By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.07.03.19

Sales of energy beverages in the U.S. jumped 8.4% in retail dollars in 2018 and 8.6% in volume, making them the second-fastest-growing major beverage category after value-added water, according to the Beverage Marketing Corporation’s May 29 press release, “U.S. Liquid Refreshment Beverage Market.”

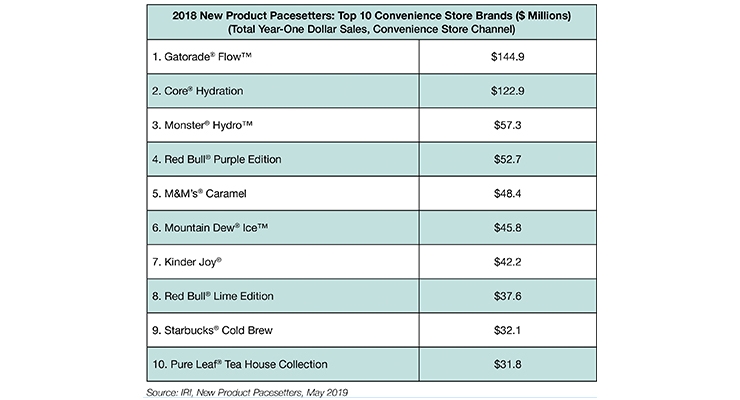

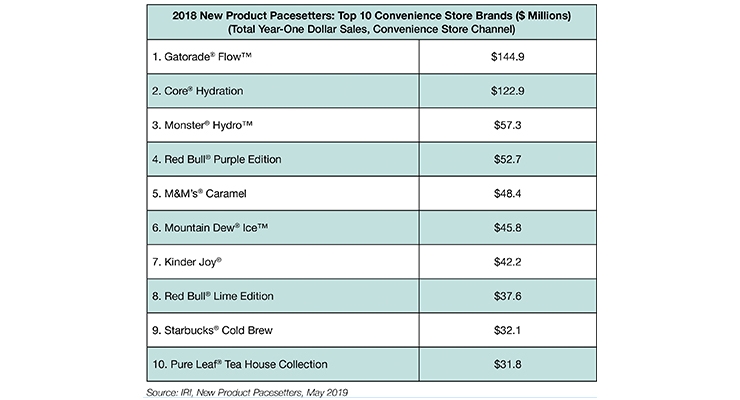

Monster Hydro ranked third among the best-selling new foods/beverages in convenience stores last year, according to IRI’s May 2019 New Product Pacesetters annual report; with $57.3 million in year-one sales. Red Bull’s Purple Edition ranked fourth and Red Bull’s Lime Edition, ninth, with $37.6 million (Figure 1).

Figure 1: Top 10 Best-Selling New Foods/Drinks in Convenience Stores 2018

Vital Pharmaceuticals’ Bang energy drinks, Brain and Body Fuel, with creatine, caffeine, and BCAAs (branched chain amino acids) continued their meteoric rise, reaching sales of $273 million for the past year, per Wells Fargo (Dec. 28, 2018).

Perhaps most important, the energy and sports drink categories had more “best-sellers” among IRI’s new product pacesetters than other drink categories, including traditional soft drinks and

alcohol products.

New Opportunities & Issues

Energy ranks third, just behind heart health and weight management, as the health benefit consumers would most like to get from foods/beverages, according to IFIC’s 2018 Food & Health Survey.

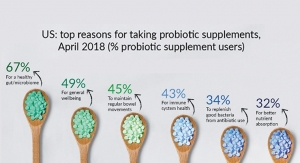

Right after “general well-being” and “nutrient deficiencies,” “increased energy” is the most popular reason for taking a dietary supplement. In 2018, just over one third (35%) of supplement users took a supplement to increase energy, per Mintel’s Vitamins, Minerals & Supplements US – September 2018.

Forty-four percent of consumers are trying to manage or treat fatigue/low energy: 40% with exercise, 38% foods/beverages, and 32% supplements, according to the Hartman Group’s Health & Wellness 2017.

