Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, RD, Sloan Trends, Inc.10.01.13

Get set for a dramatic—and high potential—redirection of the nutraceutical marketplace.

Specialty ingredients are now second only to vitamins in terms of consumers’ nutrition priorities.1 Ayurvedic and Chinese herbal supplement sales jumped 26.2% and 14.7%, respectively, in 2012; whole food supplements topped $1.2 billion.2

One-third (34%) of adults are now confident that the foods they eat satisfy all their nutritional requirements. One in five has cut back on supplement use because they’re eating so many fortified foods.3

Atherosclerosis, muscle/mobility, lower GI, stroke and liver health are among the new must-address conditions. Medical foods and the OTC/natural remedy interface will be hot market segments.

More multinational companies, rising economic confidence and an enormous fast-emerging middle class in many of the world’s largest countries (Brazil, Russia, India and China), which are anxious to benefit from “Western” health-promoting products, will make nutraceuticals a significant global opportunity.

Global nutraceutical sales are projected to reach $204.8 billion by 2017. Asia-Pacific, including Japan, will become the second largest sector after North America.4

What’s Up?

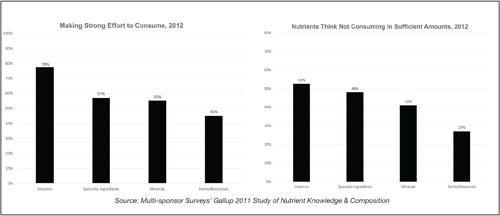

Nearly nine in 10 (86%) adults made a strong effort to consume more nutrients in 2012—78% more vitamins, 57% specialty nutritional ingredients, 45% herbs/botanicals and 42% minerals.1 (See Figure 1.)

Figure 1: Specialty Ingredients Overtake Minerals in Consumer Nutrition Priorities 2012 vs. 2010

New/unique ingredients/formula claims drove sales of the best-selling dietary supplements and OTCs in 2012, appearing on two-thirds of new blockbuster products; one-half carried claims of greater effectiveness and new/unique technology. One in five best-sellers touted longer-lasting results, doctor recommended or faster relief; 15% stronger/extra strength.5

Bioavailability, potency and purity have become key nutraceutical purchase factors. Four in 10 adults are concerned they don’t absorb enough of the nutrients in the fortified foods/supplements they consume.6 Bioavailability has been a strong and growing mass market opportunity for the past five years.7

Magnesium is the next ingredient to enhance bone formula effectiveness and bioavailability. It has enjoyed double-digit growth as a supplement since 2007.2, 7 Magnesium is the third most popular ingredient in heart healthy functional foods globally (e.g., high magnesium milks in France).8

Natural is a sustainable trend; four in 10 users, and half of core users, look for supplements without fillers or chemicals (e.g., alcohol, parabens), products made with natural and/or hypoallergenic ingredients and gentle/buffered formulations. One in three users avoid supplements with artificial colors/flavors.9

Core users continue to cut back on supplements because they believe the nutrients in whole foods are best.9 Whole-food supplements, which jumped 9.3% in 2011 and 10% in 2012, were second only to meal replacements as the fastest-growing supplement sector last year, up 14.8% to $3.6 billion.10 Fruit and vegetable supplement sales reached $97 million, +11.9%.2

Fewer supplement users feel they don’t eat right today compared to 10 years ago (23% in 2012 vs. 39% in 2003).3 Consumers estimate that half (50%) of their daily nutrient intake comes from foods/beverages containing naturally-occurring nutrients, one-third (31%) from supplements and 19% from fortified foods/beverages.3

New forms are posting strong sales. Sales of gummy vitamins increased 35.3%, liquids 7.5%, powders 10.2%, lozenges 9.6% for the year ended April 2013, albeit from relatively small bases vs. traditional forms. In contrast, tablets declined 0.3%.11

Tablets, liquid filled/soft gels, caplets, capsules, gel coats and chewable tablets were the most frequently used “medication” forms in the U.S. in 2012. Liquid filled capsules, chewables and caplets were the preferred consumer dosage form for vitamin/mineral supplements. Boomers are twice as likely to say they’d use a new supplement if it were in capsule form.12

Easy to swallow, doesn’t get stuck in your throat, works quickly, leaves no bad aftertaste, is easy on the stomach and works the quickest of all forms were the most important criteria for delivery forms in 2012.12

New multi-layer pill/capsules and time-released/targeted technologies will become significant product differentiators as consumer concern over product effectiveness grows and major pharmaceutical players enter the dietary supplement space. America’s Finest Inc.’s NiLitis SR offers tailored releases for joint health.

At the same time, eight in 10 (79%) are trying to limit their use of traditional medications.13 Homeopathic remedies were the 7th largest “supplement” category in 2012 at $1 billion, + 5.6%.2 Use of homeopathics is highest among Gen Xers, followed by Millennials, likely due to their high use with children.

Supplement sales through practitioner’s offices are also on the rise and are projected to reach $3.5 billion by 2015.14 In 2012, one-quarter (27%) took a supplement to satisfy a doctor’s recommendations.3

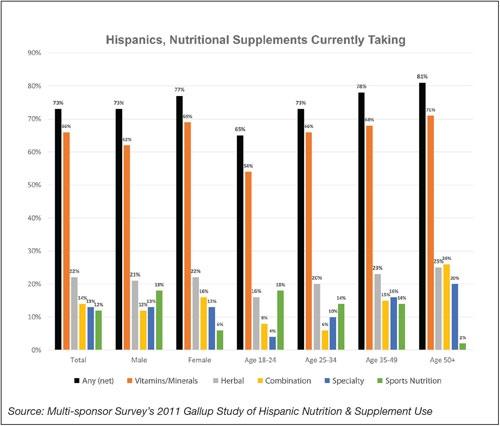

While Hispanics are less likely to visit physicians, their doctors are significantly more likely to recommend nutritional supplements: 88% vs. 66% in 2012.15 Hispanics continue to be strong supplement users.

Demo Memos

Two demographic groups remain surprisingly untapped for supplements and functional foods: children and Hispanics.

