Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.03.01.16

Few nutritionals have been able to hold mass-market attention as long—or have the diversity of ingredients (e.g., vitamins, minerals, botanicals, phytochemicals, spices) that continuously offer new and intriguing health linkages—than the antioxidant category.

Although down from a high of 68% in 2008, 51% of consumers still tried to add/increase their antioxidant intake last year, according to the Hartman Group’s 2015 Health & Wellness Trends—48% of Millennials, 49% of Gen Xers and 56% of those age 50 and older.

Collective sales of antioxidant supplements reached an all-time high of $6 billion in 2014, up 3.7%, according to Nutrition Business Journal (NBJ), down slightly from 5.7% the previous year. (Note: 2014 is the last full year of data available at this time.)

One in five consumers looked for antioxidant-rich claims while shopping for food in 2015, according to FMI’s 2015 U.S. Grocery Shopper Trends. Four in 10 said a good source of antioxidants claim is very/extremely important, per HealthFocus (2014).

With the 2015-2020 Dietary Guidelines for Americans Advisory Committee identifying antioxidant vitamins A, C, E and folate as “other shortfall nutrients,” the future looks brighter still.

However, as the antioxidant category matures, marketers would be wise to better tie their ingredients to more natural sources, especially foods. According to Hartman, 62% of consumers would rather get their antioxidants from foods. The dietary guidelines also encourage Americans to select antioxidant-rich and plant-based foods as part of a more nutrient-dense diet.

With vegetables, followed by fruits, considered the most inherently healthy dietary components, according to Technomic’s Healthy Eating Consumer Trend Report, phytonutrients and other plant-based antioxidants will increasingly grab the spotlight.

Whole-food supplements are projected to top $2.7 billion by 2017; fruit/vegetable supplements have enjoyed three years of double-digit growth, according to NBJ. Anthocyanins and resveratrol are the most recent phytonutrients to reach mass-market potential, per Sloan Trends’ TrendSense model.

As they search for more natural solutions, Americans are increasingly recognizing the antioxidant properties of herbs/botanicals, including spices. Herbal sales reached $6.4 billion in 2014, up 7.1%, according to HerbalGram. Cranberry and cinnamon were among the top sellers in mass channels; turmeric among the fastest growing supplements overall.

Spices (e.g., cinnamon and ginger) are predicted to be among the best-selling new beverage flavors in 2016, representing a virtually untapped nutritional opportunity. Ginger, clove, rosemary, oregano, fenugreek and green tea also have high antioxidant capacities.

Lastly, and perhaps most important, novel and scientifically valid health linkages for antioxidants, including anxiety, blood pressure, cataracts, sleep apnea, liver health and diabetes, will help keep antioxidants center stage.

Antioxidants play a key role in quenching free radicals and reducing oxidative stress. Chronic oxidative stress is not only associated with disease, including cancer, lung disease and asthma, it has also been shown to affect mood, anxiety, stress, depression and fatigue. Vitamin C may also help reduce the oxidative stress that potentially triggers disease and neuropsychological disorders.

Market Potential

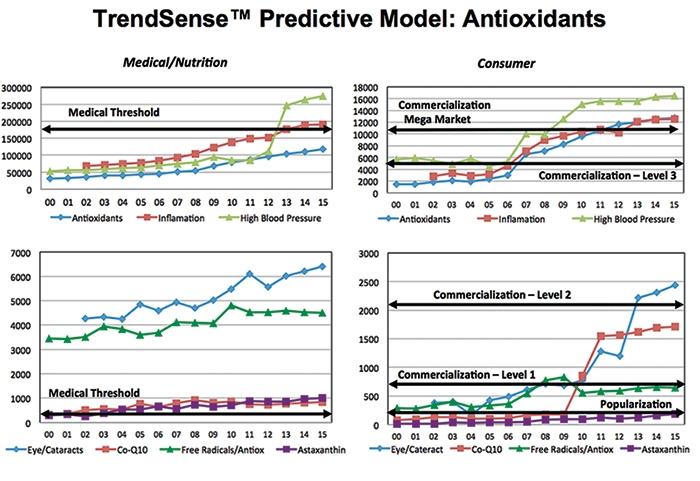

According to Sloan Trend’s TrendSense model, antioxidants remain a strong and vibrant mega mass market with research activity/new scientific findings continuing at an explosive pace. At the same time, the market for anti-inflammatory nutraceuticals—following a similar pattern—continues to soar.

