By Julian Mellentin, Director and Founder, New Nutrition Business10.25.22

If you want to find a good idea—an idea that will succeed with consumers—then go to Japan. We should never lose sight of the fact that many of the paths our industry has followed for the past 20 years originated in Japan, including energy drinks, probiotics, collagen for skin care, blueberries for health, ready-to-drink (RTD) coffee drinks, and even the concept of functional foods.

Today, Japan-based Yakult Honsha, one of the two most successful probiotic brands in the world, may be signposting a new route to success in the tricky area of mood and mind benefits.

Mood and mind benefits can include some “regular” foods. For example, about 25% of people use chocolate to lift their spirits. It doesn’t need any claims for that effect, or deep science; all that matters is that, as committed chocolate eaters say, they feel better after indulging, even if briefly.

However, companies so far have not managed to turn consumer need into a major growth trend. Try to develop a new food or beverage for mood and mind health using added science-based ingredients, and that's when the problems start. With a few exceptions, most products fail or survive as ultra-niche. The reasons are not hard to find:

Science is looking at how improving the microbiome can potentially deliver mood and mind benefits. So far, this area has been more about scientific research than about tangible products, but that may now change.

Launched in Japan in 2021, Yakult 1000 is a 100 ml probiotic dairy drink aimed at people in their 30s to 50s. The product contains the company’s signature Lactobacillus casei strain Shirota and is formulated to “alleviate stress” and “improve sleep quality.” It seems to have addressed all of the four concerns above and become a hit product.

Yakult was a pioneer in probiotic products back in the 1950s and started the probiotic revolution. But it’s the first time Yakult has moved beyond its focus on digestive wellness and immunity. It is a focus that has served the company well, creating a $2.5 billion annual sales business with a strong position across Asia and South America.

Selecting a probiotic for a stress-management benefit that’s backed by science was a big step. But Yakult 1000 clearly delivers a benefit the consumer can feel. It has proved a huge hit, achieving $1 million of sales every single day during 2022.

The market for probiotic yogurt and dairy drinks addressing digestive wellness and immunity is crowded, and growth is elusive. Harnessing an effective probiotic for mood benefits may be a way for brands to start to widen their appeal. This move will need to come from the U.S. and Asia, as European regulatory restrictions make it impossible to communicate a probiotic benefit.

The key to succeeding in mood is investing in science so that the consumer can feel the benefit. A science-based approach has also helped New Zealand-based entrepreneurial start-up Ārepa to create a success.

Ārepa is sold as a drink, a supplement, and a mix-in powder. Its active ingredients include New Zealand blackcurrants (which have a very high anthocyanin content), pine bark extract, and L-theanine from green tea. The company has nine clinical trials in the pipeline, building on its earlier research which demonstrated the cognitive health benefits of its ingredient combination, such as improving memory in university students.

Ārepa launched five years ago in just two stores; today it is widely available at supermarkets, gas stations, and C-stores in Australia and New Zealand. Its commercial success has come because people can feel the difference when they drink it. That advantage, coupled with its “all-natural” ingredients, good taste, great packaging, and clever marketing has also enabled the brand to break into the Singapore and Japanese markets.

2023 could be good timing for products that effectively tackle brain health, stress, and sleep. With inflation and other economic challenges spreading around the world seemingly set to stay for the next 2-3 years, managing stress will become a bigger issue for more people. And it won't just be Millennials who will feel the stress. Around the world, meeting the needs of Baby Boomers is about to come back into fashion.

There is also a major shift in demographics under way. People aged over 50 are becoming a more significant percentage of the population in almost every country of the world at a level unprecedented in human history.

Europe is on the road to becoming an “old continent,” with 47% of the population already aged over 50. The same trend is at work in most of Asia; soon 50% of the population of Singapore and South Korea will be aged over 50 (a threshold Japan has already passed).

Even in the U.S., 36% of the population was over 50 in 2021. The U.S. Census describes the years after 2030 as a “transformative decade” in which people aged 65 and older will outnumber children for the first time in American history. Understanding the dynamics of healthy aging, and how to create successful brands, is about to become more important than ever.

