By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.12.04.17

Interest in, and awareness of, sustainability continues to grow. According to the Hartman Group’s Sustainability 2017 report, 83% of Americans are familiar with the concept of sustainability, up from 79% in 2015. Eight in 10 say they consider sustainability when making a purchase decision at least some of the time.

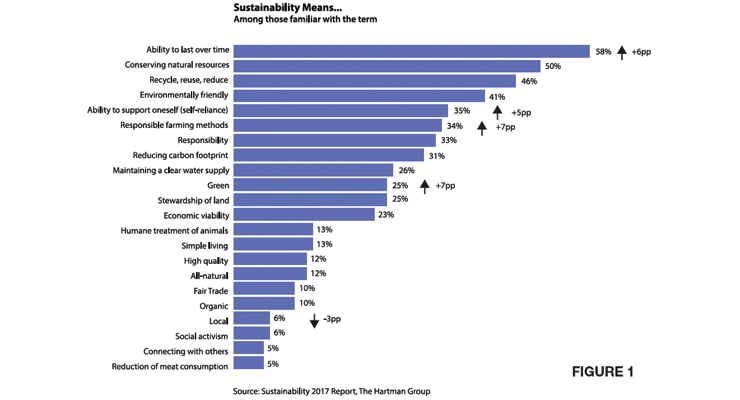

Although consumers’ definition of sustainability still embodies the personal, social, economic, and environmental principles of good stewardship, today, sustainable issues are more likely to reflect a responsibility to protect future generations and farm/land-oriented concerns, according to Hartman (Figure 1). Moreover, Americans’ sustainability efforts have become more personalized, prioritizing issues that impact “me/my family” vs. global environmental and social concerns.

Sustainability has become a moniker of higher quality products that command a premium price. All-natural, minimal processing, 100% organic, local, and sustainably-produced are among attributes that now define high quality in foods/drinks, per the Hartman’s Group’s Culture of Food 2015.

Globally, 42% are willing to pay a premium for products made with organic/all-natural ingredients, 39% eco-friendly/sustainable attributes, and 31% that tout social responsibility claims, according to Nielsen’s 2016 Move on Up survey.

Many sustainability claims are now being perceived as healthier. Two-thirds of adults equate grass-fed with healthy, 62% free-range, 49% local, per Technomic’s 2016 Healthy Eating Consumer Trend Report. One in five say sustainable food offerings are tastier.

And the future looks good. Millennials are twice as likely as those age 65+ to buy products from companies whose values are most like their own, according to the Natural Marketing Institute’s 2017 Sustainability Report.

Corporate Responsibility: Big Picture

Two-thirds of adults are interested in learning what companies are doing to keep jobs in the U.S., 54% treat animals humanely, 51% reduce trash/waste, 46% support the community, and 45% to create a safer workplace, according to NMI.

More than four in 10 also want more information on corporate efforts to increase the recycled content in their products/packaging, access to clean water, use of renewable energy/energy conservation, community children’s education efforts, gender equality, and reduce packaging.

Consumers are most interested in purchasing green or eco-friendly versions of foods, pet products, disposable diapers, and personal care items. Over the past five years, interest in eco-friendly disposable diapers has jumped 51%, home fragrances 27%, pet products 15%, and beverages 12%, per NMI.

One-quarter of consumers say a worker-friendly fair-trade label makes them more likely to buy a product; Rainforest Alliance and Marine Stewardship Council Certifications are also on the rise, per Mintel’s Sustainable Food Trends 2016.

One-third of adults overall want sustainable packaging, 36% reduced packaging and 27% biodegradable packaging; about half of those aged 25-44, per IRI.

