By Sean Moloughney, Editor06.03.19

Consumers are searching for convenient beverage options that offer nutritional value and specific health benefits, including protein, vitamins and minerals, energy and relaxation support. At the same time, people want healthy, low-sugar or sugar-free products. And it doesn’t hurt if they sparkle either.

Tapping into Trends

According to HealthFocus International‘s 2019 USA Trend Study: Shoppers’ Journey Towards Living & Eating Healthier, 39% of consumers overall agree that beverages can provide the same nutrition as foods. Young people in particular are likely to believe that idea (59% of 18-29 year olds; 54% of 30-39 year olds), as well as households with children (54%), fueling a trend HealthFocus has termed “Drinkable Health.”

In fact, 38% of consumers are very or extremely interested in drinks that offer health benefits; 61% of 18-29 year olds; 42% of men; and 49% of households with children.

In terms of usage patterns, 26% of consumers reported drinking fruit and vegetable juice blends once a week or more in 2018; vegetable juice 24%; plant milks 23% (e.g., almond, cashew, rice, coconut); sparkling water 23%; sports drinks 22%; vitamin or mineral fortified bottled water 21%; protein drinks 20%.

Convenience (34%), weight management (33%), and added vitamins and nutrients (33%) were top attributes in which consumers expressed strong interest.

Millennials have a unique perception of beverages, according to the Hartman Group, which said in its Modern Beverage Culture report, that “The combination of relaxed norms around eating and drinking and the increased importance of health and wellness in our food and beverage choices has expanded the roles that beverages play in our everyday lives.”

Millennials have a broad range of motivations and aspirations when it comes to beverages. For example, the desire to drink more water and consume less sugar and soda is tied to their health and wellness goals. When asked what they would like to change about what they drink, 49% said more water, 32% less soda, 29% less sugar, 25% less caffeine, 22% more nutritious, 22% more tea, 20% more natural/less processed.

According to Innova Market Insights, the five fastest-growing beverage categories in the U.S. in 2018—comparing product launch numbers for that year with those in 2017 as an approximate percentage change—were: 1) Sports Protein Based Ready-to-Drink (RTD) (+93%), 2) Meal Replacement & Other Drinks (+62%), 3) Energy Drinks (+50%), 4) Drinking Yogurt (+48%), and 5) Unflavored Bottled Water (+48). Globally, the top five categories were 1) Sports Drinks RTD (+62%), 2) Sports Protein Based RTD (+60%), 3) Iced Coffee (+50%), 4) Meal Replacements & Other Drinks (+28%), and 5) Iced Tea (+24%).

“Functional beverage categories are leading the growth parade, including sports protein-based ready-to-drink products, meal replacements, and even energy drinks,” said Tom Vierhile, vice president, strategic insights, North America, Innova Market Insights. “Some of these categories are quite niche, including sports protein-based RTD products and meal replacements and other drinks. The latter is a commentary on the desire to ‘snackify’ beverages.”

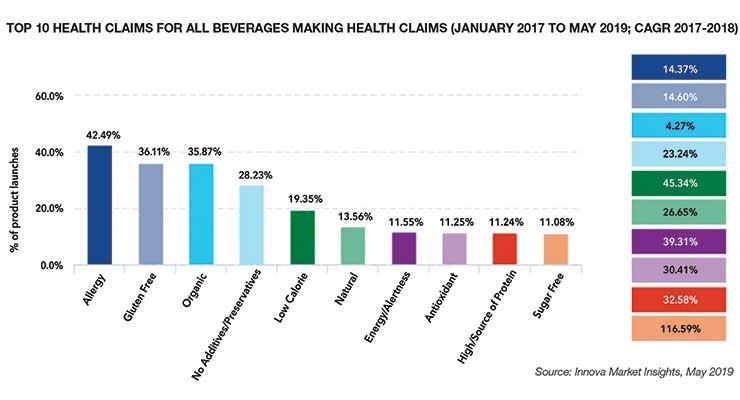

In terms of health claims, sugar reduction and functionality—including energy and protein—are top trends around the world, according to Innova. The top three claims for U.S. beverage launches, ranked by largest CAGR from 2017 to 2018, were 1) Sugar Free (+117%), 2) Low Calorie (+45%), and 3) Energy/Alertness (+39%). Globally, the top claims were 1) High/Source of Protein (+26%), 2) Low Calorie (+16%), and 3) No Added Sugar (+15%).

