David Sprinkle, Publisher & Research Director, Packaged Facts06.01.12

In its March 2012 report,”Targeted Health and Wellness Foods,” Packaged Facts discusses in detail the market for retail packaged foods and beverages specially formulated and distinctively marketed as targeting a specific health or wellness concern. This positioning is evident in the way the product is presented to the consumer through brand and product name, explicit health claims and packaging and labeling copy and imagery. Based on this product positioning, it is reasonable to assume that most consumers are purchasing and consuming the product in large part—if not primarily—to gain health advantages in relation to the specific health concerns (including medical conditions or diseases) being targeted.

This report focuses on products sold in stores, rather than specialty distribution products or foodservice offerings. Because this study spotlights food and beverage products formulated and marketed to address a specific health concern, whole foods (including produce) fall outside the market scope. Dietary supplements, energy drinks, sports/fitness performance products and weight loss/maintenance products are also excluded from Packaged Facts’ definition of targeted health and wellness (THW) foods and beverages.

THW products are primarily associated with the following specific health concerns:

• Blood PressureFu

• Cancer

• Cholesterol

• Diabetes

• Digestive Health

• Eye/Vision Health

• Female Health

• Heart/Circulatory Health

• Joint/Bone Health

• Male Health

• Mental clarity/cognition/memory

• Prostate Health

• Urinary Tract Health

Finding a Product’s Voice

Because the positioning of a THW food is crucial, marketers must take advantage of all legitimate means to convey that message to consumers. Needless to say, a critical element of this strategy is to make the greatest possible use of whatever health claims are permissible under regulatory guidelines. This is a more challenging task for marketers of THW foods and beverages than it is for marketers of other products positioned as health-promoting, for several reasons: few “positive” health claims (touting the presence of a beneficial ingredient rather than the absence of a detrimental one) have been authorized by the U.S. government; required disclaimers may compromise the credibility of qualified health claims; structure/function claims are barred from referring to any disease; dietary guideline statements are vague; and nutrient content claims don’t address the issue at all.

In the U.S. market, there are five basic ways food and beverage marketers can use labels to communicate the healthful properties of their products: health claims, which must undergo a rigorous approval process; qualified health claims, which must be accompanied by strict disclaimers; structure/function claims, which can make general statements but cannot make reference to specific diseases; dietary guidance statements, which typically address the benefits of food categories rather than individual food components; and nutrient content claims, which generally or specifically characterize the level of a nutrient in the food (e.g., “low fat,” “high in oat bran” or “contains 100 calories”).

The key driver in this market is the growing body of evidence that diet and lifestyle play an instrumental role in the development and, correspondingly, the potential prevention of adverse health conditions. According to the U.S. Department of Health and Human Services, chronic diseases—including heart disease, stroke, cancer, diabetes and arthritis—are among the most common, costly and preventable of all health problems in the U.S. Seven out of 10 Americans die each year from chronic diseases. As reported by the National Institutes of Health’s (NIH) National Cancer Institute, “Serious diseases that are linked to what we eat kill an estimated three out of four Americans each year. These diseases include heart disease, high blood pressure, stroke, some types of cancer and diabetes.”

Shopper Patterns

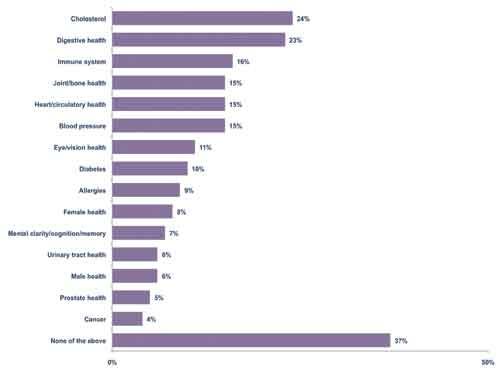

According to a May-June 2011 survey conducted by Packaged Facts, nearly two-thirds (63%) of U.S. grocery shoppers have purchased a food or beverage in the past year for the purpose of addressing one or more of 22 common health and wellness concerns (see Figure 1).

