By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.03.01.19

“Fit” consumers are a new and very large mainstream consumer segment who live a healthy active lifestyle differentiated by integrating frequent physical exercise (3-5 days per week) and a focus on enhancing everyday mental/physical performance. While Fit consumers span all life stages, the core block is under age 40, and the older edge is age 65.

Fit consumers tend to be more casually active and do not include serious athletes/bodybuilders, and gym fanatics who work out almost every day. While understanding of the attitudes/behaviors of fit consumers is still evolving, it’s likely that they may represent about 40% of consumers.

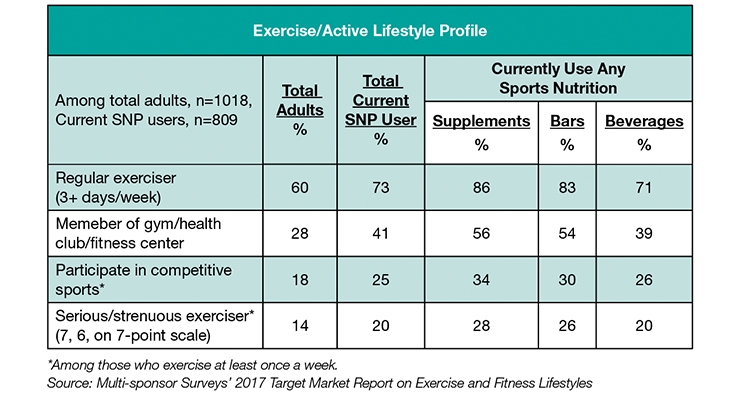

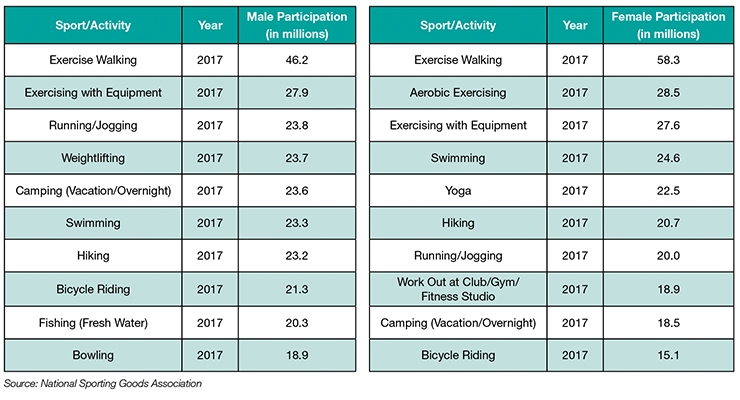

According to Multi-sponsor Surveys’ 2017 Target Market Report on Exercise and Fitness Lifestyles, 60% of adults exercised 3+ days/week, up from 43% 10 years ago; 15% exercised 6-7 days. On average, adults exercise 3 hours per week; 3.6 hours for sports nutrition product users. Those under age 44 living in higher income households or in the West are most likely to exercise 3 or more days/week.

Fit consumers have been credited with helping to drive the sports nutrition (SN) and weight loss category, estimated by Nutrition Business Journal at $40 billion in 2017. Among those who exercise 3+ times/week, 86% use SN supplements, 83% SN bars, and 71% SN beverages.

Although sports nutrition users are likely to exercise more regularly than adults overall, they are not highly focused on sports and serious/strenuous fitness; only 20% of SN product users describe themselves as “serious/strenuous” exercisers, per Multi-sponsor (Figure 1).

A New Role for Exercise

Over the past five years, physical activity and mental/emotional health have become more prominent health/wellness goals. Three-quarters now believe “mind” is as important for health as body, according to IRI’s February 2018 Top Trends in Fresh webinar.

Similarly, 60% believe that “feeling emotionally stable” and 51% “having time to relax,” are essential healthy living components, per Mintel’s Healthy Lifestyles – US (October 2017).

