By Sean Moloughney, Editor03.01.24

With economic pressures impacting markets and margins, dietary supplement brand owners and their manufacturing partners are challenged to reduce costs, optimize supply networks, exceed quality standards, and deliver innovative products that address consumer health needs and preferences.

Facing tight margins in a competitive landscape, reinforcing supply networks and ensuring quality standards must be at the core of every brand owner’s operations. When outsourcing manufacturing, brands retain responsibility for the integrity of the finished product; so vetting contractors, conducting periodic audits, and frequent communication are essential to success.

Supply networks have transitioned from a “new normal” to “never normal,” said Nikunj Desai, head of global supply chain at ACG Group. “We are faced with multiple uncertainties on a global level ... With this challenging backdrop, supply chain management has to find the agility and efficiency sweet spots,” he said, advising brands to consider geographic de-risking, strong supplier relationships, and digitization initiatives that offer end-to-end visibility.

Kristine Halliwell, purchasing director for Vitaquest, said the best way to manage supply networks today is “to have strong and trustworthy relationships with suppliers, to plan ahead as much as possible, and to always have a solid back-up plan in case issues do arise. I find that with open and upfront communication, both internally and externally, we can better prepare ourselves for any upcoming challenges we may be facing.”

While inflation and economic pressures have impacted bottom lines, it’s crucial to maintain oversight throughout the supply network, and to have close relationships with partners, said Sara Lesina, general manager, Sirio (Europe and the Americas). “This means not only a thorough vetting of raw material providers once at onset, but continually monitoring performance, and scoring them based on reliability and product consistency.”

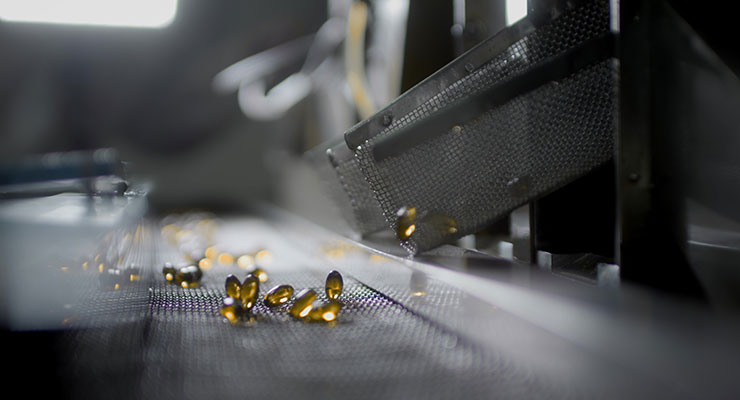

Implementing in-house quality checks throughout manufacturing facilities is vital, she added, “ensuring compliance with specifications and purity standards. This includes rigorous screening for impurities and upholding quality standards for every ingredient received and every final capsule or gummy produced.”

Additionally, maintaining an audited list of alternative suppliers, analyzing demand patterns, lead times, and market conditions will help ensure optimal inventory levels to mitigate any future disruptions, Lesina said.

“A forward-looking CDMO will always stockpile essential and strategic ingredients in order to maintain flexibility in the event of supply disruption. One of the keys to this is having a really strong and experienced purchasing team,” she said. “They can build in lower lead times, check capacity, and even monitor prices and any medium-term disruption (such as potential price spikes or logistical disruption). Continuity planning as a consistent state of readiness is the best way to ensure that our customers’ deliveries always remain on time and meet specifications.”

Increasingly, brands receive more and detailed questions from consumers about the source of ingredients and how products are manufactured, noted Scott Steinford, founder of Trust Transparency Consulting. “The brands are too often placed in the middle of the conversation, unable to get the information from the contract manufacturer and therefore unable to answer the consumer. The contract manufacturer should regard a difficult consumer question as an opportunity to display transparency and partnership. Answers such as ‘proprietary,’ ‘it depends.’ or ‘information unknown’ do not work in today’s consumer environment and cannot be accepted by the brand owner.”

According to Steinford, “in general, innovation in nutraceutical manufacturing is a bit of the tail wagging the dog. Contract manufacturers are slow to incentivize innovation until the innovation is already established to the consumer.”

Given such narrow margins, it’s understandable some manufacturers may be hesitant to take risks, he added. “However, an innovative and risk-taking contract manufacturer is more likely to have higher retention of innovative customers.”

Brands that rely on contract manufacturers should look for new innovations “from trade shows, trade publications, and other industries, and seek early-adopter contract manufacturers offering innovation,” Steinford said. “Relying solely on innovation from your contract manufacturer might leave you behind the curve as it relates to recognizing upcoming trends.”