Food Sustainability

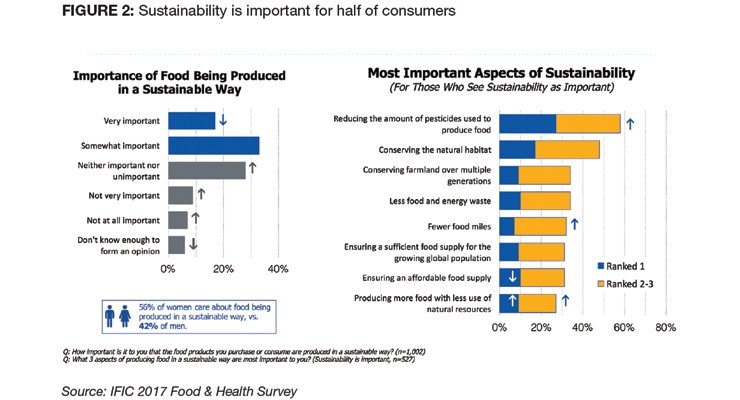

Four in 10 consumers say sustainability has an impact on their food/beverage purchases, according to IFIC’s 2017 Food & Health Survey; 1 in 10 a great impact. Pesticide reduction and conserving the natural habitat/farmland over multiple generations are their top concerns (see Figure 2).

Two-thirds of adults are concerned about the humane treatment of food animals; 58% more so than last year. One-quarter have purchased antibiotic/hormone-free foods, one in five cage-free/pasture-raised eggs, per Packaged Facts, 2017 Animal Welfare and the Meat and Dairy Case Industries 2017.

Over the past five years, sales of antibiotic-free meat grew at an annual rate of 13% per IRI; chicken 30%; pork 32%; grass-fed beef 54%. One in five retailers say clean label was the strongest wellness trend in 2016 per, Supermarket News 2017 Health & Wellness Survey.

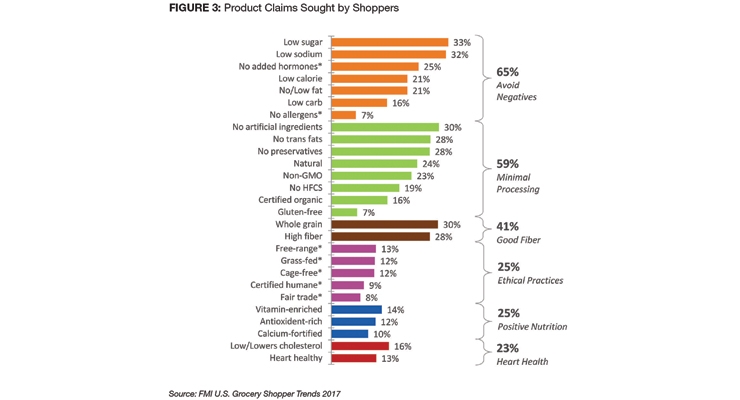

In 2017, 67% of food shoppers looked for claims that avoid negatives, 59% that confirm minimal processing, and 25% ethical practices (e.g., free-range). (See Figure 3.)

Of the 57% of consumers at least somewhat familiar with the term, 30% say they look for minimally processed foods often, if not all the time, per FMI 2016 Shopping for Health report. Cold or expeller pressed, cold brewed, extra virgin, craft processed, etc. are among the new less processed food production techniques gaining favor.

Between June 2016 and May 2017, 23% of all new U.S foods/drinks carried a no-additives/ preservatives claim; 19% GMO-free, 15% organic and 9% all-natural, per Mintel’s 2017 Clean label 2.0.

Sales of foods/beverages with an organic claim posted a compound annual growth rate of 14.8% over the past four years; GMO-free 12.5%; gluten-free 11.2%; and natural 11.1% for the year ending Oct. 29, 2016, per Nielsen.

According to the Organic Trade Association’s 2017 Organic Industry Survey, organic food/beverage sales reached $43 billion in 2016, up 8.4%. Fruits/vegetables were the largest sector at $15.6 billion, up 8.4%. Sales of organic meat/poultry jumped 17%.

Forty-one percent of grocery shoppers are trying to avoid GMOs, vs. 45% in 2015, per FMI’s 2017 U.S. Grocery Shopper Survey.

Half of shoppers would be willing to scan a QR code to find out more about the sourcing of a product’s ingredients, 46% country of origin, 38% the manufacturing process, and 31% company practices (e.g., animal welfare), according to FMI.

Dean’s continuously tested Promise Dairy Pure was the best-selling new food/beverage of 2016 with year one sales of $1.5 billion, per IRI’s 2017 New Product Pacesetters. Its “5 point-purity promise” guarantees no artificial growth hormones, tested for antibiotics, continually quality tested to ensure purity, only from cows fed a nutritious diet, and cold shipped fresh.

