Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.05.02.16

America’s 122 million women have long been the “go to” market when it comes to health. Women are more likely than men to take supplements, OTC drugs and prescription medications, manage their diet for health reasons, and take action to manage their weight.

According to Mintel’s Healthy Lifestyles U.S. report (October 2015), 33% of women describe their lifestyle as very healthy, 55% as somewhat healthy. Two-thirds of women now base how healthy they are by how they feel, rather than how they look.

In 2015, 71% of U.S. women took dietary supplements. Seventy-one percent of female users took a multivitamin, 37% vitamin D, 32% calcium, 25% vitamin C and 18% B-vitamins/complex, according to the 2015 CRN Consumer Survey on Dietary Supplements.

Women are also more likely to take antioxidants, biotin, iron, probiotics/prebiotics, lutein and fiber supplements than men, according to the 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements.

In mass channels, IRI reported that calcium supplement dollar sales fell 8.6%, while unit sales were down 9.8% for the year ending Nov. 22, 2015. Sales of bone health supplements are estimated to have reached $2 billion in 2015, up 3.4% according to Nutrition Business Journal (NBJ).

Choline, calcium, folic acid, magnesium and iron are among nutrient deficiencies demanding renewed attention.

Retaining mental sharpness and normal activities as they age are the top health concerns with six in 10 women very/extremely concerned; followed by bone health/strength 55%; eye health and tiredness/lack of energy each 54%; stress 52%; cancer and mental focus each 51%; back pain 50%; skin/appearance 49%; and weight 48%, per HealthFocus (2015).

Seven in 10 women think that their diet could be healthier, one in five a lot healthier, according to FMI’s 2015 U.S. Grocery Shoppers Trends.

Women are more likely to try vegetarian, gluten-free, dairy-free, lactose-free and raw dietary regimens than men, per FMI. Women are more likely to opt for the Weight Watchers, Atkins, Paleo or South Beach diet plans.

Life Stage Marketing

According to the Department of Health and Human Services (DHHS), the number of births in the U.S. reached 3.9 million in 2014, the highest level in recent years. Three-quarters of infants began life breast-feeding; 49% were breastfeeding at 6 months, up from 35% in 2010. In 2014, 1.6% of the population took a prenatal supplement; Hispanic women were the most likely to do so, per Packaged Facts’ 2014 Nutritional Supplements in the U.S. report. Pregnant women do not consume the Adequate Intake (AI) for choline, which may adversely affect fetal brain development (S. Zeisel, 2015); choline is not currently in many prenatal vitamin supplements.

DHHS reported that the average age of menopause onset is 51, with a duration of 1.5-3 years. NBJ estimated sales of menopause supplements reached $515 million, up 3.6% in 2015. With Generation X only one-third the size of the Baby Boomer cohort, expect sales of menopause products to slow.

However, a woman’s life expectancy is now 81.2 years; and with boomers now turning age 70, attention is quickly focusing on America’s 57 million post-menopausal women who are being confronted with two to three times the risk of heart disease/stroke, sarcopenia, mobility loss, memory issues, osteoporosis, and different later-life stage digestive conditions.

Market Potential

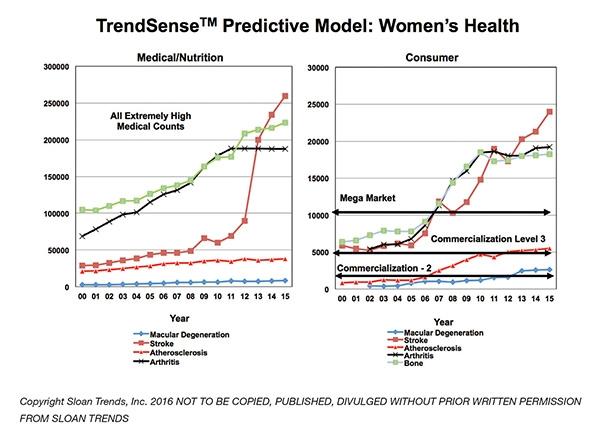

Women’s health provides a unique point of entry to many of the largest and fastest growing nutraceutical condition-specific markets. According to Sloan Trend’s TrendSense model, stroke and atherosclerosis are two of the fastest growing condition-specific mega markets. Women are more likely to have high total and LDL cholesterol, high blood pressure, and a higher prevalence of stroke than men. One-third of women have undesirable blood plaque levels, according to the American Heart Association, AHA (2016).

