By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.03.22.21

COVID 19 changed the game plan. It is not a transient alteration of our concerns and behaviors, but a deeply entrenched metamorphosis that prioritizes mental and physical health, with food and dietary supplements used as agents of change.

Health = Happiness

Globally, having good health/mental well-being is now the number one reason for happiness, more so than consumers’ relationship with their partner or family, according to Ipsos’ Oct. 2020 Happiness Report.

As of HealthFocus Internationals’ 4th Qtr. 2020 Now & Beyond the COVID-19 Pandemic Survey, nearly half (46%) of the global consumers surveyed had taken greater control of their health; 38% improved their diet, and 28% increased their activity level since the pandemic.

Shoppers have accelerated their efforts to help manage/treat conditions with food. In the U.S. from May to Dec. 29, 2020, sales of foods/drinks that helped control diabetes grew 14%, weight control 13%, and hypertension 9%, per IRI’s Feb. 25, 2021 Vitamins, Minerals, Supplements Propel Self Care; sales of foods with an immunity claim jumped 21%; an antioxidant or botanical claim, each 12%; and a nutrient claim, 10%. One-third of adults were more likely to buy a food/drink with multiple health benefits.

Sales of supplements aimed at immunity/cold/flu increased by $1.8 billion in the U.S. in 2020; general health up $755 million; mental health/mood/stress up $268 million; sleep support up $243 million; and gut health up $167 million, according to Nutrition Business Journal’s “The Business of Immunity.”

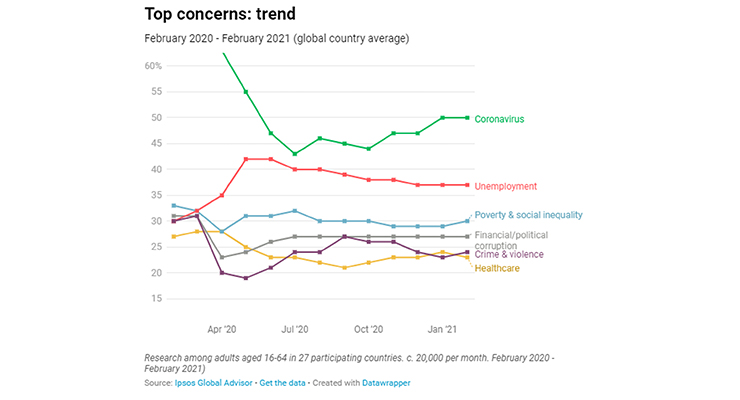

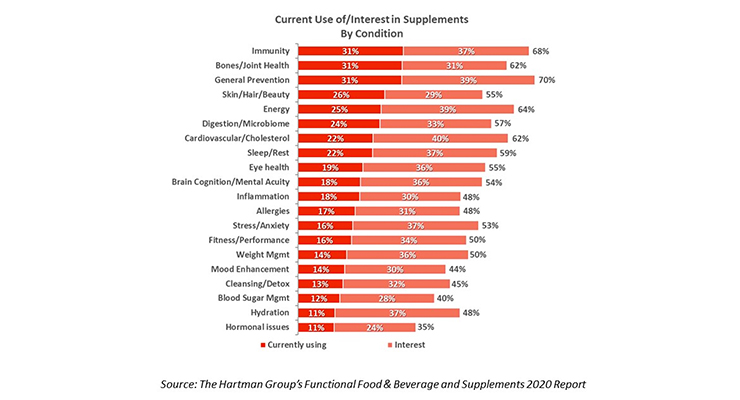

As of February 2021, COVID-19 remains the top worry among consumers worldwide, per Ipsos’ What Worries the World Survey conducted in 27 countries each month (Figure 1).

Figure 1. What Worries the World?

Source: Ipsos’ 2021 What Worries the World Survey, February, 2021

Moreover, according to Ipsos’ March 2021’s Shaping the Future survey, those who think the pandemic will soon be contained is lower than a year ago. Although many are optimistic that COVID-19 will be controlled later this year, over one-third in Japan (37%) and one-quarter in France (26%) and Australia (24%) believe COVID-19 will never be contained.

AXA’s October 2020, Future Risk Report cited pandemic/infectious diseases as the number one future global risk for 2021 and beyond, ahead of climate change. The Atlantic Council’s December 2021 Top 10 Risks for 2021 were led by a deepening concern for COVID-19 due to the rise of strain variants and a potentially inadequate supply of vaccine. As such, the market changes detailed here will likely remain strong and stable for the foreseeable future.

