Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends Inc12.05.16

Weight loss was among the top 10 fastest growing non-food U.S. consumer product categories in 2015, according to IRI. Nutrition Business Journal projected sales of weight-loss meal replacements will top $4.1 billion in 2016 and $4.6 billion by 2018; meanwhile, the stagnant $2.1 billion weight loss pill market will grow 4.5% in 2017 and 3.2% in 2018.

Slim-Fast’s fall 2015 rollout of its 15-item Advanced Nutrition line helped it secure a spot among IRI’s Top 10 “Breakthrough Healthcare Brands” for 2015, which requires a 300% increase in past year sales to qualify. Sales of high protein drinks reached $2.5 billion in 2015, per IRI. For the year ended May 15, 2016, sales of Atkins weight control meal replacements jumped 22.5%, Premier Protein drink sales 95%.

Marketdata Enterprises estimated the home delivery diet food market at $910 million in 2015 and reported that sales of medically supervised diet plans reached $7.8 billion last year.

Nielsen reported that weight monitoring is the top category for use of personal devices/technology for consumer health management; 17% used a diet support app, according to Mintel.

Euromonitor predicted the global slimming and weight loss meal replacement markets will enjoy a 4.9% annual global growth rate from 2015-2020 and be the fifth-fastest-growing healthcare category globally.

With more than half (55%) of U.S. adults trying to lose weight, up from 52% in 2015, and 25% trying to maintain weight, a better understanding of contemporary weight loss needs/behaviors is essential to maximize the full potential of the weight opportunity.

Market Potential

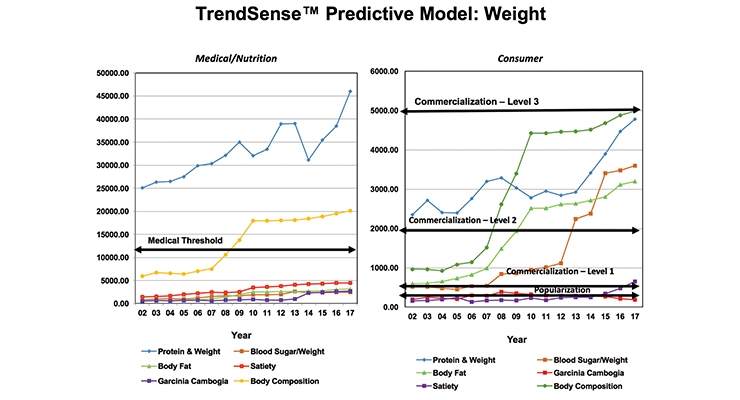

According to Sloan Trend’s TrendSense model, although not shown here, weight loss, obesity, kid’s weight control and weight control for women and men remain among the largest and strongest nutraceutical Mega markets. In 2017, weight loss in general and weight control efforts for men are projected to rise; weight control/children will continue a slow but steady decline.

Protein/weight loss, which is now fast approaching a Level 3 mass market will continue to accelerate in 2017 likely due to growing marketability of the type of protein, timing issues and other weight loss benefits associated with protein.

Two-thirds of U.S. adults believe that protein aids weight loss. Additionally, 87% believe it builds muscle; 73% helps you feel full; 68% increases lean body mass; and 33% boosts metabolism (IFIC’s 2015 Food & Health Survey). According to Mintel, 18% were on a high protein diet in 2015.

Reducing body fat/body composition, which now ranks second to appearance as the top weight loss goal, per the Natural Marketing Institute, remains a strong Level 2 mass market. In descending order, health reasons, longevity, increasing metabolism, and managing cholesterol, blood pressure, and diabetes round out the top dieting motivations.

As signaled by the new Go Low and other glycemic/insulin resistance-based diets, blood sugar control/weight loss is also now a strong and fast accelerating Level 2 mass market.

While satiety/weight control is approaching mass market status, it appears to be hampered by two issues. First, it is only in the top 10 product attributes for those who need to lose more than 25 pounds, per Packaged Facts. Secondly, there is an innate fear that something undesirable has been done to alter the integrity of the food’s composition.

Garcinia cambogia supplements, with sales of $66 million in 2015, are still well positioned for marketing in the health food/specialty channel despite a drop of 12.5% due to Dr. Oz and herbal controversies.

Growth Potential

• Weight loss is the second-largest functional food opportunity, behind cholesterol lowering (Packaged Facts, 2015).

• Over the past five years, men drove 69% of the growth in the weight control sector; those aged 18–34 accounted for 43% of the gains in the weight maintenance segment (Packaged Facts, 2015).

• One in five dieters wants to lose 20-49 pounds; 13% more than 50 pounds (Mintel).