In 2012, 59% of children 12 years and younger took a dietary supplement. After general health/fill nutrition gaps, 70% of moms looked to supplements to boost their child’s immunity, 42% cognitive development/brain, 31% energy/strength, 28% digestive aid, 23% vision and 10% ADD/ADHD.15

Last year, one-third of moms made a strong effort to increase their child’s intake of calcium and protein; one-quarter vitamins C, D, fiber and omega 3s; one in five probiotics. Seven in 10 moms made a strong/some effort to buy fortified foods/drinks, down net 5 points vs. 2010.16 Kids and omega 3s are currently a market opportunity only among very health conscious moms.7

Moreover, only 40% of kids’ foods/drinks are “better-for-you.”17 There is opportunity since the kid-specific food/drink marketplace is projected to reach $32.8 billion in North America by 2015, $29.5 billion in Europe and $19.4 billion in Asia-Pacific.18

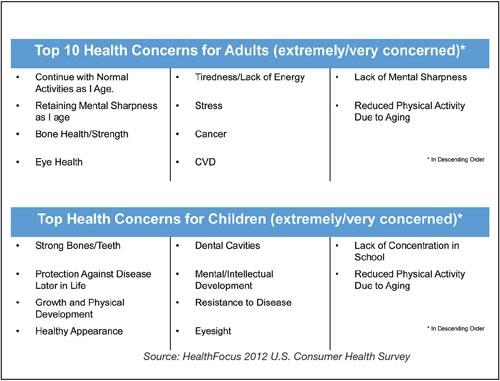

Lastly, moms are extremely/very concerned about protecting against diseases later in life; heart health is their #2 concern.19 (See Figure 2.) One-quarter of insured U.S. kids take at least one Rx medication to treat a chronic condition; 30% of those aged 10-19.20

Figure 2: Top 10 Health Concerns

Top health concerns among teens in 2012 include dental health, appearance, stress, lack of concentration/attention in school, tiredness/lack of energy and skin health. Organized team sports are giving way to individual workouts as exercise of choice among older teens aged 15-18; 35% of those aged 15 work out vs. 18% involved in team sports.21

The Hispanic market is a hotbed of opportunity. Hispanics are younger than the general U.S. population with a median age of 27.6 vs. 37.3 years. They are prime targets for lifestyle supplements: a positive mental state/mood and getting enough sleep are their top health issues. Hispanics are most likely to buy nutritional products for their children compared with other demographics.22

Half of Hispanics (53%) are making an effort to eat healthier and take supplements to improve physical performance/endurance; 50% to boost energy. One in five Hispanic men (18%) aged 18-24 and 12% aged 25-49 take a sports supplement.23

Hispanics aged 50+ are projected to grow by 63% from 2011-2021, creating a new condition-specific market.23 Backache, cold/flu, high cholesterol, heart burn and high blood pressure are their top doctor diagnosed conditions.22

One-third of Hispanics use herbal remedies and 22% use homeopathic remedies.22 Hispanic women over-index for use of menopause, women’s, pre-natal, beauty and anti-aging supplements. Overall, Hispanics over-index for arthritis and cholesterol-lowering supplements.24 (See Figure 3.)

Figure 3: Hispanic Supplement Use Increases with Age; Strong Sports/Performance Group

Boomers and seniors are another missed opportunity. This demographic is 130 million strong and one in four aged 50+ are self-treating simple ailments.25

In terms of healthcare purchases, Boomers/seniors index the highest for vitamins, home healthcare kits, gastrointestinal liquids/tablets and internal analgesics. They are also the key drivers of sleep remedies, incontinence, denture/dental tools, first aid and nasal products.25

Millennials are more interested than Gen Xers and Boomers in calories, vitamins/minerals, protein and serving sizes for foods, but not sugar.9 Stress, weight, meat/poultry with antibiotics, high fructose corn syrup and artificial colors/flavors are their top health concerns.26

The Supplement Story

U.S. supplement sales reached $32.5 billion in 2012, +7.5%.10 Vitamins remained the largest supplement category with sales of $10.6 billion, +5.4%; specialty supplements $6.1 billion, +8.2%; herbs/botanicals $5.6 billion, +5.5%; and minerals $2.4 billion, +3.7%.10, 27

Just more than two-thirds (68%) of consumers are using dietary supplements in 2013, with 53% using them regularly. More women take supplements than men (72% vs. 64%). Meanwhile, 97% of both genders opt for vitamins/minerals; 47% of women take specialty supplements, 29% herbals and 23% sports nutrition/weight management; 46%, 28% and 25% of men, respectively.28

Multivitamins are the most commonly used supplement, now taken by 52% of U.S. adults, followed by vitamin D (20%), omega 3/fish oil (19%), calcium (18%) and vitamin C (17%). Vitamin B/B-complex, vitamin E, magnesium, protein bars and fiber round out the top 10 list.28

In 2012, 73% thought they weren’t consuming some nutrients in sufficient amounts—up 11% from two years earlier—led by omega 3s, calcium, vitamin D, B vitamins, antioxidants, vitamin C and iron.3

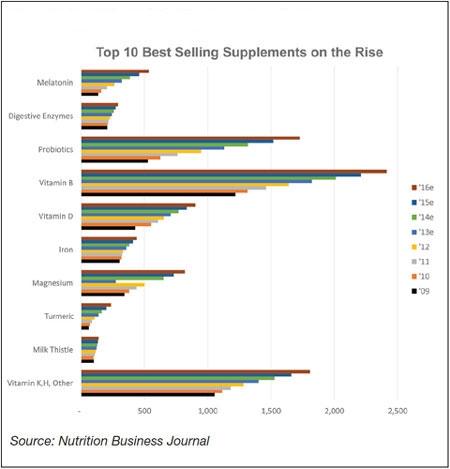

Among traditional nutrients, magnesium, B vitamins, vitamin D and other vitamins, (e.g., vitamin K) are projected to be among the best-selling supplements through 2016; turmeric/curcumin, melatonin, probiotics, digestive enzymes and milk thistle are among the hot specialty ingredients.2 (See Figure 4.)

Figure 4: Top 10 Best Selling Supplements on the Rise

With more than 80% of the U.S. population likely deficient in choline—along with its critical roles in brain development in infants/toddlers, pregnancy, cognitive function and liver health—expect this vital nutrient to explode onto the nutritional scene in 2013.

Although the science isn’t robust for most functionality, CoQ10, the 12th most frequently taken dietary supplement in 2012, is another popular nutritional.28

Just more than half (52%) of adults used a specialty supplement in 2012. While awareness of fish oil is very high (73% in 2012 among supplement users), it has dropped 7 points from 2011. Use of omega 3 has fallen 8 points from 2010 to 65% in 2012.

