By John George, Senior Research Analyst, Euromonitor International10.02.17

Omega-3 fatty acids have numerous health claims, most relating to heart and brain health, and this has encouraged consumer intake in order to reap the associated benefits. In the early to mid-2000s awareness of the value of omega-3s grew rapidly, and packaged food and beverage manufacturers capitalized by incorporating them into their products. While still tiny in comparison to the likes of fresh fish and dietary supplements, many processed products suddenly became good sources of omega-3.

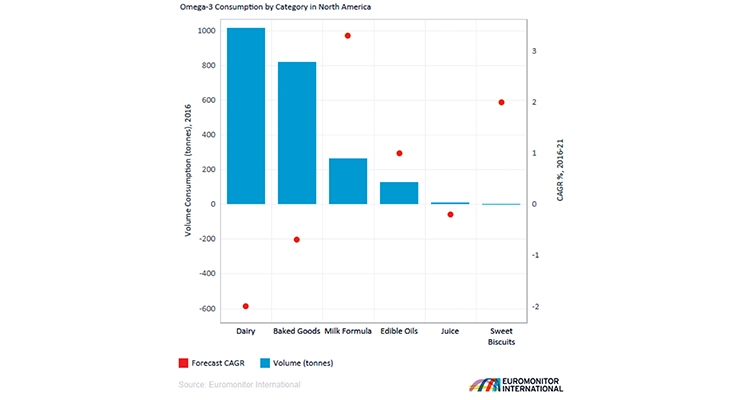

However, in the years since, omega-3 use in food and beverage has stalled, especially in North America, where long-chain omega-3s recorded a compound annual growth rate (CAGR) of 0% between 2011 and 2016, and short-chain omega-3s registered a CAGR of -3% over the same period. Usage of these ingredients between 2016 and 2021 is still expected to be limited, with both ingredients forecasted to record combined volume growth of just 70 tons in North America. There appears to be difficulty in communicating research on omega-3s to consumers and convincing them of the advantages.

Inclusion Far from Straightforward

A reason for the current malaise of omega-3 inclusion in food could be that the weight of data and studies relating to omega-3 results in the number of associated benefits becoming difficult to distill. This makes it harder to provide a clear, relevant message detailing the reason for omega-3 intake to consumers. The upshot of this is that consumers are not clamoring for increased omega-3 fortification and so manufacturers are not under pressure to include them.

There are more practical issues to account for as well. Omega-3s derived from fish oils are easily oxidized and this can cause products to have an unpleasant taste or smell. It is also difficult for manufacturers to include the quantity of omega-3 required to elicit a beneficial health effect and still produce a viable product.

Omega-3s could also face a new threat from the rise of the clean label trend. One of the core principles of clean label is that products are as simple as possible, with a minimal number of ingredients. Fortification flies in the face of this. Health-conscious consumers who, 10-15 years ago would have welcomed omega-3s in their products, now reject the same products on the basis that they do not fulfil the criteria for simplicity.

Grounds for Optimism

Despite the hurdles, there are signs of green shoots when it comes to increased fortification of foods with omega-3. Thanks to favorable media coverage, there is a general acceptance of omega-3 being beneficial among consumers. Several healthcare associations, for a variety of physical conditions, also recommend consumption of omega-3 fatty acids, and this filters down to physicians, who often recommend that patients ensure they meet recommended intake levels.

Furthermore, for those consumers deterred from using omega-3s because of clean label issues, there are new options. Chia and flaxseed, sources of short-chain omega-3 fatty acids, are already included in many products to promote a natural image, so the addition of their oils is unlikely to provoke consumer unrest as there is a high degree of familiarity. Additionally, algal omega-3s are increasingly providing an option for sustainable supply of long-chain omega-3s, which do not have the same sensory issues that plague fish oils, and there are new technologies that can mitigate the issues encountered when using fish oils, such as microencapsulation and spray drying.

Key to Future Fortification

Between 2016 and 2021, milk formula is set to be the best product area of omega-3 growth, with a CAGR of 3% forecasted in North America, considerably better than other areas of major omega-3 use. If this trend persists, there is the potential for a “fortification cliff” effect, where there is a significant drop-off in omega-3 consumption after early childhood. For consumers who are unwilling or unable to give their children supplements and are unaccustomed to consuming fish as part of their diet, increased fortification is the best method of avoiding a drop-off in omega-3 consumption.

The lack of pressure on manufacturers to fortify with omega-3s and subsequent poor levels of inclusion suggest that a degree of apathy has set in among consumers. Perhaps the problem is that omega-3s target several areas of health, meaning consumers cannot identify with a specific reason for making them part of their daily routines. For comparison, fiber is very clearly associated with improved digestion. If consumers had a more detailed understanding of what omega-3s do, beyond simply recognizing that they are generally good for health, there might be greater clamor for their inclusion in foods.

