By Erik Goldman, Holistic Primary Care05.03.22

Fullscript’s recent acquisition of its former main competitor, Emerson Ecologics, is a major consolidation of the practitioner channel that will have ripple effects for years to come.

The deal, announced in March, couples the nation’s two largest practitioner-channel supplement distribution platforms. Combined, the two companies serve an estimated 70,000 healthcare professionals, and roughly 5 million patients. They carry products from more than 400 brands.

The eventual integration of the IT, data processing, and educational resources developed independently by the two companies will have some major upsides for practitioners and their patients.

But the acquisition also aggregates tremendous purchasing power under one corporate roof, raising concerns about the potential for monopoly.

Executives at many of the major practitioner channel brands worry that the new, merged entity will be able to demand deeper wholesale discounts, which could affect their profit margins, especially for companies that derive the lion’s share of their total revenue from online distributors.

Brand executives were not the only ones concerned about the deal’s impact on the market. The Department of Justice had to review and clear the acquisition before it could proceed.

Market Growth or Monopoly?

“I was called before the DOJ about this, as were a number of other heads of companies,” said Chris Shade, PhD, founder and CEO of Quicksilver Scientific, a leading practitioner-focused brand. “Just about all of us did see anti-competitiveness issues.”

Shade said sales via Emerson and Fullscript represent “a substantial portion” of Quicksilver’s total revenue, though like most practitioner brands, the company also sells products directly to practitioners’ offices.

“This is a massive consolidation. I frankly didn’t think DOJ would let it happen,” Shade said. “This is going to put a lot of pressure on us and the other brands. If there’s nowhere else to go, they (Fullscript) can pretty much set their own course as far as the discount they demand, and you’ll have to agree or else you won’t get that scale of distribution. There will likely be a loss of margin for us, hopefully not all that much.”

Aaron Bartz, president of Ortho Molecular Products, is also concerned about Fullscript’s potential market dominance. “I’m cautious on the lack of competition. Competition is good for innovation, and for a lot of things. You need competition for things to remain healthy. Now, Fullscript will have almost no competition.”

On the other hand, Bartz sees the deal as evidence of the overall health and growth of the practitioner channel. The investor community, he said, is well aware that holistic, functional, and naturopathic medicine have legitimacy, and that they will play an important role in the future of American healthcare.

The financial terms of the Emerson acquisition have not been disclosed. But the sum is likely sizeable. “It shows there’s a lot of interest in our channel when you see that kind of money roll through,” Bartz told Holistic Primary Care.

Fullscript’s CEO, Kyle Braatz, was quick to mollify concerns about monopoly. Though he understands the worry that some brand executives feel, he stressed that Fullscript has no intention to hammer the companies on product prices.

“That’s just not our agenda. Our objective is to build this industry up, and create economies of scale that we share in with our practitioners, our patients, our supplier partners.”

Pricing is important, Braatz said. But in the long run, Fullscript won’t thrive if it coerces the supplement brands into untenable discounts. “If we only think short-term and just try to extract as much value as we can out of this space, we’ll never be able to build the infrastructure needed to make integrative medicine simply medicine.”

That, he said, is the ultimate goal: to bring nutrition-based medicine to center stage in American healthcare, so it is no longer “alternative” or “complementary.”

“We’re focused on the ecosystem, and a big part of this ecosystem is the suppliers.”

He added that once the Emerson and Fullscript catalogs are fully integrated across both platforms, the supplement makers will quickly see big advantages. “From an operational perspective it will be much easier for these supplier partners to work directly with just one group when it comes to purchasing, procurement, forecasting, and everything else.”

Niches for Smaller Players

And there are other distribution options for supplement makers. Though Emerson and Fullscript are, by far, the two biggest players in the channel, they are not the only ones.

Doctors Supplement Store (DSS), a St. Louis-based company with approximately 3,000 active practitioners, is among a number of smaller distribution companies serving the medical market.

Dave Preis, the president of DSS said the new situation won’t change his business strategy. He’s confident that if his company continues to cultivate its core values and its commitment to direct customer service, it will grow and thrive even in a rapidly consolidating market.