Adel Villalobos, founder and CEO of Lief Labs, noted that innovation has encountered notable hurdles, “largely stemming from the disruptive aftermath of the COVID-19 pandemic.”

“Prior to the global health crisis, the industry was experiencing a steady trajectory of growth, buoyed by significant advancements such as the rise of gummy supplements and the introduction of pioneering ingredients,” he said. “These innovations catered to evolving consumer preferences for natural and scientifically backed dietary solutions.”

However, the pandemic ushered in a period of unprecedented growth, Villalobos added, “fostering a sense of complacency within the industry. With demand soaring and profits escalating, many companies opted to prioritize short-term gains over long-term innovation.”

Consequently, research and development initiatives were kept on the back burner, he said, “leading to a saturation of the market with similar products.”

“This saturation, coupled with the plateauing of previous innovations, created a reluctance among companies to venture into uncharted territory, further exacerbating the slowdown in innovation. As a result, the industry experienced a contraction in 2023, underscoring the urgent need for a revitalized approach to innovation.”

Recognizing healthy consumer demand for dietary supplements, many contract manufacturers understand they must keep pace with a market on the move.

“At Lief Labs, we are acutely aware of the imperative for innovation and have made substantial investments to cultivate an environment conducive to it,” said Villalobos. “We are witnessing promising developments in areas such as regenerative farming and the exploration of novel botanicals and herbal compounds.”

Innovation teams should broaden their horizons beyond gummies, he added, acknowledging this popular format has “undeniably revolutionized supplement consumption.”

While gummies will continue to be a staple, according to Villalobos, “it’s high time for the industry to diversify and explore new avenues of innovation in delivery formats.”

“Innovative dosage and delivery technologies have significantly elevated the effectiveness, convenience, and appeal of dietary supplements,” he continued.

For example, “microencapsulation and nanotechnology bolster stability, solubility, and bioavailability of nutrients, while time-release formulations guarantee sustained efficacy,” he noted. “Liposomal delivery shields nutrients from degradation and boosts absorption, and transdermal patches offer hassle-free administration. Nanogels and nanocapsules ensure targeted delivery and enhanced bioavailability. Overall, these innovations empower manufacturers to craft products that cater to the evolving needs of consumers, thereby fostering better health outcomes.”

Following Covid, and despite ongoing challenges, Lesina said the nutraceutical landscape is “entering a dynamic time” for innovation. “We see increasing numbers of new products enter the market in newer areas, and for newer types of customers. All across the industry we see great medium-term growth potential.”

To keep pace with evolving consumer trends, manufacturers are compelled to develop new formulations and formats. Lesina cited recent research from Ingredient Transparency Center that indicated consumers prioritize the physical characteristics of supplements, with ease of swallowing and a single daily dosage being paramount on a global scale. “What does this mean for our customers? We need to always be one step ahead to help them succeed,” she said.

At the same time, formulators are creating unique options tailored for busy adults, offering “a sensory experience with various flavors, shapes, and colors,” Lesina said, noting opportunities to continue advancing the gummies market.

“Ultimately, innovation in the market is being driven by consumers of today who are armed with a greater quantity and quality of information and are very conscious about what they are putting in their bodies and the benefits they can expect,” she said. “They seek unique products with ‘better ingredients,’ sugar-free, superior formulations, and enhanced technical attributes.”

For example, there’s growing emphasis on bioavailability due to heightened customer awareness, according to Lesina. “Liposomes present a novel ingredient delivery format, perceived as less harmful to the body and requiring a lower dose for equivalent efficacy, given their reduced loss in the gastrointestinal tract.”

Sirio has recently launched “the first-ever gummy with a semi-liquid filling,” known as HoneyChill, “which not only delivers both on the gummy and the syrup dosage front, it also creates an indulgent sensory experience for the consumer,” Lesina said. “Additionally, our R&D team is constantly working on new formats, such as our Plantegrity platform. Innovative technologies like this are key for brands looking to stand out in a competitive landscape.”

In terms of product and category trends, beauty-from-within, healthy aging, gut health, nootropics, and sports recovery continue to be strong categories, according to Blayney McEneaney, sales executive, business development at Vitaquest. “With so many great ingredients in these categories, they create great opportunities for brands to develop products consumers notice and appreciate. This is especially true with some branded ingredients in these categories.”

With sustained emphasis on gummies as a preferred delivery system, Lesina noted an evolution beyond simply getting a gummy to market, and toward “best-in-class gummies” with newer ingredients and proven health benefits.

