By Julian Mellentin, Director, New Nutrition Business11.09.20

It’s easy to pick out trends. It’s a bigger challenge to pick the ones that are going to carry you through the next 5 years. To do that, you must look at every point of the compass—not just consumer research, but also emerging technologies, competitive strategies, and established consumer needs that keep re-asserting themselves, sometimes in unexpected ways. When you take that 360-degree view, the landscape is easier to read; even surprises turn out to have a foundation to them that we could have foreseen.

Protein Power

The business of food and health is full of surprises, and one of the surprises that 2020 has thrown up is the rapid emergence of collagen. Collagen’s successes remind us that consumers embrace animal-based innovation just as much as plant-based, despite what you read in the media.

In 2020, Nestlé Health Science gave collagen its seal of approval by announcing the acquisition of a majority stake in Vital Proteins, America’s leading collagen brand. It may be the first-ever takeover of a collagen-based wellness company.

Vital Proteins products are in 35,000 retail outlets in America and Europe, including Whole Foods, Costco, Target, Walgreens, and Kroger. It also sells direct-to-consumer. In addition to supplement powders and pills, its range includes nutrition bars, bone broths, matcha products, creamers, and an enhanced water.

The company reportedly earned $100 million (€89 million) in sales in 2018 and told Forbes magazine that it was on track for $200 million (€178 million) in 2019. That’s not bad for a company founded in 2012.

Vital Proteins is America’s leading collagen brand.

Vital isn’t alone in realizing the potential of collagen, which is showing up more and more in products from reputable brands, such as Danone’s Light & Fit yogurt.

Collagen accounts for about 30% of the protein in the human body, and 70% of the protein content of the skin. It is a key component of connective tissues, supporting the health of skin, hair, nails, bones, and joints. Collagen production in the body begins to decline at about age 25. This leads to skin wrinkles, joint pain, weaker muscles, and lower bone density.

Collagen scores high on sustainability; it’s a waste-stream product from the process of making gelatin, usually from bones and skin of cattle, pigs, or fish. Vital Proteins’ collagen is said to be sustainably sourced from grass-fed, pasture-raised cattle.

Collagen is “protein with benefits,” offering joint health, stronger nails, and healthier skin; it accounts for 9% of the beauty-from-within supplements market in the U.S. compared to 1% in 2015, according to Nutrition Business Journal. And because those benefits are ones that matter to consumers, collagen’s Instagram profile has increased phenomenally over the past two years.

It’s good to see that it’s not Millennials driving the surge in demand for collagen. That honor goes to Generation X, aged 40-55 years old, the ages at which you start noticing the loss of collagen.

And, somewhat ironically, the move toward more plant-based diets may be helping demand for this byproduct of animal agriculture. While a plant-based diet often includes some meat and fish, people increasingly have low collagen intakes because they tend to remove the richest collagen sources from their food in an effort to avoid fat.

Will demand for all proteins keep progressing? Yes, it will. Protein is “the nutrient that can do no wrong.” Unlike fat, carbohydrates or sugar, it has never been demonized. And its positive association with weight management will keep demand high for as long as people make that connection.

An important factor in protein’s progress is how creative companies have been adding it to ice-cream, for example, or even repositioning a basic slice of natural cheese as a gluten-free, high-protein substitute for a sandwich wrap. U.S. cheese maker Crystal Farms has created yet another usage occasion for cheese, billing its wraps as “cheese in place of bread.” Cheese Wraps are a result, the company said, of “not looking in our own category and asking what need wasn’t being met by cheese, but looking at the entire grocery store and rising food trends and figuring out where consumers weren’t happy with the options they had.”

Cheese Wraps are tortilla-sized slices of cheese packaged in a re-sealable bag. Packaging communicates: 7-8 grams of protein per serving; gluten-free; cheese in place of bread; and specially cut to roll up easily.

Crystal Farms has billed its Cheese Wraps as “cheese in place of bread.”

A product like this meets the needs of people who are trying to consume fewer carbs and those looking for protein. It provides extreme convenience and the kind of easy-to-understand novelty that gets the attention of today’s new-experience-seeking consumer.