Low energy is no longer just a concern of younger adults. According to HealthFocus’ 2019 U.S. Consumer Trends Survey, 57% of those aged 18-39 are extremely/very concerned about tiredness/lack of energy, 51% of those aged 40-49, and 54% aged 50-64.

Energy for adults age 50 and over is a fast-emerging opportunity. Seventy percent said they have less energy than 20 years ago; 50% that they don’t have the energy to do the things they really want to do, per IFIC’s 2018 Nutrition Over 50.

Gallup’s 2018 HealthWays Exercise Survey reported that half of adults 65 and older exercised three or more days/week for more than 30 minutes. Twenty million 65 and older were exercise walkers, 8 million aerobic exercisers, and 5 million worked out at a gym in 2018, per the National Sporting Goods Association.

Parents with kids at home are another high potential target. As the number of kids in the household increases, energy drink/shot use grows. Parents with three or more kids are twice as likely to use energy beverages vs. childless adults their age, according to Packaged Facts’ May 2017 Energy and Sports Drinks.

With the number of millennial parents expected to double from 40% to 80% over the next five years, the market will grow bigger still. One in five parents exercise regularly so that they have the energy to “keep up with my kids,” per Mintel’s Exercise Trends – US, 2016.

The massive mainstream “fit consumer” demographic—characterized by exercising for at least 30 minutes three or more times per week and living a healthier lifestyle—could be as much as 40% of the U.S. population, representing another fast-moving emerging mainstream opportunity.

Seventy-two percent of “fit” consumers say they always/usually choose foods to help improve their energy level, according to HealthFocus. Three-quarters say they change what they eat to meet their body’s need for different levels of activity.

Just over half of adults cite “more energy” as a reason for using plant-based foods, beverages, powders, and bars; two thirds of younger adults aged 18-29 and households with kids are the most likely to say they do so for extra energy, per HealthFocus. Nearly half (44%) of the 27% of supplement users who took a protein supplement for sports or weight loss in 2018 opted for plant protein, per CRN’s 2018 Consumer Survey on Dietary Supplements.

Perhaps, most important, one third of adults are looking for products that provide sustainable energy; one quarter mental energy, 20% morning energy, and 16% energy for sports/exercise, according to HealthFocus.

Protein: A Missed Energizing Opportunity?

One of the highest potential opportunities may rest with tying energy more closely with protein, perhaps by the addition of other mainstream energizing ingredients (e.g., adding B vitamins to protein shakes, powders, and even bars). Other ingredients that can provide energy include caffeine, including natural sources like guarana, matcha, yerba mate, and green coffee extract. Ginger is another naturally energizing ingredient.