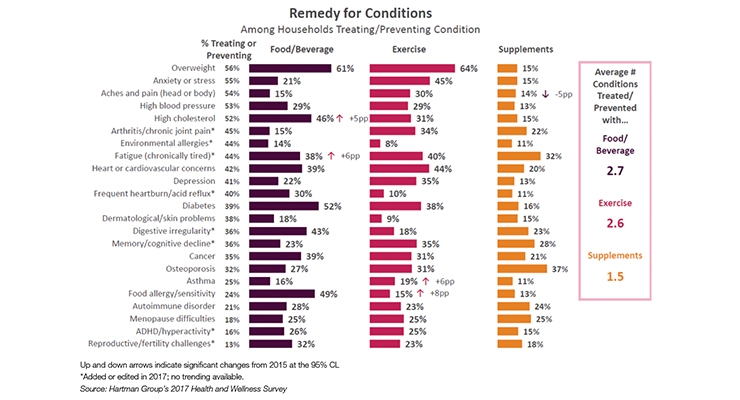

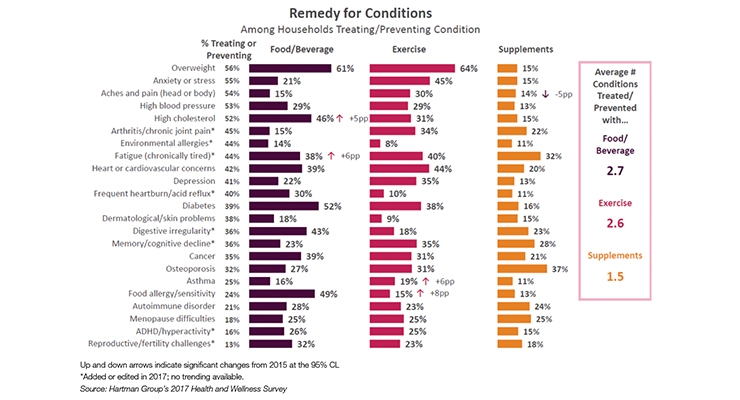

According to the Hartman Group’s 2017 Health & Wellness, consumers now view exercise as a mood and energy management strategy vs. simply a weight loss tool or means to a better-looking body. Body shape, cardio fitness, weight control, strength/flexibility, sustained energy, better sleep, and appetite management are the physical benefits adults now associate with exercise; stress management, improved mood, and a sense of self-esteem are among the emotional advantages.

Exercise is also increasingly being used as a remedy for treating/preventing conditions (e.g., stress, fatigue, diabetes, cognitive/memory, etc.). (See Figure 2.)

The top U.S. health concerns have refocused to everyday performance issues (e.g., tiredness/lack of energy, stress, mental sharpness, muscle health/tone, back/neck pain, and the ability to continue normal activities with age), according to HealthFocus.