One of the world's strongest examples of “how to do it right” is Anlene, a brand of New Zealand dairy giant Fonterra. Originally launched back in the 1990s as a bone health brand, Anlene has been gradually re-positioned to focus on mobility and activity. Successfully targeting the over-50s with a range of nutrient-dense mix-in powders and milk drinks with 9 grams of protein per serving, it has become a $700 million annual sales brand in Asia.

The Anlene Gold range has been upgraded with the addition of collagen for joint health. Anlene is one of the first brands to use MFGM (milk-fat globule membrane), a milk fraction composed of lipids and proteins offering a number of health benefits. In clinical trials, people who consumed Anlene with MFGM enjoyed significant improvements in flexibility, balance, and muscle mass.

Making a brand succeed with seniors isn't just about science-based ingredients. Your strategy needs to be very different from that of other age groups. Companies often struggle to define and segment older consumer markets. The target is complex and each life-stage has different needs.

You need to have realistic sales targets, a well thought-out product, and a creative go-to-market strategy. A good example is the Jelly Drops brand in the UK. The problem that inspired the entrepreneur behind this brand is that seniors are often at risk of dehydration. Jelly Drops are 95% water and include electrolytes to improve hydration. Vegan, sweetened with sucralose and naturally colored and flavored, they come in familiar varieties like lemon, lime, strawberry, orange, blackberry, and raspberry. Selling online and via care-homes, this UK company expanded distribution to the U.S. in 2022.

A creative strategy has also delivered success for Norway’s biggest dairy company, Tine, with its E+ brand. The product is founded in science and resulted from a university cooperation. The main focus during product development was on taste, and creating products that were fresh, familiar, and appealing. All E+ products are based on dairy (milk, yogurt, or cream cheese) and deliver 7.5 grams of protein per 100 grams).

The E+ range includes nine easy-to-swallow products. Initially, they were available exclusively in hospitals and care homes, before they were rolled out in drugstores. Marketing has focused on pharmacists, family members, caregivers and healthcare professionals with a mixture of social media marketing, video, and billboards.

Tine focuses on positive messages that are not too clinical, promoting the range as “tempting.” The key message is that products “help preserve your everyday strength.” Consumer feedback has indicated the E+ products are seen as “products for maintaining good health,” and not “products for sick people,” which has been critical to the brand’s success.

It requires technical and marketing creativity to reach older consumers, but as a target they have many attractions:

Protein quality is an untapped competitive advantage for dairy. Whey protein has a much better profile of amino acids (the building blocks of protein) than any plant protein and it is significantly more bioavailable.

Chobani was one of the first companies to have seen the potential of educating consumers about protein quality. Its Chobani Complete range, which features spoonable and drinkable yogurts that deliver 15-25 grams of protein per serving, is targeted at consumers who have an active interest in nutrition and fitness. The line’s communications underscore dairy protein’s “advanced nutrition” value, explaining amino acids and the meaning of complete protein. The brand earned year-one sales of $34.1 million, according to IRI data.

Protein quality is a “new benefit” for most consumers, and not something they think about. But people into sports and fitness are early-adopters of new benefits that will help them perform at their best. Once this group adopts an idea it then spreads out to the wider population. This is how today’s dairy protein market was created. Back in the 1990s only serious bodybuilders were interested in dairy protein; today it’s a mass-market “must-have” nutrient.

Consumers’ love of protein is shown by the continuing success of the meat-snack category. Consumer interest in snacks with more protein and less sugar, coupled with their declining fear of fat means meat snacking is an opportunity for brand owners and ingredient suppliers of all kinds.

IRI retail sales data show it has been one of the fastest-growing categories in the U.S. supermarket for several years, and has also produced double-digit growth in volume and value in the UK, France, and Germany.

Meat snacks used to be all about beef jerky, an unappetizing texture for many people. But in the U.S., jerky is now outsold by softer meat snacks such as salami sticks and small bite-size pieces. Now a $4.7 billion market, meat snacks grew 21.8% in 2021, and 13.1% in 2022, according to IRI.

Brands position themselves on authenticity, provenance, and sustainability. “Grass-fed” in particular is growing fast. Millennials are strongly represented among meat snack consumers, who see grass-fed as healthier for them, the animal, and the planet. This means they can give themselves “permission to indulge.”