“There’s a growing demand for unique formulations that blend natural actives, but a desire for these ingredients to be backed by proper scientific evidence,” she added. “We have also moved along in terms of microbiome products, and we are now exploring pro- and postbiotics into gummies.”

Another other big shift for 2024, is emphasis on women’s health supplements that feature personalized combinations tailored to individual needs.

“For example, a recent survey suggested that women over the age of 55 are now the biggest buyers of supplements, prompting brands to increasingly tailor products for this consumer class,” Lesina said. “So the women’s health category, which in isolation is still only moderately sized, has tremendous growth potential, particularly as brands start to tailor formulations for issues women in these age groups face.”

Additionally, the convergence of mental wellbeing with cognitive health, including focus, concentration, and acuity, has led consumers to specialty products like mushrooms, nootropics and herbal ingredients.

Villalobos agreed that transparency along with regulatory compliance are paramount “to foster a successful and mutually beneficial relationship” between brand owner and contract manufacturer.

“A manufacturing partner should be forthcoming about what is feasible and what is not, ensuring that all products meet regulatory standards,” Villalobos said. “It’s essential for the partnership to be collaborative, with both parties working together to navigate the complexities of regulatory requirements. Brands should seek a manufacturing partner that not only possesses regulatory knowledge but also actively shares it, fostering a collaborative environment where both parties take ownership of quality and compliance.”

The optimal partner should extend beyond manufacturing capabilities, he added. “They should act as product developers. Brands ought to seek out partners equipped with robust R&D and technical formulation expertise, capable of not only conceptualizing product ideas but also scaling them efficiently.”

Lief Labs’ methodology strikes a balance between addressing immediate needs and making long-term R&D investments, Villalobos said. Additionally, proactive risk mitigation strategies instill confidence in navigating uncertainties.

“This collaborative ethos empowers us to collaborate with brands in product differentiation and seizing market opportunities,” he added. “Consequently, brands can maintain a competitive edge and consistently offer innovative products to consumers. Ultimately, brands should seek a manufacturing partner that shares their vision and values, prioritizing open communication, mutual respect, and a commitment to excellence.”

Quality and reliability are top priorities, according to Lesina. “Brands should seek partners with a proven track record of delivering high-quality products consistently. Secondly, and linked to quality are the partner’s ability to innovate and adapt.”

Alongside manufacturing capabilities, like the ability to handle complex formulations and dosage types, brands should consider softer skills like the ability to communicate and adjust during both the development and post-manufacturing process, Lesina said.

“One of our key strengths is that we are always looking with our customers at what might be the next ‘killer product’ 6 months or a year ahead, and we have a very large R&D team so we can expedite the development stage to be first-to-market with products.”

Desai advised brands to evaluate the following qualities: management strength, multi-locational supply capability, regulatory approvals, financial strength, having a long-term and progressive outlook, R&D strength, traceability, and quality standards.

“Identify your needs as a brand and make sure your manufacturer’s capabilities line up,” said McEneaney. Assessment should consider: formulation expertise, pricing that includes label/packaging printing; manufacturing and packaging services; in-house lab testing; on-site third-party logistics services; planning/retailer knowledge for distribution; artwork regulatory review and guidance; transparent lead time estimates; clear understanding of product specifications; flavor development; packaging solutions; and certifications and FDA inspections.

Third-party certifications are important during initial discovery and qualification of contract manufacturers, according to Steinford. “A brand retailer should investigate the legitimacy of each declared certification by verifying the current status of the certification with the certification body. Too often, contract manufacturer websites are not updated when certifications are dropped.”

Bryan Losier, quality assurance director at Vitaquest, said third-party certifications obtained through regulatory bodies, such as the NSF ANSI 455-2, USP, and FSSC22000 “demonstrate the tremendous level of confidence we have in our business. These certifications represent the value we place on a quality-first approach to operations, so our customers can rest assured that their products are being manufactured at a higher standard than the competition, increasing their viability in a growing and competitive market.”

However, certifications can’t be a shortcut for due diligence, Steinford said. “It is the brand’s obligation to verify the quality of production and adherence to regulations. Before, and routinely after determining a contract manufacturing partner, physical inspection of the facility and SOPs (standard operating procedures) are necessary to maintain the confidence of a successful quality manufacturing partnership.”

“All of these issues are easily missed by the brand owner that relies solely on the CofA (certificate of analysis) provided by the contract manufacturer,” Steinford said. “These issues are usually discovered by a dedicated quality control/quality assurance specialist that reviews manufacturing batch records in addition to the CofA. The extra time and expense required to review manufacturing to this detail defends against unexpected results being discovered by consumers or consumer advocates and provides more consistent quality from the contract manufacturer.”

