By A. Elizabeth Sloan, PhD & Catherine Adams Hutt, PhD, RD, CFS, Sloan Trends, Inc.09.08.15

Pharmavite’s Nature Made supplements were new to the top 10 over-the-counter (OTC) products list last year.1 Amazon.com ranks seventh among sources from which consumers regularly buy dietary supplements; Walmart tops the list.2

Dietary supplements are now the third most used remedy for minor ailments for adults and kids, right behind popping an OTC and “waiting it out.”3 Half of consumers stock up on immunity boosting supplements prior to cold season, 54% of working women keep them on-the-job.4-5

It’s no longer business as usual. However, despite the tough year for supplements, new consumer attitudes/practices, health issues and a rising fear of all things artificial are creating a bevy of new health-focused nutraceutical opportunities.

Market Mega Trends

An unprecedented demand for more natural health solutions, a fundamental shift toward food and naturally functional food-based ingredients, as well as demand for cleaner, safer and more effective products are the underlying forces set to redefine the nutraceutical market.

1) Natural Solutions

Sales of herbs/botanical supplements reached an all-time high of $6.4 billion, up 7.1% in 2014, marking 10 years of consecutive growth, according to Nutrition Business Journal (NBJ).6

Sales of plant oil supplements hit $312 million, while the $140 million bee product category grew another 7.9%.6

Anthocyanins joined polyphenols as the most marketable mass market phytonutrients followed by flavonoids and resveratrol, according to Sloan Trends’ TrendSense model.7

According to the 2013 Gallup Study on Nutrition Knowledge & Consumption, 62% of adults were aware of polyphenols in 2013; 21% were making a strong effort to get more.8

Hydroxytyrosol (especially for heart, reducing arterial plaque formation), French maritime pine bark (especially for circulation, anti-inflammatory, preventing oxidative stress); astaxanthan (especially for heart, lowering blood pressure, preventing oxidative stress) and pterostilbene (especially for heart, lowering blood pressure, preventing oxidative stress) are among the up-and-coming scientifically-supportable phytonutrients.

Herbs/botanicals have been a driving force in the penetration of natural remedies into the OTC drug category. Among the top 10 best-selling OTC sleep aids, MidNite PM contains melatonin, lavender, lemon balm and chamomile; Alteril contains L-tryptophan, melatonin and valerian.9

Homeopathics ranked seventh on NBJ’s list of best-selling supplements in 2014 with sales of $1.2 billion, up 5.1% per NBJ.6

Homeopathic remedies were among the top 10 best-sellers in the kids’ OTC internal analgesic, cough/cold, ear, allergy and sleep sectors. Hyland’s baby oral pain relief products are outpacing the category, which includes Orajel and Anbesol, nearly 2:1.10

Ayurvedic supplement sales grew 5.8%; Chinese herbs delivered $51 million to the bottom line. Turmeric supplement sales are on fire, up 21% in 2014 per NBJ.6

One-third (34%) of adults used a complementary alternative medical (CAM) approach in the past year, 37% of those aged 45-64.11

2) Whole Foods Lifestyle

Since 2013, the number of consumers who think they need supplements to meet their nutritional goals has fallen from 59% in 2012 to 51% in 2014, while those who believe they can meet their needs through food alone has increased from 41% to 49%, according to the 2014 Gallup Study of Nutrient Knowledge & Consumption.12

Ten years of ethnographic research from the Hartman Group confirms that core users are cutting back on supplements because they believe the nutrients in food are best and have pervasive doubts about the bioavailability of even the highest quality supplement brands.13

Three in 10 consumers classify their “diet lifestyle” as “whole foods;” 24% “minimally processed.”6

Not surprisingly, whole food supplements were one of the fastest growing supplement sectors in 2014, with sales projected by NBJ to grow from $1.7 billion to $2.7 billion by 2017.6

Fruit/vegetable supplement sales topped $117 million in 2014, after three years of double-digit growth.6

With the exception of goji, up 10.4% in 2014, superfood juice supplements appear to have lost their luster (e.g., noni juice sales grew 1.8% and mangosteen 1.5%, per NBJ).6

Green tea supplement sales topped $135 million, green foods $103 million, mushrooms $32 million and hops $15 million in 2014.6

The naturally functional movement has also moved center stage in the food and beverage business. According to IFIC’s 2013 Functional Foods Survey, 51% of adults prefer to get nutrients/health benefits that are naturally-occurring in foods.14

In 2014, 36% of the best-selling new foods/drinks on IRI’s New Product Pacesetters list touted real fruit health benefits, 14% real vegetable.15

Three-quarters of adults believe that some foods have natural components that help manage current health issues (e.g., digestion); 54% think foods can be used to reduce the use of some medicines.16

While fortified foods/beverages led global growth of healthy foods in 2013, up 10%, naturally nutritious food positionings were a close second (+8%).17

3) Clean, Safe & Effective

In 2014, 43% of supplement users reported using clean label supplements, up from 36% in 2012, according to the 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements. One-quarter (23%) of users opted for supplements that were labeled natural/naturally-sourced, 19% no artificial colors/flavors, 15% organic, 12% preservative-free, 8% gluten-free, 6% non-dairy/vegetarian/made from whole foods and 5% yeast or soy-free.18

Four in 10 are concerned they don’t absorb enough of the nutrients that supplements are supposed to deliver; 58% want clinical proof of the active ingredient.19 After value, potency was the most important attribute for supplement purchases; 41% of supplement buyers shopped by ingredient.2

When it comes to food, 23% of consumers are heavy clean label advocates, according to the 2013 Gallup Survey of Clean Label Foods & Beverages.20

For food, clean label is first and foremost about avoiding artificial additives. Chemicals are now the #1 consumer food safety issue, up 13 percentage points vs. 2014, according to IFIC’s 2015 Health & Nutrition Survey.21

All-natural, recognizable and no artificial ingredients, followed by no preservatives, are the top clean label drivers. Organic, natural, free-from and non-GMO are second tier clean label attributes.20

According to the Organic Trade Association, organic food/drink sales topped $35.9 billion in 2014, up 11.3%. Fruits/vegetables were the largest category followed by dairy, packaged/prepared foods and beverages.22

According to the Hartman Group’s 2014 Organic & Natural Report, 29% bought more local, 28% organic, 25% natural and 23% non-GMO foods last year; 27% of adults buy organic to avoid GMOs.23

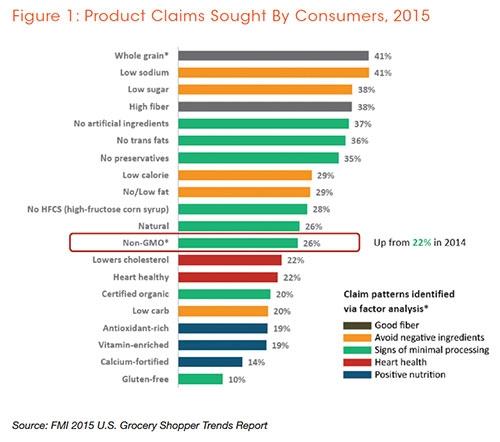

The percentage of shoppers avoiding GMOs doubled last year from 22% in 2014 to 40%, according to FMI’s 2015 U.S. Grocery Shopper Trends. GMOs have moved up behind natural and ahead of organic in terms of the food claims sought by consumers (see Figure 1).24

For the first time, health was among the top reasons 145 million consumers bought specialty foods in 2014. Organic was the most sought after gourmet food claim, however, retailers predict non-GMO will take its place within three years.25