We will also see dairy developing its competitive advantage of higher measurable protein quality (this is based on the amino-acid content) in order to compete more effectively with plant proteins. Chobani’s newly-launched Complete brand, which delivers 15 grams of protein per 150-gram serving, communicates that it: “Offers the full set of 20 nutritionally-important amino acids, including all nine essential amino acids, which are the building blocks of proteins for the body.”

This kind of messaging—starting to educate consumers on what protein quality is and why it matters—is also used by Nestlé’s Lindahl high-protein brand in Europe. It will be picked up first by people interested in sports and fitness and from them it will migrate to the wider population, just as protein did over the last 10 years.

The plant protein market will also be affected by this shift to quality. Of the major plant proteins, only soy can at present compete effectively with animal protein. But many more newer proteins with good amino acid profiles—and often good sustainability credentials—are coming to market.

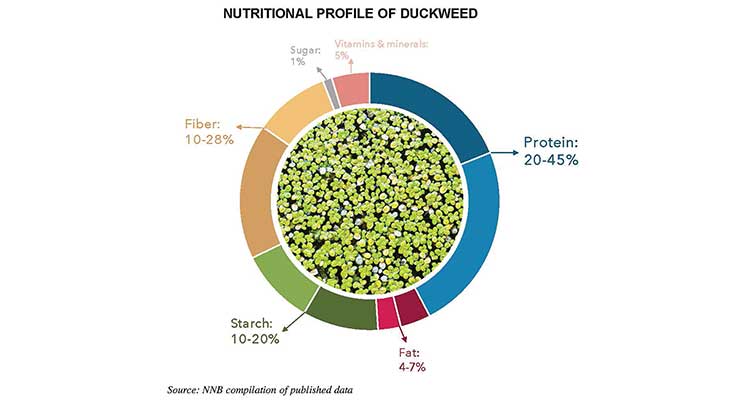

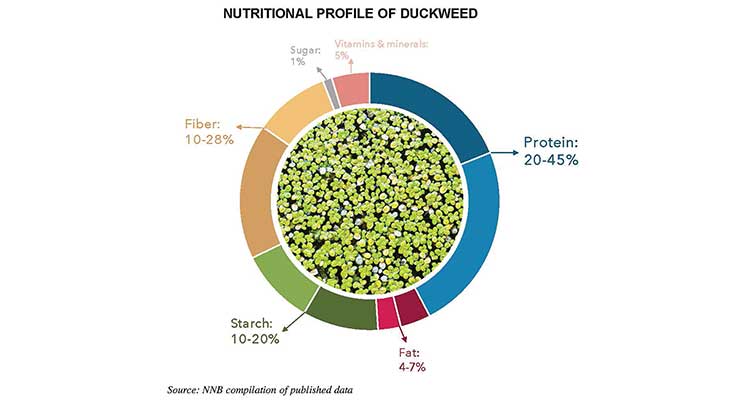

One example is duckweed, also known as water lentils. It has a high amount of essential amino acids as well as bioavailable vitamin B12. It grows rapidly, allowing a harvest every two-three weeks. Kellogg’s venture arm Eighteen94 Capital is an investor in U.S.-based duckweed start-up Plantible Foods.

It’s only a matter of time before more quality plant proteins come to market; and that may not be good news for the competitive position of pea protein, with its weaker amino acid and nutritional profile.

Immune Health

Of the many changes accelerated by the novel coronavirus pandemic, one that will endure is consumers’ thinking more about how to maintain a healthy immune system. Two of the biggest winners are likely to be probiotics and vitamin D.

After digestive wellness, immune health is the benefit that consumers associate most with probiotics. In Asia, it has already been common for over a decade for probiotic products to offer both benefits.

Dairy and dietary supplements remain, for consumers, the most credible categories in which to find probiotics, along with foods that have a traditional “fermented” image, such as kimchi and sauerkraut. Sales of these products surged during the pandemic, with kimchi up 900%.

