By Ally Dai, Correspondent09.03.19

The global beauty industry runs through Asia. The region is extremely important both in terms of massive consumer demand and also constant product innovations. In this ever-evolving market, Japan and South Korea are leading the way with several internationally-renowned companies such as Shiseido and Amore Pacific. Meanwhile, China is building its billion-dollar beauty businesses, as demand in India, Indonesia, and Malaysia continues to rise.

In an attempt to stand out from fierce competitors, brands nowadays are increasingly turning to ingredients native to the region and/or regarded to possess local wisdom; such ingredients not only differentiate products, they also resonate with local consumers. Here are a few of the cosmetic ingredients, with roots in Asia, that are winning the hearts and minds of local consumers, and have the potential to gain wider popularity.

More Than Food

In recent years, consumers’ concerns about what they put on their bodies has led to the incorporation of traditional food ingredients in cosmetic formulas, something Asians have been doing for centuries.

Asian Rice: Originating in Asia thousands of years ago, Asian rice (Oryza sativa) is still a major food staple in the region. Local rice consumption has been on a steady decline due to urbanization and growing awareness of balanced nutrition, yet, the use of rice in cosmetics is on the rise, especially among Japanese brands.

In cosmetics, the rice ingredients mainly include rice bran (such as Oryza sativa bran wax/oil, and hydrolyzed rice bran exact/oil), along with rice flour and starch, and rice proteins and amino acids. They are often used as antioxidants and skin conditioners with claimed benefits like increasing skin softness and hydration as well as whitening and anti-aging, which are largely based on contained gamma-oryzanol, tocotrienols, and phytic acid. In addition, colored rice, including purple, black, and red, are increasingly incorporated into formulas due to their higher content of antioxidants, including phenolic compounds, flavonoids, and anthocyanins, than white rice.

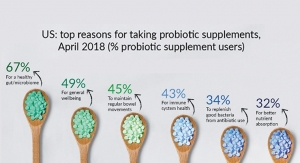

Fermentation is a widespread tradition in Asian food preservation and preparation. It also aligns with the booming natural and prebiotic/probiotic trend, so it is no wonder to see that fermented rice is increasingly harnessed as materials for beauty products. Rice ferment filtrate (often marketed as a beautifying ingredient from Japanese rice wine sake) is perhaps most popular in today’s rice beauty category, as it reportedly delivers skin care benefits ranging from skin whitening/brightening to toning and anti-aging.

In addition, interest is growing in rice koji, particularly red rice koji (red yeast rice, monascus/rice ferment) in the local personal care market. Rich in various nutrients like flavonoids, polyunsaturated fats, phytosterols, and kojic acid, this nutraceutical ingredient is incorporated into various Asia beauty brands. One of the most notable examples is su:m37 of LG, which incorporates it into a range of products including cleansers, toners, serums, creams, and cushions.

Another local brand that harnesses the power of rice is Keana Nadeshiko by Ishiza Wa Labs. The Japanese brand utilizes a combination of various rice-derived ingredients to create a rice skin care series. Its Rice Pack highlights ingredients including rice ferment filtrate, rice ceramide, rice bran oil, and hydrolyzed rice bran extract, and promises to deliver “an appearance of tightened and smaller pores like perfectly steamed fresh rice.”

Soy and Tea: Although native to Asia, both soybean and tea have transcended the region to become widely cultivated and consumed around the world. As a result, these ubiquitous ingredients have been incorporated into beauty products marketed by companies inside and outside Asia. In that sense, these two seem to lose the local representation. Some Asian brands, however, still manage to strike a different chord with local audiences by adding new twists to either formulating strategy or ingredient sourcing.