4) Viable Venues

Sales of supplements through health practitioner offices remain a big opportunity, topping $3.1 billion in 2014 sales, up 7.9%; only 18% of sales came through physicians’ offices in 2013, according to NBJ.6

IMS reported that physicians wrote 76 million prescriptions for vitamins/minerals in 2012, mostly to those on government-funded or supplement-covered insurance plans.26 Eight in 10 physicians recommend supplements to their patients, 72% of patients given a recommendation comply.27

Physicians were most likely (42%) to recommend vitamin D, one-third calcium/fish oil, one in five B vitamins/C and one in 10 iron, antioxidants, fiber, vitamin A/E, probiotics or potassium.12

NBJ estimated the U.S. nutritional cosmetic market at $17.2 billion in 2013.6 More than half (56%) of facial skin care users are interested in products made from natural food ingredients (e.g., ginger or olive), according to Mintel 2014 Facial Skin Care – U.S.28 The natural personal care sector has reached $14.3 billion.6

Sales of all-natural pet foods jumped 12% in 2014; pet supplement sales grew 2.4% to $541.3 million. One-quarter of dog owners give their pet a nutraceutical treat, per Packaged Facts 2015 Pet Supplements in the U.S. report.29

Globally, Euromonitor projected sports nutrition will be the fastest growing health category through 2018.30 Protein, fish oil, ginseng, combination supplements, probiotics, eye health, minerals/calcium and co-enzyme Q10 are projected to be the fastest growing supplement categories.31

Singapore, Hong Kong, Norway, Australia and South Korea are the highest per capita supplement spenders by household. Globally, energy/tiredness is the top health concern for those aged 18-39, eye health for those aged 40-49 and retaining mental sharpness with age for those aged 50+.31

Energy boosting, food intolerance, general well-being, digestive health and beauty were among the fastest growing new food positionings globally over the past five years, per Euromonitor; general well-being, weight management, digestive health, energy boosting and endurance the top five best-selling.17

Demo Memos

The misinformation on the market about longevity and vitality of consumers aged 50+ is appalling. By 2019, Americans 50+ will account for more than half of the U.S. population. While Millennials (73.4 million) began to outnumber the Boomers in 2014, the Census projected Boomers will number more than 70 million through 2028—and that’s good for business.32

Two-thirds of the projected growth in dietary supplement use from 2015-2020 will come from those aged 65+ (+12%), according to Packaged Facts 2014 Nutritional Supplements in the U.S.33

IRI’s 2015 Aging America report indicated that on most days 46% of seniors take a calcium supplement; 24% a fiber supplement; 36% use an antacid/digestive product. Seniors are expected to drive dollar sales of GI liquids up 6-8% from 2014 to 2016, home healthcare kits 4-6%, vitamins 2-4%, and internal analgesics/pain products 1-3%.34

These new age seniors are also projected to drive dollar sales of nutrition bars up 17-19%; energy drinks 7-9%; sports drinks 3-5%; and refrigerated tea products 3-5%.34 Boomers are also the #1 user of protein drinks for energy.35

With the U.S. lifespan now 81 years for women and 76 for men—and 29 million people now aged 70–87—a large new market focused on concerns of much older Americans is taking shape.32 Stroke, mobility, joint, muscle mass/strength/sarcopenia, memory/cognition, Alzheimer’s, diverticulitis, regularity, weight maintenance and pain will continue to move into the spotlight.

Low-income households ($35,000 or less) are projected to increase from 45% of U.S. households in 2015 to 51% by 2020, delivering $110 billion incremental CPG income from 2010-2020.36

Better targeting America’s 22.8 million households supported by the U.S. Dept. of Agriculture’s Supplemental Nutrition Assistance Program (SNAP, formerly food stamps) with foods and beverages that deliver high nutritional value is a very big idea.37

With males now 43% of primary shoppers—52% of Dads have young kids at home—and 14 million men living alone, catering to the health, grooming and food preferences of men is another smart idea.24 Weight, followed by cholesterol, hypertension, joint pain, acid reflux, arthritis, vision and prostate issues are men’s top health concerns.16

Willingness to pay more for men’s health products is 24 percentage points above average for specialty supplements/functional foods.38

Hispanics remain a “must-have” nutraceutical target. Half (53%) are making an effort to eat healthier, 50% look for an energy boost/enhancement. Hispanics are most likely to buy nutritional products for their children.39

Four in 10 Hispanics (42%) are watching their diet for health; 53% to lose/maintain weight; 31% cholesterol; 29% blood sugar levels; 20% high blood pressure; and 20% diabetes.40

Young Hispanic men represent an enormous untapped sports nutrition opportunity; 18% of men aged 18–24 and 12% of those aged 25–49 take a sports supplement.39

One-quarter (23%) of the best-selling new foods/beverages in IRI’s 2014 Pacesetters were kid-specific.15 Sales of kid-specific foods/drinks are projected to reach $41 billion by 2018.41

Lastly, from laborers to those who stand on their feet (e.g., waiters, computer desk-jockeys) workers are a virtually untapped supplement demographic.

Soft Supplement Sales

Dietary supplements reached $36.8 billion in 2014, up 5.1%, and are projected to reach $46.6 billion by 2018.6 Meal supplements tied with sports supplements as the fastest growing segments, both at 7%.

From 2012 to 2014, the number of adults who took any supplement fell from 78% to 72%; those taking a vitamin/mineral supplement from 72% to 64%, per Gallup’s 2014 vitamins and supplements survey.18

Supplement use continues to increase with age; 85% of those aged 65+ used supplements in 2014; those aged 45-64 are the largest single cohort. The greatest decline in use was among those 35-49; half of those 18-34 use supplements.18

In 2014, 138.9 million adults took a vitamin/mineral supplement; 67% of these took a multivitamin, 40% omega-3/DHA/EPA, 35% B vitamins or vitamin D, 32% calcium, 28% vitamin C, 15% magnesium or iron and 14% vitamin E.18

Use of vitamin D, magnesium, iron, CoQ10 and biotin were at historically high levels. One in five made a strong effort to get more antioxidants.18

Vitamin sales topped $11.7 billion, up 3%; multivitamin sales were flat. “Other vitamins,” jumped 9%, vitamin D 8.8%, vitamin A/carotenoids 6.7% and B vitamins 5.2%.6

Magnesium, chromium, selenium, iron and zinc—in descending order—were the mineral “hot spots.”6

Specialty supplements also struggled, although they delivered $6.8 billion in sales in 2014. After five years of near 20% growth, probiotics fell to 14.2%, animal/fish oil to 2.8% and glucosamine to 5.5%.6

Melatonin, turmeric and multi-herb were the big double-digit winners. Heat-stable probiotics, novel prebiotics and digestive enzymes will likely get more attention.6

Two-thirds (57%) of adults were aware of probiotics in 2014, 57% amino acids, 47% melatonin, 41% glucosamine/chondroitin, 37% whey protein, 34% krill oil, 32% lycopene, 31% CoQ10/acidophilus and 30% lutein.18

With recent data confirming a deficiency among nine in 10 Americans, expect the essential nutrient choline to grab the spotlight. Choline’s role is well established for cognition, memory, healthy pregnancy, sports performance and liver health. Choline also plays a role in eye health, muscle performance, endurance and unique post-menopausal needs. New research links choline status with increased sperm count; the reduction of preeclampsia during pregnancy; and reduced anxiety hormone cortisol in fetus, infants and children.42

Three herbs have seen steady growth in terms of awareness over the past few years: turmeric with 35% aware in 2014, goji berry 28% and Garcinia cambogia 21%.18

Horehound was the best-selling herbal supplement in mass channels in 2014 followed by yohimbe, cranberry, black cohosh, senna, cinnamon, flaxseed/oil, echinacea, valerian and saw palmetto.43

Turmeric, followed by grass (wheat and/or barley), flaxseed/oil, aloe vera, spirulina, blue green algae, milk thistle, elderberry, echinacea, mace and saw palmetto were the top sellers in the natural channel.43

Matcha (especially for heart health, blood sugar and blood pressure regulation) and mushroom species including Maitake (especially for immunity, modulaton of blood sugar and insulin response), King Trumpet (especially for antioxidant L-ergothioneine, cholesterol management, bone health), Cordyceps (especially for energy, respiration) and Reishi (especially for immune, heart health) are other up-and-comers.

