortify.

Figure 1. Consumer Expectations for Plant-Based Dairy Alternatives

Source: Cargill proprietary consumer research, 2021

This leads to another trend shaping the marketplace: category blurring. Historically, the protein-fortified beverage space was divided between two distinct segments: performance nutrition drinks packed with 20 or more grams of protein; and traditional dairy milks and their plant-based alternatives, averaging anywhere from 1-10 grams of protein.

That left a big gap in the middle, which brands are only beginning to fill. First came the ultra-filtered milks, which bumped protein levels from 8 grams to 13 or more. Now, we’re seeing innovation on the plant-based side, as a handful of entrants launch products touting double-digit protein levels paired with viscosities more akin to dairy milk than a performance shake.

Weighing Protein Choices

Brands can only push the boundaries of protein fortification if they also continue to meet consumers’ taste and texture expectations. Newer botanical sources, like up-and-comers oat and coconut, are a help. Oat has familiar cereal-tinged notes, while coconut brings a sweeter, lighter flavor. Those profiles can be easier to work with than many of the botanical options on the market, but nutritionally, they have their limits.

That’s where protein blends come into play. Most often, pea protein is the go-to protein-fortifying ingredient in today’s plant-based beverages. It’s high in protein—Cargill’s option from PURIS is at least 80% protein—and it has a solid PDCAS (protein digestibility corrected amino acid score) of 0.78, well above most plant proteins. Beyond its nutritional benefits, it has a neutral flavor profile and good solubility and emulsion properties. Equally important, pea protein’s more robust supply chain offers greater ingredient availability and a better value proposition as compared to oat, coconut, or even category-leader almond.

Soy has many of these same benefits, including a “complete” PDCAS score of 1, but it’s fallen out of favor with some brands. In part, that’s because consumers who trialed early iterations of plant-based beverages still have a bad taste in their mouth from previous encounters with soy milk. Others may aim to avoid major allergens or associate soy with GMOs. Unencumbered by those concerns, relative newcomer pea protein is today’s star of plant-based protein fortification.

Formulating Possibilities

Settling on a workable protein blend is a good start, but from a formulation perspective, the amount of protein is the real decision driver. The higher the protein content, the bigger the formulation headaches. Flavor, forever king in the food and beverage world, is the major consideration.

In the beverage space, flavors can be very exposed. Add protein to a snack bar, and there are a host of other ingredients that help cover off-notes. Push protein levels in an almond milk and there’s not as much room to hide. While flavor profiles of botanical proteins have come a long way in a short time, they remain prone to earthy, beany, and grassy notes—off-tastes that become more apparent as inclusion levels rise. Compensating starts with selecting a characterizing flavor that pairs well with the protein. Chocolate and vanilla are often good choices, especially when aided by flavor or protein maskers, which can dramatically improve the finished product’s sensory profile.

Plant-based beverages also need the right stabilizer. Left to their own devices, high-protein beverages, whether made with animal or plant proteins, tend to thicken and gel over shelf life, creating off-putting textures and mouthfeels. In these situations, adding hydrocolloids like carrageenan or gellan gum help stabilize proteins and maintain viscosity.

Solubility is another concern. For beverages targeting 1-10 grams of protein, options like pea protein typically provide enough solubility. However, push past those inclusion levels and brands historically run into texture and mouthfeel challenges, as grittiness, sandiness, and viscosity become a factor.

Fortunately, advances on the ingredient side are rapidly chipping away at this limitation. Suppliers have made significant improvements in protein solubility over the last decade, and plant proteins with even greater solubility are on the horizon. Today, 10 grams of plant protein is widely viewed as the limit for most botanicals, but the next generation of ingredients with enhanced solubility will give developers more flexibility. These advances could open the door to plant-based beverages with 15 or more grams of protein.

Sugar levels can be another stumbling block. Brands launching plant-based fortified protein beverages often want to double down on their health halo by formulating reduced-sugar products. High-intensity sweeteners like stevia are widely used in this space, and another example of how improvements on the ingredient side are reshaping formulation possibilities.

Cargill’s newest solution, which combines our best-tasting Reb M and Reb D EverSweet stevia sweetener with a natural flavor, is a great example. The combination, sold as EverSweet + ClearFlo, delivers the most sugar-like flavor profile yet, with plenty of sweetness and little linger, while also modifying off-notes associated with plant proteins.

Sustainable Solutions

Factors like health and taste weigh heaviest on purchase decisions, but environmental and ethical sourcing considerations are influential for a segment of plant-based consumers. Plants generally enjoy favorable views on this front, and botanicals like pea have an especially strong story to tell. Part of the legume family, peas convert nitrogen to fertilizer, enriching the soil for themselves and other crops. This reduces the need for commercial fertilizers, which in turn helps protect vulnerable waterways. They also serve as cover crops, helping to hold soil, promote soil health, improve soil water-holding capacity, and increase organic matter. In the years ahead, these earth-friendly credentials may hold even greater sway with consumers.

Plants Poised for Continued Growth

The plant-based, protein-fortified beverage space has been one of the most dynamic categories for the last decade, growing from a small niche into a market segment with true mainstream appeal. Recent developments suggest it’s far from done, as consumer demands for products with great taste, high protein, reduced sugar, and a solid sustainability story align with ongoing ingredient advances on both the sweetener and plant protein side. Together, these forces are kick-starting a fourth wave of innovation, which promises to dramatically boost both protein levels and consumer appeal for plant-based, protein-fortified beverages.

About the Authors: Vince Cavallini is Cargill’s beverage, dairy and convenience foods applications manager. With 21 years of experience in the food and beverage industry, Vince has a deep understanding of beverage processing and has helped bring countless new products to market. Mark Fahlin is responsible for business development at Cargill. For over 20 years, he has supported innovation in the U.S. and abroad. Currently, he leads Cargill’s dairy, plant-based, and meat alternative development efforts.