“We can’t compete with Fullscript on their level. That ship passed long ago. So, we have to play to our strengths. We’ll be promoting the extremely high level of personalized service we provide, as well as our order accuracy rate and shipping times.

We get the products out on the day they’re ordered almost 100% of the time. That really matters to people. We have a ton of practitioners that love what we do for them and their patients. That’s our largest growth driver.”

Pries was among the executives interviewed by the DOJ, and he did voice concerns about the market becoming anti-competitive.

He said that in actuality, there are two margins at play in the practitioner distribution game: there’s the discount margin the distributors obtain from the brands, and there’s the cut of the retail price that they give to the practitioners who generate the sales. The profitability of any distributor—large or small—depends on how skillfully it can triangulate between those two percentages, and how well it nurtures its relationships with practitioners.

There’s no doubt Fullscript will now dominate the channel, but Preis said there are small but important practitioner and patient niches not well-served by existing systems. These sub-markets might be too small, volume-wise, to interest titans like Fullscript. But they could provide fertile fields of growth for DSS and other small distributors.

Eyes on the Mainstream

Most of the executives I interviewed see potential for overall market expansion in the wake of the Fullscript-Emerson merger. The new entity has the potential to open up practitioner segments within mainstream medicine that have, so far, remained closed to nutraceuticals.

“One of the areas that I don’t think anybody has tapped is that ‘blue ocean’ of conventional doctors,” said Ortho Molecular’s Aaron Bartz. “How to enable them to access, integrate, and utilize our products? A lot of conventional docs are in managed care systems where they can’t have a formulary. The Fullscript platform gives them opportunities. There’s a lot of potential growth in that conventional space, and Fullscript is going after it.”

Braatz, Fullscript’s leader, said the combined company’s current practitioner base of 70,000 is a good starting point, but he envisions a much greater expansion.

“There’s about 1 million practitioners in North America today, and 80% of them recommend supplements in one way or another. So, when you look at those 800,000 practitioners and you hear about 60% transitioning to focus more on prevention … that’s a market which we want to be readily available to support,” Braatz said, referring to a recent Deloitte analysis of physician practice patterns.

“So, what does that mean in 3-5 years? That means that the market number could be hundreds of thousands of practitioners that we’re supporting to deliver better care.”

Private Equity Influence

Fullscript and Emerson are both backed by private equity groups—Fullscript by HGGC (Huntsman Gay Global Capital) and Snapdragon Capital Partners, and Emerson by Liberty Lane Partners.

In November 2021, Fullscript raised $240 million in capital from Snapdragon and HGGC.

In an interview with private equity news site PE Hub, following the Emerson acquisition, Bill Conrad a partner at HGGC said, “Now we have a really large platform that is driving market growth within integrative health.” Speaking of Emerson by Fullscript, Conrad said, “We will take the best of both businesses.”

He noted that the pandemic has been a boon for Emerson, Fullscript, and the supplement industry as a whole. “COVID accelerated the consumers’ focus on their health across the board and it has also increased the focus on things such as integrative health, like natural health solutions, preventive type of healthcare. You see more and more acceptance of that, specifically vitamins, minerals, and supplements from the patient perspective but also from healthcare practitioners across the board.”

Liberty Lane, the key investors in Emerson, will maintain “a substantial minority share” in the combined company, Braatz said, adding that several top Emerson executives will remain with the new entity. “They’re very bought-in to our vision and mission … which I think is a testament to the opportunity we have in front of us.”