However, awareness of krill oil has increased from 17% in 2010 to 27% in 2012.3

Half of supplement users are aware of amino acids (49%), glucosamine/chondroitin sulfate 43%, melatonin 42%, lycopene 33%, lutein 32% and plant sterols 31%. However, less than 10% are currently taking these supplements.3

Despite recent negative publicity and a fast-emerging preference for natural antioxidants, neither antioxidants nor their health linkages to heart health, cancer, free radicals, skin and aging—all at mass market status—show any signs of slowing down.7

Resveratrol, carotenoids and anthocyanins have joined polyphenols and flavonoids as mass market phytochemical opportunities.7

Lycopene and lutein remain highly marketable in specialty channels and among very health conscious and condition-specific consumers.7

Pterostilbene, astaxanthin, hydroxytyrosol/olive derivatives and zeaxanthin are among the next up-and-coming, scientifically substantiated group of phytochemicals. However, they have yet to reach mass market status.7

As forecasted following the European Food Safety Authority’s (EFSA) rejection of health claims, sales of probiotic foods and supplements continue to fall in Europe.29 Danone’s Actimel Powerfruit Yogurt now relies on vitamin C sourced from acerola to support its immunity claim rather than probiotics in Europe. GlaxoSmithKline is focused on the high vitamin C content of black currants for its Ribena brand.

Despite EFSA’s rejection for health claims, prebiotics just might take the lead in the U.S., and the world. With awareness of prebiotics at 31% in 2012, it is time to promote prebiotics’ role in naturally nurturing “good bacteria” in the gut, along with its own health-promoting properties, which may include immunity, protection from chronic diseases and more.30

Super fibers are likely to be the most successful positioning for prebiotics. Frost & Sullivan projected the U.S. prebiotic ingredient market to double in the next five years; prebiotics are projected to reach mass market status in 2013.7, 31

Spices, herbals and botanicals are another high potential category with sales up 5.5% in 2012 to $5.6 billion, up 2.2% in mass channels and 6.1% in natural food stores. Herbal sales grew for the ninth consecutive year.27

The top-selling single herbs of 2012 in mass channels were cranberry, garlic, saw palmetto, soy and ginkgo; flaxseed oil, grass (wheat and barley), turmeric and concentrated curcumin extracts, aloe vera and spirulina/blue-green algae in the natural/health food channel. Turmeric enjoyed a 40% sales increase in the natural channel in 2012.27

One-third of adults took a supplement in 2012 to treat an existing health problem.3

Immunity is the top benefit supplement users associate with taking supplements: 56% used a supplement for immunity in 2012, 49% to provide energy and 46% to maintain a healthy digestive tract.3

Supplements are more frequently associated with lowering cholesterol (43%) than preventing heart disease (38%) or helping to maintain healthy blood pressure (37%).3

Just more than one-third associate supplements with the ability to promote healthy skin, improve memory or concentration and to aid digestive issues/prevent heartburn.3

Multivitamins are also focusing on conditions for a much needed boost. Cold/flu bundled nutrients accounted for 8% of the $5.2 billion in multivitamin sales in 2012; bone health 7%, sports/weight loss 6% and anti-cancer 5%.10

Centrum Silver remains the best-selling multivitamin in mass channels followed by Bausch + Lomb’s PreserVision, Centrum’s Flintstones, Centrum, Airborne, One-A-Day VitaCraves and Bausch + Lomb’s Ocuvite, which suggests that eye health is a market with major consumer interest.32

The sports nutrition category is on fire, posting 11.7% growth in 2012. Hardcore sports nutrition drinks jumped 16.7% and sports nutrition powders 11.5% to $3.4 billion; 16% took a sports nutrition supplement for performance/endurance in 2012.3, 33

Functional Fever

Functional food sales reached $43.9 billion in the U.S. in 2012; natural and organic food sales $47.9 billion.10 Nine in 10 consumers regularly consume fortified foods; six in 10 functional foods or beverages.34

Energy drinks, +15.5% in unit sales, were the fastest-growing consumer packaged goods food category in 2012 in food, drug, mass merchandiser, convenience and dollar stores, followed by weight control liquids/powders, up 12.7%.35

Not surprisingly, the average number of benefits touted on the best-selling new foods/beverages of 2012 has increased to 6.2 from 4.2 19 years ago.5 One-quarter (27%) of the best-selling new foods/drinks of 2012 claimed better-for-you benefits.

Real/100% Real was the top health claim appearing on 41% of these blockbuster health products—37% claimed a good source of vitamins/minerals, 33% less calories/sugar, 30% natural/organic, 30% a good source of protein, 30% high fiber/whole grain and 20% less fat.5

“Suitable for…” (e.g., diabetics, kids, gluten/lactose sensitive) is one of the fastest growing health claims globally.8

In early 2013, 66% of grocery shoppers frequently/occasionally bought foods/beverages for a specific nutritional ingredient: 45% whole grain; 34% high fiber, low sugar/sugar-free; 28% natural; 24% organic; 21% low salt/sodium; 18% omega 3, calcium or antioxidants.24

More than half of consumers (57%) are trying to get more protein in 2013; 62% for energy, 56% to build muscle strength, 51% to feel fuller longer/delay hunger and 33% to aid weight loss.36

Beverage executives said that healthy and natural are more important for beverages now than convenience. Collectively, low sugar, low calorie, high protein and energy are a close second.37

Two-thirds (66%) of consumers looked for descriptors signaling no artificial sweeteners, 56% unprocessed or local, 52% preservative-free or hormone-free and 40% antibiotic-free in 2012.38

Just more than half of consumers frequently/occasionally bought foods/beverages that targeted a specific health condition in early 2013: 29% for cholesterol-lowering, 24% weight loss/control, 20% blood pressure, 17% digestive health, 14% heart/circulatory, 13% diabetes and 11% bone/joint health.24

Heart health was the condition that had the greatest influence on food selection among grocery shoppers in 2012: 37% said heart health was very important; 32% lower calorie/cancer prevention; 29% energy, digestive health, mind health; 27% bone density; 26% immunity; and 25% physical strength.