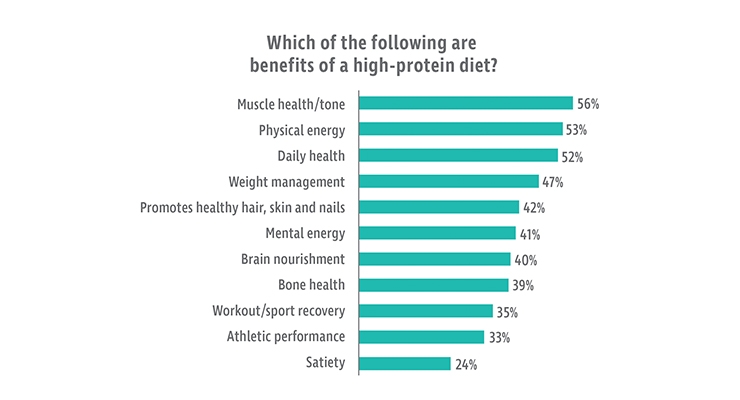

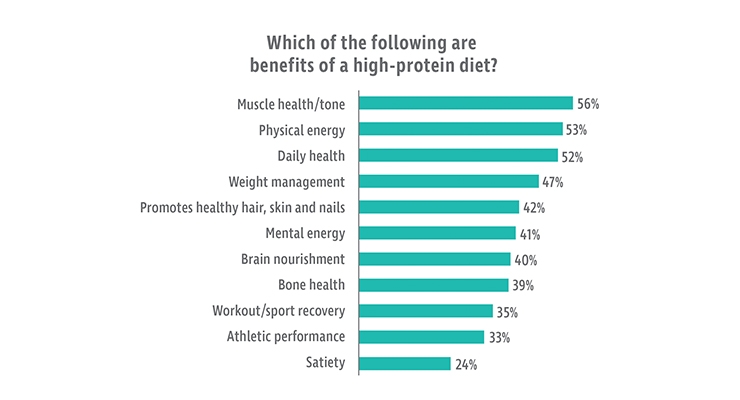

HealthFocus reported that energy is second only to muscle in terms of the health benefits consumers associate with protein; 53% of adults most-associate protein with energy, 41% mental energy (see Figure 2).

