03.22.16

Nutrition Capital Network (NCN), an organization that connects investors with high-potential growth companies in the nutrition and health & wellness industry through four annual investor meetings and year-round networking, has released its top-deal lists for 2015.

Strategic Acquirers Hanker for Healthier Protein

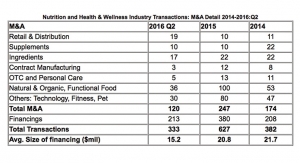

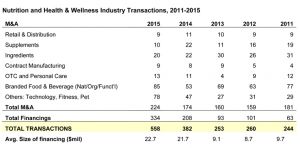

The NCN Transaction Database recorded 558 total transactions across all seven categories of the nutrition and health & wellness industry tracked by NCN in 2015, with Equity Financings up 61% in 2015 to 334, and Mergers & Acquisitions up 29% to 224.

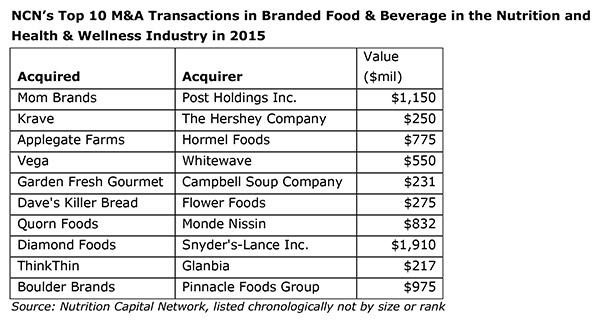

Healthier protein in the form of plant-based meat alternatives, in addition to healthier versions of real meat snacks and staples, dominated the top acquisitions in NCN’s Branded Food & Beverage category in 2015. “Big Food demonstrated it is willing to pay high multiples for growing brands that reflect changing consumer tastes for better food choices, with Hershey and Hormel both shelling out for healthier meat products,” said Grant Ferrier, NCN’s CEO and co-founder. Plant-based proteins featured prominently in both M&As and financings, Mr. Ferrier noted.

Hormel’s 2015 purchase of Applegate Farms, a purveyor of additive-free natural deli meats, bacon and sausages, was one of the nutrition industry’s largest at $775 million. Also ranked in the top 10 deals in NCN’s Branded Food & Beverage category, which includes natural, organic and functional brands, was Hershey’s acquisition of Krave natural jerky snacks, which commanded a reported $240 million purchase price. (In 2014 Hershey acquired Muscle Milk protein shakes for $450 million.) The healthier meat trend continued in early 2016 with General Mills’ acquisition of EPIC Provisions, the maker of protein bars made with grass-fed beef.

“As conventional food companies see more consumers choosing innovative natural, organic, and better-for-you products over legacy brands, they are seeking ways to meet that demand from acquisition to early-stage investments,” said Mr. Ferrier. “This continues a trend that started more than 15 years ago with companies like Nestlé, General Mills, Coca-Cola, Kellogg and others which are now years into their campaigns to acquire a portfolio of healthier food and beverage brands, build on an acquired platform, and evolve existing brands into more healthy options.”

Quorn and Vega Deals Prove Plant-Based Food Appeal

NCN’s top 10 acquisitions in Branded Food & Beverage were not confined to the U.S. Also making NCN’s list was Monde Nissin’s (The Philippines) purchase of Quorn Foods, a manufacturer of mycoprotein meat-substitute products based in the U.K., for $832 million. Vega, a Canadian manufacturer of plant based nutritional powder and bars, became a $550-million target for WhiteWave, maker of Silk soymilk, which continued to expand its plant-based protein portfolio.

Nutritional ingredients manufacturer Glanbia plc of Ireland, known historically for cheese and dairy ingredients and more recently whey protein, acquired thinkThin protein bars for $217 million in 2015, extending its reach in consumer lifestyle brands and continuing its transformation into a performance nutrition and ingredients supplier. Glanbia had already acquired a raft of sports nutrition brands, including Isopure, Optimum Nutrition, ABB and Nutramino.