One example is Sana Soy Milk series launched by Japan’s pharmaceutical company Tokiwa. The series features a combination of soybean (glycine soja) protein and seed extract, as well as lactobacillus/soy milk ferment filtrate to convey a unique concept of soy milk beauty. Another example is the rising applications of oolong (Oolong-cha ekisu), a category of tea (Camellia sinensis) produced through a traditional semi-oxidized process. In terms of the antioxidant compounds contained, it is distinct from more common green tea, which is not oxidized, and black tea (kou-cha), which is completely oxidized.

Snow Ear and Bird’s Nest: Also known as white wood ear or white jelly mushroom, snow ear (Tremella fuciformis) is very popular in traditional Chinese cuisine and medicine for nourishing lungs and relieving dry cough. In cosmetic applications, this species of fungus is often hailed as “plant hyaluronic acid” due to its rich polysaccharide content. Extracts of Tremella fuciformis and its sporocarp, as well as the polysaccharide, are already widely utilized as natural humectants, antioxidants, and conditioners by the local beauty brands, especially in China, Japan and Korea.

Created by some particular swiftlets using solidified saliva, bird’s nest (or cubilose) is well known in East and Southeast Asia, as a precious dietary material for numerous health benefits including nourishing lungs and skin. Its extracts (Swift Nest Extract and Hydrolyzed Swift Nest Extract) are utilized as skin conditioners and humectants in some anti-aging products in the regions. However, due to its scarcity and environmental concern, there is an increasing outcry for Bird’s nest to be phased out, or replaced by Snow ear.

Native Plants

Bamboo: For thousands of years, bamboo has been one of the most widespread crops in Asia. As one of the fastest-growing plants in the world, it is of notable economic and cultural significance in the area, and commonly used as a versatile raw material for building and food. Largely due to the deeply rooted cultural symbolism, bamboo is now increasingly featured in products targeting the local markets, particularly China and Japan.

Among bamboo-derived ingredients, charcoal is perhaps most widely found in beauty care products. Possessing a strong adsorption ability largely attributed to its densely-porous structure, bamboo charcoal is used in cosmetics promising to purify and detoxify the skin safely and effectively, mainly for oily and acne-prone skin. Furthermore, bamboo vinegar, which is formed during the process of producing bamboo charcoal, is rich in volatile organics and has applications as an antiseptic and humectant in skin care (especially body- and foot-specific formulas), as well as hair care.

Although they have been available in the local beauty market for nearly a decade, bamboo ingredients are constantly evolving in order to tap into rapidly emerging trends. As a result, extracts and water of bamboo (mainly Bambusa vulgaris and arundinacea, as well as Phyllostachys pubescens) are increasingly utilized as conditioners and antioxidants to deliver moisturizing, balancing, and anti-inflammation benefits in skin and hair care, as well as oral care products.

Similar to rice, the latest spin on bamboo ingredients is fermentation. One such example is Goongsecret by Evercos, a South Korean brand. Its Hyo 72 Oriental Baby Cream features patented soothing herbal ingredients fermented in bamboo tubes for 72 hours in order to “penetrate deep into skin,” according to the brand.

Flower Power

No ingredient class epitomizes beauty more than flower, which explains why a variety of flowers are embraced for functional and promotional purposes in beauty care. Due to Asia’s diverse physical and cultural landscape, a variety of flowering plants are cultivated in different countries and regions. Still, some are more popular and recognizable than others, largely due to the dominance of the brands and influence of the markets.

Camellia (Camellia japonica), also called Tsubaki in Japan and Dongbaekseom flower in Korea, is the official flower of several cities across China, Japan, and South Korea. It is no wonder that beauty brands from these countries are increasingly capitalizing on this flower, namely Camellia Japonica Flower Extract as an antioxidant and seed oil as an emollient. It is reported that the flower extract contains high levels of antioxidants like quercetins, quercitrin, and kaempferol, and the seed oil is rich in vitamin E and various unsaturated fatty acids. One recent example is Marubi Tokyo, a premium skin care created by China’s Marubi and featuring camellia sourced from Japan’s Toshima.

