02.04.19

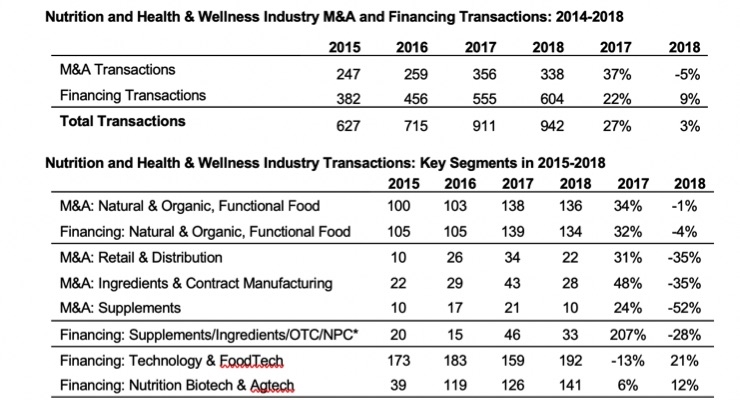

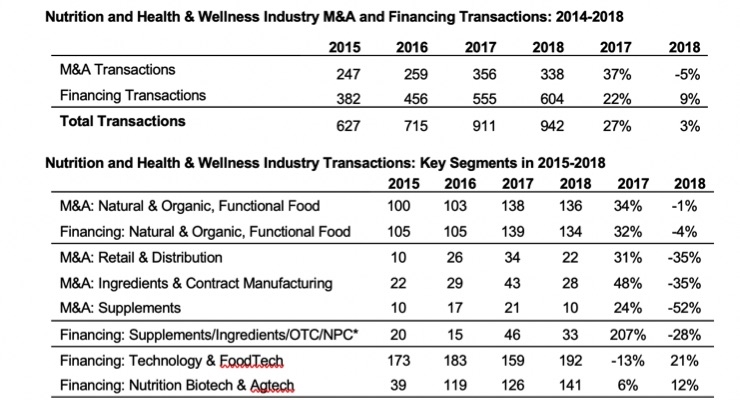

After four years of dramatic growth that averaged almost 40% annually, the Nutrition and Health & Wellness Industry saw only a 3% increase in transaction activity in 2018 compared to 2017, with the number of mergers and acquisitions (M&As) down 5% and financings up 9% compared to 2017, according to Nutrition Capital Network (NCN) and the NCN Transaction Database.

The NCN Transaction Database follows transactions in two categories: 1) mergers & acquisitions (M&As) or changes in ownership or control, and 2) investment or equity financing (excluding debt or non-cash strategic partnerships) from around the world in what NCN defines as the Nutrition and Health & Wellness Industry.

