Julian Mellentin, New Nutrition Business11.01.13

Over the last 20 years the term “functional foods” has evolved to be industry shorthand for the marketing of any food or beverage with health benefits. It’s not an expression that consumers use. And while in industry we can easily get excited about “the next hit ingredient,” consumers are driven by benefits. Ingredients only take off when consumers see the benefit as credible, and when the product is relevant to their lifestyles, available in a convenient format and tastes good.

‘Naturally Functional’

Functional foods have taken off in some unexpected directions. For example, there has been a confluence between health benefits and being “naturally functional”—now the most influential driver in functional foods. Here are the two best examples:

1. Coconut Water has rocketed from zero in 2007 to a $400 million market today in the U.S., where Vita Coco holds a 60% market share. Sales have surged both in Europe and the U.S. on the back of its strong image as an “all-natural” sports recovery beverage—“nature’s answer to Gatorade,” as one industry executive put it. When you use an ingredient with a strong “naturally functional” image you don’t need to worry about health claims. In Europe, where coconut water is not allowed to make any health claims, one of the biggest brands, Green Coco, saw sales jump 60%, “with no advertising, no marketing, no health claim,” as its CEO explained, driven solely by its positive image.

2. Almond Milk is another category that has emerged from almost zero. U.S. sales of almond milk rose 51% in the year to $497 million as of August 2013 (SPINS and Nielsen). By contrast, sales of soy milk slid by more than 12% to $408 million.

The great nutritional profile and health halo of almonds (which in whole form can use an FDA-approved heart health claim) in the minds of consumers extends to most things that contain almonds, including almond milk. However, as an industry executive explained: “A single serving of almonds would have a very beneficial nutritional profile. But a serving of almond milk contains less than a single almond.” Put simply, almond milk is not the best way to get the health benefits of almonds. However, that’s not front-of-mind for consumers. It tastes good, it’s convenient and it has a health halo.

Functional Dairy: Dairy 1.0 to Dairy 2.0

The power of “naturalness” can be seen very clearly in the dairy category. Internationally, dairy has long been at the leading edge of functional food development, with brands such as Yakult and Danone Activia achieving global success.

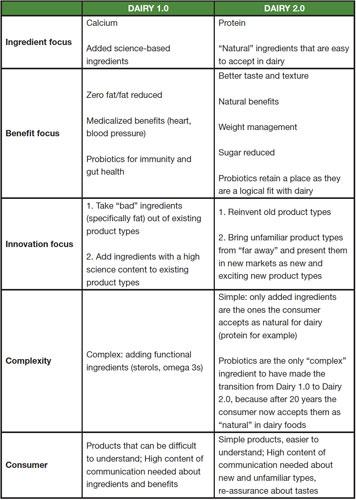

Dairy 1.0—the first wave of functional dairy products—was a two-decade-long effort to shoehorn ingredients such as plant sterols, omega 3s, conjugated linoleic acid (CLA), glucosamine and many others into dairy products in order to market medicalized benefits, such as lowering cholesterol and supporting heart health and joint health. The added ingredients provided the health benefit, rather than a “whole dairy food” product format.

Some attempts were very successful, such as probiotics. Others, such as marine omega 3s, were not. Among the reasons were: 1) ingredient was not a logical fit with the carrier (fish oil in yogurt); 2) the product didn’t deliver an effective dose (you can supply a full dose of probiotics in a yogurt easily enough, but a significant dose of omega 3s, magnesium, etc. may have a negative taste effect and turn consumers away).

But this period is over. The new direction is what some companies are calling “Dairy 2.0.” In this new wave, innovation is no-longer focused on positioning dairy as a competitor with dietary supplements. Instead, emphasis is being placed on:

Here are three examples of Dairy 2.0 in action:

1. Greek Yogurt. An entrepreneur took what is an everyday and unexciting product in Europe and presented it as new and exciting to consumers in the U.S. under the brand Chobani. The Greek segment has grown to about $1.6 billion in the U.S., from essentially nothing five years ago. Naturalness, great texture, a focus on great flavors and the perceived benefits of a naturally high protein content have all contributed to the Greek success story. Danone launched its own Oikos brand in 2012; since then it has became the most successful new product launch ever in the U.S., according to IRI, with $400 million in sales in 2013.

