By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.05.03.21

It is time to think of the pet food/nutrition industry as akin to the baby food and infant formula business. After all, 95% of dog and cat parents—and 85% of other pet owners—consider their pet part of the family, according to Packaged Facts November/December 2020 Pet Owners Survey.

Marketers that demonstrate sound animal-specific nutritional science, labeling/claim credibility, veterinarian endorsements/formulations, and simplicity/transparency in processing, sourcing, and safety practices will win. And a big prize it will be.

The recent controversy over DCM (dilated canine cardiomyopathy) and the safety of grain-free dog foods with pulse (peas/lentils) ingredients has once again jolted confidence in pet food safety, similar to the melamine incident in 2012.

(For a Regulatory Briefing on Pet Supplements, Click Here.)

According to NielsenIQ, total grain-free dry dog food sales in mainstream and specialty retailers, which were up 15.2% in June 2018, ended 2020 down 14.9%; brands named in the FDA’s investigation fell 16.1%. Nielsen reported a 19% shift in volume from grain-free dry dog food over to grain-inclusive.

Big Kibble: The Hidden Dangers of the Pet Food Industry and How to Do Better by Our Dogs, by Shawn Buckley and Dr. Oscar Chavez (November 2020) is the latest book to expose the lack of transparency/regulatory integrity in the pet food/nutrition industry; it is eerily reminiscent of the impact of the tell-all blockbuster, Fast Food Nation: The Dark Side of the All-American Meal, on the food industry.

Although still technically illegal at the federal level, some supplement marketers continue to market CBD pet products, primarily through the Internet, without formal guidance as to dose or optimal ingredient formulation.

Pet food recalls (e.g., lots of Smucker’s Meow Mix in April 2021) are still far too commonplace, as are claims improperly imposing human nutrient requirements (e.g., vitamins C and D supplementation to boost immunity for cats and dogs).

Banner Year for Pet Products

The U.S. pet food industry hit an all-time high of $103.6 billion in 2020, up 6.7% vs. 2019, according to the American Pet Products Association (APPA). Sales are projected to top $109.6 billion in 2021. Online sales accounted for 30% of pet care purchases last year.

Pet food/treat sales reached $42 billion in 2020, up 9.7%; vet care and product sales $31.4 billion, up 7.2%; and pet supplies, live animals, and OTC medications $22.1 billion, up 15.1% vs 2019. Sales of “other” services (e.g., grooming) totaled $8.1 billion, down 21.4%. APPA projected pet food sales will grow 5% in 2021, supplies 6%, veterinary sales 3%, and “other” services 20% in 2021.

Pet supplement sales jumped 21% in 2020 to reach nearly $800 million and are projected by Packaged Facts to top $1.2 billion by 2025 (2021 Pet Supplements in the U.S.)

One-quarter of dog and one in five cat owners added another dog or cat to their household in 2020, according to Packaged Facts Pet Market Outlook 2021-22. Americans now own 96 million pet dogs (up 10 million vs. 2019) and 32 million cats (up over 2 million). Seventy-one million, or 56% of U.S. households, own at least one dog or cat.

It is time to stop treating cats and other pets as second-class citizens and offer a wider variety of food and nutraceutical offerings. Since the pandemic, households with pets other than dogs or cats increased by 14% to 16.1 million; 13.1 million households have fresh/saltwater fish; 5.7 million at least one bird; 5.4 million a small animal (e.g., rabbit), 4.5 million a reptile, and 1.6 million a horse, per APPA.

Four in 10 cat and dog owners report paying more attention to their pets’ health since COVID-19, per Packaged Facts’ owner survey; 15% of dog and cat owners respectively have changed the pet healthcare products they buy. One-quarter of dog or cat parents are now especially concerned about their pet’s anxiety and stress; one in five their immunity. The feline market has been underserved for years.

Bone Appetite! What Dogs & Cats in America Are Eating

Dog food accounts for two-thirds of dog or cat food sales, per Packaged Facts 2020 Pet Food in the U.S. Nine in 10 dog and cat owners buy dry food. Two-thirds of cat owners also buy wet or moist food; half of dog parents. One-third of dog and cat households buy wet food, dry food, and treats, per NielsenIQ. For the year ended August 2020, wet dog and cat food sales were up 7.7% and 7.2%, respectively, per IRI.

Functional Foods

Regular adult pet food is purchased by four in 10 (42%) dog and cat owners; one in five dog owners buy size-specific dog food. Thirteen percent of both dog and cat owners buy food formulated for senior pets, one in 10 for weight management, and 9% and 7% for puppies and kittens, respectively. One in 10 dog owners purchase foods for “active” pets, 8% for specific breeds, per Packaged Facts’ pet food report.

Of the one-quarter of dog and cat owners who changed their pet’s diet in the past year, one-third did so to be healthier, one in five due to a life stage change, and 15% a specific sensitivity or allergy.

Veterinarians had the greatest influence on food product changes; 15% of dogs and 12% of cats are currently using veterinarian-recommended formulations. Hill’s Science Diet’s new Perfect Digestion dog and cat foods have put management of the microbiome at the forefront of GI care, with its ActivBiome ingredient.