Digestive products including natural antacids and laxatives are among the OTC crossover opportunities for supplements. Digestive enzyme supplements delivered $251 million in sales in 2014.6

Nearly half (46%) of consumers are afraid of the long-term effects of using digestive/antacid OTC products, becoming too reliant on them and possibly developing an immunity.44

In mass channels, digestive OTC sales rose 13.6%, pain relief 10.7%, weight loss meal replacements 13.6% and cough-cold/allergy/sinus 19.9%.1

Tiger Balm, Blue Emu and Australian Dream are among the top 10 best-sellers among external pain relief OTC products, up 20% overall in 2014.45

The allergy category is up 15%; Procter & Gamble’s QlearQuil brand has introduced nighttime and liquid relief into the category.46

Zicam is the #5 brand in the nasal spray category with sales up 21% in 2014. Toms of Maine’s toothpaste—with purposeful ingredients derived solely from plants and minerals—grew 20% in 2014.47

Lastly, form continues to play an important role in supplement selection. Gummy delivery forms contributed $58.8 million in absolute dollar growth for the category in 2014.48

Just about half of supplements are now in pill form, 27% softgel, 9.8% gummy, 3.7% chewable, 3.2% liquid, 2.6% effervescent and 1.2% vegetable caps.6

Airborne ranked third in the multivitamin category for the year ended 10/2014 in mass channels; Pfizer’s Emergen-C liquid sales grew 6.2%.49

Conditions

The top condition-specific benefits users take supplements for are immunity 60%, energy/mental focus 58%, digestive 53%, cold/flu 46%, lowering cholesterol 42%, healthy skin 43%, improving memory or concentration 43%, healthy blood pressure levels 40% and preventing heart disease 38%.18

Seven in 10 moms want kids’ supplements for immunity, 42% cognitive development, 31% energy/strength, 28% digestion, 23% vision, 12% mood and 10% ADD/ADHD.8

NBJ projected the fastest growing categories in 2015 in the condition-specific supplement sector will be gastrointestinal health +14.8%, insomnia +13.2%, liver/detox +12.6%, anti-aging 9%, mood/depression 7.1% and hair, skin and nails 6.7%.6

In mass channels, Bausch & Lomb PreserVision eye health supplements ranked fifth in the multivitamin category with sales up 15.8% in 2014; B& L’s Ocuvite ranked #8.49

According to the American Heart Association’s 2015 statistics, 87 million adults have coronary vascular disease, 80 million high blood pressure, 67 million pre-hypertension, 100 million cholesterol > 200 mm Hg/dL, 31 million cholesterol > 240 mm Hg/dL, 74 million LDLs > 130, 45 million with HDLs < 40, and 27 million with high triglycerides.50

In terms of other conditions, 21 million have been diagnosed with diabetes, 81 million are pre-diabetic and 77 million have metabolic syndrome.50

Packaged Facts reported that 66 million adults are trying to lose weight; 31.7 million are trying to maintain their weight. Sales of meal supplements reached $4.3 billion in 2014, up 7.9%.51

Seeking symptom relief or more natural partial solutions to serious health issues has proven to be a rewarding supplement strategy. In 2014, 705 million prescriptions were written for high blood pressure, 537 million for mental health, 480 million for pain, 263 million for lipid regulation, 201 million for diabetes, 131 million for thyroid, 109 million for dermatological issues, 83 million for ADD, 61 million for gastrointestinal conditions and 44 million for eyes.52

With the prevalence of stroke on the rise among Americans under age 35—and 32% of women and 54% of men having undesirable levels of blood plaque—expect stroke prevention to move center stage.50

Expect non-alcoholic fatty liver disease and liver health to get more attention, especially among the 159 million people who are overweight and the 82 million who are obese.50

America’s 59 million post-menopausal women, who suffer from a variety of issues—and are more at risk for heart attack, insomnia, decreased metabolism and periodontal disease—are a grossly overlooked segment.53

Young adults are over diagnosing the prevalence of irritable bowel disease and other gastric conditions. Could it be the new gluten-free? They are the top sufferers of upset and nervous stomach, per Mintel.44

During the last year, 1 in 10 adults reported age-related muscle loss/loss of strength; 30% are concerned about muscle loss with aging.8

Fortified & Functional

Just over half (53%) of adults and more than half of U.S. households (55%) are watching their diet; 66% do so for general health reasons; 55% to lose weight; 40% to limit fat, sugar, sodium and other negative nutrients; 38% to prevent future medical issues; 37% to maintain weight; 22% to treat a current medical condition; and 10% for a real/perceived food allergy or intolerance.51

One-third of Americans now strongly agree, up 7% from 2014, that they’d rather hear what they should eat vs. what they should not eat; 45% somewhat agree.21

While naturally functional may be getting attention, fortified foods remain the backbone of consumers’ nutritional strategy and interest has remained strong and stable over time. Eight in 10 consumers say vitamin fortified foods are a convenient way of getting their nutrients.12

One-third of consumers look for extra vitamins/minerals when shopping for food, 34% say they’re very important on a label, 49% important.24 Over the past three years, the percentage of Millennials who say they’re very concerned with the nutritional content of their food jumped 14%—from 23% in 2011 to 37% in 2014.54

Consumers say that getting nutrients in the morning is even more important than avoiding negatives, having real food, or using the best quality ingredients.54

Interestingly, those who are making a strong effort to consume nutrients (including probiotics, fiber, calcium, organic foods), and to limit additives are also making an effort to eat more fresh foods, suggesting that these emerging fresh advocates could be receptive to fortification of fresh foods, according to Gallup.12

Seventy percent of adults now associate meat with nutrients, especially protein and iron; 50% link it with energy, and 44% to building physical strength.55

More than half (56%) are making an effort to get more whole grains, 55% fiber, 54% protein, 43% calcium, 27% omega-3, 26% potassium and 19% probiotics.21

More than half are trying to avoid sugars in general, 54% added sugars, 53% sodium/salt, 49% trans fats, 48% HFCS, 47% calories/saturated fat, 45% cholesterol, 42% fats/oils, 37% preservatives and 35% MSG.21

More than one-third (37%) are avoiding aspartame, 33% fructose, 31% saccharin and 25% sucralose.21

Half (54%) of consumers are making an effort to consume more protein.21 Issues surrounding the amount, type and frequency of protein consumption and greater awareness of a wide range of performance, muscle and satiety benefits will drive a new generation of high-protein foods/beverages.