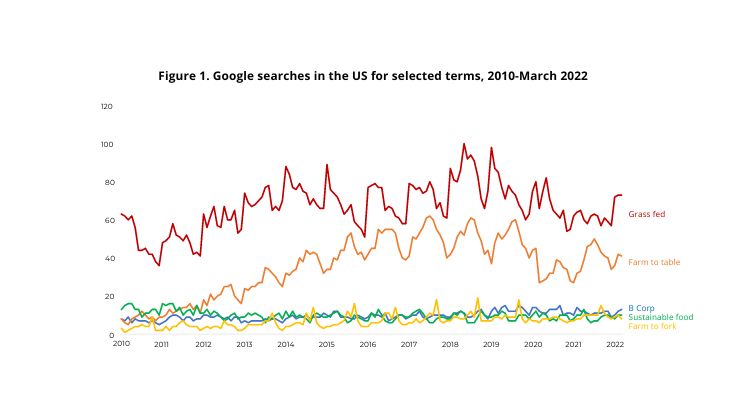

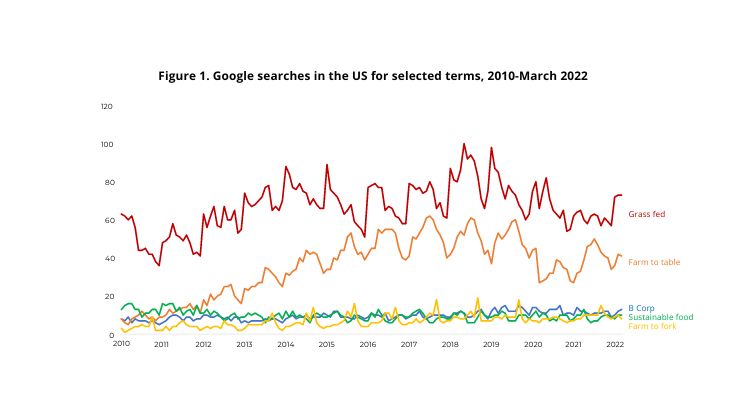

Interestingly, the grass-fed message has gone from being marginal five years ago to a fast-emerging reason to purchase among a growing number of consumers. The term “grass-fed” is what American consumers search for on Google more than ‘”sustainable food,” “B Corp” or any other term associated with sustainability.

For a small but growing number of consumers—not only in America but also in Europe—"grass-fed” signifies “better for the cows” (animal welfare), “better for the environment,” and (the most important part), “better for my health.” All of these are growing in importance to consumers. Increasingly, grass-fed is used on U.S. dairy brands as well, such as Alexandre Family Farm. In Europe this was pioneered by the Terra Nostra brand in Portugal for its milk and cheese.

In the U.S., “grass-fed” is of such perceived value to consumers that the unthinkable has happened: Hu Kitchen, the world’s most-successful vegan chocolate brand—and now part of Mondelēz—added dairy milk chocolate products to its range in 2022, using a clear “grass-fed” message. It’s the second time this year that a significant vegan brand has launched a grass-fed dairy-based product in a bid to grow sales and reduce dependence on the struggling vegan niche. The other vegan brand to start using grass-fed dairy was Cosmic Bliss, owned by Jason Karp, one of the co-founders of the Hu brand.

What developments like these remind us is that most people like animal proteins in some form or other, and for a wide variety of reasons. Outside California and New York City, there's no inevitable move by consumers to "plant-based everything," as shown by the way the plant-based meat substitute category has stalled, with sales down 10% this year and most substitute makers losing money.

Consumer desire for “what works for me” makes them flexible and open to innovations that are not only about plants. For example, women of all ages, but particularly Gen Z and younger Millennials, have eagerly embraced collagen—that’s bovine collagen, harvested from scraping the hides of cattle. These buyers include mostly younger women who describe their diets as plant-based. People’s health beliefs and behaviors are complex and don’t allow easy simplifications.

Consumer beliefs about what “healthy” means are fragmenting. Personalization is already an established fact of consumer behavior. We’re all food explorers now, engaged in an endless, restless search for something new and different; willing to give almost anything new a try; eager for provenance, for new and interesting tastes and experiences, and for health benefits that make a difference. Ultimately, achieving mass success is much more difficult than in the past. On the other hand, there is a viable niche for almost everything.

About the Author: Julian Mellentin is director and founder of New Nutrition Business, which delivers insight and consultancy into the key trends in foods, beverages, nutrition, and health for food, beverage, and ingredients companies worldwide.

