Features

Gummy Formulas Continue to Win Supplement Market Share

Condition-specific products that deliver taste, nutrition, and convenience offer added value.

By: Sean Moloughney

Sales of gummy format dietary supplements grew 23% to $2.63 billion for the 52 weeks ending Dec. 26, 2021, according to SPINS data for the Natural Enhanced and Conventional/MultiOutlet channels—outpacing powders (+5.6%, $2.05 billion), capsules (+8.7%, $1.51 billion), tablets (+1.9%, $1.92 billion), softgels (+7.1%, $1.56 billion), liquids (+1%, $596 million), caplets (+12%, $298.6 million), and soft chews (+7.7%, $17.5 million).

Growth among gummies last year was most significant for condition-specific supplement formulas (30% overall). Platforms posting the biggest gains were calmative and mood support (192.7%), cognitive health (184.4%), sleep (51.1%), energy (32.5%), and beauty (16.3%).

Immune health gummies fell 11.2% after the icepick spike of 2020. However, mineral-fortified gummies grew 169% thanks in large part to zinc and magnesium. CBD gummies and other therapeutic oils grew 56.3%, though the category declined 13.9% overall when including other formats, according to SPINS.

Prebiotic and probiotic gummies also saw 18.7% sales growth in 2021. In January of this year Jarrow Formulas launched its new Probiotic+ Gummies line, which includes three formulas for digestive, immune, and gut health. The products all feature a proprietary probiotic blend of two clinically-studied strains: Bacillus coagulans (MTCC 5856) and Bacillus subtilis (DE111). Available in raspberry flavor, Probiotic Duo Gummies contain 3 billion live cells to help promote digestive and immune system health, according to the company.

Jarrow’s Probiotic+ Prebiotic gummies (blackberry flavor) support digestion, strengthen the immune system, and fuel healthy gut bacteria with the combination of 2 billion live cells and the prebiotic xylooligosaccharides (XOS).

Probiotic+ Immune gummies are formulated to promote a healthy digestive system and keep the immune system strong. Two orange-flavored gummies contain 2 billion live cells as well as 90 mg of vitamin C, 50 mcg (2,000 IU) of vitamin D, and 2.3 mg of zinc.

Each product is non-GMO, gluten-free, vegetarian-friendly, and contains no artificial flavors, sweeteners, colors, or preservatives, according to Jarrow.

Responding to consumer demand for calmative, relaxation products, Gaia Herbs debuted three gummy formulas in late 2021 that are USDA certified organic and free from artificial colors, preservatives, flavors, or sweeteners.

Ashwagandha Gummies contain 600 mg of ashwagandha root extract along with a proprietary blend of cinnamon bark and ginger root extract to promote stress reduction and increase resistance to stress. The company said three gummies provide the equivalent of 6 grams of dried ashwagandha root.

Formulated to promote a good night’s rest and help combat occasional sleeplessness, the company’s Sleep Gummies combine 140 mg of ashwagandha root extract; 136 mg of passionflower aerial parts extract; and a proprietary blend of jujube date fruit and seed paste, reishi fruiting body extract, and orange peel essential oil.

Lastly, Gaia Herbs’ new Relax Gummies contain 450 mg of passionflower aerial parts extract, 195 mg of lemon balm leaf juice, and a blend of lemon peel essential oil and holy basil leaf extract.

“At Gaia Herbs, we believe that plants have the power to heal. This belief is and always has been at the forefront of our product growth and innovation as a company,” said Tracy Earnes, vice president of marketing at Gaia Herbs. “Over the last two years, we have introduced gummy products that have set a new standard combining taste, convenience, potency, and quality. The launch of our new herbal gummies is a testament to the commitment we have made to provide consumers with a delicious, convenient way to incorporate herbal supplements into their daily routines. We know ingredients are important, so each new gummy formula is sweetened only with real fruit, flavored only with herbs and pure essential oils, and made with sustainably sourced ingredients that are clean and traceable.”

Demand for Flavor & Convenience

About 37% of U.S. consumers prefer taking vitamins, minerals, or supplements in a gummy format, according to a 2021 market report from Mintel (U.S. Trends in Vitamins, Minerals and Supplements). Younger adults in particular prefer gummies to traditional pills and capsules. They are also more open to alternative formats in general, from chewables and liquids to powders and lozenges.

A 2021 report by Grand View Research predicted the global gummy market will reach $42.06 billion by 2028, expanding at a CAGR of 12.6%. Growth is influenced in part by consumer demand for nutrition with flavor and convenience.