2. Kefir. Originated in Eurasia, where its digestive health benefits have been known for centuries, kefir was introduced to Americans by Lifeway Foods, Morton Grove, IL, which has created a successful business with $100 million in sales in 2012.

3. Quark. A soft fresh cheese, quark is commonplace in many parts of northern Europe. In the last 12 months, its all-natural, high-protein, low-fat credentials have produced 100% growth in some markets. But it’s a little-known product in the U.K., where the Lake District Dairy Company, a farmer-owned co-op, has launched the U.K.’s first quark brand.

Table 1: Characteristics of Dairy 1.0 and 2.0 Compared

Protein

Protein went “mainstream” in 2012 in the U.S., where General Mills’ Nature Valley protein bar was one of the 10 most-successful new products, earning $95 million in sales, according to IRI.

The Nature Valley brand has been one of the most successful growth stories. Launched back in 1975, it was marketed from the outset as “100% Natural” long before this idea became ubiquitous in our industry.

With more than $740 million in retail sales, Nature Valley’s growth rate of almost 30% over the period 2010-2012 is an amazing achievement for any brand.

Nature Valley was the first mainstream bar brand to seize the protein opportunity, launching its Protein Granola bar, with 10 grams of protein per 40-gram bar. The product boldly proclaims “Protein” on the front and features a circle around the 10 grams attribute below it.

The brand’s strong “natural” identity in the mind of the mainstream consumer legitimizes the protein. “Consumers think ‘If it’s in Nature Valley it must be natural,’” as one executive said.

In the wake of this success, there has been a surge in launches of products featuring protein. At the moment, the dairy category is in the lead, according to Mintel’s Global New Product Database (GNPD), with more “high protein” claims on new products than any other category (other than meats).

This trend is adding pressure on what was already a growing global demand for protein. We are likely to see companies increasingly experiment with protein forms other than the traditional mainstays of dairy and soy as they look for price stability, higher quality and sustainability.

Microalgae, for example, is attracting intense industry interest for its excellent nutritional profile; some varieties can be as much as 50% protein, as well as having essential fatty acids and more than 20 different vitamins and minerals.

In some parts of Asia it is an established part of the diet, but for western consumers, basic acceptance remains a challenge and that is not something that can be resolved overnight.

Netherlands-based algae producer Phycom is one of the companies working on this challenge. Its first step has been to create a bakery mix for fresh bread with microalgae integrated into the recipe, with 5% by weight Chlorella pyrenoidosa microalgae. Called Meerbrood, today it’s produced by 125 Dutch bakeries; its success has led to requests for the Meerbrood mix from the Nordic countries, Germany, France, the U.K. and the U.S.

It’s a first step on the way to “normalizing” algae as a source of good nutrition, and enabling manufacturers in a variety of categories to use it. (For more on the Marine Nutraceuticals market, click here.)

We are at Day 1 of a new market for protein. At the moment, it has the virtue of being seen as a “good ingredient” by a wide range of consumers willing to respond to a variety of messages about it, which, according to consumer research by a leading beverage company, include:

Slow Energy

A number of factors have come together to make “slow energy” one of the key areas of interest for some companies, although most are still figuring out how to make the message work in practice. Among the three most important factors were:

1. The Diogenes Study. The benefits of both slow blood sugar response—also known as low glycemic index—and high-quality protein got a shot in the arm from a New England Journal of Medicine article, which detailed the results of the world’s largest-ever diet study. Called Diogenes, it involved 14 universities and research institutes and investigated the optimum diet composition for preventing and treating obesity.

Researchers found that high-protein, low-glycemic index (GI) diets were the most effective for weight management. The quality and scale of the study is slowly gaining media attention and it is already having an impact on food marketing.

2. Breakfast Transformation. Breakfast cereal is no longer convenient enough and breakfast itself is undergoing a shift, with urban dwellers—the majority of the world’s population—increasingly looking for something that is:

These changes have made the breakfast meal occasion ripe for “disruptive innovation.”