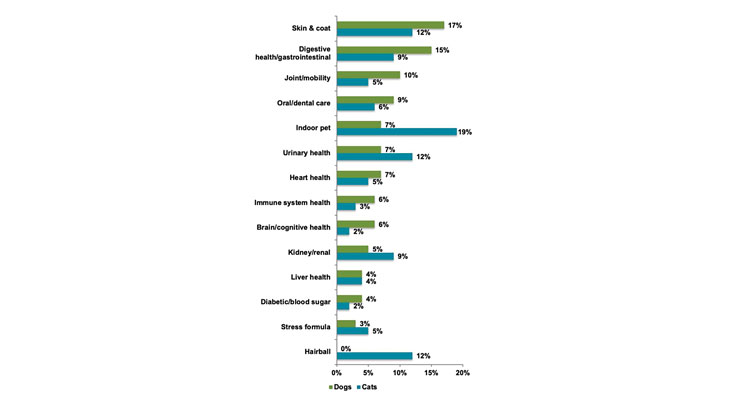

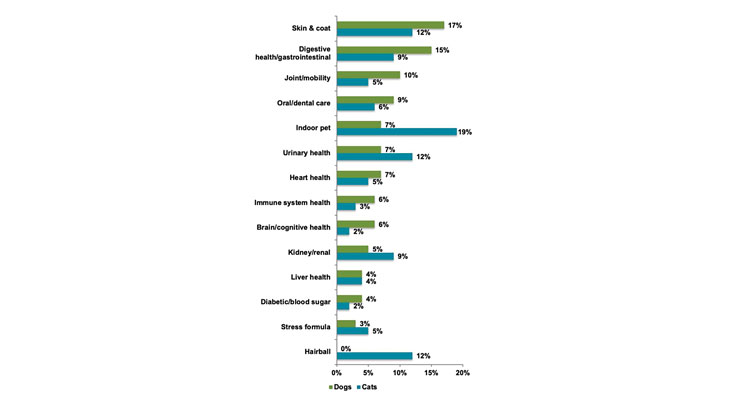

Hairball, indoor pet, dental, and urinary care are the most purchased condition-specific food formulations for cats; skin/coat and joint/mobility for dogs, per Packaged Facts (Figure 1).

Figure 1. Usage of Condition-Specific Pet Food Formulations

Source: Packaged Facts, Pet Food in the U.S., 2020

Solution-based and veterinarian-formulated foods dominated new product introductions at the Global Pet Expo (March/April 2021).

Evanger’s new EVx Restricted Diet wet canned cat foods include a Bland Diet, and a formula for kidney, renal, senior/joint, and more. SquarePet introduced a Low Phosphorus Formula premium dry dog food for kidney issues.

Bocce’s Bakery Dailies treats for dogs offers a “Sweet Dreams” formula. Natural Balance Targeted Nutrition dry dog food provides anxiety relief.

Plato Pet Treats Thinkers New Zealand imported lamb sticks deliver omega-3 fatty acids EPA and DHA for brain, skin, and coat; Pet Naturals’ Heartibles Heart Healthy Dog Treats deliver taurine and omega-3 without pulses.

Group customized diets (e.g., Victor’s premium dog food for hunting and sports dogs, and Champion’s ACANA Rescue Care transition food for pets adopted from a shelter) continue to gain in popularity.

Protein Please!

Meat or poultry as the first ingredient remains the most sought-after and purchased ingredient-based cat or dog food formulation, followed by grain-free, limited ingredient formula, high omega-3, probiotic, antioxidant foods, and those for food sensitivities. Three-quarters of owners pay attention to the primary (first) ingredient; 38% are extremely concerned, per Packaged Facts.

Purina’s new Beneful protein rich dry dog food provides 31 grams of protein per cup. Canidae offers varying protein level formulations designed for the dog’s activity level and lifestyle.

Fish or seafood, turkey, and pork are among the traditional proteins getting more attention in pet foods and treats; along with exotics (e.g., kangaroo, quail, and rabbit). More non-meat protein flavors (e.g., cheese and peanut butter) are also being featured.

SeaBiscuits Artisan Dog Treats include Salmon Snacks and Cod Chips. MiracleCorp’s Steward Pro-Treats Bacon Pop-its feature real bacon as the first ingredient.

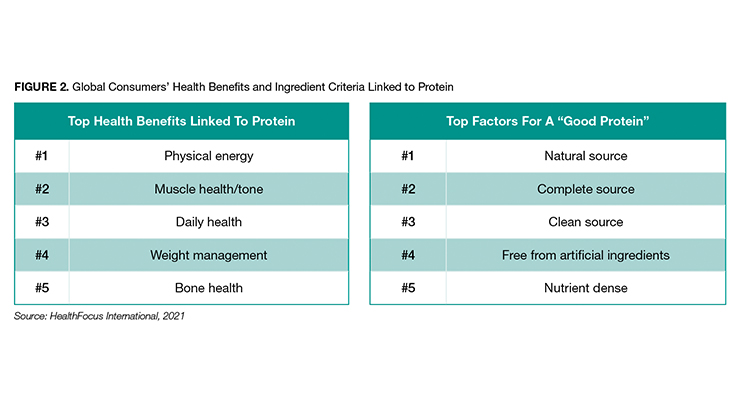

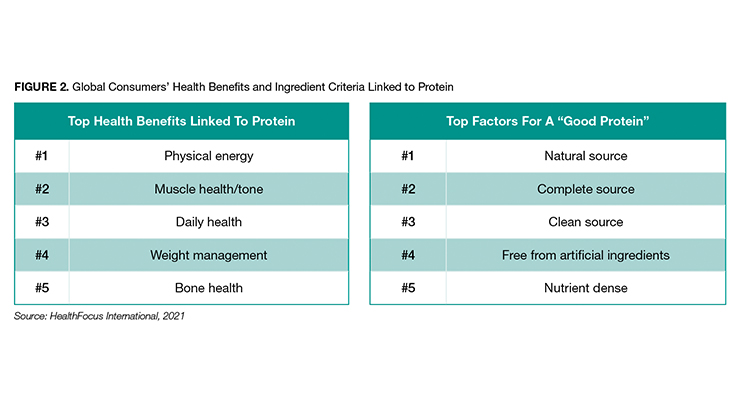

The amount of protein per serving, protein digestibility, protein completeness, and taurine status will gain in importance as plant protein marketers attempt to enter the pet marketplace. Globally, protein completeness is second in importance only to its natural source, according to HealthFocus’ 2021 Global Protein Report (Figure 2).