Beyond Supplements

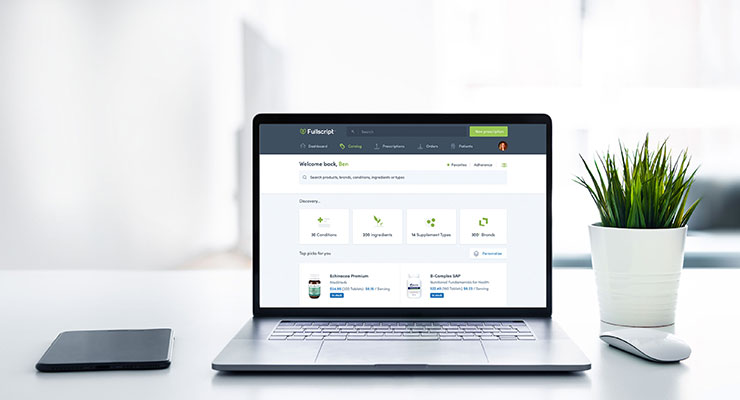

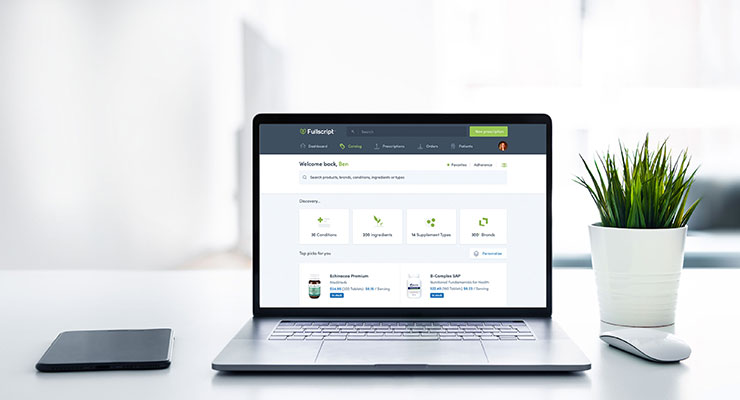

Fullscript’s leader is eager to reframe public perception of his Ottawa-based company.

“A lot of people see Fullscript as strictly a supplement dispensing platform. But what they don’t see is the work we’ve put in to building a user experience that makes it easy for a practitioner to deliver a comprehensive treatment plan, to leverage our education and evidence-based library of nutrition articles, exercise, mindfulness content. We’ve done a tremendous amount of adherence work, to really be a partner to practitioners.”

Jeff Gladd, MD, a functional medicine physician in Ft. Wayne, IN, is Fullscript’s chief medical officer. Over the years, he has been a customer of both companies. “When I started a hospital-based integrative practice, and early on in my own practice, Emerson was my in-clinic dispenser. Then I started bringing in online dispensing through Fullscript. So, I’ve seen the advantages of both.”

He, too, emphasized that the combined entity will be much more than a supplement vending machine. “We want to offer everything related to health optimization.”

Integration Challenges

The integration of Emerson and Fullscript will no doubt be fraught with logistical challenges. Once achieved, though, there will likely be major advantages for practitioners, including:

In the near term, practitioners who have accounts with one, the other, or both companies won’t notice any changes other than a new statement under the Emerson logo indicating that it is now “a Fullscript company.” Emerson’s Wellevate suite of practice management tools will remain in place for the foreseeable future.

According to Gladd, “Emerson is a very strong brand with a great reputation, extremely strong in the in-clinic dispensing space. We know that for lots of practitioners, their practices are really built on that. We have no interest in changing that. Kyle and everyone here recognize that practicing integrative medicine is difficult. So, we don’t want to add complexity to something that is already complex. Keeping those existing workflows in place is critical.”

A key step will be the harmonization of the product catalogs. Gladd said a near-term goal is to ensure that practitioners with Fullscript accounts have access to everything on the Emerson side, and vice versa. Gladd said the company is seeking input and guidance from practitioner-customers of both companies.

The team is also working to create consistency between the two platforms in terms of credentialing various types of practitioners. Gladd noted that in the past there were some differences between Emerson and Fullscript with regard to which practitioner categories are authorized to become customers.

Further, some practitioner-focused brands have specific limitations on which practitioner types may purchase and re-sell their products. Gladd said Fullscript will respect and honor those stipulations. But he said the company is not planning on imposing any new restrictions. He expects to see more nurses, nutritionists, dietitians, and health coaches using the platform in the future.

