Hope Lee, Senior Analyst, Beverages, Euromonitor International07.05.16

Euromonitor International is watching the unfolding repercussions of the already infamous Brexit referendum closely, evaluating its likely impact on the organic industry and trade relations. Immediately following the referendum result, Martin Sawyer, CEO of the Soil Association sent a statement to all its licensees to express his disappointment. In these uncertain times, British organic food and beverage farmers and suppliers face major challenges: how to handle uncertain relationships with the EU member states, and how to explore opportunities elsewhere to mitigate the instability of leaving Europe. For smart business owners and managers, the future starts now; today's decisions and planning will have an impact on tomorrow's sustainability. This is particularly true of the highly-regulated environment of organic farming and trade.

The Soil Association's Statement On Brexit

The Soil Association stated that "the team at Soil Association Certification will be working very hard on ensuring we represent your interests and concerns; we absolutely believe in the ongoing recovery of the market in the U.K. As Chair of UKOCG, the U.K. Organic Certification Bodies Group, I will be coordinating discussions for the certification bodies with Defra to ensure we are all clear as to how organic will be properly represented in the coming months and years, both in regard to regulation and the provision of a sustainable farming model. As a non-member of the EU, the U.K. will still be required to comply with EU organic standards to maintain the flow of organic products to and from the EU, so the U.K. will likely also continue to be bound by the EU Organic Regulation, and any changes made to it by EU Member States. Those communities who are most vulnerable such as those on low incomes and upland farmers need to be foremost in our minds as we consider what policies should be developed over the next couple of years in preparation for our exit."

So, the first impact of Brexit will be an increased workload for regulators, policy lawyers and specialists. They will have to make time to identify which are the vulnerable farmers and to what extent they need regulatory help and assistance. Negotiators may have to work out a strategy as to how to strike a favorable deal to secure trade post-exit. For the EU, British exporters currently have access to their markets without tariffs or other barriers. They in turn have access to the U.K. Will the EU apply tariffs to organic food and beverages following Brexit? This uncertainty will very probably deter or reduce investment in organic trade. Indeed, organic farming and trade is not only a sustainable farming model but also a business investment for some developers, requiring investment, borrowing and financial commitment. Some organic investors will halt their investments, threatening growth of organic arable land until uncertainty is resolved.

The Organic Milk Suppliers Cooperative: Implications of Brexit

The Organic Milk Suppliers Cooperative (OMSCo) has over 200 farmer members across the U.K., producing over 250 million liters and 65% of the U.K.'s organic milk supply. It is the only 100% organic farmer-owned and farmer-run dairy cooperative in the U.K. It is also the largest and longest established U.K. organic dairy cooperative and the second largest dedicated organic milk pool in the world. OMSCo supplies its products on a regular basis to all main European markets and the U.S. Will the EU choose to punish U.K. farmers and start to levy tariffs? And will farmers be able to pass on the weight of increased costs to EU consumers, or will the British Government subsidize exports?

If exports are subsidized, this raises questions as to how much is adequate and how much the government is prepared to spend. Conversely, the EU could give British organic farmers an "associate status" and carry on the existing trading rules as if the U.K. is a member state, in order to protect the environment and encourage the organic farming model.