Not tying high protein levels in pet foods to physical energy, muscle health/tone, mobility with age (beyond glucosamine), and weight management is a missed opportunity. Plato’s introduced On the Go! Energy Bars for canines.

Plants & Superfoods

There is a slow but steady rise in pet foods and treats, mostly for dogs, that are formulated using non-meat ingredients, or more specifically plant-based protein, fruits and vegetables,

and superfoods.

Pet Naturals Impawsiby Good Treats are among the first plant protein-based treats for canines. Lord Jameson’s Carrot and Apple Pops treats are formulated with fresh fruits and vegetables. In 2020, 4% of owners bought a vegetarian dog or cat food; 6% gluten-free, per Packaged Facts. Kale, spinach, pumpkin, sweet potato, salmon, and turmeric are among the common pet superfoods.

A word of caution for vegetarian and vegan consumers wanting to feed their pets like they want to eat themselves: dogs are omnivores and require a mixed diet that contains all essential nutrients. Cats are carnivores which require animal protein, and actually require little carbohydrate. Taurine is one nutrient that can be deficient or too low in plant-based diets which may fail to meet complete pets’ nutritional needs.

With less than 10% of consumers interested in consuming laboratory-made proteins and 60% saying they will never eat cell-based meats, truly novel proteins are unlikely to soon find favor in the pet food industry, according to FMI’s 2021 Power of Meat.

Pupsiclez! are shelf stable, freeze-at-home ice pop treats that feature functional ingredients.

Emerging Pet Food Formats

Refrigerated and fresh pet foods are among the fastest growing pet food formats in the specialty pet marketplace, up 20.7% in 2020, albeit from a small base of $78.3 million, per NielsenIQ.

Sales of dehydrated dog foods reached $304.3 million, up 10.7%; sales of freeze-dried pet food sales reached $239.9 million in the specialty sector, up 7%, per NielsenIQ.

Vital Essentials’ Vital Cat Pork Dinner Patties Freeze-Dried Cat Food is made from pure, raw pork. Pure Bites offers Minnow Freeze-Dried Cat Treats. Raw frozen pet foods and treats are coming on strong with sales of $236.1 million, up 14% in 2020. Boss offers Cat Raw Frozen Entrees. Raw blends and raw coated kibble (e.g., Stella & Chewy’s) are other fast-emerging trends. Some consumers have concerns about the effects of processing on pet foods and choose to feed a raw food diet, similar to what their pet’s ancestors ate. The health benefits of these raw diets, also called a “BARF” (biologically appropriate raw food) diet, have not been demonstrated through scientific research, and there is risk of infectious disease (e.g., from Salmonella) to the pet and to humans in the pet’s environment.

Savvy human food marketers are eyeing the frozen pet food trend. Ben & Jerry’s introduced frozen Doggie Desserts; Luv Tails offers Pooch Ice Pops.

With nearly two-thirds of dog and cat owners adding human foods to their pet’s food, it is no wonder that food toppers, mix-ins, and mousse are a fast-emerging segment. Meal enhancers grew 5.9% last year to $165.5 million in sales in the specialty sector, per NielsenIQ,

Four in 10 dog owners have added cooked meat and poultry, 24% vegetables, 20% broths and liquids, 16% vegetables and fruits, and 10% raw meat or poultry to their pet’s meal. One in five cat owners add raw fish, per Packaged Facts.

With such a dramatic jump in new pet adoptions in 2020, milk replacements (e.g., goat-milk products for puppies and kittens) are enjoying brisk sales.

Foodie Pets or People Food

Pet parents are increasingly looking for pet foods that are prepared, look, and smell like human foods. WellPet’s Wellness Stews come in six “slow-cooked classics.” Celebrity chef Bobby Flay introduced Nacho Flay cat foods, tested by his cat, Nacho.

Caesar’s Wholesome Bowls Dog food with human grade ingredients comes in a ready to serve bowl. A Pup Above is among the first pet foods to use sous vide technology; Catit Introduced its Gold Fern “gently air-dried” cat food.

Just Food for Dogs and the Farmer’s Dog are human grade food delivery services for dog meals. Home-baked and hand-made are among the new descriptors for treats. Seasonal pet food formulas are coming on strong. Are microwaveable (frozen) pet meals and seasonal entrees far behind?

One in five cat owners look for wild and ocean caught-sourced fish and seafood; one in 10 of both dog and cat owners seek grass-fed and cage-free foods, and less than 10% look for local or sustainably farmed foods, per Packaged Facts’ Pet Food Report.