Nine in 10 adults (81%) believe that protein builds muscle; 77% think it aids in exercise recovery; 73% helps you feel full; 6% aids weight loss; and 64% provides energy throughout the day.21

U.S. functional food sales totaled $51 billion in 2014, +7.8% and are projected to reach $62.7 billion by 2018, per NBJ.6 Young adults are the most likely to use functional foods/beverages (64% versus 57% of consumers overall).12

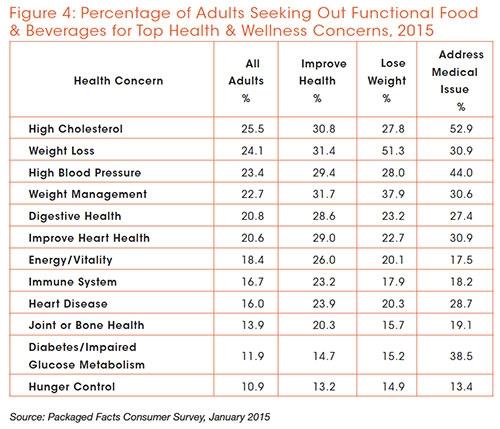

High cholesterol is the new top reason consumers seek out functional foods, according to Packaged Facts 2015 Functional Foods report, followed by weight loss, high blood pressure, digestive health, heart health, energy and immunity.56

One-quarter of U.S. households say that food restrictions, avoidances, intolerances or allergies have an influence on what they eat; 10% are very strongly influenced, according to Packaged Facts 2014 Ingredients Consumers Avoid report.57

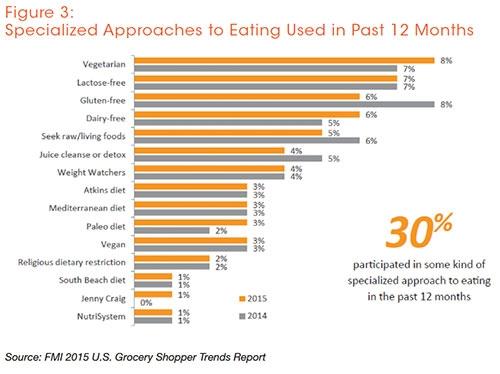

In 2014, 30% of food shoppers—four in 10 Millennials—tried a specialized eating regiment: 9% vegetarian, 7% lactose-free, 6% gluten- or dairy-free, 5% raw/living, 4% juice cleanse/detox, 4% Weight Watchers or Atkins and 3% the Mediterranean, Paleo or a vegan diet (see Figure 3).24

Interest in the gluten-free trend peaked in 2012.7 In 2014, 46% of those aged 18-34 described gluten-free as healthy, down from 60% in 2012.58

These “free-from” markets will likely remain niche. It is worth noting that scanner data, which simply tallies sales of products that carry a claim, does not measure “intent to buy” and will continue to deliver unrealistic inflated sales figures that misrepresent these free-from market opportunities as it did with gluten-free.

Dairy-based drinks/alternative drinks are the most active new beverage development category for 2015, followed by sports/energy drinks and coffee/tea.59

Four in 10 meal preparers (44%) serve meals without meat, poultry or fish one to three times per week; 7% do so four or more times. Eggs are the most popular meat alternative, prepared by 78% of consumers; 61% serve beans, lentils or legumes; 28% veggie burgers; 28% quinoa/other whole grains; 18% seeds/nuts; and 14% tofu or tempeh.55

Seventeen percent of adults are making some effort to follow a partially vegetarian diet; those aged 18-24 are most likely to do so; 2% avoided all animal products in 2014.12

Health is also an important snack selection factor for half (50%) of adults. The average number of in-between meal snacks grew from 1.9 per person per day in 2010 to 2.8 in 2014.60

Nearly half of consumers (50%) look for snacks that have additional health benefits beyond nutrition.60 One in five buy snacks for an energy boost or to improve their mood; 17% do so to manage weight.

Gluten-free led the fastest growing snack claims in 2014; followed by hormone claims, oil type, other omega claims, natural, protein, soy, omega/ALA, vegan/vegetarian, whole grain and organic, according to IRI in 2015; organic snacks grew 11.6% in 2014.60

Sustainability

The percentage of consumers who say sustainability has a significant impact on their food purchase decisions has fallen from 52% in 2011 to 35% in 2015.21

Two issues have intensified; the first is animal welfare, both in terms of humane treatment and the risk posed to consumers via hormones/antibiotics.61

Secondly, in 2015, one-quarter of adults are giving a lot of thought as to how their foods were farmed or produced; 47% a little thought; 20% give a lot of thought to their foods’ environmental sustainability.21

Moreover, consumers are associating terms including farm-raised, grass-fed and free-range with health, more so than claims of vegan, local, sustainable and fair trade.58

Farm/estate branded items, environmental sustainability, natural ingredients/minimally processed food and hyper-local sourcing are among the chef’s hot culinary trends for 2015.62 Organic is no longer mentioned in their top 10 culinary trends.

Performance Nutrition

Targeting the growing ranks of active, exercising and sports-minded adults and kids is a very big idea, and it is driving the $33 billion sports nutrition and weight loss sector mainstream.6 Just more than half of adults are giving the amount of physical activity they get a lot of thought, up from 41% in 2014.21 Ninety-six million adults are exercise walkers; 56 million exercise with equipment, 39 million are aerobic exercisers and 36 million work out at a club.63

About the Authors: Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com

References

Dietary supplements are now the third most used remedy for minor ailments for adults and kids, right behind popping an OTC and “waiting it out.”3 Half of consumers stock up on immunity boosting supplements prior to cold season, 54% of working women keep them on-the-job.4-5

It’s no longer business as usual. However, despite the tough year for supplements, new consumer attitudes/practices, health issues and a rising fear of all things artificial are creating a bevy of new health-focused nutraceutical opportunities.

Market Mega Trends

An unprecedented demand for more natural health solutions, a fundamental shift toward food and naturally functional food-based ingredients, as well as demand for cleaner, safer and more effective products are the underlying forces set to redefine the nutraceutical market.

1) Natural Solutions

Sales of herbs/botanical supplements reached an all-time high of $6.4 billion, up 7.1% in 2014, marking 10 years of consecutive growth, according to Nutrition Business Journal (NBJ).6

Sales of plant oil supplements hit $312 million, while the $140 million bee product category grew another 7.9%.6

Anthocyanins joined polyphenols as the most marketable mass market phytonutrients followed by flavonoids and resveratrol, according to Sloan Trends’ TrendSense model.7

According to the 2013 Gallup Study on Nutrition Knowledge & Consumption, 62% of adults were aware of polyphenols in 2013; 21% were making a strong effort to get more.8

Hydroxytyrosol (especially for heart, reducing arterial plaque formation), French maritime pine bark (especially for circulation, anti-inflammatory, preventing oxidative stress); astaxanthan (especially for heart, lowering blood pressure, preventing oxidative stress) and pterostilbene (especially for heart, lowering blood pressure, preventing oxidative stress) are among the up-and-coming scientifically-supportable phytonutrients.

