By Ian Crook, Managing Editor, Nicholas Hall OTC Reports05.01.17

As the proportion of the global population over age 50 steadily increases, demand for solutions to the myriad of problems associated with old age also continues to rise. People in nearly every part of the world are living longer, but their chances of spending these later years in good health vary within and between countries.

With up to five decades of a person’s life after 50, the rapidly-growing market for healthy aging encompasses a broad demographic group—from those who recently entered their 50s and want to maintain their quality of life, stay fit and ward off illness, to the very elderly who may be managing long-term chronic illness and recurring health problems.

Healthy aging can be seen as the development and maintenance of optimal mental and physical well-being in older adults, encompassing exercise, good nutrition, regular health screenings, getting enough sleep, and participating in activities. To some people, healthy aging will mean being able to continue a sport or activity into later life with the help of OTCs for pain relief or maintaining joints; for others, it might be looking after their eyesight via supplementation, taking erectile dysfunction (ED) treatments to maintain a healthy sex life, or using a low-dose aspirin regimen to keep heart problems at bay.

Of course, healthy aging is not just about old age, and for many it begins much earlier; numerous studies have highlighted the benefits of looking after health from as young an age as possible, including eating a balanced diet, exercising, taking supplements for maintaining healthy bones, joints, eyes, etc. For many people, longer lives will mean an extended middle age rather than a descent into frailty, and it is important that marketers wishing to target older consumers do not lose sight of the fact that few people want to be thought of as “old”; products and promotions need to find the balance between meeting the needs and expectations of 50+ consumers, and avoiding being patronizing or condescending. Marketers keen to create a point of differentiation for their products and services will find a receptive audience in older consumers, but will need to tailor their approach to the diverse needs and expectations of this wide demographic.

An Aging Population

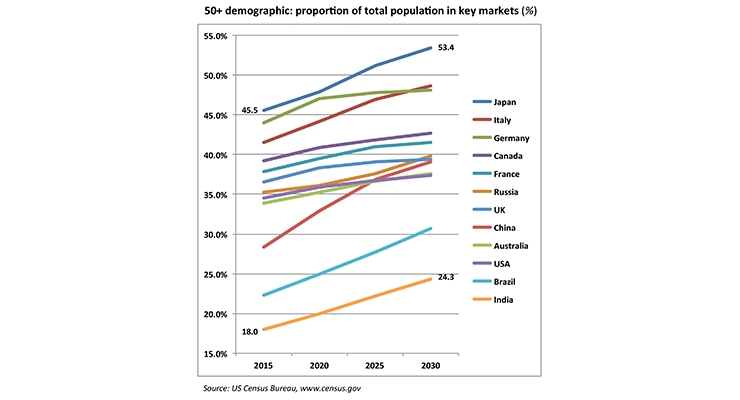

Consistently low birth rates and higher life expectancy are transforming the shape of the global age pyramid. The most important change will likely be the marked transition toward a much older population structure, a development that is already apparent in several developed markets. People 65+ already outnumber children under 14 in many developed countries like Japan, Germany and Italy. The 50+ demographic is expanding in all major markets, with the pace of growth varying between them. Markets like Japan, Italy and Germany have the highest proportion of older people (and will continue to), while in Brazil and India the proportion is considerably lower but growing fast. China’s 50+ population will be among the fastest to expand to the year 2030.

The vast majority of people around the world will make it to age 70, once considered extraordinary old age. This rise in longevity has seen policy on pensions and healthcare revised, with retirement ages rising and responsibility for health shifting to individuals. Naturally, this aging population also offers opportunities, with the chance for marketers to target a new and expanding demographic.

Understanding Older Consumers

50+ consumers are set to be the largest, fastest-growing and wealthiest section of the population in most developed markets (and many developing countries). They are healthier and wealthier when compared to earlier generations of the same age; crucially, their spending power is also generally greater than that of the more frequently targeted 18 to 39 year olds. During the next two decades, older consumers will be the primary drivers of consumer expenditure in Asia-Pacific, Europe and the U.S. Factors such as increasing life expectancy, raised retirement ages, longer working lives, as well as inheritance, will all contribute to boosting the incomes and spending power of older consumers.

In general, older consumers place more focus on their health, are better than younger generations at ensuring they have routine medical examinations, and put greater emphasis on maintaining a healthy weight. Many actively look for products and services that help them live a healthy lifestyle, and they generally put greater emphasis on quality, with price less of an issue than with other groups.