Growth in soft drinks in the U.S. in 2018 almost entirely stemmed from beverages that are naturally healthy, according to Euromonitor International. “Consumers are increasingly looking for natural products and are leery of both added sugars and artificial sweeteners,” the firm said in its report Naturally Healthy Beverages in the US.

Products with shorter and easier to understand ingredient lists are outperforming those with more additives. For example, within RTD coffee, the strongest growth is occurring in the cold brew category, which mainly consists of coffee and water.

In the juice category, consumers are attracted to the naturally healthy benefits that come from superfruits rather than from ingredients added to the fruit, Euromonitor noted. Superfruit juices with 100% juice content in particular have seen growth unlike almost every category within fruit/vegetable juice, the firm stated.

Overall, interest in new fruits and flavors has been expanding within fruit/vegetable juice. While cranberry has long been the most recognizable ingredient within superfruit juices in the U.S., consumers are becoming interested in new types of ingredients for their taste and nutritional benefits.

Tea constitutes the third-most important category in naturally healthy beverages behind bottled water and naturally healthy fruit/vegetable juice, Euromonitor noted. Its importance will continue to grow as it takes away consumption occasions from fruit and vegetable juice.

Success in Sparkling

Interest in sparkling water has continued to percolate into the mainstream, according to Nielsen data. In fact, for the 12 months ended July 28, 2018, sales of sparkling water across all Nielsen-tracked channels reached $2.2 billion. Within the past four years, the sparkling water category grew 54%.

There has been resurgence in sparkling beverages in other categories as well—most notably seen in the RTD tea category, with the rising popularity of kombucha (+49% dollar growth over the 52 weeks ending July 28, 2018).

“Renewed interest in sparkling waters is yet another reflection of consumers’ ongoing shift toward opting to make healthier choices,” Nielsen said. The sparkling water category taps into several health and wellness trends, including focus on low carbohydrate and low calorie options. Beyond the potential health benefits, these drinks can be refreshing and provide interesting flavors.

Major companies and brands are responding to demand. For example, Coca-Cola introduced sparkling Smartwater this year. It also debuted Odwalla Smoobucha, a smoothie-kombucha drink available in three flavors: Apple & Greens, Berry & Ginger, and Citrus & Guava.

Market research firm Packaged Facts has noted that consumers are looking for plant-based alternatives across most food and beverage categories—in most cases driven by a desire for healthier sources of protein or to suit vegan, vegetarian, and flexitarian diets.

Following the success of coconut water, companies are tapping into other trees. For example, maple and birch sap yield water that is packaged and marketed as offering functional benefits, in addition to unique flavors. For example, Drink Simple maple water is “naturally alkaline and contains electrolytes, antioxidants, and prebiotics.” The company also claims that maple water is more hydrating than water with half the sugar of coconut water.

Similarly, Sap! calls its waters “plant-based superfood sparkling beverages” made from 100% pure maple and birch sap sourced in Vermont. The company said its line of Bubbles with Benefits contains nutrients and antioxidants that can help boost immunity, fight fatigue, and reduce inflammation.

Asarasi Sparkling Tree Water is also sourced from maple sap and positioned as a more sustainable choice than typical bottled water.

Energy on the Rise

The U.S. beverage market overall is benefiting from the added intrigue of new innovations and formulations in recent years, according to Packaged Facts. Efforts by marketers and manufacturers have given the otherwise mature beverage industry the buoyancy necessary to stay afloat and thrive, the firm said in its report U.S. Beverage Market Outlook 2019.

Among the most important recent innovations Packaged Facts identified in its report involves mashups—the crossover fusion of two or more beverage products that traditionally wouldn’t be expected to go together. For example, here are a few mashup trends expected to spur growth in the beverage industry.

1) Coffee is being integrated into sparkling beverages, energy drinks, and juices. This is a trend that should see continued expansion as consumers seek the indulgence and flavor of coffee while also thirsting for the effervescence of a carbonated beverage, the additional boost of energy ingredients, and/or more taste options.

“The carbonated soft drink or soda category is challenged, but many consumers moving away from soda still want flavored drinks that have bubbles,” said David Sprinkle, research director for Packaged Facts. “They also want healthier, more natural versions with less or no sugar. One of these soda alternatives is ready-to-drink coffee, which has seen a spate of sparkling versions on store shelves. Even more interesting is when we see coffee and sodas converge into an amalgamation that satisfies multiple tastes with a single beverage.”