3. Kraft Belvita. Belvita is just such a disruptive innovation. Mondelez International—the new name for Kraft Foods—debuted its belVita Breakfast Biscuits in Europe in 2003, where they grew into a mega-brand, with $400 million in sales. Launched in the U.S. in 2012, the cookies offering “sustained energy” became an instant success, with sales of $67 million in 2012.

The idea behind Belvita was to meet the unmet breakfast need by providing sustained energy to fuel the body throughout the morning.

A graphic on the side of the package in Europe reinforces the balanced breakfast message and adds: “They are carefully made and gently baked so that, as part of a balanced breakfast, the carbohydrates are regularly released over 4 hours to keep you going all morning. This has been proven in several clinical studies.”

The brand’s message reassures people they can eat sweet biscuits for breakfast and still feel virtuous by emphasizing slow energy-release carbohydrates.

It was a formula that already proved successful in Europe, where the brand has benefited from an approval of the science underpinning its slow release energy claims by the European Food Safety Authority (EFSA). Fruit sugars, too, can use an approved slow release energy health claim in Europe.

It is slow release energy, not “diabetes,” that presents our industry with a big functional foods opportunity. Ingredion, maker of one of the ingredients in Belvita, has already recommended that manufacturers don’t make explicit connections between their products and diabetes. “If a healthy blood-sugar claim gives you an easy to understand message that consumers gravitate to, why put on a scary medical-sounding label?” said an executive. “You don’t need to put a medical diagnosis on it. It has to be friendly and easy to understand.”

Weight Management

The subjects of protein and “slow energy” are tied strongly to people’s desire to maintain a healthy weight. So you can say that people’s desire to maintain their weight by eating “regular foods,” rather than “specially formulated” foods, is now a driver across all food categories.

When you look specifically at clear weight management positioning, there’s no brand in the world that does it better than Kellogg’s Special K. In recent years, its growth rate has never dipped below 8% annually, despite a down economy. Sales in the U.S. alone have grown from $1.1 billion in 2010 to $1.38 billion in 2013. Globally, it’s a $2 billion-plus brand.

Special K is based on no clever science or amazing ingredients; its success is based on a clear, consistent communications strategy, with a tangible promise of “drop a jeans size,” a promise backed by a full (and free) service of information, advice and motivational groups.

What’s more, Special K challenges the myth that a brand that works in one country won’t work in another. The positioning is the same whether it’s France or the U.S.—two very different countries—or Mexico or Dubai. The flavors are the same—with red fruits and chocolate (this last one developed for France originally) leading in most markets.

Digestion

For the past decade, digestive health has rivaled energy as one of the biggest and most important trends, ranking consistently among consumers’ top needs.

It has demographics on its side. The core consumer is 40+ and the largest growth will be among the growing number of people 60+.

The story so far has been dominated by probiotics, with Danone’s Activia yogurt the world’s biggest digestive health brand; but the opportunity is opening for other ingredients.

Many products now communicate that they deliver 20% of the RDA of fiber per serving. However, this message isn’t a point of difference, as it’s so widely used and there’s little evidence that it does much for sales.

Much more successful has been General Mills’ Fiber One, positioned as “the expert brand” for fiber, with its bars and cereals delivering 25-55% of the RDA per serving. It’s a dose that enables people to “feel the benefit”—another key success factor.

From $35 million in 2005, the brand grew to $420 million in 2010, according to IRI InfoScan data, and to $500 million in 2013, when sales were up 8% over the previous year.

Other digestive health ingredients are emerging. One example is a French ingredients start-up that was spun off from a major multinational chemical company. Solactis has already had its GalactoFructose product—based on lactulose—approved for digestive health claims in foods and beverages in South Korea and Europe. One of the first significant applications of GalactoFructose is in Korea in a 100 ml, shot-style, fermented-dairy product called “Gut,” which contains 5 grams of GalactoFructose. The claim enables a 40% higher price for Gut than a typical shot product.

Food vs. Supplements

Many companies have been misled over the last 15 years to think the functional food category must compete with supplements—offering the same benefits but in a food form. However, the biggest successes have come where functional foods and beverages have focused instead on benefits that are a strong and logical fit to food, or on benefits that supplements cannot yet provide.

