Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.12.03.15

While the relatively small group of loyal, core gluten-free (GF) users continues to grow, consumers’ belief in the movement’s fundamental drivers (i.e., that GF is healthier, helps with weight loss and improves digestion) has dropped dramatically since 2010, according to Packaged Fact’s 2015 report “Gluten-Free Foods in the U.S.” Most important, despite the ongoing promises and predictions of double-digit growth, the size of the GF market has been grossly inflated and appears to have peaked in 2013.

Use of traditional scanner data, which tallies sales based on the presence of any “on pack” GF claim—regardless of whether it influenced the consumers’ purchase decision—has resulted in very high market size declarations. For example, Nielsen reported GF sales reached $23 billion in 2014 (SPINS $20 billion); Mintel projected GF sales will reach $16.8 billion by 2018.

However, if the GF market is more specifically and appropriately defined to include only products that feature a GF claim on the front panel as a major selling point and includes only products that would normally contain gluten but have been reformulated to be GF, the size of the market falls into the $1 billion range, according to Packaged Facts.

Not surprisingly, the explosion in new foods/beverages carrying a GF claim, and subsequent scanner reporting, is contributing to the perceived increase in sales. Innova Market Insights reported that 21.6% of all new U.S. foods/drinks introduced in 2014 carried a GF claim, with a North American CAGR of 30% per year since 2010.

The number of larger corporate players now entering the market, albeit late, will continue to inflate the sales tally, with many adding GF labels to products that never contained gluten. In 2013, an Ardent Mills Survey estimated that 2,200 products that never contained gluten were already labeled GF.

As GF marketers add other appealing claims to better compete (e.g., serving of fruits/vegetables, heart healthy or culinary claims), assessing the size of GF-motivated purchases will become even more difficult.

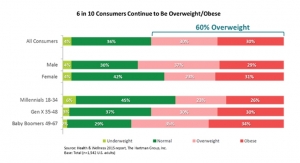

The percentage of consumers who need to buy GF foods for specific health reasons will remain at relatively low levels, making it impossible to deliver a market of the size that GF is commonly thought to be. According to the Hartman Group’s 2015 Health & Wellness report, one in five (20%) consumers avoid gluten; 6% buy GF food/beverages daily, 7% weekly, 5% monthly, 41% occasionally, while 38% never buy GF.

The number one reason consumers give for buying GF is “no reason at all” (35%); other reasons include: a healthier option 26%, digestive health 19%, weight loss 13%, and 10% because someone in their household has a gluten sensitivity, the Hartman Group explained.

Five specialty brands still accounted for just less than half of GF sales in 2014, led by Mission Foods and Boulder Brands/Glutino/Udi’s Health Foods. Pirate Brands, Dale and Thomas Popcorn, Crunchmaster & TH Foods, and Blue Diamond were the other companies with more than a 5% share.

Lastly, the long-term potential of the General Mills recall of 1.9 million boxes of GF Cheerios will not go unnoticed by users. The potential consequences include a lack of trust for big industry players and a return of GF purchases to specialty/natural retailers.

Market Potential

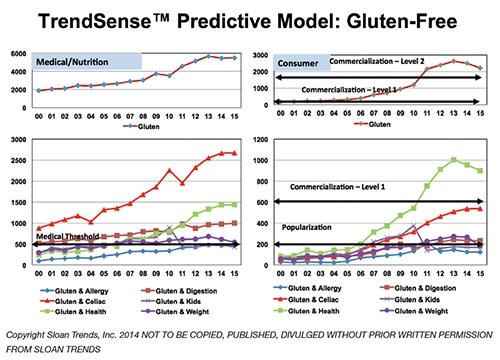

According to Sloan Trend’s TrendSense model, the market for gluten-free has begun to wane, peaking in early 2013. The “core” market—consisting of 2-3 million Celiac Disease sufferers and the 18 million consumers that USDA states have a non-Celiac gluten sensitivity—represents a strong, high repeat purchase target for GF foods long-term.

The other segment of GF users who are driven by the belief that GF is healthier is declining, although still a viable Level 1 mass market. Similarly, the gluten connection with weight management is losing its marketing draw. However, the connection for gluten with digestion and kids remains a solid specialty/health food channel opportunity.