Reprioritizing Global Health Concerns

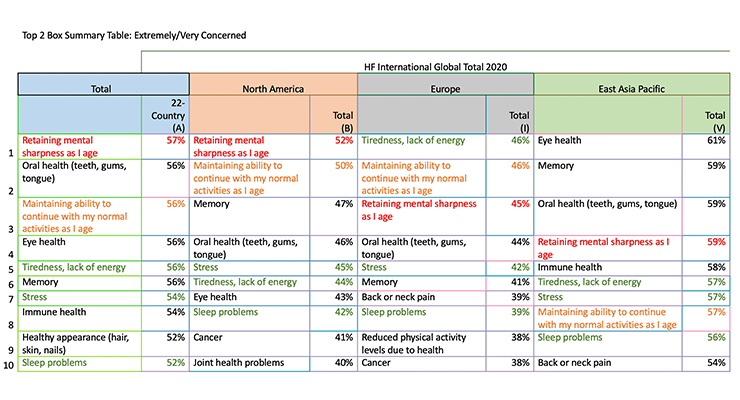

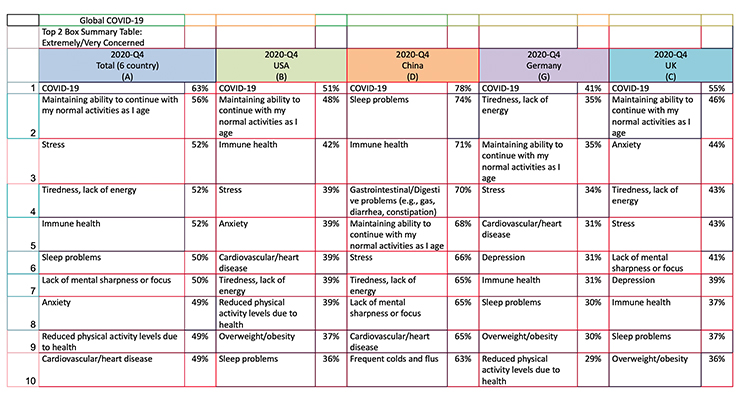

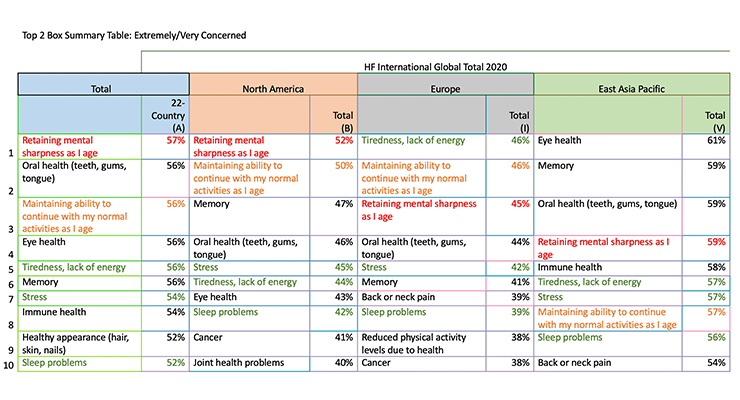

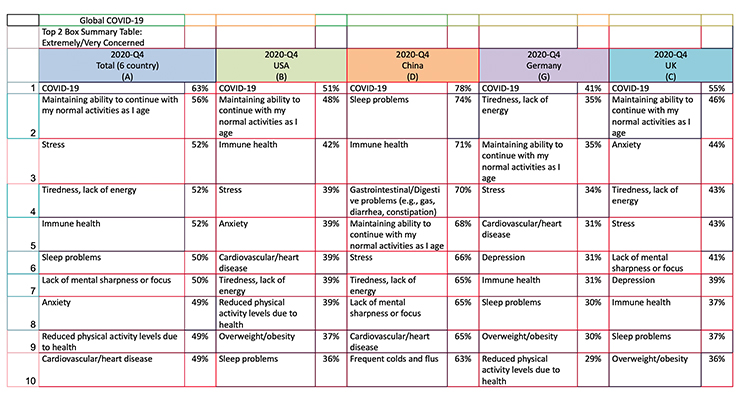

According to HealthFocus’ 2020 Global Trend Survey, covering 40 major global markets, and its 4th Qtr. post-COVID survey report, top health concerns around the world shifted in 2020, away from the many effects of aging, i.e., maintaining mental sharpness, memory, eye health, and oral health—as well as a healthy appearance (hair, skin, nails)—to concerns related to COVID-19 (Figures 2 and 3).

Figure 2. Global Health Concerns, April 2020

Source: HealthFocus International Global Consumer Survey, April 2020

Figure 3.Global Health Concerns, Quarter 4, 2020

Source: HealthFocus International Global Consumer Survey, Quarter 4, 2020

Concerns about anxiety, stress, tiredness, and lack of sleep have escalated across the world. Immunity, which along with heart health and overweight had fallen out of the top 10 concerns earlier in 2020 for North America and Europe, are now once again mainstream health worries.

Already in 2019 and 2020 we saw a redefinition of health to include mental as well as physical well-being (Euromonitor, 2020 Food and Nutrition Survey). “Mental well-being” and “feeling ‘good’” are the ways consumers now describe the meaning of health, outpacing “absence of disease,” “healthy appearance,” and “living longer,” which fell out of the top 10 ways to define health.