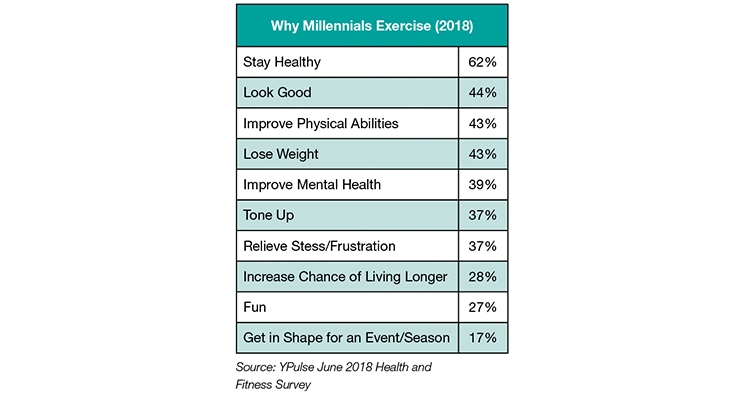

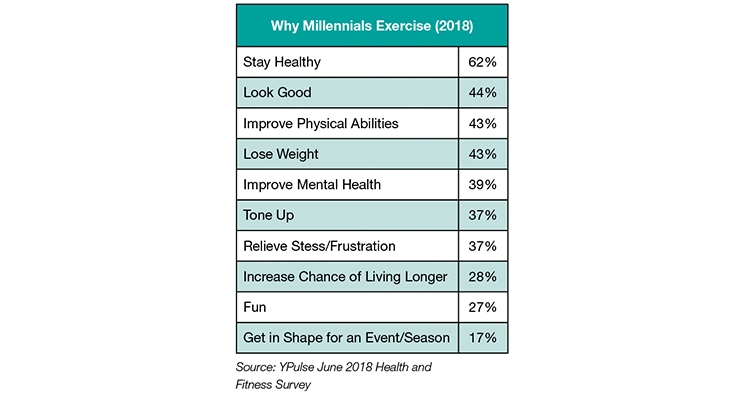

Right after staying healthy (62%), to look good (44%), improve physical abilities (43%), lose weight (43%), improve mental health (39%), tone up (37%), relieve stress (39%), increase the chance of living longer (28%), and for fun (27%) are the top reasons millennials exercise, per YPulse’s June 2018 Health & Fitness Survey (Figure 3).

Lastly, being “fit” has gone glam. Eight in 10 millennials/gen Zers believe “fit is the new pretty.” Nine in 10 say it’s cool to work out; 77% work out more often; and 78% say they don’t want to be skinny, but athletic, according to YPulse.

What They’re Doing

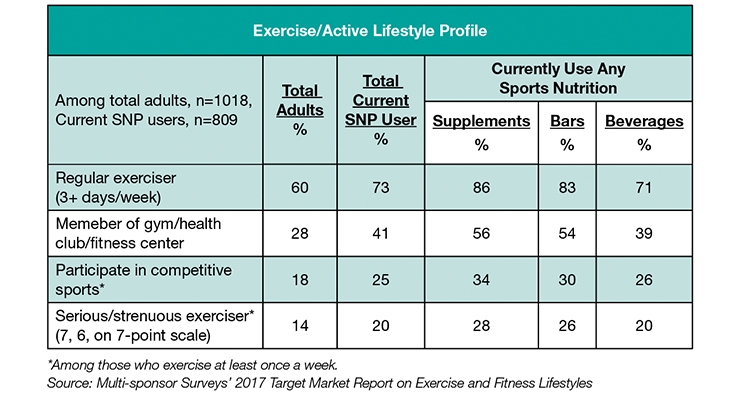

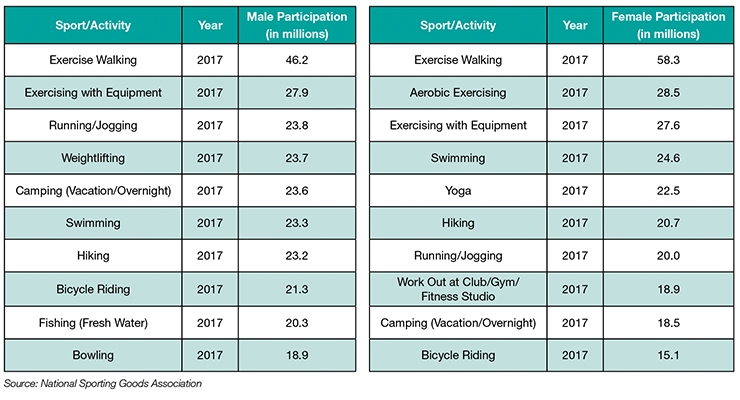

Walking is the top exercise activity for men (46 million) and women (58 million), according to the National Sporting Goods Association. For men, exercising with equipment ranks second; aerobic exercising for women (Figure 4). Yoga, dance, and cross-training are the top classes taken by millennials.

