By Marcela Chifu, Marketing Manager, Kline Consumer Products05.03.21

Within the growing phenomenon of “wellness” and “well-being,” an increasing number of consumers opt for food and beverage products they perceive to be “clean” or “natural.” Given the absence of the specific definition of “clean,” consumers interpret it in their own way, defining it as products that have “no chemicals/no artificial additives” or “all-natural ingredients.”

Consumer Perceptions

Kline’s Clean Label in Food & Beverages: Perception vs. Reality study found that approximately half (48%) of the consumers surveyed purchase products that are labeled “clean” or “natural.” Out of those who state that buying clean or natural foods is important to them, more than half believe such products have positive implications for health; one-fifth are reluctant to ingest chemicals and artificial ingredients.

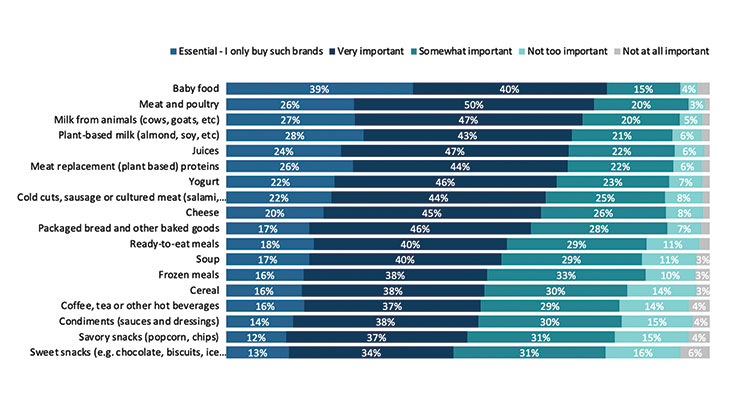

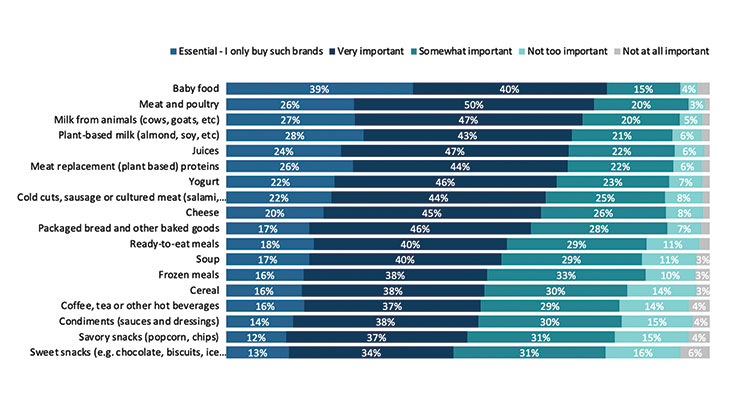

Buying clean or natural is more important in some categories than in others. For instance, baby food, meat and poultry, and milk from animals are categories where consumers lean toward cleaner and more natural products (see Figure 1).

Figure 1. Categories in which Clean and Natural Products are Most Important

Source: Kline’s Clean Label in Food & Beverages: Perception vs. Reality

“All-natural” was considered the most important element in selecting baby food, followed closely by “no added sugar” and “inspected by the USDA.” “Hormone-free” and “antibiotic-free” are key considerations of consumers when buying meat and poultry, while “preservative-free” and “minimally processed” top importance in cultured meats.

In packaged foods, “no preservatives” and “no artificial flavors” are neck-and-neck for the most important element. “No artificial flavors,” “preservative-free,” and “no added sugar” all rated highest in importance to those shopping for hot beverages.