Perhaps most important, Cargill’s The Chomper butcher-quality dog treats (e.g., Beef Knee Bones) is moving into the fresh meat aisle, after traditionally being found in pet specialty retail. Loving Pets’ Deli-Licious Deli Style Dog Treats come in classic New York deli flavors (e.g., Corned Beef).

Half (49%) of dog owners and 39% of cat owners look for pet foods that are not only made in the U.S., but whose ingredients are sourced in the U.S., per Packaged Facts.

Pet Supplements

Despite the fact there is no recognized category for pet supplements, according to the U.S. Food and Drug Administration (FDA), sales of pet supplements jumped 21% in 2020 to $800 million and are projected by Packaged Facts’ supplement report to top $1.1 billion by 2025, with a 5-year CAGR of 5.8%.

Four in 10 (38%) dog owners give their dog a supplement, up from 29% prior to the pandemic; 19% of cat owners, up from 17%, per Packaged Facts’ pet owners survey.

Soft chews are the most popular traditional non-CBD supplement format purchased by nearly half of users, followed by pills and capsules 39%, and liquid 29%.

More feline-friendly supplement forms (e.g., broths, toppers, waters, lick-able, or freeze-dried treats) will be important to attract difficult-to-pill feline users.

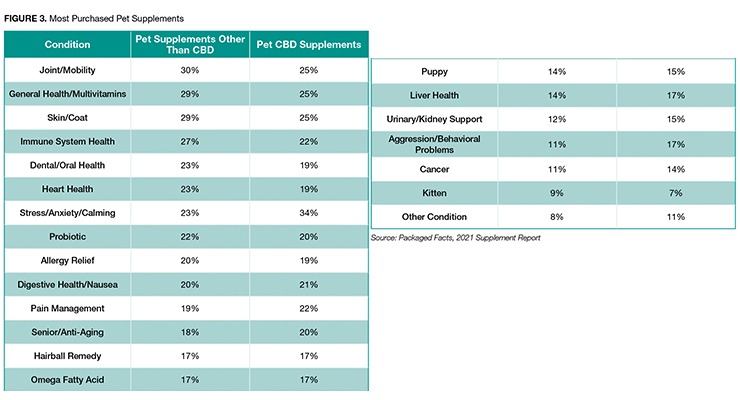

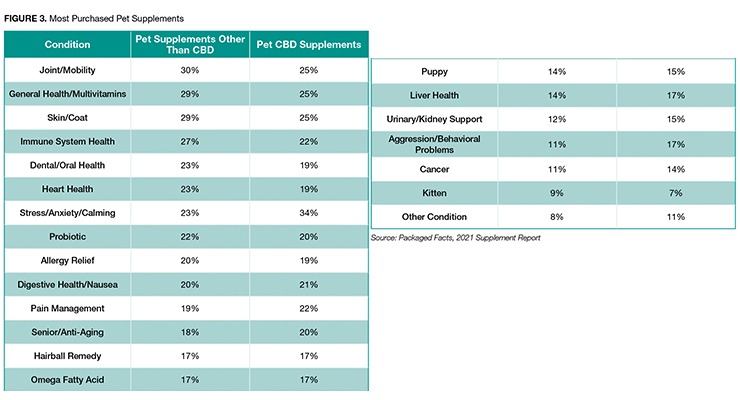

Joint/mobility, multivitamins/general health, skin coat, and immunity are among the most popular condition-specific supplements for both dogs and cats, according to Packaged Facts (Figure 3).

Men, consumers under age 54, urbanites, and those living in households with children are by far the most likely to purchase pet supplements. Four in 10 look for supplements with natural ingredients, 36% organic.

The vet channel accounts for 46% of pet supplement sales, online 30%, pet specialty stores 15% and mass market retailers, 5% per Packaged Facts.

Sales of pet CBD product sales are fast approaching $100 million, according to Packaged Facts. One in five (21%) of dog owners and 10% of cat owners have purchased a CBD supplement in the past year, per Packaged Facts survey.

Half of dog or cat owners would be interested in purchasing CBD supplements for their pet if they were legal, up from 29% in 2019; 48% if they remain in the gray regulatory area, per Packaged Facts.

Stress, anxiety, and calming are the top reasons owners purchased pet CBD supplements; followed by general health, joint/mobility, skin/coat, immunity, and pain management (Figure 3).

Veterinarian recommended or formulated, followed by multi-functional formulations and broad-spectrum CBD/THC products are the most influential CBD supplement purchase criteria, according to Packaged Facts. One-quarter look for CBD pet supplements that are easy to get their pets to take.

Cat owners also seek out help with bladder and kidney health, tooth and gum support, and upper respiratory issues. Cats are more prone to certain cancers (e.g., lymphoma of the intestines and chest), as well as sarcoma.

Recent introductions with formulas designed to relax pets include CBD-free calming supplements with L-theanine, passionflower, valerian root, and melatonin.

Petralyte is an electrolyte supplement (powder sachet) designed to deliver nutrients and maximize hydration in dogs.

To Watch & Work On…

Aging Pets. The number of senior pets is increasing and are a fast-emerging priority for pet care. Nearly half of dog owners have a dog age 7 or older; four in 10 cat owners, per Packaged Facts. Almost one in five pet owners are caring for an aging dog; one in 10 cat owners.

Obese Pets. According to the Association for Pet Obesity, 60% of cats and 56% of dogs are overweight. When it comes to weight loss, low-carb, keto, and paleo are the diets with a higher propensity for current adoption and align well with the high protein trend. Nulo Challenger hearty stews for dogs are human-grade and paleo-inspired.