A Long Time Coming

Though the acquisition took many by surprise, Fullscript and Emerson have a long and entwined history. Informal discussions about the possibility of joining forces have been going on for years, Braatz said. He, and other key players in the deal, have had long relationships with both companies.

Ten years ago, the nascent Fullscript—then called HealthWave—was actually born out of a partnership with Emerson.

“Our entrance into the U.S. market was as a partner to Emerson,” said Braatz. “We built a software platform, we launched it in Canada, and saw strong success with the naturopathic doctor market. We ended up partnering with Emerson to be our distribution partner, and we launched the same software platform in the U.S. in 2012.”

That early iteration, he said, was “a complete failure, but probably the best mistake we’ve ever had. It allowed us to step back and broaden the vision. We started off just building a virtual dispensary platform, an e-commerce platform for practitioners to sell products. Then we realized we needed to build something bigger than just e-commerce.”

What was missing, Braatz said, was an integrative care-delivery platform that facilitated practitioner-patient relationships and dovetailed with existing practice patterns.

Braatz and Fullscript eventually broke away from Emerson and in 2014 acquired Natural Partners, a successful Arizona-based distributor with strong ties to the naturopathic community.

This put Fullscript in direct competition with Emerson. But Braatz said executives at both companies have kept in touch over the years, and relations have been friendly.

Fran Towey, Emerson’s former CEO and president from 2008 to 2011 was CEO of Natural Partners at the time it was acquired by Fullscript. Towey became CEO of Fullscript in 2018, and was the company’s executive chairman until last January.

Braatz said the merger made perfect sense because ultimately, Fullscript and Emerson have the same mission.

“We’re both aligned with helping doctors, and arming doctors to provide better care. We would talk about, what if we put our collective resources together to really build this industry up and be that rising tide that lifts all boats, which is what integrative medicine really needs. We’ve been having these conversations for a long time, and finally the timing was right.”

Upsides for Clinicians

The fusion of Fullscript and Emerson will be a big win for clinicians and their patients, predicted Paul Mittman, ND, president of Southwest College of Naturopathic Medicine.

“The naturopathic community has close ties to both companies. Many prominent naturopaths have worked at or represented both, and both companies have done so much for the profession,” he told Holistic Primary Care. “The core values and missions are so strong and aligned. The merger will mean everyone will be better served.”

Mittman has had long experience with both camps. In the early 1990s, when he was practicing in Connecticut, he used Emerson to stock his medicinary. Throughout his tenure at SCNM, Natural Partners (which then became Fullscript) has provided the back-end support for the school’s online formulary.

Mittman said online dispensing is “strong and only going to grow in the coming years. We do have a brick and mortar medicinary at the SCNM clinic, but in-person sales have dropped in recent years, especially since the pandemic. Sales via the school’s ShopSCNM.com website have increased.”

Inroads into Conventional Care

While fully committed to serving its core customer base within naturopathic and functional medicine, Fullscript’s executive team intends to grow the company into the mainstream.

The company has already made inroads into a few major hospital systems, said Braatz. But typically, it has been siloed in the integrative clinics of those hospitals, isolated from the broader clinical networks. He wants to break through those constraints.

The good news, he said, is the groundwork has been laid. “We’ve already gone through all of the contracting, the security assessments, the privacy assessments, the sign-offs from the CEOs. When it does come to the expansion, we’re really well-positioned.”

Gladd said more hospital administrators are willing to take a look these days, but they are not easily convinced. “They want a couple of things. First, they want some basic education and evidence base for making supplement recommendations. Second, this has to be integrated into the workflow. So that’s why we’re working on building interfaces toward the bigger EHRs.”

‘IPO Ready’

What’s on the far horizon for Fullscript? Will the company go public? Will it be acquired by an even larger corporate entity—say a CVS/Caremark or even an Amazon? At this early stage, it’s anybody’s guess.

Braatz said the company’s strategic decisions will all center on the main objective of establishing a solid practice infrastructure for integrative medicine.