Trying to carve out a slice of an already established supplements market has proven a hard road. The hype over joint health beverages for example—drinks offering the clinically effective dose of 1,500 mg of glucosamine and 200 grams of chondroitin sulphate—remains steady, even while sales of joint health beverages are in free-fall. The two leading U.S. brands, for example, had combined sales of $50 million in 2010, plunging to $20 million by 2013.

The reason is simple: the $900 million joint health supplements market already has “share of mind” with consumers as the most effective way to obtain the benefit. It’s also the cheapest, with the cost per day of supplements about 35% below that of beverages.

In France, for example, magnesium milks were briefly marketed, and have largely disappeared, because French people were already spending $110 million a year on magnesium supplements, which offered a higher (and more effective) dose than a glass of milk and at a lower cost per dose.

Foods and beverages cannot be a carrier for every benefit—taste, dose and format all play a role in success—and if the benefit the food is offering is already “owned” by a supplement category, the challenge becomes even greater, as supplements may be significantly cheaper per dose. It’s better to focus on “food values” and “beverage values” and offer benefits where foods and beverages have a competitive advantage (as with dairy and protein), or seem “more natural” as a way of getting the benefit.

Asian Ideas Work in the West

Lastly, one of the great, exciting opportunities about functional foods is how ideas can be found in faraway places and made to work in totally new markets. It’s a fact that some of the most successful ideas of the last 20 years are ones that originated in Asia, such as:

Other Asian ideas that have succeeded in other markets include: probiotic dairy products, soy milk, green tea (and indeed black tea), Kombucha (a fermented tea drink with probiotics and yeast widely consumed for its health benefits in north Asia and already a $300 million business in the U.S.).

About the author: Julian Mellentin is an expert on the business of functional foods, who has been involved in this area for nearly 20 years. He is also the editor of New Nutrition Business, a long-established international journal covering the global nutrition business. He can be reached at julian.mellentin@new-nutrition.com; Website: www.new-nutrition.com.

‘Naturally Functional’

Functional foods have taken off in some unexpected directions. For example, there has been a confluence between health benefits and being “naturally functional”—now the most influential driver in functional foods. Here are the two best examples:

1. Coconut Water has rocketed from zero in 2007 to a $400 million market today in the U.S., where Vita Coco holds a 60% market share. Sales have surged both in Europe and the U.S. on the back of its strong image as an “all-natural” sports recovery beverage—“nature’s answer to Gatorade,” as one industry executive put it. When you use an ingredient with a strong “naturally functional” image you don’t need to worry about health claims. In Europe, where coconut water is not allowed to make any health claims, one of the biggest brands, Green Coco, saw sales jump 60%, “with no advertising, no marketing, no health claim,” as its CEO explained, driven solely by its positive image.

2. Almond Milk is another category that has emerged from almost zero. U.S. sales of almond milk rose 51% in the year to $497 million as of August 2013 (SPINS and Nielsen). By contrast, sales of soy milk slid by more than 12% to $408 million.

The great nutritional profile and health halo of almonds (which in whole form can use an FDA-approved heart health claim) in the minds of consumers extends to most things that contain almonds, including almond milk. However, as an industry executive explained: “A single serving of almonds would have a very beneficial nutritional profile. But a serving of almond milk contains less than a single almond.” Put simply, almond milk is not the best way to get the health benefits of almonds. However, that’s not front-of-mind for consumers. It tastes good, it’s convenient and it has a health halo.

Functional Dairy: Dairy 1.0 to Dairy 2.0

The power of “naturalness” can be seen very clearly in the dairy category. Internationally, dairy has long been at the leading edge of functional food development, with brands such as Yakult and Danone Activia achieving global success.

Dairy 1.0—the first wave of functional dairy products—was a two-decade-long effort to shoehorn ingredients such as plant sterols, omega 3s, conjugated linoleic acid (CLA), glucosamine and many others into dairy products in order to market medicalized benefits, such as lowering cholesterol and supporting heart health and joint health. The added ingredients provided the health benefit, rather than a “whole dairy food” product format.