• While women 18-34 have traditionally been the most likely to diet, Boomers are now the most active weight loss cohort (Packaged Facts).

• Age-specific weight loss is a fast-emerging area (e.g., 70% of those aged 75+ are overweight, leading to complications with mobility, falling, fraility, etc.)

• Weight loss programs tailored to ethnic groups represents a missed opportunity; 48% of Blacks are obese, 43% of Hispanics, 35% Whites and 12% Asian (CDC).

• 41% of U.S. adults bought sports nutrition products in hope of accelerating weight loss in 2015 (NBJ). Lose/manage weight is the #1 reason to exercise (IFIC).

• 7% of adults are on the Flat Belly Diet; 6% each on Paleo or a fasting/detox plan; 5% each on Jenny Craig, Weight Watchers, or a vegetarian diet; 4% the Mediterranean diet; 3% the Zone diet or a packaged food diet; 2% the DASH diet; and 2% a vegan diet. Glycemic control/insulin resistance-based diets are the latest wave (e.g., Go-Lo).

• 1.4 billion people globally are obese. In China, more than half of men and 46% of women aged 30+ are overweight.

Functional Foods

In the U.S., weight loss remains the top reason for making dietary changes, per IFIC. The most popular dieting activity is still “just watching calories,” according to FMI.

About 41% of consumers are trying to avoid low-calorie sweeteners; 55% of frozen food purchases are influenced by clean label, free from, and nutrient concerns, per Deloitte’s 2015 Evolving Values report. Not surprisingly, 77% surveyed by Mintel think that traditional diet products are unhealthy.

As a result, many weight loss marketers have shifted to simply offering healthier foods. While the demands of those trying to eat healthier align well with those trying to manage their weight, priorities differ for the larger group—those trying to lose weight. Not recognizing these differences will likely cause food markets to lose motivated weight loss consumers.

Half of those trying to lose weight monitor their calorie intake, per FMI. Carb reduction diets (e.g., Atkins or South Beach) rank second, used by 22% of consumers, followed by reducing fat (20%), no sugar diet (11%) and high protein or body building diets (9%).

Prominently displaying lower calorie counts, offering calorie-driven portion packs, and categorizing fresh foods by calorie content (e.g., Subway sandwiches with fewer than 400 calories) are smart strategies.

In May 2016, NutriSystem successfully tested a single-day kit of frozen meals that includes breakfast, lunch, dinner and snacks for $12 at 400 Walmart stores; a shelf-stable, 5-day kit is now available.

Dietary Supplements

Supplement marketers need to better capitalize on the complexity of weight loss motivations/behaviors by delivering multi-functional products—for example, aiding weight loss but also helping lower cholesterol. Overweight adults also have a high incidence of insomnia.

While 37% of adults want supplements that will help manage weight, 39% would like products to provide healthier muscle/tone, 37% boost metabolism, 37% boost immunity, and 35% to maintain bone, joint and muscle function, which is often seriously compromised by being overweight/obese, according to HealthFocus (2015).

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

Slim-Fast’s fall 2015 rollout of its 15-item Advanced Nutrition line helped it secure a spot among IRI’s Top 10 “Breakthrough Healthcare Brands” for 2015, which requires a 300% increase in past year sales to qualify. Sales of high protein drinks reached $2.5 billion in 2015, per IRI. For the year ended May 15, 2016, sales of Atkins weight control meal replacements jumped 22.5%, Premier Protein drink sales 95%.

Marketdata Enterprises estimated the home delivery diet food market at $910 million in 2015 and reported that sales of medically supervised diet plans reached $7.8 billion last year.

Nielsen reported that weight monitoring is the top category for use of personal devices/technology for consumer health management; 17% used a diet support app, according to Mintel.

Euromonitor predicted the global slimming and weight loss meal replacement markets will enjoy a 4.9% annual global growth rate from 2015-2020 and be the fifth-fastest-growing healthcare category globally.

With more than half (55%) of U.S. adults trying to lose weight, up from 52% in 2015, and 25% trying to maintain weight, a better understanding of contemporary weight loss needs/behaviors is essential to maximize the full potential of the weight opportunity.

Market Potential

According to Sloan Trend’s TrendSense model, although not shown here, weight loss, obesity, kid’s weight control and weight control for women and men remain among the largest and strongest nutraceutical Mega markets. In 2017, weight loss in general and weight control efforts for men are projected to rise; weight control/children will continue a slow but steady decline.

Protein/weight loss, which is now fast approaching a Level 3 mass market will continue to accelerate in 2017 likely due to growing marketability of the type of protein, timing issues and other weight loss benefits associated with protein.

