By Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt, Sloan Trends, Inc.10.07.19

Protein remains second only to dietary fiber as the top ingredient U.S. consumers are adding or increasing in their diet, according to the Hartman Group’s Health + Wellness 2019. Sixty-percent are trying to get more protein; the same percentage as in 2017, but up 9% since 2013.

More than one-third (36%) of consumers say they’re adding more plant-based protein; 21% more animal protein. “High protein” is an important attribute in 54% of U.S. households when shopping for food, per Nielsen’s March 2019 Homescan Panel Health Care Survey.

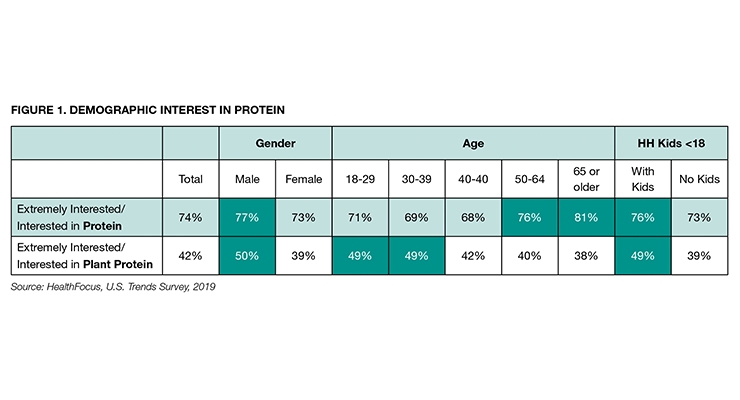

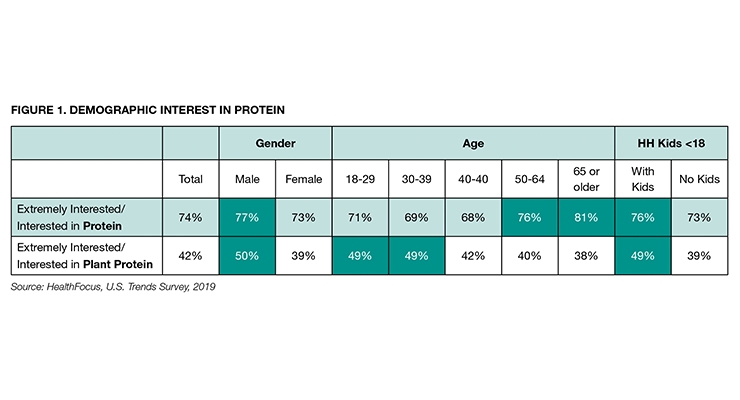

Interest in protein is highest among adults age 50 and older, particularly those 65 and over, men, and households with children. Interest in plant protein skews younger, but also toward men and households with kids, per HealthFocus’ 2019 U.S. Trends Survey (see Figure 1).

Women are most likely to look to protein for satiety and weight management, men for physical performance and muscle strength, and parents for mental alertness and enjoyment, according to Cargill.

One in five (22%) supplement users are taking a protein supplement, according to CRN’s 2019 Consumer Survey on Dietary Supplements. Just over one-quarter (26%) of male and 19% of female supplement users take a protein supplement; 32% aged 18-34, 24% 35-54, and 13% aged 55 and over.

Almost half of global food shoppers say they always/usually choose foods and beverages because they are high in protein, according to HealthFocus’ 2018 Global Trends Study. Protein is on par with whole grains and just behind less sugar/more natural foods in terms of ingredients that have gained importance in the diet of global consumers; protein outpaced organic and plant-based foods.