“The convenience of supplements in gummy format makes it easier for consumers with busy lifestyles to take their supplements with them on the go,” noted Jacqueline Rizo, digital engagement and communications specialist, Stratum Nutrition. “For consumers finding it difficult to swallow pills or who may have pill fatigue, the delivery format of a gummy is a favorable alternative. Gummy supplements are chewable and similar to gummy candies. The availability of flavors, colors, and attractive shapes help make gummies a more convenient delivery format for children, who are reluctant to consume supplements in other forms.”

What started in the U.S. as a delivery format focused on children’s nutrition has expanded to all age groups, she added. “According to Mintel, gummy supplements are popular among younger consumers, appealing to 67% of U.S. consumers aged 18 to 34 who currently take or plan to take vitamins, minerals, or supplements. Gummies are easy to chew and can be consumed on the go, which provides an easy supplementation solution during busy lifestyles for adult consumers.”

The success of flavorful gummy supplements as a perceived indulgence is based on three key factors, according to Angie Rimel, marketing communications manager, North America, GELITA. “First, gummies taste better than traditional supplements. Secondly, chewable products eliminate the difficulties associated with swallowing large tablets or capsules, which can be particularly problematic for children and the older population. Thirdly, switching to a gummy version of a vitamin or dietary supplement makes people feel as though they’re not taking too many pills.”

Formulation Factors

Developing the right product formulation for consumers requires weighing benefits and tradeoffs, according to Sam Wright, CEO and president of The Wright Group. “There will always be tradeoffs between cost pressures, quality desired, physical characteristics, taste, stability, and other parameters. Dosage forms such as chewable vitamins, softgel capsules, gummies, sachets, liquids, etc. all target specific demographics. Kids like chewable vitamins, older adults who have difficulty swallowing tablets and may already be taking many medications prefer the ease of chewables, softgels, and gummies.”

“One of the tradeoffs in gummies vs. tablets is the dosage load that can be put into the product,” Wright continued. “Younger adults and students tend to gravitate to more food-form supplements such as bars and shakes.”

Rimel agreed that a major challenge in gummy formulation is the limited amount of active nutritional ingredients that can be added compared to traditional formats like capsules and tablets. “However, if a gummy requires the properties of gelatin as well as the functionality of collagen peptides, it is now also possible to achieve this with one ingredient. GELITA’s new products, SOLUFORM for protein enrichment and sugar reduction and VERISOL HST for beauty gummies, are solutions for those requirements.”

The products also provide adjustable viscosity, gel strength, gel formation, and emulsion-forming and stabilizing properties, as well as adjustable foaming and foam stabilization properties, Rimel added. “By harnessing all of this in one ingredient, the need to order, transport, and store multiple products becomes unnecessary, allowing manufacturers to create entirely new products or extend existing lines without the need for investment in new equipment.”

For example, she said, consider the production of high-protein gummies. “By using SOLUFORM and a recipe adapted to high protein levels, clear fruit gummies with a protein content of up to 35% can be realized on a standard mogul production line. This is not currently possible with the conventional combination of standard gelatins and generic collagen powder products.”

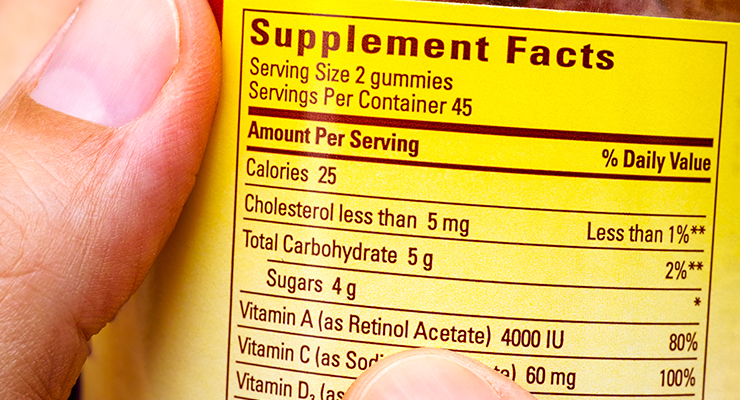

Sugar represents another barrier in gummies, said Rizo. “Sugar content has definitely been a concern for consumers and gummies have more sugar content than any other form of dietary supplements, resulting in increased calorie intake. The sugar and high fructose corn syrup work as both a sweetener and a way to mask the unpleasant taste of minerals. For health-conscious customers, this becomes a concern since they prefer supplements that are either sugar-free or low in sugar.”

