By Lisa Olivo, Associate Editor07.27.17

News of Amazon’s $13.7 billion purchase of Whole Foods Market, Inc. has been a hot topic in the natural products space, with many industry insiders speculating what the future may look like once these two retail powerhouses join forces.

Daniel Fabricant, PhD, CEO and executive director of the Natural Products Association (NPA), believes this partnership will be beneficial for the natural products space overall. “The piece of the pie keeps getting bigger,” he said. “For a long time the industry wasn’t mainstream, and I don’t think there is any question now that this is part and parcel of everyone’s life. I think that’s a good moment of pause for people to take and reflect on—people are clearly voting with their dollar.” This resounding vote, he implied, was for quality products that are made from natural origins, often utilizing sustainable business practices. “It’s important for sellers in the space to embody the types of business rules and ethics that the people want,” Dr. Fabricant stated.

According to Jeff Hilton, co-founder and partner of BrandHive, a healthy lifestyle branding agency, an Amazon/Whole Foods partnership means category growth and expansion, plus increased incidence of supplement usage nationwide. In addition, he said uniting these two companies could bring a “greater awareness for our category and products. It means more eyes on our industry to keep us in line.”

In terms of what implications the Amazon and Whole Foods partnership could mean for suppliers and manufacturers in the dietary supplement space, Dr. Fabricant pointed to some key observations. Top of the list was Amazon’s launch of its Elements brand of dietary supplements this year. While in the past Amazon didn’t produce its own branded goods, it now offer supplements and baby wipes (and previously diapers) under the Elements brand. “Amazon doesn’t really have a grocery brand,” Dr. Fabricant explained. “People know a little bit about Amazon Fresh, but that’s other people’s products. I would envision a world where if you buy Amazon/Whole Foods products your delivery is free, where if you don’t, you’re going to pay for it, like on Amazon Fresh. It’s a very smart business move by them, and I fully anticipate that’s the way they’ll look at things.”

Dr. Fabricant also forecasted private label suppliers will be clamoring to work with and be of service to Amazon/Whole Foods. “Their buying power is certainly going to increase in that regard,” he said.

Mr. Hilton predicted increased competition in the dietary supplement (DS) space. He also predicted “a higher standard of DS transparency in terms of sourcing and manufacturing since Amazon has already raised the bar with its Elements line. DS manufacturers will need to step up their game in terms of quality, purity, efficacy, and transparency.” This, he said, is a good thing, but companies are going to need to become more competitive and diligent to claim their stake in the market.

How this will all impact consumers is a bit unclear, according to Dr. Fabricant. “Now there’s the tricky word: consumers. If you look at this as a one size fits all consumer—don’t.” Dr. Fabricant suggested the demographics for Amazon consumers tend to run younger, tech savvy, and female. “So this demographic is getting everything they wanted [with the Amazon/Whole Foods merger]—they can get everything in one spot. They don’t just have to order their toilet paper for the home through Amazon, but they can also get their dietary supplements, whatever health and beauty aids they like, etc.”

However, for older demographics looking for a traditional grocery store experience, they may have to make some adjustments. “I think for some of the more senior consumers…they’re going to have a different shopping experience at Whole Foods. I would anticipate that Whole Foods is going to be less store front, and maybe more of a warehouse and distribution center. Not that their whole store front is going away; they’ll certainly have the ready to eat stuff, because that’s a big money maker for them. I’m sure they’ll have the produce, cut vegetables. But I think in terms of packaged goods, I would imagine there would be less shelf space out front, but more stock space in the back for filling orders and things like that.”

Mr. Hilton believes consumers will benefit from this deal “without question.” He commented, “The consumer is really the winner here as they will have greater access to more, higher quality products.”

Culture Clash?