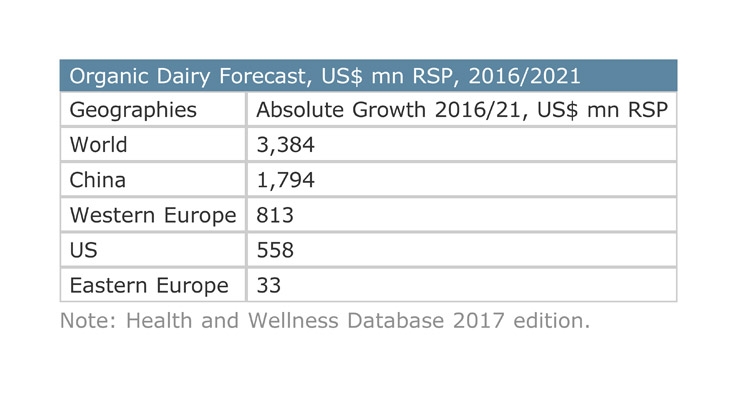

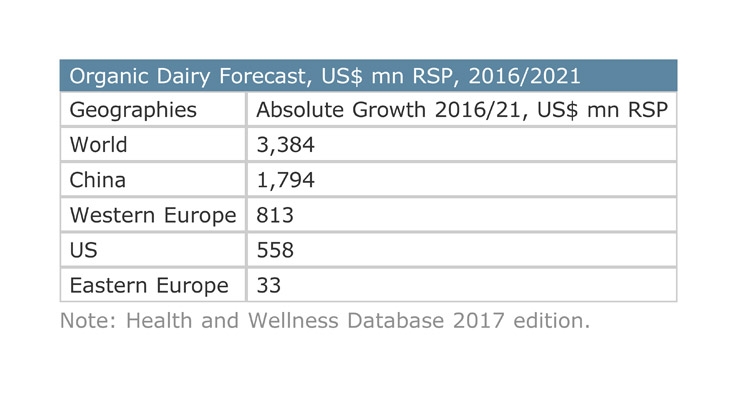

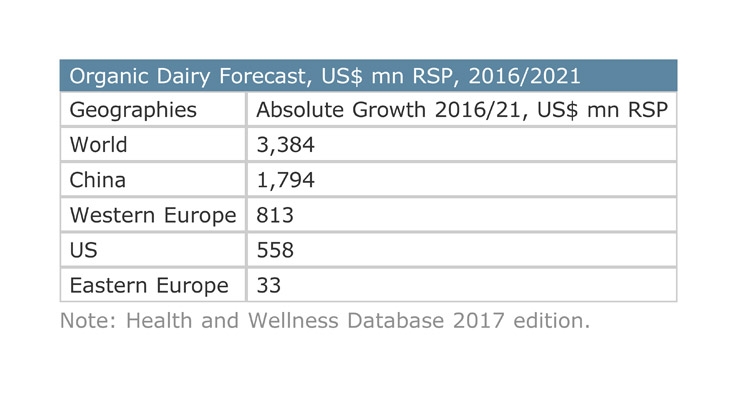

According to Euromonitor’s Health and Wellness database, retail value sales of organic dairy are set to grow by $850 million in 2016-2021 in Western Europe and Eastern Europe. U.K. exporters will not want to be excluded from these positive gains. EU consumers are increasingly gravitating to organic produce. This is partially due to government support, and in some countries, further supported by powerful green lobbies, which influence government policy, retailers and funding allocation. While there are plenty of issues that need to be considered and resolved, organic trade is certainly not on the government's priority list right now.

Brexit Implications for Trade Between U.K. & U.S.

President Obama said that if Britain leaves EU, Britain will be at the back of the trade queue. The reality is that there is a growing demand for organic produce in the U.S. and the demand for organic is outstripping production. Our Health and Wellness database shows that the U.S. is set to see a net increase in sales of organic dairy of around $560 million in 2016-2021. The Soil Association stated that the key selling points for U.S. consumers interested in U.K. produce are innovation and heritage. The Soil Association has partnerships with certifying organizations in the U.S., which means it is easier than other countries for licensees to be certified there.

The organic products equivalence agreement between the U.S. and EU which came into force on June 1, 2012 means that most U.K. organic food products, provided they are free from livestock ingredients, can enter the U.S. market without additional certification. OMSCo set up an historic relationship with the U.S. Organic Valley, the world's largest independent cooperative of organic farmers. However, if Brexit becomes a reality, the U.K. may need to renegotiate the rules. Potentially, the U.K. might have to carry both USDA and Soil Association labels.

Look East

Our Health and Wellness database shows that China is set to see a net increase of organic dairy by around $1.8 billion in 2016-2021, doubling that projected for Western Europe and Eastern Europe, combined. OMSCo estimates that around 20% of its revenues were generated by its premium organic exports in 2015 and China is a hot pursuit market for U.K. dairy farmers. China will prove an important destination in this time of Brexit uncertainty.

Likewise, organic certification is a regulated sector in China. OMSCo obtained accreditation to Chinese standards through the Soil Association in 2015. Its partnership with Organic Valley enabled OMSCo to cooperate with a major organic brand owner to expand internationally. As a result of these developments, OMSCo has agreed to supply milk that is certified organic by both the USDA and Chinese certification bodies to a European processor. The first three consignments of UHT organic milk in one-liter Organic Valley branded bottles arrived in China's first-tier cities in May 2016. Chinese consumers have solid confidence in USDA organic standards. In view of food safety concerns and subsequent distrust of domestic milk products, middle-class Chinese are likely to continue to purchase foreign dairy imports.

The organic milk industry should also accelerate its marketing and increase attendance of overseas exhibitions to promote its organic credentials. A recent study by Newcastle University has reawakened the organic/non-organic food debate. The study found that organically grown produce contains far higher levels of antioxidants, believed to help stave off cancer. The number of reported cancer cases in China is rising, and the health benefits of organic dairy, supported by academic findings such as this, can be marketed effectively to Chinese consumers, creating business opportunities and a positive feel towards British and U.S. brands. Already, there are positive trade relations between China and the U.K., and if the door to Europe closes, China offers a window of opportunity for British dairy farmers.

For questions on this article or further insights, contact Victoria Dele, communications executive, at victoria.dele@euromonitor.com.

The Soil Association's Statement On Brexit

The Soil Association stated that "the team at Soil Association Certification will be working very hard on ensuring we represent your interests and concerns; we absolutely believe in the ongoing recovery of the market in the U.K. As Chair of UKOCG, the U.K. Organic Certification Bodies Group, I will be coordinating discussions for the certification bodies with Defra to ensure we are all clear as to how organic will be properly represented in the coming months and years, both in regard to regulation and the provision of a sustainable farming model. As a non-member of the EU, the U.K. will still be required to comply with EU organic standards to maintain the flow of organic products to and from the EU, so the U.K. will likely also continue to be bound by the EU Organic Regulation, and any changes made to it by EU Member States. Those communities who are most vulnerable such as those on low incomes and upland farmers need to be foremost in our minds as we consider what policies should be developed over the next couple of years in preparation for our exit."

