Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, RD, Sloan Trends, Inc.12.03.13

With 87% of adults experiencing some sleep issue a few nights per week and 60% every night/almost every other night, according to the National Sleep Foundation’s (NSF) Sleep in America Polls, it’s not surprising that the sleep industry is exploding.

One-quarter of respondents in NSF’s 2013 survey said their sleep quality is fairly/very bad; one-third get less sleep than needed on workdays. Two-thirds woke up during the night, 59% felt un-refreshed in the morning, 38% had difficulty falling asleep and 35% woke up early and couldn’t get back to sleep a few nights per week.

One in five adults used an over-the-counter (OTC) sleep aid in 2012, according to Mintel’s OTC Sleep Aids – U.S. – January 2012; 8.5% a Rx sleep aid, per the Centers for Disease Control and Prevention (CDC).

Sales of liquid/tablet OTC sleep remedies jumped 51% in mass channels for the year ended August 2013, according to IRI. Procter & Gamble’s Zzzquil, which posted sales of $127 million since its launch in June 2012, now leads the category, igniting a new liquid sleep-aid sector. Moreover, P&G’s clout has ensured a desirable retail shelf location for the category, including dietary supplements.

In 2012, Nutrition Business Journal reported sleep/insomnia was the fastest-growing condition-specific supplement sector, +17% to $393 million. P&G’s Zzzquil, Alteril, Unisom Natural Nights Sleep Tabs, MidNite PM and Nature Made Sleep are among the top 10 best-selling non-Rx sleep aids.

Melatonin, valerian and L-theanine are among the top ingredients in these best sellers. Other amino acids, including tryptophan, and a variety of botanicals are popular sleep inducing nutraceuticals. Melatonin has the greatest scientific support of any ingredient for sleep, with demonstrated effectiveness for jet lag recovery, sleep quality enhancement and insomnia.

Although 60 million prescriptions were written for sleep aids in the U.S. in 2012, according to IMS Health, sales of the leading Rx brands (Ambien and Lunesta) continue to fall. Moreover, publicity on the negative side effects of Rx sleep aids continues.

FDA has taken action recently to safeguard against drugs that induce excessive or long-lasting drowsiness. A promising new sleep drug, Suvorexant, with a novel mechanism of action was recently rejected for dosage issues. Evidence showed long-lasting drowsiness that impaired motor skills—notably the ability to drive—and memory. FDA has raised concerns about time-release formulas for similar reasons. These regulatory concerns, along with recent recalls/manufacturing issues for Tylenol PM and Excedrin PM, will continue to drive the sleep aid market in a more natural direction.

IRI estimated the market potential for insomnia/sleep supplements and OTC products is $5.3 billion annually. Increased use of caffeinated beverages and round-the-clock use of electronic devices will also accelerate growth for the sleep aid market.

Market Potential

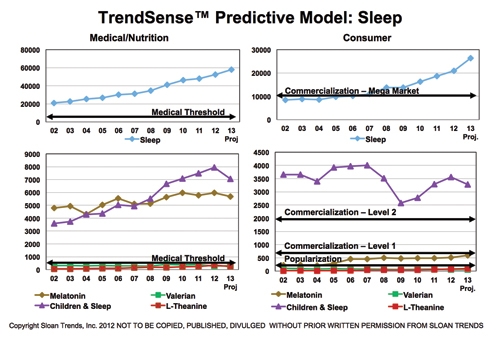

According to Sloan Trend’s TrendSense model, sleep is among the largest mega market nutraceutical opportunities and shows no sign of slowing down. Children and sleep is a very large Level 2 mass market—on par with vitamin D and omega 3—and is virtually untapped by major marketers beyond kids’ homeopathic options (e.g., Hyland’s Calms Forte).

The timing is optimal for launching melatonin-based sleep supplements, as melatonin is projected to become a mass market opportunity in 2013. NBJ projected that melatonin supplement sales specifically related to sleep will reach $266 million in 2013, +26% vs. 2012. NBJ also cited melatonin among the top 10 fastest-growing supplements through 2018.

Although chamomile has been marketable for sleep in specialty/health food channels, among condition-specific and very health conscious consumers since 2004, it is projected to cross the Medical Threshold this year, indicating the beginning of a long-term sustainable ingredient trend.