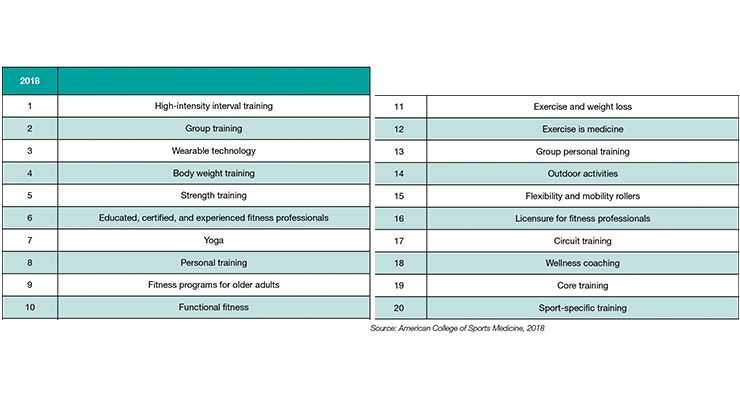

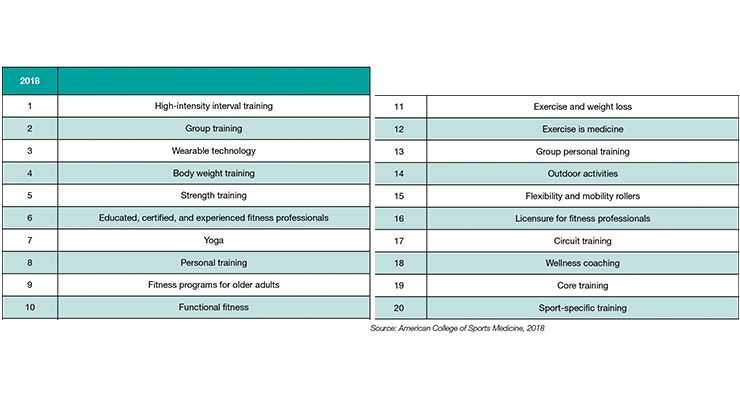

Globally, high intensity interval training tops the 2018 list of hot global fitness trends; body weight training ranks fourth, strength training fifth, yoga seventh, and fitness for older adults ninth. Exercise and weight loss fell to eleventh place; core training and sport-specific training are new entries in the top 20 trends, per the American College of Sports Medicine’s annual survey (Figure 5).

Muscle/strength is the number one reason that consumers buy personal exercise equipment; followed by weight loss 64%, cardio 57%, cognitive function 47%, and energy 41%, according to ECRM’s/Wella 2016 Sport Consumer Survey.

According to the Council for Responsible Nutrition’s 2018 Consumer Survey of Dietary Supplements, 32% of supplement users take a sports supplement, up from 29% in 2017. Moreover, protein and green tea supplements, used respectively by 22% and 16%, are now among the top 10 most taken supplements.

Interest in improving performance through foods/beverages is also on the rise. According to the International Food Information Council’s 2018 Food & Health Survey, 49% ranked cardio among the top three benefits they want from foods; 39% weight control, 36% energy, 31% brain function, 25% muscle/strength, 18% emotional health, and 7% performance.

What They’re Looking for

With Fit consumers looking for a wide variety of performance attributes—strength, endurance, alertness/mental focus, flexibility, muscle/tone, strong bones, improved circulation, stress-relief, no pain/injury, and improved appearance—multi-functional performance products will gain in popularity.

According to HealthFocus’ deep dive, food/beverage performance shoppers tend to skew younger and to households with kids. Adult use of energy drinks/shots, sports drinks, and meal replacements increases as the number of kids in the household goes up, per Packaged Facts’ May 2017 Energy & Sports Drinks.

With 72% of kids ages 6-12 involved in sports, 37% regularly all year, kids’ SN products are a missed opportunity. Moreover, HealthFocus reported that 45% of parents with kids at home are more concerned about their physical development (e.g., height, bones, and muscle), than about low exercise.

One third of teens say being fit is a big part of their life, according to YPulse; 38% of those aged 13-17 workout 3 or more days per week; 27% 1-2 times.

Perhaps most important, interest in new performance issues that may be improved by exercise is kicking in around age 50. One in two 50+ adults wish they had more strength/energy to participate in activities they enjoy; 28% have noticed muscle loss, and 40% a loss of strength; 34% are extremely concerned, per Abbott’s 2016 Muscle Health Survey.

Moreover, HealthFocus reported that consumers become very/extremely concerned about maintaining their ability to continue normal activities between age 50-64 (69%). Only one in five over age 50 meet the National Institutes of Health’s Muscle Strength Guidelines; 17% age 65+. With the average age of menopause at 51, bone issues and falls become of greater concern; osteoporosis is increasing in older men.