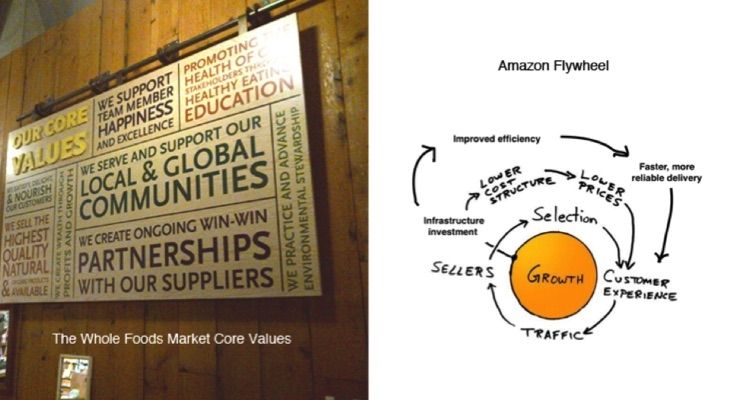

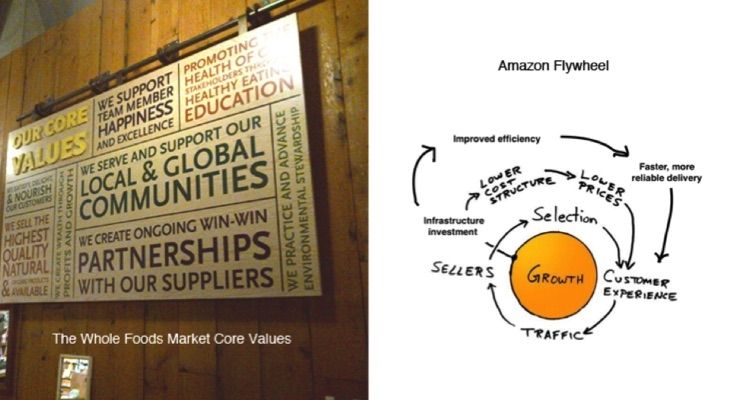

Scott Steinford, CEO of Trust Transparency Consulting observed that the corporate cultures and cornerstones of these companies may be at odds in some regards. To demonstrate these differences, Mr. Steinford pointed to each company’s internal corporate values and driving objectives.

“The Amazon flywheel is found on walls and parking garages throughout the campus in Seattle. Whole Foods Market Core Values are seen in every store. Both are the heart of the culture of their respective organizations,” explained Mr. Steinford.

He pointed out that one word absent from the Amazon flywheel is “quality,” which is found at the center of Whole Foods’ core values. “Quality is a missing element of one culture and a dominant factor in the other; can two cultures so juxtaposed assimilate smoothly?”

However, he suggested that quality is recognized in both organizations, but from opposite directions. “Amazon maintains a ‘bottom-up’ selection criteria by allowing almost every item to be placed for sale with the customer review and market to determine if the product is viable,” he said. “Whole Foods Market selects its product offering in a very structured and careful review process conducted by Regional or Corporate Management. For the most part, the Amazon supply chain goes unnoticed. The Whole Foods Market supply chain is promoted as the centerpiece of its commitment to quality.”

To Mr. Steinford, Amazon represents “Huge Selection & Great Prices” compared to “America’s Healthiest Grocery Store.” Adding to this contrast, as of January 2017 Amazon reported its marketplace had over 400 million SKUs while the largest Whole Foods Market maintained under 50,000 SKUs. “Both organizations are often recognized as the best at what they offer,” he said. “Both businesses are committed to being the best, if not offering the best. The question becomes, can the two companies merge cultures that represent two distinct values? It would seem one culture will prevail, but it will be interesting to see how the merger recognizes the difference.”

Daniel Fabricant, PhD, CEO and executive director of the Natural Products Association (NPA), believes this partnership will be beneficial for the natural products space overall. “The piece of the pie keeps getting bigger,” he said. “For a long time the industry wasn’t mainstream, and I don’t think there is any question now that this is part and parcel of everyone’s life. I think that’s a good moment of pause for people to take and reflect on—people are clearly voting with their dollar.” This resounding vote, he implied, was for quality products that are made from natural origins, often utilizing sustainable business practices. “It’s important for sellers in the space to embody the types of business rules and ethics that the people want,” Dr. Fabricant stated.

According to Jeff Hilton, co-founder and partner of BrandHive, a healthy lifestyle branding agency, an Amazon/Whole Foods partnership means category growth and expansion, plus increased incidence of supplement usage nationwide. In addition, he said uniting these two companies could bring a “greater awareness for our category and products. It means more eyes on our industry to keep us in line.”