Herbs/botanicals have been a driving force in the penetration of natural remedies into the OTC drug category. Among the top 10 best-selling OTC sleep aids, MidNite PM contains melatonin, lavender, lemon balm and chamomile; Alteril contains L-tryptophan, melatonin and valerian.9

Homeopathics ranked seventh on NBJ’s list of best-selling supplements in 2014 with sales of $1.2 billion, up 5.1% per NBJ.6

Homeopathic remedies were among the top 10 best-sellers in the kids’ OTC internal analgesic, cough/cold, ear, allergy and sleep sectors. Hyland’s baby oral pain relief products are outpacing the category, which includes Orajel and Anbesol, nearly 2:1.10

Ayurvedic supplement sales grew 5.8%; Chinese herbs delivered $51 million to the bottom line. Turmeric supplement sales are on fire, up 21% in 2014 per NBJ.6

One-third (34%) of adults used a complementary alternative medical (CAM) approach in the past year, 37% of those aged 45-64.11

2) Whole Foods Lifestyle

Since 2013, the number of consumers who think they need supplements to meet their nutritional goals has fallen from 59% in 2012 to 51% in 2014, while those who believe they can meet their needs through food alone has increased from 41% to 49%, according to the 2014 Gallup Study of Nutrient Knowledge & Consumption.12

Ten years of ethnographic research from the Hartman Group confirms that core users are cutting back on supplements because they believe the nutrients in food are best and have pervasive doubts about the bioavailability of even the highest quality supplement brands.13

Three in 10 consumers classify their “diet lifestyle” as “whole foods;” 24% “minimally processed.”6

Not surprisingly, whole food supplements were one of the fastest growing supplement sectors in 2014, with sales projected by NBJ to grow from $1.7 billion to $2.7 billion by 2017.6

Fruit/vegetable supplement sales topped $117 million in 2014, after three years of double-digit growth.6

With the exception of goji, up 10.4% in 2014, superfood juice supplements appear to have lost their luster (e.g., noni juice sales grew 1.8% and mangosteen 1.5%, per NBJ).6

Green tea supplement sales topped $135 million, green foods $103 million, mushrooms $32 million and hops $15 million in 2014.6

The naturally functional movement has also moved center stage in the food and beverage business. According to IFIC’s 2013 Functional Foods Survey, 51% of adults prefer to get nutrients/health benefits that are naturally-occurring in foods.14

In 2014, 36% of the best-selling new foods/drinks on IRI’s New Product Pacesetters list touted real fruit health benefits, 14% real vegetable.15

Three-quarters of adults believe that some foods have natural components that help manage current health issues (e.g., digestion); 54% think foods can be used to reduce the use of some medicines.16

While fortified foods/beverages led global growth of healthy foods in 2013, up 10%, naturally nutritious food positionings were a close second (+8%).17

3) Clean, Safe & Effective

In 2014, 43% of supplement users reported using clean label supplements, up from 36% in 2012, according to the 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements. One-quarter (23%) of users opted for supplements that were labeled natural/naturally-sourced, 19% no artificial colors/flavors, 15% organic, 12% preservative-free, 8% gluten-free, 6% non-dairy/vegetarian/made from whole foods and 5% yeast or soy-free.18

Four in 10 are concerned they don’t absorb enough of the nutrients that supplements are supposed to deliver; 58% want clinical proof of the active ingredient.19 After value, potency was the most important attribute for supplement purchases; 41% of supplement buyers shopped by ingredient.2

When it comes to food, 23% of consumers are heavy clean label advocates, according to the 2013 Gallup Survey of Clean Label Foods & Beverages.20

For food, clean label is first and foremost about avoiding artificial additives. Chemicals are now the #1 consumer food safety issue, up 13 percentage points vs. 2014, according to IFIC’s 2015 Health & Nutrition Survey.21

All-natural, recognizable and no artificial ingredients, followed by no preservatives, are the top clean label drivers. Organic, natural, free-from and non-GMO are second tier clean label attributes.20

According to the Organic Trade Association, organic food/drink sales topped $35.9 billion in 2014, up 11.3%. Fruits/vegetables were the largest category followed by dairy, packaged/prepared foods and beverages.22

According to the Hartman Group’s 2014 Organic & Natural Report, 29% bought more local, 28% organic, 25% natural and 23% non-GMO foods last year; 27% of adults buy organic to avoid GMOs.23

The percentage of shoppers avoiding GMOs doubled last year from 22% in 2014 to 40%, according to FMI’s 2015 U.S. Grocery Shopper Trends. GMOs have moved up behind natural and ahead of organic in terms of the food claims sought by consumers (see Figure 1).24

For the first time, health was among the top reasons 145 million consumers bought specialty foods in 2014. Organic was the most sought after gourmet food claim, however, retailers predict non-GMO will take its place within three years.25

4) Viable Venues

Sales of supplements through health practitioner offices remain a big opportunity, topping $3.1 billion in 2014 sales, up 7.9%; only 18% of sales came through physicians’ offices in 2013, according to NBJ.6

IMS reported that physicians wrote 76 million prescriptions for vitamins/minerals in 2012, mostly to those on government-funded or supplement-covered insurance plans.26 Eight in 10 physicians recommend supplements to their patients, 72% of patients given a recommendation comply.27

Physicians were most likely (42%) to recommend vitamin D, one-third calcium/fish oil, one in five B vitamins/C and one in 10 iron, antioxidants, fiber, vitamin A/E, probiotics or potassium.12

NBJ estimated the U.S. nutritional cosmetic market at $17.2 billion in 2013.6 More than half (56%) of facial skin care users are interested in products made from natural food ingredients (e.g., ginger or olive), according to Mintel 2014 Facial Skin Care – U.S.28 The natural personal care sector has reached $14.3 billion.6

Sales of all-natural pet foods jumped 12% in 2014; pet supplement sales grew 2.4% to $541.3 million. One-quarter of dog owners give their pet a nutraceutical treat, per Packaged Facts 2015 Pet Supplements in the U.S. report.29

Globally, Euromonitor projected sports nutrition will be the fastest growing health category through 2018.30 Protein, fish oil, ginseng, combination supplements, probiotics, eye health, minerals/calcium and co-enzyme Q10 are projected to be the fastest growing supplement categories.31

Singapore, Hong Kong, Norway, Australia and South Korea are the highest per capita supplement spenders by household. Globally, energy/tiredness is the top health concern for those aged 18-39, eye health for those aged 40-49 and retaining mental sharpness with age for those aged 50+.31

Energy boosting, food intolerance, general well-being, digestive health and beauty were among the fastest growing new food positionings globally over the past five years, per Euromonitor; general well-being, weight management, digestive health, energy boosting and endurance the top five best-selling.17

Demo Memos

The misinformation on the market about longevity and vitality of consumers aged 50+ is appalling. By 2019, Americans 50+ will account for more than half of the U.S. population. While Millennials (73.4 million) began to outnumber the Boomers in 2014, the Census projected Boomers will number more than 70 million through 2028—and that’s good for business.32

Two-thirds of the projected growth in dietary supplement use from 2015-2020 will come from those aged 65+ (+12%), according to Packaged Facts 2014 Nutritional Supplements in the U.S.33

IRI’s 2015 Aging America report indicated that on most days 46% of seniors take a calcium supplement; 24% a fiber supplement; 36% use an antacid/digestive product. Seniors are expected to drive dollar sales of GI liquids up 6-8% from 2014 to 2016, home healthcare kits 4-6%, vitamins 2-4%, and internal analgesics/pain products 1-3%.34

These new age seniors are also projected to drive dollar sales of nutrition bars up 17-19%; energy drinks 7-9%; sports drinks 3-5%; and refrigerated tea products 3-5%.34 Boomers are also the #1 user of protein drinks for energy.35

With the U.S. lifespan now 81 years for women and 76 for men—and 29 million people now aged 70–87—a large new market focused on concerns of much older Americans is taking shape.32 Stroke, mobility, joint, muscle mass/strength/sarcopenia, memory/cognition, Alzheimer’s, diverticulitis, regularity, weight maintenance and pain will continue to move into the spotlight.