Emerging health linkages for antioxidants aimed at high blood pressure (also of mega market status) and cataracts (now a fast emerging Level 2 market) offer high-potential new opportunities.

CoQ10 is also fast approaching a Level 2 mass-market opportunity; astaxanthin is perfectly timed for marketing in the health food/specialty sector.

Free radicals and their effect on health remain among the most underutilized, but highly marketable, storylines for the effectiveness of antioxidants.

Market opportunities with structure/function health claims exist for a range of well-known and novel antioxidants, including cranberry, grape seed extract, noni, green tea, flavanoid-rich cocoa, carotenoids, rosemary, curcumin/turmeric, clove, ginger, capsaicin (red pepper), piperine (black pepper), garlic, onion, fenugreek, resveratrol, pine bark extract, hydroxytyrosol, selenium, zinc, vitamins A, C, E, melatonin, folic acid and CoQ10.

Growth Potential

Functional Foods

Beverage marketers should consider a “naturally functional” and tasty, campaign, with antioxidants among the top reasons to buy a healthy beverage. Fruit flavors and spices projected by beverage company executives to be among the best-selling for 2016 include: raspberry #1; lemon/pomegranate tied for #2; and blueberry, cherry, ginger, mint, cinnamon, green tea and black coffee extract expected to make large gains.

However, be wary of traditional superfruits (e.g., acai), since they fell out of the top 10 drink flavors back in 2011, according to Beverage Industry.

As food marketers move toward more naturally functional foods, they need to look for more synergistic opportunities to tout the potential for antioxidants (e.g., when almonds are added to breakfast cereals or bars).

While fortified foods/beverages led global growth of healthy foods in 2014 (up 10%), naturally nutritious food platforms were a close second (+8%), according to Euromonitor.

Dietary Supplements

With those aged 50 and older the most likely demographic to use antioxidant supplements—and novel health linkages for antioxidants still emerging—the opportunity for condition-specific, antioxidant-supported supplements is unprecedented.

Moreover, while antioxidants are infrequently mentioned when it comes to kids’ health, their benefits are highly desirable to parents and may well represent a well-proven and untapped positioning for supplements.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Although down from a high of 68% in 2008, 51% of consumers still tried to add/increase their antioxidant intake last year, according to the Hartman Group’s 2015 Health & Wellness Trends—48% of Millennials, 49% of Gen Xers and 56% of those age 50 and older.

Collective sales of antioxidant supplements reached an all-time high of $6 billion in 2014, up 3.7%, according to Nutrition Business Journal (NBJ), down slightly from 5.7% the previous year. (Note: 2014 is the last full year of data available at this time.)

One in five consumers looked for antioxidant-rich claims while shopping for food in 2015, according to FMI’s 2015 U.S. Grocery Shopper Trends. Four in 10 said a good source of antioxidants claim is very/extremely important, per HealthFocus (2014).

With the 2015-2020 Dietary Guidelines for Americans Advisory Committee identifying antioxidant vitamins A, C, E and folate as “other shortfall nutrients,” the future looks brighter still.

However, as the antioxidant category matures, marketers would be wise to better tie their ingredients to more natural sources, especially foods. According to Hartman, 62% of consumers would rather get their antioxidants from foods. The dietary guidelines also encourage Americans to select antioxidant-rich and plant-based foods as part of a more nutrient-dense diet.

With vegetables, followed by fruits, considered the most inherently healthy dietary components, according to Technomic’s Healthy Eating Consumer Trend Report, phytonutrients and other plant-based antioxidants will increasingly grab the spotlight.

Whole-food supplements are projected to top $2.7 billion by 2017; fruit/vegetable supplements have enjoyed three years of double-digit growth, according to NBJ. Anthocyanins and resveratrol are the most recent phytonutrients to reach mass-market potential, per Sloan Trends’ TrendSense model.

As they search for more natural solutions, Americans are increasingly recognizing the antioxidant properties of herbs/botanicals, including spices. Herbal sales reached $6.4 billion in 2014, up 7.1%, according to HerbalGram. Cranberry and cinnamon were among the top sellers in mass channels; turmeric among the fastest growing supplements overall.

Spices (e.g., cinnamon and ginger) are predicted to be among the best-selling new beverage flavors in 2016, representing a virtually untapped nutritional opportunity. Ginger, clove, rosemary, oregano, fenugreek and green tea also have high antioxidant capacities.

Lastly, and perhaps most important, novel and scientifically valid health linkages for antioxidants, including anxiety, blood pressure, cataracts, sleep apnea, liver health and diabetes, will help keep antioxidants center stage.