Feline-Focused. According to Label Insight, urinary tract health, skin and coat health, weight control, and digestive support are among the fastest growing Internet searches by cat owners.

Dental Care. Interest in pet dental care products is on the rise, especially for gum issues. Dental issues can have a serious impact on heart health, immunity, and more.

Hydration/Beverages. Since COVID-19, hydration has become the most practiced selfcare trend in the U.S. and represents a large untapped opportunity for pet supplementation and beverages. Wolf Spring Canine Vitamin Blend is among the first dog waters. Petralyte is an electrolyte supplement designed to maximize hydration in dogs.

Do-it-Yourself Pampered Pets. Personal care products that help pets relax and switch stressful salon visits to home are a big idea (e.g., herbal shampoos, sleep aids, and non-allergic skin care/hair coat/nail products).

Going Global…

Pet health/wellness is a fast-emerging global phenomenon. The European pet food market topped $23 billion in 2020; pet food sales in China are projected to reach $24.5 billion by 2024, according to the APPA.

Other countries with at least $1 billion in combined dog and cat food sales include Canada, France, Spain, U.K., Italy, Germany, Japan, Brazil, Argentina, and Australia. According to the European Pet Food Federation (2020), there are over 106 million cats in Europe and over 87 million dogs.

Lastly, dog and cat foods were the third most valuable category of U.S. animal food industry exports in 2020, per the American Feed Industry Association, totaling $1.7 billion last year.

Regulatory Note

Pet foods are regulated in the U.S. by the FDA. Unlike human foods and dietary supplements, which are regulated by the FDA Center for Food Safety and Applied Nutrition (CFSAN), pet foods are regulated by the Center for Veterinary Medicine (CVM). FDA requires that pet foods are “safe to eat, produced under sanitary conditions, contain no harmful substances, and be truthfully labeled.” FDA further requires that ingredients used in pet foods have an appropriate function for the animal. Ingredients, including meat, poultry, and grains are considered safe and do not require pre-market approval. Vitamins, minerals, other nutrients, flavors, colors, preservatives, or processing aids may be Generally Recognized As Safe (GRAS) or be an approved food additives. Pet food labels are regulated by FDA, but states have the right to create their own labeling requirements, generally based on the model established by the Association of American Feed Control Officials (AAFCO). Pet food labels are, therefore, regulated at the state level; although the AAFCO organization works to create a standardized approach across all 50 states.

FDA and AAFCO allow only pet food components that provide nutrition. Any ingredient that has as its intended use to treat or prevent a disease is a drug and is not permitted. If the intended use is to affect the structure or function of the body and this effect is not derived from the ingredient’s nutrition, taste, or aroma, then it is a drug. Calcium to support bone health is allowed, but many other ingredients typically found in human dietary supplements to support bone health are not. Probiotics are also not recognized as permissible pet food ingredients.

Editor’s Note: If you found this article about pets and pet foods useful, please consider donating to a national or local animal shelter or rescue organization of your choice. Some organizations are listed here, for convenience ...

Best Friends Animal Society, Save Them All: www.bestfriends.org

ASPCA: www.aspca.org

National Humane Education Society: www.nhes.org

National Humane Society: www.nationalhumane.com

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Marketers that demonstrate sound animal-specific nutritional science, labeling/claim credibility, veterinarian endorsements/formulations, and simplicity/transparency in processing, sourcing, and safety practices will win. And a big prize it will be.

The recent controversy over DCM (dilated canine cardiomyopathy) and the safety of grain-free dog foods with pulse (peas/lentils) ingredients has once again jolted confidence in pet food safety, similar to the melamine incident in 2012.

(For a Regulatory Briefing on Pet Supplements, Click Here.)

According to NielsenIQ, total grain-free dry dog food sales in mainstream and specialty retailers, which were up 15.2% in June 2018, ended 2020 down 14.9%; brands named in the FDA’s investigation fell 16.1%. Nielsen reported a 19% shift in volume from grain-free dry dog food over to grain-inclusive.

Big Kibble: The Hidden Dangers of the Pet Food Industry and How to Do Better by Our Dogs, by Shawn Buckley and Dr. Oscar Chavez (November 2020) is the latest book to expose the lack of transparency/regulatory integrity in the pet food/nutrition industry; it is eerily reminiscent of the impact of the tell-all blockbuster, Fast Food Nation: The Dark Side of the All-American Meal, on the food industry.

Although still technically illegal at the federal level, some supplement marketers continue to market CBD pet products, primarily through the Internet, without formal guidance as to dose or optimal ingredient formulation.

Pet food recalls (e.g., lots of Smucker’s Meow Mix in April 2021) are still far too commonplace, as are claims improperly imposing human nutrient requirements (e.g., vitamins C and D supplementation to boost immunity for cats and dogs).

Banner Year for Pet Products

The U.S. pet food industry hit an all-time high of $103.6 billion in 2020, up 6.7% vs. 2019, according to the American Pet Products Association (APPA). Sales are projected to top $109.6 billion in 2021. Online sales accounted for 30% of pet care purchases last year.

Pet food/treat sales reached $42 billion in 2020, up 9.7%; vet care and product sales $31.4 billion, up 7.2%; and pet supplies, live animals, and OTC medications $22.1 billion, up 15.1% vs 2019. Sales of “other” services (e.g., grooming) totaled $8.1 billion, down 21.4%. APPA projected pet food sales will grow 5% in 2021, supplies 6%, veterinary sales 3%, and “other” services 20% in 2021.