According to McEneaney, one of the biggest challenges is constant change of branded products, consumer trends, packaging innovations, and overall consistency regarding business flow.

“The supply chain is vast, ranging from raw materials to packaging components,” he said. “You are only as efficient as the last material that arrives.”

The review process for artwork is another consideration, he added. “If you are a new brand, this is the area that requires the most amount of attention to ensure your launch is successful. If your manufacturer does not review your artwork for regulatory compliance, it can add potential risks down the road as the product grows more popular.”

Complex formulations that include unique ingredients may lead to more time in the R&D stage, requiring contract manufacturers with large and experienced scientific teams to resolve formulation challenges like taste and stability, said Lesina. “Over the next few years, we expect the market to want an increasing number of truly novel products and therefore R&D expertise of contract providers will be critical.”

Additionally, sourcing strategies for clean label products and pure, high-quality ingredients, can present challenges, Lesina said. “Meeting organic standards and using natural sweeteners and colors, especially in Europe, is a growing requirement from customers. So while we have been doing this for many years, the auditing of our supplies and testing of ingredients is something we see customers asking for more visibility on. They want to ensure quality and stability in their supply. One approach we have taken is to launch a number of high-profile collaborations with premium and branded ingredient suppliers. With concerns about the sustainability of fish oil, we’ve also been looking into alternative sources for omega-3, like algae.”

In terms of formulations, ingredient overages in product manufacturing are almost always necessary, noted Steinford, but they can impact the price competitiveness of a product. The exact amount of, or need for, an overage is often different from one manufacturer to another when quotations are provided, he added.

“A brand retailer should not submit a formula expecting the contract manufacturer to determine the proper overage from a supplement facts panel style RFQ. Overages should be included in the quotation request formula based on substantiation of expected shelf life. Additionally, the contract manufacturer should explain any unexpected additional requirements of ingredients due to the production process and testing of ingredients. Failure to identify this calculation in advance results in decreased yields and affects the cost of the product.”

Terry Coyle, chief innovation officer at Vitaquest, said the company can overcome any issues with meeting label claims based on its own stability data and internal testing. “We add overages to ingredients we know have stability issues to compensate for variability and regulatory requirements, ensuring consistency and efficacy throughout the product’s shelf-life. Proper formulation, testing, and documentation are crucial for regulatory compliance and product quality.”

Meanwhile, the impacts of inflation, which affect both manufacturers and brands, continue to present challenges, according to Villalobos. “Rising costs of raw materials and labor directly increase manufacturing expenses, leading to higher prices for brands sourcing products. Consequently, brands may exert pressure on manufacturers to reduce costs, inadvertently stifling innovation in the process.”

This challenge threatens to impede the industry’s overall ability to innovate and deliver greater value to consumers, he added. “When cost reduction becomes the sole focus, it undermines our capacity to invest in new ideas and technologies that drive innovation. However, it is imperative for companies with the means to resist price pressures by prioritizing innovation. By leveraging our resources and creativity, we can overcome these challenges and continue to provide innovative solutions that meet the evolving needs of consumers while maintaining sustainable margins.”

Sustainability in blister packaging concerns creating and utilizing blister packs in a way that reduces environmental impact. Blister packaging is a popular, efficient way to package pharmaceuticals and nutraceuticals. Worthy of consideration are ways to conscientiously manufacture and dispose of blister packs that minimize impact on

the environment.

As the leading blister packaging machine manufacturer in the U.S., Pharmaworks can provide solutions and expertise in your blister packaging processes and your

associated sustainability efforts.

Some critical aspects of sustainability in blister packaging include:

1. Materials: Using recyclable and/or environmentally friendly materials when feasible.

2. Reduced Packaging: Design and creation of blister packaging with a concerted effort to minimize material use while still obtaining all the benefits of the blister package.

3. Recycling: When possible.

4. Environmentally Friendly Inks and Printing: Using environmentally friendly inks and printing processes to minimize environmental impact.

5. Energy Efficiency in Manufacturing: Auditing of manufacturing processes to ensure energy consumption is optimized and minimized.

6. Supply Chain Optimization: Optimization and minimization of carbon-emitting transportation of materials.

7. Regulatory Compliance: Using relevant environmental regulations as benchmarks/goals and working to exceed these standards when possible.

