Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.07.01.16

Sales of herbs/botanical supplements reached an all-time high of $7 billion in 2015, up 7.7% vs. 2014—enjoying more than 10 years of consecutive growth—and are projected to top $8.3 billion in sales by 2018, according to Nutrition Business Journal (NBJ), Boulder, CO. Herbs/botanicals accounted for 18% of supplement sales in 2015.

Combination herbs/herbal formulas drove the category, with sales of $2.7 billion in 2015, up 12% vs. 2014. NBJ projected overall category growth of 6% annually through 2018—about 8% for blends.

Perhaps most important, herbs/botanicals outpaced supplement industry growth despite highly publicized negative attacks on herbal supplements that claimed they were mislabeled and fraudulently marketed. In February 2015, the New York Attorney General (NY AG) claimed that 79% of herbal products tested from four major retailers failed to contain the labeled herb. Harvard Health Publications also conveyed a much-publicized story in its monthly newsletter that herbal supplements frequently did not contain the herbs listed.

Although IRI reported that 38 herbal products had suffered either flat or declining sales, 13% posted increases in 2015. Four of the herbs attacked by the New York Attorney General—Ginkgo biloba, St. John’s Wort, valerian root and saw palmetto—experienced double-digit growth overall for the year ending Nov. 2, 2015, according to SPINS. Two other herbs involved in the NY AG report were ginseng and echinacea; ginseng sales rose 8% and echinacea sales were flat.

NBJ reported that turmeric/curcumin, maca and rhodiola helped to carry the category. Sales of turmeric reached $196 million in 2015, up 20%, and are projected to reach $433 million by 2020. Maca supplements reached $108 million in 2015, bee pollen $167 million, milk thistle $131 million and “other Ayurvedic” supplements $93 million, per NBJ.

Melatonin, cranberry, garlic and lutein ranked in the top 20 best-selling supplements overall in mass channels for the year ending Nov. 22, 2015, according to IRI, with sales up 5.3%, up 10.2%, down 0.4% and down 2.9%, respectively. Although sales of melatonin across all channels fell from 16.7% in 2014 to 6.8% in 2015, NBJ projected sales will reach $500 million by 2018.

In 2015, 31% of consumers used an herbal supplement, according to the Council for Responsible Nutrition’s (CRN) 2015 Consumer Survey on Dietary Supplements. Green Tea was the most used herbal supplement in 2015, taken by 12% of supplement users, followed by cranberry 8%, garlic 6%, ginseng 6%, echinacea 5%, Ginkgo biloba 5%, turmeric 5% and milk thistle 4%, per CRN.

Turmeric, goji berry and Garcinia cambogia posted the highest growth in consumer awareness, up in 2014 compared with 2013 (35%, 28% and 21%, respectively), according to the 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements.

With herbs/botanicals traditionally associated with many natural remedies, it is not surprising that they are more frequently being used for purposes typically found in the OTC drug category; herbs and botanicals easily convey a more natural solution. Four of the top 10 best-selling OTC sleep aids contain botanical ingredients, according to IRI data. MidNite PM contains melatonin, lavender, lemon balm and chamomile; Alteril contains melatonin and valerian root.

Herbal products’ growth in the mass market is being led by formulas targeting allergy, brain health, child remedies and cleansing—each growing more than 20% in 2015, per SPINS. Allergy and immunity led herbal product growth in the natural/specialty channel (up 15%). Topical analgesics, cough/cold/allergy and bottled drinks are the fastest growing herbal categories in the U.S., according to Euromonitor.

Overall, the future looks good for herbal supplements. Millennials are the demographic most likely to use herbals, followed by Baby Boomers, according to Gallup.

America’s fast-growing Hispanic population is among the heaviest users of herbal/botanical products. Also of note is that herbals/botanicals support a clean label, which is important to 43% of supplement users, per Gallup.

Market Potential

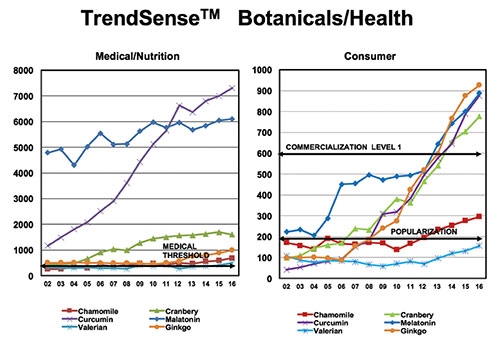

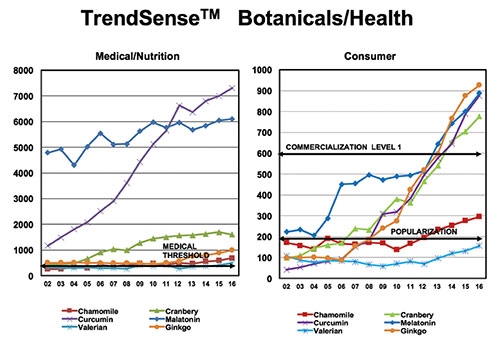

According to Sloan Trend’s TrendSense model, herbs/botanicals still remain most marketable in specialty channels. Curcumin, melatonin, Gingko biloba and cranberry are among the few that enjoy mass market status.