Nine in 10 grocery shoppers are positively influenced by a made/grown/raised in the USA label. Six in 10 shoppers believe that foods from China pose health risks, per FMI, 2017.

Environmental sustainability, local sourcing and health/nutrition are expected to be the top “hot culinary trends” 10 years from now (National Restaurant Association (NRA), 2017).

Hyper-local sourcing is the top hot culinary concept for 2017, per the NRA’s annual What’s Hot survey. Natural/clean ingredients rank third, environmental sustainability fourth, locally-sourced produce fifth, locally-sourced meat/seafood sixth, and food waste reduction seventh. Two-thirds of chefs cited estate/farm brands as a hot culinary trend.

More than half of diners said using sustainable foods is important for foodservice operators to create good value, 65% clean foods, 53% environmentally-friendly practices, and 45% local ingredients, per Technomic’s 2017 Value & Pricing Consumer Trend Report.

Half of shoppers view farmers as a strong ally in staying healthy, right behind their doctor, family and friends, and just above fitness/health clubs. One-quarter say they rely on farms to make sure their food is safe/nutritious, per FMI.

Prince Charles has launched a program to rediscover lost crops, fruits, and vegetables (e.g., pig weed and dragon beans), called the Forgotten Foods Network. Regenerative agriculture, hydroponics, and vertical farming are among the next hot sustainable agricultural techniques. BPA, heavy metal contamination, and non-GMO animal feed are among the emerging concerns.

The Supplement Story

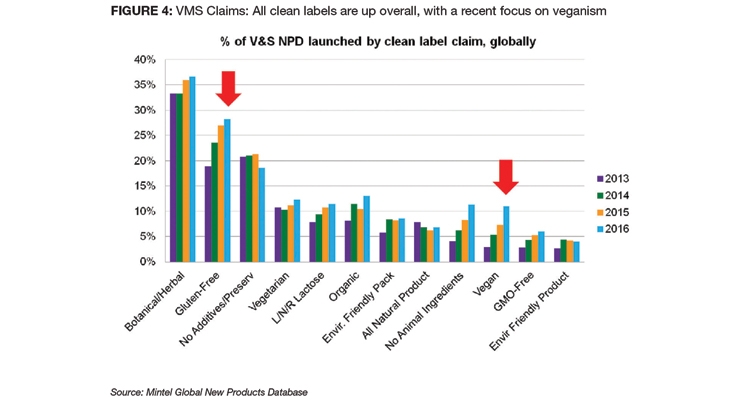

Globally, clean/sustainable label claims have increased on new dietary supplements over the past few years. Clean botanical/herbal claims were the most prominent, appearing on 37% of all new supplements in 2016, followed by gluten-free, no additives/preservatives, organic, no animal ingredients, vegan and less, no, reduced lactose formulations, per Mintel (Figure 4).

In North America, natural botanical/herbal and no additives/preservatives claims were carried on one-third of new supplements; GMO-free one in five; and organic, vegetarian, vegan, and/or reduced lactose 1 in 10, per Mintel.

According to the 2017 CRN Consumer Survey on Dietary Supplements, 23% of supplement users identify “country of origin” as most important when it comes to purchasing supplements; 29% of those aged 55+, the heaviest supplement users. Fifteen percent of users cite “labeled as organic” as most important.

In 2016, 28% of probiotic supplements dollar sales came from products that also had claims around natural/sustainable. Probiotics with claims for gluten-free jumped 36% in dollar sales, natural 49%, no artificial colors/flavors 39%, organic 47%, GMO-free 101%, Kosher 42%, preservative presence 29%, and natural presence 20%, according to Nielsen (year ending Aug. 27, 2016).

In 2016, herbal dietary supplements grew 7.7% to $7.4 billion and are projected to reach $9.3 billion by 2020. Euromonitor predicted that clean cultures, vitamins/minerals, and botanicals/bioactives will be the fastest growing specialty nutritional ingredients through 2019.