Sustainability in blister packaging is a topical concern, and manufacturing processes need to implement eco-friendly practices and procedures to reduce environmental impact. These efforts not only benefit the environment, but also lead to cost savings through less material used and more efficient manufacturing processes.

Facing tight margins in a competitive landscape, reinforcing supply networks and ensuring quality standards must be at the core of every brand owner’s operations. When outsourcing manufacturing, brands retain responsibility for the integrity of the finished product; so vetting contractors, conducting periodic audits, and frequent communication are essential to success.

Supply Networks

Following Covid, geopolitical tension and wars in Ukraine and Gaza, climate- and weather-related events, trade barriers, inflation and price volatility, are a few major issues presenting serious challenges for global commerce.Supply networks have transitioned from a “new normal” to “never normal,” said Nikunj Desai, head of global supply chain at ACG Group. “We are faced with multiple uncertainties on a global level ... With this challenging backdrop, supply chain management has to find the agility and efficiency sweet spots,” he said, advising brands to consider geographic de-risking, strong supplier relationships, and digitization initiatives that offer end-to-end visibility.

Kristine Halliwell, purchasing director for Vitaquest, said the best way to manage supply networks today is “to have strong and trustworthy relationships with suppliers, to plan ahead as much as possible, and to always have a solid back-up plan in case issues do arise. I find that with open and upfront communication, both internally and externally, we can better prepare ourselves for any upcoming challenges we may be facing.”

While inflation and economic pressures have impacted bottom lines, it’s crucial to maintain oversight throughout the supply network, and to have close relationships with partners, said Sara Lesina, general manager, Sirio (Europe and the Americas). “This means not only a thorough vetting of raw material providers once at onset, but continually monitoring performance, and scoring them based on reliability and product consistency.”

Implementing in-house quality checks throughout manufacturing facilities is vital, she added, “ensuring compliance with specifications and purity standards. This includes rigorous screening for impurities and upholding quality standards for every ingredient received and every final capsule or gummy produced.”

Additionally, maintaining an audited list of alternative suppliers, analyzing demand patterns, lead times, and market conditions will help ensure optimal inventory levels to mitigate any future disruptions, Lesina said.

“A forward-looking CDMO will always stockpile essential and strategic ingredients in order to maintain flexibility in the event of supply disruption. One of the keys to this is having a really strong and experienced purchasing team,” she said. “They can build in lower lead times, check capacity, and even monitor prices and any medium-term disruption (such as potential price spikes or logistical disruption). Continuity planning as a consistent state of readiness is the best way to ensure that our customers’ deliveries always remain on time and meet specifications.”

Increasingly, brands receive more and detailed questions from consumers about the source of ingredients and how products are manufactured, noted Scott Steinford, founder of Trust Transparency Consulting. “The brands are too often placed in the middle of the conversation, unable to get the information from the contract manufacturer and therefore unable to answer the consumer. The contract manufacturer should regard a difficult consumer question as an opportunity to display transparency and partnership. Answers such as ‘proprietary,’ ‘it depends.’ or ‘information unknown’ do not work in today’s consumer environment and cannot be accepted by the brand owner.”

Innovation Impact and Expectations

With so many pressures on supply networks, what’s the state of product innovation today?According to Steinford, “in general, innovation in nutraceutical manufacturing is a bit of the tail wagging the dog. Contract manufacturers are slow to incentivize innovation until the innovation is already established to the consumer.”

Given such narrow margins, it’s understandable some manufacturers may be hesitant to take risks, he added. “However, an innovative and risk-taking contract manufacturer is more likely to have higher retention of innovative customers.”

Brands that rely on contract manufacturers should look for new innovations “from trade shows, trade publications, and other industries, and seek early-adopter contract manufacturers offering innovation,” Steinford said. “Relying solely on innovation from your contract manufacturer might leave you behind the curve as it relates to recognizing upcoming trends.”

Adel Villalobos, founder and CEO of Lief Labs, noted that innovation has encountered notable hurdles, “largely stemming from the disruptive aftermath of the COVID-19 pandemic.”

“Prior to the global health crisis, the industry was experiencing a steady trajectory of growth, buoyed by significant advancements such as the rise of gummy supplements and the introduction of pioneering ingredients,” he said. “These innovations catered to evolving consumer preferences for natural and scientifically backed dietary solutions.”

However, the pandemic ushered in a period of unprecedented growth, Villalobos added, “fostering a sense of complacency within the industry. With demand soaring and profits escalating, many companies opted to prioritize short-term gains over long-term innovation.”

Consequently, research and development initiatives were kept on the back burner, he said, “leading to a saturation of the market with similar products.”