In terms of what implications the Amazon and Whole Foods partnership could mean for suppliers and manufacturers in the dietary supplement space, Dr. Fabricant pointed to some key observations. Top of the list was Amazon’s launch of its Elements brand of dietary supplements this year. While in the past Amazon didn’t produce its own branded goods, it now offer supplements and baby wipes (and previously diapers) under the Elements brand. “Amazon doesn’t really have a grocery brand,” Dr. Fabricant explained. “People know a little bit about Amazon Fresh, but that’s other people’s products. I would envision a world where if you buy Amazon/Whole Foods products your delivery is free, where if you don’t, you’re going to pay for it, like on Amazon Fresh. It’s a very smart business move by them, and I fully anticipate that’s the way they’ll look at things.”

Dr. Fabricant also forecasted private label suppliers will be clamoring to work with and be of service to Amazon/Whole Foods. “Their buying power is certainly going to increase in that regard,” he said.

Mr. Hilton predicted increased competition in the dietary supplement (DS) space. He also predicted “a higher standard of DS transparency in terms of sourcing and manufacturing since Amazon has already raised the bar with its Elements line. DS manufacturers will need to step up their game in terms of quality, purity, efficacy, and transparency.” This, he said, is a good thing, but companies are going to need to become more competitive and diligent to claim their stake in the market.

How this will all impact consumers is a bit unclear, according to Dr. Fabricant. “Now there’s the tricky word: consumers. If you look at this as a one size fits all consumer—don’t.” Dr. Fabricant suggested the demographics for Amazon consumers tend to run younger, tech savvy, and female. “So this demographic is getting everything they wanted [with the Amazon/Whole Foods merger]—they can get everything in one spot. They don’t just have to order their toilet paper for the home through Amazon, but they can also get their dietary supplements, whatever health and beauty aids they like, etc.”

However, for older demographics looking for a traditional grocery store experience, they may have to make some adjustments. “I think for some of the more senior consumers…they’re going to have a different shopping experience at Whole Foods. I would anticipate that Whole Foods is going to be less store front, and maybe more of a warehouse and distribution center. Not that their whole store front is going away; they’ll certainly have the ready to eat stuff, because that’s a big money maker for them. I’m sure they’ll have the produce, cut vegetables. But I think in terms of packaged goods, I would imagine there would be less shelf space out front, but more stock space in the back for filling orders and things like that.”

Mr. Hilton believes consumers will benefit from this deal “without question.” He commented, “The consumer is really the winner here as they will have greater access to more, higher quality products.”

Culture Clash?

Scott Steinford, CEO of Trust Transparency Consulting observed that the corporate cultures and cornerstones of these companies may be at odds in some regards. To demonstrate these differences, Mr. Steinford pointed to each company’s internal corporate values and driving objectives.

“The Amazon flywheel is found on walls and parking garages throughout the campus in Seattle. Whole Foods Market Core Values are seen in every store. Both are the heart of the culture of their respective organizations,” explained Mr. Steinford.

He pointed out that one word absent from the Amazon flywheel is “quality,” which is found at the center of Whole Foods’ core values. “Quality is a missing element of one culture and a dominant factor in the other; can two cultures so juxtaposed assimilate smoothly?”

However, he suggested that quality is recognized in both organizations, but from opposite directions. “Amazon maintains a ‘bottom-up’ selection criteria by allowing almost every item to be placed for sale with the customer review and market to determine if the product is viable,” he said. “Whole Foods Market selects its product offering in a very structured and careful review process conducted by Regional or Corporate Management. For the most part, the Amazon supply chain goes unnoticed. The Whole Foods Market supply chain is promoted as the centerpiece of its commitment to quality.”

To Mr. Steinford, Amazon represents “Huge Selection & Great Prices” compared to “America’s Healthiest Grocery Store.” Adding to this contrast, as of January 2017 Amazon reported its marketplace had over 400 million SKUs while the largest Whole Foods Market maintained under 50,000 SKUs. “Both organizations are often recognized as the best at what they offer,” he said. “Both businesses are committed to being the best, if not offering the best. The question becomes, can the two companies merge cultures that represent two distinct values? It would seem one culture will prevail, but it will be interesting to see how the merger recognizes the difference.”