Lastly, while the U.S. Department of Health and Human Services’ June 2008 Physical Activity Guidelines for Americans reported that only 23% of adults 18-64 meet their exercise standards, it’s important to note that their lofty goals require at least 150 minutes (2.5 hours) a week of moderate intensity exercise or 1.5 hours of vigorous-intensity aerobic activity, as well as two sessions of strength training for 75 minutes per week.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Fit consumers tend to be more casually active and do not include serious athletes/bodybuilders, and gym fanatics who work out almost every day. While understanding of the attitudes/behaviors of fit consumers is still evolving, it’s likely that they may represent about 40% of consumers.

According to Multi-sponsor Surveys’ 2017 Target Market Report on Exercise and Fitness Lifestyles, 60% of adults exercised 3+ days/week, up from 43% 10 years ago; 15% exercised 6-7 days. On average, adults exercise 3 hours per week; 3.6 hours for sports nutrition product users. Those under age 44 living in higher income households or in the West are most likely to exercise 3 or more days/week.

Fit consumers have been credited with helping to drive the sports nutrition (SN) and weight loss category, estimated by Nutrition Business Journal at $40 billion in 2017. Among those who exercise 3+ times/week, 86% use SN supplements, 83% SN bars, and 71% SN beverages.

Although sports nutrition users are likely to exercise more regularly than adults overall, they are not highly focused on sports and serious/strenuous fitness; only 20% of SN product users describe themselves as “serious/strenuous” exercisers, per Multi-sponsor (Figure 1).

A New Role for Exercise

Over the past five years, physical activity and mental/emotional health have become more prominent health/wellness goals. Three-quarters now believe “mind” is as important for health as body, according to IRI’s February 2018 Top Trends in Fresh webinar.

Similarly, 60% believe that “feeling emotionally stable” and 51% “having time to relax,” are essential healthy living components, per Mintel’s Healthy Lifestyles – US (October 2017).

According to the Hartman Group’s 2017 Health & Wellness, consumers now view exercise as a mood and energy management strategy vs. simply a weight loss tool or means to a better-looking body. Body shape, cardio fitness, weight control, strength/flexibility, sustained energy, better sleep, and appetite management are the physical benefits adults now associate with exercise; stress management, improved mood, and a sense of self-esteem are among the emotional advantages.

Exercise is also increasingly being used as a remedy for treating/preventing conditions (e.g., stress, fatigue, diabetes, cognitive/memory, etc.). (See Figure 2.)

The top U.S. health concerns have refocused to everyday performance issues (e.g., tiredness/lack of energy, stress, mental sharpness, muscle health/tone, back/neck pain, and the ability to continue normal activities with age), according to HealthFocus.

Right after staying healthy (62%), to look good (44%), improve physical abilities (43%), lose weight (43%), improve mental health (39%), tone up (37%), relieve stress (39%), increase the chance of living longer (28%), and for fun (27%) are the top reasons millennials exercise, per YPulse’s June 2018 Health & Fitness Survey (Figure 3).

Lastly, being “fit” has gone glam. Eight in 10 millennials/gen Zers believe “fit is the new pretty.” Nine in 10 say it’s cool to work out; 77% work out more often; and 78% say they don’t want to be skinny, but athletic, according to YPulse.

What They’re Doing

Walking is the top exercise activity for men (46 million) and women (58 million), according to the National Sporting Goods Association. For men, exercising with equipment ranks second; aerobic exercising for women (Figure 4). Yoga, dance, and cross-training are the top classes taken by millennials.

Globally, high intensity interval training tops the 2018 list of hot global fitness trends; body weight training ranks fourth, strength training fifth, yoga seventh, and fitness for older adults ninth. Exercise and weight loss fell to eleventh place; core training and sport-specific training are new entries in the top 20 trends, per the American College of Sports Medicine’s annual survey (Figure 5).

Muscle/strength is the number one reason that consumers buy personal exercise equipment; followed by weight loss 64%, cardio 57%, cognitive function 47%, and energy 41%, according to ECRM’s/Wella 2016 Sport Consumer Survey.

According to the Council for Responsible Nutrition’s 2018 Consumer Survey of Dietary Supplements, 32% of supplement users take a sports supplement, up from 29% in 2017. Moreover, protein and green tea supplements, used respectively by 22% and 16%, are now among the top 10 most taken supplements.