Compared to camellia, other flowers widely seen in local markets are built in more cultural representation. These include Japan’s sakura (Prunus speciose), India’s lotus (Nelumbo nucifera), China’s peony (Paeonia suffruticosa) and South Korea’s hibiscus (Hibiscus syriacus), all of which are regarded as national symbols in their respective countries. In terms of beauty applications, extracts of Prunus speciosa flower and leaf are often utilized for skin brightening and hyperpigmentation formulas, as well as antioxidant and anti-inflammatory, while Paeonia root extracts are largely formulated into anti-aging products for anti-inflammatory and anti-allergic effects.

In order to differentiate from competitors, beauty companies are now more inclined to adopt those flowers indigenous to geographically unique areas. TianShan snow lotus (Saussurea involucrata) is one example. Sourced from China’s Xinjiang TianShan mountain, the flower is featured in the latest moisturizing skin care by Jala, one of biggest local cosmetic manufacturers.

Traditional Medicines

With cosmeceuticals trending everywhere, traditional medicine (TM) has become a go-to source of inspiration in the local cosmetic industry. Rooted in Asian cultures, TM systems vary among countries, with each becoming an integral part of the healthcare system. The popular ones in the region include traditional Chinese medicine (TCM), Japanese Kampo medicine, and Korean Hanyak medicine, as well as Ayurveda from India and Jamu from Indonesia. Despite their differences, some herbal ingredients transcend cultural boundaries to achieve popularity across various countries, such as ginseng (Panax ginseng) and turmeric (Curcuma longa). Others draw inspiration from the TM systems of China, Japan, and Korea and are appearing more widely and quickly.

Rehmannia: Used as a medicinal herb for many health conditions within TCM for thousands of years, Rehmannia is appearing more frequently in Asian beauty care formulas. Rich in phytochemicals like iridoid glycosides, the root extracts of Rehmannia glutinosa and chinensis can be found in various product ranges launched by prestige and mass brands alike, including Sulwhasoo of Amore Pacific and Whoo of LG, as well as Dr. Ci: Labo of J&J and Herborist of Jahwa. Largely used for nourishing skin and controlling excessive sebum and seborrheic dermatitis, Rehmannia is often incorporated into skin moisturizers, as well as anti-aging and anti-hair loss products.

Astragalus, Angelica and Chinese Ginseng: In TCM, all three reportedly possess the same benefits, such as improving blood circulation; sometimes, they are combined in formulas to produce synergistic effects. In beauty care, however, they are separately adopted. Astragalus complanatus and membranaceus are mainly sourced thanks to beneficial compounds like astragaloside, and used as antioxidant and anti-inflammatory in anti-aging and anti-wrinkle products. Besides many Chinese brands, South Korea’s Sulwhasoo and Missha also embrace the herb. For Angelica, the frequently-used species in beauty care include sinensis, acutiloba, and gigas, which are harnessed as antioxidants by many brands like China’s Dr. Yu, Japan’s Albion and S. Korea’s AHC. Rich in PNS (Panax notoginseng saponins), the extracts of Chinese ginseng root, leaf/stem are normally incorporated into anti-acne formulas for their anti-inflammatory, antioxidant, and antibacterial properties.

Holy Basil: Native to the India subcontinent, holy basil (also known as Tulsi) is widely used in local traditional medicines, especially Ayurveda, as well as spiritual rituals. For beauty care, the extract of holy basil (Ocimum sanctum) leaf is present in various brands from both the west and the east, including Dr. Andrew Weil for Origins and Dr.Jart+, as well as Innisfree and The Face Shop. Due to its broad-spectrum antimicrobial activity and photo-protective property, this herbal ingredient is often used in anti-dandruff hair care and sensitive skin care products.