Lastly, and perhaps most importantly, the trend toward naturally functional foods and delivering health benefits naturally in foods/drinks continues. There is no doubt that the most appealing food enhancements are those that add nothing beyond what is normally found in the product.39

Pomegranate, acai, lychee, acerola and goji are still the lead superfruit flavors in new beverage launches around the globe; guanabana, marula and gooseberry, however, were the fastest risers in 2012.8

Conditions

Eight in 10 adults believe that supplements and/or functional foods/drinks can be effective for preventing or delaying the onset of high blood pressure, heart disease, osteoporosis and type 2 diabetes; two-thirds believe that supplements and/or functional foods can down-regulate normal age-related memory loss.34

While sports nutrition/weight loss, heart health, cold/flu/immune, bone and joint health were the largest U.S. condition-specific supplement markets in 2012, insomnia is up 17%, and liver/detox, hair/skin/nails and gastrointestinal health were the fastest-growing condition-specific supplement categories.2

Energy was the most active new product category for supplements and foods in North America.8

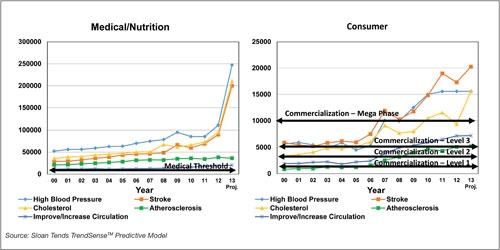

Stroke, atherosclerosis, blood plaque and improving circulation are among the new mass market heart opportunities.7 (See Figure 5.)

Figure 5: TrendSense Predictive Model

Two-thirds of adults are very/somewhat concerned about their circulatory health.40 Natural components that help increase circulation (e.g., cocoa flavanols) will be in high demand, but need more visibility and marketing.

Worries about mobility—the ability to continue with normal activities with age—top the list of health concerns adults are very/extremely concerned about in 2012.19

Muscle strength/tone has been among the top health concerns since 2010 in the U.S. and Canada.19 Body toning/composition are now mainstream mass market opportunities.7 Sarcopenia/dynapenia are fast-emerging markets, as is a new role for muscle in joint health.

Lower GI issues are quickly becoming a new hot market segment. Digestive regularity is now more important to consumers than general digestive health; children and older adults are the top sufferers of constipation.9

There appears to be a significant segment of the population in search of remedies for other lower GI conditions, which simply don’t exist outside of the Rx venue (e.g., irritable bowel disease). However, health claims for these disease states are limited for dietary supplements.

One-third of consumers would like more ingredients to help balance blood sugar.6 Long-term sustainable energy and weight control are the most marketable mainstream health linkages for blood sugar control, beyond diabetes.7 However, claims can be made for energy, but not for weight control or diabetes outside of the medical foods or drug markets.

Products to help people deal with diabetic risk factors (e.g., insulin resistance and metabolic syndrome) are other untapped opportunities. Structure/function claims about the Glycemic Index are perfectly positioned for marketing in the health/specialty food channel.7

Worries over retaining mental sharpness with age was the #2 health concern consumers are very/extremely concerned about in 2012; lack of mental sharpness in general was #9.19

With Boomers aged 55-64 the most likely group trying to lose weight—and those aged 65+ most likely trying to maintain weight—the weight market is expected to explode. IRI-tracked weight loss sales totaled $36.9 billion in 2012; foods/beverages $29.4 billion, meal replacements/diet aids $4.2 billion and commercial weight management programs $3.3 billion.41 Marketers must be careful about claims, since weight is an active area of interest for regulatory enforcement.

Eye health moved up to the #4 concern U.S. adults were very/extremely concerned about in 2012.19 With the Age-Related Eye Disease Study 2 (AREDS2) not supporting roles for lutein, zeaxanthin or omega 3 fatty acids in relation to macular degeneration, watch for creative marketing and/or nutrients long associated with eye health that have been virtually abandoned to regain their ground.

Lastly, without a doubt, the largest untapped market remains with post-menopausal women.

Medical Foods: Where Are You?

With the limitations on health claims for supplements and functional foods, where are the new entries for medical foods in the marketplace? It requires a full understanding of the regulations and willingness to comply, but the medical food category remains an interesting and compelling market segment.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

References

1. MSI, 2012. The 2011 Gallup study of nutrient knowledge & consumption. Multi-sponsor Surveys, Princeton, NJ. (Numbers reflect 2012 data as Gallup’s studies are titled when they begin, not when they are fielded.)

2. Nutrition Business Journal, 2013. Datasheets. Nutrition Business Journal. Boulder, CO. www.newhope360.com.

3. MSI, 2013. The 2012 Gallup study of the U.S. market for vitamins & other dietary supplements. March.

4. Transparency, 2012. Nutraceuticals product market. Transparency Market Research. Albany, NY. www.transparencymarketresearch.com.

5. IRI, 2013. New product pacesetters. Times & Trends. May. Information Resources Inc., Chicago, IL. www.infores.com.

6. Molyneaux, M. (NMI), 2012. Consumer trends; an up-to-date analysis. October. Council for Responsible Nutrition Annual Meeting. Laguna Beach, CA.

7. Sloan Trends, 2013. Sloan Trends’ TrendSense predictive model.

8. Innova, 2013. Innova Market Insights food and nutrition database, The Netherlands.

9. Hartman, 2012. Health + wellness deep dive. The Hartman Group. Bellevue, WA. www.hartman-group.com.

10. NBJ, 2013. Supplement market grows to $32.5 billion. Nutrition Business Journal, June/July.

11. SPINS, 2013. Sales data combined channel for the year ended April 19, 2013. Nielsen. Schaumburg, IL. www.spins.com.

12. Lowery, M., (Capsugel) 2013. Delivering the right dose: why form matters. Global Consumer Attitude & Usage Study, Capsugel, 2012.

13. Boiron, 2011. Boiron Consumer Survey, 2011.

14. NBJ, 2013. Nutrition Business Journal, April.

15. MSI, 2011. The 2011 Gallup Study of children’s supplement use.

16. MSI, 2012. The 2012 Gallup Study of children’s nutrition and eating habits, November.

17. Pkg. Facts, 2011. Kids’ food & beverage market in the U.S. May. Packaged Facts, Rockville, MD. www.packagedfacts.com.

18. GIA, 2012. 2011-12 Kids food & beverage market report, Global Industry Analysts, San Jose, CA. www.strategyr.com.

19. HealthFocus, 2012 HealthFocus 2012 U.S. consumer survey. HealthFocus, St. Petersburg, FL. www.healthfocus.com.

20. Medco, 2010. Medco 2010 drug trend report. www.chaindrugreview.com. May 20, 2010.

21. HealthFocus, 2013. Teens from the top down survey, March.

22. Mintel, 2013. Hispanic diet and wellness – US

23. MSI, 2011. The 2011 Gallup Study of Hispanic nutrition and supplement use.

24. Pkg. Facts, 2013. Experian consumer survey, spring 2013. Experian 2013.

25. IRI, 2012. Baby Boomers. Times & Trends. September.

26. IRI, 2012 Millennials. Times & Trends June/July.

27. ABA, 2013. Herbal dietary supplement retail sales up 5.5% in 2012. www.herbalgram.com.

28. CRN, 2013. The 2013 Council for Responsible Nutrition consumer survey on dietary supplements. September 2013. www.crn.org.