Figure 2: Benefits Consumers Most Associate with Protein

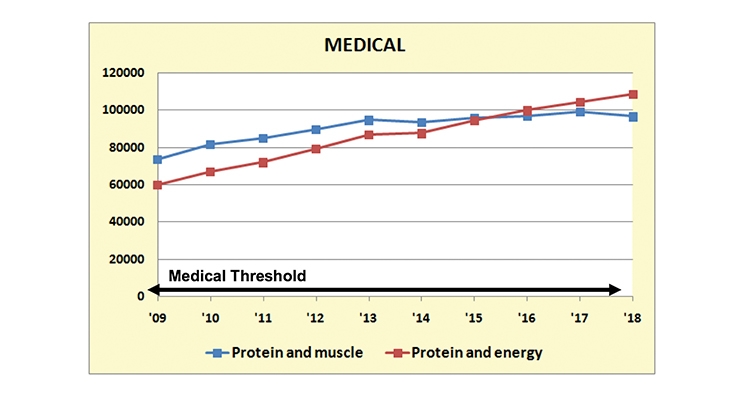

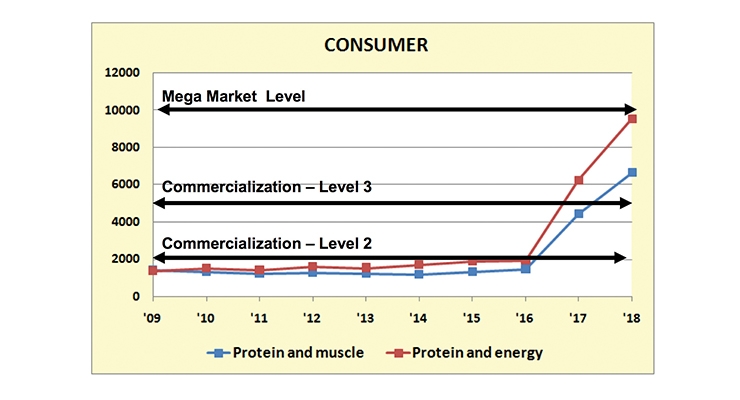

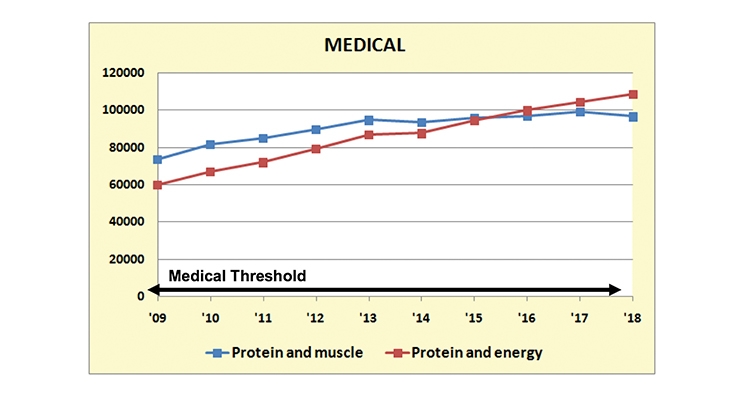

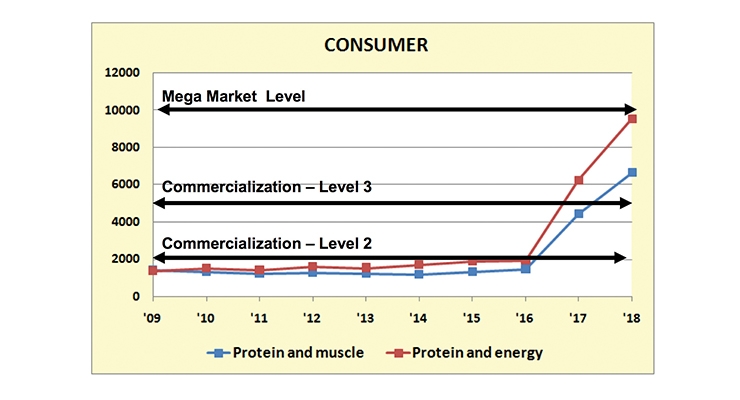

As seen in Sloan Trends’ TrendSense model (Figures 3 and 4), protein/energy is fast approaching mega market status, as protein/muscle continues to accelerate as a very large level 3 market opportunity. Perhaps most important is that Medical Counts, although at a massive level for both protein associations, continue to accelerate through new research findings, which will help to effectively market the energy/protein connection.

Nielsen reported that high protein was very important to 55% of U.S. households in 2018. Interestingly, half of consumers also link natural protein products like meat with providing energy, 43% poultry; 62% and 66% of millennials, respectively, per FMI’s 2015 Power of Meat.

Figures 3 and 4: TrendSense Predictive Model Protein/Energy and Protein/Muscle

Source: Sloan Trends 2019

Energy Supplements

Sales of energy supplements are predicted by Nutrition Business Journal (NBJ) to reach $2.5 billion by 2021 with an estimated CAGR of 8% from 2019 to 2021.

Younger adults aged 18-24 are the most likely to take an energy supplement (37%), followed by those 35-54 (33%), and aged 55 and over (21%), per CRN. Just over one quarter (26%) of all supplement users took a B vitamin supplement and 16% green tea in 2018; 13% of millennials took ginseng/ginkgo, and 23% green tea, per CRN.

Energizing Edibles

When it comes to functional foods, energy topped the list of “go-to” benefits of interest for 57% of adults, according to Datassential’s November 2018 Functional Food report.

Thirty percent of adults are very/extremely interested in drinkable products that provide sustainable energy, 50% aged 18-29, and 44% 30-39; 28% are interested in a boost of energy, 45% aged 18-29, and 18% of those aged 30-39, per HealthFocus.

Sales of energy mixes, which consist of a liquid or powder concentrate that can be added to water, while still a small market segment, increased 16% in mass outlets for the year ended May 22, per IRI. Low-sugar, all-natural ingredients, and low-calorie options are also driving strong sales.

The largest untapped opportunity for energizing products may rest with functional snacks, with sales projected by NBJ to reach $8.5 billion by 2020.

Two thirds (64%) want snacks that give them an energy boost, up 8% over the past two years, according to IRI’s 2019 State-of-the-Snack Food Industry; seven in 10 under age 44.

With 57% of bar users and 82% of shake users primarily eating them as a snack, and over half of users buying bars and shakes for their protein content, high protein energizing snacks will find a

welcome market.

At this year’s Institute of Food Technologists meeting, nutrient premix marketer, Watson, Inc. introduced a snackable Heart Bar prototype—like a KIND bar in texture (blueberry, pomegranate, almond). Each piece was individually wrapped as a square snack bite with four snacks in a standard packaged-bar format.

Additionally, Watson introduced a new energizing pop-rocks candy prototype—Powersparks in “blue raspberry energy crystals” that delivers 2.5 times the energizing jolt of a can of Red Bull—in a pocket-sized format.

Although B vitamins, ginseng, ginkgo, taurine, caffeine, and guarana are the more popular energizing ingredients, matcha and ginger are moving into the mainstream for energy. It is important that ingredients promising to support the energy platform work.