One example, Matchless Coffee Soda, is made from locally roasted coffee which is brewed hot and flash-chilled. The drink is sweetened with Demerara sugar and carbonated. Similarly, Brooklyn-based startup Keepers produces sparkling coffee in two versions—Citrus and Black. The company roasts organic beans using a Japanese flash cold-brewing method, and blends the coffee with fresh-pressed Florida tangerine juice to make the Citrus version. Also in the conversation is Upruit, which offers a blend of cold-pressed fruit juice and cold brew coffee with light carbonation.

Beyond soda and juice, coffee is also being paired with bottled water. Happy Tree combines cold brew coffee with its maple water, which is marketed with focus on its naturally-occurring nutrients not found in traditional water and on the fact the beverage is sweet yet low in calories.

On a similar development trajectory to coffee, tea is increasingly being incorporated into sparkling beverages, energy drinks, and juices. The results impart tea’s health benefits into beverages whose energy ingredients, carbonation, and flavors often have a wider appeal to younger adults.

As a soda alternative, new products to market include sparking versions of RTD tea. An interesting sparkling iced tea brand is Sound Sparkling Tea, available in Chamomile, Green Tea, Rose Tea, Yerba Mate, and White Tea versions.

Tea merges into the energy drink space not only with stimulants like guayusa, green tea, and matcha, but also yerba mate, which is starting to catch on with young millennial consumers who are often adventurous with their food and beverages. The Guayaki organic iced tea brand features yerba mate more prominently than its own name on its bottle’s label.

Similarly, DanoneWave’s STōK brand added a new range of cold brewed teas, STōK Yerba Mate Cold Brew Teas, to complement its cold brewed coffees. The teas contain 75% more caffeine than typical RTD iced teas.

There is an increasing blurring of the lines between sports and energy drinks, and indeed for many beverage categories. An example of that is hybrid RTD energy teas and coffees. Coffee and tea are naturally energizing; and most Americans would consider these beverages their original energy drink. After all, they share the most ubiquitous energy ingredient—caffeine—with today’s most popular energy drinks. Even everyday cola and its caffeine are used by many consumers as energy drinks. More recently, entrepreneurs have launched coffee and tea-based beverages that more clearly play upon their energy functionality.

Energy drink Runa, backed by celebrities Channing Tatum, Leonardo DiCaprio, and others, gets what it calls its “clean energy” from the Amazon rainforest guayusa leaf, for which the company has built its own vertical supply chain.

Meanwhile, energy shot segment leader 5-hour ENERGY turned the tides with 5-hour TEA Shots, launched in 2018. The product, designed to appeal to more health-conscious users, gets its caffeine from green tea leaves. The drinks contain the same ingredients as regular 5-hour ENERGY except for caffeine.

Phocus sparkling waters border on being energy drinks with 75 mg of natural caffeine from green tea in each can. The waters also contain L-theanine, an amino acid the company said provides a “smoother energy lift.” Phocus promotes “clean energy,” and sets itself apart from traditional energy drinks by claiming the boost of caffeine, “without the crash.”

Tapping into Trends

According to HealthFocus International‘s 2019 USA Trend Study: Shoppers’ Journey Towards Living & Eating Healthier, 39% of consumers overall agree that beverages can provide the same nutrition as foods. Young people in particular are likely to believe that idea (59% of 18-29 year olds; 54% of 30-39 year olds), as well as households with children (54%), fueling a trend HealthFocus has termed “Drinkable Health.”

In fact, 38% of consumers are very or extremely interested in drinks that offer health benefits; 61% of 18-29 year olds; 42% of men; and 49% of households with children.

In terms of usage patterns, 26% of consumers reported drinking fruit and vegetable juice blends once a week or more in 2018; vegetable juice 24%; plant milks 23% (e.g., almond, cashew, rice, coconut); sparkling water 23%; sports drinks 22%; vitamin or mineral fortified bottled water 21%; protein drinks 20%.

Convenience (34%), weight management (33%), and added vitamins and nutrients (33%) were top attributes in which consumers expressed strong interest.

Millennials have a unique perception of beverages, according to the Hartman Group, which said in its Modern Beverage Culture report, that “The combination of relaxed norms around eating and drinking and the increased importance of health and wellness in our food and beverage choices has expanded the roles that beverages play in our everyday lives.”

Millennials have a broad range of motivations and aspirations when it comes to beverages. For example, the desire to drink more water and consume less sugar and soda is tied to their health and wellness goals. When asked what they would like to change about what they drink, 49% said more water, 32% less soda, 29% less sugar, 25% less caffeine, 22% more nutritious, 22% more tea, 20% more natural/less processed.