29. Hudson, E. (Euromonitor), Global probiotic strategic business planning 2013. Presented at Nutracon 2013. March. Anaheim, CA.

30. Multi-sponsor Surveys’ 2012 Gallup Study of probiotic & prebiotic consumers.

31. Frost & Sullivan, 2012. Prebiotic report, 2012.

32. IRI, 2013. IRI-tracked multivitamin sales; total sales drug stores, supermarkets, discount stores, military commissaries and selected clubs and dollar stores for year ended 4/21/13.

33. NBJ, 2013, Nutrition Business Journal. March.

34. The 2012 Gallup Study of nutrient knowledge & consumption. March 2013.

35. IRI, 2013. The CPG year in review. February.

36. IFIC, 2013. Food & health survey, International Food Information Council Foundation. Washington, D.C. www.foodinsight.org.

37. BI, 2013. Beverage Industry Magazine’s 2013 annual global beverage industry executive product development survey. January 2013.

38. Technomic, 2012 Consumer health trend report. Technomic, Inc. Chicago IL. www.technomic.com.

39. FMI, 2012. Shopping for health. Food Marketing Institute, Arlington, VA. www.fmi.org.

40. MSI, 2012. Multi-sponsor Survey’s circulatory health study.

41. Pkg. Facts, 2013. Weight management trends in the U.S. March 2013.

Specialty ingredients are now second only to vitamins in terms of consumers’ nutrition priorities.1 Ayurvedic and Chinese herbal supplement sales jumped 26.2% and 14.7%, respectively, in 2012; whole food supplements topped $1.2 billion.2

One-third (34%) of adults are now confident that the foods they eat satisfy all their nutritional requirements. One in five has cut back on supplement use because they’re eating so many fortified foods.3

Atherosclerosis, muscle/mobility, lower GI, stroke and liver health are among the new must-address conditions. Medical foods and the OTC/natural remedy interface will be hot market segments.

More multinational companies, rising economic confidence and an enormous fast-emerging middle class in many of the world’s largest countries (Brazil, Russia, India and China), which are anxious to benefit from “Western” health-promoting products, will make nutraceuticals a significant global opportunity.

Global nutraceutical sales are projected to reach $204.8 billion by 2017. Asia-Pacific, including Japan, will become the second largest sector after North America.4

What’s Up?

Nearly nine in 10 (86%) adults made a strong effort to consume more nutrients in 2012—78% more vitamins, 57% specialty nutritional ingredients, 45% herbs/botanicals and 42% minerals.1 (See Figure 1.)

Figure 1: Specialty Ingredients Overtake Minerals in Consumer Nutrition Priorities 2012 vs. 2010

New/unique ingredients/formula claims drove sales of the best-selling dietary supplements and OTCs in 2012, appearing on two-thirds of new blockbuster products; one-half carried claims of greater effectiveness and new/unique technology. One in five best-sellers touted longer-lasting results, doctor recommended or faster relief; 15% stronger/extra strength.5

Bioavailability, potency and purity have become key nutraceutical purchase factors. Four in 10 adults are concerned they don’t absorb enough of the nutrients in the fortified foods/supplements they consume.6 Bioavailability has been a strong and growing mass market opportunity for the past five years.7

Magnesium is the next ingredient to enhance bone formula effectiveness and bioavailability. It has enjoyed double-digit growth as a supplement since 2007.2, 7 Magnesium is the third most popular ingredient in heart healthy functional foods globally (e.g., high magnesium milks in France).8

Natural is a sustainable trend; four in 10 users, and half of core users, look for supplements without fillers or chemicals (e.g., alcohol, parabens), products made with natural and/or hypoallergenic ingredients and gentle/buffered formulations. One in three users avoid supplements with artificial colors/flavors.9

Core users continue to cut back on supplements because they believe the nutrients in whole foods are best.9 Whole-food supplements, which jumped 9.3% in 2011 and 10% in 2012, were second only to meal replacements as the fastest-growing supplement sector last year, up 14.8% to $3.6 billion.10 Fruit and vegetable supplement sales reached $97 million, +11.9%.2

Fewer supplement users feel they don’t eat right today compared to 10 years ago (23% in 2012 vs. 39% in 2003).3 Consumers estimate that half (50%) of their daily nutrient intake comes from foods/beverages containing naturally-occurring nutrients, one-third (31%) from supplements and 19% from fortified foods/beverages.3

New forms are posting strong sales. Sales of gummy vitamins increased 35.3%, liquids 7.5%, powders 10.2%, lozenges 9.6% for the year ended April 2013, albeit from relatively small bases vs. traditional forms. In contrast, tablets declined 0.3%.11

Tablets, liquid filled/soft gels, caplets, capsules, gel coats and chewable tablets were the most frequently used “medication” forms in the U.S. in 2012. Liquid filled capsules, chewables and caplets were the preferred consumer dosage form for vitamin/mineral supplements. Boomers are twice as likely to say they’d use a new supplement if it were in capsule form.12

Easy to swallow, doesn’t get stuck in your throat, works quickly, leaves no bad aftertaste, is easy on the stomach and works the quickest of all forms were the most important criteria for delivery forms in 2012.12

New multi-layer pill/capsules and time-released/targeted technologies will become significant product differentiators as consumer concern over product effectiveness grows and major pharmaceutical players enter the dietary supplement space. America’s Finest Inc.’s NiLitis SR offers tailored releases for joint health.

At the same time, eight in 10 (79%) are trying to limit their use of traditional medications.13 Homeopathic remedies were the 7th largest “supplement” category in 2012 at $1 billion, + 5.6%.2 Use of homeopathics is highest among Gen Xers, followed by Millennials, likely due to their high use with children.

Supplement sales through practitioner’s offices are also on the rise and are projected to reach $3.5 billion by 2015.14 In 2012, one-quarter (27%) took a supplement to satisfy a doctor’s recommendations.3

While Hispanics are less likely to visit physicians, their doctors are significantly more likely to recommend nutritional supplements: 88% vs. 66% in 2012.15 Hispanics continue to be strong supplement users.

Demo Memos

Two demographic groups remain surprisingly untapped for supplements and functional foods: children and Hispanics.

