Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.05.01.14

Although still dominated by interest in weight control and muscle building, the 2014 protein market is set to explode into a series of high-potential, condition-specific health opportunities.

In 2013, 57% of consumers made an effort to get more protein, up 9% vs. 2012, according to the International Food Information Council’s (IFIC) “2013 Food & Health Survey”; those aged 18-34 and 65+ were the most likely to do so.

Six in 10 adults believe protein works for weight loss, per IFIC; 80% of dieters are making a strong effort to get more protein, according to Multi-Sponsor Survey’s “2012 Gallup Study of Weight Loss.” One-third of adults surveyed in the “2012 Gallup Study of Protein” thought protein boosts metabolism and aids in fat burning.

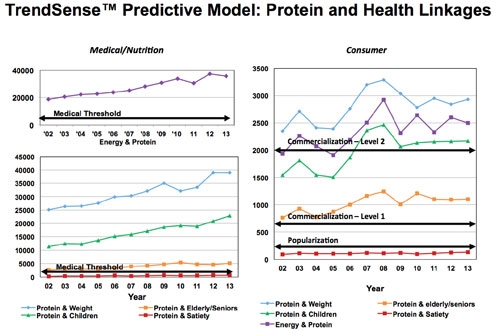

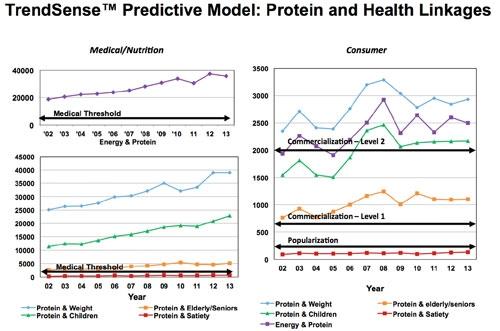

In 2013, Atkins Frozen Meals was the 10th best-selling new food/beverage overall, with first-year sales of $74 million, according to IRi’s “New Product Pacesetters” report. According to Sloan Trends’ TrendSense model, protein and weight are a large, strong and stable Level 2 mass market.

One in five “dieters” in Gallup’s report made a “great deal of effort” to consume foods/beverages promoting satiety. Seven in 10 adults said protein helps you feel full and 59% said it suppresses your hunger between meals (IFIC).

Currently, according to TrendSense, satiety is perfectly posed to be a new market in the health food/specialty channels and among very health conscious/condition-specific shoppers. However, it is far from a mass-market opportunity at this time.

While sales of protein powders are projected to top $4.5 billion by 2015, according to Nutrition Business Journal, it’s the development of a new mainstream segment within the $24 billion sports nutrition industry that will fuel explosive growth for protein.

Consumers making up this new market segment include recreational sports enthusiasts, casual athletes and gym exercisers; women looking to sports nutrition for greater performance and weight/fitness products; Boomers who want to age well; and moms looking for more intense nutritional support for their kids.

Muscle strength/tone has been among the top 10 U.S. health concerns since 2010, according to HealthFocus International. The Food Marketing Institute’s (FMI) “2013 Shopping for Health” reported that building physical strength is a “very important” consideration when buying foods for 25% of shoppers.

Three-quarters of adults believe protein helps build muscle, 68% believe it increases muscle mass and 68% understand it aids more complete recovery from exercise (IFIC).

Protein contributes to optimal body toning, body composition and body fat; all of which are now mainstream mass-market opportunities, according to TrendSense.

Market Potential

According to TrendSense, energy linked to protein has reached mega mass-market status and is among the largest overlooked opportunities for protein. Two-thirds of adults think protein helps provide energy throughout the day; 62% said it helps maintain energy levels, according to IFIC.

Worries over mobility—the ability to continue with normal activities as you age—is the second biggest U.S. health concern; 65% believe protein prevents muscle loss during aging, according to Dairy Management Inc.’s (DMI) “2012 Consumer Survey.” “Muscle and aging” and “protein and elderly/seniors” are strong Level 1 mass markets.

Sarcopenia, a prevalent condition for seniors involving age-related loss of lean body mass, strength and function is a new and fast emerging opportunity; 63% of adults think protein helps you stay active as you get older, according to DMI.

TrendSense indicates the timing is optimal for launching sarcopenia-directed products in specialty/health food channels and among very health conscious/condition-specific consumers.