Overall, a larger percentage of adult consumers choose foods or beverages for the management of two specific health concerns—cholesterol (24%) and digestive health (23%)—than to address even such popular functional or quality-of-life benefits as energy levels (17%) or appearance/beauty (13%). Priorities, of course, shift with age and vary by gender. Younger adult shoppers are much more likely to buy products that address allergies, aging, appearance, digestive health, women’s health, immunity and mental clarity. Baby Boomer men are the heaviest consumers of health and wellness foods and beverages targeting men’s health, while senior adults are disproportionately likely to buy products for cancer, cholesterol and joint/bone health.

Figure 1: Consumer Purchase Rates for Health and Wellness Foods and Beverages by Specific Health or Wellness Concern, 2011 (percent of U.S. grocery shoppers) Note: Based on product purchasing within the past 12 months.

Source: Packaged Facts, May-June 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

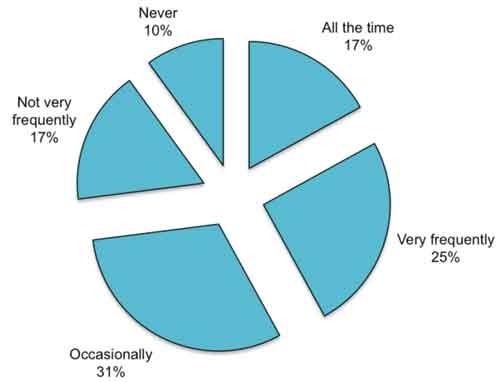

Asked how often they buy grocery products at least partly because of their nutritional advantag

es in relation to specific personal or household health concerns, such as heart health, digestive health, joint/bone health or diabetes/ blood sugar levels, 17% of shoppers responded “all the time.” One-quarter (25%) buy THW foods and beverages quite often, and 31% occasionally do (see Figure 2).

Figure 2: Frequency of Purchasing Grocery Products

Because of Nutritional Advantages Addressing Specific Health Concerns, 2011 (percent of U.S. grocery shoppers)

Note: Based on product purchasing within the past 12 months. Heart health, digestive health, joint/bone health and diabetes/blood sugar levels were given as examples of specific health concerns. Percentages are rounded. Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

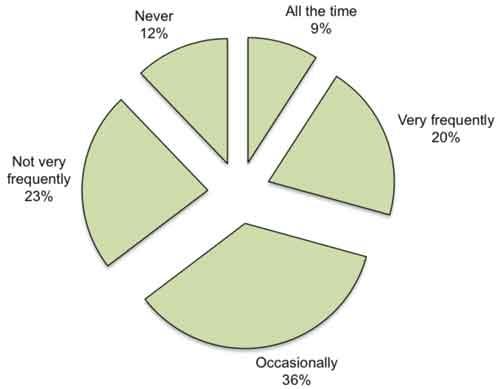

In addition, according to the Packaged Facts survey, one in three U.S. adult grocery shoppers (29%) always or usually buy grocery products that are explicitly marketed or labeled as targeting specific health concerns, such as heart health, digestive health, joint/bone health or

diabetes/blood sugar levels, while 36% sometimes do (see Figure 3).

Figure 3: Frequency of Purchasing Grocery Products Marketed or Labeled as Targeting Specific Health Concerns, 2011 (percent of U.S. grocery shoppers)

Note: Based on product purchasing within the past 12 months. Heart health, digestive health, joint/bone health, and diabetes/blood sugar levels were given as examples of specific health concerns. Percentages are rounded.

Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

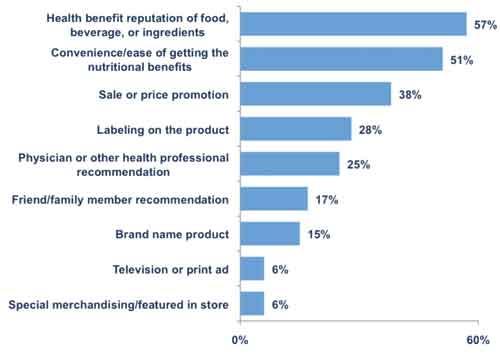

Among the shoppers who buy grocery products at least partly because of a specific personal or household health concern, the number-one purchasing influence is the health benefit reputation of the food/beverage or its ingredients, at 57%. This finding underscores the importance of conveying health benefits clearly, consistently and frequently. It also confirms the key role of credibility for THW product sales success. Sale pricing/product promotion (38%) and product labeling (28%) trail in importance (see Figure 4).