He said he ultimately wants Fullscript to be “IPO-ready.” But he stressed that going public might not be the road that his executive team and his investors choose to take. “Whatever allows us and enables us to deliver on our vision, that’s what we’re going to do. So that could mean taking more funding, that could mean going IPO.”

Fullscript’s leaders believes integrative medicine is the best healthcare investment we as a nation could make, whether that is via insurance companies, federal payers, or private out-of-pocket expenditures. “I’ve seen the outcomes with my own eyes, thousands of times,” said Gladd said. “So has every integrative medicine practitioner.”

By providing services that increase the efficiency and economic viability of integrative care while simultaneously gathering and sharing data on best practices, the now-augmented Fullscript plans to be a major influence on the future of the field.

About the Author: Erik Goldman is co-founder and editor of Holistic Primary Care: News for Health & Healing, a quarterly medical publication reaching about 60,000 physicians and other healthcare professionals nationwide. He is also co-producer of the Practitioner Channel Forum, the nation’s leading conference focused on opportunities and challenges in the practitioner segment of the dietary supplement industry.

The deal, announced in March, couples the nation’s two largest practitioner-channel supplement distribution platforms. Combined, the two companies serve an estimated 70,000 healthcare professionals, and roughly 5 million patients. They carry products from more than 400 brands.

The eventual integration of the IT, data processing, and educational resources developed independently by the two companies will have some major upsides for practitioners and their patients.

But the acquisition also aggregates tremendous purchasing power under one corporate roof, raising concerns about the potential for monopoly.

Executives at many of the major practitioner channel brands worry that the new, merged entity will be able to demand deeper wholesale discounts, which could affect their profit margins, especially for companies that derive the lion’s share of their total revenue from online distributors.

Brand executives were not the only ones concerned about the deal’s impact on the market. The Department of Justice had to review and clear the acquisition before it could proceed.

Market Growth or Monopoly?

“I was called before the DOJ about this, as were a number of other heads of companies,” said Chris Shade, PhD, founder and CEO of Quicksilver Scientific, a leading practitioner-focused brand. “Just about all of us did see anti-competitiveness issues.”

Shade said sales via Emerson and Fullscript represent “a substantial portion” of Quicksilver’s total revenue, though like most practitioner brands, the company also sells products directly to practitioners’ offices.

“This is a massive consolidation. I frankly didn’t think DOJ would let it happen,” Shade said. “This is going to put a lot of pressure on us and the other brands. If there’s nowhere else to go, they (Fullscript) can pretty much set their own course as far as the discount they demand, and you’ll have to agree or else you won’t get that scale of distribution. There will likely be a loss of margin for us, hopefully not all that much.”

Aaron Bartz, president of Ortho Molecular Products, is also concerned about Fullscript’s potential market dominance. “I’m cautious on the lack of competition. Competition is good for innovation, and for a lot of things. You need competition for things to remain healthy. Now, Fullscript will have almost no competition.”

On the other hand, Bartz sees the deal as evidence of the overall health and growth of the practitioner channel. The investor community, he said, is well aware that holistic, functional, and naturopathic medicine have legitimacy, and that they will play an important role in the future of American healthcare.

The financial terms of the Emerson acquisition have not been disclosed. But the sum is likely sizeable. “It shows there’s a lot of interest in our channel when you see that kind of money roll through,” Bartz told Holistic Primary Care.

Fullscript’s CEO, Kyle Braatz, was quick to mollify concerns about monopoly. Though he understands the worry that some brand executives feel, he stressed that Fullscript has no intention to hammer the companies on product prices.

“That’s just not our agenda. Our objective is to build this industry up, and create economies of scale that we share in with our practitioners, our patients, our supplier partners.”

Pricing is important, Braatz said. But in the long run, Fullscript won’t thrive if it coerces the supplement brands into untenable discounts. “If we only think short-term and just try to extract as much value as we can out of this space, we’ll never be able to build the infrastructure needed to make integrative medicine simply medicine.”

That, he said, is the ultimate goal: to bring nutrition-based medicine to center stage in American healthcare, so it is no longer “alternative” or “complementary.”