Some attempts were very successful, such as probiotics. Others, such as marine omega 3s, were not. Among the reasons were: 1) ingredient was not a logical fit with the carrier (fish oil in yogurt); 2) the product didn’t deliver an effective dose (you can supply a full dose of probiotics in a yogurt easily enough, but a significant dose of omega 3s, magnesium, etc. may have a negative taste effect and turn consumers away).

But this period is over. The new direction is what some companies are calling “Dairy 2.0.” In this new wave, innovation is no-longer focused on positioning dairy as a competitor with dietary supplements. Instead, emphasis is being placed on:

- Ingredients and benefits that are a more logical and “easy-to-accept” fit with dairy;

- New and more interesting product formats—usually in the form of companies reinventing “old formats” or taking traditional, regional dairy products from one geography and launching them into new markets where they are “new and exciting,” but adapted to suit the tastes of the new demographics.

Here are three examples of Dairy 2.0 in action:

1. Greek Yogurt. An entrepreneur took what is an everyday and unexciting product in Europe and presented it as new and exciting to consumers in the U.S. under the brand Chobani. The Greek segment has grown to about $1.6 billion in the U.S., from essentially nothing five years ago. Naturalness, great texture, a focus on great flavors and the perceived benefits of a naturally high protein content have all contributed to the Greek success story. Danone launched its own Oikos brand in 2012; since then it has became the most successful new product launch ever in the U.S., according to IRI, with $400 million in sales in 2013.

2. Kefir. Originated in Eurasia, where its digestive health benefits have been known for centuries, kefir was introduced to Americans by Lifeway Foods, Morton Grove, IL, which has created a successful business with $100 million in sales in 2012.

3. Quark. A soft fresh cheese, quark is commonplace in many parts of northern Europe. In the last 12 months, its all-natural, high-protein, low-fat credentials have produced 100% growth in some markets. But it’s a little-known product in the U.K., where the Lake District Dairy Company, a farmer-owned co-op, has launched the U.K.’s first quark brand.

Table 1: Characteristics of Dairy 1.0 and 2.0 Compared

Protein went “mainstream” in 2012 in the U.S., where General Mills’ Nature Valley protein bar was one of the 10 most-successful new products, earning $95 million in sales, according to IRI.

The Nature Valley brand has been one of the most successful growth stories. Launched back in 1975, it was marketed from the outset as “100% Natural” long before this idea became ubiquitous in our industry.

With more than $740 million in retail sales, Nature Valley’s growth rate of almost 30% over the period 2010-2012 is an amazing achievement for any brand.

Nature Valley was the first mainstream bar brand to seize the protein opportunity, launching its Protein Granola bar, with 10 grams of protein per 40-gram bar. The product boldly proclaims “Protein” on the front and features a circle around the 10 grams attribute below it.

The brand’s strong “natural” identity in the mind of the mainstream consumer legitimizes the protein. “Consumers think ‘If it’s in Nature Valley it must be natural,’” as one executive said.

In the wake of this success, there has been a surge in launches of products featuring protein. At the moment, the dairy category is in the lead, according to Mintel’s Global New Product Database (GNPD), with more “high protein” claims on new products than any other category (other than meats).

This trend is adding pressure on what was already a growing global demand for protein. We are likely to see companies increasingly experiment with protein forms other than the traditional mainstays of dairy and soy as they look for price stability, higher quality and sustainability.

Microalgae, for example, is attracting intense industry interest for its excellent nutritional profile; some varieties can be as much as 50% protein, as well as having essential fatty acids and more than 20 different vitamins and minerals.

In some parts of Asia it is an established part of the diet, but for western consumers, basic acceptance remains a challenge and that is not something that can be resolved overnight.

Netherlands-based algae producer Phycom is one of the companies working on this challenge. Its first step has been to create a bakery mix for fresh bread with microalgae integrated into the recipe, with 5% by weight Chlorella pyrenoidosa microalgae. Called Meerbrood, today it’s produced by 125 Dutch bakeries; its success has led to requests for the Meerbrood mix from the Nordic countries, Germany, France, the U.K. and the U.S.