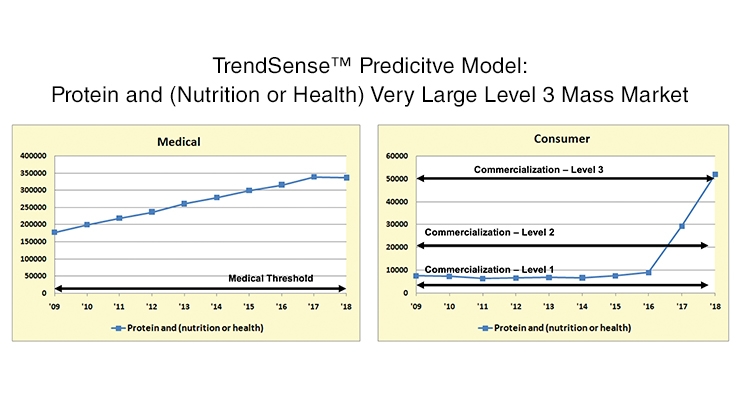

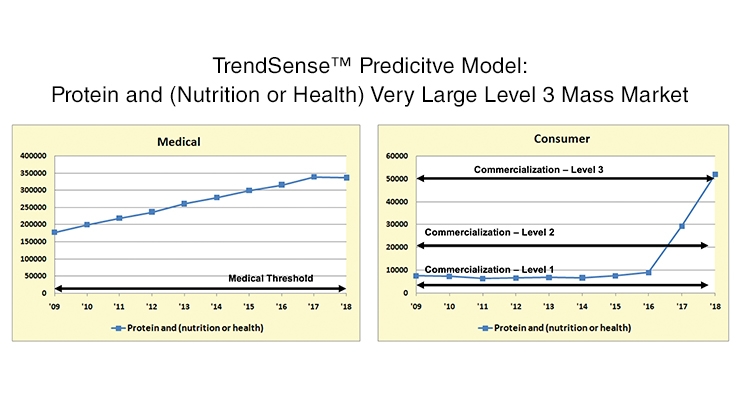

According to Sloan Trends’ TrendSense model, protein nutrition/health is a very large Level 3 mass market, supported by an enormous level of medical research activity (Figure 2). The plateauing of its very high medical interest is an indication that the protein market is maturing and shifting to one involving more specific applications, benefits, and product attributes.

For example, protein/energy is fast approaching mega market status; protein/muscle continues to accelerate as a very large Level 3 market opportunity. The high level of interest in the medical community is creating new research findings, which will help to effectively market these more specific protein benefit linkages in the future. (See Getting Ahead of the Curve: Energy Gen 2, Nutraceuticals World, July/August, 2019.)

The protein ingredients market is projected to grow from $49.8 billion in 2018 to $70.7 billion by 2025, at a CAGR of 6.0% during the forecast period, per Markets and Markets’ Protein Ingredients Market by Source, Application & Region - Global Forecast to 2025.

Quality Matters

As consumers become more familiar with an ever-widening array of proteins, it’s not surprising that users have begun to focus on protein quality and on trying to get the right type of protein for their personal needs. One-third of U.S. adults agree that the source of protein does matter, per Nielsen’s Homescan Survey.

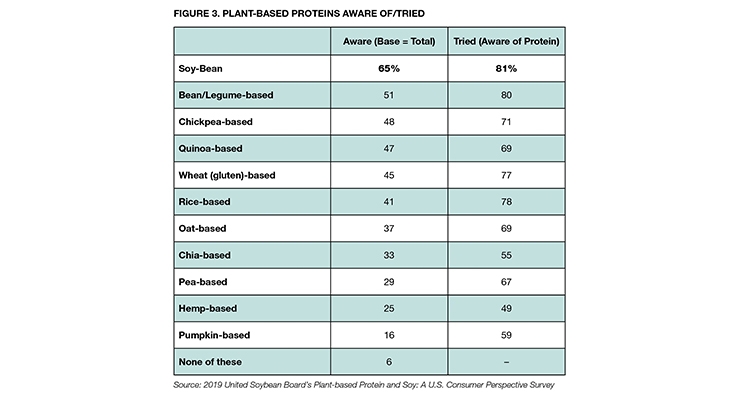

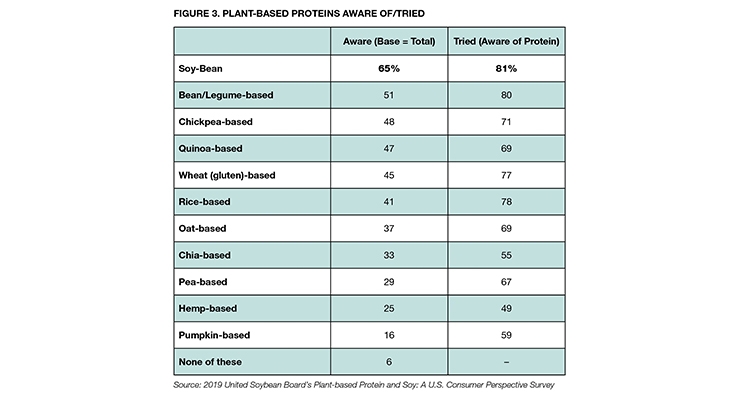

Americans have become aware of and tried a variety of proteins, led by soy, bean/legume, chickpea, and quinoa proteins, according to the April 2019 United Soybean Board’s (USB) Plant-based Protein and Soy: A U.S. Consumer Perspective Survey.

