Paul Altaffer, Product and Business Development, RFI Ingredients, & Grant Washington-Smith11.01.12

This column last reviewed Latin America in November of 2010. At that time, Latin America, led by Brazil, was booming with strong economic growth and great optimism. While Latin America is still performing well compared to many developed economies, the commodity-driven growth of a few years ago is waning.

Latin America is still dominated by regional powers Brazil and Mexico. A couple of years ago, we reported on the success and optimism of Brazil and expressed some caution regarding Mexico. Since then, however, Brazil has been struggling to maintain growth while Mexico, on the other hand, seems to be recovering from the slowdown beginning with the global recession of 2007-2008. While some of the air may be out of the “Brazilian balloon,” Brazil remains a good bet for many companies, especially those in the functional foods and nutraceuticals industry. This article looks at Brazil and asks whether it can be expected to continue its spectacular boom.

Government, Infrastructure, World Cup Soccer & Olympics

Brazil had a stellar first decade leading in the new millennium. Of the BRICS (Brazil, Russia, India, China and South Africa) countries, Brazil has demonstrated a unique combination of rapid economic expansion along with strongly pro-democratic economic programs and social policies. Brazil has enjoyed new prominence and respect in the global community. Even as the global economic crisis has torn through many countries, Brazil has seemingly thrived. This new confidence has helped Brazil gain the right to host the 2014 Soccer World Cup and 2016 Olympic Games in Rio de Janeiro.

However, the boom of this past decade has largely been driven by commodity exports, like soya beans, iron ore and oil. Over the past two years, demand for these commodities has softened, with China—a major trading partner—slowing previously insatiable demand for Brazilian commodities. This may suggest a stalling in Brazil’s economy. The Economist magazine estimates Brazil’s growth in GDP (Gross Domestic Product) for 2011 to be at 2.7% and expects growth in 2012 to be a disappointing 2.0%.

Part of the problem for Brazil is that much of the windfall from the commodities boom has been invested in expanding the size of government, payroll (especially governmental), pensions and social transfers. These were all welcomed changes and have done quite a bit to redistribute some wealth. But after years of growth, Brazil’s infrastructure remains poor and this will significantly hamper its ability to continue growth moving forward. Brazil will need to upgrade infrastructure dramatically though to host these global events successfully, as well as lead Latin America in growth and prosperity.

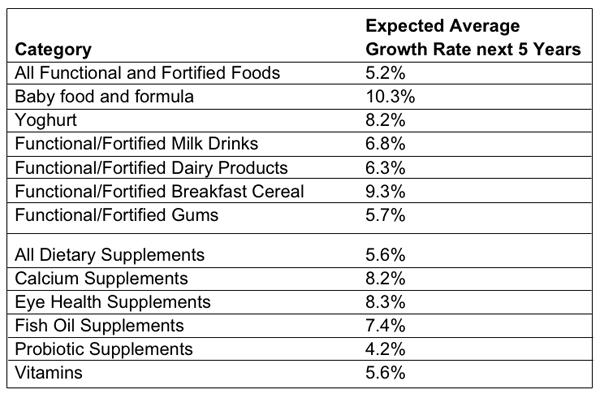

Trends & the Brazilian Nutraceuticals Consumer

The functional foods and nutraceuticals industry remains robust, following the fast-paced decade and recent slow-down. There has been sustained growth and the mood is still optimistic for the category. According to a report by Euromonitor International, the fortified and functional foods category grew by 11% in 2010 to a total of a little more than R$ (Real) 12.7 billion, or about USD$6.4 billion at today’s exchange rate. Similarly, the vitamins and dietary supplements category experienced growth of 12% in 2011, reaching sales of R$2.7 billion. Industry-wide growth rates are expected to be respectable at 5-6% per year, demonstrating continued consumer confidence and concern for health lifestyles. Some of the most promising product categories include: baby food and formula, yogurt, as well as functional and fortified milk drinks, dairy products, breakfast cereal and gum.

Brazilian consumers seem very interested in pre- and probiotic products, which account for considerable growth in the yogurt and functional dairy drinks and products categories. There is also considerable growth in fiber products, as seen in many functional breakfast cereals. Consumer concerns about gut health should continue to be a significant trend.

Oral health is another area of concern as Brazilians consume more functional gums, especially those containing xylitol, for tooth and gum health. Similarly, consumers also supplement more with probiotic products.