Private Equity Investors Favor Protein; Healthy Beverages Still Have Appeal

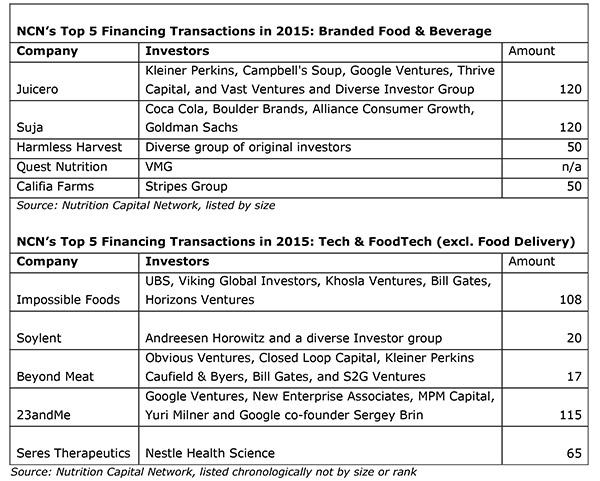

The meat-alternative theme also showed up strongly in the top financing transactions, this time in NCN’s Technology category, with Impossible Foods attracting $108 million on the promise of developing meats and cheeses made entirely from plants. (Including prior investment, Impossible’s total capital raised is $183 million). Soylent, maker of vegan powdered meal replacements, also captured investors’ imagination, raising $20 million; and Beyond Meat, a maker of meat substitutes using mostly soy and pea protein, raised $17 million in 2015 in a series E round.

Healthy beverages sustained their investor-appeal in 2015, with Harmless Harvest (coconut water) and Califia Farms (almond milks) both securing $50 million commitments. “High pressure processed” juice company and former NCN presenter Suja kept up its financing momentum by securing a minority investment and distribution partnership with The Coca-Cola Company. And start-up Juicero, developer of a machine reckoned to do for home juicing what Keurig did for coffee, raised its total funding to $120 million with Kleiner Perkins, Campbell Soup and others participating in early in 2015.

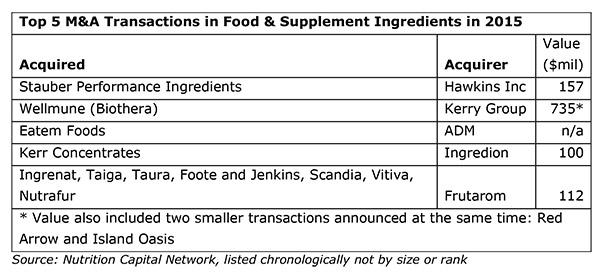

Supplements Fall Out of Favor But 2015 Sees Notable Ingredient Deals

Transactions declined or leveled off in both the Supplements and Ingredients categories in 2015, most likely due to product integrity uncertainties in the supplement industry. The Ingredients and Contract Manufacturing category saw Kerry Group acquire Biothera’s Wellmune branded ingredient business, focused on immunity ingredients and broadening Kerry’s functional and wellness portfolio. Hawkins, a bulk and specialty chemicals manufacturer, paid $157 million for Stauber Performance Ingredients, founded in 1969 and a leading nutritional ingredient manufacturer and distributor in the U.S. with the $117 million in revenues last year. Consolidators like Israel’s Frutarom were also active in the specialty food and nutrition supply business.

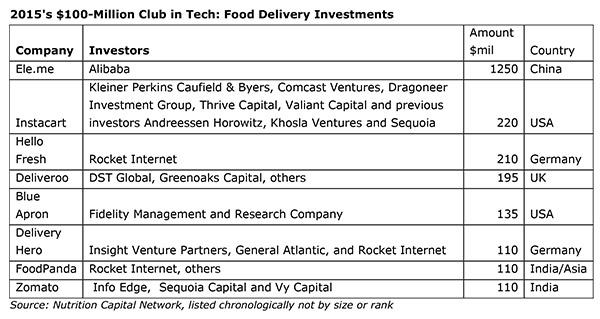

Food Delivery Goes Wild with 78 Financings in 2015

In Delivery Services (a subcategory of NCN’s Technology category), there were 78 financings in 2015 up from 28 in 2014, itself a year of record transactions. NCN’s $100-million club in foodtech delivery accounted for more than $2 billion invested in eight tech-enabled food delivery companies, from InstaCart and Blue Apron in the U.S. to aggressive leaders in Germany, India and China. “The category started strong in 2015, but as the year drew to a close some pessimism entered the market,” noted Mike Dovbish, NCN executive director. “There was some talk of consolidation and possibly layoffs at some companies, increasing competition in the U.S., with some of this already happening abroad.”

Strategic Acquirers Hanker for Healthier Protein

The NCN Transaction Database recorded 558 total transactions across all seven categories of the nutrition and health & wellness industry tracked by NCN in 2015, with Equity Financings up 61% in 2015 to 334, and Mergers & Acquisitions up 29% to 224.

Healthier protein in the form of plant-based meat alternatives, in addition to healthier versions of real meat snacks and staples, dominated the top acquisitions in NCN’s Branded Food & Beverage category in 2015. “Big Food demonstrated it is willing to pay high multiples for growing brands that reflect changing consumer tastes for better food choices, with Hershey and Hormel both shelling out for healthier meat products,” said Grant Ferrier, NCN’s CEO and co-founder. Plant-based proteins featured prominently in both M&As and financings, Mr. Ferrier noted.