Two-thirds (67%) of adults say consuming a complete plant-based protein is important to them; one in five say it’s very important, per the USB survey. Among the most familiar plant-based proteins, consumers rate the overall quality of bean/legume-sourced protein the highest with 42% rating it as excellent; followed by soy 34%, pea 25%, and wheat 24%, per USB. The only plant proteins that are of high quality with all essential amino acids include soy, quinoa, and buckwheat.

A similar hierarchy occurs for positive perceptions about the leading plant proteins; 67% rate bean-based protein as “very or somewhat positive,” soy 57%, pea 51%, and wheat 51%, per USB. Despite the ongoing “mud-slinging” between protein ingredient marketers, only 10% of consumers cite soy protein’s quality as being very negative, 8% wheat, 5% pea, and 4% bean/legumes.

Six in 10 global food shoppers focus on the type of protein they consume. “Natural” is by far the top indicator of a “good source” of protein, cited by 56% of global consumers surveyed by HealthFocus’ 2019 Global Opportunities in Protein Report; followed by a complete source of protein (38%), a clean source (37%), and a nutrient dense source 30%. Although interest in plant-based protein is high globally, only 27% selected it as an indicator of a good source of protein. Beans/legumes, eggs, and seafood topped the list of good proteins worldwide.

While marketers are differentiating the type of protein, they should talk more about the amount and type of protein needed to trigger muscle synthesis, including the presence of essential amino acids (and specifically, leucine); the timing of protein consumption for optimal muscle development; and pursue other highly desired health linkages (e.g., long-lasting energy and satiety).

CRN’s 2019 survey reported that 11% of supplement users aged 18-34 are taking an amino acid supplement; 7% 35-54, and 2% age 55.

Linked In

Muscle health/tone is now the top benefit consumers associate with a high-protein diet (56%); 53% link physical energy; 47% weight management; 42% healthy hair, skin, and nails; 41% mental energy; 40% brain nourishment; 39% bone health; 35% sports recovery; 33% athletic performance; and 24% satiety, according to HealthFocus.

Muscle health/strength ranks fifth among sought-after health benefits from food/beverages, second among those age 50 and over, according to the International Food Information Council’s (IFIC) 2019 Food & Healthy Survey. Forty-seven percent buy high-protein products to help build muscle; 35% to keep their physical performance at a high level, per Cargill.

With interest in protein highest at ages 50 and older, only 13% age 55 and over are taking a protein supplement. The potential for targeting age-specific protein products for older consumers has never been greater, with 109 million Americans over age 50 and 48 million age 65 an older.

Moreover, “maintaining your ability to continue with normal activities as you age” is the second overall health concern in the U.S., per HealthFocus. Three-quarters of those age 50 and older are aware of the natural process of muscle loss with aging; 28% have noticed muscle loss, and 40% a loss of strength, per Abbott’s 2016 Managing Muscle Loss Survey. In the U.S., 45% of those over 65 years of age already have age-related muscle loss/strength, called sarcopenia.

At the same time, a clear split in the $42.5 billion U.S. sports nutrition category into mainstream “fit” consumers vs. competitive/serious exercisers and bodybuilders, will force marketers to reformulate protein-based products specific to each group. (See Getting Ahead of the Curve: The Fit Consumers, Nutraceuticals World, March 2019).

Among the new demographic of “fit” consumers who exercise three or more days per week for more than 30 minutes, representing as much as 40% of U.S. adults, 74% always/usually choose foods/drinks because they’re high in protein, per HealthFocus.

Globally, strength/muscle tone is the top reason for consuming sports nutrition products for men and women; recovery number three, per Euromonitor’s 2019 Top Consumer Trends Impacting Health & Nutrition.