Pet supplement sales jumped 21% in 2020 to reach nearly $800 million and are projected by Packaged Facts to top $1.2 billion by 2025 (2021 Pet Supplements in the U.S.)

One-quarter of dog and one in five cat owners added another dog or cat to their household in 2020, according to Packaged Facts Pet Market Outlook 2021-22. Americans now own 96 million pet dogs (up 10 million vs. 2019) and 32 million cats (up over 2 million). Seventy-one million, or 56% of U.S. households, own at least one dog or cat.

It is time to stop treating cats and other pets as second-class citizens and offer a wider variety of food and nutraceutical offerings. Since the pandemic, households with pets other than dogs or cats increased by 14% to 16.1 million; 13.1 million households have fresh/saltwater fish; 5.7 million at least one bird; 5.4 million a small animal (e.g., rabbit), 4.5 million a reptile, and 1.6 million a horse, per APPA.

Four in 10 cat and dog owners report paying more attention to their pets’ health since COVID-19, per Packaged Facts’ owner survey; 15% of dog and cat owners respectively have changed the pet healthcare products they buy. One-quarter of dog or cat parents are now especially concerned about their pet’s anxiety and stress; one in five their immunity. The feline market has been underserved for years.

Bone Appetite! What Dogs & Cats in America Are Eating

Dog food accounts for two-thirds of dog or cat food sales, per Packaged Facts 2020 Pet Food in the U.S. Nine in 10 dog and cat owners buy dry food. Two-thirds of cat owners also buy wet or moist food; half of dog parents. One-third of dog and cat households buy wet food, dry food, and treats, per NielsenIQ. For the year ended August 2020, wet dog and cat food sales were up 7.7% and 7.2%, respectively, per IRI.

Functional Foods

Regular adult pet food is purchased by four in 10 (42%) dog and cat owners; one in five dog owners buy size-specific dog food. Thirteen percent of both dog and cat owners buy food formulated for senior pets, one in 10 for weight management, and 9% and 7% for puppies and kittens, respectively. One in 10 dog owners purchase foods for “active” pets, 8% for specific breeds, per Packaged Facts’ pet food report.

Of the one-quarter of dog and cat owners who changed their pet’s diet in the past year, one-third did so to be healthier, one in five due to a life stage change, and 15% a specific sensitivity or allergy.

Veterinarians had the greatest influence on food product changes; 15% of dogs and 12% of cats are currently using veterinarian-recommended formulations. Hill’s Science Diet’s new Perfect Digestion dog and cat foods have put management of the microbiome at the forefront of GI care, with its ActivBiome ingredient.

Hairball, indoor pet, dental, and urinary care are the most purchased condition-specific food formulations for cats; skin/coat and joint/mobility for dogs, per Packaged Facts (Figure 1).

Figure 1. Usage of Condition-Specific Pet Food Formulations

Source: Packaged Facts, Pet Food in the U.S., 2020

Solution-based and veterinarian-formulated foods dominated new product introductions at the Global Pet Expo (March/April 2021).

Evanger’s new EVx Restricted Diet wet canned cat foods include a Bland Diet, and a formula for kidney, renal, senior/joint, and more. SquarePet introduced a Low Phosphorus Formula premium dry dog food for kidney issues.

Bocce’s Bakery Dailies treats for dogs offers a “Sweet Dreams” formula. Natural Balance Targeted Nutrition dry dog food provides anxiety relief.

Plato Pet Treats Thinkers New Zealand imported lamb sticks deliver omega-3 fatty acids EPA and DHA for brain, skin, and coat; Pet Naturals’ Heartibles Heart Healthy Dog Treats deliver taurine and omega-3 without pulses.

Group customized diets (e.g., Victor’s premium dog food for hunting and sports dogs, and Champion’s ACANA Rescue Care transition food for pets adopted from a shelter) continue to gain in popularity.

Protein Please!

Meat or poultry as the first ingredient remains the most sought-after and purchased ingredient-based cat or dog food formulation, followed by grain-free, limited ingredient formula, high omega-3, probiotic, antioxidant foods, and those for food sensitivities. Three-quarters of owners pay attention to the primary (first) ingredient; 38% are extremely concerned, per Packaged Facts.

Purina’s new Beneful protein rich dry dog food provides 31 grams of protein per cup. Canidae offers varying protein level formulations designed for the dog’s activity level and lifestyle.

Fish or seafood, turkey, and pork are among the traditional proteins getting more attention in pet foods and treats; along with exotics (e.g., kangaroo, quail, and rabbit). More non-meat protein flavors (e.g., cheese and peanut butter) are also being featured.

SeaBiscuits Artisan Dog Treats include Salmon Snacks and Cod Chips. MiracleCorp’s Steward Pro-Treats Bacon Pop-its feature real bacon as the first ingredient.

The amount of protein per serving, protein digestibility, protein completeness, and taurine status will gain in importance as plant protein marketers attempt to enter the pet marketplace. Globally, protein completeness is second in importance only to its natural source, according to HealthFocus’ 2021 Global Protein Report (Figure 2).

Not tying high protein levels in pet foods to physical energy, muscle health/tone, mobility with age (beyond glucosamine), and weight management is a missed opportunity. Plato’s introduced On the Go! Energy Bars for canines.

Plants & Superfoods

There is a slow but steady rise in pet foods and treats, mostly for dogs, that are formulated using non-meat ingredients, or more specifically plant-based protein, fruits and vegetables,

and superfoods.