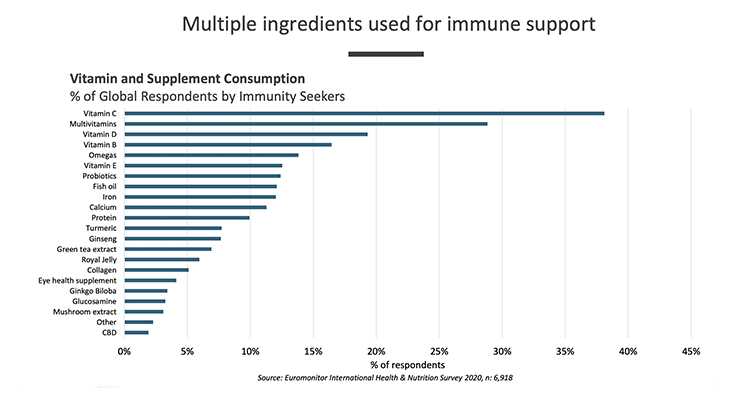

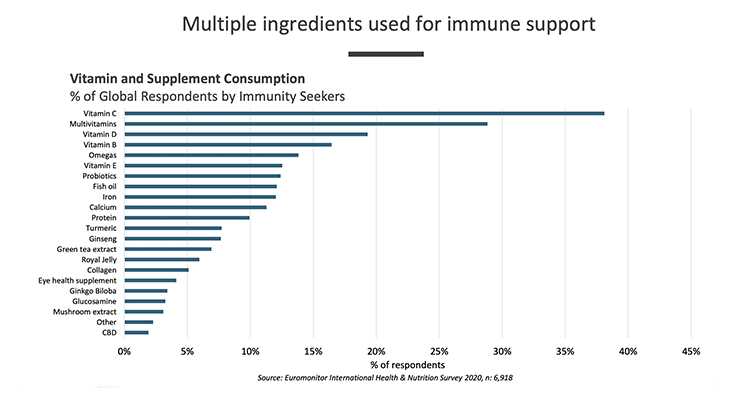

Immune health has risen to the third most significant health concern in the U.S. and China, according to HealthFocus. Immunity is the number one reason U.S. Millennials take a supplement, number two overall, per CRN’s 2020 U.S. Consumer Survey on Dietary Supplements. Since COVID-19, those aged 65 and older have joined Millennials, especially those with kids, as the top immune-seekers. Globally, vitamin C is the most popular immune-boosting supplement, along with vitamin D, B vitamins, omega-3, and probiotics, per Euromonitor’s October 2020 Health & Nutrition Trends Webinar (Figure 4).

Figure 4. Supplement Users by Immune Seekers Globally

Source: Euromonitor’s Oct. 2020 Health & Nutrition Trends Webinar

A majority of U.S. consumers link probiotics and the microbiome to immune health (55%); 68% of global consumers. Nearly, two-thirds of global consumers link digestive heath to daily energy, mood, and weight management, according to HealthFocus. Half (55%) of global consumers select foods with digestive health in mind. Digestive health problems (e.g., diarrhea and gas) are consumers’ fourth most important health concern in China.

More Aggressive Weight Management

One-third of consumers in Japan, South Korea, China, and Russia reported under-exercising during the pandemic last year; one-quarter in Canada, U.K., and Russia reported over-eating, according to Ipsos’ 2020 COVID-19 Poll across 16 major countries. In the U.S., 40% of those aged 18-24, one third of Millennials/Gen X, and one-quarter of Boomers gained weight since COVID-19, according to the Natural Marketing Institute, spawning new opportunities for the weight loss category. For example, Jenny Craig’s new Rapid Results Max weight loss program is based on intermittent fasting and a Recharge Bar to increase fat burn.

In 2020, the U.S. weight management market fell slightly to $71 billion. Through 2021-2027, the China weight management market is projected to grow at a GAGR of 10.6% to reach $92.6 billion; Asia-Pacific will top $58 billion, per ReportLinker’s December 2020 Global-Weight Management Industry. The Japanese market will grow at a CAGR of 3.9%, Canada 6.3%, and Germany 4.5% through 2027.