Most important, plant-based protein marketers not offering a complete protein should proceed with caution in the muscle-building and exercise recovery segments. Recent studies confirm that incomplete proteins are not as effective in building muscle or strength [Current Developments in Nutrition, Vol 3(1), June 2019], and may not be as effective as complete proteins for sports recovery.

Of those who took a protein supplement last year for sports or weight loss, 44% opted for plant protein, per CRN’s 2018 survey. However, only 16% of U.S. consumers connect plant-based foods/protein to muscle growth, per Mintel’s 2018 Trends in the Still Hot Protein Marketplace.

Seventeen percent of adults used protein beverages in 2018, 12% meal replacements/mixes, 11% nutritional drinks (e.g., Boost), and 6% weight loss drinks/mixes, per Mintel’s Nutrition & Performance Drinks – U.S., 2018. Nutrition Business Journal (NBJ) projected that sales of sports powder supplements will approach $7 billion by 2022, with a CAGR from 2020-22 of about 6%.

Additionally, 57% of U.S. adults buy high-protein products to give them energy, 26% to keep them mentally alert, per Cargill. Energy ranks second, after weight loss, as the benefit consumers would most like to get from food, per IFIC.

Right after “general well-being” and “nutrient deficiencies,” “increased energy” is the most popular reason for taking a dietary supplement, per Mintel’s Vitamins, Minerals & Supplements US – Sep. 2018. NBJ projected sales of energy supplements will reach $2.5 billion by 2021.

Low energy is no longer just a concern of younger adults. According to HealthFocus, 57% of those aged 18-39 are extremely/very concerned about tiredness/lack of energy, 51% of those aged 40-49, and 54% aged 50-64.

Consumers look for products that provide “long-lasting physical energy” and “energy they can draw on throughout the day” at twice the rate of “energy for exercise. “Mental” and “morning energy to get the day started” ranked third and fourth, per HealthFocus. Just over half of adults cite “more energy” as a reason for using plant-based foods, beverages, powders, and bars; two-thirds of younger adults aged 18-29 and households with kids are the most likely to say they do so for extra energy, per HealthFocus.

Not surprisingly with consumers taking a more holistic view of health, in which the mind is as important as body, brain nourishment and mental energy are now among the high-demand health benefits—and protein can deliver. “Retaining mental sharpness with age” is America’s top health concern, per HealthFocus; memory ranks third overall, and stress is eighth. Stress/anxiety has replaced being overweight as the top health condition America’s households are trying to treat or prevent, per the Hartman Group.

NBJ projected that brain health supplements will reach $1.1 billion by 2022; mood, stress, and mental health supplements $1.0 billion. Twenty-three percent of adults (26% age 50 and older) take a supplement for brain health; 10 million a proprietary brain supplement (e.g., Prevagen), 60 million a traditional supplement (e.g., omega-3), according to AARP’s 2019 Brain Health and Dietary Supplements Survey.

One-quarter of consumers (26%) say they seek out protein to help with weight control. Nielsen reported that 6% of U.S. households have a family member on a high-protein diet (5.4 million people). Of the 38% who followed a diet regimen in the past year, 3% were on the Paleo diet in 2019, down from 7% in 2018, per IFIC. Globally, 8% follow a high-protein diet, according to Euromonitor.

Just under half of adults who seek out protein do so because it keeps them feeling fuller longer; 17% say satiety is their most important reason, per Cargill. Hair, skin, and nail supplements are another protein opportunity and projected by NBJ to reach $1.2 billion by 2021, with a CAGR of 5%. Inner beauty remains a missed opportunity for food marketers.

Lastly, soy is the only protein that currently has an FDA-approved heart health claim. Heart ranks fourth on the list of health benefits consumers are looking for in foods, per IFIC. Nearly one-quarter (23%) of users take a supplement for heart health, 30% of those aged 55 and over, 20% ages 35-54, and 16% ages 18-34, per CRN’s 2019 survey.

Food for Thought

One in five (19%) U.S. households cite legumes, nuts, and seeds among their primary protein sources, according to Nielsen’s Homescan.

After “taste” and “no artificial ingredients,” protein content is the most important reason consumers buy plant-based foods/drinks, according to Mintel’s July 2018 What Consumers Really Think about Alternative Proteins.