Low-income households ($35,000 or less) are projected to increase from 45% of U.S. households in 2015 to 51% by 2020, delivering $110 billion incremental CPG income from 2010-2020.36

Better targeting America’s 22.8 million households supported by the U.S. Dept. of Agriculture’s Supplemental Nutrition Assistance Program (SNAP, formerly food stamps) with foods and beverages that deliver high nutritional value is a very big idea.37

With males now 43% of primary shoppers—52% of Dads have young kids at home—and 14 million men living alone, catering to the health, grooming and food preferences of men is another smart idea.24 Weight, followed by cholesterol, hypertension, joint pain, acid reflux, arthritis, vision and prostate issues are men’s top health concerns.16

Willingness to pay more for men’s health products is 24 percentage points above average for specialty supplements/functional foods.38

Hispanics remain a “must-have” nutraceutical target. Half (53%) are making an effort to eat healthier, 50% look for an energy boost/enhancement. Hispanics are most likely to buy nutritional products for their children.39

Four in 10 Hispanics (42%) are watching their diet for health; 53% to lose/maintain weight; 31% cholesterol; 29% blood sugar levels; 20% high blood pressure; and 20% diabetes.40

Young Hispanic men represent an enormous untapped sports nutrition opportunity; 18% of men aged 18–24 and 12% of those aged 25–49 take a sports supplement.39

One-quarter (23%) of the best-selling new foods/beverages in IRI’s 2014 Pacesetters were kid-specific.15 Sales of kid-specific foods/drinks are projected to reach $41 billion by 2018.41

Lastly, from laborers to those who stand on their feet (e.g., waiters, computer desk-jockeys) workers are a virtually untapped supplement demographic.

Soft Supplement Sales

Dietary supplements reached $36.8 billion in 2014, up 5.1%, and are projected to reach $46.6 billion by 2018.6 Meal supplements tied with sports supplements as the fastest growing segments, both at 7%.

From 2012 to 2014, the number of adults who took any supplement fell from 78% to 72%; those taking a vitamin/mineral supplement from 72% to 64%, per Gallup’s 2014 vitamins and supplements survey.18

Supplement use continues to increase with age; 85% of those aged 65+ used supplements in 2014; those aged 45-64 are the largest single cohort. The greatest decline in use was among those 35-49; half of those 18-34 use supplements.18

In 2014, 138.9 million adults took a vitamin/mineral supplement; 67% of these took a multivitamin, 40% omega-3/DHA/EPA, 35% B vitamins or vitamin D, 32% calcium, 28% vitamin C, 15% magnesium or iron and 14% vitamin E.18

Use of vitamin D, magnesium, iron, CoQ10 and biotin were at historically high levels. One in five made a strong effort to get more antioxidants.18

Vitamin sales topped $11.7 billion, up 3%; multivitamin sales were flat. “Other vitamins,” jumped 9%, vitamin D 8.8%, vitamin A/carotenoids 6.7% and B vitamins 5.2%.6

Magnesium, chromium, selenium, iron and zinc—in descending order—were the mineral “hot spots.”6

Specialty supplements also struggled, although they delivered $6.8 billion in sales in 2014. After five years of near 20% growth, probiotics fell to 14.2%, animal/fish oil to 2.8% and glucosamine to 5.5%.6

Melatonin, turmeric and multi-herb were the big double-digit winners. Heat-stable probiotics, novel prebiotics and digestive enzymes will likely get more attention.6

Two-thirds (57%) of adults were aware of probiotics in 2014, 57% amino acids, 47% melatonin, 41% glucosamine/chondroitin, 37% whey protein, 34% krill oil, 32% lycopene, 31% CoQ10/acidophilus and 30% lutein.18

With recent data confirming a deficiency among nine in 10 Americans, expect the essential nutrient choline to grab the spotlight. Choline’s role is well established for cognition, memory, healthy pregnancy, sports performance and liver health. Choline also plays a role in eye health, muscle performance, endurance and unique post-menopausal needs. New research links choline status with increased sperm count; the reduction of preeclampsia during pregnancy; and reduced anxiety hormone cortisol in fetus, infants and children.42

Three herbs have seen steady growth in terms of awareness over the past few years: turmeric with 35% aware in 2014, goji berry 28% and Garcinia cambogia 21%.18

Horehound was the best-selling herbal supplement in mass channels in 2014 followed by yohimbe, cranberry, black cohosh, senna, cinnamon, flaxseed/oil, echinacea, valerian and saw palmetto.43

Turmeric, followed by grass (wheat and/or barley), flaxseed/oil, aloe vera, spirulina, blue green algae, milk thistle, elderberry, echinacea, mace and saw palmetto were the top sellers in the natural channel.43

Matcha (especially for heart health, blood sugar and blood pressure regulation) and mushroom species including Maitake (especially for immunity, modulaton of blood sugar and insulin response), King Trumpet (especially for antioxidant L-ergothioneine, cholesterol management, bone health), Cordyceps (especially for energy, respiration) and Reishi (especially for immune, heart health) are other up-and-comers.

Digestive products including natural antacids and laxatives are among the OTC crossover opportunities for supplements. Digestive enzyme supplements delivered $251 million in sales in 2014.6

Nearly half (46%) of consumers are afraid of the long-term effects of using digestive/antacid OTC products, becoming too reliant on them and possibly developing an immunity.44

In mass channels, digestive OTC sales rose 13.6%, pain relief 10.7%, weight loss meal replacements 13.6% and cough-cold/allergy/sinus 19.9%.1

Tiger Balm, Blue Emu and Australian Dream are among the top 10 best-sellers among external pain relief OTC products, up 20% overall in 2014.45

The allergy category is up 15%; Procter & Gamble’s QlearQuil brand has introduced nighttime and liquid relief into the category.46

Zicam is the #5 brand in the nasal spray category with sales up 21% in 2014. Toms of Maine’s toothpaste—with purposeful ingredients derived solely from plants and minerals—grew 20% in 2014.47

Lastly, form continues to play an important role in supplement selection. Gummy delivery forms contributed $58.8 million in absolute dollar growth for the category in 2014.48

Just about half of supplements are now in pill form, 27% softgel, 9.8% gummy, 3.7% chewable, 3.2% liquid, 2.6% effervescent and 1.2% vegetable caps.6

Airborne ranked third in the multivitamin category for the year ended 10/2014 in mass channels; Pfizer’s Emergen-C liquid sales grew 6.2%.49

Conditions

The top condition-specific benefits users take supplements for are immunity 60%, energy/mental focus 58%, digestive 53%, cold/flu 46%, lowering cholesterol 42%, healthy skin 43%, improving memory or concentration 43%, healthy blood pressure levels 40% and preventing heart disease 38%.18

Seven in 10 moms want kids’ supplements for immunity, 42% cognitive development, 31% energy/strength, 28% digestion, 23% vision, 12% mood and 10% ADD/ADHD.8

NBJ projected the fastest growing categories in 2015 in the condition-specific supplement sector will be gastrointestinal health +14.8%, insomnia +13.2%, liver/detox +12.6%, anti-aging 9%, mood/depression 7.1% and hair, skin and nails 6.7%.6

In mass channels, Bausch & Lomb PreserVision eye health supplements ranked fifth in the multivitamin category with sales up 15.8% in 2014; B& L’s Ocuvite ranked #8.49

According to the American Heart Association’s 2015 statistics, 87 million adults have coronary vascular disease, 80 million high blood pressure, 67 million pre-hypertension, 100 million cholesterol > 200 mm Hg/dL, 31 million cholesterol > 240 mm Hg/dL, 74 million LDLs > 130, 45 million with HDLs < 40, and 27 million with high triglycerides.50

In terms of other conditions, 21 million have been diagnosed with diabetes, 81 million are pre-diabetic and 77 million have metabolic syndrome.50