Today, Japan-based Yakult Honsha, one of the two most successful probiotic brands in the world, may be signposting a new route to success in the tricky area of mood and mind benefits.

Mind and Mood, Stress and Sleep

Consumer interest in foods that offer mood and mind benefits like managing stress, better sleep, mental wellbeing or improved focus, has always existed. Around a fifth of consumers claim to be eating foods to boost their mood and mental wellbeing, according to a New Nutrition Business five-country survey of 4,800 consumers. Mood/mental wellness has been one of our top 10 growth trends for the past three years, and it is set to stay in the top 10.Mood and mind benefits can include some “regular” foods. For example, about 25% of people use chocolate to lift their spirits. It doesn’t need any claims for that effect, or deep science; all that matters is that, as committed chocolate eaters say, they feel better after indulging, even if briefly.

However, companies so far have not managed to turn consumer need into a major growth trend. Try to develop a new food or beverage for mood and mind health using added science-based ingredients, and that's when the problems start. With a few exceptions, most products fail or survive as ultra-niche. The reasons are not hard to find:

- Lack of tangible benefits: feeling the benefit is what consumers want;

- Consumer credibility: it's difficult to engage the consumer if they don't believe the product is making a difference;

- Product development challenge: it's a tall order to create a product that provides a benefit the consumer can experience, uses an ingredient that is effective, legal, and credible to the consumer;

- Taste: using an effective dose of ingredients and delivering good taste is difficult to achieve.

Science is looking at how improving the microbiome can potentially deliver mood and mind benefits. So far, this area has been more about scientific research than about tangible products, but that may now change.

Launched in Japan in 2021, Yakult 1000 is a 100 ml probiotic dairy drink aimed at people in their 30s to 50s. The product contains the company’s signature Lactobacillus casei strain Shirota and is formulated to “alleviate stress” and “improve sleep quality.” It seems to have addressed all of the four concerns above and become a hit product.

Yakult was a pioneer in probiotic products back in the 1950s and started the probiotic revolution. But it’s the first time Yakult has moved beyond its focus on digestive wellness and immunity. It is a focus that has served the company well, creating a $2.5 billion annual sales business with a strong position across Asia and South America.

Selecting a probiotic for a stress-management benefit that’s backed by science was a big step. But Yakult 1000 clearly delivers a benefit the consumer can feel. It has proved a huge hit, achieving $1 million of sales every single day during 2022.

The market for probiotic yogurt and dairy drinks addressing digestive wellness and immunity is crowded, and growth is elusive. Harnessing an effective probiotic for mood benefits may be a way for brands to start to widen their appeal. This move will need to come from the U.S. and Asia, as European regulatory restrictions make it impossible to communicate a probiotic benefit.

The key to succeeding in mood is investing in science so that the consumer can feel the benefit. A science-based approach has also helped New Zealand-based entrepreneurial start-up Ārepa to create a success.

Ārepa is sold as a drink, a supplement, and a mix-in powder. Its active ingredients include New Zealand blackcurrants (which have a very high anthocyanin content), pine bark extract, and L-theanine from green tea. The company has nine clinical trials in the pipeline, building on its earlier research which demonstrated the cognitive health benefits of its ingredient combination, such as improving memory in university students.

Ārepa launched five years ago in just two stores; today it is widely available at supermarkets, gas stations, and C-stores in Australia and New Zealand. Its commercial success has come because people can feel the difference when they drink it. That advantage, coupled with its “all-natural” ingredients, good taste, great packaging, and clever marketing has also enabled the brand to break into the Singapore and Japanese markets.

2023 could be good timing for products that effectively tackle brain health, stress, and sleep. With inflation and other economic challenges spreading around the world seemingly set to stay for the next 2-3 years, managing stress will become a bigger issue for more people. And it won't just be Millennials who will feel the stress. Around the world, meeting the needs of Baby Boomers is about to come back into fashion.

Healthy Aging

Healthy aging for seniors is an under-developed growth trend. Seniors want to maintain mobility and independent living for as long as possible. The erosion of savings and pension funds that is happening now, and will continue for several years, means many people will find themselves needing to work longer than they planned. Mobility and strength will become more important.There is also a major shift in demographics under way. People aged over 50 are becoming a more significant percentage of the population in almost every country of the world at a level unprecedented in human history.

