10.08.18

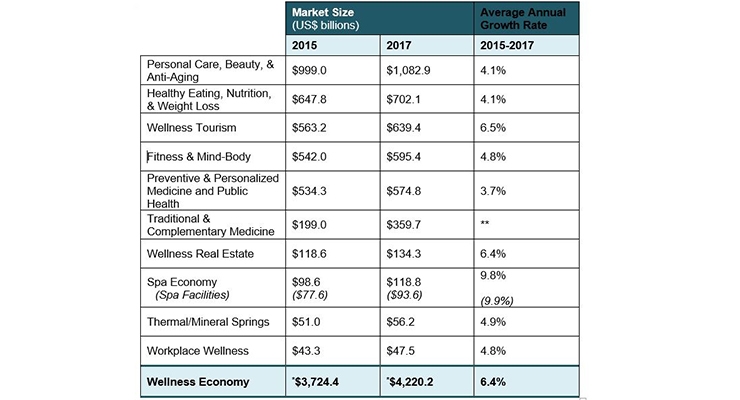

The global wellness industry grew 12.8% in the last two years, from a $3.7 trillion market in 2015 to $4.2 trillion in 2017, according to the 2018 Global Wellness Economy Monitor, released by the non-profit Global Wellness Institute (GWI). Data on 10 markets that comprise the global wellness economy provides new evidence that wellness remains one of the world’s biggest and fast-growing industries.

From 2015-2017, the wellness economy grew 6.4% annually, nearly twice as fast as global economic growth (3.6%), according to GWI. Wellness expenditures ($4.2 trillion) are now more than half as large as total global health expenditures ($7.3 trillion). The wellness industry now represents 5.3% of global economic output.

The report was released at the 12th annual Global Wellness Summit, held at Technogym Village in Cesena, Italy. The 2018 edition features more global, regional, and national data and analysis than ever before—from the fact that Europe is the fastest growing spender on workplace wellness to the finding that China and India are the fastest growing wellness tourism markets.

Among the 10 wellness markets analyzed, revenue growth leaders from 2015-2017 (per annum) were: 1) the spa industry (9.8%), 2) wellness tourism (6.5%), and 3) wellness real estate (6.4%). For the complementary medicine market, the definition changed since 2015 (adding traditional medicine sectors like Ayurveda, Traditional Chinese Medicine), so a formal percentage growth rate can’t be provided.

“Once upon a time, our contact with wellness was occasional: we went to the gym or got a massage,” noted Katherine Johnston, senior research fellow, GWI. “But this is changing fast; a wellness mindset is starting to permeate the global consumer consciousness, affecting people’s daily decision-making—whether food purchases, a focus on mental wellness and reducing stress, incorporating movement into daily life, environmental consciousness, or their yearning for connection and happiness. Wellness, for more people, is evolving from rarely to daily, from episodic to essential, from a luxury to a dominant lifestyle value. And that profound shift is driving powerful growth.”

Spotlight on Five Markets

Wellness Real Estate: Real estate that incorporates intentional wellness elements into its design, materials and building, and its amenities and programming, is growing fast as more people want to bring more health into the places where they spend the majority of their time. For comparison, the $134 billion wellness real estate market is now about 1.5% of the total annual global construction market and about half the size of the global green building industry. There are now more than 740 wellness real estate and community developments built or in development across 34 countries—a number that grows weekly.

Workplace Wellness: Valued at $47.5 billion, the workplace wellness market remains very small in comparison to the massive economic burden and productivity losses (10-15% of global economic output) associated with an unwell and disengaged workforce. Only 9.8% of world employees are covered by a workplace wellness program (321 million people), and programs are heavily concentrated in high-income countries in North America, Western Europe, and Asia.

Wellness Tourism: The $639 billion wellness travel market’s annual growth rate of 6.5% from 2015-2017 is more than double the growth rate for tourism overall (3.2%). World travelers made 830 million wellness trips in 2017, 139 million more than in 2015, and these trips now represent 17% of total tourism expenditures. Wellness tourism growth is very much a tale of developing markets, with Asia-Pacific, Latin America-Caribbean, Middle East-North Africa and Sub-Saharan Africa all clocking robust gains, and accounting for 57% of the increase in wellness trips since 2015. Over the past five years, Asia is the #1 gainer in both wellness tourism trips and revenues (trips grew a whopping 33% in two years, to 258 million annually). China and India rank #1 and #2 for growth worldwide, adding over 12 million and 17 million wellness trips, respectively, from 2015-2017.

Spa Industry: The spa economy, which includes spa facility revenues (now $93.6 billion yearly), and also education, consulting, associations, media and event sectors that enable spa businesses (now $25.2 billion), has grown to a $118.8 billion market. Spa locations jumped from 121,595 in 2015 to over 149,000 in 2017, employing nearly 2.6 million workers. The 9.9% annual revenue growth for spas is much higher than the pace from 2013-2015 (2.3%). From 2015-2017, the hotel/resort spa category added the largest number of spas and revenue, and has now surpassed day/salon spas as the industry’s revenue leader.

Thermal & Mineral Springs: The thermal/mineral springs market continues to clock strong growth as more people turn to water for stress relief, healing, and community. The market grew from $51 billion in 2015 to $56.2 billion in 2017, while facilities jumped from 27,507 (in 109 countries) to 34,057 (in 127 countries)—employing 1.8 million workers. The market is intensely concentrated in Asia-Pacific and Europe, which account for 95% of revenues.