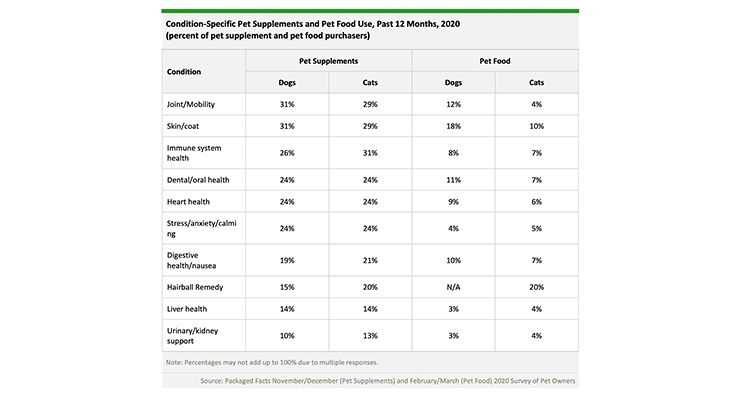

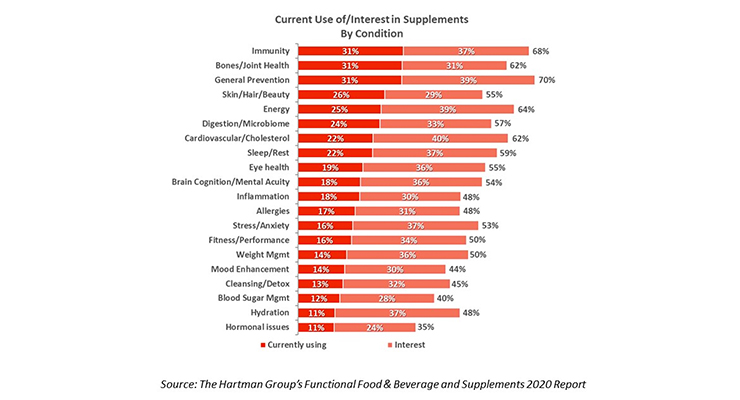

According to Zhou et al (Lancet, Jun. 24, 2019), 26% of adults in China are obese/overweight, 16% of children. In the U.S., 121 million consumers tried to lose weight in 2019, according to Mintel. In 2020, 14% of U.S. supplement users took a weight management supplement, 36% want more product options, per the Hartman Group’s 2020 Functional Foods & Beverages and Dietary Supplements (Figure 5).

Protein supplements are the choice for 48% of consumers looking for weight management solutions in South Korea, Thailand, and Australia; 45% in Indonesia, according to Euromonitor’s 2019 Evolving Trends in Food & Nutrition webinar.

Figure 5. Current Use of/Interest in Supplements by Condition

Source: Hartman Group, 2020 Functional Foods & Beverages and Dietary Supplements

Dollar sales of foods and beverages carrying a “lifestyle” diet claim grew 13% for the year ended Dec. 27, 2020, per IRI February 2021 innovation report. Sales of foods with a low-carbohydrate positioning reached $136.9 million in the U.S.; ketogenic, $68.5 million; paleo, $56.9 million; the Whole 30 Diet, $54.2 million; and low-glycemic, $19.3 million, according to IRI.

Fit Consumers

Faced with a new set of health/lifestyle issues driven by COVID-19, consumers are increasingly opting to live a more “fit” holistic active lifestyle which uses exercise as a means to help manage their health and mental well-being. We have previously discussed the “Fit Consumer” as consumers differentiated by integrating frequent physical exercise (three to five days per week for at least 30 minutes each day) and a focus on enhancing their everyday mental and physical performance. While fit consumers span all age groups, core consumers are under age 40; the older edge is 65 years (See Sloan & Adams Hutt, The Fit Consumer March, 2019).

As 2020 closed, the number of “fit” consumers in the U.S. were more than double those who considered themselves athletes (37% vs. 16%, per Mintel) and they will continue to drive the sports nutrition sector. Six in 10 global consumers were committed to exercising more frequently this year, spawning new fitness trends and a demand for more aggressive sports nutrition, weight loss, and energizing foods/supplements. Watch for more home centered exercise applications/product forms, more emphasis on seniors and at-risk exercisers, and a greater emphasis on exercise for kids/teens. (See Sloan & Adams Hutt, The Exercise as Medicine Movement, December 2020.)

Mobility & Sarcopenia

Concerns about mobility have also escalated due to COVID-19, with consumers increasingly seeking dietary support for muscle, strength, healthy aging, and joint support, per HealthFocus.

Being in relative lockdown has made some more aware of mobility issues. Lack of mobility and movement restriction caused by COVID are of special concern to the aging consumer. Sarcopenia, the age-related loss of lean body mass, strength, and function, is a prevalent concern among seniors globally.

Sarcopenia is now recognized as a disease by the World Health Organization and is preventable and reversible through nutrition and exercise. In the U.S., 45% of those over 65 years of age have some degree of sarcopenia; 20 million Japanese are sarcopenia patients; in China, 12% of women and 8% of men over 70 years are affected, according to Ipsos October 2020 Global Aging Study. Asia has taken the lead in combating sarcopenia and has established specialized organizations to address the disease. Supplements that provide high quality protein in sufficient amount (20-30 grams per serving)can effectively target sarcopenia concerns; the opportunity is to call out the risk for this debilitating condition for consumers seeking solutions.

Stress Levels & Anxiety Will Linger

One-quarter (25%) of consumers in 16 major countries have increased levels of anxiety since the beginning of the pandemic, led by Canada, Italy, U.K., Germany, China, and France, according to Ipsos’ 2020 COVID-19 Poll. One half of U.S. Millennials report being more anxious, per NMI. Anxiety is now the number one condition U.S. consumers are trying to prevent and/or treat, according to the Hartman Group. One-third globally are taking measures to treat anxiety, stress, and mental health, according to Euromonitor, Health and Wellness Survey, February 2020.

While those under the age of 45 are most affected by stress, anxiety, and sleep issues, 39% of Gen X and 36% of Boomers in the U.S. report being more anxious than they used to be; 32% and 21%, respectively, are not as focused or concentrated on tasks; and 26% and 18%, respectively, report their ability to get a good night’s sleep is more difficult, according to NMI. Sleep problems are second only to COVID-19 as the number one health concern in China, according to HealthFocus. Energy and sleep supplements will remain in high demand.