Although the American Botanical Council reported that valerian was the 11th best-selling herbal in both natural and mass channels in 2012—and along with L-theanine it is used in some of the best-selling sleep supplements—these two ingredients remain in the Emerging Phase, likely due to low consumer awareness. As such, they are currently better off incorporated into combination sleep supplements.

• Emerging Phase = Potential trends begin to appear on the radar screen. Companies should begin to investigate those that exhibit continual growth, if they are a good strategic fit. • Popularization Phase = Indicates when a trend, market or ingredient has become a marketable opportunity in specialty/health food channels and/or among condition-specific and very health conscious shoppers. The higher into the phase the trend line goes, the bigger the specialty opportunity. • Commercialization Phase = Indicates when a trend, market or ingredient is a marketable mass market opportunity. The higher the trend line goes into the Commercialization Phase — Level 1, 2, 3 or Mega — the larger the opportunity. Optimal timing for competitive advantage is achieved when the trend line first crosses into a particular phase. • Medical Threshold is a statistical value, which a trend must cross in terms of Medical Counts to be a long-term sustainable trend, not just a fad. Medical/Nutrition Counts are an indication of research activity/scientific support.

Growth Opportunity

• 35 million U.S. households have a member trying to cope with serious insomnia/sleeplessness (IRI, 2010).

• The CDC reported that 50-70 million have sleep or wakefulness disorders.

• Sleep issues increase with age; those aged 55-64 will grow 39% to 2018; 65+, 43%.

• 70 million people suffer from insomnia, 18 million sleep apnea, 20 million restless leg syndrome; 26% are at moderate risk for sleep apnea.

• Overweight, smoking, pregnancy, menopause/post menopause, menstrual cycle drive higher levels of sleep issues; women age 50+ are the top sleep disorder sufferers.

• Pain is a major sleep deterrent; 100 million Americans report chronic pain (CDC, 2013). Pain/night analgesics continue to drive the sleep aid category, led by Pfizer’s Advil PM.

• Right after a positive attitude, sleep is the most important healthy lifestyle factor for Hispanics; only 1 in 4 always get a good night’s sleep (NSF, 2012).

• 58% of high school kids feel too tired or sleepy during the day, 41% of 6th-8th graders (NSF, 2012).

• Sleep is at the base of the energy continuum. Half of consumers say that lack of sleep is the top reason for low energy levels and for being tired (2012 Gallup Nutrition Knowledge & Consumption).

• Globally, 1 in 4 are affected by sleep issues; 9% of global consumers used an Rx sleep aid (HealthFocus International, 2012).

Regulatory Issues

There are no dietary supplement ingredients with sufficient scientific evidence to support health claims beyond structure/function claims in the U.S. FDA has raised the red flag for drug approvals and has indicated concern regarding long-lasting effects of drowsiness that impair the ability to drive. This regulatory concern does not bode well for time-release formulas for sleep aids.

Functional Foods

While there are a number of small players offering sleep milks, waters and chocolate snacks, with the exception of tea, the sleep functional food/drink market is relatively undeveloped.

One-third of consumers associate tea with aiding sleep, according to Gallup’s 2012 Study of Nutrition Knowledge & Composition. Tea aligns well with older women who suffer the most sleep issues and are the top tea consumers. Warm milk (tryptophan), tart cherries and chocolate are other foods recently touting sleep associations.

Dietary Supplements

The opportunity for sleep supplements is diverse, ranging from general sleep aids to products aimed at specific conditions (e.g., menopause/post-menopause, jet lag, restless leg syndrome and more).

The top 10 best-selling sleep aids are already touting new forms, including liquids that offer the convenience of not needing a glass of water. However, new 2013 consumer research by Capsugel indicated that liquid-filled tabs, traditional capsules and tablets are the three most preferred forms of delivery for sleep medication in the U.S. (34%, 17% and 17%, respectively). Melt-aways are another form growing in popularity; Nature Made sold $2.4 million in one- and two-letter VitaMelts, including Sleep in the year ending May 19, 2013.