Looking at which advertising and promotion (A&P) channels to use to best target this older demographic, the answer is probably a mix of traditional and digital. While older consumers still rely heavily on traditional media (e.g., TV, newspapers, radio) when making brand decisions, marketers should not rule out digital media, as there is a growing number of Internet/social media users among this group. According to the Pew Research Center, Internet use among those aged 65+ increased by 150% between 2009 and 2011, the largest growth in a demographic group. Of those in this age group that went online in 2012, 71% did so daily and 34% used social media. Older adults are using Facebook in increasing numbers, not simply for social reasons but also to discuss health issues or current ailments with other people who have the same condition/problem.

Health Categories in Focus

Certain OTC categories have a distinct link to healthy aging, or are by their nature wholly or partially concerned with the health issues affecting 50+ consumers. Examples include:

Osteoarthritis & Joint Pain—Osteoarthritis is the most common form of arthritis, occurring when the body’s repair mechanisms for damaged joint tissue are insufficient to cope with the disease, resulting in abnormal joint tissue. It usually occurs later in life, typically after the age of 50. Treatments for OA often focus on reducing the symptoms of pain and restricted mobility, including systemic analgesics (e.g., ibuprofen, paracetamol, etc.), topical patches, creams and gels, herbal and natural joint health supplements (e.g., glucosamine, chondroitin, fish oil/omega-3s), and certain single vitamins.

Calcium Supplements—The main cause of osteoporosis is an age-related decrease in the body’s hormone production (less estrogen in women after menopause, and less testosterone in older men). Women aged 50+ and men 70+ have an increased risk for osteoporosis. Calcium is key to maintaining bone health, and most healthcare professionals recommend those aged 50+ take at least 1,200 mg of calcium every day. As many older people eat fewer calcium-rich foods (it can be harder to digest high-calcium dairy products with age), a popular option is OTC calcium supplements.

Menopause Supplements—Menopause is a natural part of female aging where a woman stops menstruating, and generally occurs between the ages of 45-55 as a woman’s natural estrogen levels begin to decline. OTC supplements for menopause are commonly formulated with isoflavones (found in natural sources such as soy and red clover), which have a chemical structure similar to that of estrogen, with products often claiming to be effective in reducing symptoms such as hot flashes, night sweats, and low mood.

Memory & Brain Health—As people age, normal changes include a decelerated blood flow to the brain and a gradual reduction in brain size, rendering most individuals less mentally flexible. Memory and attention are two basic brain functions most affected by aging. Several supplements are believed to play a role in maintaining brain health, including ginseng, ginkgo biloba, omega-3s, amino acids, vitamins A, B, C, D, E and choline, which are frequent inclusions in memory and brain health supplements; ginkgo and omega-3 are particularly prominent.

Eye Health Supplements—Age-related macular degeneration (AMD) is the leading cause of vision loss in those aged 50+, as the macula (a small area near the center of the retina) becomes damaged, affecting central vision. Age is a major risk factor for the development of AMD, which is most likely to occur after the age of 60. Many eye health supplements are formulated in line with the AREDS and AREDS2 formulas—two major clinical trials that identified ingredient combinations to best slow the progression of AMD. (For more on the eye health market, click here.)

Cardiovascular Health—Heart disease is a leading cause of death in most markets, and while the condition can frequently be prevented or managed via lifestyle changes, a number of products for cardiovascular health are available. The OTC category comprises low-dose aspirin products for reducing heart attack risk and a range of heart health supplements positioned for hypertension and general cardiac health. Aspirin is widely positioned for the reduction of risk of a second heart attack or stroke, but the level of OTC self-medication is comparatively low. A December 2016 study in the U.S. suggested that as many as 40% of men and 10% of women aged 50-79 are at high risk of CVD and do not use aspirin to manage the condition.

Other OTC categories with a healthy aging focus include circulatory aids, urinary products, ED, sleep aids and sedatives, and more.

Meeting Consumer Needs

The aging demographic is expanding rapidly, has more disposable income than younger consumers, and places health as a higher priority. This audience should be a core focus for marketing promotion and product development—but is it? Research suggests that older consumers generally feel ill-served by ads, packaging, labeling, and the retail experience. With a focus on products aimed at younger generations in ads on TV, in print and online, marketers appear to be giving less attention than may be warranted to older consumers.