Chamomile is highly marketable in specialty channels; valerian root is a rising star, likely riding on the wave of sleep remedies, since it is included in several sleep aid supplements. Both chamomile and valerian root have crossed the TrendSense Medical Threshold, signaling the beginning of a long-term sustainable consumer trend for these two herbal products.

Growth Potential

According to the Hartman Group’s “Culture of Food 2015,” “uses real spices and herbs” is now the fourth most important factor in defining high quality foods/beverages, following “better ingredients,” “better taste” and “100% natural.”

Unusual/uncommon herbs are among the hot culinary trends for 2016, according to the National Restaurant Association’s Annual Chefs “What’s Hot” survey. New food/drinks carrying a superfood, fruit, grain, or herb claim increased 202% globally from 2011-2015, according to Mintel; the U.S. accounted for 30% of superfood launches.

Sales of traditional herbal teas jumped 13% in 2015, herbal/medicinal tea up 14%, according to Euromonitor’s March 2016 “Tea in the U.S.” report. IRI reported sales of herbal/plant waters and infused waters rose 22% in 2015. Globally, the functional/fortified fruit/herbal tea category is projected to grow 63% from 2015 to 2020 with a CAGR of 10.3% (Euromonitor). Turmeric and maca are projected to show strong growth in the tea category.

Dietary Supplements

There is no question that herbs/botanicals hold great promise for the supplement industry and can help drive greater penetration into the natural remedy sector. However, it will be important that manufacturers of herb and botanical supplements adhere to quality and safety standards that include ingredient and potency verification and good manufacturing practices. The presence of fillers and ingredients not listed on the label constitutes mislabeling and false advertising. These illegitimate practices expose consumers to potential allergens, deprive them of intended health benefits and jeopardize the future of the industry.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Combination herbs/herbal formulas drove the category, with sales of $2.7 billion in 2015, up 12% vs. 2014. NBJ projected overall category growth of 6% annually through 2018—about 8% for blends.

Perhaps most important, herbs/botanicals outpaced supplement industry growth despite highly publicized negative attacks on herbal supplements that claimed they were mislabeled and fraudulently marketed. In February 2015, the New York Attorney General (NY AG) claimed that 79% of herbal products tested from four major retailers failed to contain the labeled herb. Harvard Health Publications also conveyed a much-publicized story in its monthly newsletter that herbal supplements frequently did not contain the herbs listed.

Although IRI reported that 38 herbal products had suffered either flat or declining sales, 13% posted increases in 2015. Four of the herbs attacked by the New York Attorney General—Ginkgo biloba, St. John’s Wort, valerian root and saw palmetto—experienced double-digit growth overall for the year ending Nov. 2, 2015, according to SPINS. Two other herbs involved in the NY AG report were ginseng and echinacea; ginseng sales rose 8% and echinacea sales were flat.

NBJ reported that turmeric/curcumin, maca and rhodiola helped to carry the category. Sales of turmeric reached $196 million in 2015, up 20%, and are projected to reach $433 million by 2020. Maca supplements reached $108 million in 2015, bee pollen $167 million, milk thistle $131 million and “other Ayurvedic” supplements $93 million, per NBJ.

Melatonin, cranberry, garlic and lutein ranked in the top 20 best-selling supplements overall in mass channels for the year ending Nov. 22, 2015, according to IRI, with sales up 5.3%, up 10.2%, down 0.4% and down 2.9%, respectively. Although sales of melatonin across all channels fell from 16.7% in 2014 to 6.8% in 2015, NBJ projected sales will reach $500 million by 2018.

In 2015, 31% of consumers used an herbal supplement, according to the Council for Responsible Nutrition’s (CRN) 2015 Consumer Survey on Dietary Supplements. Green Tea was the most used herbal supplement in 2015, taken by 12% of supplement users, followed by cranberry 8%, garlic 6%, ginseng 6%, echinacea 5%, Ginkgo biloba 5%, turmeric 5% and milk thistle 4%, per CRN.