Despite 20 years of effort by marketers, probiotics struggle to migrate far beyond the categories where they have an established connection. The market landscape is littered with failed probiotic breakfast cereals—such as Kellogg’s most recent failure, the Happy Inside brand—bars, juices, and more. Those that survive are mostly niche.

Note that seniors and mothers of young children over-index among the buyers of products for immune health. These two groups have always been the most aware of vulnerability and the pandemic threw a harsh spotlight on older seniors in particular, with around 80% of deaths among those over 70 years of age.

Mood

Food has long been used by people to influence their mood. For the food and beverage industry, “mood food” was already a growth trend with strong consumer interest, but it has been accelerated in 2020.

The percentage of Americans reporting symptoms of depression more than tripled during the ongoing coronavirus pandemic, according to a study by Brown University and Boston University.

In surveys conducted prior to the pandemic, 9% of respondents reported depressive symptoms, researchers found. Once the pandemic hit, that percentage jumped to 28% of respondents, according to reported survey data.

Many everyday foods are well-established in popular belief as helping to improve how you feel. Chocolate is a mood food for many people, along with ice cream, coffee, and tea—loved the world over for their uplifting effects. But in 2020 interest in “comfort foods” surged: 40% of Americans said they are now eating more indulgent and comforting foods than before COVID-19.

Specifically, among people’s needs are: a mental energy boost; improved focus, attention and concentration; reduction in anxiety and stress; and better sleep.

Over the last decade, many companies have tried to create brands that deliver one of the above benefits—almost entirely without success. The huge failure rate in nootropics is simply because of the number of products that don’t get repeat purchase because they focus on the cool-sounding ingredient, not the consumer benefit.

Take cordyceps, the mushroom ingredient often talked up in the trade media; in practice, it has no level of consumer awareness and using it or any other ingredient known to only a tiny niche of people won’t help you.

Select your ingredients based on the benefit you think you can credibly deliver. One of the critical success factors in this area will be delivering a benefit people can feel, or at least think they can feel. It’s only when people feel they’re getting a benefit that you will get repeat purchase.

At present, brands that tend to succeed are based on ingredients like caffeine and vitamin B where you’re delivering something tangible. For example, Berocca in Australia is a very successful supplement brand based on the clear benefit people feel from taking a big dose of B vitamins (with guarana there as a kind of signature ingredient to flag up the energy benefit).

Fat Re-Born

Continuing a trend that was born 10 years ago, fat is re-born and will appear in more products and at higher levels. Even five years ago, the idea that a major retailer would routinely sell own-label 10% fat content yogurt would have seemed unlikely. But just such a product is already part of the line of Greek yogurts sold by Tesco, the U.K.’s biggest grocery chain, under its own brand.

In Greece, 10% fat yogurt is pretty much the market standard. The second-biggest brand in Greece, KriKri, took a risk when it launched its 10% fat yogurt in northern Europe two years ago. But KriKri has been rewarded with surging sales.

In the U.S., the keto trend is also re-shaping consumers’ beliefs and categories. The launch in 2020 of a high-fat keto yogurt by Yoplait was a radical move by a traditionally conservative brand—and a sign of the changing consumer demand for more fat.

People’s changing beliefs about weight management are behind the shift. Lower-carb, higher-fat (LCHF) eating patterns have gone from weird (2010) to mainstream (2020). The drivers include evolving science and legitimization by authorities, such as Diabetes Canada, which in 2020 published a statement that LCHF was “safe and effective” for weight loss and the management of diabetes. The American Diabetes Association had come to the same conclusion the year before.

We will see many new products using more fats—which give a significant taste and texture advantage—and including not only dairy fat but plant sources such as avocado and coconut.

Provenance & Authenticity

Provenance and authenticity is a trend that matters more and more in health and wellness. In a world where ingredients can be “from anywhere,” people find it reassuring that they come “from somewhere,” and they’re voting with their pocketbooks in favor of provenance.

It’s an emergent strategy that may be a way for ingredient businesses to create value by offering a health benefit with provenance as differentiation, and reducing the risk of their ingredient being copied and turned into a commodity. It can work well when the ingredient:

New Zealand companies are pioneering in this area, focusing on using ingredients specifically from New Zealand and backed by science. One example is a variety of blackcurrant (cassis) only found in New Zealand. Research has demonstrated that it has significant advantages for sports performance and it is being commercialized successfully in the supplement market.