Figure 4: Most Important Factors in Targeted Health and Wellness Food and Beverage Purchase Decisions, 2011 (percent of U.S. grocery shoppers)

Respondents were asked: “When you buy grocery products at least partly because of a specific personal or household health concern, what factors are most important to your purchase decisions?”

Note: Based on product purchasing within the past 12 months.

Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

The Importance of Clinical Evidence

Because the reliability and effectiveness of a given food or beverage used to address specific health concerns are critical to success, the vast majority of marketers affiliate themselves in some way with members of the medical/healthcare/scientific communities. This way, marketers can navigate the often difficult regulatory waters while making the health implications clear and getting the marketing message across.

Nearly half of shoppers in Packaged Facts’ survey say doctors are one of their key sources of information about nutrients in food, and about one-quarter cite other medical professionals. Furthermore, as shown in Figure 4, one-quarter of shoppers say a recommendation by a health professional is an important factor when buying grocery products targeting a specific health concern. Obviously, healthcare providers lend credibility to claims—supporting the all-important health benefit reputation—and can also generate awareness among their patients about individual products and ingredients.

A decade ago, Clare Hasler, founding director of Functional Foods for Health Program, Department of Food Science and Human Nutrition and Functional Foods for Health Program, University of Illinois, Urbana, urged marketers of functional foods to enter their products into clinical trials to support their petitions for health claims. She wrote:

“Linking the consumption of functional foods or food ingredients with health claims should be based on sound scientific evidence, with the ‘gold standard’ being replicated, randomized, placebo-controlled, intervention trials in human subjects. However, not all foods on the market today that are claimed to be functional foods are supported by enough solid data to merit such claims.” (Journal of Nutrition, December 2002, abstract)

Stephen DeFelice, MD, who coined the term “nutraceutical” and promoted the prevention, treatments and cures of disease through dietary means also protested the dearth of products with clinical studies supporting their claims. The considerable investment of time and money in clinical trials made sense for a brand such as Quaker Oats or Ocean Spray, or another company with a stranglehold on a branded commodity, but most manufacturers and marketers of functional foods and ingredients neither had the resources nor would enjoy research payoffs at that level. If clinical trials were once an anomaly, they are now increasingly the norm—essentially a competitive necessity. The studies marketers make references to may apply to general findings about a food or food component; they may have been conducted to test the efficacy a specific branded ingredient; or they may have been conducted on a branded, packaged food or beverage product.

More than ever, manufacturers and marketers of condition-specific foods and beverages cite clinical studies supporting their claims that a particular product or its ingredients can deliver the promised benefits. Because companies are restricted by regulations governing the use of health claims, this information is typically disseminated through press releases and on company or product websites.

In this context, a two-fold finding of the Packaged Facts survey bears noting. On the one hand, half of all grocery shoppers surveyed by Packaged Facts indicate that they have cut back on their grocery spending, and THW product purchasers are economizing at a significantly higher-than-average rate. This is partly a function of the fact that shoppers who buy foods and beverages for their condition-specific benefits overall tend to be older and, accordingly, earning less household income—although the profile of THW consumer in certain categories skews younger and relatively upscale. On the other hand, purchasers of targeted health and wellness products are more likely than average to say they are willing to pay more for “better-for-you” grocery products. About half of all shoppers agree strongly or somewhat with this statement, while consumers of products addressing eye/vision health, cognition, men’s or women’s health, digestion, immunity and joint/bone health agree at rates that are significantly above average.

