Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.03.02.15

Despite children-specific products currently being a relatively small supplement segment, healthy foods, beverages and specialty nutraceuticals aimed at America’s 74 million kids under age 18, and their 39 million moms, is a very big idea.

Sales of kid-specific foods/beverages are projected to jump from $32 billion in 2013 to $41 billion by 2018, according to Packaged Facts’ 2014 report Kids Food and Beverage Market. In 2013, 23% of the best-selling new foods/drinks were kid-specific, up from 16% in 2012, according to IRI’s 2014 New Product Pacesetters report.

Moms are most interested in and committed to seeking out labels for “non-GMO,” “organic” and “hormone-free,” according to Packaged Facts; and 69% of moms make a strong effort to buy fortified foods, according to The 2012 Gallup Study of Children’s Nutrition and Eating Habits.

Kid-specific foods are not just adult foods in smaller portions. Age-appropriate nutrient levels are very important to one-third of parents with kids under age 7 when making food selections, per Mintel’s Feeding Your Kids (August 2014). There’s plenty of room for growth as well. Packaged Facts reported that as recently as 2012, only 40% of all U.S. kid-specific foods/drinks had a health positioning.

Six in 10 U.S. kids take a dietary supplement: 46% under age 4, 70% aged 4-5 years, 60% 7-12 and 54% aged 13-17, according to the 2012 Gallup Study of Children’s Supplement Use.

Multivitamins still dominate the kids supplement sector, led by Flintstones, Disney and L’il Critters brands. However, many moms want specialty supplements: 70% want supplements that boost their child’s immunity, 62% to fill nutrition gaps, 42% to aid cognitive development/brain health, 31% to provide energy/strength, 28% to support digestion, 23% to enhance vision, 12% to improve mood and 10% to help with ADHD, Gallup reported.

Importantly, nearly half of moms said that having the “most complete” kids’ multivitamin available is very important. Choline is an essential nutrient proven to have a role in cognitive development of the brain in children and is associated with enhanced academic achievement, yet it is missing in many multivitamins targeted for children.

Also important to consider is that “protection against diseases later in life (e.g., heart disease, diabetes, liver disease) is second only to a “balanced diet” and “strong bones/teeth” as the children’s health issues moms are very/extremely concerned about. This means that we can expect products that help support a healthy heart, normal glucose metabolism and healthy liver to get unprecedented attention (HealthFocus, 2013).

“Proper growth/physical development,” a “healthy appearance,” “mental/intellectual development,” “resistance to disease,” good “eyesight” and “concentration in school” round out moms’ top health concerns for their children.

Herbal and alternative remedies are gaining strength for children: 16% of those aged 12-17 use contemporary alternative treatments, 11% aged 5-11 and 8% under age 4 use such remedies, according to NIH’s National Center for Complementary and Integrative Health. In 2008, the American Academy of Pediatrics recognized the increasing use of alternative medicine in children and the need to provide information and support for pediatricians.

Homeopathic medicines were among the top 10 best-selling cough/cold, sleep and ear OTC remedies for children in the mass market in 2014, according to IRI.

According to the President’s Council on Physical Fitness, 31 million children regularly participate in organized sports, and gym workouts are on the rise among teenagers. We can expect to see child-oriented sports performance products to move into the spotlight.

Market Potential

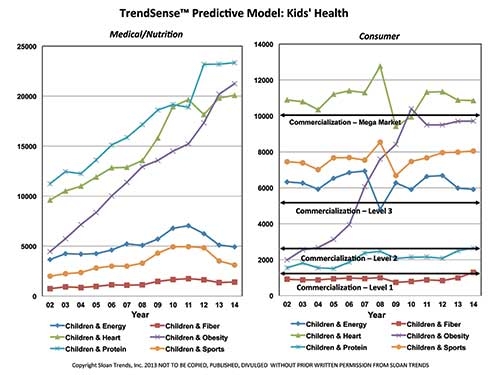

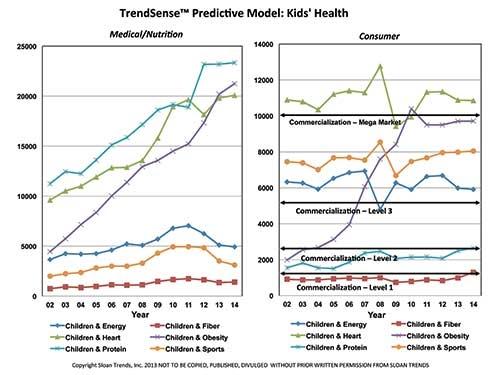

According to Sloan Trends TrendSense model, children/heart health and kids/obesity remain among the largest—and virtually untapped—kids’ health Mega Level markets. Medical Counts, which indicate the degree of scientific support and research activity, have increased five-fold for both these markets over the past decade. This level of interest in the scientific and professional community indicates that children’s heart health and obesity-prevention markets will be strong for years to come.