Hormel’s 2015 purchase of Applegate Farms, a purveyor of additive-free natural deli meats, bacon and sausages, was one of the nutrition industry’s largest at $775 million. Also ranked in the top 10 deals in NCN’s Branded Food & Beverage category, which includes natural, organic and functional brands, was Hershey’s acquisition of Krave natural jerky snacks, which commanded a reported $240 million purchase price. (In 2014 Hershey acquired Muscle Milk protein shakes for $450 million.) The healthier meat trend continued in early 2016 with General Mills’ acquisition of EPIC Provisions, the maker of protein bars made with grass-fed beef.

“As conventional food companies see more consumers choosing innovative natural, organic, and better-for-you products over legacy brands, they are seeking ways to meet that demand from acquisition to early-stage investments,” said Mr. Ferrier. “This continues a trend that started more than 15 years ago with companies like Nestlé, General Mills, Coca-Cola, Kellogg and others which are now years into their campaigns to acquire a portfolio of healthier food and beverage brands, build on an acquired platform, and evolve existing brands into more healthy options.”

Quorn and Vega Deals Prove Plant-Based Food Appeal

NCN’s top 10 acquisitions in Branded Food & Beverage were not confined to the U.S. Also making NCN’s list was Monde Nissin’s (The Philippines) purchase of Quorn Foods, a manufacturer of mycoprotein meat-substitute products based in the U.K., for $832 million. Vega, a Canadian manufacturer of plant based nutritional powder and bars, became a $550-million target for WhiteWave, maker of Silk soymilk, which continued to expand its plant-based protein portfolio.

Nutritional ingredients manufacturer Glanbia plc of Ireland, known historically for cheese and dairy ingredients and more recently whey protein, acquired thinkThin protein bars for $217 million in 2015, extending its reach in consumer lifestyle brands and continuing its transformation into a performance nutrition and ingredients supplier. Glanbia had already acquired a raft of sports nutrition brands, including Isopure, Optimum Nutrition, ABB and Nutramino.

Private Equity Investors Favor Protein; Healthy Beverages Still Have Appeal

The meat-alternative theme also showed up strongly in the top financing transactions, this time in NCN’s Technology category, with Impossible Foods attracting $108 million on the promise of developing meats and cheeses made entirely from plants. (Including prior investment, Impossible’s total capital raised is $183 million). Soylent, maker of vegan powdered meal replacements, also captured investors’ imagination, raising $20 million; and Beyond Meat, a maker of meat substitutes using mostly soy and pea protein, raised $17 million in 2015 in a series E round.

Healthy beverages sustained their investor-appeal in 2015, with Harmless Harvest (coconut water) and Califia Farms (almond milks) both securing $50 million commitments. “High pressure processed” juice company and former NCN presenter Suja kept up its financing momentum by securing a minority investment and distribution partnership with The Coca-Cola Company. And start-up Juicero, developer of a machine reckoned to do for home juicing what Keurig did for coffee, raised its total funding to $120 million with Kleiner Perkins, Campbell Soup and others participating in early in 2015.

Supplements Fall Out of Favor But 2015 Sees Notable Ingredient Deals

Transactions declined or leveled off in both the Supplements and Ingredients categories in 2015, most likely due to product integrity uncertainties in the supplement industry. The Ingredients and Contract Manufacturing category saw Kerry Group acquire Biothera’s Wellmune branded ingredient business, focused on immunity ingredients and broadening Kerry’s functional and wellness portfolio. Hawkins, a bulk and specialty chemicals manufacturer, paid $157 million for Stauber Performance Ingredients, founded in 1969 and a leading nutritional ingredient manufacturer and distributor in the U.S. with the $117 million in revenues last year. Consolidators like Israel’s Frutarom were also active in the specialty food and nutrition supply business.

Food Delivery Goes Wild with 78 Financings in 2015

In Delivery Services (a subcategory of NCN’s Technology category), there were 78 financings in 2015 up from 28 in 2014, itself a year of record transactions. NCN’s $100-million club in foodtech delivery accounted for more than $2 billion invested in eight tech-enabled food delivery companies, from InstaCart and Blue Apron in the U.S. to aggressive leaders in Germany, India and China. “The category started strong in 2015, but as the year drew to a close some pessimism entered the market,” noted Mike Dovbish, NCN executive director. “There was some talk of consolidation and possibly layoffs at some companies, increasing competition in the U.S., with some of this already happening abroad.”