Some industry sources acknowledged that previous attempts to raise awareness of omega-3s have lacked focus, and in part, this is attributed to a lack of industry input when it comes to food fortification. Going forward, stakeholders must work closely with food manufacturers to ensure a clear message is communicated that informs consumers and does not simply repeat generic messages. Claims regarding function, mechanism, or health also increase the risk of legal challenges, so increased collaboration should enable suppliers to provide manufacturers with better understanding, reducing the risk of litigation. If this is achieved, the result will be greater consumer awareness and desire for omega-3 enrichment in foods.

John George is an analyst in the ingredients industry at Euromonitor International. He is responsible for publishing research relating to the global ingredients industry as well as providing analysis on market trends and ingredient innovation. For more information, visit: www.euromonitor.com/ingredients-industry.

However, in the years since, omega-3 use in food and beverage has stalled, especially in North America, where long-chain omega-3s recorded a compound annual growth rate (CAGR) of 0% between 2011 and 2016, and short-chain omega-3s registered a CAGR of -3% over the same period. Usage of these ingredients between 2016 and 2021 is still expected to be limited, with both ingredients forecasted to record combined volume growth of just 70 tons in North America. There appears to be difficulty in communicating research on omega-3s to consumers and convincing them of the advantages.

Inclusion Far from Straightforward

A reason for the current malaise of omega-3 inclusion in food could be that the weight of data and studies relating to omega-3 results in the number of associated benefits becoming difficult to distill. This makes it harder to provide a clear, relevant message detailing the reason for omega-3 intake to consumers. The upshot of this is that consumers are not clamoring for increased omega-3 fortification and so manufacturers are not under pressure to include them.

There are more practical issues to account for as well. Omega-3s derived from fish oils are easily oxidized and this can cause products to have an unpleasant taste or smell. It is also difficult for manufacturers to include the quantity of omega-3 required to elicit a beneficial health effect and still produce a viable product.

Omega-3s could also face a new threat from the rise of the clean label trend. One of the core principles of clean label is that products are as simple as possible, with a minimal number of ingredients. Fortification flies in the face of this. Health-conscious consumers who, 10-15 years ago would have welcomed omega-3s in their products, now reject the same products on the basis that they do not fulfil the criteria for simplicity.

Grounds for Optimism

Despite the hurdles, there are signs of green shoots when it comes to increased fortification of foods with omega-3. Thanks to favorable media coverage, there is a general acceptance of omega-3 being beneficial among consumers. Several healthcare associations, for a variety of physical conditions, also recommend consumption of omega-3 fatty acids, and this filters down to physicians, who often recommend that patients ensure they meet recommended intake levels.

Furthermore, for those consumers deterred from using omega-3s because of clean label issues, there are new options. Chia and flaxseed, sources of short-chain omega-3 fatty acids, are already included in many products to promote a natural image, so the addition of their oils is unlikely to provoke consumer unrest as there is a high degree of familiarity. Additionally, algal omega-3s are increasingly providing an option for sustainable supply of long-chain omega-3s, which do not have the same sensory issues that plague fish oils, and there are new technologies that can mitigate the issues encountered when using fish oils, such as microencapsulation and spray drying.

Key to Future Fortification

Between 2016 and 2021, milk formula is set to be the best product area of omega-3 growth, with a CAGR of 3% forecasted in North America, considerably better than other areas of major omega-3 use. If this trend persists, there is the potential for a “fortification cliff” effect, where there is a significant drop-off in omega-3 consumption after early childhood. For consumers who are unwilling or unable to give their children supplements and are unaccustomed to consuming fish as part of their diet, increased fortification is the best method of avoiding a drop-off in omega-3 consumption.

The lack of pressure on manufacturers to fortify with omega-3s and subsequent poor levels of inclusion suggest that a degree of apathy has set in among consumers. Perhaps the problem is that omega-3s target several areas of health, meaning consumers cannot identify with a specific reason for making them part of their daily routines. For comparison, fiber is very clearly associated with improved digestion. If consumers had a more detailed understanding of what omega-3s do, beyond simply recognizing that they are generally good for health, there might be greater clamor for their inclusion in foods.

Some industry sources acknowledged that previous attempts to raise awareness of omega-3s have lacked focus, and in part, this is attributed to a lack of industry input when it comes to food fortification. Going forward, stakeholders must work closely with food manufacturers to ensure a clear message is communicated that informs consumers and does not simply repeat generic messages. Claims regarding function, mechanism, or health also increase the risk of legal challenges, so increased collaboration should enable suppliers to provide manufacturers with better understanding, reducing the risk of litigation. If this is achieved, the result will be greater consumer awareness and desire for omega-3 enrichment in foods.

John George is an analyst in the ingredients industry at Euromonitor International. He is responsible for publishing research relating to the global ingredients industry as well as providing analysis on market trends and ingredient innovation. For more information, visit: www.euromonitor.com/ingredients-industry.