Those who believe GF foods are healthier fell from 46% in 2010 to 25% in 2014; those believing GF can help manage weight fell from 30% to 19%; and that GF is low carb fell from 22% to 16%, per Packaged Facts.

Future Considerations

More than half of GF food users purchased snack foods in 2014; 43% pasta/noodles, 38% bread products, 36% baking ingredients (e.g., rice flour), 33% sweet baked goods, and 32% hot/cold breakfast cereal, according to Packaged Facts.

Salty snacks are the largest GF category with IRI-tracked multi-outlet sales of $533 million in 2014, followed by crackers $35 million, pasta $56 million and bread products $54 million. All GF categories enjoyed double-digit growth, albeit some from a relatively small base.

GF food marketers should continue to concentrate on offering GF versions of products that traditionally have contained gluten. Per Packaged Facts, while consumers recognize improvements in the quality of GF, taste is still a barrier. Marketers should abandon touting GF claims on products that never contained gluten. Only a very small percentage say they look for claims on products that have never contained gluten (e.g., water).

Marketers also need to pay closer attention to calorie and fat values of their GF products. Manufacturers often substitute starches and oils to recreate the texture and mouth-feel of their gluten-containing counterparts, increasing the calorie, fat and carbohydrate content for some GF foods. Fortification with key nutrients that are generally low in GF diets would provide needed nutritional value.

Dietary Supplements

Supplementation is advised for Celiac patients who have impaired intestinal villi that cause malabsorption of nutrients.Those who choose a GF diet, but do not have Celiac disease, may also be at risk for nutritional deficiencies for iron, folate, B vitamins, calcium and fiber. A condition-specific supplement for GF users should find a welcome market.

Although 43% of supplement users reported buying a clean label supplement in 2014, only 8%—or 3.4% of the general population of supplement users—looked for GF on the label, according to Gallup.

We recommend CPG marketers and retailers take a more precautionary position on GF going forward. GF will continue to be a sustainable market and it may provide a healthier aura for some products, but a major expansion in delivering GF products that usually do not contain gluten is not recommended.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Use of traditional scanner data, which tallies sales based on the presence of any “on pack” GF claim—regardless of whether it influenced the consumers’ purchase decision—has resulted in very high market size declarations. For example, Nielsen reported GF sales reached $23 billion in 2014 (SPINS $20 billion); Mintel projected GF sales will reach $16.8 billion by 2018.

However, if the GF market is more specifically and appropriately defined to include only products that feature a GF claim on the front panel as a major selling point and includes only products that would normally contain gluten but have been reformulated to be GF, the size of the market falls into the $1 billion range, according to Packaged Facts.

Not surprisingly, the explosion in new foods/beverages carrying a GF claim, and subsequent scanner reporting, is contributing to the perceived increase in sales. Innova Market Insights reported that 21.6% of all new U.S. foods/drinks introduced in 2014 carried a GF claim, with a North American CAGR of 30% per year since 2010.

The number of larger corporate players now entering the market, albeit late, will continue to inflate the sales tally, with many adding GF labels to products that never contained gluten. In 2013, an Ardent Mills Survey estimated that 2,200 products that never contained gluten were already labeled GF.

As GF marketers add other appealing claims to better compete (e.g., serving of fruits/vegetables, heart healthy or culinary claims), assessing the size of GF-motivated purchases will become even more difficult.

The percentage of consumers who need to buy GF foods for specific health reasons will remain at relatively low levels, making it impossible to deliver a market of the size that GF is commonly thought to be. According to the Hartman Group’s 2015 Health & Wellness report, one in five (20%) consumers avoid gluten; 6% buy GF food/beverages daily, 7% weekly, 5% monthly, 41% occasionally, while 38% never buy GF.

The number one reason consumers give for buying GF is “no reason at all” (35%); other reasons include: a healthier option 26%, digestive health 19%, weight loss 13%, and 10% because someone in their household has a gluten sensitivity, the Hartman Group explained.

Five specialty brands still accounted for just less than half of GF sales in 2014, led by Mission Foods and Boulder Brands/Glutino/Udi’s Health Foods. Pirate Brands, Dale and Thomas Popcorn, Crunchmaster & TH Foods, and Blue Diamond were the other companies with more than a 5% share.