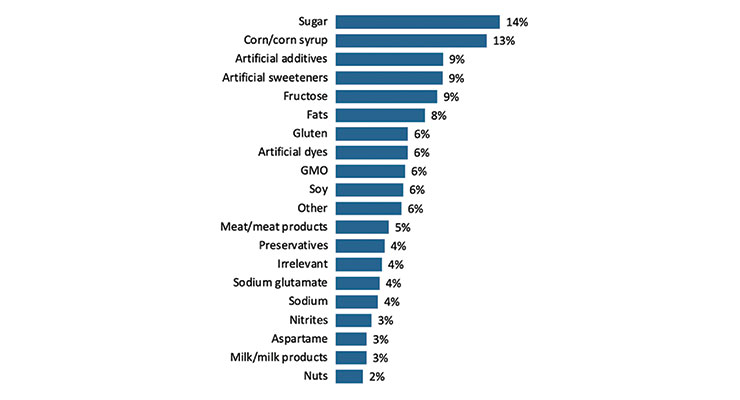

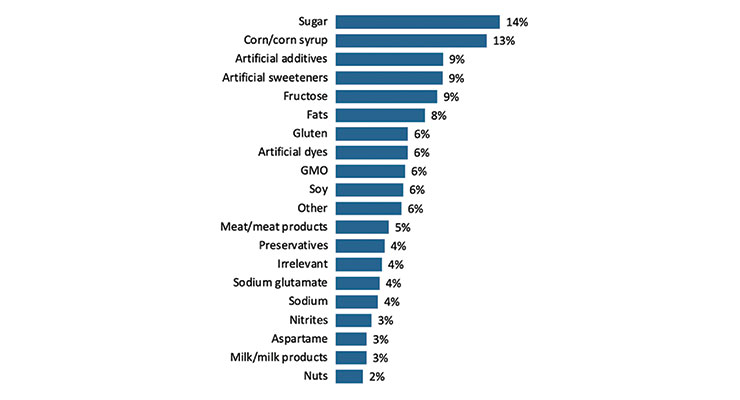

When choosing a product, most consumers pay attention to price and nutrition information, and more than half avoid certain ingredients. Sugar, corn/corn syrup, artificial additives and artificial sweeteners, and fructose are the top ingredients consumers avoid (see Figure 2).

Figure 2. Top Ingredients Consumers Avoid

Source: Kline’s Clean Label in Food & Beverages: Perception vs. Reality

Ingredient listing and labeling is another important factor. While consumers generally trust brands and their labeling, they do believe the fewer ingredients a product has, the cleaner and more natural it is. There are no current scientific, legal, or regulatory definitions for clean-label ingredients. However, generally, three main criteria are followed to recognize an ingredient as clean label: it should be naturally derived, non-GMO, and easily recognizable or not have a chemical-sounding name. To get a quick snapshot of key consumer research findings, Kline’s “Navigating How U.S. Consumers Perceive ‘Clean’ in Food and Beverages” infographic can be found here: https://bit.ly/3tGiQia.

Key Retailer Initiatives

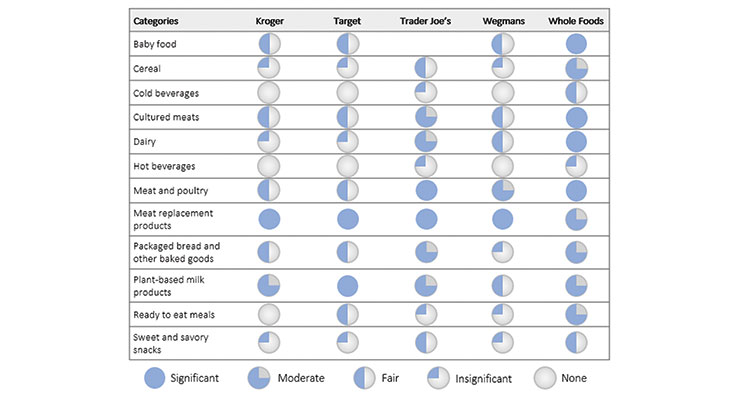

Retailers play a vital role in establishing labeling standards and requirements for clean and natural products. Specialty stores such as Whole Foods and Trader Joe’s have stricter requirements for clean products and their labels. In fact, Whole Foods is the most notable national grocery chain catering specifically to this movement. Not only must brands adhere to a list of banned ingredients, but they must also offer proof of humane animal husbandry practices.

Conventional grocers such as Target are also establishing banned ingredient lists or creating clean or natural seals identifying brands that offer clean products. Other grocers, such as Kroger and Wegmans do not require products or suppliers to follow rigorous guidelines due to a large number of conventional product offerings.