Meanwhile, fillers may be used to bind and bulk up gummy supplements to achieve that thick, candy-like consistency, Rizo noted. “For consumers who follow a vegan or vegetarian diet, gelatin becomes a problem as this ingredient is sourced from certain animal parts. Carrageenan, on the other hand, is a common food additive that is derived from seaweed and is added to gummies as a vegan alternative to gelatin. However, according to some research, it comes with its own health risks.”

At first glance, brightly colored gummies may seem more appealing too, however, the potential health risks of artificial food coloring may be too much for consumers to stomach, especially when considering nutrition products for children.

“The stability issue in a gummy delivery system plays another challenging role for manufacturers,” said Rizo. “Unlike tablets or capsules, gummies are not protected by films. By the time it has reached the mouth of the consumer, the nutrient content has the possibility of degradation.”

Ingredients & Labels

Many consumers seek out multivitamins simply because they are not getting all the necessary nutrients from their daily diet, Rizo noted. “However, minerals like iron are often not included in gummies due to difficulty incorporating it into a gummy format and masking its distinct taste. For iron-deficient consumers, taking a multivitamin gummy may not provide the nutrients needed to potentially avoid health problems down the road.”

On a positive note, she added, postbiotics are an ingredient class that has been gaining traction. “According to Lumina Intelligence, postbiotics have become the fastest growing area in terms of gut-health related Google searches, with a nearly 1,300% increase in the last two years,” Rizo said.

“Researched in a postbiotic form for over 100 years, LBiome is backed by an impressive research portfolio that includes support for its use as a digestive aid in both adults and children of all ages. In over 12 published human trials, most subjects experienced benefits in 7 days or less. It is a human strain-derived, heat-treated postbiotic (Lactobacillus LB) that provides the digestive benefits of a probiotic and the formulation flexibility of a spore, with none of the stability or manufacturing concerns. Since they are not live microorganisms, they are not susceptible to decreases in their efficacy resulting from poor storage conditions or gastric transit.”

In addition to the usual suspects like vitamins and minerals, collagen for beauty-from-within is a market leader, said Rimel. “For example, GELITA’s VERISOL are natural BCPs (Bioactive Collagen Peptides) which have been specifically developed to provide the highest possible efficacy in human skin. Studies have also shown beneficial effects of VERISOL supplementation on hair and nail support. With a low dose of only 2.5 grams, a health benefit can be received in just three gummies.”

Now more than ever, consumers are interested in clean labels and transparency, Rimel noted. “For food producers, the term ‘clean label’ does indeed mean something, but there’s some ambiguity. And we’ve seen an evolution of the term. Foundational in any definition of clean label is the desire for simplicity and naturalness in the ingredient panel. Here, the challenge for food producers is to rethink food formulations and the ingredients being used.”

Gelatin is a smart choice for many clean label food formulations, including gummies, she added, because “gelatin is natural and it’s familiar (and has been for centuries). And that’s likely because gelatin offers multiple functionalities. So imagine now, as a food formulator looking to simplify an ingredient panel, here gelatin is a single natural ingredient that combines multiple benefits and functionalities and is derived from native collagen and a food in its own right—rather than an additive—and thus contributes meaningfully to a clean label.”

Rizo noted the clean label movement has gained momentum in part because consumers today “are the most informed and health-conscious of any previous generation. While there is no official definition of ‘clean label’ requirements provided by the FDA, the most accepted description is that of products containing simple ingredients with no processing.”

“Demand for transparency and truth by consumers has challenged the dietary supplement and functional foods industries all the way from raw ingredient supplier to finished product marketer,” she continued. “Consumers who desire products with clean labels that are truthful and with an ingredient list that is easily understood are often willing to pay a premium for high-quality products.”

Ultimately, consumers want assurance that if a label says the supplement contains “natural” ingredients, then there shouldn’t be cheap, synthetic substitutes in the bottle. “The end-consumer deserves to know what is in their products, and manufacturers and distributors need to know they can trust their ingredient suppliers to provide raw ingredients that are what they say they are. Certain artificial colorings, commonly used to give gummies their attractive appearance are not considered ‘clean’ by the majority of consumers.”

“Natural” and “free from,” are key purchasing drivers as consumers look to support their health, she added. “When it comes to the gummy format, the use of gelatin is key in production due to its superior texturizing and gelling functionality. It is derived from natural sources and considered a safe and clean label ingredient.”

Ultimately, gummies present an exciting opportunity for supplement brands, Rizo concluded. “As demand for gummy alternatives continues to grow, more and more manufacturers will be left with the challenge to create a clean label option.”

Sean Moloughney has been the Editor of Nutraceuticals World since 2012. He can be reached at SMoloughney@RodmanMedia.com.