Conclusion

Beauty consumers are increasingly demanding products that are ethically-sourced. As a result, indigenous ingredients provide more possibilities for brands. The unique ingredients detailed here are only a beginning, as Asia is a diverse region—geographically and culturally. Major beauty trends are mirrored in these culturally-inspired and often TM-based ingredients, including natural and clean, cosmeceutical and nutraceutical. Today and into the future, ingredients of choice are those that are safe, effective, stable, and compatible.

In an attempt to stand out from fierce competitors, brands nowadays are increasingly turning to ingredients native to the region and/or regarded to possess local wisdom; such ingredients not only differentiate products, they also resonate with local consumers. Here are a few of the cosmetic ingredients, with roots in Asia, that are winning the hearts and minds of local consumers, and have the potential to gain wider popularity.

More Than Food

In recent years, consumers’ concerns about what they put on their bodies has led to the incorporation of traditional food ingredients in cosmetic formulas, something Asians have been doing for centuries.

Asian Rice: Originating in Asia thousands of years ago, Asian rice (Oryza sativa) is still a major food staple in the region. Local rice consumption has been on a steady decline due to urbanization and growing awareness of balanced nutrition, yet, the use of rice in cosmetics is on the rise, especially among Japanese brands.

In cosmetics, the rice ingredients mainly include rice bran (such as Oryza sativa bran wax/oil, and hydrolyzed rice bran exact/oil), along with rice flour and starch, and rice proteins and amino acids. They are often used as antioxidants and skin conditioners with claimed benefits like increasing skin softness and hydration as well as whitening and anti-aging, which are largely based on contained gamma-oryzanol, tocotrienols, and phytic acid. In addition, colored rice, including purple, black, and red, are increasingly incorporated into formulas due to their higher content of antioxidants, including phenolic compounds, flavonoids, and anthocyanins, than white rice.

Fermentation is a widespread tradition in Asian food preservation and preparation. It also aligns with the booming natural and prebiotic/probiotic trend, so it is no wonder to see that fermented rice is increasingly harnessed as materials for beauty products. Rice ferment filtrate (often marketed as a beautifying ingredient from Japanese rice wine sake) is perhaps most popular in today’s rice beauty category, as it reportedly delivers skin care benefits ranging from skin whitening/brightening to toning and anti-aging.

In addition, interest is growing in rice koji, particularly red rice koji (red yeast rice, monascus/rice ferment) in the local personal care market. Rich in various nutrients like flavonoids, polyunsaturated fats, phytosterols, and kojic acid, this nutraceutical ingredient is incorporated into various Asia beauty brands. One of the most notable examples is su:m37 of LG, which incorporates it into a range of products including cleansers, toners, serums, creams, and cushions.

Another local brand that harnesses the power of rice is Keana Nadeshiko by Ishiza Wa Labs. The Japanese brand utilizes a combination of various rice-derived ingredients to create a rice skin care series. Its Rice Pack highlights ingredients including rice ferment filtrate, rice ceramide, rice bran oil, and hydrolyzed rice bran extract, and promises to deliver “an appearance of tightened and smaller pores like perfectly steamed fresh rice.”

Soy and Tea: Although native to Asia, both soybean and tea have transcended the region to become widely cultivated and consumed around the world. As a result, these ubiquitous ingredients have been incorporated into beauty products marketed by companies inside and outside Asia. In that sense, these two seem to lose the local representation. Some Asian brands, however, still manage to strike a different chord with local audiences by adding new twists to either formulating strategy or ingredient sourcing.

One example is Sana Soy Milk series launched by Japan’s pharmaceutical company Tokiwa. The series features a combination of soybean (glycine soja) protein and seed extract, as well as lactobacillus/soy milk ferment filtrate to convey a unique concept of soy milk beauty. Another example is the rising applications of oolong (Oolong-cha ekisu), a category of tea (Camellia sinensis) produced through a traditional semi-oxidized process. In terms of the antioxidant compounds contained, it is distinct from more common green tea, which is not oxidized, and black tea (kou-cha), which is completely oxidized.