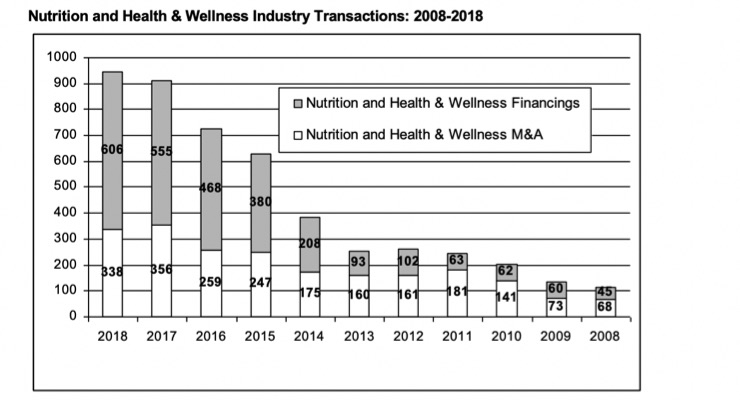

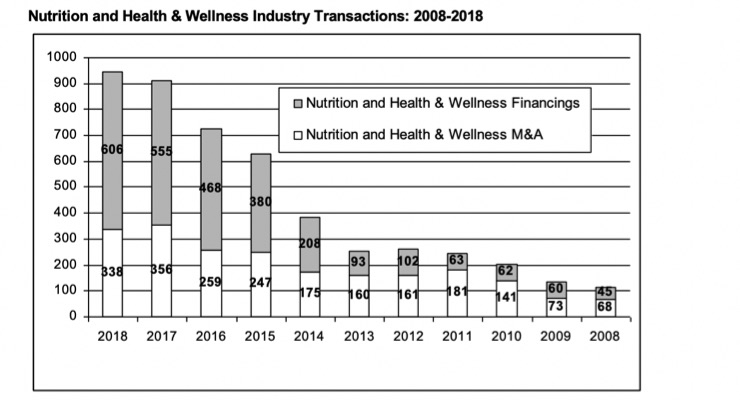

The NCN Transaction Database recorded a total of 942 transactions in the Nutrition and Health & Wellness Industry in January-December 2018 compared to 911 in January-December 2017, 715 in 2016, and 627 in 2015. NCN has tracked transactions in the industry using the same methodology since 2009. Total transactions numbered 203 in 2010 and grew fairly steadily to 253 in 2013 before taking off in 2014-2017.

“Given the steep growth rates of the last four years, it's hardly surprising to see that the Nutrition and Health & Wellness Industry has not sustained that pace of growth in M&A and financing transactions," said Grant Ferrier, managing director of Nutrition Capital Network. "But it's still impressive that 2018 exceeded 2017's record numbers. Moreover, the absolute number of transactions has risen from 253 in 2013 to 942 in 2018—an increase of 690 transactions in five years. I find that remarkable, even in light of the sustained growth in nutrition and health & wellness markets.”

"Investor interest in the industry has continued to mushroom as natural, functional, and healthier alternatives penetrate further into mainstream product categories, especially in food and beverage,” he continued. “It is also remarkable that the number of companies with investible propositions is keeping up with investor demand for opportunities in nutrition and health & wellness, although there are signs that the quantity of quality deal-flow may soon fall short of demand in light of slowing growth in 2018."

New investors and acquirers in nutrition and health & wellness include more strategic players from food and beverage: NCN sees not only household names like Coca-Cola, Pepsi, General Mills, Kellogg and Campbell, etc. participating but also increasingly a number of mid-tier and smaller firms becoming more active in healthier and natural & organic products. Health & Wellness has certainly become the centerpiece of the competitive game board in food & beverage this century, intertwined with other trends shaping future market demand like e-commerce, convenience and the millennial preference for grazing or multiple consumption occasions throughout the day rather than three sit-down meals.

The landscape of investors in health & wellness, nutrition science and the still-emerging sectors of agtech and foodtech include private equity investors with a consumer or nutrition science focus; family offices dedicating themselves to this industry or at least to social, health or sustainability causes; venture capital firms broadening their scope out of tech and biotech, including the top technology global superstars like Google, Alibaba and Tencent; high-net-worth individuals and a growing list of industry players that have sold businesses for tens of millions and are "giving back" and leveraging their experience, expertise and contacts in early-stage investments; and angel investors willing to support local startups or entrepreneurs that share their ethos or just have a good value proposition and happen to be in the same zip code.

Key Segment Trends

Nutrition Capital Network reported a moderate decline in activity in transactions in Natural & Organic and Functional Foods in 2018, but still 30% above 2015 and 2016 levels. The segment saw M&As decrease by 1% to 136 in 2018, and financings decrease by 4% to 134, but as these figures indicate there were still well more than two deals per week. Overall industry transactions increased 3%, with growth in financings and a decline in M&As. NCN noted the increasingly finite number of M&A candidates in many key segments is a factor, as well as the resulting supply-demand equation leading to understandably high expectations of value.

Nutrition Capital Network produces annual lists of top transactions in the Nutrition and Health & Wellness Industry, in addition to a summary of investment and M&A activity by segment, derived from the NCN Transaction Database. NCN has maintained a database on transactions since 2004, and has been compiling nutrition industry market data and top company lists data since 1996 when NCN founders founded Nutrition Business Journal. NCN also maintains and produces bi-annual summaries from its Dealflow Database and the NCN Presenter Tracking Database.