Antioxidants play a key role in quenching free radicals and reducing oxidative stress. Chronic oxidative stress is not only associated with disease, including cancer, lung disease and asthma, it has also been shown to affect mood, anxiety, stress, depression and fatigue. Vitamin C may also help reduce the oxidative stress that potentially triggers disease and neuropsychological disorders.

Market Potential

According to Sloan Trend’s TrendSense model, antioxidants remain a strong and vibrant mega mass market with research activity/new scientific findings continuing at an explosive pace. At the same time, the market for anti-inflammatory nutraceuticals—following a similar pattern—continues to soar.

Emerging health linkages for antioxidants aimed at high blood pressure (also of mega market status) and cataracts (now a fast emerging Level 2 market) offer high-potential new opportunities.

CoQ10 is also fast approaching a Level 2 mass-market opportunity; astaxanthin is perfectly timed for marketing in the health food/specialty sector.

Free radicals and their effect on health remain among the most underutilized, but highly marketable, storylines for the effectiveness of antioxidants.

Market opportunities with structure/function health claims exist for a range of well-known and novel antioxidants, including cranberry, grape seed extract, noni, green tea, flavanoid-rich cocoa, carotenoids, rosemary, curcumin/turmeric, clove, ginger, capsaicin (red pepper), piperine (black pepper), garlic, onion, fenugreek, resveratrol, pine bark extract, hydroxytyrosol, selenium, zinc, vitamins A, C, E, melatonin, folic acid and CoQ10.

Growth Potential

- 66% of consumers are nutritionally aware of antioxidants: 63% garlic, 62% polyphenols, 55% cinnamon, 50% green tea or cranberry, 48% olive extract/oil, 47% melatonin, 43% acai, 35% turmeric, 32% lycopene, 31% CoQ10, 30% lutein, 28% goji berry and 24% resveratrol (according to the 2014 Gallup Study of Nutrition Knowledge & Consumption).

- 27% of supplement users took vitamin C, 13% vitamin E, 10% CoQ10 in 2015 (Council for Responsible Nutrition, 2015).

- Only 34% of consumers think they get enough antioxidants to make a health difference (IFIC, 2013 Functional Food Survey).

- 59% of those managing their weight are trying to consume more antioxidants—30% higher than the general population (Hartman).

- The Mediterranean diet, which is rich in antioxidants, is the eighth-hottest culinary cuisines trend for 2016 (National Restaurant Association, 2015).

- 28% of women link antioxidants with skin care benefits (2013 Gallup Study of Skincare).

- Consumers would be more likely to purchase a beverage that was antioxidant-rich; more so than immunity 47%, digestion 47%, probiotics 40% or energy/stamina 39% (Technomic’s 2014 Consumer Beverage Trend Report).

- Right after vitamin A/beta-carotene, consumers most link antioxidants to vision (2013 Gallup Study of Eye Health).

- Cognitive health is among the top 10 new beverage trends for 2016 (Beverage Industry, 2016).

- 12% of doctors recommend antioxidant supplements to their patients (Gallup).

- The global market for antioxidants is growing at a CAGR of 4.7% through 2018; Asia-Pacific and North American markets are the fastest growing (TechNavio, 2014).

Functional Foods

Beverage marketers should consider a “naturally functional” and tasty, campaign, with antioxidants among the top reasons to buy a healthy beverage. Fruit flavors and spices projected by beverage company executives to be among the best-selling for 2016 include: raspberry #1; lemon/pomegranate tied for #2; and blueberry, cherry, ginger, mint, cinnamon, green tea and black coffee extract expected to make large gains.

However, be wary of traditional superfruits (e.g., acai), since they fell out of the top 10 drink flavors back in 2011, according to Beverage Industry.

As food marketers move toward more naturally functional foods, they need to look for more synergistic opportunities to tout the potential for antioxidants (e.g., when almonds are added to breakfast cereals or bars).

While fortified foods/beverages led global growth of healthy foods in 2014 (up 10%), naturally nutritious food platforms were a close second (+8%), according to Euromonitor.

Dietary Supplements

With those aged 50 and older the most likely demographic to use antioxidant supplements—and novel health linkages for antioxidants still emerging—the opportunity for condition-specific, antioxidant-supported supplements is unprecedented.

Moreover, while antioxidants are infrequently mentioned when it comes to kids’ health, their benefits are highly desirable to parents and may well represent a well-proven and untapped positioning for supplements.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.