Women are more likely to suffer from arthritis than men, with the back, knees, hands and hips their top priority (Institute of Medicine, 2014). Meanwhile, 61% of women over age 50 have low bone mass and 16% have osteoporosis. Women account for 65% of all cases of age-related macular-degeneration (DHHS, 2014).

Body composition is one of the fastest growing weight-related markets; 43.2 million women are obese and 77.7 million are overweight.

Growth Potential

Four in 10 women are very concerned about the nutrient content of their food (FMI, 2015). Nine in 10 women think fortified foods are a convenient way to get their nutrients (Gallup, 2014). Calories, sugar, total fat, protein and sodium are the most important label information for women (Packaged Facts, Functional Foods, 2015).

Women age 55 and over are second only to those aged 18-34 as heavy nutrition bar users (Packaged Facts, Nutrition & Cereal Bars in the U.S., 2015). Over one-quarter of women use sports beverages; 11% energy drinks or shots. Women are most likely to buy any diet food, according to Packaged Facts.

Dietary Supplements

Women are increasingly concerned about conditions that impact their ability to function every day (e.g., stress, tiredness, muscle/joint pain, mental alertness), according to HealthFocus (2015). They are most likely to take a supplement for general wellness, to fill nutrient gaps, for bone health, healthy aging, immunity and energy (CRN, 2015). Women are also more likely than men to use weight loss supplements. Post-menopausal women have long been an overlooked but lucrative market for supplements.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

According to Mintel’s Healthy Lifestyles U.S. report (October 2015), 33% of women describe their lifestyle as very healthy, 55% as somewhat healthy. Two-thirds of women now base how healthy they are by how they feel, rather than how they look.

In 2015, 71% of U.S. women took dietary supplements. Seventy-one percent of female users took a multivitamin, 37% vitamin D, 32% calcium, 25% vitamin C and 18% B-vitamins/complex, according to the 2015 CRN Consumer Survey on Dietary Supplements.

Women are also more likely to take antioxidants, biotin, iron, probiotics/prebiotics, lutein and fiber supplements than men, according to the 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements.

In mass channels, IRI reported that calcium supplement dollar sales fell 8.6%, while unit sales were down 9.8% for the year ending Nov. 22, 2015. Sales of bone health supplements are estimated to have reached $2 billion in 2015, up 3.4% according to Nutrition Business Journal (NBJ).

Choline, calcium, folic acid, magnesium and iron are among nutrient deficiencies demanding renewed attention.

Retaining mental sharpness and normal activities as they age are the top health concerns with six in 10 women very/extremely concerned; followed by bone health/strength 55%; eye health and tiredness/lack of energy each 54%; stress 52%; cancer and mental focus each 51%; back pain 50%; skin/appearance 49%; and weight 48%, per HealthFocus (2015).

Seven in 10 women think that their diet could be healthier, one in five a lot healthier, according to FMI’s 2015 U.S. Grocery Shoppers Trends.

Women are more likely to try vegetarian, gluten-free, dairy-free, lactose-free and raw dietary regimens than men, per FMI. Women are more likely to opt for the Weight Watchers, Atkins, Paleo or South Beach diet plans.

Life Stage Marketing

According to the Department of Health and Human Services (DHHS), the number of births in the U.S. reached 3.9 million in 2014, the highest level in recent years. Three-quarters of infants began life breast-feeding; 49% were breastfeeding at 6 months, up from 35% in 2010. In 2014, 1.6% of the population took a prenatal supplement; Hispanic women were the most likely to do so, per Packaged Facts’ 2014 Nutritional Supplements in the U.S. report. Pregnant women do not consume the Adequate Intake (AI) for choline, which may adversely affect fetal brain development (S. Zeisel, 2015); choline is not currently in many prenatal vitamin supplements.

DHHS reported that the average age of menopause onset is 51, with a duration of 1.5-3 years. NBJ estimated sales of menopause supplements reached $515 million, up 3.6% in 2015. With Generation X only one-third the size of the Baby Boomer cohort, expect sales of menopause products to slow.

However, a woman’s life expectancy is now 81.2 years; and with boomers now turning age 70, attention is quickly focusing on America’s 57 million post-menopausal women who are being confronted with two to three times the risk of heart disease/stroke, sarcopenia, mobility loss, memory issues, osteoporosis, and different later-life stage digestive conditions.