By retail channel shopped, according to Packaged Facts survey data, purchasers of THW foods and beverages are much more likely than adults on average to order groceries by catalog, mail order or over the Internet. For example, while 6% of grocery shoppers overall purchase groceries over the Internet, that rate rises to 20% among those who purchase health and wellness products related to cancer concerns, and to 18% among those purchasing products related to memory and cognition. Other grocery outlets used by THW shoppers at a much higher-than-average rate include Asian grocery stores or Hispanic bodegas, independent/ neighborhood natural food or grocery stores, Whole Foods Market or Trader Joe’s, gourmet food stores and community co-ops and farmers’ markets.

Packaged Facts estimates that North America accounts for roughly 40% of new targeted health and wellness food and beverage stock-keeping units (SKUs) being introduced into the global market. In terms of product positioning, immunity, women’s health, diabetes, heart/ circulatory health and cholesterol each account for more than a tenth of these new SKUs being introduced.

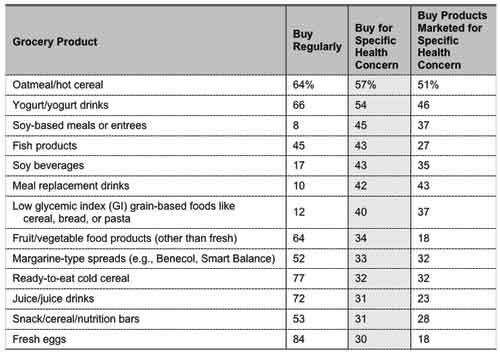

Packaged Facts’ survey of U.S. grocery shoppers shows that oatmeal/hot cereal and yogurt/yogurt drinks are the packaged food and beverage products that shoppers purchase more than any other for specific health benefits. These are also the top two categories in which shoppers regularly buy products that are marketed or labeled as delivering specific health benefits. Of the 64% of shoppers who regularly buy oatmeal or hot cereal, 57% do so at least partly because of its nutritional advantages in relation to specific personal or household health concerns. And, of these regular consumers, just over half routinely buy hot cereal brands and products that are marketed or labeled as targeting specific health concerns. Of the 66% of shoppers who regularly buy yogurt or yogurt drinks, 54% do so at least partly because of its nutritional advantages in relation to specific personal or household health concerns, and nearly half buy yogurt brands and products that are marketed or labeled as targeting specific health concerns.

Fish products (not including fresh fish), similarly, boast both high purchasing rates and high rates on purchasing in relation to specific health concerns. Other product categories have relatively low overall adult purchasing rates but relatively high purchasing rates in relation to specific health concerns, or vice versa (see Figure 5).

Figure 5: Purchasing of Selected Types of Grocery Products With Targeted Health and Wellness Positioning, 2011 (percent of U.S. grocery shoppers)

Note: Based on product purchasing within the past 12 months.

Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

While there are legitimate concerns about uninformed and inappropriate use of food and beverage products to address medical issues, our survey shows that shoppers who purchase foods and beverages for their nutritional benefits with respect to a specific health concern are also significantly more likely than average to strive for overall wellness. In fact, 62% of shoppers who purchase food or beverage products for their nutritional benefits in relation to a specific health concern consider themselves to be in good physical health. Not surprisingly, this percentage rises significantly (to 84%) in the case of products targeting sports/fitness performance. However, the percentage who consider themselves to be in good physical health also rises significantly for products targeting health issues and concerns such as anti-aging (76%), cancer (72%), joint/bone health (72%), and male health (72%), and similarly rises above the two-thirds mark for products targeting appearance, digestive health, energy, eye/vision health, immune system, mental clarity and prostate health. The most significant exception to this overall pattern involves those who purchase health and wellness products that target diabetes; of this group, only 45% consider themselves to be in good health.

About the author: David Sprinkle is the publisher and research director for Packaged Facts. For more information on Packaged Facts syndicated market research reports, please see www.packagedfacts.com. Specific product and purchasing information on Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012) is available at www.packagedfacts.com/Targeted-Health-Wellness-6497898/

This report focuses on products sold in stores, rather than specialty distribution products or foodservice offerings. Because this study spotlights food and beverage products formulated and marketed to address a specific health concern, whole foods (including produce) fall outside the market scope. Dietary supplements, energy drinks, sports/fitness performance products and weight loss/maintenance products are also excluded from Packaged Facts’ definition of targeted health and wellness (THW) foods and beverages.