Supplements aimed at sleep support and passive restoration (i.e., restoring and building muscle and bone strength) are key for this market now and going forward. Vick’s/Procter and Gamble’s ZzzQuil Pure Zzzs promotes beauty sleep; Bayer’s Alka-Seltzer PM supports sleep while relieving heartburn. Natrol’s Sleep product includes Sleep’n Restore in its name.

Concerns for relief from anxiety and desire for more sleep and unwinding is likely to drive the CBD market; 60% of consumers use CBD for unwinding, 42% for stress, 41% anxiety, 35% relaxation, and 58% use it for pain (New Frontier, Cannabis in America 2021 & Beyond, February, 2021).

Heart Off the Back Burner

COVID focused unprecedented attention on at-risk individuals, especially those with heart issues or diabetes. By the fourth quarter of 2020, cardiovascular disease (CVD) and heart health were on the top 10 health issues in the U.S., China, and Germany, according to HealthFocus.

CVD affects 423 million consumers globally, with 6 million new cases reported each year in the E.U., according to the World Health Organization (2019); 122 million Americans have CVD. Four in 10 supplement users want more supplements to lower cholesterol. In the U.S., heart health is now the number four reason for taking supplements, per CRN. It is time to put the American Heart Association’s Heart Check symbol on foods and beverages. New Cinnamon Cheerios cereal from General Mills carries a “can help lower cholesterol”claim.

COVID-19 has driven greater recognition of the growing global diabetes epidemic. One third of all diabetics live in Asia; 463 million people worldwide are afflicted, according to the International Diabetes Federation, World Atlas of Diabetes, 2019.

No Kidding …

Ironically, although 55% of school-aged children and 61% of teens were still learning remotely as of January 2021, according to IRI, with limited exposure to others, the pandemic has drawn much needed attention to kids’ health. For the year ended Nov. 29, 2020, sales of vitamins/minerals for children jumped 34%, according to SPINS. An immune boost was the top reason for increased use.

Per the Dietary Guidelines for Americans,vitamin D, calcium, dietary fiber, and potassium are the nutrients of public health significance deficient in children aged 1-8. Nutrients under consumed but not a public health issue include vitamins A, C, E, K, magnesium, and choline.

Parents in households with kids are more likely than those without kids at home to say it is important to eat fortified foods (66% versus 53%), per HealthFocus. Horizon Organic’s Growing Years milks deliver omega-3 DHA, choline, and prebiotics, as well as protein and calcium.

While the anticipated COVID baby boom did not take place, with 30% of families delaying planned pregnancies during the pandemic, per the Brookings Institution, babies remain big business. Baby foods were the fastest-growing frozen food item for the year ending Oct. 4, per IRI.

Four-Legged Friends as Family

Expect 2021 to be a blockbuster year for the pet food, supplement, and functional pet food businesses. Nearly two-thirds (63%) of U.S. households own at least one dog, 43% at least one cat. One-quarter of dog owners and 21% of cat owners added another dog/cat to their house since the pandemic, according to Packaged Facts’ January 2021 Pet Supplements U.S.

The U.S. pet food and treat market is a $39 billion opportunity, $23 billion in the E.U., and expected to be $24.5 billion in China by 2024. Other countries with at least $1 billion in combined dog and cat food sales include Canada, France, Spain, U.K., Italy, Germany, Japan, Brazil, Argentina, and Australia, per Packaged Facts. According to the European Pet Food Federation, there were over 106 million cats in Europe and over 87 million dogs as pets in 2020.

Since the pandemic, four in 10 dog and 42% of cat parents are paying more attention to their pet’s health. Immunity and anxiety top their pet health concerns.

Pet supplement sales jumped 21% in 2020 to $800 million and are projected by Packaged Facts to top $1.2 billion by 2025. Pet CBD product sales are fast approaching $100 million.