Turmeric, goji berry and Garcinia cambogia posted the highest growth in consumer awareness, up in 2014 compared with 2013 (35%, 28% and 21%, respectively), according to the 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements.

With herbs/botanicals traditionally associated with many natural remedies, it is not surprising that they are more frequently being used for purposes typically found in the OTC drug category; herbs and botanicals easily convey a more natural solution. Four of the top 10 best-selling OTC sleep aids contain botanical ingredients, according to IRI data. MidNite PM contains melatonin, lavender, lemon balm and chamomile; Alteril contains melatonin and valerian root.

Herbal products’ growth in the mass market is being led by formulas targeting allergy, brain health, child remedies and cleansing—each growing more than 20% in 2015, per SPINS. Allergy and immunity led herbal product growth in the natural/specialty channel (up 15%). Topical analgesics, cough/cold/allergy and bottled drinks are the fastest growing herbal categories in the U.S., according to Euromonitor.

Overall, the future looks good for herbal supplements. Millennials are the demographic most likely to use herbals, followed by Baby Boomers, according to Gallup.

America’s fast-growing Hispanic population is among the heaviest users of herbal/botanical products. Also of note is that herbals/botanicals support a clean label, which is important to 43% of supplement users, per Gallup.

Market Potential

According to Sloan Trend’s TrendSense model, herbs/botanicals still remain most marketable in specialty channels. Curcumin, melatonin, Gingko biloba and cranberry are among the few that enjoy mass market status.

Chamomile is highly marketable in specialty channels; valerian root is a rising star, likely riding on the wave of sleep remedies, since it is included in several sleep aid supplements. Both chamomile and valerian root have crossed the TrendSense Medical Threshold, signaling the beginning of a long-term sustainable consumer trend for these two herbal products.

Growth Potential

- More than six in 10 supplement users are aware of healthful properties associated with ginseng, garlic and Aloe vera; more than 50% are aware of benefits for flaxseed oil, St. John’s Wort, cinnamon, Ginkgo biloba, cranberry and/or green tea; more than 40% are aware of ginger root, chamomile, peppermint, pomegranate, echinacea and acai; and more than 30% are aware of oregano, rose hips, turmeric and bee pollen (Gallup).

- Although women are more likely than men to use herbal/botanical supplements, (12% vs. 9%), men are more likely to take garlic, ginseng, Ginkgo biloba, saw palmetto and St. John’s Wort (Gallup).

- 5% of women used an herb/botanical supplement for a women’s health issue in 2015 (TABS 2016 Supplement Survey); menopause and PMS were the top women’s health categories for herbal remedies (Gallup).

- Immunity is the number one reason consumers purchase a supplement, according to Gallup. Immune boosting supplement sales reached $2.6 billion in 2015, up 6.3%, per NBJ.

- 18% of those who had a cognitive issue associate Ginkgo biloba with improving brain/memory function; 13% for ginseng (Gallup Segmentation of the Market for Cognitive Health Supplements, 2014).

- Global sales of brain health supplements reached $2.7 billion in 2015, per Euromonitor. Combination herbs/vitamin and single herb products drive the market.

- Botanicals/bioactives are projected to have the highest growth rate for food/beverage ingredients globally from 2013 to 2018 (Euromonitor).

According to the Hartman Group’s “Culture of Food 2015,” “uses real spices and herbs” is now the fourth most important factor in defining high quality foods/beverages, following “better ingredients,” “better taste” and “100% natural.”

Unusual/uncommon herbs are among the hot culinary trends for 2016, according to the National Restaurant Association’s Annual Chefs “What’s Hot” survey. New food/drinks carrying a superfood, fruit, grain, or herb claim increased 202% globally from 2011-2015, according to Mintel; the U.S. accounted for 30% of superfood launches.

Sales of traditional herbal teas jumped 13% in 2015, herbal/medicinal tea up 14%, according to Euromonitor’s March 2016 “Tea in the U.S.” report. IRI reported sales of herbal/plant waters and infused waters rose 22% in 2015. Globally, the functional/fortified fruit/herbal tea category is projected to grow 63% from 2015 to 2020 with a CAGR of 10.3% (Euromonitor). Turmeric and maca are projected to show strong growth in the tea category.

Dietary Supplements

There is no question that herbs/botanicals hold great promise for the supplement industry and can help drive greater penetration into the natural remedy sector. However, it will be important that manufacturers of herb and botanical supplements adhere to quality and safety standards that include ingredient and potency verification and good manufacturing practices. The presence of fillers and ingredients not listed on the label constitutes mislabeling and false advertising. These illegitimate practices expose consumers to potential allergens, deprive them of intended health benefits and jeopardize the future of the industry.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.