“This saturation, coupled with the plateauing of previous innovations, created a reluctance among companies to venture into uncharted territory, further exacerbating the slowdown in innovation. As a result, the industry experienced a contraction in 2023, underscoring the urgent need for a revitalized approach to innovation.”

Recognizing healthy consumer demand for dietary supplements, many contract manufacturers understand they must keep pace with a market on the move.

“At Lief Labs, we are acutely aware of the imperative for innovation and have made substantial investments to cultivate an environment conducive to it,” said Villalobos. “We are witnessing promising developments in areas such as regenerative farming and the exploration of novel botanicals and herbal compounds.”

Innovation teams should broaden their horizons beyond gummies, he added, acknowledging this popular format has “undeniably revolutionized supplement consumption.”

While gummies will continue to be a staple, according to Villalobos, “it’s high time for the industry to diversify and explore new avenues of innovation in delivery formats.”

“Innovative dosage and delivery technologies have significantly elevated the effectiveness, convenience, and appeal of dietary supplements,” he continued.

For example, “microencapsulation and nanotechnology bolster stability, solubility, and bioavailability of nutrients, while time-release formulations guarantee sustained efficacy,” he noted. “Liposomal delivery shields nutrients from degradation and boosts absorption, and transdermal patches offer hassle-free administration. Nanogels and nanocapsules ensure targeted delivery and enhanced bioavailability. Overall, these innovations empower manufacturers to craft products that cater to the evolving needs of consumers, thereby fostering better health outcomes.”

Following Covid, and despite ongoing challenges, Lesina said the nutraceutical landscape is “entering a dynamic time” for innovation. “We see increasing numbers of new products enter the market in newer areas, and for newer types of customers. All across the industry we see great medium-term growth potential.”

To keep pace with evolving consumer trends, manufacturers are compelled to develop new formulations and formats. Lesina cited recent research from Ingredient Transparency Center that indicated consumers prioritize the physical characteristics of supplements, with ease of swallowing and a single daily dosage being paramount on a global scale. “What does this mean for our customers? We need to always be one step ahead to help them succeed,” she said.

At the same time, formulators are creating unique options tailored for busy adults, offering “a sensory experience with various flavors, shapes, and colors,” Lesina said, noting opportunities to continue advancing the gummies market.

“Ultimately, innovation in the market is being driven by consumers of today who are armed with a greater quantity and quality of information and are very conscious about what they are putting in their bodies and the benefits they can expect,” she said. “They seek unique products with ‘better ingredients,’ sugar-free, superior formulations, and enhanced technical attributes.”

For example, there’s growing emphasis on bioavailability due to heightened customer awareness, according to Lesina. “Liposomes present a novel ingredient delivery format, perceived as less harmful to the body and requiring a lower dose for equivalent efficacy, given their reduced loss in the gastrointestinal tract.”

Sirio has recently launched “the first-ever gummy with a semi-liquid filling,” known as HoneyChill, “which not only delivers both on the gummy and the syrup dosage front, it also creates an indulgent sensory experience for the consumer,” Lesina said. “Additionally, our R&D team is constantly working on new formats, such as our Plantegrity platform. Innovative technologies like this are key for brands looking to stand out in a competitive landscape.”

In terms of product and category trends, beauty-from-within, healthy aging, gut health, nootropics, and sports recovery continue to be strong categories, according to Blayney McEneaney, sales executive, business development at Vitaquest. “With so many great ingredients in these categories, they create great opportunities for brands to develop products consumers notice and appreciate. This is especially true with some branded ingredients in these categories.”

With sustained emphasis on gummies as a preferred delivery system, Lesina noted an evolution beyond simply getting a gummy to market, and toward “best-in-class gummies” with newer ingredients and proven health benefits.

“There’s a growing demand for unique formulations that blend natural actives, but a desire for these ingredients to be backed by proper scientific evidence,” she added. “We have also moved along in terms of microbiome products, and we are now exploring pro- and postbiotics into gummies.”

Another other big shift for 2024, is emphasis on women’s health supplements that feature personalized combinations tailored to individual needs.

“For example, a recent survey suggested that women over the age of 55 are now the biggest buyers of supplements, prompting brands to increasingly tailor products for this consumer class,” Lesina said. “So the women’s health category, which in isolation is still only moderately sized, has tremendous growth potential, particularly as brands start to tailor formulations for issues women in these age groups face.”

Additionally, the convergence of mental wellbeing with cognitive health, including focus, concentration, and acuity, has led consumers to specialty products like mushrooms, nootropics and herbal ingredients.