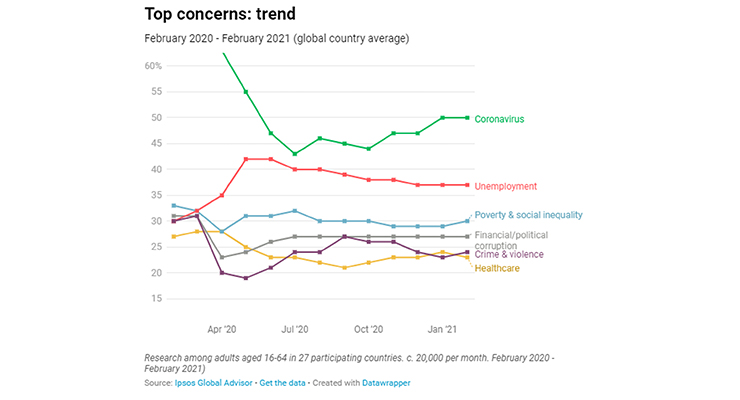

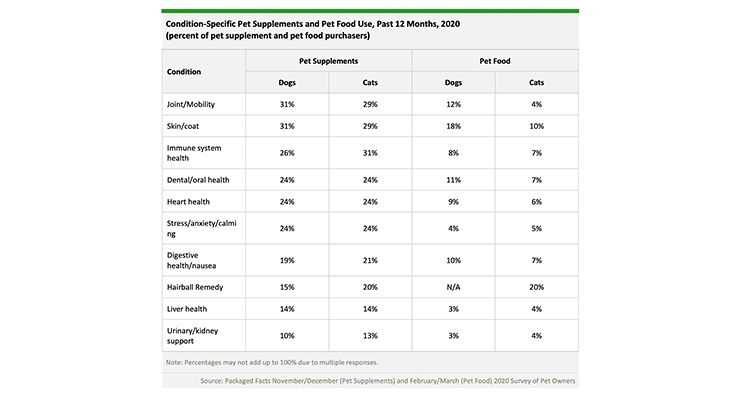

Hairball is the most used condition-specific pet food formulation for cats/dogs, followed by indoor pet, skin/coat, joint/mobility, dental care, urinary health, digestive, and heart health, per Packaged Facts. Joint/mobility, multivitamins, skin/coat, and immunity are the most purchased supplements (Figure 6).

Figure 6. Condition-specific Pet Supplements & Pet Food Use

Source: Packaged Facts, January 2020 Pet Supplements U.S.

About the Authors: Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: Phone: 760-741-9611; E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Health = Happiness

Globally, having good health/mental well-being is now the number one reason for happiness, more so than consumers’ relationship with their partner or family, according to Ipsos’ Oct. 2020 Happiness Report.

As of HealthFocus Internationals’ 4th Qtr. 2020 Now & Beyond the COVID-19 Pandemic Survey, nearly half (46%) of the global consumers surveyed had taken greater control of their health; 38% improved their diet, and 28% increased their activity level since the pandemic.

Shoppers have accelerated their efforts to help manage/treat conditions with food. In the U.S. from May to Dec. 29, 2020, sales of foods/drinks that helped control diabetes grew 14%, weight control 13%, and hypertension 9%, per IRI’s Feb. 25, 2021 Vitamins, Minerals, Supplements Propel Self Care; sales of foods with an immunity claim jumped 21%; an antioxidant or botanical claim, each 12%; and a nutrient claim, 10%. One-third of adults were more likely to buy a food/drink with multiple health benefits.

Sales of supplements aimed at immunity/cold/flu increased by $1.8 billion in the U.S. in 2020; general health up $755 million; mental health/mood/stress up $268 million; sleep support up $243 million; and gut health up $167 million, according to Nutrition Business Journal’s “The Business of Immunity.”

As of February 2021, COVID-19 remains the top worry among consumers worldwide, per Ipsos’ What Worries the World Survey conducted in 27 countries each month (Figure 1).

Figure 1. What Worries the World?

Source: Ipsos’ 2021 What Worries the World Survey, February, 2021

Moreover, according to Ipsos’ March 2021’s Shaping the Future survey, those who think the pandemic will soon be contained is lower than a year ago. Although many are optimistic that COVID-19 will be controlled later this year, over one-third in Japan (37%) and one-quarter in France (26%) and Australia (24%) believe COVID-19 will never be contained.

AXA’s October 2020, Future Risk Report cited pandemic/infectious diseases as the number one future global risk for 2021 and beyond, ahead of climate change. The Atlantic Council’s December 2021 Top 10 Risks for 2021 were led by a deepening concern for COVID-19 due to the rise of strain variants and a potentially inadequate supply of vaccine. As such, the market changes detailed here will likely remain strong and stable for the foreseeable future.

Reprioritizing Global Health Concerns

According to HealthFocus’ 2020 Global Trend Survey, covering 40 major global markets, and its 4th Qtr. post-COVID survey report, top health concerns around the world shifted in 2020, away from the many effects of aging, i.e., maintaining mental sharpness, memory, eye health, and oral health—as well as a healthy appearance (hair, skin, nails)—to concerns related to COVID-19 (Figures 2 and 3).

Figure 2. Global Health Concerns, April 2020

Source: HealthFocus International Global Consumer Survey, April 2020

Figure 3.Global Health Concerns, Quarter 4, 2020

Source: HealthFocus International Global Consumer Survey, Quarter 4, 2020

Concerns about anxiety, stress, tiredness, and lack of sleep have escalated across the world. Immunity, which along with heart health and overweight had fallen out of the top 10 concerns earlier in 2020 for North America and Europe, are now once again mainstream health worries.

Already in 2019 and 2020 we saw a redefinition of health to include mental as well as physical well-being (Euromonitor, 2020 Food and Nutrition Survey). “Mental well-being” and “feeling ‘good’” are the ways consumers now describe the meaning of health, outpacing “absence of disease,” “healthy appearance,” and “living longer,” which fell out of the top 10 ways to define health.

Immune health has risen to the third most significant health concern in the U.S. and China, according to HealthFocus. Immunity is the number one reason U.S. Millennials take a supplement, number two overall, per CRN’s 2020 U.S. Consumer Survey on Dietary Supplements. Since COVID-19, those aged 65 and older have joined Millennials, especially those with kids, as the top immune-seekers. Globally, vitamin C is the most popular immune-boosting supplement, along with vitamin D, B vitamins, omega-3, and probiotics, per Euromonitor’s October 2020 Health & Nutrition Trends Webinar (Figure 4).