In 2012, 59% of children 12 years and younger took a dietary supplement. After general health/fill nutrition gaps, 70% of moms looked to supplements to boost their child’s immunity, 42% cognitive development/brain, 31% energy/strength, 28% digestive aid, 23% vision and 10% ADD/ADHD.15

Last year, one-third of moms made a strong effort to increase their child’s intake of calcium and protein; one-quarter vitamins C, D, fiber and omega 3s; one in five probiotics. Seven in 10 moms made a strong/some effort to buy fortified foods/drinks, down net 5 points vs. 2010.16 Kids and omega 3s are currently a market opportunity only among very health conscious moms.7

Moreover, only 40% of kids’ foods/drinks are “better-for-you.”17 There is opportunity since the kid-specific food/drink marketplace is projected to reach $32.8 billion in North America by 2015, $29.5 billion in Europe and $19.4 billion in Asia-Pacific.18

Lastly, moms are extremely/very concerned about protecting against diseases later in life; heart health is their #2 concern.19 (See Figure 2.) One-quarter of insured U.S. kids take at least one Rx medication to treat a chronic condition; 30% of those aged 10-19.20

Figure 2: Top 10 Health Concerns

Top health concerns among teens in 2012 include dental health, appearance, stress, lack of concentration/attention in school, tiredness/lack of energy and skin health. Organized team sports are giving way to individual workouts as exercise of choice among older teens aged 15-18; 35% of those aged 15 work out vs. 18% involved in team sports.21

The Hispanic market is a hotbed of opportunity. Hispanics are younger than the general U.S. population with a median age of 27.6 vs. 37.3 years. They are prime targets for lifestyle supplements: a positive mental state/mood and getting enough sleep are their top health issues. Hispanics are most likely to buy nutritional products for their children compared with other demographics.22

Half of Hispanics (53%) are making an effort to eat healthier and take supplements to improve physical performance/endurance; 50% to boost energy. One in five Hispanic men (18%) aged 18-24 and 12% aged 25-49 take a sports supplement.23

Hispanics aged 50+ are projected to grow by 63% from 2011-2021, creating a new condition-specific market.23 Backache, cold/flu, high cholesterol, heart burn and high blood pressure are their top doctor diagnosed conditions.22

One-third of Hispanics use herbal remedies and 22% use homeopathic remedies.22 Hispanic women over-index for use of menopause, women’s, pre-natal, beauty and anti-aging supplements. Overall, Hispanics over-index for arthritis and cholesterol-lowering supplements.24 (See Figure 3.)

Figure 3: Hispanic Supplement Use Increases with Age; Strong Sports/Performance Group

Boomers and seniors are another missed opportunity. This demographic is 130 million strong and one in four aged 50+ are self-treating simple ailments.25

In terms of healthcare purchases, Boomers/seniors index the highest for vitamins, home healthcare kits, gastrointestinal liquids/tablets and internal analgesics. They are also the key drivers of sleep remedies, incontinence, denture/dental tools, first aid and nasal products.25

Millennials are more interested than Gen Xers and Boomers in calories, vitamins/minerals, protein and serving sizes for foods, but not sugar.9 Stress, weight, meat/poultry with antibiotics, high fructose corn syrup and artificial colors/flavors are their top health concerns.26

The Supplement Story

U.S. supplement sales reached $32.5 billion in 2012, +7.5%.10 Vitamins remained the largest supplement category with sales of $10.6 billion, +5.4%; specialty supplements $6.1 billion, +8.2%; herbs/botanicals $5.6 billion, +5.5%; and minerals $2.4 billion, +3.7%.10, 27

Just more than two-thirds (68%) of consumers are using dietary supplements in 2013, with 53% using them regularly. More women take supplements than men (72% vs. 64%). Meanwhile, 97% of both genders opt for vitamins/minerals; 47% of women take specialty supplements, 29% herbals and 23% sports nutrition/weight management; 46%, 28% and 25% of men, respectively.28

Multivitamins are the most commonly used supplement, now taken by 52% of U.S. adults, followed by vitamin D (20%), omega 3/fish oil (19%), calcium (18%) and vitamin C (17%). Vitamin B/B-complex, vitamin E, magnesium, protein bars and fiber round out the top 10 list.28

In 2012, 73% thought they weren’t consuming some nutrients in sufficient amounts—up 11% from two years earlier—led by omega 3s, calcium, vitamin D, B vitamins, antioxidants, vitamin C and iron.3

Among traditional nutrients, magnesium, B vitamins, vitamin D and other vitamins, (e.g., vitamin K) are projected to be among the best-selling supplements through 2016; turmeric/curcumin, melatonin, probiotics, digestive enzymes and milk thistle are among the hot specialty ingredients.2 (See Figure 4.)

Figure 4: Top 10 Best Selling Supplements on the Rise

With more than 80% of the U.S. population likely deficient in choline—along with its critical roles in brain development in infants/toddlers, pregnancy, cognitive function and liver health—expect this vital nutrient to explode onto the nutritional scene in 2013.

Although the science isn’t robust for most functionality, CoQ10, the 12th most frequently taken dietary supplement in 2012, is another popular nutritional.28

Just more than half (52%) of adults used a specialty supplement in 2012. While awareness of fish oil is very high (73% in 2012 among supplement users), it has dropped 7 points from 2011. Use of omega 3 has fallen 8 points from 2010 to 65% in 2012.

However, awareness of krill oil has increased from 17% in 2010 to 27% in 2012.3

Half of supplement users are aware of amino acids (49%), glucosamine/chondroitin sulfate 43%, melatonin 42%, lycopene 33%, lutein 32% and plant sterols 31%. However, less than 10% are currently taking these supplements.3

Despite recent negative publicity and a fast-emerging preference for natural antioxidants, neither antioxidants nor their health linkages to heart health, cancer, free radicals, skin and aging—all at mass market status—show any signs of slowing down.7

Resveratrol, carotenoids and anthocyanins have joined polyphenols and flavonoids as mass market phytochemical opportunities.7

Lycopene and lutein remain highly marketable in specialty channels and among very health conscious and condition-specific consumers.7

Pterostilbene, astaxanthin, hydroxytyrosol/olive derivatives and zeaxanthin are among the next up-and-coming, scientifically substantiated group of phytochemicals. However, they have yet to reach mass market status.7

As forecasted following the European Food Safety Authority’s (EFSA) rejection of health claims, sales of probiotic foods and supplements continue to fall in Europe.29 Danone’s Actimel Powerfruit Yogurt now relies on vitamin C sourced from acerola to support its immunity claim rather than probiotics in Europe. GlaxoSmithKline is focused on the high vitamin C content of black currants for its Ribena brand.