Interest in improving performance through foods/beverages is also on the rise. According to the International Food Information Council’s 2018 Food & Health Survey, 49% ranked cardio among the top three benefits they want from foods; 39% weight control, 36% energy, 31% brain function, 25% muscle/strength, 18% emotional health, and 7% performance.

What They’re Looking for

With Fit consumers looking for a wide variety of performance attributes—strength, endurance, alertness/mental focus, flexibility, muscle/tone, strong bones, improved circulation, stress-relief, no pain/injury, and improved appearance—multi-functional performance products will gain in popularity.

- Instant Nutrition: Expect Fit consumers to drive interest beyond bars/shakes to functional snacks. Six in 10 consumers want snacks that go beyond basic nutrition; 57% with an energy boost, per IRI’s 2018 State-of-the-Snack Food Industry. NBJ projected functional snack sales will hit $8.5 billion by 2020.

- Sustainable Energy: According to HealthFocus’ 2016 Deep Dive Athletic Performance Consumer Market Overview, performance consumers are most likely to seek out “long-lasting physical energy” and “energy they can draw on throughout the day,” at twice the rate of “energy for exercise”; “mental and morning energy to get started” ranked third and fourth. NBJ projected energy supplement sales will approach $2.5 billion by 2021, with a CAGR of 8-9%.

- Muscle: 39% of consumers want supplements for muscle tone, according to HealthFocus; 28% to maintain muscle strength.

- Protein Gen 2: Six in 10 adults tried to get more protein last year, per the Hartman Group. In 2017, 59% of women and 52% of men bought a shake for its protein content; 48% and 49% bought a high protein bar, according to Packaged Facts November 2017 Nutrition Shakes & Bars. While marketers are differentiating the type of protein, they need to adjust the amount and talk more about the role of leucine, a trigger for muscle synthesis; the timing of consumption; and pursue other high awareness health linkages (e.g., feeling full and longer lasting energy). CRN reported 10% of all supplement users take an amino acid; 5% creatine.

- Pain Relief: With explosive interest in “natural OTCs” and the fact there are 18 million sprains per year from leisure activity, sports, and housework, per the CDC’s Burden of Musculoskeletal Diseases 2016; it is not surprising that 10 of the 15-best-selling external analgesic were made with less pharmaceutical and more natural ingredients (e.g., BioFreeze and Blue Emu). Half of analgesics were taken for muscle aches; one-third for backaches, per Mintel’s Analgesics – US, 2017.

According to HealthFocus’ deep dive, food/beverage performance shoppers tend to skew younger and to households with kids. Adult use of energy drinks/shots, sports drinks, and meal replacements increases as the number of kids in the household goes up, per Packaged Facts’ May 2017 Energy & Sports Drinks.

With 72% of kids ages 6-12 involved in sports, 37% regularly all year, kids’ SN products are a missed opportunity. Moreover, HealthFocus reported that 45% of parents with kids at home are more concerned about their physical development (e.g., height, bones, and muscle), than about low exercise.

One third of teens say being fit is a big part of their life, according to YPulse; 38% of those aged 13-17 workout 3 or more days per week; 27% 1-2 times.

Perhaps most important, interest in new performance issues that may be improved by exercise is kicking in around age 50. One in two 50+ adults wish they had more strength/energy to participate in activities they enjoy; 28% have noticed muscle loss, and 40% a loss of strength; 34% are extremely concerned, per Abbott’s 2016 Muscle Health Survey.

Moreover, HealthFocus reported that consumers become very/extremely concerned about maintaining their ability to continue normal activities between age 50-64 (69%). Only one in five over age 50 meet the National Institutes of Health’s Muscle Strength Guidelines; 17% age 65+. With the average age of menopause at 51, bone issues and falls become of greater concern; osteoporosis is increasing in older men.

Lastly, while the U.S. Department of Health and Human Services’ June 2008 Physical Activity Guidelines for Americans reported that only 23% of adults 18-64 meet their exercise standards, it’s important to note that their lofty goals require at least 150 minutes (2.5 hours) a week of moderate intensity exercise or 1.5 hours of vigorous-intensity aerobic activity, as well as two sessions of strength training for 75 minutes per week.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.