With notable exceptions such as the U.S. and Germany, where the older demographic is largely well represented, in many markets, much of the A&P supporting OTC brands does not seem focused on older consumers. Marketers have yet to fully embrace the potential of healthy aging and the vast underserved 50+ audience, and there remains considerable scope within most categories for more effective, more targeted A&P.

This article contains selected highlights from the report “Healthy Ageing: The Expanding OTC Market for 50+ Consumers” by Nicholas Hall’s OTC Reports. For more information about this report, contact ian.crook@nicholashall.com.

With up to five decades of a person’s life after 50, the rapidly-growing market for healthy aging encompasses a broad demographic group—from those who recently entered their 50s and want to maintain their quality of life, stay fit and ward off illness, to the very elderly who may be managing long-term chronic illness and recurring health problems.

Healthy aging can be seen as the development and maintenance of optimal mental and physical well-being in older adults, encompassing exercise, good nutrition, regular health screenings, getting enough sleep, and participating in activities. To some people, healthy aging will mean being able to continue a sport or activity into later life with the help of OTCs for pain relief or maintaining joints; for others, it might be looking after their eyesight via supplementation, taking erectile dysfunction (ED) treatments to maintain a healthy sex life, or using a low-dose aspirin regimen to keep heart problems at bay.

Of course, healthy aging is not just about old age, and for many it begins much earlier; numerous studies have highlighted the benefits of looking after health from as young an age as possible, including eating a balanced diet, exercising, taking supplements for maintaining healthy bones, joints, eyes, etc. For many people, longer lives will mean an extended middle age rather than a descent into frailty, and it is important that marketers wishing to target older consumers do not lose sight of the fact that few people want to be thought of as “old”; products and promotions need to find the balance between meeting the needs and expectations of 50+ consumers, and avoiding being patronizing or condescending. Marketers keen to create a point of differentiation for their products and services will find a receptive audience in older consumers, but will need to tailor their approach to the diverse needs and expectations of this wide demographic.

An Aging Population

Consistently low birth rates and higher life expectancy are transforming the shape of the global age pyramid. The most important change will likely be the marked transition toward a much older population structure, a development that is already apparent in several developed markets. People 65+ already outnumber children under 14 in many developed countries like Japan, Germany and Italy. The 50+ demographic is expanding in all major markets, with the pace of growth varying between them. Markets like Japan, Italy and Germany have the highest proportion of older people (and will continue to), while in Brazil and India the proportion is considerably lower but growing fast. China’s 50+ population will be among the fastest to expand to the year 2030.

The vast majority of people around the world will make it to age 70, once considered extraordinary old age. This rise in longevity has seen policy on pensions and healthcare revised, with retirement ages rising and responsibility for health shifting to individuals. Naturally, this aging population also offers opportunities, with the chance for marketers to target a new and expanding demographic.

Understanding Older Consumers

50+ consumers are set to be the largest, fastest-growing and wealthiest section of the population in most developed markets (and many developing countries). They are healthier and wealthier when compared to earlier generations of the same age; crucially, their spending power is also generally greater than that of the more frequently targeted 18 to 39 year olds. During the next two decades, older consumers will be the primary drivers of consumer expenditure in Asia-Pacific, Europe and the U.S. Factors such as increasing life expectancy, raised retirement ages, longer working lives, as well as inheritance, will all contribute to boosting the incomes and spending power of older consumers.

In general, older consumers place more focus on their health, are better than younger generations at ensuring they have routine medical examinations, and put greater emphasis on maintaining a healthy weight. Many actively look for products and services that help them live a healthy lifestyle, and they generally put greater emphasis on quality, with price less of an issue than with other groups.

Looking at which advertising and promotion (A&P) channels to use to best target this older demographic, the answer is probably a mix of traditional and digital. While older consumers still rely heavily on traditional media (e.g., TV, newspapers, radio) when making brand decisions, marketers should not rule out digital media, as there is a growing number of Internet/social media users among this group. According to the Pew Research Center, Internet use among those aged 65+ increased by 150% between 2009 and 2011, the largest growth in a demographic group. Of those in this age group that went online in 2012, 71% did so daily and 34% used social media. Older adults are using Facebook in increasing numbers, not simply for social reasons but also to discuss health issues or current ailments with other people who have the same condition/problem.