Snow Ear and Bird’s Nest: Also known as white wood ear or white jelly mushroom, snow ear (Tremella fuciformis) is very popular in traditional Chinese cuisine and medicine for nourishing lungs and relieving dry cough. In cosmetic applications, this species of fungus is often hailed as “plant hyaluronic acid” due to its rich polysaccharide content. Extracts of Tremella fuciformis and its sporocarp, as well as the polysaccharide, are already widely utilized as natural humectants, antioxidants, and conditioners by the local beauty brands, especially in China, Japan and Korea.

Created by some particular swiftlets using solidified saliva, bird’s nest (or cubilose) is well known in East and Southeast Asia, as a precious dietary material for numerous health benefits including nourishing lungs and skin. Its extracts (Swift Nest Extract and Hydrolyzed Swift Nest Extract) are utilized as skin conditioners and humectants in some anti-aging products in the regions. However, due to its scarcity and environmental concern, there is an increasing outcry for Bird’s nest to be phased out, or replaced by Snow ear.

Native Plants

Bamboo: For thousands of years, bamboo has been one of the most widespread crops in Asia. As one of the fastest-growing plants in the world, it is of notable economic and cultural significance in the area, and commonly used as a versatile raw material for building and food. Largely due to the deeply rooted cultural symbolism, bamboo is now increasingly featured in products targeting the local markets, particularly China and Japan.

Among bamboo-derived ingredients, charcoal is perhaps most widely found in beauty care products. Possessing a strong adsorption ability largely attributed to its densely-porous structure, bamboo charcoal is used in cosmetics promising to purify and detoxify the skin safely and effectively, mainly for oily and acne-prone skin. Furthermore, bamboo vinegar, which is formed during the process of producing bamboo charcoal, is rich in volatile organics and has applications as an antiseptic and humectant in skin care (especially body- and foot-specific formulas), as well as hair care.

Although they have been available in the local beauty market for nearly a decade, bamboo ingredients are constantly evolving in order to tap into rapidly emerging trends. As a result, extracts and water of bamboo (mainly Bambusa vulgaris and arundinacea, as well as Phyllostachys pubescens) are increasingly utilized as conditioners and antioxidants to deliver moisturizing, balancing, and anti-inflammation benefits in skin and hair care, as well as oral care products.

Similar to rice, the latest spin on bamboo ingredients is fermentation. One such example is Goongsecret by Evercos, a South Korean brand. Its Hyo 72 Oriental Baby Cream features patented soothing herbal ingredients fermented in bamboo tubes for 72 hours in order to “penetrate deep into skin,” according to the brand.

Flower Power

No ingredient class epitomizes beauty more than flower, which explains why a variety of flowers are embraced for functional and promotional purposes in beauty care. Due to Asia’s diverse physical and cultural landscape, a variety of flowering plants are cultivated in different countries and regions. Still, some are more popular and recognizable than others, largely due to the dominance of the brands and influence of the markets.

Camellia (Camellia japonica), also called Tsubaki in Japan and Dongbaekseom flower in Korea, is the official flower of several cities across China, Japan, and South Korea. It is no wonder that beauty brands from these countries are increasingly capitalizing on this flower, namely Camellia Japonica Flower Extract as an antioxidant and seed oil as an emollient. It is reported that the flower extract contains high levels of antioxidants like quercetins, quercitrin, and kaempferol, and the seed oil is rich in vitamin E and various unsaturated fatty acids. One recent example is Marubi Tokyo, a premium skin care created by China’s Marubi and featuring camellia sourced from Japan’s Toshima.