U.S. retail sales of plant-based foods have grown 11% for the year ended April 2019, to reach $4.5 billion, according to SPINS and the Plant-Based Foods Association (PBFA).

Sales of foods/drinks with a “good” or “excellent” source of protein claim reached $22.6 billion for the year ended Jun. 9, 2018, per Nielsen. Grocery accounted for $16 billion, dairy $953 million, bakery $168 million, deli $166 million, meat $93 million, frozen foods $68 million, and produce $37 million, per Nielsen.

Sales of all edibles with a protein claim jumped 9% in 2018; those with a protein claim plus “no preservative” or “no hormones” were up 15%, those with a protein claim plus “GMO-free” up 21%, plus “whole grains” up 27%, plus “no antibiotics” up 41%, and plus “probiotics” up 59%, per Nielsen.

When shopping for a nutritional shake/meal replacement, 72% look for high protein content; 67% when buying a nutrition bar, per Packaged Facts’ 2017 Nutrition Shakes & Bars.

Sales of liquid nutritionals/meal replacements reached $5.4 billion for the year ended Dec. 2, 2018, per IRI. Premier Protein led unit growth, up 39%; followed by Boost 28%, Slim Fast 10%, and Ensure 9%. Unit sales of KIND intrinsic health value bars grew 693%, the Rx Bar 160%, Atkins 30%, and Quest bars up 25%, per IRI.

Nearly one-third (30%) of non-dairy milk consumers said extra protein would encourage them to drink more non-dairy milk, per Mintel’s Plant-based Proteins - US - May 2019. Watch for growth in waters with added protein.

“High protein” is among the top claims driving growth in the dairy sector. fairlife’s ultra-filtered high-protein, high-calcium fresh milks led unit sales growth in the whole milk and reduced fat sectors, up 47% and 37%, respectively, for the year ended Aug. 12, 2018. High-protein ice cream continues to post strong gains.

Sales of meat alternatives reached $878 million, according to FMI’s 2019 the Power of Meat, up 19.2% vs. 2018. Meat alternatives with pea, soy, or wheat proteins alone or in combination with other ingredients scored the highest for purchase intent; followed by brassica vegetables, chickpeas, pulses, rice, eggs, and quinoa, per Mintel’s 2018 What Consumers Really Think About Meal Replacements.

IRI’s 2019 State-of-the-Snack Food Industry reported that sales of meat, cheese, egg, and nut combination protein packs jumped 24% in 2018. IRI projected sales of high-protein snacks made with chickpeas will grow 35% in the next few years; with beans up 25%.

Sales of produce products (e.g., salads), carrying a “high protein” claim on the package jumped 147% for the year ended Jul. 23, 2018, per Nielsen.

High protein breads/toast remain a big idea; four in 10 believe that sprouted grains deliver more protein, per Packaged Facts’ August 2016 Ancient and Sprouted Grains report.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.

More than one-third (36%) of consumers say they’re adding more plant-based protein; 21% more animal protein. “High protein” is an important attribute in 54% of U.S. households when shopping for food, per Nielsen’s March 2019 Homescan Panel Health Care Survey.

Interest in protein is highest among adults age 50 and older, particularly those 65 and over, men, and households with children. Interest in plant protein skews younger, but also toward men and households with kids, per HealthFocus’ 2019 U.S. Trends Survey (see Figure 1).

Women are most likely to look to protein for satiety and weight management, men for physical performance and muscle strength, and parents for mental alertness and enjoyment, according to Cargill.

One in five (22%) supplement users are taking a protein supplement, according to CRN’s 2019 Consumer Survey on Dietary Supplements. Just over one-quarter (26%) of male and 19% of female supplement users take a protein supplement; 32% aged 18-34, 24% 35-54, and 13% aged 55 and over.

Almost half of global food shoppers say they always/usually choose foods and beverages because they are high in protein, according to HealthFocus’ 2018 Global Trends Study. Protein is on par with whole grains and just behind less sugar/more natural foods in terms of ingredients that have gained importance in the diet of global consumers; protein outpaced organic and plant-based foods.