According to NMI’s 2016 Supplements/OTC/Rx Report, 71% of supplement users recognize and understand the USDA organic seal, 51% non-GMO verified, 34% fair-trade certified and 20% U.S. Pharmacopeia.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Although consumers’ definition of sustainability still embodies the personal, social, economic, and environmental principles of good stewardship, today, sustainable issues are more likely to reflect a responsibility to protect future generations and farm/land-oriented concerns, according to Hartman (Figure 1). Moreover, Americans’ sustainability efforts have become more personalized, prioritizing issues that impact “me/my family” vs. global environmental and social concerns.

Sustainability has become a moniker of higher quality products that command a premium price. All-natural, minimal processing, 100% organic, local, and sustainably-produced are among attributes that now define high quality in foods/drinks, per the Hartman’s Group’s Culture of Food 2015.

Globally, 42% are willing to pay a premium for products made with organic/all-natural ingredients, 39% eco-friendly/sustainable attributes, and 31% that tout social responsibility claims, according to Nielsen’s 2016 Move on Up survey.

Many sustainability claims are now being perceived as healthier. Two-thirds of adults equate grass-fed with healthy, 62% free-range, 49% local, per Technomic’s 2016 Healthy Eating Consumer Trend Report. One in five say sustainable food offerings are tastier.

And the future looks good. Millennials are twice as likely as those age 65+ to buy products from companies whose values are most like their own, according to the Natural Marketing Institute’s 2017 Sustainability Report.

Corporate Responsibility: Big Picture

Two-thirds of adults are interested in learning what companies are doing to keep jobs in the U.S., 54% treat animals humanely, 51% reduce trash/waste, 46% support the community, and 45% to create a safer workplace, according to NMI.

More than four in 10 also want more information on corporate efforts to increase the recycled content in their products/packaging, access to clean water, use of renewable energy/energy conservation, community children’s education efforts, gender equality, and reduce packaging.

Consumers are most interested in purchasing green or eco-friendly versions of foods, pet products, disposable diapers, and personal care items. Over the past five years, interest in eco-friendly disposable diapers has jumped 51%, home fragrances 27%, pet products 15%, and beverages 12%, per NMI.

One-quarter of consumers say a worker-friendly fair-trade label makes them more likely to buy a product; Rainforest Alliance and Marine Stewardship Council Certifications are also on the rise, per Mintel’s Sustainable Food Trends 2016.

One-third of adults overall want sustainable packaging, 36% reduced packaging and 27% biodegradable packaging; about half of those aged 25-44, per IRI.

Food Sustainability

Four in 10 consumers say sustainability has an impact on their food/beverage purchases, according to IFIC’s 2017 Food & Health Survey; 1 in 10 a great impact. Pesticide reduction and conserving the natural habitat/farmland over multiple generations are their top concerns (see Figure 2).

Two-thirds of adults are concerned about the humane treatment of food animals; 58% more so than last year. One-quarter have purchased antibiotic/hormone-free foods, one in five cage-free/pasture-raised eggs, per Packaged Facts, 2017 Animal Welfare and the Meat and Dairy Case Industries 2017.

Over the past five years, sales of antibiotic-free meat grew at an annual rate of 13% per IRI; chicken 30%; pork 32%; grass-fed beef 54%. One in five retailers say clean label was the strongest wellness trend in 2016 per, Supermarket News 2017 Health & Wellness Survey.

In 2017, 67% of food shoppers looked for claims that avoid negatives, 59% that confirm minimal processing, and 25% ethical practices (e.g., free-range). (See Figure 3.)

Of the 57% of consumers at least somewhat familiar with the term, 30% say they look for minimally processed foods often, if not all the time, per FMI 2016 Shopping for Health report. Cold or expeller pressed, cold brewed, extra virgin, craft processed, etc. are among the new less processed food production techniques gaining favor.

Between June 2016 and May 2017, 23% of all new U.S foods/drinks carried a no-additives/ preservatives claim; 19% GMO-free, 15% organic and 9% all-natural, per Mintel’s 2017 Clean label 2.0.

Sales of foods/beverages with an organic claim posted a compound annual growth rate of 14.8% over the past four years; GMO-free 12.5%; gluten-free 11.2%; and natural 11.1% for the year ending Oct. 29, 2016, per Nielsen.