Children/sports and kids/energy remain very large, strong and stable Level 3 mass markets. They are also relatively underutilized as a marketing approach for the child nutraceutical category. Children/protein is a growing Level 2 mass market opportunity; children/fiber is gaining strength as a Level 1 mass market.

While not shown in this figure, children/calcium, children/bone health and children/vitamin D are still sound child-oriented nutrition markets, but lack luster at the moment. Children/probiotics is a growing specialty/health food channel market, perfectly timed for growth among very health conscious and condition-specific moms.

Growth Opportunities

Functional Foods

Over the past five years, snacks have been the fastest growing kid-specific food category, up 30% in dollar sales per IRI, followed by produce up 26%, dairy 13.6%, frozen foods 13.2%, shelf stable meals 11.5% and beverages 8.9% (Packaged Facts, 2014). In descending order, dairy, snacks, frozen food, drinks and cereal remain the largest kid-specific categories.

Fortification is important to 79% of moms (Gallup, 2013 Children’s Snack Habits). One-third of moms are making a strong effort to increase vitamins/minerals, unprocessed foods, whole grains, calcium and/or protein in their child’s diet. One-quarter are working to increase vitamin D, vitamin C and dietary fiber for their children; 24% for omega-3s; one in five probiotics, prebiotics or calories, per Gallup.

No artificial sweeteners, colors or flavors and high-fructose corn syrup (HFCS) top the list of food ingredients moms are trying to avoid.

Key platforms should include kid-specific levels of nutrients (unlike the current practice of giving children bars and beverages formulated for adult nutrient needs) and optimizing nutrient bioavailability.

Other big ideas include: sports drinks with protein and B vitamins for energy; heart health products featuring soy, omega-3s, fiber and protein; and foods that support digestive health.

Dietary Supplements

General health, immunity, closing potential dietary gaps and boosting cognitive development/brain function are the top reasons moms give supplements to their kids, according to Gallup.

Multi-nutrient formulas with added immune-boosting benefits are a good idea, since kids suffer more colds/flu than adults. Ideas that should also do well in the market include supplements designed for school-aged children that boost immunity and/or aid in school performance/learning and cognition; a sports/active kids/performance formulation; and a children’s heart health supplement marketed for families with a history of heart disease.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Sales of kid-specific foods/beverages are projected to jump from $32 billion in 2013 to $41 billion by 2018, according to Packaged Facts’ 2014 report Kids Food and Beverage Market. In 2013, 23% of the best-selling new foods/drinks were kid-specific, up from 16% in 2012, according to IRI’s 2014 New Product Pacesetters report.

Moms are most interested in and committed to seeking out labels for “non-GMO,” “organic” and “hormone-free,” according to Packaged Facts; and 69% of moms make a strong effort to buy fortified foods, according to The 2012 Gallup Study of Children’s Nutrition and Eating Habits.

Kid-specific foods are not just adult foods in smaller portions. Age-appropriate nutrient levels are very important to one-third of parents with kids under age 7 when making food selections, per Mintel’s Feeding Your Kids (August 2014). There’s plenty of room for growth as well. Packaged Facts reported that as recently as 2012, only 40% of all U.S. kid-specific foods/drinks had a health positioning.

Six in 10 U.S. kids take a dietary supplement: 46% under age 4, 70% aged 4-5 years, 60% 7-12 and 54% aged 13-17, according to the 2012 Gallup Study of Children’s Supplement Use.

Multivitamins still dominate the kids supplement sector, led by Flintstones, Disney and L’il Critters brands. However, many moms want specialty supplements: 70% want supplements that boost their child’s immunity, 62% to fill nutrition gaps, 42% to aid cognitive development/brain health, 31% to provide energy/strength, 28% to support digestion, 23% to enhance vision, 12% to improve mood and 10% to help with ADHD, Gallup reported.

Importantly, nearly half of moms said that having the “most complete” kids’ multivitamin available is very important. Choline is an essential nutrient proven to have a role in cognitive development of the brain in children and is associated with enhanced academic achievement, yet it is missing in many multivitamins targeted for children.

Also important to consider is that “protection against diseases later in life (e.g., heart disease, diabetes, liver disease) is second only to a “balanced diet” and “strong bones/teeth” as the children’s health issues moms are very/extremely concerned about. This means that we can expect products that help support a healthy heart, normal glucose metabolism and healthy liver to get unprecedented attention (HealthFocus, 2013).

“Proper growth/physical development,” a “healthy appearance,” “mental/intellectual development,” “resistance to disease,” good “eyesight” and “concentration in school” round out moms’ top health concerns for their children.