Europe is on the road to becoming an “old continent,” with 47% of the population already aged over 50. The same trend is at work in most of Asia; soon 50% of the population of Singapore and South Korea will be aged over 50 (a threshold Japan has already passed).

Even in the U.S., 36% of the population was over 50 in 2021. The U.S. Census describes the years after 2030 as a “transformative decade” in which people aged 65 and older will outnumber children for the first time in American history. Understanding the dynamics of healthy aging, and how to create successful brands, is about to become more important than ever.

One of the world's strongest examples of “how to do it right” is Anlene, a brand of New Zealand dairy giant Fonterra. Originally launched back in the 1990s as a bone health brand, Anlene has been gradually re-positioned to focus on mobility and activity. Successfully targeting the over-50s with a range of nutrient-dense mix-in powders and milk drinks with 9 grams of protein per serving, it has become a $700 million annual sales brand in Asia.

The Anlene Gold range has been upgraded with the addition of collagen for joint health. Anlene is one of the first brands to use MFGM (milk-fat globule membrane), a milk fraction composed of lipids and proteins offering a number of health benefits. In clinical trials, people who consumed Anlene with MFGM enjoyed significant improvements in flexibility, balance, and muscle mass.

Making a brand succeed with seniors isn't just about science-based ingredients. Your strategy needs to be very different from that of other age groups. Companies often struggle to define and segment older consumer markets. The target is complex and each life-stage has different needs.

You need to have realistic sales targets, a well thought-out product, and a creative go-to-market strategy. A good example is the Jelly Drops brand in the UK. The problem that inspired the entrepreneur behind this brand is that seniors are often at risk of dehydration. Jelly Drops are 95% water and include electrolytes to improve hydration. Vegan, sweetened with sucralose and naturally colored and flavored, they come in familiar varieties like lemon, lime, strawberry, orange, blackberry, and raspberry. Selling online and via care-homes, this UK company expanded distribution to the U.S. in 2022.

A creative strategy has also delivered success for Norway’s biggest dairy company, Tine, with its E+ brand. The product is founded in science and resulted from a university cooperation. The main focus during product development was on taste, and creating products that were fresh, familiar, and appealing. All E+ products are based on dairy (milk, yogurt, or cream cheese) and deliver 7.5 grams of protein per 100 grams).

The E+ range includes nine easy-to-swallow products. Initially, they were available exclusively in hospitals and care homes, before they were rolled out in drugstores. Marketing has focused on pharmacists, family members, caregivers and healthcare professionals with a mixture of social media marketing, video, and billboards.

Tine focuses on positive messages that are not too clinical, promoting the range as “tempting.” The key message is that products “help preserve your everyday strength.” Consumer feedback has indicated the E+ products are seen as “products for maintaining good health,” and not “products for sick people,” which has been critical to the brand’s success.

It requires technical and marketing creativity to reach older consumers, but as a target they have many attractions:

- They are an ideal target market for science-based companies. They want something that actually delivers a real benefit;

- When they commit to a brand they become very loyal customers, with very high repeat purchase rates of 80+%;

- They are a low-volume but high-value market, willing to pay a premium for products they believe deliver relevant benefits;

- There are many channels to reach them outside of the supermarket;

- Their numbers are increasing rapidly, and will continue for the next 30 years.

Consumer beliefs about what “healthy” means are fragmenting. Personalization is already an established fact of consumer behavior. We’re all food explorers now, engaged in an endless, restless search for something new and different; willing to give almost anything new a try; eager for provenance, for new and interesting tastes and experiences, and for health benefits that make a difference. Ultimately, achieving mass success is much more difficult than in the past. On the other hand, there is a viable niche for almost everything.

Protein Quality

Seniors' interest in maintaining their strength and mobility will be a big element in keeping the protein trend going. Protein is the key nutrient in most products for seniors’ mobility. Dairy protein in particular is simple for the consumer to understand, versatile, and easy to incorporate into a range of formulations.Protein quality is an untapped competitive advantage for dairy. Whey protein has a much better profile of amino acids (the building blocks of protein) than any plant protein and it is significantly more bioavailable.