Sales of homeopathic sleep supplements reached $56 million in 2012, up 9% over 2011. Overall sales of homeopathic supplement sales topped $1 billion in 2012, up 5.6%.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

One-quarter of respondents in NSF’s 2013 survey said their sleep quality is fairly/very bad; one-third get less sleep than needed on workdays. Two-thirds woke up during the night, 59% felt un-refreshed in the morning, 38% had difficulty falling asleep and 35% woke up early and couldn’t get back to sleep a few nights per week.

One in five adults used an over-the-counter (OTC) sleep aid in 2012, according to Mintel’s OTC Sleep Aids – U.S. – January 2012; 8.5% a Rx sleep aid, per the Centers for Disease Control and Prevention (CDC).

Sales of liquid/tablet OTC sleep remedies jumped 51% in mass channels for the year ended August 2013, according to IRI. Procter & Gamble’s Zzzquil, which posted sales of $127 million since its launch in June 2012, now leads the category, igniting a new liquid sleep-aid sector. Moreover, P&G’s clout has ensured a desirable retail shelf location for the category, including dietary supplements.

In 2012, Nutrition Business Journal reported sleep/insomnia was the fastest-growing condition-specific supplement sector, +17% to $393 million. P&G’s Zzzquil, Alteril, Unisom Natural Nights Sleep Tabs, MidNite PM and Nature Made Sleep are among the top 10 best-selling non-Rx sleep aids.

Melatonin, valerian and L-theanine are among the top ingredients in these best sellers. Other amino acids, including tryptophan, and a variety of botanicals are popular sleep inducing nutraceuticals. Melatonin has the greatest scientific support of any ingredient for sleep, with demonstrated effectiveness for jet lag recovery, sleep quality enhancement and insomnia.

Although 60 million prescriptions were written for sleep aids in the U.S. in 2012, according to IMS Health, sales of the leading Rx brands (Ambien and Lunesta) continue to fall. Moreover, publicity on the negative side effects of Rx sleep aids continues.

FDA has taken action recently to safeguard against drugs that induce excessive or long-lasting drowsiness. A promising new sleep drug, Suvorexant, with a novel mechanism of action was recently rejected for dosage issues. Evidence showed long-lasting drowsiness that impaired motor skills—notably the ability to drive—and memory. FDA has raised concerns about time-release formulas for similar reasons. These regulatory concerns, along with recent recalls/manufacturing issues for Tylenol PM and Excedrin PM, will continue to drive the sleep aid market in a more natural direction.

IRI estimated the market potential for insomnia/sleep supplements and OTC products is $5.3 billion annually. Increased use of caffeinated beverages and round-the-clock use of electronic devices will also accelerate growth for the sleep aid market.

Market Potential

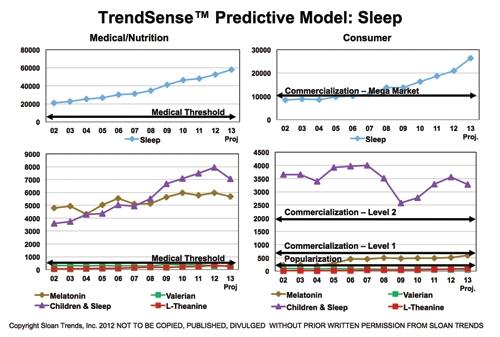

According to Sloan Trend’s TrendSense model, sleep is among the largest mega market nutraceutical opportunities and shows no sign of slowing down. Children and sleep is a very large Level 2 mass market—on par with vitamin D and omega 3—and is virtually untapped by major marketers beyond kids’ homeopathic options (e.g., Hyland’s Calms Forte).

The timing is optimal for launching melatonin-based sleep supplements, as melatonin is projected to become a mass market opportunity in 2013. NBJ projected that melatonin supplement sales specifically related to sleep will reach $266 million in 2013, +26% vs. 2012. NBJ also cited melatonin among the top 10 fastest-growing supplements through 2018.

Although chamomile has been marketable for sleep in specialty/health food channels, among condition-specific and very health conscious consumers since 2004, it is projected to cross the Medical Threshold this year, indicating the beginning of a long-term sustainable ingredient trend.