Health Categories in Focus

Certain OTC categories have a distinct link to healthy aging, or are by their nature wholly or partially concerned with the health issues affecting 50+ consumers. Examples include:

Osteoarthritis & Joint Pain—Osteoarthritis is the most common form of arthritis, occurring when the body’s repair mechanisms for damaged joint tissue are insufficient to cope with the disease, resulting in abnormal joint tissue. It usually occurs later in life, typically after the age of 50. Treatments for OA often focus on reducing the symptoms of pain and restricted mobility, including systemic analgesics (e.g., ibuprofen, paracetamol, etc.), topical patches, creams and gels, herbal and natural joint health supplements (e.g., glucosamine, chondroitin, fish oil/omega-3s), and certain single vitamins.

Calcium Supplements—The main cause of osteoporosis is an age-related decrease in the body’s hormone production (less estrogen in women after menopause, and less testosterone in older men). Women aged 50+ and men 70+ have an increased risk for osteoporosis. Calcium is key to maintaining bone health, and most healthcare professionals recommend those aged 50+ take at least 1,200 mg of calcium every day. As many older people eat fewer calcium-rich foods (it can be harder to digest high-calcium dairy products with age), a popular option is OTC calcium supplements.

Menopause Supplements—Menopause is a natural part of female aging where a woman stops menstruating, and generally occurs between the ages of 45-55 as a woman’s natural estrogen levels begin to decline. OTC supplements for menopause are commonly formulated with isoflavones (found in natural sources such as soy and red clover), which have a chemical structure similar to that of estrogen, with products often claiming to be effective in reducing symptoms such as hot flashes, night sweats, and low mood.

Memory & Brain Health—As people age, normal changes include a decelerated blood flow to the brain and a gradual reduction in brain size, rendering most individuals less mentally flexible. Memory and attention are two basic brain functions most affected by aging. Several supplements are believed to play a role in maintaining brain health, including ginseng, ginkgo biloba, omega-3s, amino acids, vitamins A, B, C, D, E and choline, which are frequent inclusions in memory and brain health supplements; ginkgo and omega-3 are particularly prominent.

Eye Health Supplements—Age-related macular degeneration (AMD) is the leading cause of vision loss in those aged 50+, as the macula (a small area near the center of the retina) becomes damaged, affecting central vision. Age is a major risk factor for the development of AMD, which is most likely to occur after the age of 60. Many eye health supplements are formulated in line with the AREDS and AREDS2 formulas—two major clinical trials that identified ingredient combinations to best slow the progression of AMD. (For more on the eye health market, click here.)

Cardiovascular Health—Heart disease is a leading cause of death in most markets, and while the condition can frequently be prevented or managed via lifestyle changes, a number of products for cardiovascular health are available. The OTC category comprises low-dose aspirin products for reducing heart attack risk and a range of heart health supplements positioned for hypertension and general cardiac health. Aspirin is widely positioned for the reduction of risk of a second heart attack or stroke, but the level of OTC self-medication is comparatively low. A December 2016 study in the U.S. suggested that as many as 40% of men and 10% of women aged 50-79 are at high risk of CVD and do not use aspirin to manage the condition.

Other OTC categories with a healthy aging focus include circulatory aids, urinary products, ED, sleep aids and sedatives, and more.

Meeting Consumer Needs

The aging demographic is expanding rapidly, has more disposable income than younger consumers, and places health as a higher priority. This audience should be a core focus for marketing promotion and product development—but is it? Research suggests that older consumers generally feel ill-served by ads, packaging, labeling, and the retail experience. With a focus on products aimed at younger generations in ads on TV, in print and online, marketers appear to be giving less attention than may be warranted to older consumers.

With notable exceptions such as the U.S. and Germany, where the older demographic is largely well represented, in many markets, much of the A&P supporting OTC brands does not seem focused on older consumers. Marketers have yet to fully embrace the potential of healthy aging and the vast underserved 50+ audience, and there remains considerable scope within most categories for more effective, more targeted A&P.

This article contains selected highlights from the report “Healthy Ageing: The Expanding OTC Market for 50+ Consumers” by Nicholas Hall’s OTC Reports. For more information about this report, contact ian.crook@nicholashall.com.