It’s a first step on the way to “normalizing” algae as a source of good nutrition, and enabling manufacturers in a variety of categories to use it. (For more on the Marine Nutraceuticals market, click here.)

We are at Day 1 of a new market for protein. At the moment, it has the virtue of being seen as a “good ingredient” by a wide range of consumers willing to respond to a variety of messages about it, which, according to consumer research by a leading beverage company, include:

- Helps you meet your weight goals

- For a firmer, healthier body

- Balanced diet

- Feel fuller

- Energy to get through your busy day

Slow Energy

A number of factors have come together to make “slow energy” one of the key areas of interest for some companies, although most are still figuring out how to make the message work in practice. Among the three most important factors were:

1. The Diogenes Study. The benefits of both slow blood sugar response—also known as low glycemic index—and high-quality protein got a shot in the arm from a New England Journal of Medicine article, which detailed the results of the world’s largest-ever diet study. Called Diogenes, it involved 14 universities and research institutes and investigated the optimum diet composition for preventing and treating obesity.

Researchers found that high-protein, low-glycemic index (GI) diets were the most effective for weight management. The quality and scale of the study is slowly gaining media attention and it is already having an impact on food marketing.

2. Breakfast Transformation. Breakfast cereal is no longer convenient enough and breakfast itself is undergoing a shift, with urban dwellers—the majority of the world’s population—increasingly looking for something that is:

- Convenient and easy to eat in a hurry

- Delicious

- Satisfying

- Provides an energy boost to “keep you going” all morning

- Healthy (or has a halo of health)

These changes have made the breakfast meal occasion ripe for “disruptive innovation.”

3. Kraft Belvita. Belvita is just such a disruptive innovation. Mondelez International—the new name for Kraft Foods—debuted its belVita Breakfast Biscuits in Europe in 2003, where they grew into a mega-brand, with $400 million in sales. Launched in the U.S. in 2012, the cookies offering “sustained energy” became an instant success, with sales of $67 million in 2012.

The idea behind Belvita was to meet the unmet breakfast need by providing sustained energy to fuel the body throughout the morning.

A graphic on the side of the package in Europe reinforces the balanced breakfast message and adds: “They are carefully made and gently baked so that, as part of a balanced breakfast, the carbohydrates are regularly released over 4 hours to keep you going all morning. This has been proven in several clinical studies.”

The brand’s message reassures people they can eat sweet biscuits for breakfast and still feel virtuous by emphasizing slow energy-release carbohydrates.

It was a formula that already proved successful in Europe, where the brand has benefited from an approval of the science underpinning its slow release energy claims by the European Food Safety Authority (EFSA). Fruit sugars, too, can use an approved slow release energy health claim in Europe.

It is slow release energy, not “diabetes,” that presents our industry with a big functional foods opportunity. Ingredion, maker of one of the ingredients in Belvita, has already recommended that manufacturers don’t make explicit connections between their products and diabetes. “If a healthy blood-sugar claim gives you an easy to understand message that consumers gravitate to, why put on a scary medical-sounding label?” said an executive. “You don’t need to put a medical diagnosis on it. It has to be friendly and easy to understand.”

Weight Management

The subjects of protein and “slow energy” are tied strongly to people’s desire to maintain a healthy weight. So you can say that people’s desire to maintain their weight by eating “regular foods,” rather than “specially formulated” foods, is now a driver across all food categories.

When you look specifically at clear weight management positioning, there’s no brand in the world that does it better than Kellogg’s Special K. In recent years, its growth rate has never dipped below 8% annually, despite a down economy. Sales in the U.S. alone have grown from $1.1 billion in 2010 to $1.38 billion in 2013. Globally, it’s a $2 billion-plus brand.

Special K is based on no clever science or amazing ingredients; its success is based on a clear, consistent communications strategy, with a tangible promise of “drop a jeans size,” a promise backed by a full (and free) service of information, advice and motivational groups.

What’s more, Special K challenges the myth that a brand that works in one country won’t work in another. The positioning is the same whether it’s France or the U.S.—two very different countries—or Mexico or Dubai. The flavors are the same—with red fruits and chocolate (this last one developed for France originally) leading in most markets.