Chobani was one of the first companies to have seen the potential of educating consumers about protein quality. Its Chobani Complete range, which features spoonable and drinkable yogurts that deliver 15-25 grams of protein per serving, is targeted at consumers who have an active interest in nutrition and fitness. The line’s communications underscore dairy protein’s “advanced nutrition” value, explaining amino acids and the meaning of complete protein. The brand earned year-one sales of $34.1 million, according to IRI data.

Protein quality is a “new benefit” for most consumers, and not something they think about. But people into sports and fitness are early-adopters of new benefits that will help them perform at their best. Once this group adopts an idea it then spreads out to the wider population. This is how today’s dairy protein market was created. Back in the 1990s only serious bodybuilders were interested in dairy protein; today it’s a mass-market “must-have” nutrient.

Consumers’ love of protein is shown by the continuing success of the meat-snack category. Consumer interest in snacks with more protein and less sugar, coupled with their declining fear of fat means meat snacking is an opportunity for brand owners and ingredient suppliers of all kinds.

IRI retail sales data show it has been one of the fastest-growing categories in the U.S. supermarket for several years, and has also produced double-digit growth in volume and value in the UK, France, and Germany.

Meat snacks used to be all about beef jerky, an unappetizing texture for many people. But in the U.S., jerky is now outsold by softer meat snacks such as salami sticks and small bite-size pieces. Now a $4.7 billion market, meat snacks grew 21.8% in 2021, and 13.1% in 2022, according to IRI.

Brands position themselves on authenticity, provenance, and sustainability. “Grass-fed” in particular is growing fast. Millennials are strongly represented among meat snack consumers, who see grass-fed as healthier for them, the animal, and the planet. This means they can give themselves “permission to indulge.”

Interestingly, the grass-fed message has gone from being marginal five years ago to a fast-emerging reason to purchase among a growing number of consumers. The term “grass-fed” is what American consumers search for on Google more than ‘”sustainable food,” “B Corp” or any other term associated with sustainability.

For a small but growing number of consumers—not only in America but also in Europe—"grass-fed” signifies “better for the cows” (animal welfare), “better for the environment,” and (the most important part), “better for my health.” All of these are growing in importance to consumers. Increasingly, grass-fed is used on U.S. dairy brands as well, such as Alexandre Family Farm. In Europe this was pioneered by the Terra Nostra brand in Portugal for its milk and cheese.

In the U.S., “grass-fed” is of such perceived value to consumers that the unthinkable has happened: Hu Kitchen, the world’s most-successful vegan chocolate brand—and now part of Mondelēz—added dairy milk chocolate products to its range in 2022, using a clear “grass-fed” message. It’s the second time this year that a significant vegan brand has launched a grass-fed dairy-based product in a bid to grow sales and reduce dependence on the struggling vegan niche. The other vegan brand to start using grass-fed dairy was Cosmic Bliss, owned by Jason Karp, one of the co-founders of the Hu brand.

What developments like these remind us is that most people like animal proteins in some form or other, and for a wide variety of reasons. Outside California and New York City, there's no inevitable move by consumers to "plant-based everything," as shown by the way the plant-based meat substitute category has stalled, with sales down 10% this year and most substitute makers losing money.

Innovation Opportunities

There’s been steady growth in the number of “meat reducers,” but that growth has slowed dramatically, and our five-country survey found that it is currently 24% of the population, compared to 23% in 2020.Consumer desire for “what works for me” makes them flexible and open to innovations that are not only about plants. For example, women of all ages, but particularly Gen Z and younger Millennials, have eagerly embraced collagen—that’s bovine collagen, harvested from scraping the hides of cattle. These buyers include mostly younger women who describe their diets as plant-based. People’s health beliefs and behaviors are complex and don’t allow easy simplifications.

Consumer beliefs about what “healthy” means are fragmenting. Personalization is already an established fact of consumer behavior. We’re all food explorers now, engaged in an endless, restless search for something new and different; willing to give almost anything new a try; eager for provenance, for new and interesting tastes and experiences, and for health benefits that make a difference. Ultimately, achieving mass success is much more difficult than in the past. On the other hand, there is a viable niche for almost everything.

About the Author: Julian Mellentin is director and founder of New Nutrition Business, which delivers insight and consultancy into the key trends in foods, beverages, nutrition, and health for food, beverage, and ingredients companies worldwide.