Lastly, it’s not all about ingestibles when it comes to improving energy levels. Four in 10 consumers buy fitness gadgets/products to get more energy; 21% for improving their energy for sports training, per ECRM/HellaWella’s 2016 survey.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Monster Hydro ranked third among the best-selling new foods/beverages in convenience stores last year, according to IRI’s May 2019 New Product Pacesetters annual report; with $57.3 million in year-one sales. Red Bull’s Purple Edition ranked fourth and Red Bull’s Lime Edition, ninth, with $37.6 million (Figure 1).

Figure 1: Top 10 Best-Selling New Foods/Drinks in Convenience Stores 2018

Vital Pharmaceuticals’ Bang energy drinks, Brain and Body Fuel, with creatine, caffeine, and BCAAs (branched chain amino acids) continued their meteoric rise, reaching sales of $273 million for the past year, per Wells Fargo (Dec. 28, 2018).

Perhaps most important, the energy and sports drink categories had more “best-sellers” among IRI’s new product pacesetters than other drink categories, including traditional soft drinks and

alcohol products.

New Opportunities & Issues

Energy ranks third, just behind heart health and weight management, as the health benefit consumers would most like to get from foods/beverages, according to IFIC’s 2018 Food & Health Survey.

Right after “general well-being” and “nutrient deficiencies,” “increased energy” is the most popular reason for taking a dietary supplement. In 2018, just over one third (35%) of supplement users took a supplement to increase energy, per Mintel’s Vitamins, Minerals & Supplements US – September 2018.

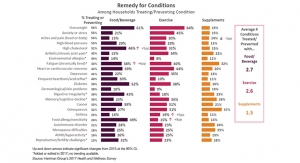

Forty-four percent of consumers are trying to manage or treat fatigue/low energy: 40% with exercise, 38% foods/beverages, and 32% supplements, according to the Hartman Group’s Health & Wellness 2017.

Low energy is no longer just a concern of younger adults. According to HealthFocus’ 2019 U.S. Consumer Trends Survey, 57% of those aged 18-39 are extremely/very concerned about tiredness/lack of energy, 51% of those aged 40-49, and 54% aged 50-64.

Energy for adults age 50 and over is a fast-emerging opportunity. Seventy percent said they have less energy than 20 years ago; 50% that they don’t have the energy to do the things they really want to do, per IFIC’s 2018 Nutrition Over 50.

Gallup’s 2018 HealthWays Exercise Survey reported that half of adults 65 and older exercised three or more days/week for more than 30 minutes. Twenty million 65 and older were exercise walkers, 8 million aerobic exercisers, and 5 million worked out at a gym in 2018, per the National Sporting Goods Association.

Parents with kids at home are another high potential target. As the number of kids in the household increases, energy drink/shot use grows. Parents with three or more kids are twice as likely to use energy beverages vs. childless adults their age, according to Packaged Facts’ May 2017 Energy and Sports Drinks.

With the number of millennial parents expected to double from 40% to 80% over the next five years, the market will grow bigger still. One in five parents exercise regularly so that they have the energy to “keep up with my kids,” per Mintel’s Exercise Trends – US, 2016.

The massive mainstream “fit consumer” demographic—characterized by exercising for at least 30 minutes three or more times per week and living a healthier lifestyle—could be as much as 40% of the U.S. population, representing another fast-moving emerging mainstream opportunity.

Seventy-two percent of “fit” consumers say they always/usually choose foods to help improve their energy level, according to HealthFocus. Three-quarters say they change what they eat to meet their body’s need for different levels of activity.

Just over half of adults cite “more energy” as a reason for using plant-based foods, beverages, powders, and bars; two thirds of younger adults aged 18-29 and households with kids are the most likely to say they do so for extra energy, per HealthFocus. Nearly half (44%) of the 27% of supplement users who took a protein supplement for sports or weight loss in 2018 opted for plant protein, per CRN’s 2018 Consumer Survey on Dietary Supplements.

Perhaps, most important, one third of adults are looking for products that provide sustainable energy; one quarter mental energy, 20% morning energy, and 16% energy for sports/exercise, according to HealthFocus.