Lastly, the long-term potential of the General Mills recall of 1.9 million boxes of GF Cheerios will not go unnoticed by users. The potential consequences include a lack of trust for big industry players and a return of GF purchases to specialty/natural retailers.

Market Potential

According to Sloan Trend’s TrendSense model, the market for gluten-free has begun to wane, peaking in early 2013. The “core” market—consisting of 2-3 million Celiac Disease sufferers and the 18 million consumers that USDA states have a non-Celiac gluten sensitivity—represents a strong, high repeat purchase target for GF foods long-term.

The other segment of GF users who are driven by the belief that GF is healthier is declining, although still a viable Level 1 mass market. Similarly, the gluten connection with weight management is losing its marketing draw. However, the connection for gluten with digestion and kids remains a solid specialty/health food channel opportunity.

Those who believe GF foods are healthier fell from 46% in 2010 to 25% in 2014; those believing GF can help manage weight fell from 30% to 19%; and that GF is low carb fell from 22% to 16%, per Packaged Facts.

Future Considerations

- 23% of consumers bought/used a GF food/beverage within a 3-month period in 2014, up from 15% in 2010 and 18% in 2012 (Packaged Facts).

- 28% have at least thought about gluten when buying foods/drinks (IFIC, 2015).

- 1 in 10 look for GF claims while shopping for foods; GF is very important to 13% of shoppers, somewhat to 21% (FMI, 2015).

- 8% of shoppers are experimenting with a GF eating style; 9% of Millennials are also experimenting (FMI).

- 24% would be interested in learning more about GF, only 11% willing to pay more (Packaged Facts).

- 41% of GF users say they’re buying more, down from 86% who were doing so in 2013 (Packaged Facts).

- Despite new FDA legal definitions, only 19% of current GF users said they’ll buy more GF as a result (Packaged Facts).

- GF is only associated with clean label issues by 8% (Packaged Facts).

- GF has been on the list of hot culinary trends for more than 5 years, but it was labeled as a “cooling trend” for 2015.

- The U.S. accounts for 36% of the world’s GF market; Australia 19%, France 9%, Italy 6%, Norway 5% and Russia/Germany 3% (Euromonitor, 2015).

More than half of GF food users purchased snack foods in 2014; 43% pasta/noodles, 38% bread products, 36% baking ingredients (e.g., rice flour), 33% sweet baked goods, and 32% hot/cold breakfast cereal, according to Packaged Facts.

Salty snacks are the largest GF category with IRI-tracked multi-outlet sales of $533 million in 2014, followed by crackers $35 million, pasta $56 million and bread products $54 million. All GF categories enjoyed double-digit growth, albeit some from a relatively small base.

GF food marketers should continue to concentrate on offering GF versions of products that traditionally have contained gluten. Per Packaged Facts, while consumers recognize improvements in the quality of GF, taste is still a barrier. Marketers should abandon touting GF claims on products that never contained gluten. Only a very small percentage say they look for claims on products that have never contained gluten (e.g., water).

Marketers also need to pay closer attention to calorie and fat values of their GF products. Manufacturers often substitute starches and oils to recreate the texture and mouth-feel of their gluten-containing counterparts, increasing the calorie, fat and carbohydrate content for some GF foods. Fortification with key nutrients that are generally low in GF diets would provide needed nutritional value.

Dietary Supplements

Supplementation is advised for Celiac patients who have impaired intestinal villi that cause malabsorption of nutrients.Those who choose a GF diet, but do not have Celiac disease, may also be at risk for nutritional deficiencies for iron, folate, B vitamins, calcium and fiber. A condition-specific supplement for GF users should find a welcome market.

Although 43% of supplement users reported buying a clean label supplement in 2014, only 8%—or 3.4% of the general population of supplement users—looked for GF on the label, according to Gallup.

We recommend CPG marketers and retailers take a more precautionary position on GF going forward. GF will continue to be a sustainable market and it may provide a healthier aura for some products, but a major expansion in delivering GF products that usually do not contain gluten is not recommended.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.