How to ‘Disrupt’

In meetings inside companies, in webinars presented by consultants, and articles by trade journalists, three of the most-used phrases to describe innovation in our industry are “disruption,” “game-changer,” and “transformative.”

Interestingly, most of the success stories which disrupt, transform or “game-change” are, and will continue to be, stories of taking a traditional food or ingredient and reinventing it. The skill of new product development (NPD) teams in re-making “old” foods with better tastes or more convenience has driven many successes, from the almond to the cauliflower. Coffee—a 400-year-old energy drink—is one example of a category which continues to reinvent itself and expand thanks to creative NPD. Once a hot beverage, it’s now chilled and ready-to-drink (RTD)—with or without dairy—and an ingredient in snack bars and breakfast cereal.

“Reinventing” can mean adapting a food into a product format that is new and more interesting, and more convenient than its traditional form, such as turning kale into chips or cauliflower into pizza.

Or it can mean taking a simple traditional food from one market where it’s an everyday food and moving it to another where it is new and different, as happened with Greek yogurt and Icelandic skyr.

And a successful move across cultures can also mean adapting the taste of the traditional product to meet a different culture’s preferences, as happened with kombucha.

The reinvention of traditional foods is also a sign of the power of the “naturally functional” mega-trend. What most people want, more than anything else, is for their foods to be naturally functional—to provide a benefit that’s intrinsic to the food.

The massive success of almonds, which back in the 1990s were in many Western countries known only as an infrequently consumed and slightly boring snack nut, shows how completely this forecast has come true. Almond processors have used technology and active NPD to capitalize on natural almonds’ health halo and make them available in more convenient forms, creating new categories, such as the $2 billion U.S. almond milk business.

The next phase in the re-invention of a traditional food is part of the plant-based trend and will see a stronger health focus for herbs and spices. Herbs and spices are naturally functional, associated with ethnic flavors, taste, and enjoyment; plus they have a health halo and a back-story about traditional usage. They will move from meals to unexpected formats such as snack bars and dairy drinks as people look for more convenient ways to get their health benefits. This is the cycle almonds have already gone through. Perhaps one day turmeric, rosemary, and cinnamon will be found in as many categories as almonds and blueberries are. Already, turmeric is showing the way, debuting in the West in “golden milk,” or turmeric lattes, and now being used in product types from bars to breakfast cereals and drinks.

If you want to succeed in the business of food and health, reinventing traditional foods will give you the greatest chance of success, as it has already done for 25 years.

How to Pick the Trends that Matter

Everyone likes to keep up with consumer trends. But the only trends that matter are those to which you can connect your products, and make a lasting difference to your business. The questions you need to ask about any trends you track are:

About the author: Julian Mellentin is the founder of New Nutrition Business, a consulting company specialized in the business of food, nutrition and health since 1995. For more information: www.new-nutrition.com; julian.mellentin@new-nutrition.com.

Protein Power

The business of food and health is full of surprises, and one of the surprises that 2020 has thrown up is the rapid emergence of collagen. Collagen’s successes remind us that consumers embrace animal-based innovation just as much as plant-based, despite what you read in the media.

In 2020, Nestlé Health Science gave collagen its seal of approval by announcing the acquisition of a majority stake in Vital Proteins, America’s leading collagen brand. It may be the first-ever takeover of a collagen-based wellness company.

Vital Proteins products are in 35,000 retail outlets in America and Europe, including Whole Foods, Costco, Target, Walgreens, and Kroger. It also sells direct-to-consumer. In addition to supplement powders and pills, its range includes nutrition bars, bone broths, matcha products, creamers, and an enhanced water.

The company reportedly earned $100 million (€89 million) in sales in 2018 and told Forbes magazine that it was on track for $200 million (€178 million) in 2019. That’s not bad for a company founded in 2012.

Vital Proteins is America’s leading collagen brand.

