10.01.19

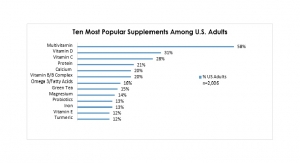

Sixty-four percent of U.S. supplement consumers take vitamins, minerals, herbs, or other dietary supplements daily, according to the 2nd annual national survey on emerging ingredient categories commissioned by Trust Transparency Center (TTC), a boutique strategy and insights firm for the natural products industry,

The survey included 1,003 U.S. supplement consumers and looked at general supplement purchasing habits with a deep dive into several established and emerging ingredient categories such as CoQ10, astaxanthin, prebiotics, turmeric, and collagen.

Health Concerns

Similar to most Americans, the respondents reported that their top five health concerns are led by anxiety or stress (30%), high blood pressure (26%) joint or other pain (25%), high cholesterol (24%), and lack of energy (24%).

Consumer Empowerment

Supplement consumers use supplements to better manage their health (83%), higher than eating good food (81%), and “being proactive” (64%); the relative ranking of these health attitudes remained consistent year-over-year.

Where & How Often They Buy

Consumers purchase supplements from a variety of retailers and the relative popularity of purchase location was mass market retailers (38%), online (27%), grocery (26%), and club stores (25%). They invest monthly in their health—57% of supplement users spend $20 or more per month on supplements.

Sustainability

While most respondents didn't think of sustainability as an issue for dietary supplements, 69% of younger supplement users’ purchases were influenced by sustainability factors.

Emerging Ingredient Categories

Fish oil, vitamin D and probiotics have reached nearly complete awareness among supplement users. Collagen and protein powder are experiencing the largest increase in usage, especially among Regular Users (taking supplements four or more times per week). Prebiotics and synbiotics are gaining traction, but 29% of respondents still think of prebiotics just as fiber.

"We're not surprised that this is a patient process—growing supplement awareness. Education and experience lead to loyal customers, but a lot of work needs to be done. This can be seen with prebiotics where more education is needed on what exactly a prebiotic is," said Len Monheit, Trust Transparency Center. "With collagen, turmeric, and astaxanthin, there are also significant education gaps. Confusion in the category is a problem for uptake. Regular users of a particular supplement are generally confident in their knowledge even if they don't know everything they should/could. This survey found a strong correlation between supplement knowledge, experience of benefits and usage levels."

Dietary supplements are regulated in the U.S. by the Food and Drug Administration and Federal Trade Commission. TTC conducts this consumer survey on an annual basis.

The survey included 1,003 U.S. supplement consumers and looked at general supplement purchasing habits with a deep dive into several established and emerging ingredient categories such as CoQ10, astaxanthin, prebiotics, turmeric, and collagen.

Health Concerns

Similar to most Americans, the respondents reported that their top five health concerns are led by anxiety or stress (30%), high blood pressure (26%) joint or other pain (25%), high cholesterol (24%), and lack of energy (24%).

Consumer Empowerment

Supplement consumers use supplements to better manage their health (83%), higher than eating good food (81%), and “being proactive” (64%); the relative ranking of these health attitudes remained consistent year-over-year.

Where & How Often They Buy

Consumers purchase supplements from a variety of retailers and the relative popularity of purchase location was mass market retailers (38%), online (27%), grocery (26%), and club stores (25%). They invest monthly in their health—57% of supplement users spend $20 or more per month on supplements.

Sustainability

While most respondents didn't think of sustainability as an issue for dietary supplements, 69% of younger supplement users’ purchases were influenced by sustainability factors.

Emerging Ingredient Categories

Fish oil, vitamin D and probiotics have reached nearly complete awareness among supplement users. Collagen and protein powder are experiencing the largest increase in usage, especially among Regular Users (taking supplements four or more times per week). Prebiotics and synbiotics are gaining traction, but 29% of respondents still think of prebiotics just as fiber.

"We're not surprised that this is a patient process—growing supplement awareness. Education and experience lead to loyal customers, but a lot of work needs to be done. This can be seen with prebiotics where more education is needed on what exactly a prebiotic is," said Len Monheit, Trust Transparency Center. "With collagen, turmeric, and astaxanthin, there are also significant education gaps. Confusion in the category is a problem for uptake. Regular users of a particular supplement are generally confident in their knowledge even if they don't know everything they should/could. This survey found a strong correlation between supplement knowledge, experience of benefits and usage levels."

Dietary supplements are regulated in the U.S. by the Food and Drug Administration and Federal Trade Commission. TTC conducts this consumer survey on an annual basis.