Joint support is another untapped health linkage; 69% aged 65+ and 38% aged 18-34 believe protein helps maintain healthy bones/joints; 44% and 29%, respectively, that it prevents bone loss during aging, according to DMI. Protein helps support joints by strengthening the muscular skeletal structure.

One-third of moms are making a strong effort to get more protein for their children, according to the “2012 Gallup Study of Children’s Nutrition and Eating Habits.” “Protein and kids” is a strong and stable Level 2 mass market.

One-third of adults believe protein strengthens the immune system, according to Gallup’s protein study. Immunity is very important to 26% of shoppers when making food purchases, reported FMI.

One-third of adults believe that protein promotes healthy hair/nails; 29% skin health and tissue repair, per the Gallup protein study.

Only 31% are currently aware that soy protein has been granted an FDA-approved health claim for reducing the risk of heart disease per the United Soybean Board’s “2013 Health & Nutrition Survey.”

Selling Science

Optimal timing of protein ingestion, appropriate quantities for consumption and the type of protein consumed are creating new marketing messages.

Ideal for supporting muscle growth and weight management, 20-30 grams of high quality protein should be consumed per sitting. A daily intake of 1.5-1.7 g/kg/day is optimal for weight reduction, increased thermogenesis, increased body fat loss, sparing muscle from energy production and regulating blood glucose. Protein intake at 25% of total calories is optimal; but protein consumption above 35% of total calories should be avoided.

Other critical keys for supporting muscle synthesis and positive muscle balance are consumption of sufficient amounts of the amino acid leucine that triggers muscle synthesis and a full complement of essential amino acids. These factors are also high potential new product differentiators.

Savvy marketers like Kashi and GNC are helping consumers to understand their unique protein requirements with their “know your number” campaigns.

Growth Opportunities

Functional Foods

Protein has a proven track record in functional foods/beverages. In 2012, 40% of new best-selling better-for-you foods/beverages carried a “high protein” claim and 30% a “good source of protein” claim, according to IRi.

Sales of snacks carrying a high protein claim rose 16.7% in 2012, IRi reported. One in five beverage R&D executives cited protein as a “must have” beverage ingredient for 2014 in Beverage Industry’s “2014 R&D Survey.”

Weight control liquids and powders were the second fastest-growing CPG product in grocery and convenience stores and the fastest-growing product in the healthcare sector in 2013, according to IRi.

Bakery products (e.g., breads/crackers) and breakfast foods are notoriously low in protein and could be boosted in protein content; kid-specific foods/drinks remain untapped opportunities for protein fortification.

Three-quarters of adults would eat breakfast if it gave them more energy, helped maintain a healthy body weight or helped them get through the morning without feeling hungry according to IFIC.

Dietary Supplements

With the exception of food-based forms of dietary supplements, protein is an untapped opportunity for other forms of dietary supplements.

Just more than one-quarter of adults use meal replacement bars (e.g., Slim-fast, EAS Myoplex); 36% use snack or nutrition protein bars; 36% fiber bars; 35% nutrition bars (e.g., Luna, Balance); 51% all-purpose snack bars (Mintel, “Nutritional Food and Drink - US – Jan. 2013”).

Lastly, a new nighttime supplement that utilizes slow-digesting protein, like casein, is an opportunity to rebuild/generate new muscle while you sleep; it is a very big idea.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com

In 2013, 57% of consumers made an effort to get more protein, up 9% vs. 2012, according to the International Food Information Council’s (IFIC) “2013 Food & Health Survey”; those aged 18-34 and 65+ were the most likely to do so.

Six in 10 adults believe protein works for weight loss, per IFIC; 80% of dieters are making a strong effort to get more protein, according to Multi-Sponsor Survey’s “2012 Gallup Study of Weight Loss.” One-third of adults surveyed in the “2012 Gallup Study of Protein” thought protein boosts metabolism and aids in fat burning.

In 2013, Atkins Frozen Meals was the 10th best-selling new food/beverage overall, with first-year sales of $74 million, according to IRi’s “New Product Pacesetters” report. According to Sloan Trends’ TrendSense model, protein and weight are a large, strong and stable Level 2 mass market.

One in five “dieters” in Gallup’s report made a “great deal of effort” to consume foods/beverages promoting satiety. Seven in 10 adults said protein helps you feel full and 59% said it suppresses your hunger between meals (IFIC).