Compared to camellia, other flowers widely seen in local markets are built in more cultural representation. These include Japan’s sakura (Prunus speciose), India’s lotus (Nelumbo nucifera), China’s peony (Paeonia suffruticosa) and South Korea’s hibiscus (Hibiscus syriacus), all of which are regarded as national symbols in their respective countries. In terms of beauty applications, extracts of Prunus speciosa flower and leaf are often utilized for skin brightening and hyperpigmentation formulas, as well as antioxidant and anti-inflammatory, while Paeonia root extracts are largely formulated into anti-aging products for anti-inflammatory and anti-allergic effects.

In order to differentiate from competitors, beauty companies are now more inclined to adopt those flowers indigenous to geographically unique areas. TianShan snow lotus (Saussurea involucrata) is one example. Sourced from China’s Xinjiang TianShan mountain, the flower is featured in the latest moisturizing skin care by Jala, one of biggest local cosmetic manufacturers.

Traditional Medicines

With cosmeceuticals trending everywhere, traditional medicine (TM) has become a go-to source of inspiration in the local cosmetic industry. Rooted in Asian cultures, TM systems vary among countries, with each becoming an integral part of the healthcare system. The popular ones in the region include traditional Chinese medicine (TCM), Japanese Kampo medicine, and Korean Hanyak medicine, as well as Ayurveda from India and Jamu from Indonesia. Despite their differences, some herbal ingredients transcend cultural boundaries to achieve popularity across various countries, such as ginseng (Panax ginseng) and turmeric (Curcuma longa). Others draw inspiration from the TM systems of China, Japan, and Korea and are appearing more widely and quickly.

Rehmannia: Used as a medicinal herb for many health conditions within TCM for thousands of years, Rehmannia is appearing more frequently in Asian beauty care formulas. Rich in phytochemicals like iridoid glycosides, the root extracts of Rehmannia glutinosa and chinensis can be found in various product ranges launched by prestige and mass brands alike, including Sulwhasoo of Amore Pacific and Whoo of LG, as well as Dr. Ci: Labo of J&J and Herborist of Jahwa. Largely used for nourishing skin and controlling excessive sebum and seborrheic dermatitis, Rehmannia is often incorporated into skin moisturizers, as well as anti-aging and anti-hair loss products.

Astragalus, Angelica and Chinese Ginseng: In TCM, all three reportedly possess the same benefits, such as improving blood circulation; sometimes, they are combined in formulas to produce synergistic effects. In beauty care, however, they are separately adopted. Astragalus complanatus and membranaceus are mainly sourced thanks to beneficial compounds like astragaloside, and used as antioxidant and anti-inflammatory in anti-aging and anti-wrinkle products. Besides many Chinese brands, South Korea’s Sulwhasoo and Missha also embrace the herb. For Angelica, the frequently-used species in beauty care include sinensis, acutiloba, and gigas, which are harnessed as antioxidants by many brands like China’s Dr. Yu, Japan’s Albion and S. Korea’s AHC. Rich in PNS (Panax notoginseng saponins), the extracts of Chinese ginseng root, leaf/stem are normally incorporated into anti-acne formulas for their anti-inflammatory, antioxidant, and antibacterial properties.

Holy Basil: Native to the India subcontinent, holy basil (also known as Tulsi) is widely used in local traditional medicines, especially Ayurveda, as well as spiritual rituals. For beauty care, the extract of holy basil (Ocimum sanctum) leaf is present in various brands from both the west and the east, including Dr. Andrew Weil for Origins and Dr.Jart+, as well as Innisfree and The Face Shop. Due to its broad-spectrum antimicrobial activity and photo-protective property, this herbal ingredient is often used in anti-dandruff hair care and sensitive skin care products.

Conclusion

Beauty consumers are increasingly demanding products that are ethically-sourced. As a result, indigenous ingredients provide more possibilities for brands. The unique ingredients detailed here are only a beginning, as Asia is a diverse region—geographically and culturally. Major beauty trends are mirrored in these culturally-inspired and often TM-based ingredients, including natural and clean, cosmeceutical and nutraceutical. Today and into the future, ingredients of choice are those that are safe, effective, stable, and compatible.