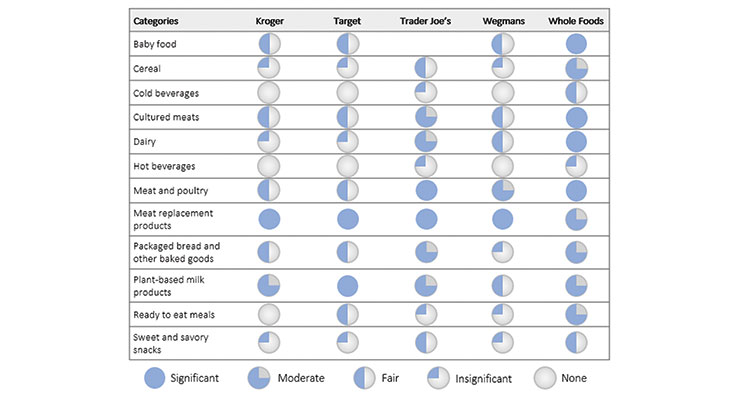

Labels also vary significantly by product category and retailer. In the baby food, hot and cold beverages, cereal, and sweet and salty snacks categories, products from more conventional retailers such as Kroger, Target, and Wegmans do not feature clean or natural labels. In contrast, Whole Foods often highlights the naturalness of products (see Figure 3).

Figure 3. Prevalence of Clean Labels in Key U.S. Retailers by Category

Source: Kline’s Clean Label in Food & Beverages: Perception vs. Reality

The most common label across all retailers focuses on animal welfare standards, such as how the animal was raised or that it has no added antibiotics or hormones. Other common labels include “organic,” “non-GMO,” “100% whole wheat,” and “gluten-free.”

Interestingly, organic products are common in private-label lines. If a retailer does not have a separate line for these products organic products are identified through labels on packaging.

Rising Market Opportunities

As people become increasingly ingredient-conscious, clean and healthy eating will remain a vital part of consumer lifestyles. According to Kline’s Clean Label in Food & Beverages: Perception vs. Reality, the U.S. clean-label food ingredient market is expected to grow at a CAGR of 9.3% by 2024. Consumers will largely continue to be responsible for determining what it means to be clean or natural and what the standards will be. This will continue to vary drastically by person, as a common definition establishing the requirements for clean or natural food and beverage products is not expected to occur within a five-year forecast period.

Retailers will also take more initiatives in establishing clean and natural food standards. Conventional grocers such as Walmart may establish seals that signify healthier options. More naturally positioned grocers will also be on the rise, especially on a national level.

The exclusion of artificial additives is expected to remain one of the most prominent labels on packaging. Organic and natural labels will also remain prominent. As new diets and fads rise in popularity, marketers may use labels that call out compatibility with particular diets. For example, as the keto diet continues to rise in popularity, more labels are beginning to indicate if they adhere to keto standards.

The market will continue to witness a rise in more truly natural or clean food and beverage products, as consumers prefer to seek products that are healthier. Greenwashing and clean-washing are expected to diminish as consumers have more access to resources to better educate themselves. Retailers may also enforce stricter standards, preventing these marketers from misleading consumers.

For a deeper dive into the importance of clean label in key product categories as well as analysis of the ingredients used within these categories, along with brand offerings and their ratings, refer to Kline’s Clean Label in Food & Beverages: Perception vs. Reality study.

Marcela Chifu is a Marketing Manager at Kline, a worldwide consulting and research firm dedicated to providing insight and knowledge that helps companies find a clear path to success. The firm has served the management consulting and market research needs of organizations in the agrochemicals, beauty & personal care, chemicals & materials, energy, and life sciences industries for more than 60 years. For more info: marcela.chifu@klinegroup.com; www.klinegroup.com.

Consumer Perceptions

Kline’s Clean Label in Food & Beverages: Perception vs. Reality study found that approximately half (48%) of the consumers surveyed purchase products that are labeled “clean” or “natural.” Out of those who state that buying clean or natural foods is important to them, more than half believe such products have positive implications for health; one-fifth are reluctant to ingest chemicals and artificial ingredients.

Buying clean or natural is more important in some categories than in others. For instance, baby food, meat and poultry, and milk from animals are categories where consumers lean toward cleaner and more natural products (see Figure 1).

Figure 1. Categories in which Clean and Natural Products are Most Important

Source: Kline’s Clean Label in Food & Beverages: Perception vs. Reality

“All-natural” was considered the most important element in selecting baby food, followed closely by “no added sugar” and “inspected by the USDA.” “Hormone-free” and “antibiotic-free” are key considerations of consumers when buying meat and poultry, while “preservative-free” and “minimally processed” top importance in cultured meats.

In packaged foods, “no preservatives” and “no artificial flavors” are neck-and-neck for the most important element. “No artificial flavors,” “preservative-free,” and “no added sugar” all rated highest in importance to those shopping for hot beverages.