THW products are primarily associated with the following specific health concerns:

• Blood PressureFu

• Cancer

• Cholesterol

• Diabetes

• Digestive Health

• Eye/Vision Health

• Female Health

• Heart/Circulatory Health

• Joint/Bone Health

• Male Health

• Mental clarity/cognition/memory

• Prostate Health

• Urinary Tract Health

Finding a Product’s Voice

Because the positioning of a THW food is crucial, marketers must take advantage of all legitimate means to convey that message to consumers. Needless to say, a critical element of this strategy is to make the greatest possible use of whatever health claims are permissible under regulatory guidelines. This is a more challenging task for marketers of THW foods and beverages than it is for marketers of other products positioned as health-promoting, for several reasons: few “positive” health claims (touting the presence of a beneficial ingredient rather than the absence of a detrimental one) have been authorized by the U.S. government; required disclaimers may compromise the credibility of qualified health claims; structure/function claims are barred from referring to any disease; dietary guideline statements are vague; and nutrient content claims don’t address the issue at all.

In the U.S. market, there are five basic ways food and beverage marketers can use labels to communicate the healthful properties of their products: health claims, which must undergo a rigorous approval process; qualified health claims, which must be accompanied by strict disclaimers; structure/function claims, which can make general statements but cannot make reference to specific diseases; dietary guidance statements, which typically address the benefits of food categories rather than individual food components; and nutrient content claims, which generally or specifically characterize the level of a nutrient in the food (e.g., “low fat,” “high in oat bran” or “contains 100 calories”).

The key driver in this market is the growing body of evidence that diet and lifestyle play an instrumental role in the development and, correspondingly, the potential prevention of adverse health conditions. According to the U.S. Department of Health and Human Services, chronic diseases—including heart disease, stroke, cancer, diabetes and arthritis—are among the most common, costly and preventable of all health problems in the U.S. Seven out of 10 Americans die each year from chronic diseases. As reported by the National Institutes of Health’s (NIH) National Cancer Institute, “Serious diseases that are linked to what we eat kill an estimated three out of four Americans each year. These diseases include heart disease, high blood pressure, stroke, some types of cancer and diabetes.”

Shopper Patterns

According to a May-June 2011 survey conducted by Packaged Facts, nearly two-thirds (63%) of U.S. grocery shoppers have purchased a food or beverage in the past year for the purpose of addressing one or more of 22 common health and wellness concerns (see Figure 1).

Overall, a larger percentage of adult consumers choose foods or beverages for the management of two specific health concerns—cholesterol (24%) and digestive health (23%)—than to address even such popular functional or quality-of-life benefits as energy levels (17%) or appearance/beauty (13%). Priorities, of course, shift with age and vary by gender. Younger adult shoppers are much more likely to buy products that address allergies, aging, appearance, digestive health, women’s health, immunity and mental clarity. Baby Boomer men are the heaviest consumers of health and wellness foods and beverages targeting men’s health, while senior adults are disproportionately likely to buy products for cancer, cholesterol and joint/bone health.

Figure 1: Consumer Purchase Rates for Health and Wellness Foods and Beverages by Specific Health or Wellness Concern, 2011 (percent of U.S. grocery shoppers) Note: Based on product purchasing within the past 12 months.

Source: Packaged Facts, May-June 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

Asked how often they buy grocery products at least partly because of their nutritional advantag

es in relation to specific personal or household health concerns, such as heart health, digestive health, joint/bone health or diabetes/ blood sugar levels, 17% of shoppers responded “all the time.” One-quarter (25%) buy THW foods and beverages quite often, and 31% occasionally do (see Figure 2).