Although the American Botanical Council reported that valerian was the 11th best-selling herbal in both natural and mass channels in 2012—and along with L-theanine it is used in some of the best-selling sleep supplements—these two ingredients remain in the Emerging Phase, likely due to low consumer awareness. As such, they are currently better off incorporated into combination sleep supplements.

• Emerging Phase = Potential trends begin to appear on the radar screen. Companies should begin to investigate those that exhibit continual growth, if they are a good strategic fit. • Popularization Phase = Indicates when a trend, market or ingredient has become a marketable opportunity in specialty/health food channels and/or among condition-specific and very health conscious shoppers. The higher into the phase the trend line goes, the bigger the specialty opportunity. • Commercialization Phase = Indicates when a trend, market or ingredient is a marketable mass market opportunity. The higher the trend line goes into the Commercialization Phase — Level 1, 2, 3 or Mega — the larger the opportunity. Optimal timing for competitive advantage is achieved when the trend line first crosses into a particular phase. • Medical Threshold is a statistical value, which a trend must cross in terms of Medical Counts to be a long-term sustainable trend, not just a fad. Medical/Nutrition Counts are an indication of research activity/scientific support.

Growth Opportunity

• 35 million U.S. households have a member trying to cope with serious insomnia/sleeplessness (IRI, 2010).

• The CDC reported that 50-70 million have sleep or wakefulness disorders.

• Sleep issues increase with age; those aged 55-64 will grow 39% to 2018; 65+, 43%.

• 70 million people suffer from insomnia, 18 million sleep apnea, 20 million restless leg syndrome; 26% are at moderate risk for sleep apnea.

• Overweight, smoking, pregnancy, menopause/post menopause, menstrual cycle drive higher levels of sleep issues; women age 50+ are the top sleep disorder sufferers.

• Pain is a major sleep deterrent; 100 million Americans report chronic pain (CDC, 2013). Pain/night analgesics continue to drive the sleep aid category, led by Pfizer’s Advil PM.

• Right after a positive attitude, sleep is the most important healthy lifestyle factor for Hispanics; only 1 in 4 always get a good night’s sleep (NSF, 2012).

• 58% of high school kids feel too tired or sleepy during the day, 41% of 6th-8th graders (NSF, 2012).

• Sleep is at the base of the energy continuum. Half of consumers say that lack of sleep is the top reason for low energy levels and for being tired (2012 Gallup Nutrition Knowledge & Consumption).

• Globally, 1 in 4 are affected by sleep issues; 9% of global consumers used an Rx sleep aid (HealthFocus International, 2012).

Regulatory Issues

There are no dietary supplement ingredients with sufficient scientific evidence to support health claims beyond structure/function claims in the U.S. FDA has raised the red flag for drug approvals and has indicated concern regarding long-lasting effects of drowsiness that impair the ability to drive. This regulatory concern does not bode well for time-release formulas for sleep aids.

Functional Foods

While there are a number of small players offering sleep milks, waters and chocolate snacks, with the exception of tea, the sleep functional food/drink market is relatively undeveloped.

One-third of consumers associate tea with aiding sleep, according to Gallup’s 2012 Study of Nutrition Knowledge & Composition. Tea aligns well with older women who suffer the most sleep issues and are the top tea consumers. Warm milk (tryptophan), tart cherries and chocolate are other foods recently touting sleep associations.

Dietary Supplements

The opportunity for sleep supplements is diverse, ranging from general sleep aids to products aimed at specific conditions (e.g., menopause/post-menopause, jet lag, restless leg syndrome and more).

The top 10 best-selling sleep aids are already touting new forms, including liquids that offer the convenience of not needing a glass of water. However, new 2013 consumer research by Capsugel indicated that liquid-filled tabs, traditional capsules and tablets are the three most preferred forms of delivery for sleep medication in the U.S. (34%, 17% and 17%, respectively). Melt-aways are another form growing in popularity; Nature Made sold $2.4 million in one- and two-letter VitaMelts, including Sleep in the year ending May 19, 2013.

Sales of homeopathic sleep supplements reached $56 million in 2012, up 9% over 2011. Overall sales of homeopathic supplement sales topped $1 billion in 2012, up 5.6%.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.