When choosing a product, most consumers pay attention to price and nutrition information, and more than half avoid certain ingredients. Sugar, corn/corn syrup, artificial additives and artificial sweeteners, and fructose are the top ingredients consumers avoid (see Figure 2).

Figure 2. Top Ingredients Consumers Avoid

Source: Kline’s Clean Label in Food & Beverages: Perception vs. Reality

Ingredient listing and labeling is another important factor. While consumers generally trust brands and their labeling, they do believe the fewer ingredients a product has, the cleaner and more natural it is. There are no current scientific, legal, or regulatory definitions for clean-label ingredients. However, generally, three main criteria are followed to recognize an ingredient as clean label: it should be naturally derived, non-GMO, and easily recognizable or not have a chemical-sounding name. To get a quick snapshot of key consumer research findings, Kline’s “Navigating How U.S. Consumers Perceive ‘Clean’ in Food and Beverages” infographic can be found here: https://bit.ly/3tGiQia.

Key Retailer Initiatives

Retailers play a vital role in establishing labeling standards and requirements for clean and natural products. Specialty stores such as Whole Foods and Trader Joe’s have stricter requirements for clean products and their labels. In fact, Whole Foods is the most notable national grocery chain catering specifically to this movement. Not only must brands adhere to a list of banned ingredients, but they must also offer proof of humane animal husbandry practices.

Conventional grocers such as Target are also establishing banned ingredient lists or creating clean or natural seals identifying brands that offer clean products. Other grocers, such as Kroger and Wegmans do not require products or suppliers to follow rigorous guidelines due to a large number of conventional product offerings.

Labels also vary significantly by product category and retailer. In the baby food, hot and cold beverages, cereal, and sweet and salty snacks categories, products from more conventional retailers such as Kroger, Target, and Wegmans do not feature clean or natural labels. In contrast, Whole Foods often highlights the naturalness of products (see Figure 3).

Figure 3. Prevalence of Clean Labels in Key U.S. Retailers by Category

Source: Kline’s Clean Label in Food & Beverages: Perception vs. Reality

The most common label across all retailers focuses on animal welfare standards, such as how the animal was raised or that it has no added antibiotics or hormones. Other common labels include “organic,” “non-GMO,” “100% whole wheat,” and “gluten-free.”

Interestingly, organic products are common in private-label lines. If a retailer does not have a separate line for these products organic products are identified through labels on packaging.

Rising Market Opportunities

As people become increasingly ingredient-conscious, clean and healthy eating will remain a vital part of consumer lifestyles. According to Kline’s Clean Label in Food & Beverages: Perception vs. Reality, the U.S. clean-label food ingredient market is expected to grow at a CAGR of 9.3% by 2024. Consumers will largely continue to be responsible for determining what it means to be clean or natural and what the standards will be. This will continue to vary drastically by person, as a common definition establishing the requirements for clean or natural food and beverage products is not expected to occur within a five-year forecast period.

Retailers will also take more initiatives in establishing clean and natural food standards. Conventional grocers such as Walmart may establish seals that signify healthier options. More naturally positioned grocers will also be on the rise, especially on a national level.

The exclusion of artificial additives is expected to remain one of the most prominent labels on packaging. Organic and natural labels will also remain prominent. As new diets and fads rise in popularity, marketers may use labels that call out compatibility with particular diets. For example, as the keto diet continues to rise in popularity, more labels are beginning to indicate if they adhere to keto standards.

The market will continue to witness a rise in more truly natural or clean food and beverage products, as consumers prefer to seek products that are healthier. Greenwashing and clean-washing are expected to diminish as consumers have more access to resources to better educate themselves. Retailers may also enforce stricter standards, preventing these marketers from misleading consumers.

For a deeper dive into the importance of clean label in key product categories as well as analysis of the ingredients used within these categories, along with brand offerings and their ratings, refer to Kline’s Clean Label in Food & Beverages: Perception vs. Reality study.

Marcela Chifu is a Marketing Manager at Kline, a worldwide consulting and research firm dedicated to providing insight and knowledge that helps companies find a clear path to success. The firm has served the management consulting and market research needs of organizations in the agrochemicals, beauty & personal care, chemicals & materials, energy, and life sciences industries for more than 60 years. For more info: marcela.chifu@klinegroup.com; www.klinegroup.com.