According to Innova Market Insights, the five fastest-growing beverage categories in the U.S. in 2018—comparing product launch numbers for that year with those in 2017 as an approximate percentage change—were: 1) Sports Protein Based Ready-to-Drink (RTD) (+93%), 2) Meal Replacement & Other Drinks (+62%), 3) Energy Drinks (+50%), 4) Drinking Yogurt (+48%), and 5) Unflavored Bottled Water (+48). Globally, the top five categories were 1) Sports Drinks RTD (+62%), 2) Sports Protein Based RTD (+60%), 3) Iced Coffee (+50%), 4) Meal Replacements & Other Drinks (+28%), and 5) Iced Tea (+24%).

“Functional beverage categories are leading the growth parade, including sports protein-based ready-to-drink products, meal replacements, and even energy drinks,” said Tom Vierhile, vice president, strategic insights, North America, Innova Market Insights. “Some of these categories are quite niche, including sports protein-based RTD products and meal replacements and other drinks. The latter is a commentary on the desire to ‘snackify’ beverages.”

In terms of health claims, sugar reduction and functionality—including energy and protein—are top trends around the world, according to Innova. The top three claims for U.S. beverage launches, ranked by largest CAGR from 2017 to 2018, were 1) Sugar Free (+117%), 2) Low Calorie (+45%), and 3) Energy/Alertness (+39%). Globally, the top claims were 1) High/Source of Protein (+26%), 2) Low Calorie (+16%), and 3) No Added Sugar (+15%).

Growth in soft drinks in the U.S. in 2018 almost entirely stemmed from beverages that are naturally healthy, according to Euromonitor International. “Consumers are increasingly looking for natural products and are leery of both added sugars and artificial sweeteners,” the firm said in its report Naturally Healthy Beverages in the US.

Products with shorter and easier to understand ingredient lists are outperforming those with more additives. For example, within RTD coffee, the strongest growth is occurring in the cold brew category, which mainly consists of coffee and water.

In the juice category, consumers are attracted to the naturally healthy benefits that come from superfruits rather than from ingredients added to the fruit, Euromonitor noted. Superfruit juices with 100% juice content in particular have seen growth unlike almost every category within fruit/vegetable juice, the firm stated.

Overall, interest in new fruits and flavors has been expanding within fruit/vegetable juice. While cranberry has long been the most recognizable ingredient within superfruit juices in the U.S., consumers are becoming interested in new types of ingredients for their taste and nutritional benefits.

Tea constitutes the third-most important category in naturally healthy beverages behind bottled water and naturally healthy fruit/vegetable juice, Euromonitor noted. Its importance will continue to grow as it takes away consumption occasions from fruit and vegetable juice.

Success in Sparkling

Interest in sparkling water has continued to percolate into the mainstream, according to Nielsen data. In fact, for the 12 months ended July 28, 2018, sales of sparkling water across all Nielsen-tracked channels reached $2.2 billion. Within the past four years, the sparkling water category grew 54%.

There has been resurgence in sparkling beverages in other categories as well—most notably seen in the RTD tea category, with the rising popularity of kombucha (+49% dollar growth over the 52 weeks ending July 28, 2018).

“Renewed interest in sparkling waters is yet another reflection of consumers’ ongoing shift toward opting to make healthier choices,” Nielsen said. The sparkling water category taps into several health and wellness trends, including focus on low carbohydrate and low calorie options. Beyond the potential health benefits, these drinks can be refreshing and provide interesting flavors.

Major companies and brands are responding to demand. For example, Coca-Cola introduced sparkling Smartwater this year. It also debuted Odwalla Smoobucha, a smoothie-kombucha drink available in three flavors: Apple & Greens, Berry & Ginger, and Citrus & Guava.

Market research firm Packaged Facts has noted that consumers are looking for plant-based alternatives across most food and beverage categories—in most cases driven by a desire for healthier sources of protein or to suit vegan, vegetarian, and flexitarian diets.

Following the success of coconut water, companies are tapping into other trees. For example, maple and birch sap yield water that is packaged and marketed as offering functional benefits, in addition to unique flavors. For example, Drink Simple maple water is “naturally alkaline and contains electrolytes, antioxidants, and prebiotics.” The company also claims that maple water is more hydrating than water with half the sugar of coconut water.

Similarly, Sap! calls its waters “plant-based superfood sparkling beverages” made from 100% pure maple and birch sap sourced in Vermont. The company said its line of Bubbles with Benefits contains nutrients and antioxidants that can help boost immunity, fight fatigue, and reduce inflammation.