Vital isn’t alone in realizing the potential of collagen, which is showing up more and more in products from reputable brands, such as Danone’s Light & Fit yogurt.

Collagen accounts for about 30% of the protein in the human body, and 70% of the protein content of the skin. It is a key component of connective tissues, supporting the health of skin, hair, nails, bones, and joints. Collagen production in the body begins to decline at about age 25. This leads to skin wrinkles, joint pain, weaker muscles, and lower bone density.

Collagen scores high on sustainability; it’s a waste-stream product from the process of making gelatin, usually from bones and skin of cattle, pigs, or fish. Vital Proteins’ collagen is said to be sustainably sourced from grass-fed, pasture-raised cattle.

Collagen is “protein with benefits,” offering joint health, stronger nails, and healthier skin; it accounts for 9% of the beauty-from-within supplements market in the U.S. compared to 1% in 2015, according to Nutrition Business Journal. And because those benefits are ones that matter to consumers, collagen’s Instagram profile has increased phenomenally over the past two years.

It’s good to see that it’s not Millennials driving the surge in demand for collagen. That honor goes to Generation X, aged 40-55 years old, the ages at which you start noticing the loss of collagen.

And, somewhat ironically, the move toward more plant-based diets may be helping demand for this byproduct of animal agriculture. While a plant-based diet often includes some meat and fish, people increasingly have low collagen intakes because they tend to remove the richest collagen sources from their food in an effort to avoid fat.

Will demand for all proteins keep progressing? Yes, it will. Protein is “the nutrient that can do no wrong.” Unlike fat, carbohydrates or sugar, it has never been demonized. And its positive association with weight management will keep demand high for as long as people make that connection.

An important factor in protein’s progress is how creative companies have been adding it to ice-cream, for example, or even repositioning a basic slice of natural cheese as a gluten-free, high-protein substitute for a sandwich wrap. U.S. cheese maker Crystal Farms has created yet another usage occasion for cheese, billing its wraps as “cheese in place of bread.” Cheese Wraps are a result, the company said, of “not looking in our own category and asking what need wasn’t being met by cheese, but looking at the entire grocery store and rising food trends and figuring out where consumers weren’t happy with the options they had.”

Cheese Wraps are tortilla-sized slices of cheese packaged in a re-sealable bag. Packaging communicates: 7-8 grams of protein per serving; gluten-free; cheese in place of bread; and specially cut to roll up easily.

Crystal Farms has billed its Cheese Wraps as “cheese in place of bread.”

A product like this meets the needs of people who are trying to consume fewer carbs and those looking for protein. It provides extreme convenience and the kind of easy-to-understand novelty that gets the attention of today’s new-experience-seeking consumer.

We will also see dairy developing its competitive advantage of higher measurable protein quality (this is based on the amino-acid content) in order to compete more effectively with plant proteins. Chobani’s newly-launched Complete brand, which delivers 15 grams of protein per 150-gram serving, communicates that it: “Offers the full set of 20 nutritionally-important amino acids, including all nine essential amino acids, which are the building blocks of proteins for the body.”

This kind of messaging—starting to educate consumers on what protein quality is and why it matters—is also used by Nestlé’s Lindahl high-protein brand in Europe. It will be picked up first by people interested in sports and fitness and from them it will migrate to the wider population, just as protein did over the last 10 years.

The plant protein market will also be affected by this shift to quality. Of the major plant proteins, only soy can at present compete effectively with animal protein. But many more newer proteins with good amino acid profiles—and often good sustainability credentials—are coming to market.

One example is duckweed, also known as water lentils. It has a high amount of essential amino acids as well as bioavailable vitamin B12. It grows rapidly, allowing a harvest every two-three weeks. Kellogg’s venture arm Eighteen94 Capital is an investor in U.S.-based duckweed start-up Plantible Foods.

It’s only a matter of time before more quality plant proteins come to market; and that may not be good news for the competitive position of pea protein, with its weaker amino acid and nutritional profile.

Immune Health

Of the many changes accelerated by the novel coronavirus pandemic, one that will endure is consumers’ thinking more about how to maintain a healthy immune system. Two of the biggest winners are likely to be probiotics and vitamin D.