Figure 2: Frequency of Purchasing Grocery Products

Because of Nutritional Advantages Addressing Specific Health Concerns, 2011 (percent of U.S. grocery shoppers)

Note: Based on product purchasing within the past 12 months. Heart health, digestive health, joint/bone health and diabetes/blood sugar levels were given as examples of specific health concerns. Percentages are rounded. Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

In addition, according to the Packaged Facts survey, one in three U.S. adult grocery shoppers (29%) always or usually buy grocery products that are explicitly marketed or labeled as targeting specific health concerns, such as heart health, digestive health, joint/bone health or

diabetes/blood sugar levels, while 36% sometimes do (see Figure 3).

Figure 3: Frequency of Purchasing Grocery Products Marketed or Labeled as Targeting Specific Health Concerns, 2011 (percent of U.S. grocery shoppers)

Note: Based on product purchasing within the past 12 months. Heart health, digestive health, joint/bone health, and diabetes/blood sugar levels were given as examples of specific health concerns. Percentages are rounded.

Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

Among the shoppers who buy grocery products at least partly because of a specific personal or household health concern, the number-one purchasing influence is the health benefit reputation of the food/beverage or its ingredients, at 57%. This finding underscores the importance of conveying health benefits clearly, consistently and frequently. It also confirms the key role of credibility for THW product sales success. Sale pricing/product promotion (38%) and product labeling (28%) trail in importance (see Figure 4).

Figure 4: Most Important Factors in Targeted Health and Wellness Food and Beverage Purchase Decisions, 2011 (percent of U.S. grocery shoppers)

Respondents were asked: “When you buy grocery products at least partly because of a specific personal or household health concern, what factors are most important to your purchase decisions?”

Note: Based on product purchasing within the past 12 months.

Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

The Importance of Clinical Evidence

Because the reliability and effectiveness of a given food or beverage used to address specific health concerns are critical to success, the vast majority of marketers affiliate themselves in some way with members of the medical/healthcare/scientific communities. This way, marketers can navigate the often difficult regulatory waters while making the health implications clear and getting the marketing message across.

Nearly half of shoppers in Packaged Facts’ survey say doctors are one of their key sources of information about nutrients in food, and about one-quarter cite other medical professionals. Furthermore, as shown in Figure 4, one-quarter of shoppers say a recommendation by a health professional is an important factor when buying grocery products targeting a specific health concern. Obviously, healthcare providers lend credibility to claims—supporting the all-important health benefit reputation—and can also generate awareness among their patients about individual products and ingredients.

A decade ago, Clare Hasler, founding director of Functional Foods for Health Program, Department of Food Science and Human Nutrition and Functional Foods for Health Program, University of Illinois, Urbana, urged marketers of functional foods to enter their products into clinical trials to support their petitions for health claims. She wrote:

“Linking the consumption of functional foods or food ingredients with health claims should be based on sound scientific evidence, with the ‘gold standard’ being replicated, randomized, placebo-controlled, intervention trials in human subjects. However, not all foods on the market today that are claimed to be functional foods are supported by enough solid data to merit such claims.” (Journal of Nutrition, December 2002, abstract)

Stephen DeFelice, MD, who coined the term “nutraceutical” and promoted the prevention, treatments and cures of disease through dietary means also protested the dearth of products with clinical studies supporting their claims. The considerable investment of time and money in clinical trials made sense for a brand such as Quaker Oats or Ocean Spray, or another company with a stranglehold on a branded commodity, but most manufacturers and marketers of functional foods and ingredients neither had the resources nor would enjoy research payoffs at that level. If clinical trials were once an anomaly, they are now increasingly the norm—essentially a competitive necessity. The studies marketers make references to may apply to general findings about a food or food component; they may have been conducted to test the efficacy a specific branded ingredient; or they may have been conducted on a branded, packaged food or beverage product.

More than ever, manufacturers and marketers of condition-specific foods and beverages cite clinical studies supporting their claims that a particular product or its ingredients can deliver the promised benefits. Because companies are restricted by regulations governing the use of health claims, this information is typically disseminated through press releases and on company or product websites.