Vetting Manufacturing Partners

Transparency and partnership are two key attributes to a successful long-term contract manufacturing relationship, said Steinford. “Your contract manufacturer should consider you an extension of your business, and vice versa. While it is typical to not divulge every aspect of the separate businesses, the line of separation of proprietary and shared communication should offer more transparency.”Villalobos agreed that transparency along with regulatory compliance are paramount “to foster a successful and mutually beneficial relationship” between brand owner and contract manufacturer.

“A manufacturing partner should be forthcoming about what is feasible and what is not, ensuring that all products meet regulatory standards,” Villalobos said. “It’s essential for the partnership to be collaborative, with both parties working together to navigate the complexities of regulatory requirements. Brands should seek a manufacturing partner that not only possesses regulatory knowledge but also actively shares it, fostering a collaborative environment where both parties take ownership of quality and compliance.”

The optimal partner should extend beyond manufacturing capabilities, he added. “They should act as product developers. Brands ought to seek out partners equipped with robust R&D and technical formulation expertise, capable of not only conceptualizing product ideas but also scaling them efficiently.”

Lief Labs’ methodology strikes a balance between addressing immediate needs and making long-term R&D investments, Villalobos said. Additionally, proactive risk mitigation strategies instill confidence in navigating uncertainties.

“This collaborative ethos empowers us to collaborate with brands in product differentiation and seizing market opportunities,” he added. “Consequently, brands can maintain a competitive edge and consistently offer innovative products to consumers. Ultimately, brands should seek a manufacturing partner that shares their vision and values, prioritizing open communication, mutual respect, and a commitment to excellence.”

Quality and reliability are top priorities, according to Lesina. “Brands should seek partners with a proven track record of delivering high-quality products consistently. Secondly, and linked to quality are the partner’s ability to innovate and adapt.”

Alongside manufacturing capabilities, like the ability to handle complex formulations and dosage types, brands should consider softer skills like the ability to communicate and adjust during both the development and post-manufacturing process, Lesina said.

“One of our key strengths is that we are always looking with our customers at what might be the next ‘killer product’ 6 months or a year ahead, and we have a very large R&D team so we can expedite the development stage to be first-to-market with products.”

Desai advised brands to evaluate the following qualities: management strength, multi-locational supply capability, regulatory approvals, financial strength, having a long-term and progressive outlook, R&D strength, traceability, and quality standards.

“Identify your needs as a brand and make sure your manufacturer’s capabilities line up,” said McEneaney. Assessment should consider: formulation expertise, pricing that includes label/packaging printing; manufacturing and packaging services; in-house lab testing; on-site third-party logistics services; planning/retailer knowledge for distribution; artwork regulatory review and guidance; transparent lead time estimates; clear understanding of product specifications; flavor development; packaging solutions; and certifications and FDA inspections.

Third-party certifications are important during initial discovery and qualification of contract manufacturers, according to Steinford. “A brand retailer should investigate the legitimacy of each declared certification by verifying the current status of the certification with the certification body. Too often, contract manufacturer websites are not updated when certifications are dropped.”

Bryan Losier, quality assurance director at Vitaquest, said third-party certifications obtained through regulatory bodies, such as the NSF ANSI 455-2, USP, and FSSC22000 “demonstrate the tremendous level of confidence we have in our business. These certifications represent the value we place on a quality-first approach to operations, so our customers can rest assured that their products are being manufactured at a higher standard than the competition, increasing their viability in a growing and competitive market.”

However, certifications can’t be a shortcut for due diligence, Steinford said. “It is the brand’s obligation to verify the quality of production and adherence to regulations. Before, and routinely after determining a contract manufacturing partner, physical inspection of the facility and SOPs (standard operating procedures) are necessary to maintain the confidence of a successful quality manufacturing partnership.”

Managing Market Challenges

As a brand owner, Steinford said the greatest conflicts he’s witnessed repeatedly with contract manufacturers include: changes to the formulation, including inactive ingredients, due to production issues without advising the brand; changes in overages due to the production process resulting in lower yields and a higher cost per unit compared to the quotation; and undisclosed differentiation of ingredients compared to specification due to supply chain issues, including price or availability.“All of these issues are easily missed by the brand owner that relies solely on the CofA (certificate of analysis) provided by the contract manufacturer,” Steinford said. “These issues are usually discovered by a dedicated quality control/quality assurance specialist that reviews manufacturing batch records in addition to the CofA. The extra time and expense required to review manufacturing to this detail defends against unexpected results being discovered by consumers or consumer advocates and provides more consistent quality from the contract manufacturer.”