Source: Nutrition Capital Network Transaction Database. Counts are from listed, announced and published transactions from reputable sources. *OTC is over-the-counter medication; *NPC is natural personal care.

Source: Nutrition Capital Network Transaction Database

The NCN Transaction Database follows transactions in two categories: 1) mergers & acquisitions (M&As) or changes in ownership or control, and 2) investment or equity financing (excluding debt or non-cash strategic partnerships) from around the world in what NCN defines as the Nutrition and Health & Wellness Industry.

The NCN Transaction Database recorded a total of 942 transactions in the Nutrition and Health & Wellness Industry in January-December 2018 compared to 911 in January-December 2017, 715 in 2016, and 627 in 2015. NCN has tracked transactions in the industry using the same methodology since 2009. Total transactions numbered 203 in 2010 and grew fairly steadily to 253 in 2013 before taking off in 2014-2017.

“Given the steep growth rates of the last four years, it's hardly surprising to see that the Nutrition and Health & Wellness Industry has not sustained that pace of growth in M&A and financing transactions," said Grant Ferrier, managing director of Nutrition Capital Network. "But it's still impressive that 2018 exceeded 2017's record numbers. Moreover, the absolute number of transactions has risen from 253 in 2013 to 942 in 2018—an increase of 690 transactions in five years. I find that remarkable, even in light of the sustained growth in nutrition and health & wellness markets.”

"Investor interest in the industry has continued to mushroom as natural, functional, and healthier alternatives penetrate further into mainstream product categories, especially in food and beverage,” he continued. “It is also remarkable that the number of companies with investible propositions is keeping up with investor demand for opportunities in nutrition and health & wellness, although there are signs that the quantity of quality deal-flow may soon fall short of demand in light of slowing growth in 2018."

New investors and acquirers in nutrition and health & wellness include more strategic players from food and beverage: NCN sees not only household names like Coca-Cola, Pepsi, General Mills, Kellogg and Campbell, etc. participating but also increasingly a number of mid-tier and smaller firms becoming more active in healthier and natural & organic products. Health & Wellness has certainly become the centerpiece of the competitive game board in food & beverage this century, intertwined with other trends shaping future market demand like e-commerce, convenience and the millennial preference for grazing or multiple consumption occasions throughout the day rather than three sit-down meals.

The landscape of investors in health & wellness, nutrition science and the still-emerging sectors of agtech and foodtech include private equity investors with a consumer or nutrition science focus; family offices dedicating themselves to this industry or at least to social, health or sustainability causes; venture capital firms broadening their scope out of tech and biotech, including the top technology global superstars like Google, Alibaba and Tencent; high-net-worth individuals and a growing list of industry players that have sold businesses for tens of millions and are "giving back" and leveraging their experience, expertise and contacts in early-stage investments; and angel investors willing to support local startups or entrepreneurs that share their ethos or just have a good value proposition and happen to be in the same zip code.

Key Segment Trends

Nutrition Capital Network reported a moderate decline in activity in transactions in Natural & Organic and Functional Foods in 2018, but still 30% above 2015 and 2016 levels. The segment saw M&As decrease by 1% to 136 in 2018, and financings decrease by 4% to 134, but as these figures indicate there were still well more than two deals per week. Overall industry transactions increased 3%, with growth in financings and a decline in M&As. NCN noted the increasingly finite number of M&A candidates in many key segments is a factor, as well as the resulting supply-demand equation leading to understandably high expectations of value.

Nutrition Capital Network produces annual lists of top transactions in the Nutrition and Health & Wellness Industry, in addition to a summary of investment and M&A activity by segment, derived from the NCN Transaction Database. NCN has maintained a database on transactions since 2004, and has been compiling nutrition industry market data and top company lists data since 1996 when NCN founders founded Nutrition Business Journal. NCN also maintains and produces bi-annual summaries from its Dealflow Database and the NCN Presenter Tracking Database.

Source: Nutrition Capital Network Transaction Database. Counts are from listed, announced and published transactions from reputable sources. *OTC is over-the-counter medication; *NPC is natural personal care.

Source: Nutrition Capital Network Transaction Database