Figure 4. Supplement Users by Immune Seekers Globally

Source: Euromonitor’s Oct. 2020 Health & Nutrition Trends Webinar

A majority of U.S. consumers link probiotics and the microbiome to immune health (55%); 68% of global consumers. Nearly, two-thirds of global consumers link digestive heath to daily energy, mood, and weight management, according to HealthFocus. Half (55%) of global consumers select foods with digestive health in mind. Digestive health problems (e.g., diarrhea and gas) are consumers’ fourth most important health concern in China.

More Aggressive Weight Management

One-third of consumers in Japan, South Korea, China, and Russia reported under-exercising during the pandemic last year; one-quarter in Canada, U.K., and Russia reported over-eating, according to Ipsos’ 2020 COVID-19 Poll across 16 major countries. In the U.S., 40% of those aged 18-24, one third of Millennials/Gen X, and one-quarter of Boomers gained weight since COVID-19, according to the Natural Marketing Institute, spawning new opportunities for the weight loss category. For example, Jenny Craig’s new Rapid Results Max weight loss program is based on intermittent fasting and a Recharge Bar to increase fat burn.

In 2020, the U.S. weight management market fell slightly to $71 billion. Through 2021-2027, the China weight management market is projected to grow at a GAGR of 10.6% to reach $92.6 billion; Asia-Pacific will top $58 billion, per ReportLinker’s December 2020 Global-Weight Management Industry. The Japanese market will grow at a CAGR of 3.9%, Canada 6.3%, and Germany 4.5% through 2027.

According to Zhou et al (Lancet, Jun. 24, 2019), 26% of adults in China are obese/overweight, 16% of children. In the U.S., 121 million consumers tried to lose weight in 2019, according to Mintel. In 2020, 14% of U.S. supplement users took a weight management supplement, 36% want more product options, per the Hartman Group’s 2020 Functional Foods & Beverages and Dietary Supplements (Figure 5).

Protein supplements are the choice for 48% of consumers looking for weight management solutions in South Korea, Thailand, and Australia; 45% in Indonesia, according to Euromonitor’s 2019 Evolving Trends in Food & Nutrition webinar.

Figure 5. Current Use of/Interest in Supplements by Condition

Source: Hartman Group, 2020 Functional Foods & Beverages and Dietary Supplements

Dollar sales of foods and beverages carrying a “lifestyle” diet claim grew 13% for the year ended Dec. 27, 2020, per IRI February 2021 innovation report. Sales of foods with a low-carbohydrate positioning reached $136.9 million in the U.S.; ketogenic, $68.5 million; paleo, $56.9 million; the Whole 30 Diet, $54.2 million; and low-glycemic, $19.3 million, according to IRI.

Fit Consumers

Faced with a new set of health/lifestyle issues driven by COVID-19, consumers are increasingly opting to live a more “fit” holistic active lifestyle which uses exercise as a means to help manage their health and mental well-being. We have previously discussed the “Fit Consumer” as consumers differentiated by integrating frequent physical exercise (three to five days per week for at least 30 minutes each day) and a focus on enhancing their everyday mental and physical performance. While fit consumers span all age groups, core consumers are under age 40; the older edge is 65 years (See Sloan & Adams Hutt, The Fit Consumer March, 2019).

As 2020 closed, the number of “fit” consumers in the U.S. were more than double those who considered themselves athletes (37% vs. 16%, per Mintel) and they will continue to drive the sports nutrition sector. Six in 10 global consumers were committed to exercising more frequently this year, spawning new fitness trends and a demand for more aggressive sports nutrition, weight loss, and energizing foods/supplements. Watch for more home centered exercise applications/product forms, more emphasis on seniors and at-risk exercisers, and a greater emphasis on exercise for kids/teens. (See Sloan & Adams Hutt, The Exercise as Medicine Movement, December 2020.)

Mobility & Sarcopenia

Concerns about mobility have also escalated due to COVID-19, with consumers increasingly seeking dietary support for muscle, strength, healthy aging, and joint support, per HealthFocus.

Being in relative lockdown has made some more aware of mobility issues. Lack of mobility and movement restriction caused by COVID are of special concern to the aging consumer. Sarcopenia, the age-related loss of lean body mass, strength, and function, is a prevalent concern among seniors globally.

Sarcopenia is now recognized as a disease by the World Health Organization and is preventable and reversible through nutrition and exercise. In the U.S., 45% of those over 65 years of age have some degree of sarcopenia; 20 million Japanese are sarcopenia patients; in China, 12% of women and 8% of men over 70 years are affected, according to Ipsos October 2020 Global Aging Study. Asia has taken the lead in combating sarcopenia and has established specialized organizations to address the disease. Supplements that provide high quality protein in sufficient amount (20-30 grams per serving)can effectively target sarcopenia concerns; the opportunity is to call out the risk for this debilitating condition for consumers seeking solutions.