Herbal and alternative remedies are gaining strength for children: 16% of those aged 12-17 use contemporary alternative treatments, 11% aged 5-11 and 8% under age 4 use such remedies, according to NIH’s National Center for Complementary and Integrative Health. In 2008, the American Academy of Pediatrics recognized the increasing use of alternative medicine in children and the need to provide information and support for pediatricians.

Homeopathic medicines were among the top 10 best-selling cough/cold, sleep and ear OTC remedies for children in the mass market in 2014, according to IRI.

According to the President’s Council on Physical Fitness, 31 million children regularly participate in organized sports, and gym workouts are on the rise among teenagers. We can expect to see child-oriented sports performance products to move into the spotlight.

Market Potential

According to Sloan Trends TrendSense model, children/heart health and kids/obesity remain among the largest—and virtually untapped—kids’ health Mega Level markets. Medical Counts, which indicate the degree of scientific support and research activity, have increased five-fold for both these markets over the past decade. This level of interest in the scientific and professional community indicates that children’s heart health and obesity-prevention markets will be strong for years to come.

Children/sports and kids/energy remain very large, strong and stable Level 3 mass markets. They are also relatively underutilized as a marketing approach for the child nutraceutical category. Children/protein is a growing Level 2 mass market opportunity; children/fiber is gaining strength as a Level 1 mass market.

While not shown in this figure, children/calcium, children/bone health and children/vitamin D are still sound child-oriented nutrition markets, but lack luster at the moment. Children/probiotics is a growing specialty/health food channel market, perfectly timed for growth among very health conscious and condition-specific moms.

Growth Opportunities

- 4 in 10 moms always buy nutritious foods for their kids; 60% of households with kids follow some sort of healthy eating strategy (FMI, Shopping for Health, 2013).

- While breakfast has long been touted by parents as the most nutritionally important meal of the day for their kids, parents now say lunch is more important (Packaged Facts, 2014).

- Hispanics are the most likely to buy nutritious products for their children; there are 17 million Hispanic kids under age 18 (Mintel, Hispanic Health & Wellness – US, 2013).

- 1 in 8 kids has two or more risk factors for coronary heart disease; 20% of teens have abnormal blood lipid levels (American Heart Association, 2014).

- Kids have the highest incidence of constipation issues (NIDDK, 2013).

- 15% of moms with kids 6 to 18 said that a child in their household is overweight (FMI, 2014).

- 1 in 5 moms are making a strong effort to give their children probiotics (Gallup); 1 in 3 moms picked up a child from school due to intestinal issues in the past 3 months (SmithKline Moms Study, 2013).

- Calcium, fiber, iron, magnesium, potassium, phosphorus and vitamins A, C, D and E were called out as nutrients of concern for children in the U.S., according to the 2010 Dietary Guidelines for Americans Advisory Committee (DGAC). The 2015 DGAC is focusing attention on all of these nutrients, as well as zinc, B6, folate, iron and thiamine. While nutrients of concern vary globally, they include vitamin D, calcium and fiber; in some regions, vitamin A, iodine, zinc, vitamin K and magnesium.

- 15% of children using supplements are doing so on the recommendation of their physician; supplement sales through pediatricians is an attractive idea (Packaged Facts, 2014 Nutritional Supplements in the U.S.).

Functional Foods

Over the past five years, snacks have been the fastest growing kid-specific food category, up 30% in dollar sales per IRI, followed by produce up 26%, dairy 13.6%, frozen foods 13.2%, shelf stable meals 11.5% and beverages 8.9% (Packaged Facts, 2014). In descending order, dairy, snacks, frozen food, drinks and cereal remain the largest kid-specific categories.

Fortification is important to 79% of moms (Gallup, 2013 Children’s Snack Habits). One-third of moms are making a strong effort to increase vitamins/minerals, unprocessed foods, whole grains, calcium and/or protein in their child’s diet. One-quarter are working to increase vitamin D, vitamin C and dietary fiber for their children; 24% for omega-3s; one in five probiotics, prebiotics or calories, per Gallup.

No artificial sweeteners, colors or flavors and high-fructose corn syrup (HFCS) top the list of food ingredients moms are trying to avoid.

Key platforms should include kid-specific levels of nutrients (unlike the current practice of giving children bars and beverages formulated for adult nutrient needs) and optimizing nutrient bioavailability.

Other big ideas include: sports drinks with protein and B vitamins for energy; heart health products featuring soy, omega-3s, fiber and protein; and foods that support digestive health.

Dietary Supplements

General health, immunity, closing potential dietary gaps and boosting cognitive development/brain function are the top reasons moms give supplements to their kids, according to Gallup.

Multi-nutrient formulas with added immune-boosting benefits are a good idea, since kids suffer more colds/flu than adults. Ideas that should also do well in the market include supplements designed for school-aged children that boost immunity and/or aid in school performance/learning and cognition; a sports/active kids/performance formulation; and a children’s heart health supplement marketed for families with a history of heart disease.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.