According to the Organic Trade Association’s 2017 Organic Industry Survey, organic food/beverage sales reached $43 billion in 2016, up 8.4%. Fruits/vegetables were the largest sector at $15.6 billion, up 8.4%. Sales of organic meat/poultry jumped 17%.

Forty-one percent of grocery shoppers are trying to avoid GMOs, vs. 45% in 2015, per FMI’s 2017 U.S. Grocery Shopper Survey.

Half of shoppers would be willing to scan a QR code to find out more about the sourcing of a product’s ingredients, 46% country of origin, 38% the manufacturing process, and 31% company practices (e.g., animal welfare), according to FMI.

Dean’s continuously tested Promise Dairy Pure was the best-selling new food/beverage of 2016 with year one sales of $1.5 billion, per IRI’s 2017 New Product Pacesetters. Its “5 point-purity promise” guarantees no artificial growth hormones, tested for antibiotics, continually quality tested to ensure purity, only from cows fed a nutritious diet, and cold shipped fresh.

Nine in 10 grocery shoppers are positively influenced by a made/grown/raised in the USA label. Six in 10 shoppers believe that foods from China pose health risks, per FMI, 2017.

Environmental sustainability, local sourcing and health/nutrition are expected to be the top “hot culinary trends” 10 years from now (National Restaurant Association (NRA), 2017).

Hyper-local sourcing is the top hot culinary concept for 2017, per the NRA’s annual What’s Hot survey. Natural/clean ingredients rank third, environmental sustainability fourth, locally-sourced produce fifth, locally-sourced meat/seafood sixth, and food waste reduction seventh. Two-thirds of chefs cited estate/farm brands as a hot culinary trend.

More than half of diners said using sustainable foods is important for foodservice operators to create good value, 65% clean foods, 53% environmentally-friendly practices, and 45% local ingredients, per Technomic’s 2017 Value & Pricing Consumer Trend Report.

Half of shoppers view farmers as a strong ally in staying healthy, right behind their doctor, family and friends, and just above fitness/health clubs. One-quarter say they rely on farms to make sure their food is safe/nutritious, per FMI.

Prince Charles has launched a program to rediscover lost crops, fruits, and vegetables (e.g., pig weed and dragon beans), called the Forgotten Foods Network. Regenerative agriculture, hydroponics, and vertical farming are among the next hot sustainable agricultural techniques. BPA, heavy metal contamination, and non-GMO animal feed are among the emerging concerns.

The Supplement Story

Globally, clean/sustainable label claims have increased on new dietary supplements over the past few years. Clean botanical/herbal claims were the most prominent, appearing on 37% of all new supplements in 2016, followed by gluten-free, no additives/preservatives, organic, no animal ingredients, vegan and less, no, reduced lactose formulations, per Mintel (Figure 4).

In North America, natural botanical/herbal and no additives/preservatives claims were carried on one-third of new supplements; GMO-free one in five; and organic, vegetarian, vegan, and/or reduced lactose 1 in 10, per Mintel.

According to the 2017 CRN Consumer Survey on Dietary Supplements, 23% of supplement users identify “country of origin” as most important when it comes to purchasing supplements; 29% of those aged 55+, the heaviest supplement users. Fifteen percent of users cite “labeled as organic” as most important.

In 2016, 28% of probiotic supplements dollar sales came from products that also had claims around natural/sustainable. Probiotics with claims for gluten-free jumped 36% in dollar sales, natural 49%, no artificial colors/flavors 39%, organic 47%, GMO-free 101%, Kosher 42%, preservative presence 29%, and natural presence 20%, according to Nielsen (year ending Aug. 27, 2016).

In 2016, herbal dietary supplements grew 7.7% to $7.4 billion and are projected to reach $9.3 billion by 2020. Euromonitor predicted that clean cultures, vitamins/minerals, and botanicals/bioactives will be the fastest growing specialty nutritional ingredients through 2019.

According to NMI’s 2016 Supplements/OTC/Rx Report, 71% of supplement users recognize and understand the USDA organic seal, 51% non-GMO verified, 34% fair-trade certified and 20% U.S. Pharmacopeia.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.