“We’re focused on the ecosystem, and a big part of this ecosystem is the suppliers.”

He added that once the Emerson and Fullscript catalogs are fully integrated across both platforms, the supplement makers will quickly see big advantages. “From an operational perspective it will be much easier for these supplier partners to work directly with just one group when it comes to purchasing, procurement, forecasting, and everything else.”

Niches for Smaller Players

And there are other distribution options for supplement makers. Though Emerson and Fullscript are, by far, the two biggest players in the channel, they are not the only ones.

Doctors Supplement Store (DSS), a St. Louis-based company with approximately 3,000 active practitioners, is among a number of smaller distribution companies serving the medical market.

Dave Preis, the president of DSS said the new situation won’t change his business strategy. He’s confident that if his company continues to cultivate its core values and its commitment to direct customer service, it will grow and thrive even in a rapidly consolidating market.

“We can’t compete with Fullscript on their level. That ship passed long ago. So, we have to play to our strengths. We’ll be promoting the extremely high level of personalized service we provide, as well as our order accuracy rate and shipping times.

We get the products out on the day they’re ordered almost 100% of the time. That really matters to people. We have a ton of practitioners that love what we do for them and their patients. That’s our largest growth driver.”

Pries was among the executives interviewed by the DOJ, and he did voice concerns about the market becoming anti-competitive.

He said that in actuality, there are two margins at play in the practitioner distribution game: there’s the discount margin the distributors obtain from the brands, and there’s the cut of the retail price that they give to the practitioners who generate the sales. The profitability of any distributor—large or small—depends on how skillfully it can triangulate between those two percentages, and how well it nurtures its relationships with practitioners.

There’s no doubt Fullscript will now dominate the channel, but Preis said there are small but important practitioner and patient niches not well-served by existing systems. These sub-markets might be too small, volume-wise, to interest titans like Fullscript. But they could provide fertile fields of growth for DSS and other small distributors.

Eyes on the Mainstream

Most of the executives I interviewed see potential for overall market expansion in the wake of the Fullscript-Emerson merger. The new entity has the potential to open up practitioner segments within mainstream medicine that have, so far, remained closed to nutraceuticals.

“One of the areas that I don’t think anybody has tapped is that ‘blue ocean’ of conventional doctors,” said Ortho Molecular’s Aaron Bartz. “How to enable them to access, integrate, and utilize our products? A lot of conventional docs are in managed care systems where they can’t have a formulary. The Fullscript platform gives them opportunities. There’s a lot of potential growth in that conventional space, and Fullscript is going after it.”

Braatz, Fullscript’s leader, said the combined company’s current practitioner base of 70,000 is a good starting point, but he envisions a much greater expansion.

“There’s about 1 million practitioners in North America today, and 80% of them recommend supplements in one way or another. So, when you look at those 800,000 practitioners and you hear about 60% transitioning to focus more on prevention … that’s a market which we want to be readily available to support,” Braatz said, referring to a recent Deloitte analysis of physician practice patterns.

“So, what does that mean in 3-5 years? That means that the market number could be hundreds of thousands of practitioners that we’re supporting to deliver better care.”

Private Equity Influence

Fullscript and Emerson are both backed by private equity groups—Fullscript by HGGC (Huntsman Gay Global Capital) and Snapdragon Capital Partners, and Emerson by Liberty Lane Partners.

In November 2021, Fullscript raised $240 million in capital from Snapdragon and HGGC.

In an interview with private equity news site PE Hub, following the Emerson acquisition, Bill Conrad a partner at HGGC said, “Now we have a really large platform that is driving market growth within integrative health.” Speaking of Emerson by Fullscript, Conrad said, “We will take the best of both businesses.”

He noted that the pandemic has been a boon for Emerson, Fullscript, and the supplement industry as a whole. “COVID accelerated the consumers’ focus on their health across the board and it has also increased the focus on things such as integrative health, like natural health solutions, preventive type of healthcare. You see more and more acceptance of that, specifically vitamins, minerals, and supplements from the patient perspective but also from healthcare practitioners across the board.”