Pet Naturals Impawsiby Good Treats are among the first plant protein-based treats for canines. Lord Jameson’s Carrot and Apple Pops treats are formulated with fresh fruits and vegetables. In 2020, 4% of owners bought a vegetarian dog or cat food; 6% gluten-free, per Packaged Facts. Kale, spinach, pumpkin, sweet potato, salmon, and turmeric are among the common pet superfoods.

A word of caution for vegetarian and vegan consumers wanting to feed their pets like they want to eat themselves: dogs are omnivores and require a mixed diet that contains all essential nutrients. Cats are carnivores which require animal protein, and actually require little carbohydrate. Taurine is one nutrient that can be deficient or too low in plant-based diets which may fail to meet complete pets’ nutritional needs.

With less than 10% of consumers interested in consuming laboratory-made proteins and 60% saying they will never eat cell-based meats, truly novel proteins are unlikely to soon find favor in the pet food industry, according to FMI’s 2021 Power of Meat.

Pupsiclez! are shelf stable, freeze-at-home ice pop treats that feature functional ingredients.

Emerging Pet Food Formats

Refrigerated and fresh pet foods are among the fastest growing pet food formats in the specialty pet marketplace, up 20.7% in 2020, albeit from a small base of $78.3 million, per NielsenIQ.

Sales of dehydrated dog foods reached $304.3 million, up 10.7%; sales of freeze-dried pet food sales reached $239.9 million in the specialty sector, up 7%, per NielsenIQ.

Vital Essentials’ Vital Cat Pork Dinner Patties Freeze-Dried Cat Food is made from pure, raw pork. Pure Bites offers Minnow Freeze-Dried Cat Treats. Raw frozen pet foods and treats are coming on strong with sales of $236.1 million, up 14% in 2020. Boss offers Cat Raw Frozen Entrees. Raw blends and raw coated kibble (e.g., Stella & Chewy’s) are other fast-emerging trends. Some consumers have concerns about the effects of processing on pet foods and choose to feed a raw food diet, similar to what their pet’s ancestors ate. The health benefits of these raw diets, also called a “BARF” (biologically appropriate raw food) diet, have not been demonstrated through scientific research, and there is risk of infectious disease (e.g., from Salmonella) to the pet and to humans in the pet’s environment.

Savvy human food marketers are eyeing the frozen pet food trend. Ben & Jerry’s introduced frozen Doggie Desserts; Luv Tails offers Pooch Ice Pops.

With nearly two-thirds of dog and cat owners adding human foods to their pet’s food, it is no wonder that food toppers, mix-ins, and mousse are a fast-emerging segment. Meal enhancers grew 5.9% last year to $165.5 million in sales in the specialty sector, per NielsenIQ,

Four in 10 dog owners have added cooked meat and poultry, 24% vegetables, 20% broths and liquids, 16% vegetables and fruits, and 10% raw meat or poultry to their pet’s meal. One in five cat owners add raw fish, per Packaged Facts.

With such a dramatic jump in new pet adoptions in 2020, milk replacements (e.g., goat-milk products for puppies and kittens) are enjoying brisk sales.

Foodie Pets or People Food

Pet parents are increasingly looking for pet foods that are prepared, look, and smell like human foods. WellPet’s Wellness Stews come in six “slow-cooked classics.” Celebrity chef Bobby Flay introduced Nacho Flay cat foods, tested by his cat, Nacho.

Caesar’s Wholesome Bowls Dog food with human grade ingredients comes in a ready to serve bowl. A Pup Above is among the first pet foods to use sous vide technology; Catit Introduced its Gold Fern “gently air-dried” cat food.

Just Food for Dogs and the Farmer’s Dog are human grade food delivery services for dog meals. Home-baked and hand-made are among the new descriptors for treats. Seasonal pet food formulas are coming on strong. Are microwaveable (frozen) pet meals and seasonal entrees far behind?

One in five cat owners look for wild and ocean caught-sourced fish and seafood; one in 10 of both dog and cat owners seek grass-fed and cage-free foods, and less than 10% look for local or sustainably farmed foods, per Packaged Facts’ Pet Food Report.

Perhaps most important, Cargill’s The Chomper butcher-quality dog treats (e.g., Beef Knee Bones) is moving into the fresh meat aisle, after traditionally being found in pet specialty retail. Loving Pets’ Deli-Licious Deli Style Dog Treats come in classic New York deli flavors (e.g., Corned Beef).

Half (49%) of dog owners and 39% of cat owners look for pet foods that are not only made in the U.S., but whose ingredients are sourced in the U.S., per Packaged Facts.

Pet Supplements

Despite the fact there is no recognized category for pet supplements, according to the U.S. Food and Drug Administration (FDA), sales of pet supplements jumped 21% in 2020 to $800 million and are projected by Packaged Facts’ supplement report to top $1.1 billion by 2025, with a 5-year CAGR of 5.8%.

Four in 10 (38%) dog owners give their dog a supplement, up from 29% prior to the pandemic; 19% of cat owners, up from 17%, per Packaged Facts’ pet owners survey.

Soft chews are the most popular traditional non-CBD supplement format purchased by nearly half of users, followed by pills and capsules 39%, and liquid 29%.

More feline-friendly supplement forms (e.g., broths, toppers, waters, lick-able, or freeze-dried treats) will be important to attract difficult-to-pill feline users.