According to Sloan Trends’ TrendSense model, protein nutrition/health is a very large Level 3 mass market, supported by an enormous level of medical research activity (Figure 2). The plateauing of its very high medical interest is an indication that the protein market is maturing and shifting to one involving more specific applications, benefits, and product attributes.

For example, protein/energy is fast approaching mega market status; protein/muscle continues to accelerate as a very large Level 3 market opportunity. The high level of interest in the medical community is creating new research findings, which will help to effectively market these more specific protein benefit linkages in the future. (See Getting Ahead of the Curve: Energy Gen 2, Nutraceuticals World, July/August, 2019.)

The protein ingredients market is projected to grow from $49.8 billion in 2018 to $70.7 billion by 2025, at a CAGR of 6.0% during the forecast period, per Markets and Markets’ Protein Ingredients Market by Source, Application & Region - Global Forecast to 2025.

Quality Matters

As consumers become more familiar with an ever-widening array of proteins, it’s not surprising that users have begun to focus on protein quality and on trying to get the right type of protein for their personal needs. One-third of U.S. adults agree that the source of protein does matter, per Nielsen’s Homescan Survey.

Americans have become aware of and tried a variety of proteins, led by soy, bean/legume, chickpea, and quinoa proteins, according to the April 2019 United Soybean Board’s (USB) Plant-based Protein and Soy: A U.S. Consumer Perspective Survey.

Two-thirds (67%) of adults say consuming a complete plant-based protein is important to them; one in five say it’s very important, per the USB survey. Among the most familiar plant-based proteins, consumers rate the overall quality of bean/legume-sourced protein the highest with 42% rating it as excellent; followed by soy 34%, pea 25%, and wheat 24%, per USB. The only plant proteins that are of high quality with all essential amino acids include soy, quinoa, and buckwheat.

A similar hierarchy occurs for positive perceptions about the leading plant proteins; 67% rate bean-based protein as “very or somewhat positive,” soy 57%, pea 51%, and wheat 51%, per USB. Despite the ongoing “mud-slinging” between protein ingredient marketers, only 10% of consumers cite soy protein’s quality as being very negative, 8% wheat, 5% pea, and 4% bean/legumes.

Six in 10 global food shoppers focus on the type of protein they consume. “Natural” is by far the top indicator of a “good source” of protein, cited by 56% of global consumers surveyed by HealthFocus’ 2019 Global Opportunities in Protein Report; followed by a complete source of protein (38%), a clean source (37%), and a nutrient dense source 30%. Although interest in plant-based protein is high globally, only 27% selected it as an indicator of a good source of protein. Beans/legumes, eggs, and seafood topped the list of good proteins worldwide.

While marketers are differentiating the type of protein, they should talk more about the amount and type of protein needed to trigger muscle synthesis, including the presence of essential amino acids (and specifically, leucine); the timing of protein consumption for optimal muscle development; and pursue other highly desired health linkages (e.g., long-lasting energy and satiety).

CRN’s 2019 survey reported that 11% of supplement users aged 18-34 are taking an amino acid supplement; 7% 35-54, and 2% age 55.

Linked In

Muscle health/tone is now the top benefit consumers associate with a high-protein diet (56%); 53% link physical energy; 47% weight management; 42% healthy hair, skin, and nails; 41% mental energy; 40% brain nourishment; 39% bone health; 35% sports recovery; 33% athletic performance; and 24% satiety, according to HealthFocus.

Muscle health/strength ranks fifth among sought-after health benefits from food/beverages, second among those age 50 and over, according to the International Food Information Council’s (IFIC) 2019 Food & Healthy Survey. Forty-seven percent buy high-protein products to help build muscle; 35% to keep their physical performance at a high level, per Cargill.

With interest in protein highest at ages 50 and older, only 13% age 55 and over are taking a protein supplement. The potential for targeting age-specific protein products for older consumers has never been greater, with 109 million Americans over age 50 and 48 million age 65 an older.

Moreover, “maintaining your ability to continue with normal activities as you age” is the second overall health concern in the U.S., per HealthFocus. Three-quarters of those age 50 and older are aware of the natural process of muscle loss with aging; 28% have noticed muscle loss, and 40% a loss of strength, per Abbott’s 2016 Managing Muscle Loss Survey. In the U.S., 45% of those over 65 years of age already have age-related muscle loss/strength, called sarcopenia.