Liberty Lane, the key investors in Emerson, will maintain “a substantial minority share” in the combined company, Braatz said, adding that several top Emerson executives will remain with the new entity. “They’re very bought-in to our vision and mission … which I think is a testament to the opportunity we have in front of us.”

Beyond Supplements

Fullscript’s leader is eager to reframe public perception of his Ottawa-based company.

“A lot of people see Fullscript as strictly a supplement dispensing platform. But what they don’t see is the work we’ve put in to building a user experience that makes it easy for a practitioner to deliver a comprehensive treatment plan, to leverage our education and evidence-based library of nutrition articles, exercise, mindfulness content. We’ve done a tremendous amount of adherence work, to really be a partner to practitioners.”

Jeff Gladd, MD, a functional medicine physician in Ft. Wayne, IN, is Fullscript’s chief medical officer. Over the years, he has been a customer of both companies. “When I started a hospital-based integrative practice, and early on in my own practice, Emerson was my in-clinic dispenser. Then I started bringing in online dispensing through Fullscript. So, I’ve seen the advantages of both.”

He, too, emphasized that the combined entity will be much more than a supplement vending machine. “We want to offer everything related to health optimization.”

Integration Challenges

The integration of Emerson and Fullscript will no doubt be fraught with logistical challenges. Once achieved, though, there will likely be major advantages for practitioners, including:

- Access to the broadest catalog of professional-level supplement products under a single umbrella;

- Ease of ordering and fulfillment from a single entity;

- Better integration into daily workflows via interfaces with electronic health record (EHR) systems;

- A wider range of educational materials and patient support tools; and

- Future integrations with telehealth platforms.

In the near term, practitioners who have accounts with one, the other, or both companies won’t notice any changes other than a new statement under the Emerson logo indicating that it is now “a Fullscript company.” Emerson’s Wellevate suite of practice management tools will remain in place for the foreseeable future.

According to Gladd, “Emerson is a very strong brand with a great reputation, extremely strong in the in-clinic dispensing space. We know that for lots of practitioners, their practices are really built on that. We have no interest in changing that. Kyle and everyone here recognize that practicing integrative medicine is difficult. So, we don’t want to add complexity to something that is already complex. Keeping those existing workflows in place is critical.”

A key step will be the harmonization of the product catalogs. Gladd said a near-term goal is to ensure that practitioners with Fullscript accounts have access to everything on the Emerson side, and vice versa. Gladd said the company is seeking input and guidance from practitioner-customers of both companies.

The team is also working to create consistency between the two platforms in terms of credentialing various types of practitioners. Gladd noted that in the past there were some differences between Emerson and Fullscript with regard to which practitioner categories are authorized to become customers.

Further, some practitioner-focused brands have specific limitations on which practitioner types may purchase and re-sell their products. Gladd said Fullscript will respect and honor those stipulations. But he said the company is not planning on imposing any new restrictions. He expects to see more nurses, nutritionists, dietitians, and health coaches using the platform in the future.

A Long Time Coming

Though the acquisition took many by surprise, Fullscript and Emerson have a long and entwined history. Informal discussions about the possibility of joining forces have been going on for years, Braatz said. He, and other key players in the deal, have had long relationships with both companies.

Ten years ago, the nascent Fullscript—then called HealthWave—was actually born out of a partnership with Emerson.

“Our entrance into the U.S. market was as a partner to Emerson,” said Braatz. “We built a software platform, we launched it in Canada, and saw strong success with the naturopathic doctor market. We ended up partnering with Emerson to be our distribution partner, and we launched the same software platform in the U.S. in 2012.”

That early iteration, he said, was “a complete failure, but probably the best mistake we’ve ever had. It allowed us to step back and broaden the vision. We started off just building a virtual dispensary platform, an e-commerce platform for practitioners to sell products. Then we realized we needed to build something bigger than just e-commerce.”

What was missing, Braatz said, was an integrative care-delivery platform that facilitated practitioner-patient relationships and dovetailed with existing practice patterns.