After digestive wellness, immune health is the benefit that consumers associate most with probiotics. In Asia, it has already been common for over a decade for probiotic products to offer both benefits.

Dairy and dietary supplements remain, for consumers, the most credible categories in which to find probiotics, along with foods that have a traditional “fermented” image, such as kimchi and sauerkraut. Sales of these products surged during the pandemic, with kimchi up 900%.

Despite 20 years of effort by marketers, probiotics struggle to migrate far beyond the categories where they have an established connection. The market landscape is littered with failed probiotic breakfast cereals—such as Kellogg’s most recent failure, the Happy Inside brand—bars, juices, and more. Those that survive are mostly niche.

Note that seniors and mothers of young children over-index among the buyers of products for immune health. These two groups have always been the most aware of vulnerability and the pandemic threw a harsh spotlight on older seniors in particular, with around 80% of deaths among those over 70 years of age.

Mood

Food has long been used by people to influence their mood. For the food and beverage industry, “mood food” was already a growth trend with strong consumer interest, but it has been accelerated in 2020.

The percentage of Americans reporting symptoms of depression more than tripled during the ongoing coronavirus pandemic, according to a study by Brown University and Boston University.

In surveys conducted prior to the pandemic, 9% of respondents reported depressive symptoms, researchers found. Once the pandemic hit, that percentage jumped to 28% of respondents, according to reported survey data.

Many everyday foods are well-established in popular belief as helping to improve how you feel. Chocolate is a mood food for many people, along with ice cream, coffee, and tea—loved the world over for their uplifting effects. But in 2020 interest in “comfort foods” surged: 40% of Americans said they are now eating more indulgent and comforting foods than before COVID-19.

Specifically, among people’s needs are: a mental energy boost; improved focus, attention and concentration; reduction in anxiety and stress; and better sleep.

Over the last decade, many companies have tried to create brands that deliver one of the above benefits—almost entirely without success. The huge failure rate in nootropics is simply because of the number of products that don’t get repeat purchase because they focus on the cool-sounding ingredient, not the consumer benefit.

Take cordyceps, the mushroom ingredient often talked up in the trade media; in practice, it has no level of consumer awareness and using it or any other ingredient known to only a tiny niche of people won’t help you.

Select your ingredients based on the benefit you think you can credibly deliver. One of the critical success factors in this area will be delivering a benefit people can feel, or at least think they can feel. It’s only when people feel they’re getting a benefit that you will get repeat purchase.

At present, brands that tend to succeed are based on ingredients like caffeine and vitamin B where you’re delivering something tangible. For example, Berocca in Australia is a very successful supplement brand based on the clear benefit people feel from taking a big dose of B vitamins (with guarana there as a kind of signature ingredient to flag up the energy benefit).

Fat Re-Born

Continuing a trend that was born 10 years ago, fat is re-born and will appear in more products and at higher levels. Even five years ago, the idea that a major retailer would routinely sell own-label 10% fat content yogurt would have seemed unlikely. But just such a product is already part of the line of Greek yogurts sold by Tesco, the U.K.’s biggest grocery chain, under its own brand.

In Greece, 10% fat yogurt is pretty much the market standard. The second-biggest brand in Greece, KriKri, took a risk when it launched its 10% fat yogurt in northern Europe two years ago. But KriKri has been rewarded with surging sales.

In the U.S., the keto trend is also re-shaping consumers’ beliefs and categories. The launch in 2020 of a high-fat keto yogurt by Yoplait was a radical move by a traditionally conservative brand—and a sign of the changing consumer demand for more fat.

People’s changing beliefs about weight management are behind the shift. Lower-carb, higher-fat (LCHF) eating patterns have gone from weird (2010) to mainstream (2020). The drivers include evolving science and legitimization by authorities, such as Diabetes Canada, which in 2020 published a statement that LCHF was “safe and effective” for weight loss and the management of diabetes. The American Diabetes Association had come to the same conclusion the year before.