Two-thirds of U.S. adults believe that protein aids weight loss. Additionally, 87% believe it builds muscle; 73% helps you feel full; 68% increases lean body mass; and 33% boosts metabolism (IFIC’s 2015 Food & Health Survey). According to Mintel, 18% were on a high protein diet in 2015.

Reducing body fat/body composition, which now ranks second to appearance as the top weight loss goal, per the Natural Marketing Institute, remains a strong Level 2 mass market. In descending order, health reasons, longevity, increasing metabolism, and managing cholesterol, blood pressure, and diabetes round out the top dieting motivations.

As signaled by the new Go Low and other glycemic/insulin resistance-based diets, blood sugar control/weight loss is also now a strong and fast accelerating Level 2 mass market.

While satiety/weight control is approaching mass market status, it appears to be hampered by two issues. First, it is only in the top 10 product attributes for those who need to lose more than 25 pounds, per Packaged Facts. Secondly, there is an innate fear that something undesirable has been done to alter the integrity of the food’s composition.

Garcinia cambogia supplements, with sales of $66 million in 2015, are still well positioned for marketing in the health food/specialty channel despite a drop of 12.5% due to Dr. Oz and herbal controversies.

Growth Potential

• Weight loss is the second-largest functional food opportunity, behind cholesterol lowering (Packaged Facts, 2015).

• Over the past five years, men drove 69% of the growth in the weight control sector; those aged 18–34 accounted for 43% of the gains in the weight maintenance segment (Packaged Facts, 2015).

• One in five dieters wants to lose 20-49 pounds; 13% more than 50 pounds (Mintel).

• While women 18-34 have traditionally been the most likely to diet, Boomers are now the most active weight loss cohort (Packaged Facts).

• Age-specific weight loss is a fast-emerging area (e.g., 70% of those aged 75+ are overweight, leading to complications with mobility, falling, fraility, etc.)

• Weight loss programs tailored to ethnic groups represents a missed opportunity; 48% of Blacks are obese, 43% of Hispanics, 35% Whites and 12% Asian (CDC).

• 41% of U.S. adults bought sports nutrition products in hope of accelerating weight loss in 2015 (NBJ). Lose/manage weight is the #1 reason to exercise (IFIC).

• 7% of adults are on the Flat Belly Diet; 6% each on Paleo or a fasting/detox plan; 5% each on Jenny Craig, Weight Watchers, or a vegetarian diet; 4% the Mediterranean diet; 3% the Zone diet or a packaged food diet; 2% the DASH diet; and 2% a vegan diet. Glycemic control/insulin resistance-based diets are the latest wave (e.g., Go-Lo).

• 1.4 billion people globally are obese. In China, more than half of men and 46% of women aged 30+ are overweight.

Functional Foods

In the U.S., weight loss remains the top reason for making dietary changes, per IFIC. The most popular dieting activity is still “just watching calories,” according to FMI.

About 41% of consumers are trying to avoid low-calorie sweeteners; 55% of frozen food purchases are influenced by clean label, free from, and nutrient concerns, per Deloitte’s 2015 Evolving Values report. Not surprisingly, 77% surveyed by Mintel think that traditional diet products are unhealthy.

As a result, many weight loss marketers have shifted to simply offering healthier foods. While the demands of those trying to eat healthier align well with those trying to manage their weight, priorities differ for the larger group—those trying to lose weight. Not recognizing these differences will likely cause food markets to lose motivated weight loss consumers.

Half of those trying to lose weight monitor their calorie intake, per FMI. Carb reduction diets (e.g., Atkins or South Beach) rank second, used by 22% of consumers, followed by reducing fat (20%), no sugar diet (11%) and high protein or body building diets (9%).

Prominently displaying lower calorie counts, offering calorie-driven portion packs, and categorizing fresh foods by calorie content (e.g., Subway sandwiches with fewer than 400 calories) are smart strategies.

In May 2016, NutriSystem successfully tested a single-day kit of frozen meals that includes breakfast, lunch, dinner and snacks for $12 at 400 Walmart stores; a shelf-stable, 5-day kit is now available.

Dietary Supplements

Supplement marketers need to better capitalize on the complexity of weight loss motivations/behaviors by delivering multi-functional products—for example, aiding weight loss but also helping lower cholesterol. Overweight adults also have a high incidence of insomnia.

While 37% of adults want supplements that will help manage weight, 39% would like products to provide healthier muscle/tone, 37% boost metabolism, 37% boost immunity, and 35% to maintain bone, joint and muscle function, which is often seriously compromised by being overweight/obese, according to HealthFocus (2015).

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.