Despite EFSA’s rejection for health claims, prebiotics just might take the lead in the U.S., and the world. With awareness of prebiotics at 31% in 2012, it is time to promote prebiotics’ role in naturally nurturing “good bacteria” in the gut, along with its own health-promoting properties, which may include immunity, protection from chronic diseases and more.30

Super fibers are likely to be the most successful positioning for prebiotics. Frost & Sullivan projected the U.S. prebiotic ingredient market to double in the next five years; prebiotics are projected to reach mass market status in 2013.7, 31

Spices, herbals and botanicals are another high potential category with sales up 5.5% in 2012 to $5.6 billion, up 2.2% in mass channels and 6.1% in natural food stores. Herbal sales grew for the ninth consecutive year.27

The top-selling single herbs of 2012 in mass channels were cranberry, garlic, saw palmetto, soy and ginkgo; flaxseed oil, grass (wheat and barley), turmeric and concentrated curcumin extracts, aloe vera and spirulina/blue-green algae in the natural/health food channel. Turmeric enjoyed a 40% sales increase in the natural channel in 2012.27

One-third of adults took a supplement in 2012 to treat an existing health problem.3

Immunity is the top benefit supplement users associate with taking supplements: 56% used a supplement for immunity in 2012, 49% to provide energy and 46% to maintain a healthy digestive tract.3

Supplements are more frequently associated with lowering cholesterol (43%) than preventing heart disease (38%) or helping to maintain healthy blood pressure (37%).3

Just more than one-third associate supplements with the ability to promote healthy skin, improve memory or concentration and to aid digestive issues/prevent heartburn.3

Multivitamins are also focusing on conditions for a much needed boost. Cold/flu bundled nutrients accounted for 8% of the $5.2 billion in multivitamin sales in 2012; bone health 7%, sports/weight loss 6% and anti-cancer 5%.10

Centrum Silver remains the best-selling multivitamin in mass channels followed by Bausch + Lomb’s PreserVision, Centrum’s Flintstones, Centrum, Airborne, One-A-Day VitaCraves and Bausch + Lomb’s Ocuvite, which suggests that eye health is a market with major consumer interest.32

The sports nutrition category is on fire, posting 11.7% growth in 2012. Hardcore sports nutrition drinks jumped 16.7% and sports nutrition powders 11.5% to $3.4 billion; 16% took a sports nutrition supplement for performance/endurance in 2012.3, 33

Functional Fever

Functional food sales reached $43.9 billion in the U.S. in 2012; natural and organic food sales $47.9 billion.10 Nine in 10 consumers regularly consume fortified foods; six in 10 functional foods or beverages.34

Energy drinks, +15.5% in unit sales, were the fastest-growing consumer packaged goods food category in 2012 in food, drug, mass merchandiser, convenience and dollar stores, followed by weight control liquids/powders, up 12.7%.35

Not surprisingly, the average number of benefits touted on the best-selling new foods/beverages of 2012 has increased to 6.2 from 4.2 19 years ago.5 One-quarter (27%) of the best-selling new foods/drinks of 2012 claimed better-for-you benefits.

Real/100% Real was the top health claim appearing on 41% of these blockbuster health products—37% claimed a good source of vitamins/minerals, 33% less calories/sugar, 30% natural/organic, 30% a good source of protein, 30% high fiber/whole grain and 20% less fat.5

“Suitable for…” (e.g., diabetics, kids, gluten/lactose sensitive) is one of the fastest growing health claims globally.8

In early 2013, 66% of grocery shoppers frequently/occasionally bought foods/beverages for a specific nutritional ingredient: 45% whole grain; 34% high fiber, low sugar/sugar-free; 28% natural; 24% organic; 21% low salt/sodium; 18% omega 3, calcium or antioxidants.24

More than half of consumers (57%) are trying to get more protein in 2013; 62% for energy, 56% to build muscle strength, 51% to feel fuller longer/delay hunger and 33% to aid weight loss.36

Beverage executives said that healthy and natural are more important for beverages now than convenience. Collectively, low sugar, low calorie, high protein and energy are a close second.37

Two-thirds (66%) of consumers looked for descriptors signaling no artificial sweeteners, 56% unprocessed or local, 52% preservative-free or hormone-free and 40% antibiotic-free in 2012.38

Just more than half of consumers frequently/occasionally bought foods/beverages that targeted a specific health condition in early 2013: 29% for cholesterol-lowering, 24% weight loss/control, 20% blood pressure, 17% digestive health, 14% heart/circulatory, 13% diabetes and 11% bone/joint health.24

Heart health was the condition that had the greatest influence on food selection among grocery shoppers in 2012: 37% said heart health was very important; 32% lower calorie/cancer prevention; 29% energy, digestive health, mind health; 27% bone density; 26% immunity; and 25% physical strength.

Lastly, and perhaps most importantly, the trend toward naturally functional foods and delivering health benefits naturally in foods/drinks continues. There is no doubt that the most appealing food enhancements are those that add nothing beyond what is normally found in the product.39

Pomegranate, acai, lychee, acerola and goji are still the lead superfruit flavors in new beverage launches around the globe; guanabana, marula and gooseberry, however, were the fastest risers in 2012.8

Conditions

Eight in 10 adults believe that supplements and/or functional foods/drinks can be effective for preventing or delaying the onset of high blood pressure, heart disease, osteoporosis and type 2 diabetes; two-thirds believe that supplements and/or functional foods can down-regulate normal age-related memory loss.34

While sports nutrition/weight loss, heart health, cold/flu/immune, bone and joint health were the largest U.S. condition-specific supplement markets in 2012, insomnia is up 17%, and liver/detox, hair/skin/nails and gastrointestinal health were the fastest-growing condition-specific supplement categories.2

Energy was the most active new product category for supplements and foods in North America.8

Stroke, atherosclerosis, blood plaque and improving circulation are among the new mass market heart opportunities.7 (See Figure 5.)

Figure 5: TrendSense Predictive Model

Two-thirds of adults are very/somewhat concerned about their circulatory health.40 Natural components that help increase circulation (e.g., cocoa flavanols) will be in high demand, but need more visibility and marketing.

Worries about mobility—the ability to continue with normal activities with age—top the list of health concerns adults are very/extremely concerned about in 2012.19

Muscle strength/tone has been among the top health concerns since 2010 in the U.S. and Canada.19 Body toning/composition are now mainstream mass market opportunities.7 Sarcopenia/dynapenia are fast-emerging markets, as is a new role for muscle in joint health.