At the same time, a clear split in the $42.5 billion U.S. sports nutrition category into mainstream “fit” consumers vs. competitive/serious exercisers and bodybuilders, will force marketers to reformulate protein-based products specific to each group. (See Getting Ahead of the Curve: The Fit Consumers, Nutraceuticals World, March 2019).

Among the new demographic of “fit” consumers who exercise three or more days per week for more than 30 minutes, representing as much as 40% of U.S. adults, 74% always/usually choose foods/drinks because they’re high in protein, per HealthFocus.

Globally, strength/muscle tone is the top reason for consuming sports nutrition products for men and women; recovery number three, per Euromonitor’s 2019 Top Consumer Trends Impacting Health & Nutrition.

Most important, plant-based protein marketers not offering a complete protein should proceed with caution in the muscle-building and exercise recovery segments. Recent studies confirm that incomplete proteins are not as effective in building muscle or strength [Current Developments in Nutrition, Vol 3(1), June 2019], and may not be as effective as complete proteins for sports recovery.

Of those who took a protein supplement last year for sports or weight loss, 44% opted for plant protein, per CRN’s 2018 survey. However, only 16% of U.S. consumers connect plant-based foods/protein to muscle growth, per Mintel’s 2018 Trends in the Still Hot Protein Marketplace.

Seventeen percent of adults used protein beverages in 2018, 12% meal replacements/mixes, 11% nutritional drinks (e.g., Boost), and 6% weight loss drinks/mixes, per Mintel’s Nutrition & Performance Drinks – U.S., 2018. Nutrition Business Journal (NBJ) projected that sales of sports powder supplements will approach $7 billion by 2022, with a CAGR from 2020-22 of about 6%.

Additionally, 57% of U.S. adults buy high-protein products to give them energy, 26% to keep them mentally alert, per Cargill. Energy ranks second, after weight loss, as the benefit consumers would most like to get from food, per IFIC.

Right after “general well-being” and “nutrient deficiencies,” “increased energy” is the most popular reason for taking a dietary supplement, per Mintel’s Vitamins, Minerals & Supplements US – Sep. 2018. NBJ projected sales of energy supplements will reach $2.5 billion by 2021.

Low energy is no longer just a concern of younger adults. According to HealthFocus, 57% of those aged 18-39 are extremely/very concerned about tiredness/lack of energy, 51% of those aged 40-49, and 54% aged 50-64.

Consumers look for products that provide “long-lasting physical energy” and “energy they can draw on throughout the day” at twice the rate of “energy for exercise. “Mental” and “morning energy to get the day started” ranked third and fourth, per HealthFocus. Just over half of adults cite “more energy” as a reason for using plant-based foods, beverages, powders, and bars; two-thirds of younger adults aged 18-29 and households with kids are the most likely to say they do so for extra energy, per HealthFocus.

Not surprisingly with consumers taking a more holistic view of health, in which the mind is as important as body, brain nourishment and mental energy are now among the high-demand health benefits—and protein can deliver. “Retaining mental sharpness with age” is America’s top health concern, per HealthFocus; memory ranks third overall, and stress is eighth. Stress/anxiety has replaced being overweight as the top health condition America’s households are trying to treat or prevent, per the Hartman Group.

NBJ projected that brain health supplements will reach $1.1 billion by 2022; mood, stress, and mental health supplements $1.0 billion. Twenty-three percent of adults (26% age 50 and older) take a supplement for brain health; 10 million a proprietary brain supplement (e.g., Prevagen), 60 million a traditional supplement (e.g., omega-3), according to AARP’s 2019 Brain Health and Dietary Supplements Survey.

One-quarter of consumers (26%) say they seek out protein to help with weight control. Nielsen reported that 6% of U.S. households have a family member on a high-protein diet (5.4 million people). Of the 38% who followed a diet regimen in the past year, 3% were on the Paleo diet in 2019, down from 7% in 2018, per IFIC. Globally, 8% follow a high-protein diet, according to Euromonitor.

Just under half of adults who seek out protein do so because it keeps them feeling fuller longer; 17% say satiety is their most important reason, per Cargill. Hair, skin, and nail supplements are another protein opportunity and projected by NBJ to reach $1.2 billion by 2021, with a CAGR of 5%. Inner beauty remains a missed opportunity for food marketers.