Stress Levels & Anxiety Will Linger

One-quarter (25%) of consumers in 16 major countries have increased levels of anxiety since the beginning of the pandemic, led by Canada, Italy, U.K., Germany, China, and France, according to Ipsos’ 2020 COVID-19 Poll. One half of U.S. Millennials report being more anxious, per NMI. Anxiety is now the number one condition U.S. consumers are trying to prevent and/or treat, according to the Hartman Group. One-third globally are taking measures to treat anxiety, stress, and mental health, according to Euromonitor, Health and Wellness Survey, February 2020.

While those under the age of 45 are most affected by stress, anxiety, and sleep issues, 39% of Gen X and 36% of Boomers in the U.S. report being more anxious than they used to be; 32% and 21%, respectively, are not as focused or concentrated on tasks; and 26% and 18%, respectively, report their ability to get a good night’s sleep is more difficult, according to NMI. Sleep problems are second only to COVID-19 as the number one health concern in China, according to HealthFocus. Energy and sleep supplements will remain in high demand.

Supplements aimed at sleep support and passive restoration (i.e., restoring and building muscle and bone strength) are key for this market now and going forward. Vick’s/Procter and Gamble’s ZzzQuil Pure Zzzs promotes beauty sleep; Bayer’s Alka-Seltzer PM supports sleep while relieving heartburn. Natrol’s Sleep product includes Sleep’n Restore in its name.

Concerns for relief from anxiety and desire for more sleep and unwinding is likely to drive the CBD market; 60% of consumers use CBD for unwinding, 42% for stress, 41% anxiety, 35% relaxation, and 58% use it for pain (New Frontier, Cannabis in America 2021 & Beyond, February, 2021).

Heart Off the Back Burner

COVID focused unprecedented attention on at-risk individuals, especially those with heart issues or diabetes. By the fourth quarter of 2020, cardiovascular disease (CVD) and heart health were on the top 10 health issues in the U.S., China, and Germany, according to HealthFocus.

CVD affects 423 million consumers globally, with 6 million new cases reported each year in the E.U., according to the World Health Organization (2019); 122 million Americans have CVD. Four in 10 supplement users want more supplements to lower cholesterol. In the U.S., heart health is now the number four reason for taking supplements, per CRN. It is time to put the American Heart Association’s Heart Check symbol on foods and beverages. New Cinnamon Cheerios cereal from General Mills carries a “can help lower cholesterol”claim.

COVID-19 has driven greater recognition of the growing global diabetes epidemic. One third of all diabetics live in Asia; 463 million people worldwide are afflicted, according to the International Diabetes Federation, World Atlas of Diabetes, 2019.

No Kidding …

Ironically, although 55% of school-aged children and 61% of teens were still learning remotely as of January 2021, according to IRI, with limited exposure to others, the pandemic has drawn much needed attention to kids’ health. For the year ended Nov. 29, 2020, sales of vitamins/minerals for children jumped 34%, according to SPINS. An immune boost was the top reason for increased use.

Per the Dietary Guidelines for Americans,vitamin D, calcium, dietary fiber, and potassium are the nutrients of public health significance deficient in children aged 1-8. Nutrients under consumed but not a public health issue include vitamins A, C, E, K, magnesium, and choline.

Parents in households with kids are more likely than those without kids at home to say it is important to eat fortified foods (66% versus 53%), per HealthFocus. Horizon Organic’s Growing Years milks deliver omega-3 DHA, choline, and prebiotics, as well as protein and calcium.

While the anticipated COVID baby boom did not take place, with 30% of families delaying planned pregnancies during the pandemic, per the Brookings Institution, babies remain big business. Baby foods were the fastest-growing frozen food item for the year ending Oct. 4, per IRI.

Four-Legged Friends as Family

Expect 2021 to be a blockbuster year for the pet food, supplement, and functional pet food businesses. Nearly two-thirds (63%) of U.S. households own at least one dog, 43% at least one cat. One-quarter of dog owners and 21% of cat owners added another dog/cat to their house since the pandemic, according to Packaged Facts’ January 2021 Pet Supplements U.S.

The U.S. pet food and treat market is a $39 billion opportunity, $23 billion in the E.U., and expected to be $24.5 billion in China by 2024. Other countries with at least $1 billion in combined dog and cat food sales include Canada, France, Spain, U.K., Italy, Germany, Japan, Brazil, Argentina, and Australia, per Packaged Facts. According to the European Pet Food Federation, there were over 106 million cats in Europe and over 87 million dogs as pets in 2020.

Since the pandemic, four in 10 dog and 42% of cat parents are paying more attention to their pet’s health. Immunity and anxiety top their pet health concerns.

Pet supplement sales jumped 21% in 2020 to $800 million and are projected by Packaged Facts to top $1.2 billion by 2025. Pet CBD product sales are fast approaching $100 million.

Hairball is the most used condition-specific pet food formulation for cats/dogs, followed by indoor pet, skin/coat, joint/mobility, dental care, urinary health, digestive, and heart health, per Packaged Facts. Joint/mobility, multivitamins, skin/coat, and immunity are the most purchased supplements (Figure 6).

Figure 6. Condition-specific Pet Supplements & Pet Food Use

Source: Packaged Facts, January 2020 Pet Supplements U.S.

About the Authors: Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: Phone: 760-741-9611; E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.