Packaged Facts reported that 66 million adults are trying to lose weight; 31.7 million are trying to maintain their weight. Sales of meal supplements reached $4.3 billion in 2014, up 7.9%.51

Seeking symptom relief or more natural partial solutions to serious health issues has proven to be a rewarding supplement strategy. In 2014, 705 million prescriptions were written for high blood pressure, 537 million for mental health, 480 million for pain, 263 million for lipid regulation, 201 million for diabetes, 131 million for thyroid, 109 million for dermatological issues, 83 million for ADD, 61 million for gastrointestinal conditions and 44 million for eyes.52

With the prevalence of stroke on the rise among Americans under age 35—and 32% of women and 54% of men having undesirable levels of blood plaque—expect stroke prevention to move center stage.50

Expect non-alcoholic fatty liver disease and liver health to get more attention, especially among the 159 million people who are overweight and the 82 million who are obese.50

America’s 59 million post-menopausal women, who suffer from a variety of issues—and are more at risk for heart attack, insomnia, decreased metabolism and periodontal disease—are a grossly overlooked segment.53

Young adults are over diagnosing the prevalence of irritable bowel disease and other gastric conditions. Could it be the new gluten-free? They are the top sufferers of upset and nervous stomach, per Mintel.44

During the last year, 1 in 10 adults reported age-related muscle loss/loss of strength; 30% are concerned about muscle loss with aging.8

Fortified & Functional

Just over half (53%) of adults and more than half of U.S. households (55%) are watching their diet; 66% do so for general health reasons; 55% to lose weight; 40% to limit fat, sugar, sodium and other negative nutrients; 38% to prevent future medical issues; 37% to maintain weight; 22% to treat a current medical condition; and 10% for a real/perceived food allergy or intolerance.51

One-third of Americans now strongly agree, up 7% from 2014, that they’d rather hear what they should eat vs. what they should not eat; 45% somewhat agree.21

While naturally functional may be getting attention, fortified foods remain the backbone of consumers’ nutritional strategy and interest has remained strong and stable over time. Eight in 10 consumers say vitamin fortified foods are a convenient way of getting their nutrients.12

One-third of consumers look for extra vitamins/minerals when shopping for food, 34% say they’re very important on a label, 49% important.24 Over the past three years, the percentage of Millennials who say they’re very concerned with the nutritional content of their food jumped 14%—from 23% in 2011 to 37% in 2014.54

Consumers say that getting nutrients in the morning is even more important than avoiding negatives, having real food, or using the best quality ingredients.54

Interestingly, those who are making a strong effort to consume nutrients (including probiotics, fiber, calcium, organic foods), and to limit additives are also making an effort to eat more fresh foods, suggesting that these emerging fresh advocates could be receptive to fortification of fresh foods, according to Gallup.12

Seventy percent of adults now associate meat with nutrients, especially protein and iron; 50% link it with energy, and 44% to building physical strength.55

More than half (56%) are making an effort to get more whole grains, 55% fiber, 54% protein, 43% calcium, 27% omega-3, 26% potassium and 19% probiotics.21

More than half are trying to avoid sugars in general, 54% added sugars, 53% sodium/salt, 49% trans fats, 48% HFCS, 47% calories/saturated fat, 45% cholesterol, 42% fats/oils, 37% preservatives and 35% MSG.21

More than one-third (37%) are avoiding aspartame, 33% fructose, 31% saccharin and 25% sucralose.21

Half (54%) of consumers are making an effort to consume more protein.21 Issues surrounding the amount, type and frequency of protein consumption and greater awareness of a wide range of performance, muscle and satiety benefits will drive a new generation of high-protein foods/beverages.

Nine in 10 adults (81%) believe that protein builds muscle; 77% think it aids in exercise recovery; 73% helps you feel full; 6% aids weight loss; and 64% provides energy throughout the day.21

U.S. functional food sales totaled $51 billion in 2014, +7.8% and are projected to reach $62.7 billion by 2018, per NBJ.6 Young adults are the most likely to use functional foods/beverages (64% versus 57% of consumers overall).12

High cholesterol is the new top reason consumers seek out functional foods, according to Packaged Facts 2015 Functional Foods report, followed by weight loss, high blood pressure, digestive health, heart health, energy and immunity.56

One-quarter of U.S. households say that food restrictions, avoidances, intolerances or allergies have an influence on what they eat; 10% are very strongly influenced, according to Packaged Facts 2014 Ingredients Consumers Avoid report.57

In 2014, 30% of food shoppers—four in 10 Millennials—tried a specialized eating regiment: 9% vegetarian, 7% lactose-free, 6% gluten- or dairy-free, 5% raw/living, 4% juice cleanse/detox, 4% Weight Watchers or Atkins and 3% the Mediterranean, Paleo or a vegan diet (see Figure 3).24

Interest in the gluten-free trend peaked in 2012.7 In 2014, 46% of those aged 18-34 described gluten-free as healthy, down from 60% in 2012.58

These “free-from” markets will likely remain niche. It is worth noting that scanner data, which simply tallies sales of products that carry a claim, does not measure “intent to buy” and will continue to deliver unrealistic inflated sales figures that misrepresent these free-from market opportunities as it did with gluten-free.

Dairy-based drinks/alternative drinks are the most active new beverage development category for 2015, followed by sports/energy drinks and coffee/tea.59

Four in 10 meal preparers (44%) serve meals without meat, poultry or fish one to three times per week; 7% do so four or more times. Eggs are the most popular meat alternative, prepared by 78% of consumers; 61% serve beans, lentils or legumes; 28% veggie burgers; 28% quinoa/other whole grains; 18% seeds/nuts; and 14% tofu or tempeh.55

Seventeen percent of adults are making some effort to follow a partially vegetarian diet; those aged 18-24 are most likely to do so; 2% avoided all animal products in 2014.12

Health is also an important snack selection factor for half (50%) of adults. The average number of in-between meal snacks grew from 1.9 per person per day in 2010 to 2.8 in 2014.60

Nearly half of consumers (50%) look for snacks that have additional health benefits beyond nutrition.60 One in five buy snacks for an energy boost or to improve their mood; 17% do so to manage weight.

Gluten-free led the fastest growing snack claims in 2014; followed by hormone claims, oil type, other omega claims, natural, protein, soy, omega/ALA, vegan/vegetarian, whole grain and organic, according to IRI in 2015; organic snacks grew 11.6% in 2014.60

Sustainability

The percentage of consumers who say sustainability has a significant impact on their food purchase decisions has fallen from 52% in 2011 to 35% in 2015.21

Two issues have intensified; the first is animal welfare, both in terms of humane treatment and the risk posed to consumers via hormones/antibiotics.61

Secondly, in 2015, one-quarter of adults are giving a lot of thought as to how their foods were farmed or produced; 47% a little thought; 20% give a lot of thought to their foods’ environmental sustainability.21

Moreover, consumers are associating terms including farm-raised, grass-fed and free-range with health, more so than claims of vegan, local, sustainable and fair trade.58

Farm/estate branded items, environmental sustainability, natural ingredients/minimally processed food and hyper-local sourcing are among the chef’s hot culinary trends for 2015.62 Organic is no longer mentioned in their top 10 culinary trends.

Performance Nutrition

Targeting the growing ranks of active, exercising and sports-minded adults and kids is a very big idea, and it is driving the $33 billion sports nutrition and weight loss sector mainstream.6 Just more than half of adults are giving the amount of physical activity they get a lot of thought, up from 41% in 2014.21 Ninety-six million adults are exercise walkers; 56 million exercise with equipment, 39 million are aerobic exercisers and 36 million work out at a club.63

About the Authors: Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com

References

- Johnsen, 2014. Cold-Cough Switches Drive Growth. Drug Store News 37(3):1.