Euromonitor International also expects heart health to continue to be a trend to explore. Many products containing phytosterols and functional oils (like omega 3s), are becoming more established with consumers.

Supplements will also enjoy higher than average growth with special attention to calcium, eye health, vitamin, fish oil and probiotic supplements.

Nutraceutical consumers seem very interested in overall health, heart, bone, eye, gut and immune health. Energy continues to be a category that can be further developed as well as the sports nutrition category.

Regulatory Climate

The regulatory framework in Brazil continues to develop rapidly. Brazil’s ANVISA (Agencia Nacional de Vigilancia Sanitaria) regulates pharmaceuticals and therapeutic goods for the country. Registration of all nutritional, therapeutic, food, pharmaceutical or even cosmetic products is required along with proof of safety and efficacy. The registration process is almost always complex, onerous and expensive for product developers. ANVISA takes its job very seriously and companies are wise to seek help in the registration process.

Brazil also has strict environmental and sustainability laws, which make it very difficult to develop and trade in biogenetic materials. Companies looking to research and develop products from Brazil’s vast biogenetic resources will need to navigate complex rules.

What to Expect From Brazil

Partly because of the difficult environmental and sustainability laws, companies developing natural and functional products in Brazil will likely need to make significant investments in R&D. Higher development costs, greater regulatory burden and longer timelines would appear to have a negative impact on development. However, larger investments will likely result in higher-valued, more technical products being developed. This suggests that Brazilian companies will soon be licensing their products and technologies to companies in the U.S. and Europe as they develop their own bio-resources and leverage technologies. It also promotes the concept of Brazil as a value-added provider of goods and services rather than a supplier of commodities. Companies looking to Brazil as a source for new ingredients or products are wise to partner with a local company that understands how to navigate the regulatory and product development processes.

For the Future

Brazil may not be quite the shining star of a couple of years ago. The recent slow-down has exposed some issues Brazil needs to address. “Custo Brasil” is a term often used to describe the cost and difficulty of dealing with Brazil. Taxes are high and the bureaucracies are complex, but there is an air of change about. Dilma Rousseff, Brazil’s President, is vigorously tackling some of the major issues in the country, like corruption and the need for greater infrastructure investment. Consumer confidence remains relatively high and the government is initiating stimulus programs to support that confidence.

According to Euromonitor International, Brazil is ranked fifth in global sales of consumer health products, and is the largest market in Latin America. Functional foods and nutraceuticals are well positioned to continue to outpace the overall economy. While Brazilians, especially at the lower economic rungs have relatively nutrient-deficient diets, there seems to be a long-term shift among consumers toward healthy lifestyles. This shift occurs at every economic level and should continue to drive consumer spending for a long time to come. There are some ups and downs, but Brazil continues to be a very promising market for functional foods and nutraceuticals.

Latin America is still dominated by regional powers Brazil and Mexico. A couple of years ago, we reported on the success and optimism of Brazil and expressed some caution regarding Mexico. Since then, however, Brazil has been struggling to maintain growth while Mexico, on the other hand, seems to be recovering from the slowdown beginning with the global recession of 2007-2008. While some of the air may be out of the “Brazilian balloon,” Brazil remains a good bet for many companies, especially those in the functional foods and nutraceuticals industry. This article looks at Brazil and asks whether it can be expected to continue its spectacular boom.

Government, Infrastructure, World Cup Soccer & Olympics

Brazil had a stellar first decade leading in the new millennium. Of the BRICS (Brazil, Russia, India, China and South Africa) countries, Brazil has demonstrated a unique combination of rapid economic expansion along with strongly pro-democratic economic programs and social policies. Brazil has enjoyed new prominence and respect in the global community. Even as the global economic crisis has torn through many countries, Brazil has seemingly thrived. This new confidence has helped Brazil gain the right to host the 2014 Soccer World Cup and 2016 Olympic Games in Rio de Janeiro.

However, the boom of this past decade has largely been driven by commodity exports, like soya beans, iron ore and oil. Over the past two years, demand for these commodities has softened, with China—a major trading partner—slowing previously insatiable demand for Brazilian commodities. This may suggest a stalling in Brazil’s economy. The Economist magazine estimates Brazil’s growth in GDP (Gross Domestic Product) for 2011 to be at 2.7% and expects growth in 2012 to be a disappointing 2.0%.