Protein: A Missed Energizing Opportunity?

One of the highest potential opportunities may rest with tying energy more closely with protein, perhaps by the addition of other mainstream energizing ingredients (e.g., adding B vitamins to protein shakes, powders, and even bars). Other ingredients that can provide energy include caffeine, including natural sources like guarana, matcha, yerba mate, and green coffee extract. Ginger is another naturally energizing ingredient.

HealthFocus reported that energy is second only to muscle in terms of the health benefits consumers associate with protein; 53% of adults most-associate protein with energy, 41% mental energy (see Figure 2).

Figure 2: Benefits Consumers Most Associate with Protein

Source: HealthFocus, 2019

As seen in Sloan Trends’ TrendSense model (Figures 3 and 4), protein/energy is fast approaching mega market status, as protein/muscle continues to accelerate as a very large level 3 market opportunity. Perhaps most important is that Medical Counts, although at a massive level for both protein associations, continue to accelerate through new research findings, which will help to effectively market the energy/protein connection.

Nielsen reported that high protein was very important to 55% of U.S. households in 2018. Interestingly, half of consumers also link natural protein products like meat with providing energy, 43% poultry; 62% and 66% of millennials, respectively, per FMI’s 2015 Power of Meat.

Figures 3 and 4: TrendSense Predictive Model Protein/Energy and Protein/Muscle

Source: Sloan Trends 2019

Energy Supplements

Sales of energy supplements are predicted by Nutrition Business Journal (NBJ) to reach $2.5 billion by 2021 with an estimated CAGR of 8% from 2019 to 2021.

Younger adults aged 18-24 are the most likely to take an energy supplement (37%), followed by those 35-54 (33%), and aged 55 and over (21%), per CRN. Just over one quarter (26%) of all supplement users took a B vitamin supplement and 16% green tea in 2018; 13% of millennials took ginseng/ginkgo, and 23% green tea, per CRN.

Energizing Edibles

When it comes to functional foods, energy topped the list of “go-to” benefits of interest for 57% of adults, according to Datassential’s November 2018 Functional Food report.

Thirty percent of adults are very/extremely interested in drinkable products that provide sustainable energy, 50% aged 18-29, and 44% 30-39; 28% are interested in a boost of energy, 45% aged 18-29, and 18% of those aged 30-39, per HealthFocus.

Sales of energy mixes, which consist of a liquid or powder concentrate that can be added to water, while still a small market segment, increased 16% in mass outlets for the year ended May 22, per IRI. Low-sugar, all-natural ingredients, and low-calorie options are also driving strong sales.

The largest untapped opportunity for energizing products may rest with functional snacks, with sales projected by NBJ to reach $8.5 billion by 2020.

Two thirds (64%) want snacks that give them an energy boost, up 8% over the past two years, according to IRI’s 2019 State-of-the-Snack Food Industry; seven in 10 under age 44.

With 57% of bar users and 82% of shake users primarily eating them as a snack, and over half of users buying bars and shakes for their protein content, high protein energizing snacks will find a

welcome market.

At this year’s Institute of Food Technologists meeting, nutrient premix marketer, Watson, Inc. introduced a snackable Heart Bar prototype—like a KIND bar in texture (blueberry, pomegranate, almond). Each piece was individually wrapped as a square snack bite with four snacks in a standard packaged-bar format.

Additionally, Watson introduced a new energizing pop-rocks candy prototype—Powersparks in “blue raspberry energy crystals” that delivers 2.5 times the energizing jolt of a can of Red Bull—in a pocket-sized format.

Although B vitamins, ginseng, ginkgo, taurine, caffeine, and guarana are the more popular energizing ingredients, matcha and ginger are moving into the mainstream for energy. It is important that ingredients promising to support the energy platform work.

Lastly, it’s not all about ingestibles when it comes to improving energy levels. Four in 10 consumers buy fitness gadgets/products to get more energy; 21% for improving their energy for sports training, per ECRM/HellaWella’s 2016 survey.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.