Digestion

For the past decade, digestive health has rivaled energy as one of the biggest and most important trends, ranking consistently among consumers’ top needs.

It has demographics on its side. The core consumer is 40+ and the largest growth will be among the growing number of people 60+.

The story so far has been dominated by probiotics, with Danone’s Activia yogurt the world’s biggest digestive health brand; but the opportunity is opening for other ingredients.

Many products now communicate that they deliver 20% of the RDA of fiber per serving. However, this message isn’t a point of difference, as it’s so widely used and there’s little evidence that it does much for sales.

Much more successful has been General Mills’ Fiber One, positioned as “the expert brand” for fiber, with its bars and cereals delivering 25-55% of the RDA per serving. It’s a dose that enables people to “feel the benefit”—another key success factor.

From $35 million in 2005, the brand grew to $420 million in 2010, according to IRI InfoScan data, and to $500 million in 2013, when sales were up 8% over the previous year.

Other digestive health ingredients are emerging. One example is a French ingredients start-up that was spun off from a major multinational chemical company. Solactis has already had its GalactoFructose product—based on lactulose—approved for digestive health claims in foods and beverages in South Korea and Europe. One of the first significant applications of GalactoFructose is in Korea in a 100 ml, shot-style, fermented-dairy product called “Gut,” which contains 5 grams of GalactoFructose. The claim enables a 40% higher price for Gut than a typical shot product.

Food vs. Supplements

Many companies have been misled over the last 15 years to think the functional food category must compete with supplements—offering the same benefits but in a food form. However, the biggest successes have come where functional foods and beverages have focused instead on benefits that are a strong and logical fit to food, or on benefits that supplements cannot yet provide.

Trying to carve out a slice of an already established supplements market has proven a hard road. The hype over joint health beverages for example—drinks offering the clinically effective dose of 1,500 mg of glucosamine and 200 grams of chondroitin sulphate—remains steady, even while sales of joint health beverages are in free-fall. The two leading U.S. brands, for example, had combined sales of $50 million in 2010, plunging to $20 million by 2013.

The reason is simple: the $900 million joint health supplements market already has “share of mind” with consumers as the most effective way to obtain the benefit. It’s also the cheapest, with the cost per day of supplements about 35% below that of beverages.

In France, for example, magnesium milks were briefly marketed, and have largely disappeared, because French people were already spending $110 million a year on magnesium supplements, which offered a higher (and more effective) dose than a glass of milk and at a lower cost per dose.

Foods and beverages cannot be a carrier for every benefit—taste, dose and format all play a role in success—and if the benefit the food is offering is already “owned” by a supplement category, the challenge becomes even greater, as supplements may be significantly cheaper per dose. It’s better to focus on “food values” and “beverage values” and offer benefits where foods and beverages have a competitive advantage (as with dairy and protein), or seem “more natural” as a way of getting the benefit.

Asian Ideas Work in the West

Lastly, one of the great, exciting opportunities about functional foods is how ideas can be found in faraway places and made to work in totally new markets. It’s a fact that some of the most successful ideas of the last 20 years are ones that originated in Asia, such as:

- Energy Drinks. Red Bull, first launched in Thailand in 1973, has created a $50 billion category, worldwide. And it was first inspired by energy drinks launched in Japan in the 1950s.

- Energy Shots. 5-Hour Energy’s 100 ml shot format, launched in the U.S. in 2007, has created a $1.5 billion business in the U.S. But the idea is an old Asian one; energy shots first appeared in Japan in 1962.

Other Asian ideas that have succeeded in other markets include: probiotic dairy products, soy milk, green tea (and indeed black tea), Kombucha (a fermented tea drink with probiotics and yeast widely consumed for its health benefits in north Asia and already a $300 million business in the U.S.).

About the author: Julian Mellentin is an expert on the business of functional foods, who has been involved in this area for nearly 20 years. He is also the editor of New Nutrition Business, a long-established international journal covering the global nutrition business. He can be reached at julian.mellentin@new-nutrition.com; Website: www.new-nutrition.com.