Part of the problem for Brazil is that much of the windfall from the commodities boom has been invested in expanding the size of government, payroll (especially governmental), pensions and social transfers. These were all welcomed changes and have done quite a bit to redistribute some wealth. But after years of growth, Brazil’s infrastructure remains poor and this will significantly hamper its ability to continue growth moving forward. Brazil will need to upgrade infrastructure dramatically though to host these global events successfully, as well as lead Latin America in growth and prosperity.

Trends & the Brazilian Nutraceuticals Consumer

The functional foods and nutraceuticals industry remains robust, following the fast-paced decade and recent slow-down. There has been sustained growth and the mood is still optimistic for the category. According to a report by Euromonitor International, the fortified and functional foods category grew by 11% in 2010 to a total of a little more than R$ (Real) 12.7 billion, or about USD$6.4 billion at today’s exchange rate. Similarly, the vitamins and dietary supplements category experienced growth of 12% in 2011, reaching sales of R$2.7 billion. Industry-wide growth rates are expected to be respectable at 5-6% per year, demonstrating continued consumer confidence and concern for health lifestyles. Some of the most promising product categories include: baby food and formula, yogurt, as well as functional and fortified milk drinks, dairy products, breakfast cereal and gum.

Brazilian consumers seem very interested in pre- and probiotic products, which account for considerable growth in the yogurt and functional dairy drinks and products categories. There is also considerable growth in fiber products, as seen in many functional breakfast cereals. Consumer concerns about gut health should continue to be a significant trend.

Oral health is another area of concern as Brazilians consume more functional gums, especially those containing xylitol, for tooth and gum health. Similarly, consumers also supplement more with probiotic products.

Euromonitor International also expects heart health to continue to be a trend to explore. Many products containing phytosterols and functional oils (like omega 3s), are becoming more established with consumers.

Supplements will also enjoy higher than average growth with special attention to calcium, eye health, vitamin, fish oil and probiotic supplements.

Nutraceutical consumers seem very interested in overall health, heart, bone, eye, gut and immune health. Energy continues to be a category that can be further developed as well as the sports nutrition category.

Regulatory Climate

The regulatory framework in Brazil continues to develop rapidly. Brazil’s ANVISA (Agencia Nacional de Vigilancia Sanitaria) regulates pharmaceuticals and therapeutic goods for the country. Registration of all nutritional, therapeutic, food, pharmaceutical or even cosmetic products is required along with proof of safety and efficacy. The registration process is almost always complex, onerous and expensive for product developers. ANVISA takes its job very seriously and companies are wise to seek help in the registration process.

Brazil also has strict environmental and sustainability laws, which make it very difficult to develop and trade in biogenetic materials. Companies looking to research and develop products from Brazil’s vast biogenetic resources will need to navigate complex rules.

What to Expect From Brazil

Partly because of the difficult environmental and sustainability laws, companies developing natural and functional products in Brazil will likely need to make significant investments in R&D. Higher development costs, greater regulatory burden and longer timelines would appear to have a negative impact on development. However, larger investments will likely result in higher-valued, more technical products being developed. This suggests that Brazilian companies will soon be licensing their products and technologies to companies in the U.S. and Europe as they develop their own bio-resources and leverage technologies. It also promotes the concept of Brazil as a value-added provider of goods and services rather than a supplier of commodities. Companies looking to Brazil as a source for new ingredients or products are wise to partner with a local company that understands how to navigate the regulatory and product development processes.

For the Future

Brazil may not be quite the shining star of a couple of years ago. The recent slow-down has exposed some issues Brazil needs to address. “Custo Brasil” is a term often used to describe the cost and difficulty of dealing with Brazil. Taxes are high and the bureaucracies are complex, but there is an air of change about. Dilma Rousseff, Brazil’s President, is vigorously tackling some of the major issues in the country, like corruption and the need for greater infrastructure investment. Consumer confidence remains relatively high and the government is initiating stimulus programs to support that confidence.

According to Euromonitor International, Brazil is ranked fifth in global sales of consumer health products, and is the largest market in Latin America. Functional foods and nutraceuticals are well positioned to continue to outpace the overall economy. While Brazilians, especially at the lower economic rungs have relatively nutrient-deficient diets, there seems to be a long-term shift among consumers toward healthy lifestyles. This shift occurs at every economic level and should continue to drive consumer spending for a long time to come. There are some ups and downs, but Brazil continues to be a very promising market for functional foods and nutraceuticals.