In this context, a two-fold finding of the Packaged Facts survey bears noting. On the one hand, half of all grocery shoppers surveyed by Packaged Facts indicate that they have cut back on their grocery spending, and THW product purchasers are economizing at a significantly higher-than-average rate. This is partly a function of the fact that shoppers who buy foods and beverages for their condition-specific benefits overall tend to be older and, accordingly, earning less household income—although the profile of THW consumer in certain categories skews younger and relatively upscale. On the other hand, purchasers of targeted health and wellness products are more likely than average to say they are willing to pay more for “better-for-you” grocery products. About half of all shoppers agree strongly or somewhat with this statement, while consumers of products addressing eye/vision health, cognition, men’s or women’s health, digestion, immunity and joint/bone health agree at rates that are significantly above average.

By retail channel shopped, according to Packaged Facts survey data, purchasers of THW foods and beverages are much more likely than adults on average to order groceries by catalog, mail order or over the Internet. For example, while 6% of grocery shoppers overall purchase groceries over the Internet, that rate rises to 20% among those who purchase health and wellness products related to cancer concerns, and to 18% among those purchasing products related to memory and cognition. Other grocery outlets used by THW shoppers at a much higher-than-average rate include Asian grocery stores or Hispanic bodegas, independent/ neighborhood natural food or grocery stores, Whole Foods Market or Trader Joe’s, gourmet food stores and community co-ops and farmers’ markets.

Packaged Facts estimates that North America accounts for roughly 40% of new targeted health and wellness food and beverage stock-keeping units (SKUs) being introduced into the global market. In terms of product positioning, immunity, women’s health, diabetes, heart/ circulatory health and cholesterol each account for more than a tenth of these new SKUs being introduced.

Packaged Facts’ survey of U.S. grocery shoppers shows that oatmeal/hot cereal and yogurt/yogurt drinks are the packaged food and beverage products that shoppers purchase more than any other for specific health benefits. These are also the top two categories in which shoppers regularly buy products that are marketed or labeled as delivering specific health benefits. Of the 64% of shoppers who regularly buy oatmeal or hot cereal, 57% do so at least partly because of its nutritional advantages in relation to specific personal or household health concerns. And, of these regular consumers, just over half routinely buy hot cereal brands and products that are marketed or labeled as targeting specific health concerns. Of the 66% of shoppers who regularly buy yogurt or yogurt drinks, 54% do so at least partly because of its nutritional advantages in relation to specific personal or household health concerns, and nearly half buy yogurt brands and products that are marketed or labeled as targeting specific health concerns.

Fish products (not including fresh fish), similarly, boast both high purchasing rates and high rates on purchasing in relation to specific health concerns. Other product categories have relatively low overall adult purchasing rates but relatively high purchasing rates in relation to specific health concerns, or vice versa (see Figure 5).

Figure 5: Purchasing of Selected Types of Grocery Products With Targeted Health and Wellness Positioning, 2011 (percent of U.S. grocery shoppers)

Note: Based on product purchasing within the past 12 months.

Source: Packaged Facts September 2011 Food Shopper Insights Survey and Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012).

While there are legitimate concerns about uninformed and inappropriate use of food and beverage products to address medical issues, our survey shows that shoppers who purchase foods and beverages for their nutritional benefits with respect to a specific health concern are also significantly more likely than average to strive for overall wellness. In fact, 62% of shoppers who purchase food or beverage products for their nutritional benefits in relation to a specific health concern consider themselves to be in good physical health. Not surprisingly, this percentage rises significantly (to 84%) in the case of products targeting sports/fitness performance. However, the percentage who consider themselves to be in good physical health also rises significantly for products targeting health issues and concerns such as anti-aging (76%), cancer (72%), joint/bone health (72%), and male health (72%), and similarly rises above the two-thirds mark for products targeting appearance, digestive health, energy, eye/vision health, immune system, mental clarity and prostate health. The most significant exception to this overall pattern involves those who purchase health and wellness products that target diabetes; of this group, only 45% consider themselves to be in good health.

About the author: David Sprinkle is the publisher and research director for Packaged Facts. For more information on Packaged Facts syndicated market research reports, please see www.packagedfacts.com. Specific product and purchasing information on Targeted Health and Wellness Foods and Beverages: The U.S. Market and Global Trends (March 2012) is available at www.packagedfacts.com/Targeted-Health-Wellness-6497898/