Lower GI issues are quickly becoming a new hot market segment. Digestive regularity is now more important to consumers than general digestive health; children and older adults are the top sufferers of constipation.9

There appears to be a significant segment of the population in search of remedies for other lower GI conditions, which simply don’t exist outside of the Rx venue (e.g., irritable bowel disease). However, health claims for these disease states are limited for dietary supplements.

One-third of consumers would like more ingredients to help balance blood sugar.6 Long-term sustainable energy and weight control are the most marketable mainstream health linkages for blood sugar control, beyond diabetes.7 However, claims can be made for energy, but not for weight control or diabetes outside of the medical foods or drug markets.

Products to help people deal with diabetic risk factors (e.g., insulin resistance and metabolic syndrome) are other untapped opportunities. Structure/function claims about the Glycemic Index are perfectly positioned for marketing in the health/specialty food channel.7

Worries over retaining mental sharpness with age was the #2 health concern consumers are very/extremely concerned about in 2012; lack of mental sharpness in general was #9.19

With Boomers aged 55-64 the most likely group trying to lose weight—and those aged 65+ most likely trying to maintain weight—the weight market is expected to explode. IRI-tracked weight loss sales totaled $36.9 billion in 2012; foods/beverages $29.4 billion, meal replacements/diet aids $4.2 billion and commercial weight management programs $3.3 billion.41 Marketers must be careful about claims, since weight is an active area of interest for regulatory enforcement.

Eye health moved up to the #4 concern U.S. adults were very/extremely concerned about in 2012.19 With the Age-Related Eye Disease Study 2 (AREDS2) not supporting roles for lutein, zeaxanthin or omega 3 fatty acids in relation to macular degeneration, watch for creative marketing and/or nutrients long associated with eye health that have been virtually abandoned to regain their ground.

Lastly, without a doubt, the largest untapped market remains with post-menopausal women.

Medical Foods: Where Are You?

With the limitations on health claims for supplements and functional foods, where are the new entries for medical foods in the marketplace? It requires a full understanding of the regulations and willingness to comply, but the medical food category remains an interesting and compelling market segment.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

References

1. MSI, 2012. The 2011 Gallup study of nutrient knowledge & consumption. Multi-sponsor Surveys, Princeton, NJ. (Numbers reflect 2012 data as Gallup’s studies are titled when they begin, not when they are fielded.)

2. Nutrition Business Journal, 2013. Datasheets. Nutrition Business Journal. Boulder, CO. www.newhope360.com.

3. MSI, 2013. The 2012 Gallup study of the U.S. market for vitamins & other dietary supplements. March.

4. Transparency, 2012. Nutraceuticals product market. Transparency Market Research. Albany, NY. www.transparencymarketresearch.com.

5. IRI, 2013. New product pacesetters. Times & Trends. May. Information Resources Inc., Chicago, IL. www.infores.com.

6. Molyneaux, M. (NMI), 2012. Consumer trends; an up-to-date analysis. October. Council for Responsible Nutrition Annual Meeting. Laguna Beach, CA.

7. Sloan Trends, 2013. Sloan Trends’ TrendSense predictive model.

8. Innova, 2013. Innova Market Insights food and nutrition database, The Netherlands.

9. Hartman, 2012. Health + wellness deep dive. The Hartman Group. Bellevue, WA. www.hartman-group.com.

10. NBJ, 2013. Supplement market grows to $32.5 billion. Nutrition Business Journal, June/July.

11. SPINS, 2013. Sales data combined channel for the year ended April 19, 2013. Nielsen. Schaumburg, IL. www.spins.com.

12. Lowery, M., (Capsugel) 2013. Delivering the right dose: why form matters. Global Consumer Attitude & Usage Study, Capsugel, 2012.

13. Boiron, 2011. Boiron Consumer Survey, 2011.

14. NBJ, 2013. Nutrition Business Journal, April.

15. MSI, 2011. The 2011 Gallup Study of children’s supplement use.

16. MSI, 2012. The 2012 Gallup Study of children’s nutrition and eating habits, November.

17. Pkg. Facts, 2011. Kids’ food & beverage market in the U.S. May. Packaged Facts, Rockville, MD. www.packagedfacts.com.

18. GIA, 2012. 2011-12 Kids food & beverage market report, Global Industry Analysts, San Jose, CA. www.strategyr.com.

19. HealthFocus, 2012 HealthFocus 2012 U.S. consumer survey. HealthFocus, St. Petersburg, FL. www.healthfocus.com.

20. Medco, 2010. Medco 2010 drug trend report. www.chaindrugreview.com. May 20, 2010.

21. HealthFocus, 2013. Teens from the top down survey, March.

22. Mintel, 2013. Hispanic diet and wellness – US

23. MSI, 2011. The 2011 Gallup Study of Hispanic nutrition and supplement use.

24. Pkg. Facts, 2013. Experian consumer survey, spring 2013. Experian 2013.

25. IRI, 2012. Baby Boomers. Times & Trends. September.

26. IRI, 2012 Millennials. Times & Trends June/July.

27. ABA, 2013. Herbal dietary supplement retail sales up 5.5% in 2012. www.herbalgram.com.

28. CRN, 2013. The 2013 Council for Responsible Nutrition consumer survey on dietary supplements. September 2013. www.crn.org.

29. Hudson, E. (Euromonitor), Global probiotic strategic business planning 2013. Presented at Nutracon 2013. March. Anaheim, CA.

30. Multi-sponsor Surveys’ 2012 Gallup Study of probiotic & prebiotic consumers.

31. Frost & Sullivan, 2012. Prebiotic report, 2012.

32. IRI, 2013. IRI-tracked multivitamin sales; total sales drug stores, supermarkets, discount stores, military commissaries and selected clubs and dollar stores for year ended 4/21/13.

33. NBJ, 2013, Nutrition Business Journal. March.

34. The 2012 Gallup Study of nutrient knowledge & consumption. March 2013.

35. IRI, 2013. The CPG year in review. February.

36. IFIC, 2013. Food & health survey, International Food Information Council Foundation. Washington, D.C. www.foodinsight.org.

37. BI, 2013. Beverage Industry Magazine’s 2013 annual global beverage industry executive product development survey. January 2013.

38. Technomic, 2012 Consumer health trend report. Technomic, Inc. Chicago IL. www.technomic.com.

39. FMI, 2012. Shopping for health. Food Marketing Institute, Arlington, VA. www.fmi.org.

40. MSI, 2012. Multi-sponsor Survey’s circulatory health study.

41. Pkg. Facts, 2013. Weight management trends in the U.S. March 2013.