- Johnsen, M., 2015. Supplement Users Healthier, Shop More Frequently. Drug Store News 37(1):26-27.

- CHPA, 2010. CHPA. Your Hand at Health: Perceptions of Over-the-Counter Medicine in the U.S. Nov. 24, 2010. Consumer Healthcare Products Assn., Washington, D.C. www.chpa.org.

- Johnsen, M., 2015. Consumers Stock Up Prior to Cold, Flu Season. Drug Store News 37(3):3.

- Workplace Impact, 2015. New Study Finds Working Women Focused on Health, Wellness. Press Release: Feb. 10, 2015. WorkPlace. Cleveland OH. www.workplaceimpact.com.

- Nutrition Business Journal, Data sheets and NBJ issues 2015. www.newhope360.com.

- Sloan Trends, 2015. TrendSense Model. Sloan Trends, Inc., Escondido, CA. www.sloantrend.com.

- MSI, 2013. The 2013 Gallup Study of Nutrient Knowledge & Consumption. Multi-Sponsor Surveys, Princeton, N.J. www.multisponsor.com.

- Johnsen, M. Awaking a Sleeping Giant. Drug Store News. 37(6):6.

- Johnsen, M., 2015. Niche Brands Bring Relief to Pain Category. Drug Store News (37(3):6. 11.

- Clarke, C.T. et al., 2015. Trends in the use of complementary health approaches among adults: US, 2012-12. National Health Statistics Reports. No 79. Feb. 10, 2015. National Center for Health Statistics, Center for Disease Control and Prevention.

- MSI, 2014. The 2014 Gallup Study of Nutrient Knowledge & Consumption. Multi-sponsor Surveys, Princeton, NJ www.multisponsor.com.

- Hartman, 2010. Ethnographic Research Supplement Study. Re-imagining Health & Wellness. The Hartman Group, Bellevue, WA. www.hartman-group.com.

- IFIC. 2014. 2014 Functional Food Survey. International Food Information Council Foundation, Washington, D.C. www.foodinsights.com.

- IRI. 2014b. “New Product Pacesetters.” Times & Trends, April. Information Resources, Inc. Chicago, IL. www.infores.com.

- HealthFocus. 2013. HealthFocus U.S. Trend Study. HealthFocus International, St. Petersburg, FL www.healthfocus.com.

- Euromonitor, 2014. Health and Wellness Performance Overview, March. London, U.K. www.euromonitor.com.

- MSI, 2014. The 2014 Gallup Study of the U.S. Market for Vitamins & Other Dietary Supplements.

- Molyneaux, M. 2013. Consumer trends: an up-to-date analysis. Presented at Council for Responsible Nutrition Ann. Mtg., Laguna Beach, CA.

- MSI. 2013. The 2013 Gallup Study of Clean Food & Beverage Labels.

- FIC. 2015. 2015 Food & Health Survey.

- OTA, 2015. 2014 Sales of Organic Foods and Beverages. Organic Trade Assn., Washington, D.C. www.OTA.com.

- Hartman. 2014. The Organic Report. The Hartman Group, Bellevue, Wash. www.hartman-group.com.

- FMI 2015. FMI. U.S. Grocery Shopper Trends. Food Marketing Institute, Arlington, VA. www.fmi.org.

- SFA, 2015. The State of the Specialty Food Industry. Specialty Food Assoc., New York, N.Y. www.specialtyfood.com

- IMS, 2015. Medical Use and Spending. IMS Institute for Healthcare Informatics. Danbury, CT. April.

- Accent health, 2014. Vitamins, Minerals & Supplements: The Role of the Physicians. October.

- Mintel, 2014a. Facial Skincare – US, 2014

- Packaged Facts, 2015. Pet Supplements in the U.S. February

- Euromonitor, 2014. Weight, Sports Nutrition & Dietary Supplements. Press release; July 10, 2014. www.euromonitor.com.

- Euromonitor, 2014. Probiotics and Beyond Datagraphic.

- U.S. Census. 2010. U.S. Census Bureau, Washington, D.C. census.gov.

- Packaged Facts, 2014. Nutritional Supplements in the U.S., June.

- IRI. 2014a. “Aging America: Carving Out Growth in Mature Markets,” Times & Trends, June.

- Mintel. 2014d. Nutritional and Performance Drinks—U.S. January. Mintel Group Ltd., Chicago, mintel.com.

- IRI. 2010. “Low Income Report.” New Product Pacesetters. Oct. Information Resources Inc., Chicago. www.iriworldwide.com.

- IRI. 2015. “Capture and Keep Your SNAP Shopper.” Presented at IRI 2015 Summit, April 20–22, Austin, Texas.

- Packaged Facts, 2012. Targeted Health and Wellness Food and Beverages. February

- MSI, 2011. The 2011 Gallup Study of Hispanic Nutrition & Supplement Use.

- Mintel. 2013. Hispanic Diet and Wellness—U.S. March.

- Packaged Facts, 2014. The Kids Food and Beverage Market in the U.S. January Rockville, MD www.packagedfacts..com.

- Anon., 2015. Choline: An Important Nutrient Most Overlooked, Institute of Food Technologists’ Annual Meeting. July 12, 2015. Chicago, IL.

- Lindstrom, A. et al. Sales of Herbal Dietary Supplements Increase by 7.9% in 2013. Herbalgram No.103. Aug. – Oct. p. 52-56.

- Mintel, 2012. Gastrointestinal Remedies - US - April 2012.

- Johnsen, M. 2015. Pain Relievers Awash with Growth Brands. 36(12):56

- Johnsen, M. 2015. Major Brands Extend Allergy Portfolios. Drug Store News Dec. 15, 2014. P. 60.

- Johnsen, M. 2015. Niche Brands Break through Retail Clutter. Drug Store News 37(5): 40.

- Johnsen, M. 2015. Growth in Four Need States Across VMS. Drug Store News 37(3):7.

- Johnsen, M. 2015. More Shelf Space Linked to Higher Sales. Drug Store News 37(1):22.

- AHA, 2015. AHA. 2015. “Heart & Stroke Statistics 2015.” American Heart Assoc. Dallas, Texas. www.heart.org.

- Packaged Facts, 2014. Weight Management: U.S. Consumer Mindsets. August

- IMS, 2015. National Prescription Audit. Jan 2015. IMS Institute for Healthcare Informatics. Danbury, CT.

- N. American Menopause Assn., Statistics. www.menopause.com.

- FMI, 2014. U.S. Grocery Shopper Trends.

- FMI, 2015. The Power of Meat.

- Packaged Facts, 2014. Functional Foods. February.

- Packaged Facts, 2014. Formulation Trends: Ingredients Consumers Avoid. February

- Technomic. 2014c. Healthy Eating Consumer Trend Report. Technomic, Chicago. www.technomic.com.

- Jacobsen, J. 2015. “2015 New Product Development Outlook.” Beverage Industry 106(1): 56, 58-60, 62, 64, 65.

- Wyatt, S. Lyons. The State of Snacking. IRI Summit Presentation. Austin TX. March 31,2015. www.iriworldwide.com.

- Hartman Group, 2015. Health & Wellness.

- NRA, 2014. What’s Hot Chef Survey? National Restaurant Assoc., Washington, D.C. restaurant.org.

- NSGA. 2014. Statistics: Sports and Exercise 2013. National Sporting Goods Assoc., North Palm Beach, FL. www.nsga.org.