Braatz and Fullscript eventually broke away from Emerson and in 2014 acquired Natural Partners, a successful Arizona-based distributor with strong ties to the naturopathic community.

This put Fullscript in direct competition with Emerson. But Braatz said executives at both companies have kept in touch over the years, and relations have been friendly.

Fran Towey, Emerson’s former CEO and president from 2008 to 2011 was CEO of Natural Partners at the time it was acquired by Fullscript. Towey became CEO of Fullscript in 2018, and was the company’s executive chairman until last January.

Braatz said the merger made perfect sense because ultimately, Fullscript and Emerson have the same mission.

“We’re both aligned with helping doctors, and arming doctors to provide better care. We would talk about, what if we put our collective resources together to really build this industry up and be that rising tide that lifts all boats, which is what integrative medicine really needs. We’ve been having these conversations for a long time, and finally the timing was right.”

Upsides for Clinicians

The fusion of Fullscript and Emerson will be a big win for clinicians and their patients, predicted Paul Mittman, ND, president of Southwest College of Naturopathic Medicine.

“The naturopathic community has close ties to both companies. Many prominent naturopaths have worked at or represented both, and both companies have done so much for the profession,” he told Holistic Primary Care. “The core values and missions are so strong and aligned. The merger will mean everyone will be better served.”

Mittman has had long experience with both camps. In the early 1990s, when he was practicing in Connecticut, he used Emerson to stock his medicinary. Throughout his tenure at SCNM, Natural Partners (which then became Fullscript) has provided the back-end support for the school’s online formulary.

Mittman said online dispensing is “strong and only going to grow in the coming years. We do have a brick and mortar medicinary at the SCNM clinic, but in-person sales have dropped in recent years, especially since the pandemic. Sales via the school’s ShopSCNM.com website have increased.”

Inroads into Conventional Care

While fully committed to serving its core customer base within naturopathic and functional medicine, Fullscript’s executive team intends to grow the company into the mainstream.

The company has already made inroads into a few major hospital systems, said Braatz. But typically, it has been siloed in the integrative clinics of those hospitals, isolated from the broader clinical networks. He wants to break through those constraints.

The good news, he said, is the groundwork has been laid. “We’ve already gone through all of the contracting, the security assessments, the privacy assessments, the sign-offs from the CEOs. When it does come to the expansion, we’re really well-positioned.”

Gladd said more hospital administrators are willing to take a look these days, but they are not easily convinced. “They want a couple of things. First, they want some basic education and evidence base for making supplement recommendations. Second, this has to be integrated into the workflow. So that’s why we’re working on building interfaces toward the bigger EHRs.”

‘IPO Ready’

What’s on the far horizon for Fullscript? Will the company go public? Will it be acquired by an even larger corporate entity—say a CVS/Caremark or even an Amazon? At this early stage, it’s anybody’s guess.

Braatz said the company’s strategic decisions will all center on the main objective of establishing a solid practice infrastructure for integrative medicine.

He said he ultimately wants Fullscript to be “IPO-ready.” But he stressed that going public might not be the road that his executive team and his investors choose to take. “Whatever allows us and enables us to deliver on our vision, that’s what we’re going to do. So that could mean taking more funding, that could mean going IPO.”

Fullscript’s leaders believes integrative medicine is the best healthcare investment we as a nation could make, whether that is via insurance companies, federal payers, or private out-of-pocket expenditures. “I’ve seen the outcomes with my own eyes, thousands of times,” said Gladd said. “So has every integrative medicine practitioner.”

By providing services that increase the efficiency and economic viability of integrative care while simultaneously gathering and sharing data on best practices, the now-augmented Fullscript plans to be a major influence on the future of the field.

About the Author: Erik Goldman is co-founder and editor of Holistic Primary Care: News for Health & Healing, a quarterly medical publication reaching about 60,000 physicians and other healthcare professionals nationwide. He is also co-producer of the Practitioner Channel Forum, the nation’s leading conference focused on opportunities and challenges in the practitioner segment of the dietary supplement industry.