So, the first impact of Brexit will be an increased workload for regulators, policy lawyers and specialists. They will have to make time to identify which are the vulnerable farmers and to what extent they need regulatory help and assistance. Negotiators may have to work out a strategy as to how to strike a favorable deal to secure trade post-exit. For the EU, British exporters currently have access to their markets without tariffs or other barriers. They in turn have access to the U.K. Will the EU apply tariffs to organic food and beverages following Brexit? This uncertainty will very probably deter or reduce investment in organic trade. Indeed, organic farming and trade is not only a sustainable farming model but also a business investment for some developers, requiring investment, borrowing and financial commitment. Some organic investors will halt their investments, threatening growth of organic arable land until uncertainty is resolved.

The Organic Milk Suppliers Cooperative: Implications of Brexit

The Organic Milk Suppliers Cooperative (OMSCo) has over 200 farmer members across the U.K., producing over 250 million liters and 65% of the U.K.'s organic milk supply. It is the only 100% organic farmer-owned and farmer-run dairy cooperative in the U.K. It is also the largest and longest established U.K. organic dairy cooperative and the second largest dedicated organic milk pool in the world. OMSCo supplies its products on a regular basis to all main European markets and the U.S. Will the EU choose to punish U.K. farmers and start to levy tariffs? And will farmers be able to pass on the weight of increased costs to EU consumers, or will the British Government subsidize exports?

If exports are subsidized, this raises questions as to how much is adequate and how much the government is prepared to spend. Conversely, the EU could give British organic farmers an "associate status" and carry on the existing trading rules as if the U.K. is a member state, in order to protect the environment and encourage the organic farming model.

According to Euromonitor’s Health and Wellness database, retail value sales of organic dairy are set to grow by $850 million in 2016-2021 in Western Europe and Eastern Europe. U.K. exporters will not want to be excluded from these positive gains. EU consumers are increasingly gravitating to organic produce. This is partially due to government support, and in some countries, further supported by powerful green lobbies, which influence government policy, retailers and funding allocation. While there are plenty of issues that need to be considered and resolved, organic trade is certainly not on the government's priority list right now.

Brexit Implications for Trade Between U.K. & U.S.

President Obama said that if Britain leaves EU, Britain will be at the back of the trade queue. The reality is that there is a growing demand for organic produce in the U.S. and the demand for organic is outstripping production. Our Health and Wellness database shows that the U.S. is set to see a net increase in sales of organic dairy of around $560 million in 2016-2021. The Soil Association stated that the key selling points for U.S. consumers interested in U.K. produce are innovation and heritage. The Soil Association has partnerships with certifying organizations in the U.S., which means it is easier than other countries for licensees to be certified there.

The organic products equivalence agreement between the U.S. and EU which came into force on June 1, 2012 means that most U.K. organic food products, provided they are free from livestock ingredients, can enter the U.S. market without additional certification. OMSCo set up an historic relationship with the U.S. Organic Valley, the world's largest independent cooperative of organic farmers. However, if Brexit becomes a reality, the U.K. may need to renegotiate the rules. Potentially, the U.K. might have to carry both USDA and Soil Association labels.

Look East

Our Health and Wellness database shows that China is set to see a net increase of organic dairy by around $1.8 billion in 2016-2021, doubling that projected for Western Europe and Eastern Europe, combined. OMSCo estimates that around 20% of its revenues were generated by its premium organic exports in 2015 and China is a hot pursuit market for U.K. dairy farmers. China will prove an important destination in this time of Brexit uncertainty.

Likewise, organic certification is a regulated sector in China. OMSCo obtained accreditation to Chinese standards through the Soil Association in 2015. Its partnership with Organic Valley enabled OMSCo to cooperate with a major organic brand owner to expand internationally. As a result of these developments, OMSCo has agreed to supply milk that is certified organic by both the USDA and Chinese certification bodies to a European processor. The first three consignments of UHT organic milk in one-liter Organic Valley branded bottles arrived in China's first-tier cities in May 2016. Chinese consumers have solid confidence in USDA organic standards. In view of food safety concerns and subsequent distrust of domestic milk products, middle-class Chinese are likely to continue to purchase foreign dairy imports.

The organic milk industry should also accelerate its marketing and increase attendance of overseas exhibitions to promote its organic credentials. A recent study by Newcastle University has reawakened the organic/non-organic food debate. The study found that organically grown produce contains far higher levels of antioxidants, believed to help stave off cancer. The number of reported cancer cases in China is rising, and the health benefits of organic dairy, supported by academic findings such as this, can be marketed effectively to Chinese consumers, creating business opportunities and a positive feel towards British and U.S. brands. Already, there are positive trade relations between China and the U.K., and if the door to Europe closes, China offers a window of opportunity for British dairy farmers.

For questions on this article or further insights, contact Victoria Dele, communications executive, at victoria.dele@euromonitor.com.