“In the face of longer lifespans, and rising chronic disease, stress, and unhappiness, we only see growth for wellness ahead,” said Ophelia Yeung, senior research fellow, GWI. “But the wellness market isn’t just growing, it’s extremely dynamic. We believe that the three sectors that represent the core spheres of life will see the strongest future growth—wellness real estate, workplace wellness, and wellness tourism—while other sectors will also grow as they support the integration of wellness into all aspects of daily life. And wellness markets will become less siloed and more interconnected, converging to offer solutions and experiences in the places where people live, work, and travel.”

From 2015-2017, the wellness economy grew 6.4% annually, nearly twice as fast as global economic growth (3.6%), according to GWI. Wellness expenditures ($4.2 trillion) are now more than half as large as total global health expenditures ($7.3 trillion). The wellness industry now represents 5.3% of global economic output.

The report was released at the 12th annual Global Wellness Summit, held at Technogym Village in Cesena, Italy. The 2018 edition features more global, regional, and national data and analysis than ever before—from the fact that Europe is the fastest growing spender on workplace wellness to the finding that China and India are the fastest growing wellness tourism markets.

Among the 10 wellness markets analyzed, revenue growth leaders from 2015-2017 (per annum) were: 1) the spa industry (9.8%), 2) wellness tourism (6.5%), and 3) wellness real estate (6.4%). For the complementary medicine market, the definition changed since 2015 (adding traditional medicine sectors like Ayurveda, Traditional Chinese Medicine), so a formal percentage growth rate can’t be provided.

“Once upon a time, our contact with wellness was occasional: we went to the gym or got a massage,” noted Katherine Johnston, senior research fellow, GWI. “But this is changing fast; a wellness mindset is starting to permeate the global consumer consciousness, affecting people’s daily decision-making—whether food purchases, a focus on mental wellness and reducing stress, incorporating movement into daily life, environmental consciousness, or their yearning for connection and happiness. Wellness, for more people, is evolving from rarely to daily, from episodic to essential, from a luxury to a dominant lifestyle value. And that profound shift is driving powerful growth.”

Spotlight on Five Markets

Wellness Real Estate: Real estate that incorporates intentional wellness elements into its design, materials and building, and its amenities and programming, is growing fast as more people want to bring more health into the places where they spend the majority of their time. For comparison, the $134 billion wellness real estate market is now about 1.5% of the total annual global construction market and about half the size of the global green building industry. There are now more than 740 wellness real estate and community developments built or in development across 34 countries—a number that grows weekly.

Workplace Wellness: Valued at $47.5 billion, the workplace wellness market remains very small in comparison to the massive economic burden and productivity losses (10-15% of global economic output) associated with an unwell and disengaged workforce. Only 9.8% of world employees are covered by a workplace wellness program (321 million people), and programs are heavily concentrated in high-income countries in North America, Western Europe, and Asia.

Wellness Tourism: The $639 billion wellness travel market’s annual growth rate of 6.5% from 2015-2017 is more than double the growth rate for tourism overall (3.2%). World travelers made 830 million wellness trips in 2017, 139 million more than in 2015, and these trips now represent 17% of total tourism expenditures. Wellness tourism growth is very much a tale of developing markets, with Asia-Pacific, Latin America-Caribbean, Middle East-North Africa and Sub-Saharan Africa all clocking robust gains, and accounting for 57% of the increase in wellness trips since 2015. Over the past five years, Asia is the #1 gainer in both wellness tourism trips and revenues (trips grew a whopping 33% in two years, to 258 million annually). China and India rank #1 and #2 for growth worldwide, adding over 12 million and 17 million wellness trips, respectively, from 2015-2017.

Spa Industry: The spa economy, which includes spa facility revenues (now $93.6 billion yearly), and also education, consulting, associations, media and event sectors that enable spa businesses (now $25.2 billion), has grown to a $118.8 billion market. Spa locations jumped from 121,595 in 2015 to over 149,000 in 2017, employing nearly 2.6 million workers. The 9.9% annual revenue growth for spas is much higher than the pace from 2013-2015 (2.3%). From 2015-2017, the hotel/resort spa category added the largest number of spas and revenue, and has now surpassed day/salon spas as the industry’s revenue leader.

Thermal & Mineral Springs: The thermal/mineral springs market continues to clock strong growth as more people turn to water for stress relief, healing, and community. The market grew from $51 billion in 2015 to $56.2 billion in 2017, while facilities jumped from 27,507 (in 109 countries) to 34,057 (in 127 countries)—employing 1.8 million workers. The market is intensely concentrated in Asia-Pacific and Europe, which account for 95% of revenues.

“In the face of longer lifespans, and rising chronic disease, stress, and unhappiness, we only see growth for wellness ahead,” said Ophelia Yeung, senior research fellow, GWI. “But the wellness market isn’t just growing, it’s extremely dynamic. We believe that the three sectors that represent the core spheres of life will see the strongest future growth—wellness real estate, workplace wellness, and wellness tourism—while other sectors will also grow as they support the integration of wellness into all aspects of daily life. And wellness markets will become less siloed and more interconnected, converging to offer solutions and experiences in the places where people live, work, and travel.”