Asarasi Sparkling Tree Water is also sourced from maple sap and positioned as a more sustainable choice than typical bottled water.

Energy on the Rise

The U.S. beverage market overall is benefiting from the added intrigue of new innovations and formulations in recent years, according to Packaged Facts. Efforts by marketers and manufacturers have given the otherwise mature beverage industry the buoyancy necessary to stay afloat and thrive, the firm said in its report U.S. Beverage Market Outlook 2019.

Among the most important recent innovations Packaged Facts identified in its report involves mashups—the crossover fusion of two or more beverage products that traditionally wouldn’t be expected to go together. For example, here are a few mashup trends expected to spur growth in the beverage industry.

1) Coffee is being integrated into sparkling beverages, energy drinks, and juices. This is a trend that should see continued expansion as consumers seek the indulgence and flavor of coffee while also thirsting for the effervescence of a carbonated beverage, the additional boost of energy ingredients, and/or more taste options.

“The carbonated soft drink or soda category is challenged, but many consumers moving away from soda still want flavored drinks that have bubbles,” said David Sprinkle, research director for Packaged Facts. “They also want healthier, more natural versions with less or no sugar. One of these soda alternatives is ready-to-drink coffee, which has seen a spate of sparkling versions on store shelves. Even more interesting is when we see coffee and sodas converge into an amalgamation that satisfies multiple tastes with a single beverage.”

One example, Matchless Coffee Soda, is made from locally roasted coffee which is brewed hot and flash-chilled. The drink is sweetened with Demerara sugar and carbonated. Similarly, Brooklyn-based startup Keepers produces sparkling coffee in two versions—Citrus and Black. The company roasts organic beans using a Japanese flash cold-brewing method, and blends the coffee with fresh-pressed Florida tangerine juice to make the Citrus version. Also in the conversation is Upruit, which offers a blend of cold-pressed fruit juice and cold brew coffee with light carbonation.

Beyond soda and juice, coffee is also being paired with bottled water. Happy Tree combines cold brew coffee with its maple water, which is marketed with focus on its naturally-occurring nutrients not found in traditional water and on the fact the beverage is sweet yet low in calories.

On a similar development trajectory to coffee, tea is increasingly being incorporated into sparkling beverages, energy drinks, and juices. The results impart tea’s health benefits into beverages whose energy ingredients, carbonation, and flavors often have a wider appeal to younger adults.

As a soda alternative, new products to market include sparking versions of RTD tea. An interesting sparkling iced tea brand is Sound Sparkling Tea, available in Chamomile, Green Tea, Rose Tea, Yerba Mate, and White Tea versions.

Tea merges into the energy drink space not only with stimulants like guayusa, green tea, and matcha, but also yerba mate, which is starting to catch on with young millennial consumers who are often adventurous with their food and beverages. The Guayaki organic iced tea brand features yerba mate more prominently than its own name on its bottle’s label.

Similarly, DanoneWave’s STōK brand added a new range of cold brewed teas, STōK Yerba Mate Cold Brew Teas, to complement its cold brewed coffees. The teas contain 75% more caffeine than typical RTD iced teas.

There is an increasing blurring of the lines between sports and energy drinks, and indeed for many beverage categories. An example of that is hybrid RTD energy teas and coffees. Coffee and tea are naturally energizing; and most Americans would consider these beverages their original energy drink. After all, they share the most ubiquitous energy ingredient—caffeine—with today’s most popular energy drinks. Even everyday cola and its caffeine are used by many consumers as energy drinks. More recently, entrepreneurs have launched coffee and tea-based beverages that more clearly play upon their energy functionality.

Energy drink Runa, backed by celebrities Channing Tatum, Leonardo DiCaprio, and others, gets what it calls its “clean energy” from the Amazon rainforest guayusa leaf, for which the company has built its own vertical supply chain.

Meanwhile, energy shot segment leader 5-hour ENERGY turned the tides with 5-hour TEA Shots, launched in 2018. The product, designed to appeal to more health-conscious users, gets its caffeine from green tea leaves. The drinks contain the same ingredients as regular 5-hour ENERGY except for caffeine.

Phocus sparkling waters border on being energy drinks with 75 mg of natural caffeine from green tea in each can. The waters also contain L-theanine, an amino acid the company said provides a “smoother energy lift.” Phocus promotes “clean energy,” and sets itself apart from traditional energy drinks by claiming the boost of caffeine, “without the crash.”