Lastly, soy is the only protein that currently has an FDA-approved heart health claim. Heart ranks fourth on the list of health benefits consumers are looking for in foods, per IFIC. Nearly one-quarter (23%) of users take a supplement for heart health, 30% of those aged 55 and over, 20% ages 35-54, and 16% ages 18-34, per CRN’s 2019 survey.

Food for Thought

One in five (19%) U.S. households cite legumes, nuts, and seeds among their primary protein sources, according to Nielsen’s Homescan.

After “taste” and “no artificial ingredients,” protein content is the most important reason consumers buy plant-based foods/drinks, according to Mintel’s July 2018 What Consumers Really Think about Alternative Proteins.

U.S. retail sales of plant-based foods have grown 11% for the year ended April 2019, to reach $4.5 billion, according to SPINS and the Plant-Based Foods Association (PBFA).

Sales of foods/drinks with a “good” or “excellent” source of protein claim reached $22.6 billion for the year ended Jun. 9, 2018, per Nielsen. Grocery accounted for $16 billion, dairy $953 million, bakery $168 million, deli $166 million, meat $93 million, frozen foods $68 million, and produce $37 million, per Nielsen.

Sales of all edibles with a protein claim jumped 9% in 2018; those with a protein claim plus “no preservative” or “no hormones” were up 15%, those with a protein claim plus “GMO-free” up 21%, plus “whole grains” up 27%, plus “no antibiotics” up 41%, and plus “probiotics” up 59%, per Nielsen.

When shopping for a nutritional shake/meal replacement, 72% look for high protein content; 67% when buying a nutrition bar, per Packaged Facts’ 2017 Nutrition Shakes & Bars.

Sales of liquid nutritionals/meal replacements reached $5.4 billion for the year ended Dec. 2, 2018, per IRI. Premier Protein led unit growth, up 39%; followed by Boost 28%, Slim Fast 10%, and Ensure 9%. Unit sales of KIND intrinsic health value bars grew 693%, the Rx Bar 160%, Atkins 30%, and Quest bars up 25%, per IRI.

Nearly one-third (30%) of non-dairy milk consumers said extra protein would encourage them to drink more non-dairy milk, per Mintel’s Plant-based Proteins - US - May 2019. Watch for growth in waters with added protein.

“High protein” is among the top claims driving growth in the dairy sector. fairlife’s ultra-filtered high-protein, high-calcium fresh milks led unit sales growth in the whole milk and reduced fat sectors, up 47% and 37%, respectively, for the year ended Aug. 12, 2018. High-protein ice cream continues to post strong gains.

Sales of meat alternatives reached $878 million, according to FMI’s 2019 the Power of Meat, up 19.2% vs. 2018. Meat alternatives with pea, soy, or wheat proteins alone or in combination with other ingredients scored the highest for purchase intent; followed by brassica vegetables, chickpeas, pulses, rice, eggs, and quinoa, per Mintel’s 2018 What Consumers Really Think About Meal Replacements.

IRI’s 2019 State-of-the-Snack Food Industry reported that sales of meat, cheese, egg, and nut combination protein packs jumped 24% in 2018. IRI projected sales of high-protein snacks made with chickpeas will grow 35% in the next few years; with beans up 25%.

Sales of produce products (e.g., salads), carrying a “high protein” claim on the package jumped 147% for the year ended Jul. 23, 2018, per Nielsen.

High protein breads/toast remain a big idea; four in 10 believe that sprouted grains deliver more protein, per Packaged Facts’ August 2016 Ancient and Sprouted Grains report.

Dr. A. Elizabeth Sloan & Dr. Catherine Adams Hutt

Sloan Trends, Inc.

Dr. A. Elizabeth Sloan and Dr. Catherine Adams Hutt are president and chief scientific and regulatory officer, respectively, of Sloan Trends, Inc., Escondido, CA, a 20-year-old consulting firm that offers trend interpretation/predictions; identifies emerging high potential opportunities; and provides strategic counsel on issues and regulatory claims guidance for food/beverage, supplement and pharmaceutical marketers. For more information: E-mail: lizsloan@sloantrend.com; Website: www.sloantrend.com.