Currently, according to TrendSense, satiety is perfectly posed to be a new market in the health food/specialty channels and among very health conscious/condition-specific shoppers. However, it is far from a mass-market opportunity at this time.

While sales of protein powders are projected to top $4.5 billion by 2015, according to Nutrition Business Journal, it’s the development of a new mainstream segment within the $24 billion sports nutrition industry that will fuel explosive growth for protein.

Consumers making up this new market segment include recreational sports enthusiasts, casual athletes and gym exercisers; women looking to sports nutrition for greater performance and weight/fitness products; Boomers who want to age well; and moms looking for more intense nutritional support for their kids.

Muscle strength/tone has been among the top 10 U.S. health concerns since 2010, according to HealthFocus International. The Food Marketing Institute’s (FMI) “2013 Shopping for Health” reported that building physical strength is a “very important” consideration when buying foods for 25% of shoppers.

Three-quarters of adults believe protein helps build muscle, 68% believe it increases muscle mass and 68% understand it aids more complete recovery from exercise (IFIC).

Protein contributes to optimal body toning, body composition and body fat; all of which are now mainstream mass-market opportunities, according to TrendSense.

Market Potential

According to TrendSense, energy linked to protein has reached mega mass-market status and is among the largest overlooked opportunities for protein. Two-thirds of adults think protein helps provide energy throughout the day; 62% said it helps maintain energy levels, according to IFIC.

Worries over mobility—the ability to continue with normal activities as you age—is the second biggest U.S. health concern; 65% believe protein prevents muscle loss during aging, according to Dairy Management Inc.’s (DMI) “2012 Consumer Survey.” “Muscle and aging” and “protein and elderly/seniors” are strong Level 1 mass markets.

Sarcopenia, a prevalent condition for seniors involving age-related loss of lean body mass, strength and function is a new and fast emerging opportunity; 63% of adults think protein helps you stay active as you get older, according to DMI.

TrendSense indicates the timing is optimal for launching sarcopenia-directed products in specialty/health food channels and among very health conscious/condition-specific consumers.

Joint support is another untapped health linkage; 69% aged 65+ and 38% aged 18-34 believe protein helps maintain healthy bones/joints; 44% and 29%, respectively, that it prevents bone loss during aging, according to DMI. Protein helps support joints by strengthening the muscular skeletal structure.

One-third of moms are making a strong effort to get more protein for their children, according to the “2012 Gallup Study of Children’s Nutrition and Eating Habits.” “Protein and kids” is a strong and stable Level 2 mass market.

One-third of adults believe protein strengthens the immune system, according to Gallup’s protein study. Immunity is very important to 26% of shoppers when making food purchases, reported FMI.

One-third of adults believe that protein promotes healthy hair/nails; 29% skin health and tissue repair, per the Gallup protein study.

Only 31% are currently aware that soy protein has been granted an FDA-approved health claim for reducing the risk of heart disease per the United Soybean Board’s “2013 Health & Nutrition Survey.”

Selling Science

Optimal timing of protein ingestion, appropriate quantities for consumption and the type of protein consumed are creating new marketing messages.

Ideal for supporting muscle growth and weight management, 20-30 grams of high quality protein should be consumed per sitting. A daily intake of 1.5-1.7 g/kg/day is optimal for weight reduction, increased thermogenesis, increased body fat loss, sparing muscle from energy production and regulating blood glucose. Protein intake at 25% of total calories is optimal; but protein consumption above 35% of total calories should be avoided.

Other critical keys for supporting muscle synthesis and positive muscle balance are consumption of sufficient amounts of the amino acid leucine that triggers muscle synthesis and a full complement of essential amino acids. These factors are also high potential new product differentiators.

Savvy marketers like Kashi and GNC are helping consumers to understand their unique protein requirements with their “know your number” campaigns.

Growth Opportunities

- Four in 10 adults are already aware that the time of day they get their protein is important (IFIC).

- Half of protein drink users do so to get more energy (Mintel, “Nutritional and Performance Drinks – US – Jan. 2014”); 42% highly desire sustainable energy (Hartman, “Health & Wellness, 2013”).

- With protein on the Institute of Medicine’s priority nutrient list for 2014, additional nutritional policy and media attention is likely.

Functional Foods

Protein has a proven track record in functional foods/beverages. In 2012, 40% of new best-selling better-for-you foods/beverages carried a “high protein” claim and 30% a “good source of protein” claim, according to IRi.