Market Potential

Women’s health provides a unique point of entry to many of the largest and fastest growing nutraceutical condition-specific markets. According to Sloan Trend’s TrendSense model, stroke and atherosclerosis are two of the fastest growing condition-specific mega markets. Women are more likely to have high total and LDL cholesterol, high blood pressure, and a higher prevalence of stroke than men. One-third of women have undesirable blood plaque levels, according to the American Heart Association, AHA (2016).

Women are more likely to suffer from arthritis than men, with the back, knees, hands and hips their top priority (Institute of Medicine, 2014). Meanwhile, 61% of women over age 50 have low bone mass and 16% have osteoporosis. Women account for 65% of all cases of age-related macular-degeneration (DHHS, 2014).

Body composition is one of the fastest growing weight-related markets; 43.2 million women are obese and 77.7 million are overweight.

Growth Potential

- Cancer is the leading cause of death for women; age-adjusted deaths from stroke fell 34%, heart disease 31%, and cancer 14% over the past decade. Deaths from Alzheimer’s rose 8% (DHHS, 2014).

- 55% of women are interested in foods/beverages that aid heart health; 51% burn fat/calories; 50% maintain bone, joint and muscle function with aging; 50% aid memory and/or sleep; and 49% boost immunity and/or energy (HealthFocus, 2015).

- 42.7 million women are trying to lose weight; 17.6 million are trying to maintain weight (Packaged Facts, 2014).

- 41.7 million women (31.7%) have high blood pressure; 54.8 million (44.9%) cholesterol levels greater than 200 mg/dL; 38.6 million high LDL and 12.2 million low HDL cholesterol; 43.8 million are diagnosed with coronary vascular disease (AHA, 2016).

- 10.6 million women have diagnosed diabetes, with 3 million undiagnosed; 34.4 million women are pre-diabetic (AHA, 2016).

- No women, regardless of age, consume the Adequate Intake for choline. Eighty percent of post-menopausal women cannot synthesize choline and need food intake or choline supplements to prevent fatty liver and muscle damage—44% premenopausal women. Choline intake during pregnancy supports development of the memory center of the fetal brain with evidence of life-long effects on memory and academic performance (S. Zeisel, 2015).

- In 2014, 52% of women exercised regularly, up 9.5% over the past five years, according to Packaged Facts (2015).

- Women are much more likely to be clean-label advocates for both supplements and foods. No preservatives, artificial sweeteners, growth hormones, antibiotics or GMOs are significantly more important to women than men (Gallup, 2015).

- Sales of hair/skin/nails supplements topped $884 million in 2015, up 6%; anti-aging supplements $462 million, up 9% (NBJ).

- Hispanic women are 67% more likely to buy supplements targeting menopause than women in general; 56% for women’s health, and 30% prenatal supplements (Gallup, 2013).

- 43% of women age 65 and over use prescription medication for cholesterol; 23% high blood pressure, and 18% diabetes medications; 21% age 45-64 use lipid lowering drugs, 19% sex hormones, and 15% antidepressants (DHHS, 2014).

- Women are 33% more likely to visit a doctor then men; 33% of physicians recommend calcium supplements (DHHS, 2014).

Four in 10 women are very concerned about the nutrient content of their food (FMI, 2015). Nine in 10 women think fortified foods are a convenient way to get their nutrients (Gallup, 2014). Calories, sugar, total fat, protein and sodium are the most important label information for women (Packaged Facts, Functional Foods, 2015).

Women age 55 and over are second only to those aged 18-34 as heavy nutrition bar users (Packaged Facts, Nutrition & Cereal Bars in the U.S., 2015). Over one-quarter of women use sports beverages; 11% energy drinks or shots. Women are most likely to buy any diet food, according to Packaged Facts.

Dietary Supplements

Women are increasingly concerned about conditions that impact their ability to function every day (e.g., stress, tiredness, muscle/joint pain, mental alertness), according to HealthFocus (2015). They are most likely to take a supplement for general wellness, to fill nutrient gaps, for bone health, healthy aging, immunity and energy (CRN, 2015). Women are also more likely than men to use weight loss supplements. Post-menopausal women have long been an overlooked but lucrative market for supplements.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.