According to McEneaney, one of the biggest challenges is constant change of branded products, consumer trends, packaging innovations, and overall consistency regarding business flow.

“The supply chain is vast, ranging from raw materials to packaging components,” he said. “You are only as efficient as the last material that arrives.”

The review process for artwork is another consideration, he added. “If you are a new brand, this is the area that requires the most amount of attention to ensure your launch is successful. If your manufacturer does not review your artwork for regulatory compliance, it can add potential risks down the road as the product grows more popular.”

Complex formulations that include unique ingredients may lead to more time in the R&D stage, requiring contract manufacturers with large and experienced scientific teams to resolve formulation challenges like taste and stability, said Lesina. “Over the next few years, we expect the market to want an increasing number of truly novel products and therefore R&D expertise of contract providers will be critical.”

Additionally, sourcing strategies for clean label products and pure, high-quality ingredients, can present challenges, Lesina said. “Meeting organic standards and using natural sweeteners and colors, especially in Europe, is a growing requirement from customers. So while we have been doing this for many years, the auditing of our supplies and testing of ingredients is something we see customers asking for more visibility on. They want to ensure quality and stability in their supply. One approach we have taken is to launch a number of high-profile collaborations with premium and branded ingredient suppliers. With concerns about the sustainability of fish oil, we’ve also been looking into alternative sources for omega-3, like algae.”

In terms of formulations, ingredient overages in product manufacturing are almost always necessary, noted Steinford, but they can impact the price competitiveness of a product. The exact amount of, or need for, an overage is often different from one manufacturer to another when quotations are provided, he added.

“A brand retailer should not submit a formula expecting the contract manufacturer to determine the proper overage from a supplement facts panel style RFQ. Overages should be included in the quotation request formula based on substantiation of expected shelf life. Additionally, the contract manufacturer should explain any unexpected additional requirements of ingredients due to the production process and testing of ingredients. Failure to identify this calculation in advance results in decreased yields and affects the cost of the product.”

Terry Coyle, chief innovation officer at Vitaquest, said the company can overcome any issues with meeting label claims based on its own stability data and internal testing. “We add overages to ingredients we know have stability issues to compensate for variability and regulatory requirements, ensuring consistency and efficacy throughout the product’s shelf-life. Proper formulation, testing, and documentation are crucial for regulatory compliance and product quality.”

Meanwhile, the impacts of inflation, which affect both manufacturers and brands, continue to present challenges, according to Villalobos. “Rising costs of raw materials and labor directly increase manufacturing expenses, leading to higher prices for brands sourcing products. Consequently, brands may exert pressure on manufacturers to reduce costs, inadvertently stifling innovation in the process.”

This challenge threatens to impede the industry’s overall ability to innovate and deliver greater value to consumers, he added. “When cost reduction becomes the sole focus, it undermines our capacity to invest in new ideas and technologies that drive innovation. However, it is imperative for companies with the means to resist price pressures by prioritizing innovation. By leveraging our resources and creativity, we can overcome these challenges and continue to provide innovative solutions that meet the evolving needs of consumers while maintaining sustainable margins.”

— SPONSORED CONTENT —

Sustainability in blister packaging concerns creating and utilizing blister packs in a way that reduces environmental impact. Blister packaging is a popular, efficient way to package pharmaceuticals and nutraceuticals. Worthy of consideration are ways to conscientiously manufacture and dispose of blister packs that minimize impact on

the environment.

As the leading blister packaging machine manufacturer in the U.S., Pharmaworks can provide solutions and expertise in your blister packaging processes and your

associated sustainability efforts.

Some critical aspects of sustainability in blister packaging include:

1. Materials: Using recyclable and/or environmentally friendly materials when feasible.

2. Reduced Packaging: Design and creation of blister packaging with a concerted effort to minimize material use while still obtaining all the benefits of the blister package.

3. Recycling: When possible.

4. Environmentally Friendly Inks and Printing: Using environmentally friendly inks and printing processes to minimize environmental impact.

5. Energy Efficiency in Manufacturing: Auditing of manufacturing processes to ensure energy consumption is optimized and minimized.

6. Supply Chain Optimization: Optimization and minimization of carbon-emitting transportation of materials.

7. Regulatory Compliance: Using relevant environmental regulations as benchmarks/goals and working to exceed these standards when possible.

Sustainability in blister packaging is a topical concern, and manufacturing processes need to implement eco-friendly practices and procedures to reduce environmental impact. These efforts not only benefit the environment, but also lead to cost savings through less material used and more efficient manufacturing processes.