Sales of snacks carrying a high protein claim rose 16.7% in 2012, IRi reported. One in five beverage R&D executives cited protein as a “must have” beverage ingredient for 2014 in Beverage Industry’s “2014 R&D Survey.”

Weight control liquids and powders were the second fastest-growing CPG product in grocery and convenience stores and the fastest-growing product in the healthcare sector in 2013, according to IRi.

Bakery products (e.g., breads/crackers) and breakfast foods are notoriously low in protein and could be boosted in protein content; kid-specific foods/drinks remain untapped opportunities for protein fortification.

Three-quarters of adults would eat breakfast if it gave them more energy, helped maintain a healthy body weight or helped them get through the morning without feeling hungry according to IFIC.

Dietary Supplements

With the exception of food-based forms of dietary supplements, protein is an untapped opportunity for other forms of dietary supplements.

Just more than one-quarter of adults use meal replacement bars (e.g., Slim-fast, EAS Myoplex); 36% use snack or nutrition protein bars; 36% fiber bars; 35% nutrition bars (e.g., Luna, Balance); 51% all-purpose snack bars (Mintel, “Nutritional Food and Drink - US – Jan. 2013”).

Lastly, a new nighttime supplement that utilizes slow-digesting protein, like casein, is an opportunity to rebuild/generate new muscle while you sleep; it is a very big idea.

|

Lower-cost, non-meat sources are in high demand, according to NPD report. U.S consumers are well-informed about the beneficial role protein plays in nutrition, with 78% agreeing that protein contributes to a healthy diet, and more than half of adults saying they want more of it in their diet, according to a report from The NPD Group titled “Protein Perceptions and Needs.” The report showed that about half of consumers say non-meat sources are best and the other half consider meat and fish the best source of protein. Those consumers willing to look beyond meat in order to obtain their protein needs are motivated by health-related reasons, the report indicated. The reasons often mentioned by Flexible Protein Users as barriers to getting more protein are that many sources of protein contain fat, are high in calories or are too expensive. NPD reported that some of these perceived barriers could be at play for the beef category, which is not seeing the same consumption increases seen with other protein sources like eggs, chicken, yogurt and nuts/seeds. The challenges for beef might be more about perception, since nearly half of primary grocery shoppers view animal protein as the best source of protein. “Consumers want more protein in their diets. In fact, the only issue that U.S. adults are now checking on the Nutrition Facts label on the back of foods and beverages is the amount of protein,” said Harry Balzer, chief industry analyst and author of “Eating Patterns in America.” “While our interest in protein is growing, we’re looking for alternatives to meat. Many of us are looking to lower the cost of our protein sources, and animal meat is generally more expensive than plant-based protein, which explains the growth in Greek yogurt and other alternate protein sources.” While there is widespread agreement among consumers that protein is necessary in a healthy diet, there is much confusion over the optimal amount of protein that should be consumed on a typical day. NPD found more than three-quarters of primary grocery shoppers said protein contributes to a healthy diet, but almost as many said they are unsure of the recommended daily amount. “It is important for food and beverage marketers to highlight wherever possible that their products are a good source of lean protein. In fact, the protein study we conducted showed certain messages about protein resonated more than others,” said Darren Seifer, NPD food and beverage industry analyst and co-author of the report. “The study also found nearly half of primary grocery shoppers have purchased protein-enriched foods, and many are willing to pay or have already paid a premium for these products.” Meanwhile, to help clarify how much protein consumers are getting from food and supplements, the American Herbal Products Association (AHPA), Silver Spring, MD, recently issued a guidance for calculating the amount of protein listed on dietary supplement and food labels. Adopted by the AHPA Board of Trustees at the recommendation of its Sports Nutrition Committee, the guidance creates a voluntary standard that will help consumers more easily compare protein levels in different products. Current FDA labeling regulations allow the amount of protein in foods and supplements to be calculated as a factor of nitrogen content, but do not define the sources of nitrogen that should be included in such calculations. The “AHPA Guidance on Labeling of Protein in Food and Dietary Supplements” creates a standard by establishing that protein is calculated to include only proteins that are chains of amino acids connected by peptide bonds and to exclude any non-protein nitrogen-containing substances from such calculations. AHPA noted that many companies already use this quantification method and encouraged others in the industry to adopt this standard. |

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com