We will see many new products using more fats—which give a significant taste and texture advantage—and including not only dairy fat but plant sources such as avocado and coconut.

Provenance & Authenticity

Provenance and authenticity is a trend that matters more and more in health and wellness. In a world where ingredients can be “from anywhere,” people find it reassuring that they come “from somewhere,” and they’re voting with their pocketbooks in favor of provenance.

It’s an emergent strategy that may be a way for ingredient businesses to create value by offering a health benefit with provenance as differentiation, and reducing the risk of their ingredient being copied and turned into a commodity. It can work well when the ingredient:

- Delivers a “feel the benefit effect”;

- Has a scientific basis for the claimed benefit;

- Has a specific provenance;

- Is a natural source and easy-to-understand ingredient.

New Zealand companies are pioneering in this area, focusing on using ingredients specifically from New Zealand and backed by science. One example is a variety of blackcurrant (cassis) only found in New Zealand. Research has demonstrated that it has significant advantages for sports performance and it is being commercialized successfully in the supplement market.

How to ‘Disrupt’

In meetings inside companies, in webinars presented by consultants, and articles by trade journalists, three of the most-used phrases to describe innovation in our industry are “disruption,” “game-changer,” and “transformative.”

Interestingly, most of the success stories which disrupt, transform or “game-change” are, and will continue to be, stories of taking a traditional food or ingredient and reinventing it. The skill of new product development (NPD) teams in re-making “old” foods with better tastes or more convenience has driven many successes, from the almond to the cauliflower. Coffee—a 400-year-old energy drink—is one example of a category which continues to reinvent itself and expand thanks to creative NPD. Once a hot beverage, it’s now chilled and ready-to-drink (RTD)—with or without dairy—and an ingredient in snack bars and breakfast cereal.

“Reinventing” can mean adapting a food into a product format that is new and more interesting, and more convenient than its traditional form, such as turning kale into chips or cauliflower into pizza.

Or it can mean taking a simple traditional food from one market where it’s an everyday food and moving it to another where it is new and different, as happened with Greek yogurt and Icelandic skyr.

And a successful move across cultures can also mean adapting the taste of the traditional product to meet a different culture’s preferences, as happened with kombucha.

The reinvention of traditional foods is also a sign of the power of the “naturally functional” mega-trend. What most people want, more than anything else, is for their foods to be naturally functional—to provide a benefit that’s intrinsic to the food.

The massive success of almonds, which back in the 1990s were in many Western countries known only as an infrequently consumed and slightly boring snack nut, shows how completely this forecast has come true. Almond processors have used technology and active NPD to capitalize on natural almonds’ health halo and make them available in more convenient forms, creating new categories, such as the $2 billion U.S. almond milk business.

The next phase in the re-invention of a traditional food is part of the plant-based trend and will see a stronger health focus for herbs and spices. Herbs and spices are naturally functional, associated with ethnic flavors, taste, and enjoyment; plus they have a health halo and a back-story about traditional usage. They will move from meals to unexpected formats such as snack bars and dairy drinks as people look for more convenient ways to get their health benefits. This is the cycle almonds have already gone through. Perhaps one day turmeric, rosemary, and cinnamon will be found in as many categories as almonds and blueberries are. Already, turmeric is showing the way, debuting in the West in “golden milk,” or turmeric lattes, and now being used in product types from bars to breakfast cereals and drinks.

If you want to succeed in the business of food and health, reinventing traditional foods will give you the greatest chance of success, as it has already done for 25 years.

How to Pick the Trends that Matter

Everyone likes to keep up with consumer trends. But the only trends that matter are those to which you can connect your products, and make a lasting difference to your business. The questions you need to ask about any trends you track are:

- Will it enable you to get more volume, either by renovating existing products or by creating new segments and categories with new products?

- Will the trend get better prices and profit margins?

- Will it stick around? No company can afford to connect its strategy to a trend that will run out of steam two years from now.

About the author: Julian Mellentin is the founder of New Nutrition Business, a consulting company specialized in the business of food, nutrition and health since 1995. For more information: www.new-nutrition.com; julian.mellentin@new-nutrition.com.