Joint/mobility, multivitamins/general health, skin coat, and immunity are among the most popular condition-specific supplements for both dogs and cats, according to Packaged Facts (Figure 3).

Men, consumers under age 54, urbanites, and those living in households with children are by far the most likely to purchase pet supplements. Four in 10 look for supplements with natural ingredients, 36% organic.

The vet channel accounts for 46% of pet supplement sales, online 30%, pet specialty stores 15% and mass market retailers, 5% per Packaged Facts.

Sales of pet CBD product sales are fast approaching $100 million, according to Packaged Facts. One in five (21%) of dog owners and 10% of cat owners have purchased a CBD supplement in the past year, per Packaged Facts survey.

Half of dog or cat owners would be interested in purchasing CBD supplements for their pet if they were legal, up from 29% in 2019; 48% if they remain in the gray regulatory area, per Packaged Facts.

Stress, anxiety, and calming are the top reasons owners purchased pet CBD supplements; followed by general health, joint/mobility, skin/coat, immunity, and pain management (Figure 3).

Veterinarian recommended or formulated, followed by multi-functional formulations and broad-spectrum CBD/THC products are the most influential CBD supplement purchase criteria, according to Packaged Facts. One-quarter look for CBD pet supplements that are easy to get their pets to take.

Cat owners also seek out help with bladder and kidney health, tooth and gum support, and upper respiratory issues. Cats are more prone to certain cancers (e.g., lymphoma of the intestines and chest), as well as sarcoma.

Recent introductions with formulas designed to relax pets include CBD-free calming supplements with L-theanine, passionflower, valerian root, and melatonin.

Petralyte is an electrolyte supplement (powder sachet) designed to deliver nutrients and maximize hydration in dogs.

To Watch & Work On…

Aging Pets. The number of senior pets is increasing and are a fast-emerging priority for pet care. Nearly half of dog owners have a dog age 7 or older; four in 10 cat owners, per Packaged Facts. Almost one in five pet owners are caring for an aging dog; one in 10 cat owners.

Obese Pets. According to the Association for Pet Obesity, 60% of cats and 56% of dogs are overweight. When it comes to weight loss, low-carb, keto, and paleo are the diets with a higher propensity for current adoption and align well with the high protein trend. Nulo Challenger hearty stews for dogs are human-grade and paleo-inspired.

Feline-Focused. According to Label Insight, urinary tract health, skin and coat health, weight control, and digestive support are among the fastest growing Internet searches by cat owners.

Dental Care. Interest in pet dental care products is on the rise, especially for gum issues. Dental issues can have a serious impact on heart health, immunity, and more.

Hydration/Beverages. Since COVID-19, hydration has become the most practiced selfcare trend in the U.S. and represents a large untapped opportunity for pet supplementation and beverages. Wolf Spring Canine Vitamin Blend is among the first dog waters. Petralyte is an electrolyte supplement designed to maximize hydration in dogs.

Do-it-Yourself Pampered Pets. Personal care products that help pets relax and switch stressful salon visits to home are a big idea (e.g., herbal shampoos, sleep aids, and non-allergic skin care/hair coat/nail products).

Going Global…

Pet health/wellness is a fast-emerging global phenomenon. The European pet food market topped $23 billion in 2020; pet food sales in China are projected to reach $24.5 billion by 2024, according to the APPA.

Other countries with at least $1 billion in combined dog and cat food sales include Canada, France, Spain, U.K., Italy, Germany, Japan, Brazil, Argentina, and Australia. According to the European Pet Food Federation (2020), there are over 106 million cats in Europe and over 87 million dogs.

Lastly, dog and cat foods were the third most valuable category of U.S. animal food industry exports in 2020, per the American Feed Industry Association, totaling $1.7 billion last year.

Regulatory Note

Pet foods are regulated in the U.S. by the FDA. Unlike human foods and dietary supplements, which are regulated by the FDA Center for Food Safety and Applied Nutrition (CFSAN), pet foods are regulated by the Center for Veterinary Medicine (CVM). FDA requires that pet foods are “safe to eat, produced under sanitary conditions, contain no harmful substances, and be truthfully labeled.” FDA further requires that ingredients used in pet foods have an appropriate function for the animal. Ingredients, including meat, poultry, and grains are considered safe and do not require pre-market approval. Vitamins, minerals, other nutrients, flavors, colors, preservatives, or processing aids may be Generally Recognized As Safe (GRAS) or be an approved food additives. Pet food labels are regulated by FDA, but states have the right to create their own labeling requirements, generally based on the model established by the Association of American Feed Control Officials (AAFCO). Pet food labels are, therefore, regulated at the state level; although the AAFCO organization works to create a standardized approach across all 50 states.

FDA and AAFCO allow only pet food components that provide nutrition. Any ingredient that has as its intended use to treat or prevent a disease is a drug and is not permitted. If the intended use is to affect the structure or function of the body and this effect is not derived from the ingredient’s nutrition, taste, or aroma, then it is a drug. Calcium to support bone health is allowed, but many other ingredients typically found in human dietary supplements to support bone health are not. Probiotics are also not recognized as permissible pet food ingredients.

Editor’s Note: If you found this article about pets and pet foods useful, please consider donating to a national or local animal shelter or rescue organization of your choice. Some organizations are listed here, for convenience ...

Best Friends Animal Society, Save Them All: www.bestfriends.org

ASPCA: www.aspca.org

National Humane Education Society: www.nhes.org

National Humane Society: www.nationalhumane.com

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.